Professional Documents

Culture Documents

Daily Market Update 21.10.2013

Uploaded by

Randora LkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Market Update 21.10.2013

Uploaded by

Randora LkCopyright:

Available Formats

Daily Market Update

21 October 2013

Today 5,946.65 3,287.53 33,232,389 1,046,683,466 544,420,664 162,514,240 15.86 2.18 Closed (Rs) 475.00 1,275.00 405.00 Closed (Rs) 214.00 71.40 150.00 Volume 1,854,316 1,153,834 3,692,441 370,382 252,215 No. of Crossings 2 1 1 Previous Day 5,976.51 3,309.00 18,569,339 545,677,265 129,225,635 157,091,778 15.94 2.19 Change (Rs) 94.90 85.00 2.70 Change (Rs) (3.30) (0.10) (7.00) Turnover 278,147,400 247,992,421 196,698,414 65,561,627 29,004,710 Volume 1,854,000 1,008,690 116,500 Change (%) -0.50 -0.65 78.96 91.81 321.29 3.45 -0.47 -0.62 Change (%) 24.97 7.14 0.67 Change (%) -1.52 -0.14 -4.46 % 26.57 23.69 18.79 6.26 2.77 Price 150.00 59.00 214.00

Tel: 0112131000 Website: www.ndbs.lk

Blue chips drive turnover

Bourse saw its indices declining on the back of a price drop in index heavy John Keells Holdings. Foreign buying seen in Hatton National Bank, John Keells Holdings as well as foreign sales on John Keells Holdings rights drove market turnover above the Rs 1 Bn mark. In addition, some activity was also seen in Sampath Bank and Aitken Spence while retail activity remained subdued. Diversified sector became the top contributor to the market turnover (due to John Keells Holdings ordinary shares, rights and Aitken Spence) and the sector index dropped 1.08%. The share price of John Keells Holdings decreased Rs 3.30 (1.52%) to close at Rs 214.00 with its foreign holding increasing by 484,668 shares. John Keells Holdings rights plunged Rs 16.90 (27.21%) to close at Rs 45.20 with its foreign holding declining by 1,587,816. The share price of Aitken Spence also dipped Rs 1.00 (0.86%) to close at Rs 115.00. Banks, Finance & Insurance sector was the second highest contributor to the market turnover (due to Hatton National Bank and Sampath Bank) and the sector index edged up 0.01%. The share price of Hatton National Bank and Sampath Bank closed flat at Rs 150.00 and Rs 177.00 respectively while Hatton National Banks foreign holding increased by 1,854,000 shares.

Turnover ASPI S&P SL20 (Indexed)

Indices

6,500 5,500

12,000 8,000

Positive Contributors George Steuart Finance Good Hope Carsons Cumberbatch Negative Contributors John Keells Holdings Aitken Spence Hotel Holdings CT Holdings Top Turnover Contributors Hatton National Bank John Keells Holdings John Keells Holdings Rights Sampath Bank Aitken Spence Company Hatton National Bank John Keells Holdings Rights John Keells Holdings

4,500 3,500 2,500 3-Jan-11

Maturity 01-04-2014 15-07-2015 01-04-2016 01-01-2017 15-08-2018 Excess Liquidity Exchange Rate

4,000 0 3-Jan-12 3-Jan-13

Bid (Closing) 9.00 10.30 10.50 10.86 11.12 Rs 20.801 Bn Rs 130.95 - 131.00 per US $ 14/10/2013 Last Week Last Year 8.58 10.66 9.61 11.83 10.50 12.37 Source: MVS Money Brokers Ask (Closing) 9.25 10.40 10.60 10.90 11.18

Source: Colombo Stock Exchange

Treasury Bill Rates (Primary Auction) Maturity Today 91 days 8.56 182 days 9.60 364 days 10.49

Turnover Rs Mn.

ASPI S&P SL20 Volume (Shares) Turnover (Rs) Foreign Purchases (Rs) Foreign Sales (Rs) PER PBV

20,000 8,500 7,500 16,000

Disclaimer This document is based on information obtained from sources believed to be reliable, but NDB Securities (Pvt) Ltd., (NDBS) accepts no responsibility or makes no warranties or representations, express or implied, as to whether the information provided in this document is accurate, complete or up-to-date. Furthermore, no representation or warranty is made by NDBS as to the sufficiency, relevance, importance, appropriateness, completeness or comprehensiveness of the information contained herein for any specific purpose. Prices, opinions and estimates reflect our judgment on the date of original publication and are subject to change at any time without notice. NDBS reserves the right to change their opinion at any point in time as they deem necessary. There is no guarantee that the target price for the stock will be met or that predicted business results for the company will be met. NDBS accepts no liability whatsoever for any direct or consequential loss or damage arising from any use of these reports or their contents. References to tax are based on our understanding of current law and Inland Revenue practices, which may change from time to time. Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressee only and is not to be taken as substitution for the exercise of judgment by addressee. The information contained in any research report does not constitute an offer to sell securities or the solicitation of an offer to buy, or recommendation for investment in, any securities within Sri Lanka or any other jurisdiction. The information in any research report is not intended as financial advice. Moreover, none of the research reports is intended as a prospectus within the meaning of the applicable laws of any jurisdiction and none of the research reports is directed to any person in any country in which the distribution of such research report is unlawful. Past results do not guarantee future performance. NDBS cautions that any forward-looking statements in any research report implied by such words as anticipate, believe, estimate, expect, and similar expressions as they relate to a company or its management are not guarantees of future performance. The investments in undertakings, securities or other financial instruments involve risks. Any discussion of the risks contained herein should not be considered to be a disclosure of all risks or complete discussion of the risks which are mentioned. NDBS and its associates, their directors, and/or employees may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other financial services for these companies.

You might also like

- Daily Market Update 25.09.2013Document2 pagesDaily Market Update 25.09.2013Randora LkNo ratings yet

- Daily Market Update 26.09.2013Document2 pagesDaily Market Update 26.09.2013Randora LkNo ratings yet

- Daily Market Update 02.10.2013Document2 pagesDaily Market Update 02.10.2013Randora LkNo ratings yet

- Banking Sector Continued To Elevate Turnover: Turnover Aspi S&P SL20 (Indexed)Document2 pagesBanking Sector Continued To Elevate Turnover: Turnover Aspi S&P SL20 (Indexed)Randora LkNo ratings yet

- Daily Market Update: Indices Closed With Gains Foreign Sales Account For 51.9% of TurnoverDocument2 pagesDaily Market Update: Indices Closed With Gains Foreign Sales Account For 51.9% of TurnoverRandora LkNo ratings yet

- Daily Market Update 29.10.2014 PDFDocument2 pagesDaily Market Update 29.10.2014 PDFRandora LkNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Daily-Sgx-Report by Epic Research Singapore 10 Dec 2013Document2 pagesDaily-Sgx-Report by Epic Research Singapore 10 Dec 2013Christopher HenryNo ratings yet

- Equity Tips and Market Outlook For 19 OCtDocument7 pagesEquity Tips and Market Outlook For 19 OCtRani RaiNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Daily News Letter 01oct2012Document7 pagesDaily News Letter 01oct2012Theequicom AdvisoryNo ratings yet

- Treasury Research News Bulletin - 27 November 2013Document2 pagesTreasury Research News Bulletin - 27 November 2013r3iherNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Daily Equtiy News Letter 11jan 2013Document7 pagesDaily Equtiy News Letter 11jan 2013Theequicom AdvisoryNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily DailyTheequicom AdvisoryNo ratings yet

- Equity Tips and Market Analysis For 12 JulyDocument7 pagesEquity Tips and Market Analysis For 12 JulySurbhi JoshiNo ratings yet

- Zztreasury Research - Daily - Global and Asia FX - April 29 2013Document2 pagesZztreasury Research - Daily - Global and Asia FX - April 29 2013r3iherNo ratings yet

- Daily News Letter 23oct2012Document7 pagesDaily News Letter 23oct2012Theequicom AdvisoryNo ratings yet

- Daily News Letter 22oct2012Document7 pagesDaily News Letter 22oct2012Theequicom AdvisoryNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report Derivative Report: CommentsDocument3 pagesDerivative Report Derivative Report: CommentsAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Head and Shoulders Broken: Punter's CallDocument5 pagesHead and Shoulders Broken: Punter's CallRajasekhar Reddy AnekalluNo ratings yet

- Technical Format With Stock 27.09Document4 pagesTechnical Format With Stock 27.09Angel BrokingNo ratings yet

- Derivatives Report 29th March 2012Document3 pagesDerivatives Report 29th March 2012Angel BrokingNo ratings yet

- Derivatives Report 2nd April 2012Document3 pagesDerivatives Report 2nd April 2012Angel BrokingNo ratings yet

- Derivatives Report, 27 June 2013Document3 pagesDerivatives Report, 27 June 2013Angel BrokingNo ratings yet

- Derivatives Report 26 Oct 2012Document3 pagesDerivatives Report 26 Oct 2012Angel BrokingNo ratings yet

- Technical Format With Stock 23.10Document4 pagesTechnical Format With Stock 23.10Angel BrokingNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily DailyTheequicom AdvisoryNo ratings yet

- Equity Market Analysis or Levels On 14th SeptemberDocument7 pagesEquity Market Analysis or Levels On 14th SeptemberTheequicom AdvisoryNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIangelbrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Derivatives Report 30-Aug-2012Document3 pagesDerivatives Report 30-Aug-2012Angel BrokingNo ratings yet

- Derivatives Report, 31st May 2013Document3 pagesDerivatives Report, 31st May 2013Angel BrokingNo ratings yet

- Derivatives Report 09 Oct 2012Document3 pagesDerivatives Report 09 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report 12 Dec 2011Document3 pagesDerivatives Report 12 Dec 2011Angel BrokingNo ratings yet

- Market Analysis Report On 12 OCTOBETRDocument7 pagesMarket Analysis Report On 12 OCTOBETRTheequicom AdvisoryNo ratings yet

- Daily News Letter 05oct2012Document7 pagesDaily News Letter 05oct2012Theequicom AdvisoryNo ratings yet

- Daily Technical Report, 24.07.2013Document4 pagesDaily Technical Report, 24.07.2013Angel BrokingNo ratings yet

- Derivatives Report 27th September 2011Document3 pagesDerivatives Report 27th September 2011Angel BrokingNo ratings yet

- Derivatives Report, 14 March 2013Document3 pagesDerivatives Report, 14 March 2013Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Equity Analysis - DailyDocument7 pagesEquity Analysis - Dailyapi-198466611No ratings yet

- Market Analysis On 24 SepDocument7 pagesMarket Analysis On 24 SepTheequicom AdvisoryNo ratings yet

- Technical Format With Stock 26.09Document4 pagesTechnical Format With Stock 26.09Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivatives Report, 13 February 2013Document3 pagesDerivatives Report, 13 February 2013Angel BrokingNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily Dailyapi-160037995No ratings yet

- Stock To Watch:: Nifty ChartDocument3 pagesStock To Watch:: Nifty ChartbidyuttezuNo ratings yet

- The Future of Your Wealth: How the World Is Changing and What You Need to Do about It: A Guide for High Net Worth Individuals and FamiliesFrom EverandThe Future of Your Wealth: How the World Is Changing and What You Need to Do about It: A Guide for High Net Worth Individuals and FamiliesNo ratings yet

- Weekly Update 04.09.2015 PDFDocument2 pagesWeekly Update 04.09.2015 PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkNo ratings yet

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkNo ratings yet

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNo ratings yet

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkNo ratings yet

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkNo ratings yet

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkNo ratings yet

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkNo ratings yet

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkNo ratings yet

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNo ratings yet

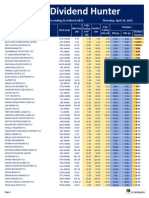

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Results Update For All Companies - Jun 2015 PDFDocument9 pagesResults Update For All Companies - Jun 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNo ratings yet

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNo ratings yet

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkNo ratings yet

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocument12 pagesCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkNo ratings yet

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocument9 pagesChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkNo ratings yet

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkNo ratings yet

- BRS Monthly (March 2015 Edition) PDFDocument8 pagesBRS Monthly (March 2015 Edition) PDFRandora LkNo ratings yet

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkNo ratings yet

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNo ratings yet

- 4Ps in Rural Markets: Rural Marketing by Jyoti MaratheDocument26 pages4Ps in Rural Markets: Rural Marketing by Jyoti Marathedesh87_sagar3672No ratings yet

- Chapter 7 Primer On Relative Valuation MethodsDocument16 pagesChapter 7 Primer On Relative Valuation MethodsPankaj AgrawalNo ratings yet

- Lesson9 - Debt RestructureDocument14 pagesLesson9 - Debt RestructureCirelle Faye SilvaNo ratings yet

- Research Paper On BankingDocument7 pagesResearch Paper On BankingHunny Pal100% (1)

- Daisy English PPT Final Version2Document33 pagesDaisy English PPT Final Version2Afaceri AllNo ratings yet

- Soal MicroeconomyDocument2 pagesSoal MicroeconomyDavid WijayaNo ratings yet

- Final Report - BhoomitDocument70 pagesFinal Report - BhoomitShubham SuryavanshiNo ratings yet

- Chapter 7: Identifying and Understanding ConsumersDocument3 pagesChapter 7: Identifying and Understanding ConsumersDyla RafarNo ratings yet

- Reaction Paper I.Plot: Game LevelsDocument4 pagesReaction Paper I.Plot: Game LevelsAira AmorosoNo ratings yet

- Review in General Mathematics (Quiz Bee)Document26 pagesReview in General Mathematics (Quiz Bee)cherrie annNo ratings yet

- The Competition ActDocument24 pagesThe Competition ActMehak AhluwaliaNo ratings yet

- IMC - TanishqDocument16 pagesIMC - Tanishqsriram_balNo ratings yet

- Ayaz Nujuraully - 59376351 1Document12 pagesAyaz Nujuraully - 59376351 1AzharNo ratings yet

- Chapter 9-45 Excel TemplateDocument10 pagesChapter 9-45 Excel TemplateAlee Di VaioNo ratings yet

- Monopolistic Competition: Chapter 16-1Document36 pagesMonopolistic Competition: Chapter 16-1Naveed ShaikhNo ratings yet

- FINS3616 Tutorials - Week 4, QuestionsDocument2 pagesFINS3616 Tutorials - Week 4, QuestionsLena ZhengNo ratings yet

- Business Strategies of Burger King PDFDocument8 pagesBusiness Strategies of Burger King PDFChristy MachaalanyNo ratings yet

- IRE1010Document12 pagesIRE1010Amy WangNo ratings yet

- IndiaMART Concall Transcript Q1FY2020 1Document17 pagesIndiaMART Concall Transcript Q1FY2020 1Harsh GandhiNo ratings yet

- Case 10: South Africa Bank: Revenue Mckinsey Struct. Comm QuantDocument7 pagesCase 10: South Africa Bank: Revenue Mckinsey Struct. Comm QuantDuong TranNo ratings yet

- Fin701 Module2Document3 pagesFin701 Module2Krista CataldoNo ratings yet

- Other Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasDocument4 pagesOther Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasLumingNo ratings yet

- Debate Bahasa Inggris LMDocument8 pagesDebate Bahasa Inggris LMJonathanNo ratings yet

- Creating A Business Development FrameworkDocument31 pagesCreating A Business Development FrameworkRoel DagdagNo ratings yet

- Customer Relationship ManagementAKMppt 22 NovDocument205 pagesCustomer Relationship ManagementAKMppt 22 NovAbhimaurya50% (2)

- HAVAL Tunisia Sponsoring Golf TournamentDocument4 pagesHAVAL Tunisia Sponsoring Golf TournamentDuverli Andree Culquicondor RuizNo ratings yet

- Strategic Capacity Planning About Classio Ballpoint PenDocument3 pagesStrategic Capacity Planning About Classio Ballpoint PenMustakim Bin Aziz 1610534630No ratings yet

- MM Flour MillDocument8 pagesMM Flour MillSulman HabibNo ratings yet

- Bonds 32319642 - JUNE 2023 IFB1-2023-007 DATED 19-06-2023Document2 pagesBonds 32319642 - JUNE 2023 IFB1-2023-007 DATED 19-06-2023Museo MuemaNo ratings yet

- Business Plans Notes by Enock MarchDocument63 pagesBusiness Plans Notes by Enock MarchNyabensi EnockNo ratings yet