Professional Documents

Culture Documents

FRP

Uploaded by

Amit BhattacherjiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FRP

Uploaded by

Amit BhattacherjiCopyright:

Available Formats

FINANCE - PROFIT AND LOSS - IP Rings Ltd (Curr: Rs in Cr.

) As on 11/09/2013

COMPANY/FINANCE/PROFIT AND LOSS/2608/IP RingsCmbDetail0CmbCommonsize0CmbAnnual0

201303 (12) 201203 (12) 201103 (12) 201003 (12) 200903 (12) 200803 (12) 200703 (12) 200603 (12) 200503 (12) 200403 (12) 200303 (12) 200203 (12) 200103 (12) 200003 (12) 199903 (12)

INCOME :

Sales Turnover

95.18

91.26

87.63

73.51

54.93

62.75

58.03

56.36

51.52

47.68

39.31

31.02

33.62

32.97

28.47

Excise Duty

10.34

8.43

7.95

5.65

6.44

8.74

8.63

7.89

7.28

6.46

5.35

4.12

4.86

5.14

3.7

Net Sales

84.84

82.83

79.68

67.86

48.49

54.01

49.4

48.47

44.24

41.22

33.96

26.9

28.76

27.83

24.77

Other Income

0.2

0.23

0.26

0.1

0.1

0.06

0.22

0.25

0.63

1.17

0.55

1.09

0.86

0.81

0.7

Stock Adjustments

0.78

-0.92

1.36

0.35

-0.24

0.06

1.77

0.16

0.62

-0.57

0.15

-0.64

-0.21

0.86

0.32

Total Income

85.82

82.14

81.3

68.31

48.35

54.13

51.39

48.88

45.49

41.82

34.66

27.35

29.41

29.5

25.79

EXPENDITURE :

Raw Materials

Power & Fuel Cost

Employee Cost

Other Manufacturing Expenses

Selling and Administration Expenses

Miscellaneous Expenses

Less: Pre-operative Expenses Capitalised

34.39

6.89

13.87

15.4

7.29

2.43

0

30.93

4.99

12.49

14.44

7.41

2.52

0

30.3

4.29

10.62

13.73

7.24

2.43

0

24.28

3.05

7.86

10.2

7.22

2.03

0

17.34

1.9

6.49

7.83

5.59

1.97

0

19.52

1.98

6.2

9

6.12

2.05

0

18.66

1.94

4.57

7.77

6.09

1.61

0

16.67

2.06

3.95

6.34

6.47

1.46

0

15.2

2.21

3.74

6.3

5.38

2.15

0

13.98

1.86

3.73

5.53

4.73

1.82

0

11.54

1.59

2.79

4

3.86

2.21

0

9.1

1.27

2.3

3.98

3.27

1.32

0

9.59

1.2

2.27

3.83

3.7

1.33

0

10.18

1.22

1.97

4.12

3.56

1.51

0

9.04

1.02

1.61

3.06

3.98

1.28

0

Total Expenditure

80.27

72.78

68.61

54.64

41.12

44.87

40.64

36.95

34.98

31.65

25.99

21.24

21.92

22.56

19.99

Operating Profit

Interest

Gross Profit

Depreciation

Profit Before Tax

Tax

Fringe Benefit tax

Deferred Tax

Reported Net Profit

Extraordinary Items

Adjusted Net Profit

5.55

5.51

0.04

6.46

-6.42

0

0

-2.24

-4.18

-0.07

-4.11

9.36

3.61

5.75

5.46

0.29

0

0

-0.29

0.58

0

0.58

12.69

1.2

11.49

4.74

6.75

2.15

0

-0.09

4.69

-0.03

4.72

13.67

0.99

12.68

4.52

8.16

2.8

0

-0.2

5.56

0

5.56

7.23

0.76

6.47

4.86

1.61

0.95

0.1

-0.53

1.09

0

1.09

9.26

0.72

8.54

4.53

4.01

1.65

0.09

-0.23

2.5

-0.01

2.51

10.75

0.58

10.17

4.14

6.03

1.75

0.09

0.3

3.89

-0.01

3.9

11.93

0.35

11.58

3.83

7.75

2.5

0.12

0.01

5.12

-0.01

5.13

10.51

0.16

10.35

3

7.35

1.05

0

1.3

5

0.1

4.9

10.17

0.12

10.05

2.95

7.1

2.35

0

-0.05

4.8

0.27

4.53

8.67

0.16

8.51

2.86

5.65

2.53

0

-0.06

3.18

-0.05

3.23

6.11

0.29

5.82

3.05

2.77

1.09

0

-0.1

1.78

-0.04

1.82

7.49

0.38

7.11

2.86

4.25

1.1

0

0

3.15

0.23

2.92

6.94

0.37

6.57

2.53

4.04

0.81

0

0

3.23

0.01

3.22

5.8

0.47

5.33

2.33

3

0.65

0

0

2.35

0

2.35

Adjst. below Net Profit

P & L Balance brought forward

Statutory Appropriations

Appropriations

P & L Balance carried down

0

0.5

0

0

-3.68

0

0.74

0

0.82

0.5

0

0.5

0

4.45

0.74

0

0.4

0

5.46

0.5

0

0.13

0

0.82

0.4

0

0.09

0

2.46

0.13

0

0.22

0

4.02

0.09

0

0.43

0

5.33

0.22

0

0.82

0

5.39

0.43

0

1.4

0

5.38

0.82

0

0.05

0

1.83

1.4

0

0.03

0

1.76

0.05

0

0.02

0

3.14

0.03

0

0.22

0

3.43

0.02

0

0.89

0

3.02

0.22

Dividend

Preference Dividend

Equity Dividend %

Dividend Per Share(Rs)

Earnings Per Share-Unit Curr

Earnings Per Share(Adj)-Unit Curr

Book Value-Unit Curr

Book Value(Adj)-Unit Curr

Dividend Per Share Adj.(Rs)

0

0

0

0

0

0

62.59

62.59

0

0.71

0

10

1

0.67

0.67

68.51

68.51

1

2.11

0

30

3

6.18

6.18

68.85

68.85

3

2.11

0

30

3

7.4

7.4

65.67

65.67

3

0.7

0

10

1

1.38

1.38

61.26

61.26

1

1.76

0

25

0

3.13

3.13

60.88

60.88

0

1.94

0

27.5

0

5.06

5.06

60.26

60.26

0

2.46

0

35

0

6.75

6.75

57.95

57.95

0

2.11

0

30

0

6.7

6.7

54.7

54.7

0

2.11

0

30

0

6.43

6.43

50.99

50.99

0

1.41

0

20

0

4.26

4.26

47.57

47.57

0

1.06

0

15

0

2.53

2.53

45.31

45.31

0

1.76

0

25

0

4.22

4.22

50.87

50.87

0

1.76

0

25

0

4.2

4.2

49.15

49.15

0

1.06

0

15

0

3.18

3.18

47.44

47.44

0

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Router Configuration Entering ConfigurationsDocument2 pagesRouter Configuration Entering ConfigurationsAmit BhattacherjiNo ratings yet

- Case Study: Subject: Micro EconomicsDocument6 pagesCase Study: Subject: Micro EconomicsAmit BhattacherjiNo ratings yet

- Twelve: Monopolistic Competition: The Competitive Model in A More Realistic SettingDocument21 pagesTwelve: Monopolistic Competition: The Competitive Model in A More Realistic SettingAmit BhattacherjiNo ratings yet

- Ashok Griha Udyog Kendra (P) LimitedDocument9 pagesAshok Griha Udyog Kendra (P) LimitedAmit BhattacherjiNo ratings yet

- Consumers' Buying Behavior - Amit, Supriya, RohitDocument8 pagesConsumers' Buying Behavior - Amit, Supriya, RohitAmit BhattacherjiNo ratings yet

- Case - 3 HSBCDocument7 pagesCase - 3 HSBCAmit BhattacherjiNo ratings yet

- 10-2 Strategic Management ProcessDocument17 pages10-2 Strategic Management ProcessMichael DawkinsNo ratings yet

- Presentation On ControllingDocument25 pagesPresentation On ControllingAmit BhattacherjiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- GFR IiiDocument128 pagesGFR Iiiavinash_vyas77813No ratings yet

- F R O M C A R R I E R MC# DOT Driver Truck # Trailer # Cell #Document2 pagesF R O M C A R R I E R MC# DOT Driver Truck # Trailer # Cell #Syed Baddar Bin ShujaNo ratings yet

- The Impact of COVID 19 Towards International Business Strategy: A Study of Coca-Cola CompanyDocument20 pagesThe Impact of COVID 19 Towards International Business Strategy: A Study of Coca-Cola CompanyDEBARPAN ADHIKARINo ratings yet

- MaricoDocument13 pagesMaricoMeghana NaiduNo ratings yet

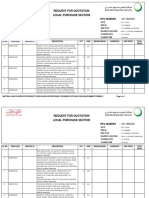

- Request For Quotation Local Purchase Section: RFQ NumberDocument4 pagesRequest For Quotation Local Purchase Section: RFQ NumberAbu Ali EltaherNo ratings yet

- CIPD - 2023 Learning at Work Survey ReportDocument52 pagesCIPD - 2023 Learning at Work Survey ReportAdarsh Sreenivasan LathikaNo ratings yet

- 2023 Rafael Aguirre-Sacasa CVDocument3 pages2023 Rafael Aguirre-Sacasa CVCalifornia Stem Cell ReportNo ratings yet

- Thomas DeMark ScriptDocument8 pagesThomas DeMark ScriptphilipskembarenNo ratings yet

- MathDocument5 pagesMathSayed Mohsin KazmiNo ratings yet

- Securities (Overweight - Initiate)Document41 pagesSecurities (Overweight - Initiate)Danh Phạm ThànhNo ratings yet

- CH 7 7 7 TBDocument40 pagesCH 7 7 7 TBRabie HarounNo ratings yet

- Chapter 6 Production and Cost Analysis in The Long RunDocument16 pagesChapter 6 Production and Cost Analysis in The Long Runtk_atiqahNo ratings yet

- Clay Brick Plant LayoutDocument4 pagesClay Brick Plant LayoutAsim Begic100% (2)

- MCQ's On Intellectual Property Act - SpeakHRDocument6 pagesMCQ's On Intellectual Property Act - SpeakHRTkNo ratings yet

- Granularity of GrowthDocument4 pagesGranularity of GrowthAlan TangNo ratings yet

- BM Ia Sample - Mccafe PDFDocument8 pagesBM Ia Sample - Mccafe PDFGermanRobertoFong100% (1)

- Understanding Consumer and Business Buyer BehaviorDocument36 pagesUnderstanding Consumer and Business Buyer BehaviorAlrifai Ziad Ahmed100% (5)

- Revised Syllabus W.E.F. 2016-17 Retail Management: Dr. Rupali Jain Nagindas Khandwala CollegeDocument22 pagesRevised Syllabus W.E.F. 2016-17 Retail Management: Dr. Rupali Jain Nagindas Khandwala Collegeansari naseem ahmadNo ratings yet

- BBA 1st, 2nd, 3rd-8th Semester, Fall 2023, Exam RoutineDocument3 pagesBBA 1st, 2nd, 3rd-8th Semester, Fall 2023, Exam Routinemustainibneselim2002No ratings yet

- LCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Dec-2017Document16 pagesLCCI Level 3 Certificate in Accounting ASE20104 ASE20104 Dec-2017Aung Zaw HtweNo ratings yet

- Avon Rewards Booklet October 2022 and Training2Document9 pagesAvon Rewards Booklet October 2022 and Training2Nazneen AliNo ratings yet

- Gohida Industrial PLC One YearDocument20 pagesGohida Industrial PLC One YearAbel GetachewNo ratings yet

- PTX - Past Year Set ADocument8 pagesPTX - Past Year Set ANUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- 16 August AI PharmaDocument3 pages16 August AI PharmahiteshguptaNo ratings yet

- CBE Lead Auditor Course ENDocument2 pagesCBE Lead Auditor Course ENSaid AbdallahNo ratings yet

- L2-Value ChainDocument2 pagesL2-Value ChainAyodele OgundipeNo ratings yet

- Construction Cost Insight Report: Research - September 2021Document5 pagesConstruction Cost Insight Report: Research - September 2021dev dasNo ratings yet

- PWC Global Annual Review 2013Document60 pagesPWC Global Annual Review 2013hermesstrategyNo ratings yet

- 01 Session Notes Taxation 1Document5 pages01 Session Notes Taxation 1Janelle ManzanoNo ratings yet

- Master Plan PDFDocument335 pagesMaster Plan PDFYash MaheshwariNo ratings yet