Professional Documents

Culture Documents

DipIFR-Session27 d08 Interest in JVs

Uploaded by

Fahmi AbdullaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DipIFR-Session27 d08 Interest in JVs

Uploaded by

Fahmi AbdullaCopyright:

Available Formats

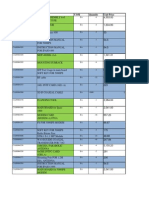

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2701

Overview

Objectives

To define joint ventures.

To describe the accounting treatment for joint ventures.

IAS 31

JOINT

VENTURES

JOINTLY

CONTROLLED

ASSETS

JOINTLY

CONTROLLED

OPERATIONS

JOINTLY

CONTROLLED

ENTITIES

Description

Presentation and

accounting

Description

Presentation and accounting

Transactions between venturer

and a joint venture

Exemptions

Separate financial statements

Investors

Ceasing to be a venturer

Definitions

Forms of joint venture

Characteristics

DISCLOSURE

Contingencies

Interests

Description

Presentation and accounting

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2702

1 IAS 31

1.1 Scope

IAS 31 should be applied in accounting for interests in joint ventures and the

reporting of joint venture assets, liabilities, income and expenses in the

financial statements of venturers and investors, regardless of the structures or

forms under which the joint venture activities take place.

However, it does not apply to venturers interests in jointly controlled entities

held by:

venture capital organisations; or

mutual funds, unit trusts and similar entities,

accounted for in accordance with IAS 39 Financial Instruments: Recognition

and Measurement.

Commentary

Such investments are measured at fair value in accordance with IAS 39, with

changes in fair value recognised in profit or loss in the period of the change.

2 Joint ventures

2.1 Definitions

A joint venture is a contractual arrangement whereby two or more parties

undertake an economic activity, which is subject to joint control.

Control is the power to govern the financial and operating policies of an

economic activity so as to obtain benefits from it.

Joint control is the contractually agreed sharing of control over an economic

activity.

Commentary

It exists only when the strategic financial and operating decisions relating to

the activity require the unanimous consent of the joint venturers.

Significant influence is the power to participate in the financial and operating

policy decisions of an economic activity but is not control or joint control

over those policies.

A venturer is a party to a joint venture and has joint control over that joint

venture.

An investor in a joint venture is a party to a joint venture and does not have

joint control over that joint venture.

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2703

Proportionate consolidation is a method of accounting and reporting

whereby a venturers share of each of the assets, liabilities, income and

expenses of a jointly controlled entity is:

(1) combined on a line by line basis with similar items in the venturers

financial statements; or

(2) reported as separate line items in the venturers financial statements.

The equity method is a method of accounting and reporting whereby an

interest in a jointly controlled entity is initially recorded at cost and adjusted

thereafter for the post acquisition change in the venturers share of net assets

of the jointly controlled entity. The profit or loss of the venturer includes the

venturers share of the profit or loss of the jointly controlled entity.

2.2 Forms of joint venture

Joint ventures take many different forms and structures. IAS 31 identifies

three broad types:

Jointly controlled operations;

Jointly controlled assets; and

Jointly controlled entities.

2.3 Characteristics

The following characteristics are common to all joint ventures:

two or more venturers are bound by a contractual arrangement; and

the contractual arrangement establishes joint control.

Commentary

No single venturer can be in a position to control the activity unilaterally.

The contractual arrangement will usually be in writing and cover:

the activity, duration and reporting obligations of the joint venture;

the appointment of the board of directors or equivalent governing

body of the joint venture and the voting rights of the venturers;

capital contributions by the venturers; and

the sharing by the venturers of the output, income, expenses or

results of the joint venture.

Commentary

One venturer may be the operator or manager under the terms of the

agreement. They will carry out the policy of the joint venture as agent for,

and as agreed by, the venturers. If they are able to govern the financial and

operating policies of the economic activity, they control the venture. If so,

the venture is a subsidiary of the operator and not a joint venture.

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2704

3 Jointly controlled operations

3.1 Description

The operation of some joint ventures involves the use of the assets and other resources

of the venturers rather than the establishment of a corporation, partnership or other

entity, or a financial structure that is separate from the venturers themselves.

Each venturer uses its own property, plant and equipment and carries its own

inventories. It also incurs its own expenses and liabilities and raises its own

finance, which represent its own obligations.

The joint venture activities may be carried out by the venturers employees

alongside the venturers similar activities.

The joint venture agreement usually provides a means by which the revenue

from the sale of the joint product and any expenses incurred in common are

shared among the venturers.

Illustration 1 Jointly controlled operations

Two or more venturers combine their operations, resources and expertise in order to

manufacture, market and distribute jointly a particular product, such as an aircraft.

Different parts of the manufacturing process are carried out by each of the venturers.

Each venturer bears its own costs and takes a share of the revenue from the sale of the

aircraft, as determined in the contractual arrangement.

3.2 Presentation and accounting

A venturer should recognise in its separate financial statements:

the assets that it controls and the liabilities that it incurs; and

the expenses that it incurs and its share of the income that it earns

from the sale of goods or services by the joint venture.

Commentary

As the assets, liabilities, income and expenses are recognised in the financial statements

of the individual venturers, no separate financial statements for external use are

required for the venture. No adjustments or consolidation procedures are required in

respect of those items in any consolidated accounts produced by the venturers.

Each venturer will usually maintain a joint venture account (as part of its management

accounts) in which all transactions they enter into on behalf of the venture are recorded.

Commentary

At end of each period a memorandum joint venture account is prepared

which combines all expenses and income from individual joint venture

accounts, in order to calculate the profit/loss to date. The profit/loss arising

is then split in the agreed profit sharing ratios.

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2705

Points for consideration

Transfer of goods between ventures should be ignored (since it does

not change who paid for the goods).

Expenses borne by one venturer only:

(1) Record expense as normal

Dr Joint venture x

Cr Cash x

(2) Remove expense from memorandum account.

(3) Adjust joint venture account of venturer who will bear expense:

Dr Expense x

Cr Joint venture x

Worked example 1

Q, a sound engineer, and R, a lighting engineer, entered into a joint venture to stage a

concert. They agreed to purchase certain items of equipment needed to convert their

local hall into a suitable venue, book the performers and sell tickets. Both are self-

employed and decided to record all transactions in joint venture accounts within their

own business books.

Q purchased a number of radio microphones for $400. He also paid $150 for the

printing of tickets and programmes.

R purchased a computerised lighting deck for $600 and paid a total of $2,000 to the

performers. She also paid $800 for the rental of the hall.

Q sold 200 tickets at $12 each. R sold 500.

After the concert, Q and R prepared a pint venture account. They agreed that they

would each retain the equipment they had purchased at a valuation of $150 for the

microphones and $350 for the lighting deck. Q and R also agreed to share profits in

the ratio 2 to 3.

Rather than liquidate the venture, they decided to form a limited company (QR). Each

would contribute the equipment purchased for the concert, valued at the amounts

agreed earlier. They would also leave a total of $800 of the cash raised from the

concert in the company, allocated to each in such a way that their investment was

equal. Q and R would be the sole shareholders and each would receive a number of $1

shares equal in value to his/her investment.

Required:

(a) Prepare a memorandum joint venture account for the concert and the

subsequent appropriation of profit.

(b) Prepare joint venture accounts for Q and R which show the amounts

invested by each in QR.

(c) Prepare the statement of financial position of QR as would have

appeared immediately after the companys incorporation.

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2706

Worked solution 1

(a) Memorandum Joint Venture Account Q and R

$ $

Sales (200 + 500 $12) 8,400

Expenses:

Cost of equipment (600 + 400) 1,000

Less: Retained (150 + 350) (500)

Net cost of equipment 500

Tickets and programmes 150

Rental 800

Performers 2,000 3,450

Net profit (4,950)

Allocated:

Q (2/5) 1,980

R (3/5) 2,970 4,950

(b) Joint Venture accounts

Q R

Bank equipment 400 600

printing 150

rents 800

performers 2,000

Profit 1,980 2,970

Balance c/d 20

2,550 6,370

Balance b/d 20

Equipment 150 350

Bank 520 280

670 650

Q R

Bank tickets 2,400 6,000

Equipment 150 350

Balance c/d 20

2,550 6,370

Balance b/d 20

Shares in QR 650 650

670 650

Q will invest equipment of $750 and cash of $520

R will invest equipment of $350 and cash of $280

(c) QR Statement of financial position on incorporation

$

Non-current assets (150 + 350) 500

Bank 800

1,300

Share capital (650 + 650) 1,300

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2707

4 Jointly controlled assets

4.1 Description

This type of joint venture involves the joint control, and often the joint

ownership, by the venturers of one or more assets contributed to, or acquired

for the purpose of, the joint venture and dedicated to the purposes of the joint

venture.

The assets are used to obtain benefits for the venturers.

Each venturer may take a share of the output from the assets and each bears

an agreed share of the expenses incurred.

These joint ventures do not involve the establishment of a corporation,

partnership or other entity, or a financial structure that is separate from the

venturers themselves. Each venturer has control over its share of future

economic benefits through its share in the jointly controlled asset.

Illustration 2 Jointly controlled assets

Many activities in the oil, gas and mineral extraction industries involve jointly

controlled assets. For example, a number of oil production companies may jointly

control and operate an oil pipeline. Each venturer uses the pipeline to transport its own

product in return for which it bears an agreed proportion of the expenses of operating

the pipeline.

4.2 Presentation and accounting

Each venturer should include the following items in its accounting records

and recognise them in its separate financial statements (and consequently in

its consolidated financial statements if the venturer is part of a group):

its share of the jointly controlled assets, classified according to the

nature of the assets rather than as an investment;

any liabilities which it has incurred on behalf of the joint venture, (e.g.

in financing its share of the assets);

its share of any joint liabilities incurred in relation to the joint venture;

its share of income the joint venture, together with its share of any

expenses incurred by the joint venture; and

any expenses that it has incurred in respect of its interest in the joint venture.

Commentary

As with jointly controlled operations, no separate financial statements for external use

are required for the venture. No adjustments or consolidation procedures are

required in respect of the jointly controlled asset in any consolidated accounts

produced by the venturers. Again, management accounts will usually be used to

assess the performance of the joint venture.

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2708

5 Jointly controlled entities

5.1 Description

This is a joint venture, which involves the establishment of a corporation,

partnership or other entity in which each venturer has an interest.

The entity operates in the same way as other entities, except that a contractual

arrangement between the venturers establishes joint control over the

economic activity of the entity.

A jointly controlled entity controls the assets of the joint venture, incurs

liabilities and expenses and earns income. It may enter into contracts in its

own name and raise finance for the purposes of the joint venture activity.

Each venturer is entitled to a share of the results of the jointly controlled

entity, although some jointly controlled entities also involve a sharing of the

output of the joint venture.

Illustration 3 Jointly controlled entities

An entity may commence a business in a foreign country in conjunction with the

government or other agency in that country, by establishing a separate entity which is

jointly controlled by the entity and the government or agency.

Commentary

A jointly controlled entity maintains its own accounting records and prepares and

presents financial statements (e.g. under IFRS) in the same way as other entities.

5.2 Presentation and accounting

Each venturer usually contributes cash or other resources to the jointly controlled

entity. These contributions are included in the accounting records of the venturer and

recognised in its financial statements as an investment in the jointly controlled entity.

A venturer shall recognise its interest in a jointly controlled entity using

either proportionate consolidation or the equity method.

5.2.1 Proportionate consolidation

The application of proportionate consolidation means that the statement of

financial position of the venturer includes its share of the assets that it controls

jointly and its share of the liabilities for which it is jointly responsible.

The statement of comprehensive income of the venturer includes its share of

the income and expenses of the jointly controlled entity.

Commentary

Note that the venturer may be a single entity or a group (in which case the

statement of financial position and statement of comprehensive income will

be consolidated statements).

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2709

Different reporting formats may be used:

The venturer may combine its share of each of the assets, liabilities,

income and expenses of the jointly controlled entity with similar

items in its financial statements on a line-by-line basis.

Commentary

For example, it may combine its share of the jointly controlled entitys

inventory with the inventory of the consolidated group and its share of the

jointly controlled entitys property, plant and equipment with the same items

of the consolidated group.

Alternatively, the venturer may include separate line items for its

share of the assets, liabilities, income and expenses of the jointly

controlled entity in its consolidated financial statements.

Worked example 2

Purple Inc owns 80% of Sepia and 40% of Jade. Jade is a jointly controlled entity.

Statements of financial position of the three companies at 31 December 2007 are:

Purple Sepia Jade

$ $ $

Investment: shares in Sepia 800

Investment: shares in Jade 600

Other non-current assets 1,600 800 1,400

Current assets 2,200 3,300 3,250

5,200 4,100 4,650

Share capital $1 ordinary shares 1,000 400 800

Retained earnings 4,000 3,400 3,600

Liabilities 200 300 250

5,200 4,100 4,650

Purple acquired its shares in Sepia many years ago when Sepias retained earnings

were $520. Purple acquired its shares in Jade at the beginning of the year when Jades

retained earnings were $400.

The balance of goodwill relating to Serpia had been written off as impaired three years

ago.The value of goodwill in respect of Jade remains unchanged at 31 December 2007.

Required:

Prepare the consolidated statement of financial position at 31 December 2007

incorporating the interest in Jade using proportionate consolidation.

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2710

Worked solution 2

Purple Inc: Consolidated statement of financial position as at 31 December 2007

$

Goodwill (W1) 120

Non-current assets (1,600 + 800 + (40% 1,400)) 2,960

Current assets (2,200 + 3,300 + (40% 3,250) 6,800

9,880

Share capital 1,000

Retained earnings (W4) 7,520

8,520

Non-controlling interests (20% (400 + 3,400)) 760

Liabilities (200 + 300 + (40% 250) 600

9,880

WORKINGS

(1) Goodwill

$

In joint venture (W3) 120

In subsidiary (W2) 64

In subsidiary amortised or written off as impaired (64)

In statement of financial position 120

(2) Goodwill in subsidiary

$

Cost of investment in subsidiary 800

Net assets of subsidiary on acquisition

(400 + 520) 80% (736)

Goodwill 64

(3) Goodwill in joint venture

$

Cost of investment in joint venture 600

Net assets of joint venture on acquisition

(800 + 420) 40% (480)

Goodwill 120

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2711

(4) Consolidated retained earnings

$

Purple 4,000

Sepia post-acquisition (3,400 520) 80% 2,304

Jade post-acquisition (3,600 400) 40% 1,280

Goodwill impaired (64)

7,520

5.2.2 Equity method

In its consolidated financial statements, a venturer should report its interest in

a jointly controlled entity using the equity method as described by IAS 28

(see previous session).

The use of the equity method is supported by those:

who argue that it is inappropriate to combine controlled items with

jointly controlled items; and

who believe that venturers have significant influence, rather than

joint control, in a jointly controlled entity.

However, IAS 31 does not recommend the use of the equity method because

proportionate consolidation better reflects the substance and economic reality of

a venturers interest in a jointly controlled entity (i.e. control over the venturers

share of the future economic benefits.

Commentary

Nevertheless, it permits the use of the equity method when recognising

interests in jointly controlled entities.

A venturer should discontinue the use of proportionate consolidation or the

equity method from the date on which it ceases to have joint control over, or

(for the equity method) have significant influence in, a jointly controlled

entity.

5.3 Transactions between venturer and a joint venture

When a venturer contributes or sells assets to a joint venture, recognition of

any portion of a gain or loss from the transaction reflects the substance of the

transaction.

While the assets are retained by the joint venture, and provided the venturer

has transferred the significant risks and rewards of ownership, the venturer

recognises only that portion of the gain or loss that is attributable to the

interests of the other venturers.

The venturer recognises the full amount of any loss when the contribution or

sale provides evidence of a reduction in the net realisable value of current

assets or an impairment loss.

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2712

When a venturer purchases assets from a joint venture, the venturer does not

recognise its share of the profits of the joint venture from the transaction until

it resells the assets to an independent party.

Commentary

A venturer recognise its share of the losses resulting from these transactions

in the same way as profits except that losses are recognised immediately

when they represent a reduction in the net realisable value of current assets

or an impairment loss.

Worked example 3

Alpha Group and Beta Group set up a joint venture, Gamma. Alpha owns 60% of Gamma whilst Beta

owns the remaining 40%.

Alpha sells to the joint venture a piece of land for $2m making a profit of $500,000 on the assets

carrying value. At the year end, the land remains in the books of the Gamma.

Required:

Show the entries that would be made in the consolidated accounts of Alpha Group to reflect the

sale of the land.

Worked solution 3

Portion of gain realised by Alpha group = 40% $500,000 = $200,000

Therefore the remaining 60% of the gain ($300,000) has not yet been realised by the

Alpha group and should be eliminated on consolidation.

On consolidation the following adjustment will be made:

Dr Profit or loss (retained earnings) 300,000

Cr Land 300,000

This eliminates Alphas unrealised share of the profit and reduces the land to $900,000, in effect

Alphas share of the carrying value prior to the sale to Gamma ($1,500,000 60%).

5.4 Exemptions to proportionate consolidation and equity methods

Commentary

The exemptions are basically the same as for interests in associates under

IAS 28 and subsidiaries under IAS 27

If the investment in a jointly controlled entity is classified as held for sale account for as

required by IFRS 5 Non-current Assets Held for Sale and Discontinued Operations.

If the investor is also a parent company within a group that has elected not to

present consolidated financial statements measure the investment at cost or in

accordance with IAS 39.

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2713

The investment in the associate will be measured at cost or in accordance with

IAS 39 if all of the following apply:

the venturer is a wholly-owned subsidiary (or partially-owned and

other owners do not object); and

the venturers debt or equity instruments are not traded in a public

market; and

the venturer does not file its financial statements with a securities

regulator; and

the ultimate (or any intermediate) parent of the venturer produces

consolidated financial statements available for public use under IFRS.

Commentary

This allows investors who do not have investments in a subsidiary, but only

have an investment in a jointly controlled entity, to be exempt from the

requirement to use proportionate consolidation or the equity method on the

same basis as parents under IAS 27.

5.5 Separate financial statements of a venturer

An interest in a jointly controlled entity is accounted for:

Under IFRS 5 if classified as held for sale; or

At cost or in accordance with IAS 39.

5.6 Reporting the interests of an investor

An investor in a joint venture that does not have joint control accounts for

that investment in accordance with IAS 39 or, if it has significant influence in

the joint venture, in accordance with IAS 28.

5.7 Ceasing to be a venturer in a joint venture

From the date on which a jointly controlled entity becomes a subsidiary of a

venturer, the venturer accounts for its interest in accordance with IAS 27.

From the date on which a jointly controlled entity becomes an associate of a

venturer, the venturer accounts for its interest in accordance with IAS 28.

6 Disclosure

A venturer shall disclose the method it uses to recognise its interests in jointly

controlled entities.

6.1 Contingencies

A venturer should disclose the aggregate amount of the following contingent

liabilities, unless the probability of loss is remote, separately from the amount

of other contingent liabilities:

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2714

any contingent liabilities hat the venturer has incurred in relation to

its interests in joint ventures and its share in each of the contingent

liabilities which have been incurred jointly with other venturers;

its share of the contingent liabilities of the joint ventures themselves

for which it is contingently liable; and

those contingencies that arise because the venturer is contingently

liable for the liabilities of the other venturers of a joint venture.

A venturer discloses the aggregate amount of any capital commitments in

respect of its interests in joint ventures separately from other commitments.

6.2 Interests

A venturer should list and describe interests in significant joint ventures and

the proportion of ownership interest held in jointly controlled entities.

A venturer which reports its interests in jointly controlled entities using the

line by line reporting format for proportionate consolidation or the equity

method should disclose the aggregate amounts of each of:

current assets

long-term assets

current liabilities

long-term liabilities

income and expenses related to its interests in joint ventures.

Illustration 4

Scope of consolidation (extract)

Five joint ventures the same number as in the previous year are included by proportionate

consolidation in compliance with IAS 31 (Interests in Joint Ventures). Excluded

from consolidation are 103 subsidiaries that in aggregate are immaterial to the net worth,

financial position and earnings of the Bayer Group; they account for less than 0.3 percent

of Group sales, less than 0.7 percent of stockholders equity and less than 0.4 percent of

total assets.

The effect of joint ventures on the Group balance sheet and income statement is as

follows:

2006 2006

million million

Current assets 21 Income 59

Noncurrent assets 56 Expenses (64)

Current liabilities (30)

Noncurrent liabilities (9)

Net assets 38 Income after taxes (5)

Notes to the Consolidated Financial Statements of the Bayer Group 2006

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2715

7 Consolidation methods Summary

The three consolidation methods give the same results as is shown by the following:

Worked example 4

Entity M has acquired 50% of Entity X.

Entity X Summary statement of financial position at year end

$

Non-current assets 600

Net current assets 400

_____

1,000

_____

Capital 200

Retained earnings 800

_____

1,000

_____

Statement of comprehensive income for the year

$

Revenue 600

Costs (400)

___

Profit 200

___

Required:

Calculate the net assets and profit of Entity X which will be included in the

consolidated financial statements of Entity M if Entity X is:

(a) a subsidiary;

(b) an associate;

(c) a jointly-controlled entity (using proportional consolidation).

SESSION 27 IAS 31 INTERESTS IN JOINT VENTURES

Accountancy Tuition Centre (International Holdings) Ltd 2008 2716

Worked solution 4

(a) Subsidiary (b) Associate (c) Joint venture

$ $ $

Non current 600 300

Net current 400 200

Investment in A 500

Non-controlling interests (500)

___ ___ ___

500 500 500

___ ___ ___

Included in

consolidated retained earnings 500 500 500

___ ___ ___

(a) Subsidiary (b) Associate (c) Joint venture

$ $ $

Revenue 600 300

Costs (400) (200)

Income from A 100

Non-controlling interests (100)

___ ___ ___

Profit for year 100 100 100

___ ___ ___

Focus

You should now be able to:

define joint ventures (i.e. jointly controlled operations, assets and entities);

distinguish between equity accounting and proportional consolidation;

describe and prepare accounts under the two formats of proportional

consolidation;

prepare consolidated financial statements to include a single subsidiary and a

joint venture (under both methods).

You might also like

- 09 Quang Linh Huynh-PDocument13 pages09 Quang Linh Huynh-PFahmi AbdullaNo ratings yet

- Internal Audit CharterDocument15 pagesInternal Audit CharterFahmi Abdulla100% (2)

- DipIFR-Session31 d08 Operating SegmentsDocument0 pagesDipIFR-Session31 d08 Operating SegmentsFahmi AbdullaNo ratings yet

- Paper 2.4 - ATC InternationalDocument0 pagesPaper 2.4 - ATC InternationalFahmi AbdullaNo ratings yet

- Acca p1 NotesDocument67 pagesAcca p1 NotesAsis KoiralaNo ratings yet

- Share Based PaymentDocument19 pagesShare Based PaymentFahmi AbdullaNo ratings yet

- Siv - Microwave ProjectDocument32 pagesSiv - Microwave ProjectFahmi AbdullaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Statement Analysis: Learning OutcomesDocument6 pagesFinancial Statement Analysis: Learning Outcomestushar gargNo ratings yet

- Daniel Dobbins PDFDocument1 pageDaniel Dobbins PDFAbhishek MishraNo ratings yet

- Unit 3: Indian Accounting Standard 7: Statement of Cash FlowsDocument37 pagesUnit 3: Indian Accounting Standard 7: Statement of Cash Flowspulkitddude_24114888No ratings yet

- Balance Sheet: As at 31st December, 2018Document22 pagesBalance Sheet: As at 31st December, 2018Ashutosh BiswalNo ratings yet

- Akl1 CH09Document41 pagesAkl1 CH09Candini NoviantiNo ratings yet

- The Need For AdjustmentDocument5 pagesThe Need For AdjustmentAnna CharlotteNo ratings yet

- ADV2Document3 pagesADV2Rommel RoyceNo ratings yet

- Jawaban Soal Siklus Dagang (Perpetual)Document10 pagesJawaban Soal Siklus Dagang (Perpetual)indira puspasariNo ratings yet

- Rastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Document3 pagesRastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Sagar ThakurNo ratings yet

- Latihan Laporan KeuanganDocument7 pagesLatihan Laporan KeuanganAldy HidayatNo ratings yet

- ACCT212 Individual Learning Project QuestionsDocument6 pagesACCT212 Individual Learning Project QuestionsRobert B. JacksonNo ratings yet

- 2020 Particulars Folio: Sold Inventories On AccountDocument22 pages2020 Particulars Folio: Sold Inventories On AccountAngry BirdNo ratings yet

- Lab Iii Audit of Sales and Collection Cycle: I. TujuanDocument8 pagesLab Iii Audit of Sales and Collection Cycle: I. TujuanyenitaNo ratings yet

- Safal Niveshak Stock Analysis Excel (Ver. 4.0) : How To Use This SpreadsheetDocument37 pagesSafal Niveshak Stock Analysis Excel (Ver. 4.0) : How To Use This Spreadsheetravi.youNo ratings yet

- Double Entry Book Keeping Rules Chapter - 03Document10 pagesDouble Entry Book Keeping Rules Chapter - 03Ramainne RonquilloNo ratings yet

- Eacc1614 Test 2 Memo 2021 AdjDocument10 pagesEacc1614 Test 2 Memo 2021 AdjshabanguntandoyenkosiNo ratings yet

- Ch13 - Statemnt of Cash FlowsDocument79 pagesCh13 - Statemnt of Cash FlowsRina KusumaNo ratings yet

- CIPRES ADORA R Drill On Partnership LiquidationDocument7 pagesCIPRES ADORA R Drill On Partnership LiquidationGumafelix, Jose Eduardo S.No ratings yet

- Accounting For PartnershipsDocument10 pagesAccounting For PartnershipsRicaRhayaMangahasNo ratings yet

- ReflectionDocument1 pageReflectionLindbergh SyNo ratings yet

- Ebook Financial Accounting 8Th Edition PDF Full Chapter PDFDocument67 pagesEbook Financial Accounting 8Th Edition PDF Full Chapter PDFjulie.morrill858100% (27)

- Case 33 California Pizza KitchenDocument10 pagesCase 33 California Pizza KitchenhnooyNo ratings yet

- Semi ElimDocument8 pagesSemi ElimMichael ArevaloNo ratings yet

- Differentiate Fiscal and Calendar Year: 2. Define Adjusting EntriesDocument9 pagesDifferentiate Fiscal and Calendar Year: 2. Define Adjusting EntriesGmef Syme FerreraNo ratings yet

- Incomplete RecordDocument30 pagesIncomplete RecordMuhammad TahaNo ratings yet

- Business Plan: Blozom BoutiqueDocument29 pagesBusiness Plan: Blozom BoutiqueOlives Fishers100% (1)

- Capital Structure Analysis OF: Maruti & InfosysDocument35 pagesCapital Structure Analysis OF: Maruti & Infosys42040No ratings yet

- Case Study On Financial Risk AnalysisDocument6 pagesCase Study On Financial Risk AnalysisolafedNo ratings yet

- 8011 Topper 21 101 503 550 10598 Basic Accounting Terms Up201904301415 1556613905 1714Document7 pages8011 Topper 21 101 503 550 10598 Basic Accounting Terms Up201904301415 1556613905 1714Madhu SNo ratings yet

- Intangible AssetsDocument63 pagesIntangible AssetsRico, Jalaica B.No ratings yet