Professional Documents

Culture Documents

European Ratings Distribution As of Second Quarter 2013: Credit Trends

Uploaded by

api-228714775Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

European Ratings Distribution As of Second Quarter 2013: Credit Trends

Uploaded by

api-228714775Copyright:

Available Formats

Credit Trends:

European Ratings Distribution As Of Second Quarter 2013

Global Fixed Income Research: Diane Vazza, Managing Director, New York (1) 212-438-2760; diane.vazza@standardandpoors.com Gregg Moskowitz, Associate Director, New York (1) 212-438-1838; gregg.moskowitz@standardandpoors.com

Table Of Contents

Definitions Of Regions

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 10, 2013 1

1202247 | 301967406

Credit Trends:

European Ratings Distribution As Of Second Quarter 2013

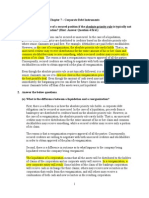

The Global Fixed Income Research team publishes a regional corporate issuer ratings distribution report every month, which analyzes data from the most recent quarter. This month we are highlighting Europe, which has seen its number of rated issuers rise to 1,289 as of June 30 from 1,262 in the previous quarter. The following are additional highlights from the second quarter: The 1,289 issuers are comprised of 849 investment- and 440 speculative-grade entities. The proportion of European speculative-grade issuers rose to 34.1% as of June 30 from 32.7% in the first quarter. The median rating of European entities declined to 'BBB' from 'BBB+' in the first quarter. The proportion of issuers rated in the 'A' category ('A+', 'A', 'A-') declined to 29.5% as of June 30 from 30.2% in the previous quarter. The proportion of issuers in the 'B' category ('B+', 'B', 'B-') increased to 18.7% from 17.5%. The majority of European issuers (57.9%) are nonfinancial entities. Financial issuers make up 55.5% of the investment-grade companies in the region. Nonfinancial issuers comprise 83.6% of the region's speculative-grade entities. As of the second quarter, the share of entities rated 'CCC' and below increased to 2.4%. By country, the greatest number of rated European entities are in the U.K. (23%), followed by France with 13% and Germany with 11%. Standard & Poor's assigned 43 new ratings to European entities in the second quarter. The downgrade to upgrade ratio is 1.28%. The financial institutions sector has the most issuers (329), followed by insurance. Europe accounts for 20% of all global corporate rated entities.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 10, 2013 2

1202247 | 301967406

Credit Trends: European Ratings Distribution As Of Second Quarter 2013

Chart 1

Table 1

European Issuer Ratings Distribution By Sector*

Sector All financials Financial institutions Insurance All nonfinancials Auto/capital goods/aero/metals Consumer and service Energy/natural resources Forestry, homebuilders Health care/chemicals High technology/office equipment Media and entertainment Real estate Telecommunications Transportation AAA 6 6 0 1 0 0 0 0 0 0 0 0 0 0 AA 79 47 32 24 3 2 5 0 5 0 0 0 0 6 A 257 128 129 123 19 12 11 2 17 3 1 2 6 6 BBB 129 84 45 230 38 31 7 9 17 3 22 13 16 16 BB 47 42 5 121 29 13 10 17 14 5 9 5 10 3 B 20 18 2 221 31 37 16 11 34 11 35 1 30 11 CCC and lower 5 4 1 26 7 3 2 3 1 1 5 1 0 2

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 10, 2013 3

1202247 | 301967406

Credit Trends: European Ratings Distribution As Of Second Quarter 2013

Table 1

European Issuer Ratings Distribution By Sector* (cont.)

Utility 1 3 44 58 6 4 1 *Data as of June 30, 2013. Includes parent and subsidiary level issuers. Source: Standard & Poor's Global Fixed Income Research, Standard & Poor's CreditPro.

Chart 2

Table 2

Summary Of Global Corporate Ratings Changes During Second Quarter 2013

Europe New ratings (count) Upgrades (%) Downgrades (%) Withdrawn ratings (%) Downgrade to upgrade ratio (%) 43 2.65 3.38 1.43 1.28 U.S. 115 3.73 2.70 1.81 0.72 Other developed 22 2.19 3.60 1.39 1.64 Emerging markets 71 4.60 2.82 2.25 0.61 Global 251 3.56 2.98 1.79 0.84

Data as of June 30, 2013. Includes parent and subsidiary level issuers. Source: Standard & Poor's Global Fixed Income Research, Standard & Poor's CreditPro.

Table 3

Issuer Ratings Distribution By Region*

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 10, 2013 4

1202247 | 301967406

Credit Trends: European Ratings Distribution As Of Second Quarter 2013

Table 3

Issuer Ratings Distribution By Region* (cont.)

Rating (% of total issuers) AAA AA A BBB BB B CCC and lower Total (count) Median rating Speculative grade (%) Europe 0.5 8.0 29.5 27.9 13.0 18.7 2.4 1289 BBB 34.1 U.S. 0.1 4.5 17.2 24.4 16.3 34.8 2.6 3148 BB+ 53.7 Other developed 0.5 8.3 33.2 31.0 11.4 13.1 2.6 665 BBB+ 27.1 Emerging markets 0.5 1.9 12.4 29.3 28.4 25.3 2.3 1417 BB+ 56.0 Global 0.3 5.1 20.2 26.9 17.8 27.3 2.5 6493 BBB47.5

*Data as of June 30, 2013. Note that the sum of the regions does not equate to the global total because some countries are components of multiple regions (for example, Latvia and Estonia are part of the European count as well as the emerging markets count). Includes parent and subsidiary level issuers. Sources: Standard & Poor's Global Fixed Income Research and Standard & Poor's CreditPro.

Definitions Of Regions

For these regional quarterly distribution studies we've divided global ratings into four regions: the U.S., Europe, other developed, and emerging markets. Note that the sum of the regions does not equal the global total because we have included some countries in multiple regions. (For example, Latvia and Estonia are part of the European count as well as the emerging markets total.)

U.S.:

The U.S., Bermuda, and the Cayman Islands.

Europe:

The U.K., Germany, France, the Netherlands, Sweden, Switzerland, Spain, Luxembourg, Ireland, Austria, Belgium, Norway, Denmark, Portugal, Greece, Poland, Finland, Italy, Czech Republic, Hungary, Bulgaria, Cyprus, Iceland, Slovakia, Lithuania, Malta, Slovenia, Latvia, Channel Islands, and Estonia.

Other developed:

Japan, Australia, New Zealand, and Canada.

Emerging markets:

Argentina, Azerbaijan, Bahamas, Bahrain, Barbados, Belarus, Belize, Bolivia, Bosnia-Herzegovina, Brazil, British Virgin Islands, Cambodia, Chile, China, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Dominican Republic, Egypt, El Salvador, Estonia, Fiji, Georgia, Guatemala, Hong Kong, Hungary, India, Indonesia, Israel, Jamaica, Jordan, Kazakhstan, Korea, Kuwait, Latvia, Lebanon, Liberia, Lithuania, Macao Special Administrative Region of China, Malaysia, Marshall Islands, Mauritius, Mexico, Mongolia, Montenegro, Morocco, Netherlands Antilles, Nigeria, Oman, Pakistan, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Qatar, Romania, Russian Federation, Saint Helena, Saudi Arabia, Singapore, Slovakia, Slovenia, South Africa, Sri Lanka, Syrian Arab Republic, Taiwan, Thailand, Togo, Trinidad and Tobago, Tunisia, Turkey, Ukraine, United Arab Emirates, Uruguay, Uzbekistan, Vanuatu,

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 10, 2013 5

1202247 | 301967406

Credit Trends: European Ratings Distribution As Of Second Quarter 2013

Venezuela, and Vietnam.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 10, 2013 6

1202247 | 301967406

Copyright 2013 by Standard & Poor's Financial Services LLC. All rights reserved. No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process. S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com (subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT

OCTOBER 10, 2013 7

1202247 | 301967406

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Strong Shekel and A Weak Construction Sector Are Holding Back Israel's EconomyDocument10 pagesA Strong Shekel and A Weak Construction Sector Are Holding Back Israel's Economyapi-228714775No ratings yet

- UntitledDocument7 pagesUntitledapi-228714775No ratings yet

- Investing in Infrastructure: Are Insurers Ready To Fill The Funding Gap?Document16 pagesInvesting in Infrastructure: Are Insurers Ready To Fill The Funding Gap?api-228714775No ratings yet

- Outlook On Slovenia Revised To Negative On Policy Uncertainty Ratings Affirmed at 'A-/A-2'Document9 pagesOutlook On Slovenia Revised To Negative On Policy Uncertainty Ratings Affirmed at 'A-/A-2'api-228714775No ratings yet

- Private BanksDocument11 pagesPrivate BanksCecabankNo ratings yet

- Ireland Upgraded To 'A-' On Improved Domestic Prospects Outlook PositiveDocument9 pagesIreland Upgraded To 'A-' On Improved Domestic Prospects Outlook Positiveapi-228714775No ratings yet

- UntitledDocument13 pagesUntitledapi-228714775No ratings yet

- Euro Money Market Funds Are Likely To Remain Resilient, Despite The ECB's Subzero Deposit RateDocument7 pagesEuro Money Market Funds Are Likely To Remain Resilient, Despite The ECB's Subzero Deposit Rateapi-231665846No ratings yet

- UntitledDocument21 pagesUntitledapi-228714775No ratings yet

- Standard & Poor's Perspective On Gazprom's Gas Contract With CNPC and Its Implications For Russia and ChinaDocument8 pagesStandard & Poor's Perspective On Gazprom's Gas Contract With CNPC and Its Implications For Russia and Chinaapi-228714775No ratings yet

- UntitledDocument7 pagesUntitledapi-228714775No ratings yet

- UntitledDocument25 pagesUntitledapi-228714775No ratings yet

- Islamic Finance Slowly Unfolds in Kazakhstan: Credit FAQDocument6 pagesIslamic Finance Slowly Unfolds in Kazakhstan: Credit FAQapi-228714775No ratings yet

- UntitledDocument9 pagesUntitledapi-228714775No ratings yet

- UntitledDocument9 pagesUntitledapi-228714775No ratings yet

- Spanish RMBS Index Report Q1 2014: Collateral Performance Continues To Deteriorate Despite Signs of Economic RecoveryDocument41 pagesSpanish RMBS Index Report Q1 2014: Collateral Performance Continues To Deteriorate Despite Signs of Economic Recoveryapi-228714775No ratings yet

- UntitledDocument8 pagesUntitledapi-228714775No ratings yet

- UntitledDocument7 pagesUntitledapi-228714775No ratings yet

- UntitledDocument14 pagesUntitledapi-228714775No ratings yet

- UntitledDocument53 pagesUntitledapi-228714775No ratings yet

- What's Holding Back European Securitization Issuance?: Structured FinanceDocument9 pagesWhat's Holding Back European Securitization Issuance?: Structured Financeapi-228714775No ratings yet

- Latvia Long-Term Rating Raised To 'A-' On Strong Growth and Fiscal Performance Outlook StableDocument8 pagesLatvia Long-Term Rating Raised To 'A-' On Strong Growth and Fiscal Performance Outlook Stableapi-228714775No ratings yet

- UntitledDocument11 pagesUntitledapi-228714775No ratings yet

- UntitledDocument9 pagesUntitledapi-228714775No ratings yet

- UntitledDocument14 pagesUntitledapi-228714775No ratings yet

- Romania Upgraded To 'BBB-/A-3' On Pace of External Adjustments Outlook StableDocument7 pagesRomania Upgraded To 'BBB-/A-3' On Pace of External Adjustments Outlook Stableapi-228714775No ratings yet

- UntitledDocument14 pagesUntitledapi-228714775No ratings yet

- UntitledDocument7 pagesUntitledapi-228714775No ratings yet

- UntitledDocument8 pagesUntitledapi-228714775No ratings yet

- Outlook On Portugal Revised To Stable From Negative On Economic and Fiscal Stabilization 'BB/B' Ratings AffirmedDocument9 pagesOutlook On Portugal Revised To Stable From Negative On Economic and Fiscal Stabilization 'BB/B' Ratings Affirmedapi-228714775No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- M5 MCQs SCIDocument28 pagesM5 MCQs SCIEveleen Gan100% (3)

- RX Guide - OverviewDocument77 pagesRX Guide - OverviewLorenzo MorosiniNo ratings yet

- NDB 2019 Ara 1 PDFDocument150 pagesNDB 2019 Ara 1 PDFFábio BorgesNo ratings yet

- Annual ReportDocument144 pagesAnnual ReportForeclosure FraudNo ratings yet

- Financial - DictionaryDocument242 pagesFinancial - DictionarySreni VasanNo ratings yet

- Pak Taufikur Bond and Their ValuationDocument40 pagesPak Taufikur Bond and Their ValuationRidhoVerianNo ratings yet

- Pointers To ReviewDocument5 pagesPointers To ReviewBeatrice Ella DomingoNo ratings yet

- Daimler AG Closed USD 21168 Millions Revolving Credit or Bridge Loan (RC or Bridge)Document3 pagesDaimler AG Closed USD 21168 Millions Revolving Credit or Bridge Loan (RC or Bridge)Othman Alaoui Mdaghri BenNo ratings yet

- Berkshire Hathaway Annual MeetingDocument18 pagesBerkshire Hathaway Annual Meetingbenclaremon100% (8)

- Glossary FinanceDocument81 pagesGlossary Financeapi-19986449No ratings yet

- TIFIA Program GuideDocument66 pagesTIFIA Program GuideKunqi ZhangNo ratings yet

- CMBS Primer 5th EditionDocument318 pagesCMBS Primer 5th Editionxavalarado100% (4)

- Eastboro Case SolutionDocument22 pagesEastboro Case Solutionuddindjm100% (2)

- (Lehman Brothers) A Guide To The Lehman Global Family of Fixed Income IndicesDocument47 pages(Lehman Brothers) A Guide To The Lehman Global Family of Fixed Income IndicesSiddhantNo ratings yet

- Ring Fencing ReportDocument52 pagesRing Fencing ReportAda C. MontagueNo ratings yet

- Unaudited Financial Results Half-Year Ended September 30, 2018Document16 pagesUnaudited Financial Results Half-Year Ended September 30, 2018Puja BhallaNo ratings yet

- HSBC Global Investment Funds - Global Emerging Markets Bond: Fund Objective and StrategyDocument11 pagesHSBC Global Investment Funds - Global Emerging Markets Bond: Fund Objective and StrategyChristopher RiceNo ratings yet

- Ratings Arbitrage and Structured ProductsDocument7 pagesRatings Arbitrage and Structured ProductsppateNo ratings yet

- Chapter 10Document32 pagesChapter 10REEMA BNo ratings yet

- Chapter 1 - OverviewDocument9 pagesChapter 1 - OverviewC12AYNo ratings yet

- Fitch EMEA Seaports - Peer Review 2023 - 2023-03-23Document27 pagesFitch EMEA Seaports - Peer Review 2023 - 2023-03-23Bob YuNo ratings yet

- Fixed Income Investments - BondsDocument39 pagesFixed Income Investments - BondsAntony PeterNo ratings yet

- JPMorgan Tactical 75-25 ETF Model Vs 75% MSCI ACWI - 23% US Agg - 2% CashDocument39 pagesJPMorgan Tactical 75-25 ETF Model Vs 75% MSCI ACWI - 23% US Agg - 2% CashofficeNo ratings yet

- Polaroid Corporation Case Solution - Final PDFDocument8 pagesPolaroid Corporation Case Solution - Final PDFPallab Paul0% (1)

- Fabozzi CH 07 HW AnswersDocument11 pagesFabozzi CH 07 HW AnswersDingo Baby100% (1)

- Case StudyDocument6 pagesCase StudyWelshfyn ConstantinoNo ratings yet

- Bond ValuationDocument51 pagesBond ValuationRudy Putro100% (1)

- Distressed Securities Class PresentationDocument42 pagesDistressed Securities Class Presentationvelandia1982100% (2)

- SIBUR - 1H 2020 - Results - PresentationDocument22 pagesSIBUR - 1H 2020 - Results - Presentation757rustamNo ratings yet

- Inside Job TermsDocument8 pagesInside Job TermsKavita SinghNo ratings yet