Professional Documents

Culture Documents

Whitehall: Monitoring The Markets Vol. 3 Iss. 38 (October 16, 2013)

Uploaded by

Whitehall & CompanyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Whitehall: Monitoring The Markets Vol. 3 Iss. 38 (October 16, 2013)

Uploaded by

Whitehall & CompanyCopyright:

Available Formats

Volume 3, Issue 38 October 16, 2013

Whitehall

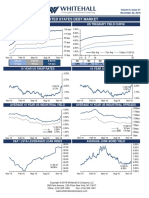

UNITED STATES DEBT MARKET

US Libor

6 mth 3 mth 1 mth 90 bps 80 bps 70 bps 60 bps 50 bps 40 bps 30 bps 20 bps 10 bps 0 bps 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% I I 30yr Avg 15yr Avg Today (10/16/13)

US Treasury Yield Curve

23

Libor 10/16/13 1 month 17 bps 3 month 24 bps 6 month 36 bps

I 5

I 7

I 10

2yr 3yr 5yr 7yr

I 30

UST 10/16/13

10yr

30yr

0.35% 0.71% 1.44% 1.95% 2.72% 3.77%

10 Year US Swap Rates

10/16/13 2.85% 3.00% 2.50% 2.00% 1.50% 1.00% 10/16/13 2.72%

10 Year US Treasury

3.00% 2.50% 2.00% 1.50% 1.00%

Average 10 Year US Industrial Yield

4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00%

Average 10 Year US Industrial Spreads

225 bps 200 bps 175 bps 150 bps 125 bps 100 bps 75 bps 50 bps 25 bps 0 bps

10/16/13 A 3.61% BBB 4.48%

10/16/13 A 92 bps BBB 179 bps

S&P/LSTA Leveraged Loan Index

10/16/13 97.55% 98.75 98.25 97.75 97.25 96.75 96.25 95.75 95.25 94.75

Average Junk-Bond Yield

10/16/13 6.23 % 7.75% 7.25% 6.75% 6.25% 5.75% 5.25% 4.75%

Source: Bloomberg This market letter is not to be construed as a recommendation to buy, hold or sell any particular security. Copyright 2013 Whitehall & Company, LLC 7 Times Square, 46th Floor, New York, NY 10036 Office: (212) 205-1380 Fax: (212) 205-1381 www.whitehallandcompany.com

Volume 3, Issue 38 October 16, 2013

Whitehall

SELECT US PRIVATE PLACEMENTS

Type

Snr Notes

Date

10/11 BASF

Issuer

$mm

$1,250

Years Spread

12 15 21 12 15 10 12 15 7 10 10 15 30 30 125bps 145bps 120bps 130bps 135bps 100bps 110bps 130bps 225bps 230bps 130bps 165bps 150bps 160bps

Coupon

3.89% 4.09% 4.43% N/A 3.64% 3.74% 3.94% 4.29% 4.94% N/A

Rating

1

Sector

Basic Materials

Country

Germany

10/11 McCain Foods Ltd 10/11 DTE Gas Co

Snr Notes FMB

$250 $170

2 N/A

Consumer, NonCyclical Utilities

Canada USA

10/11 Associated Estates Realty Corp 10/11 United Illuminating Companies

Snr Notes Snr Notes

$100 $135

2 2

Financial Utilities

USA USA

Public and private market information is from sources that are deemed reliable, but information has not been confirmed.

US PUBLIC MARKET ISSUANCES

SELECT INVESTMENT GRADE ISSUANCES

Date Issuer Type

Snr Notes Snr Notes Snr Notes

$mm

$950 $1,350 $2,750

Years Spread

30 10 30 5 10 30 3 3 200bps 140bps 165bps 120bps 180bps 165bps FRN 42bps

Coupon

5.63% 4.00% 5.38% 2.50% 4.38% 5.38% L+29bps 6.50%

Rating

A1/AAA3 Aa3/A+

Sector

Basic Materials Utilities Energy

Country

Chile United Kingdom China

10/10 Corp Nacional del Cobre de Chile 10/10 Centrica PLC 10/9 Sinopec Group Overseas Development Ltd 10/8 John Deere Capital Corp

Source: Bloomberg

Snr Notes

$750

A2/A

Industrial

USA

SELECT BELOW INVESTMENT GRADE ISSUANCES

Date

10/8

Issuer

T-Mobile USA Inc

Type

Snr Notes

$mm

$3,100

Years Spread

6 7 8 9 10 5 7 10 441bps 460bps 447bps 444bps 450bps N/A

Coupon

6.46% 6.52% 6.63% 6.73% 6.83% 7.13% 6.00% 5.00%

Rating

Ba3/BB

Sector

Communications

Country

USA

10/7

Virgin Australia Holdings Ltd

Snr Sec

$733

Ba3

Consumer, Cyclical

Australia

Source: Bloomberg

SELECT CLOSED SYNDICATED LOANS

Date Issuer Type

Revolver Term Revolver

$mm

$250 $2,500 $1,000

Months

60 84 60

Spread

L+225bps L+250bps L+175bps

Rating

BB+ BB

Sector

Technology Energy

10/11 Activision Blizzard Inc 10/7 Crestwood Midstream Partners LP

Source: Bloomberg

CONTACT WHITEHALL

Jonathan Cody Managing Director (646) 450-9750 jp.cody@ whitehallandcompany.com Timothy Page Managing Director (212) 205-1399 timothy.page@ whitehallandcompany.com Roland DaCosta Managing Director (212) 205-1394 roland.dacosta@ whitehallandcompany.com Oliver Langel Managing Director (212) 205-1386 oliver.langel@ whitehallandcompany.com Vincas Snipas Managing Director (212) 205-1385 vincas.snipas@ whitehallandcompany.com Susan Vick Managing Director (212) 205-1398 susan.vick@ whitehallandcompany.com Brian Burchfield Director (212) 205-1395 brian.burchfield@ whitehallandcompany.com

Natalia Kotlyarchuk Vice President (212) 205-1396 natalia.kotlyarchuk@ whitehallandcompany.com

Nicholas Page Associate (212) 205-1389 nicholas.page@ whitehallandcompany.com

Gabrielle Sullivan Analyst (212) 205-1383 gabrielle.sullivan@ whitehallandcompany.com

Blaine Burke Analyst (212) 205-1382 blaine.burke@ whitehallandcompany.com

This market letter is not to be construed as a recommendation to buy, hold or sell any particular security. Copyright 2013 Whitehall & Company, LLC 7 Times Square, 46th Floor, New York, NY 10036 Office: (212) 205-1380 Fax: (212) 205-1381 www.whitehallandcompany.com

You might also like

- Capital Market Report TypesDocument32 pagesCapital Market Report TypesRahul Ghosale100% (1)

- Bond Market Strategies ECOM074 PDFDocument5 pagesBond Market Strategies ECOM074 PDFBen OusoNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 33 (September 10, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 33 (September 10, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 34 (September 17, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 34 (September 17, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 43 (November 19, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 43 (November 19, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 22 (June 11, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 22 (June 11, 2013)Whitehall & CompanyNo ratings yet

- 2.46 Whitehall: Monitoring The Markets Vol. 2 Iss. 46 (November 13, 2012)Document2 pages2.46 Whitehall: Monitoring The Markets Vol. 2 Iss. 46 (November 13, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 46 (December 10, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 46 (December 10, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 45 (December 3, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 45 (December 3, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 31 (August 20, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 31 (August 20, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 27 (July 23, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 27 (July 23, 2013)Whitehall & CompanyNo ratings yet

- 2.42 Whitehall: Monitoring The Markets Vol. 2 Iss. 42 (October 16, 2012)Document2 pages2.42 Whitehall: Monitoring The Markets Vol. 2 Iss. 42 (October 16, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 13 (April 8, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 13 (April 8, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 23 (June 18, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 23 (June 18, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 28 (July 30, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 28 (July 30, 2013)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 20 (May 29, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 20 (May 29, 2013)Whitehall & CompanyNo ratings yet

- 2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Document2 pages2.29 Whitehall: Monitoring The Markets Vol. 2 Iss. 29 (July 17, 2012)Whitehall & CompanyNo ratings yet

- 2.41 Whitehall: Monitoring The Markets Vol. 2 Iss. 41 (October 9, 2012)Document2 pages2.41 Whitehall: Monitoring The Markets Vol. 2 Iss. 41 (October 9, 2012)Whitehall & CompanyNo ratings yet

- 2.40 Whitehall: Monitoring The Markets Vol. 2 Iss. 40 (October 2, 2012)Document2 pages2.40 Whitehall: Monitoring The Markets Vol. 2 Iss. 40 (October 2, 2012)Whitehall & Company0% (1)

- 2.49 Whitehall: Monitoring The Markets Vol. 2 Iss. 49 (December 4, 2012)Document2 pages2.49 Whitehall: Monitoring The Markets Vol. 2 Iss. 49 (December 4, 2012)Whitehall & CompanyNo ratings yet

- 2.47 Whitehall: Monitoring The Markets Vol. 2 Iss. 47 (November 20, 2012)Document2 pages2.47 Whitehall: Monitoring The Markets Vol. 2 Iss. 47 (November 20, 2012)Whitehall & CompanyNo ratings yet

- MTM 239 2012-09-25Document2 pagesMTM 239 2012-09-25whitehall4883No ratings yet

- 2.45 Whitehall: Monitoring The Markets Vol. 2 Iss. 45 (November 6, 2012)Document2 pages2.45 Whitehall: Monitoring The Markets Vol. 2 Iss. 45 (November 6, 2012)Whitehall & CompanyNo ratings yet

- 2.23 Whitehall: Monitoring The Markets Vol. 2 Iss. 23 (June 5, 2012)Document2 pages2.23 Whitehall: Monitoring The Markets Vol. 2 Iss. 23 (June 5, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 45 (November 8, 2016)Whitehall & CompanyNo ratings yet

- United States Debt Market: Us Libor Us Treasury Yield CurveDocument2 pagesUnited States Debt Market: Us Libor Us Treasury Yield CurveWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 31 (August 19, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 31 (August 19, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 21 (June 10, 2014)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 40 (November 4, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 40 (November 4, 2014)Whitehall & CompanyNo ratings yet

- 1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Document2 pages1.37 Whitehall: Monitoring The Markets Vol. 1 Iss. 37 (October 12, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 43 (November 17, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 38 (October 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 17 (May 13, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 17 (May 13, 2014)Whitehall & CompanyNo ratings yet

- 2.24 Whitehall: Monitoring The Markets Vol. 2 Iss. 24 (June 12, 2012)Document2 pages2.24 Whitehall: Monitoring The Markets Vol. 2 Iss. 24 (June 12, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 3 Iss. 35 (September 24, 2013)Document2 pagesWhitehall: Monitoring The Markets Vol. 3 Iss. 35 (September 24, 2013)Whitehall & CompanyNo ratings yet

- 1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Document2 pages1.46 Whitehall: Monitoring The Markets Vol. 1 Iss. 46 (December 13, 2011)Whitehall & CompanyNo ratings yet

- 2.22 Whitehall: Monitoring The Markets Vol. 2 Iss. 22 (May 30, 2012)Document2 pages2.22 Whitehall: Monitoring The Markets Vol. 2 Iss. 22 (May 30, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 39 (October 28, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 39 (October 28, 2014)Whitehall & CompanyNo ratings yet

- 2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Document2 pages2.15 Whitehall: Monitoring The Markets Vol. 2 Iss. 15 (April 10, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 44 (December 16, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 44 (December 16, 2014)Whitehall & CompanyNo ratings yet

- 1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Document2 pages1.47 Whitehall: Monitoring The Markets Vol. 1 Iss. 47 (December 20, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 4 Iss. 26 (July 15, 2014)Document2 pagesWhitehall: Monitoring The Markets Vol. 4 Iss. 26 (July 15, 2014)Whitehall & CompanyNo ratings yet

- 2.31 Whitehall: Monitoring The Markets Vol. 2 Iss. 31 (July 31, 2012)Document2 pages2.31 Whitehall: Monitoring The Markets Vol. 2 Iss. 31 (July 31, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 25 (July 16, 2015)Whitehall & CompanyNo ratings yet

- 2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Document2 pages2.19 Whitehall: Monitoring The Markets Vol. 2 Iss. 19 (May 9, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 44 (November 1, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 44 (November 1, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 37 (September 14, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 36 (September 29, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 36 (September 29, 2015)Whitehall & CompanyNo ratings yet

- 1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Document2 pages1.34 Whitehall: Monitoring The Markets Vol. 1 Iss. 34 (September 20, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 41 (October 11, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 40 (October 27, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 47 (December 15, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 24 (June 14, 2016)Whitehall & CompanyNo ratings yet

- 1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Document2 pages1.30 Whitehall: Monitoring The Markets Vol. 1 Iss. 30 (August 23, 2011)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 20 (May 17, 2016)Whitehall & CompanyNo ratings yet

- 2.26 Whitehall: Monitoring The Markets Vol. 2 Iss. 26 (June 26, 2012)Document2 pages2.26 Whitehall: Monitoring The Markets Vol. 2 Iss. 26 (June 26, 2012)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 11 (March 25, 2015)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 47 (November 22, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 47 (November 22, 2016)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Document2 pagesWhitehall: Monitoring The Markets Vol. 6 Iss. 33 (August 17, 2016)Whitehall & CompanyNo ratings yet

- 1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Document2 pages1.35 Whitehall: Monitoring The Markets Vol. 1 Iss. 35 (September 27, 2011)Whitehall & CompanyNo ratings yet

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- WhitehallDocument2 pagesWhitehallWhitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 38 (September 25, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 36 (September 5, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 18Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 18Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 25 (June 19, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 29 (July 25, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 34 (August 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 32 (August 7, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 24 (June 12, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 27 (July 3, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 18 (May 1, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 28 (July 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 22 (June 5, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 23 (June 5, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 21 (May 22, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 12 (March 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 13 (March 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 16 (April 17, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 14 (April 2, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 15 (April 10, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 11 (March 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 9 (February 27, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 10 (March 6, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 8 (February 21, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Document2 pagesWhitehall: Monitoring The Markets Vol. 7 Iss. 6 (February 6, 2017)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 7 (February 13, 2018)Whitehall & CompanyNo ratings yet

- Whitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Document2 pagesWhitehall: Monitoring The Markets Vol. 8 Iss. 5 (January 30, 2018)Whitehall & CompanyNo ratings yet

- CDO StructureDocument2 pagesCDO StructuretvlodekNo ratings yet

- MCQ 4Document16 pagesMCQ 4Dương Hà LinhNo ratings yet

- Case Studies in Finance 8th Edition Bruner Solutions ManualDocument38 pagesCase Studies in Finance 8th Edition Bruner Solutions Manualsalvablegumption7xqek100% (16)

- International Capital MarketsDocument30 pagesInternational Capital MarketsmeetwithsanjayNo ratings yet

- Ch17 - Analysis of Bonds W Embedded Options.ADocument25 pagesCh17 - Analysis of Bonds W Embedded Options.Akerenkang100% (1)

- Bond Analysis and Valuation CEFA 2003/2004 Lecture NotesDocument76 pagesBond Analysis and Valuation CEFA 2003/2004 Lecture NotesMoguche CollinsNo ratings yet

- Chapter 24 Debt Financing: Corporate Finance, 5E (Berk/Demarzo)Document3 pagesChapter 24 Debt Financing: Corporate Finance, 5E (Berk/Demarzo)Alexandre LNo ratings yet

- The Business Cycle Approach To Investing - Fidelity InvestmentsDocument8 pagesThe Business Cycle Approach To Investing - Fidelity InvestmentsKitti WongtuntakornNo ratings yet

- New Ca3fin526 AsgnmtDocument2 pagesNew Ca3fin526 Asgnmtlalbabu guptaNo ratings yet

- TB 3 7Document134 pagesTB 3 7Lea Lyn FuasanNo ratings yet

- Financial Planning: S.B. Mainak Faculty Member National Insurance AcademyDocument55 pagesFinancial Planning: S.B. Mainak Faculty Member National Insurance AcademyRajesh YadavNo ratings yet

- Interest Rates and Bond Valuation: Mcgraw-Hill/IrwinDocument28 pagesInterest Rates and Bond Valuation: Mcgraw-Hill/IrwinCharbel HatemNo ratings yet

- Question Bank Topic 5 - Fixed IncomeDocument9 pagesQuestion Bank Topic 5 - Fixed IncomemileNo ratings yet

- Chapter 5 - Introduction To The Valuation of Debt SecuritiesDocument40 pagesChapter 5 - Introduction To The Valuation of Debt SecuritiesMpiloNo ratings yet

- Mindmap TACN1Document17 pagesMindmap TACN1tngocmai36No ratings yet

- Bonds and Stocks GuideDocument61 pagesBonds and Stocks GuideJulie Mae Caling MalitNo ratings yet

- Financial Markets: Our Lady of The Pillar College-Cauayan CampusDocument58 pagesFinancial Markets: Our Lady of The Pillar College-Cauayan CampusMaricar Dela Cruz VLOGSNo ratings yet

- BKM9e Answers Chap014Document2 pagesBKM9e Answers Chap014Tayba AwanNo ratings yet

- Indian Securities Market Handbook 2018Document241 pagesIndian Securities Market Handbook 2018ishuch24No ratings yet

- Sovereign Bonds: Prospects For Bangladesh: Published: Saturday, 06 October 2012Document4 pagesSovereign Bonds: Prospects For Bangladesh: Published: Saturday, 06 October 2012Hamed RiyadhNo ratings yet

- SolutionsChpt 08Document12 pagesSolutionsChpt 08Brenda LeonNo ratings yet

- MCQ 5Document21 pagesMCQ 5Dương Hà LinhNo ratings yet

- Itaú Latam Big Book 2012Document247 pagesItaú Latam Big Book 2012Fernando ParaguassuNo ratings yet

- Chapter 1.indian Capital MarketDocument16 pagesChapter 1.indian Capital MarketKaüshäl BeräwäläNo ratings yet

- 04 v1 2016cfa一级强化班 固定收益Document88 pages04 v1 2016cfa一级强化班 固定收益Mario XieNo ratings yet

- EY Commercial Real Estate DebtDocument16 pagesEY Commercial Real Estate DebtPaul BalbinNo ratings yet

- Report Indian Capital Market 2023Document52 pagesReport Indian Capital Market 2023bhanjasomanath4No ratings yet

- L3 The Arbitrage Approach of Bond PricingDocument52 pagesL3 The Arbitrage Approach of Bond PricingVy HàNo ratings yet