Professional Documents

Culture Documents

Prof Indemnity-Proposal Form For Architecteng

Uploaded by

GoanengineerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prof Indemnity-Proposal Form For Architecteng

Uploaded by

GoanengineerCopyright:

Available Formats

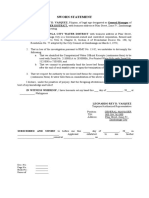

UNITED INDIA INSURANCE COMPANY LIMITED

REGD & HEAD OFFICE NO 24 WHITES ROAD CHENNAI 600 014

Proposal Form for Professional Indemnity Insurance Applicable to Consulting Engineers, Architects and Interior Decorators This proposal must be signed. All questions must be answered. The completion and signature of this proposal does not bind the proposer or Insurer to complete a contract of Insurance. If there is insufficient space to answer questions, please use additional sheets and attach it to this form. The Company does not assume any liabilities until the Proposal has been accepted and premium paid. 1. Name & Address of Proposer 2. When established 3. Description of the Business: (Please attach brochure, information booklet, etc.) 4. a) i) Names in full of all Partners/Directors/Principals i) ii) Qualifications in full iii) Date qualified ii) iv) How long Principal in this practice iii) b) Is coverage required in respect of past work for any iv) Partner/Principal who has left, retired or died? Yes/No. If Yes please give the following i) Full Name i) ii) Qualifications ii) iii) How long Principal in this practice iii) 5. State: a) i) No. of qualified engineers i) ii) No. of draftsmen ii) iii) No. of administrative personnel including clerks, iii) typists, office boys, etc., b) Specify nature of supervision exercised over the employees c) Total amount of annual wages payable 6. a) Please state the 5 largest contracts where construction has commenced during the past 6 years. Sl. No. Starting Date Type of Contract Total Contract Value Rs. Approx. Comp. Date

1 2 3 4 5 b) Please give details of Contracts where construction is expected to commence in the next 12 months Type of Total Contract Sl.No. Starting Date Approx. Comp. Date Contract Value Rs.

7. State whether you undertake supervision of Contract works being executed? If yes, periodicity of inspection with details. 8. Do you engage persons outside your organisation? If yes, specify the details of purpose and nature of control exercised by you over them (specimen contract be enclosed) 9. Loss record for 5 years: Year Cause Kind of Loss Amount of Loss Rs.

19 19 19 19 19 10. Have you during the past 12 months dismissed or do you contemplate dismissal of any member of staff on account of any omission, neglect, error or for like (please give full details) 11. Are you aware of any neglect, omission or error or existence of any circumstances likely to give rise to a claim? 12. (a) Please give gross fees received during the past five years 19------------Rs.-------------19------------Rs.-------------19------------Rs.-------------19------------Rs.-------------19------------Rs.-------------b) Estimated fees for the coming 12 months Rs. 13. Has any Company (a) declined your proposal a) (b) required an increased premium b) (c) refused to renew your policy c) (d) cancelled such a policy d) 14. Limits of Indemnity required : Any one year

15. Period of Insurance required From To 16. Voluntary Excess, if any 17. Any other relevant information not stated above I/We hereby declare that the above statement and particulars are true and I/we have not suppressed or misstated any material facts and that at the present time I/we have no reason to anticipate any claim being brought against me/us for any negligent act, error or omission on my/our part and against the company and agree that this declaration shall be the basis of the contract between me/us and the Insurer. I/We also agrethat the indemnity under the Insurance shall not be availed for claims arising out of acts of negligence, error or omission or misconduct committed prior to commencement of this insurance. Date : Place : Signature of Proposer Rs.

SECTION 41 OF THE INSURANCE ACT 1938 - PROHIBITION OF REBATES 1. No person shall allow or offer to allow either directly or indirectly as an inducement to any person to take out or renew or continue an insurance in respect of any kind or risk relating to lives or property in India any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy nor shall any person taking out or continuing a policy accept any rebate except such rebate as may be allowed in accordance with the prospectus or tables of the Insurer. Any person making default in complying with the provisions of this Section shall be punishable with fine, which may extend to Rs.500/-.

You might also like

- Basic Definitions of Soils PDFDocument7 pagesBasic Definitions of Soils PDFAntónio FontesNo ratings yet

- Goa Board of Secondary & Higher Secondary EducationDocument4 pagesGoa Board of Secondary & Higher Secondary EducationGoanengineerNo ratings yet

- RCC To STR 960Document1 pageRCC To STR 960GoanengineerNo ratings yet

- Standard Slab System Helical Anchorage ReinforcementDocument2 pagesStandard Slab System Helical Anchorage ReinforcementGoanengineerNo ratings yet

- Box Pier CapDocument1 pageBox Pier CapGoanengineerNo ratings yet

- Design and DetailingDocument7 pagesDesign and DetailingVarun ChandrasekaranNo ratings yet

- Design of Deep Beam Using Strut and Tie MethodDocument17 pagesDesign of Deep Beam Using Strut and Tie Methodsuman33100% (2)

- General SpecificationDocument241 pagesGeneral Specificationcyong7788No ratings yet

- Un Bonded Tendons Realistic RequirementsDocument10 pagesUn Bonded Tendons Realistic RequirementsGoanengineerNo ratings yet

- Chapter 5 Trusses: Typical Roof StructureDocument6 pagesChapter 5 Trusses: Typical Roof StructureGoanengineerNo ratings yet

- Guidelines for Designing Heavy-Duty Railway FormationsDocument75 pagesGuidelines for Designing Heavy-Duty Railway Formationsselva_651950100% (1)

- Deviation DiaphragmDocument1 pageDeviation DiaphragmGoanengineerNo ratings yet

- RCC Design SheetsDocument69 pagesRCC Design SheetsFahim H bepari100% (1)

- A Study On Resource Planning in Highway Construction ProjectsDocument8 pagesA Study On Resource Planning in Highway Construction Projectsabimranf39No ratings yet

- Checking slenderness limits of PEB structuresDocument1 pageChecking slenderness limits of PEB structuresjamilNo ratings yet

- Prof Indemnity-Proposal Form For ArchitectengDocument3 pagesProf Indemnity-Proposal Form For ArchitectengGoanengineerNo ratings yet

- Additional Guidelines for Design of Flexible Pavements for Low Volume Rural RoadsDocument1 pageAdditional Guidelines for Design of Flexible Pavements for Low Volume Rural RoadsArunashish MazumdarNo ratings yet

- Expansion JointDocument1 pageExpansion JointGoanengineerNo ratings yet

- Pune City Development Plan AppraisalDocument4 pagesPune City Development Plan AppraisalGoanengineerNo ratings yet

- RCF Trombay Foundation Construction Price BidDocument6 pagesRCF Trombay Foundation Construction Price BidGoanengineerNo ratings yet

- QF2Document2 pagesQF2GoanengineerNo ratings yet

- Well Pile Foundation PDFDocument17 pagesWell Pile Foundation PDFlingamkumarNo ratings yet

- UpvcDocument35 pagesUpvcGoanengineerNo ratings yet

- Fabrication DrawingDocument1 pageFabrication DrawingGoanengineerNo ratings yet

- TysonsDocument2 pagesTysonsGoanengineerNo ratings yet

- TysonsDocument2 pagesTysonsGoanengineerNo ratings yet

- GUJARAT ENERGY TRANSMISSION CORPORATION LTD PILE CONSTRUCTION FQPDocument18 pagesGUJARAT ENERGY TRANSMISSION CORPORATION LTD PILE CONSTRUCTION FQPGoanengineer100% (1)

- Crown FarmsDocument4 pagesCrown FarmsGoanengineerNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- TowsonDocument4 pagesTowsonGoanengineerNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- NSW Photo Card Application PDFDocument2 pagesNSW Photo Card Application PDFRavi NakarmiNo ratings yet

- Sillars & Canary (2012)Document20 pagesSillars & Canary (2012)Alexandra MargineanuNo ratings yet

- Beth's PlightDocument9 pagesBeth's PlightyadmosheNo ratings yet

- Vietnamese Youth LifestyleDocument9 pagesVietnamese Youth Lifestylenamphong_vnvnNo ratings yet

- Qualities of A CoachDocument3 pagesQualities of A Coachapi-443558457No ratings yet

- The Wilderness Society Style Guide 2014-2018Document52 pagesThe Wilderness Society Style Guide 2014-2018SaheemNo ratings yet

- Metro Bank vs. NLRC DigestDocument2 pagesMetro Bank vs. NLRC DigestChantal Evanne CastañedaNo ratings yet

- English 9 Quarter 3 Budget of WorkDocument2 pagesEnglish 9 Quarter 3 Budget of WorkChello Ann AsuncionNo ratings yet

- Pötscher W. Theophrastos, Peri EusebeiasDocument197 pagesPötscher W. Theophrastos, Peri EusebeiasalverlinNo ratings yet

- Student Bill of RightsDocument3 pagesStudent Bill of Rightsapi-266676026No ratings yet

- Ethics Midterm ReviewerDocument3 pagesEthics Midterm ReviewerHannieeeNo ratings yet

- GENERAL BULLETIN 202 - 2020 - Vice Principal (Admin) Performance Appraisal With Descriptors VIIDocument13 pagesGENERAL BULLETIN 202 - 2020 - Vice Principal (Admin) Performance Appraisal With Descriptors VIIDane SinclairNo ratings yet

- Hipaa Information and Consent FormDocument1 pageHipaa Information and Consent FormJake HennemanNo ratings yet

- Forrest Gump Research PaperDocument13 pagesForrest Gump Research Paperapi-229600480No ratings yet

- Torres-Madrid Brokerage v. FEB Mitsui InsuranceDocument2 pagesTorres-Madrid Brokerage v. FEB Mitsui InsuranceJoshua OuanoNo ratings yet

- Sworn Statement-Bir - Loose LeafDocument1 pageSworn Statement-Bir - Loose LeafEkeena LimNo ratings yet

- Organization and ManagementDocument359 pagesOrganization and Managementdeepenlove2u89% (28)

- Types of Leadership StylesDocument3 pagesTypes of Leadership StylesAnas Shifan50% (2)

- ACCCOB2-Ethics Reflection Paper - Engbino, Flores, Venida PDFDocument4 pagesACCCOB2-Ethics Reflection Paper - Engbino, Flores, Venida PDFAngela Michelle Francheska EngbinoNo ratings yet

- Peace Not War BY: Patricia Lithuanian: Reader'S Theathre/Speech Choir GRADES 10-12Document2 pagesPeace Not War BY: Patricia Lithuanian: Reader'S Theathre/Speech Choir GRADES 10-12dump account qNo ratings yet

- Gracewood ElementaryDocument4 pagesGracewood ElementaryJeremy TurnageNo ratings yet

- Darwins Dangerous Idea by Daniel C. DennettDocument31 pagesDarwins Dangerous Idea by Daniel C. DennettSimon and Schuster100% (6)

- Data Protection Trustmark Certification by IMDADocument14 pagesData Protection Trustmark Certification by IMDASTBNo ratings yet

- Communism, Communist MusicsDocument19 pagesCommunism, Communist MusicsJustin CookNo ratings yet

- Local Governance, Democracy and Civil Society in Mugla, TurkeyDocument24 pagesLocal Governance, Democracy and Civil Society in Mugla, TurkeyjculllumNo ratings yet

- CRISIS & CRITIQUE - Vol 3, Issue 3, 2016 - Critique of Political EconomyDocument261 pagesCRISIS & CRITIQUE - Vol 3, Issue 3, 2016 - Critique of Political EconomySamuelCampos100% (1)

- Apologetics - Bibliography - Apologetics. Recommended Reading List - Theology 2008Document14 pagesApologetics - Bibliography - Apologetics. Recommended Reading List - Theology 2008TM14REUNo ratings yet

- A Good Man Is Hard To Find - EditedDocument5 pagesA Good Man Is Hard To Find - Editedkevin MuthomiNo ratings yet

- Tesla's Innovative Organizational Culture Enables Cutting-Edge ProductsDocument6 pagesTesla's Innovative Organizational Culture Enables Cutting-Edge ProductsGabriel GomesNo ratings yet