Professional Documents

Culture Documents

Form 15 CB

Uploaded by

Adarsh Singh KshatriyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 15 CB

Uploaded by

Adarsh Singh KshatriyaCopyright:

Available Formats

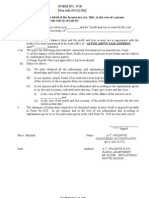

FORM 15 CB

(See rule 37BB) Certificate of an accountant I/we have examined the agreement (wherever applicable) between Mr/Ms/M/s. and Mr/Ms/M/s (Remitters) (Beneficiary) requiring the above remittances as well as the relevant documents and books of accounts required for ascertaining the nature of remittance and for determining the rate of deduction of tax at source as per provisions of chapter XVII-B. We hereby certify the following:A B 1 2 3 4 5 6 7 8 Name and address of the benificiary of the remittance Country to which remittance is made Amount payable Name of the bank BSR Code of the bank (7digit) Proposed date of remittance Nature of remittance as per agreement / document In case the remittance is net of tax whether tax payable has been groseed up Taxability under the provisions of the Income tax Act (without considering DTAA) (a) the relevant section of the act under which the remittance is covered (b) the amount of income chargeable to tax (c ) the tax liability (d) basis of determining taxable income and tax liability if any releif is claimed under DTAA (i) whether tax residency certificate is obtained from the receipient of remittance (ii) please specify relevant DTAA (iii) taxable income as per DTAA (iv) tax liability as per DTAA A. If the remittance is for royalties, fee for technical services, interest,dividend,etc (not connected with permanent establishment) please indicate:(a) Article of DTAA (b) Rate of TDS required to be deducted in terms of such article of the applicable DTAA B. In case the remittance is on account of business income,please indicate:(a) The amount of income liable to tax in India Country: In foreign currency: Branch of the bank (DD/MM/YYYY) Currency : In Indian Rs.

(Tick) Yes No

(Tick) Yes No

Nature of Payment as per DTAA

(Tick) Yes No

As per DTAA (%)

(Tick) Yes No

10 11

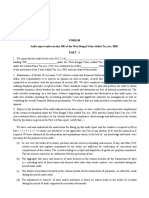

(b) The basis of arriving at the rate ofdeduction of tax C. In case the remittance is on account of capital gains, please indicate:(a) amount of long term capital gains (b) amount of short term capital gains (c ) basis of arriving at taxable income D. In case of other remittance not covered by sub items A,B and C (a) Please specify nature of remittance . (b) Whether taxable in india as per DTAA (c ) If yes, rate of TDS required to be deducted in terms of such article of the applicable DTAA (d) if not, the please furnish brief reasons thereof specifying relevant article of DTAA Amount of TDS Rate of TDS Actual amount of remittance after TDS Date of deduction of tax at source. If any

(Tick) Yes No

(Tick) Yes No

In foreign currency In Indian Rs. As per Income-tax Act (%) or As per DTAA (%)

12 13

(DD/MM/YYYY) Signature: Name: Name of the proprietorship/firm: Address: Registration No.

Certificate No.

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Foreign Exchange 1Document32 pagesForeign Exchange 1Abhay ParkarNo ratings yet

- Strama-Ayala Land, Inc.Document5 pagesStrama-Ayala Land, Inc.Akako MatsumotoNo ratings yet

- U.S. Individual Income Tax Return: Miller 362-94-3108 DeaneDocument2 pagesU.S. Individual Income Tax Return: Miller 362-94-3108 DeaneKeith MillerNo ratings yet

- Quiz MicrobiologyDocument65 pagesQuiz MicrobiologyMedShare98% (51)

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Movie ReviewDocument2 pagesMovie ReviewJohanna Gwenn Taganahan LomaadNo ratings yet

- Fundamental of Transport PhenomenaDocument521 pagesFundamental of Transport Phenomenaneloliver100% (2)

- Form No. 15CBDocument3 pagesForm No. 15CBParth UpadhyayNo ratings yet

- Form No. 15CB: B 1. Country To Which Remittance Is MadeDocument3 pagesForm No. 15CB: B 1. Country To Which Remittance Is MadeDaman GillNo ratings yet

- Form 15ca FormatDocument4 pagesForm 15ca FormattejashtannaNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- A SimDocument4 pagesA Simsana_rautNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Form 16Document3 pagesForm 16Bijay TiwariNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Form No 16Document4 pagesForm No 16Md ZhidNo ratings yet

- BD0010990 Co Code: LC NO: 154013010272Document2 pagesBD0010990 Co Code: LC NO: 154013010272D M Shafiqul IslamNo ratings yet

- (See Rule 31 (1) (B) )Document2 pages(See Rule 31 (1) (B) )B RNo ratings yet

- Flytxt - ECB Interest - Form 15CB - 21 Nov 22Document4 pagesFlytxt - ECB Interest - Form 15CB - 21 Nov 22RahulNo ratings yet

- A1 For Import Goods PaymentsDocument3 pagesA1 For Import Goods PaymentskollarajasekharNo ratings yet

- Wa0008.Document7 pagesWa0008.amyashu22No ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- For All "Bank To Bank" Telex Transfers: Policy Number/s Currency Option USD SAR CAD GBP EUR INR OthersDocument2 pagesFor All "Bank To Bank" Telex Transfers: Policy Number/s Currency Option USD SAR CAD GBP EUR INR Otherskarpagam nddNo ratings yet

- Sample in QDocument8 pagesSample in QMOHD SUHAILNo ratings yet

- Form No. 16: Finotax 1 of 3Document3 pagesForm No. 16: Finotax 1 of 3dugdugdugdugiNo ratings yet

- Form VAT - 17: Return by A Registered PersonDocument3 pagesForm VAT - 17: Return by A Registered PersonYf WoonNo ratings yet

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADocument16 pagesForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ARaj PalNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxNo ratings yet

- Umesh C-Form16 - 2020-21Document10 pagesUmesh C-Form16 - 2020-21Umesh CNo ratings yet

- FX 5Document3 pagesFX 5madhaventerprisesjdpNo ratings yet

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument3 pagesCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharNo ratings yet

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Form 16 Excel FormatDocument4 pagesForm 16 Excel FormatAUTHENTIC SURSEZNo ratings yet

- Form 15CADocument4 pagesForm 15CAManoj MahimkarNo ratings yet

- CertificateDocument2 pagesCertificateapi-3822396No ratings yet

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Document2 pages(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Form No. 3Cb (See Rule 6G (1) (B) )Document12 pagesForm No. 3Cb (See Rule 6G (1) (B) )Jay MogradiaNo ratings yet

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuNo ratings yet

- Revised Request Letter Format For Import Remittance (Advance & Direct)Document3 pagesRevised Request Letter Format For Import Remittance (Advance & Direct)SALE EXECUTIVES75% (4)

- Form 16a New FormatDocument2 pagesForm 16a New FormatJayNo ratings yet

- 15 CaDocument8 pages15 CadamanNo ratings yet

- 3 - Place of Supply Long Answer Type QuestionsDocument7 pages3 - Place of Supply Long Answer Type QuestionsMighty SinghNo ratings yet

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDocument6 pages(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashNo ratings yet

- Sample Inwward RemittanceDocument5 pagesSample Inwward RemittancejgaeqNo ratings yet

- S.No Particulars: Client Name: Period EndedDocument19 pagesS.No Particulars: Client Name: Period EndedNeelam GoelNo ratings yet

- All About Form 15CA Form 15CBDocument6 pagesAll About Form 15CA Form 15CBKirti SanghaviNo ratings yet

- Form27d Applicable From 01.04Document2 pagesForm27d Applicable From 01.04sudhrengeNo ratings yet

- New VAT Audit FormatDocument12 pagesNew VAT Audit FormatTarifNo ratings yet

- 5 - Principles of Taxation07092021Document10 pages5 - Principles of Taxation07092021Jahirul IslamNo ratings yet

- RTGS&NEFTDocument1 pageRTGS&NEFTsubhra_p_dey1978No ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Form 15CB - Filed FormDocument4 pagesForm 15CB - Filed FormBhagya RajoriaNo ratings yet

- FORM A2 Revised FormDocument6 pagesFORM A2 Revised Formcopy catNo ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- Role of DDO in GovtDocument27 pagesRole of DDO in GovtPratik ViholNo ratings yet

- Withholding Tax (Eng)Document10 pagesWithholding Tax (Eng)WN TV programsNo ratings yet

- Cent27 2012 AnnxDocument4 pagesCent27 2012 Annxyogesh_gunaNo ratings yet

- User Manual With FAQs - Party Address Label PrintingDocument9 pagesUser Manual With FAQs - Party Address Label PrintingAdarsh Singh KshatriyaNo ratings yet

- TDL Reference ManualDocument684 pagesTDL Reference ManualJumriyahNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Adarsh Singh KshatriyaNo ratings yet

- StepDocument2 pagesStepAdarsh Singh KshatriyaNo ratings yet

- Form 15 CBDocument2 pagesForm 15 CBAdarsh Singh KshatriyaNo ratings yet

- Operations Management-CP PDFDocument4 pagesOperations Management-CP PDFrey cedricNo ratings yet

- Houses WorksheetDocument3 pagesHouses WorksheetYeferzon Clavijo GilNo ratings yet

- Critical Evaluation of Biomedical LiteraturesDocument34 pagesCritical Evaluation of Biomedical LiteraturesPratibha NatarajNo ratings yet

- Adressverificationdocview Wss PDFDocument21 pagesAdressverificationdocview Wss PDFabreddy2003No ratings yet

- Job Description: Jette Parker Young Artists ProgrammeDocument2 pagesJob Description: Jette Parker Young Artists ProgrammeMayela LouNo ratings yet

- Factoring Problems-SolutionsDocument11 pagesFactoring Problems-SolutionsChinmayee ChoudhuryNo ratings yet

- Soft Skills PresentationDocument11 pagesSoft Skills PresentationRishabh JainNo ratings yet

- Dental CeramicsDocument6 pagesDental CeramicsDeema FlembanNo ratings yet

- Assignment 2 Format Baru 17042011Document8 pagesAssignment 2 Format Baru 17042011Noor Zilawati SabtuNo ratings yet

- A Detailed Lesson Plan - The Fundamental Law of ProportionDocument10 pagesA Detailed Lesson Plan - The Fundamental Law of ProportionPrincess De LeonNo ratings yet

- My Husband'S Family Relies On Him Too Much.... : Answered by Ustadha Zaynab Ansari, Sunnipath Academy TeacherDocument4 pagesMy Husband'S Family Relies On Him Too Much.... : Answered by Ustadha Zaynab Ansari, Sunnipath Academy TeacherAlliyahNo ratings yet

- LAID BACK - Sunshine ReggaeDocument16 pagesLAID BACK - Sunshine ReggaePablo ValdezNo ratings yet

- Aptitude For Civil ServicesDocument17 pagesAptitude For Civil Servicesnagarajuvcc123No ratings yet

- 7C Environment Test 2004Document2 pages7C Environment Test 2004api-3698146No ratings yet

- Spoken Word (Forever Song)Document2 pagesSpoken Word (Forever Song)regNo ratings yet

- National Service Training Program 1Document13 pagesNational Service Training Program 1Charlene NaungayanNo ratings yet

- The Foundations of Ekistics PDFDocument15 pagesThe Foundations of Ekistics PDFMd Shahroz AlamNo ratings yet

- Bos 22393Document64 pagesBos 22393mooorthuNo ratings yet

- ColceruM-Designing With Plastic Gears and General Considerations of Plastic GearingDocument10 pagesColceruM-Designing With Plastic Gears and General Considerations of Plastic GearingBalazs RaymondNo ratings yet

- Securingrights Executive SummaryDocument16 pagesSecuringrights Executive Summaryvictor galeanoNo ratings yet

- Chapter 4 Higher Order Differential EquationsDocument50 pagesChapter 4 Higher Order Differential EquationsAlaa TelfahNo ratings yet

- TestertDocument10 pagesTestertjaiNo ratings yet

- The Organization of PericentroDocument33 pagesThe Organization of PericentroTunggul AmetungNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Business Research Chapter 1Document27 pagesBusiness Research Chapter 1Toto H. Ali100% (2)