Professional Documents

Culture Documents

President Uhuru Kenyatta's Speech During The 2013 Taxpayers Award Ceremony at KICC Nairobi

Uploaded by

State House KenyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

President Uhuru Kenyatta's Speech During The 2013 Taxpayers Award Ceremony at KICC Nairobi

Uploaded by

State House KenyaCopyright:

Available Formats

SPEECH BY HIS EXCELLENCY HON. UHURU KENYATTA, C.G.H.

, PRESIDENT AND COMMANDER IN CHIEF OF THE DEFENCE FORCES OF THE REPUBLIC OF KENYA DURING THE 2013 TAXPAYERS AWARD CEREMONY, KENYATTA INTERNATIONAL CONFERENCE CENTRE, NAIROBI, 22ND OCTOBER, 2013 Esteemed Taxpayers, Ladies and Gentlemen, It gives me much pleasure to join you today to preside over the 2013 Taxpayers' Day, now in its 10th edition since inception. I thank you all for making time to be here. This occasion is important. It is the occasion when we recognise and celebrate our taxpayers for their contribution and productivity to our national development agenda, and, indeed, our civilization. This years Taxpayers Award Ceremony comes soon after our 2013 Mashujaa Day celebrations; the day when we commemorated our forefathers and foremothers who liberated us to be a free people and to control our destiny. We must be self-reliant, if as a people, we are to sustain our dignity. For this reason, I applaud you, our taxpayers, for being patriotic and paying your taxes and as such enabling us to take charge of our countrys destiny. Ladies and Gentlemen, The Taxpayers Award is the fruit of sustained close collaboration between you, the taxpayers, and the management of the Kenya Revenue Authority. I commend the Board, Management and Staff of the Authority for continuing a rewarding partnership with our esteemed taxpayers, and for enabling us recognise and thank them. Please keep up the good work and enable Kenya afford her sovereign aspirations. Todays event comes at an early stage of my Administration. This is welcome as it affords my Government an opportunity to directly engage and forge a strong partnership with our key financiers the taxpayers. Your support is indispensable to the journey we have set for ourselves to first transform our economy and ultimately our entire society, and secondly to ensure we remain truly an independent nation. There is no doubt that, compared to where we were in 1963, we have made commendable progress since then in education, health, construction of road network countrywide, provision of clean water, rural electrification, to mention but a few. But we are still as a country, far from achieving fully our development potential. Domestic and external factors have disrupted the momentum of economic growth.

Unemployment, particularly among our youth, food insecurity and widespread poverty, are still major challenges requiring our action. As Government, we remain committed to tackling these challenges and achieving a Better Kenya For All our people. The broad development agenda of my Administration is, therefore, intended to address these challenges holistically and comprehensively. We want growth of our economy to be more robust and more inclusive, because this is the only means of moving Kenya to the next level of prosperity. The fundamental objective of our Government is the attainment of high rate of economic growth and sustainable development, within a stable and secure environment. Indeed, this is the sure way to sustain our dignity as a people.

Distinguished Taxpayers, Ladies and Gentlemen, We have elaborated our economic policies as well as structural reform measures in various policy documents. In particular, the Budget Policy Statement, the Budget Highlights for 2013/14 fiscal year, as well as the Second Medium Term Plan of Vision 2030, which I launched a couple of weeks ago, amply set out the measures we are implementing to put our country on the path of sustainable development. First, we must urgently take measures to reduce the cost of production and make Kenyan products cheaper and more competitive. Investment in transport and logistics as well as energy and other infrastructure will achieve this objective. Construction of the standard-gauge railway is about to commence. Upon its completion, we expect transport costs to reduce significantly. This can only be great news to consumers and producers in our region. Secondly, we know a friendly investment environment is indispensable if we are to realise sustainable development. To this end, we remain committed to maintaining inflation at a low level and ensuring that the Kenya shilling exchange rate is stable. In addition, we are deepening structural reforms as well as taking steps to improve security and law enforcement, interventions that are critically needed to encourage investment and therefore generate more jobs. Furthermore, we have taken comprehensive measures to invest in rural development and agriculture, both to raise incomes and achieve food security. The aim is to expand food supply, reduce food prices and support an expanded agro-processing industry. Obviously, the other outcome is to generate employment and enhance the wealth of our rural folks.

Finally, we are continuing to invest in the provision of high quality health services, but at no cost to the consumers of those services. Likewise, we are expanding the social safety net to reduce the unfair burden that poverty and illness visit on households, obstructing long-term growth and development. Our Government has its focus firmly fixed on swift, inclusive and sustainable economic transformation and growth. Dear Taxpayers, Ladies and Gentlemen, I am aware of concerns raised by Kenyans about the possible impact of recent security-related challenges on the growth momentum our national economy. These concerns are legitimate. However, even with the Westgate incident, if the buoyant activity at the Nairobi Securities Exchange is anything to go by, our economy remains resilient. The mood at the Exchange is a good means of gauging investor confidence. All sectors of our economy are gaining momentum. This confidence is not mistaken: investors do not stake their fortunes on mere hunch, or unfounded hopes. It is because the fundamentals of our economy are solid and dependable. This is thanks to the sound economic policies we have pursued in the last several years under our own Economic Programme supported by the International Monetary Fund. Interest rates remain stable, and for a while now, are the lowest in our region. Likewise, the Kenya shilling exchange rate against other currencies has been stable while inflation has been confined to a single-digit range for some time. I stand here to reassure you of Government's commitment to continue implementing sound economic policies in order to ensure the macroeconomic environment remains favourable to the investing community. We are confident of our economy's vibrancy, dynamism and resilience. Distinguished Taxpayers, Ladies and Gentlemen, I am grateful that we have worked hard, and continue to strive for sound macroeconomic stewardship. But to ensure we remain on the right economic path, security is critical. In this regard, I want to declare that we are going further to protect our growth by enhancing government investment in security. We will shortly commence a comprehensive medium-term security reform strategy. As part of this programme, we will enhance infrastructure development, equipment, mobility, training and skill development, forensic research and partnership with communities and other security agencies. The aim is to institute robust, visible, effective and sustainable improvements to

our security sector. That is, security capable to defend our country, protect our people and secure our prosperity. Distinguished Taxpayers, Ladies and Gentlemen, All these good things we intend to do will require substantial financing and hence the need for us to take further steps to realize fully our tax revenue potential. This brings me to the subject of tax reforms and revenue mobilisation. Without a doubt, there exists great potential to grow the national revenue yield, even under the existing taxes and rates of taxation. Through an appropriate and facilitative policy regime and effective tax administration, we can strengthen revenue and improve growth prospects. In order to support a high level of broad-based economic growth and development, we must embark on the Second Generation Tax Reforms, with emphasis on tax policy as well as institutional and legal reforms underpinning tax administration. Over the medium term, our Government's tax reform agenda shall cover institutional and legislative reorganisation, investment in infrastructure and skill development and building partnership with taxpayers. To begin with, the Kenya Revenue Authority will be reformed. The aim of the reforms is to make it responsive, efficient and effective in revenue collection, trade facilitation and securing our borders. In this endeavour, we are partly informed by recent border security challenges, as well as the East African Community Common Market Protocol, which requires the establishment of a Single Customs Territory. The effect of that is free movement of goods in the region. Reorganising the Kenya Revenue Authority will entail the establishment of two semi-autonomous entities. That is, the Domestic or Inland Tax Agency and the Customs and Border Control Agency. With respect to legislative reorganisation, the intention is to further review and modernise outstanding tax legislations, particularly excise and income tax regimes. By December, I expect an Excise Management Bill to be submitted to the National Assembly. This Bill will make the law on excise management simple, modern and easier to comply with. It will also align it with international best practice. Secondly, in order to conform to the Constitution, the Tax Appeals Tribunal Bill has been submitted to Parliament, and goes into final debate this week. Likewise, the process to consolidate and standardise all tax administration procedures is underway. Presently these procedures are scattered in various legislations. The draft Taxpayer Code Bill should be ready by March, 2014.

Thirdly, owing to increased exploration activity in our extractive industry, we must develop a robust fiscal regime to regulate and enforce taxation of income generated in this sector. We are reviewing the fiscal regimes currently existing under various legislations and, taking into account international best practice, we intend to consolidate them so that we have a clear framework that is applicable to the extractive industries in this country. Distinguished Taxpayers, Ladies and Gentlemen, I see infrastructure and skills development as pillars of our tax reform agenda. I am happy to note the tremendous progress that we have achieved in this regard, but hasten to caution that much remains to be done. To entrench efficiency, we are investing in the automation of our tax system. This will enable taxpayers submit their returns from the comfort of their offices and homes. By March 2014, we will have rolled out production accounting under the excise tax management system. All firms dealing in products that attract excise duties will be covered under this roll-out. Additionally, we want to make it cheaper, faster and easier for importers to lodge their import documentations, that is: ships notification of arrival list, ship-and air-cargo manifests, Import Declaration Form (IDF), pre-clearance licenses and permits issued by government agencies. All required payments will be made through the planned single portal. The roll-out of the National Single Window system is scheduled for the end of this month, midnight of October, 31, 2013 and will commence with pre-clearance live of the documentations which I have mentioned earlier. I understand the Revenue Authority plans to intensify on-job training in order to impart necessary skills without disrupting services. I encourage the Authority to form partnerships with more experienced revenue departments in other parts of the world through exchange programmes; and also enforce measures to enhance integrity in tax administration. Total integrity must be the philosophy for all of us. Distinguished Taxpayers, Ladies and Gentlemen, The Government is implementing the reforms I have enumerated in order to better serve taxpayers and make it easy for you to comply. This way, we expect revenue yield to be enhanced. This is a partnership to ensure that every eligible income earner makes their contribution through payment of tax. On our part, Government will invest these resources in programmes that will facilitate private sector growth. The partnership between our

Government and you, our taxpayers, is a partnership to achieve our shared vision of transforming Kenya into a middle income country by year 2030, if not earlier. As I conclude my remarks, let me emphasize that it is our civic duty to pay taxes to finance our development as a modern State. I, therefore, urge all eligible Kenyans to embrace their patriotic duty and pay taxes. Everyone who fails to pay tax sabotages that shared and noble vision of transforming Kenya into a middle income country. The attainment of Vision 2030 depends on all taxpayers meeting their tax obligations. Thank you once again for finding the time to be here today. We value your presence and support, and I look forward to a dynamic and productive partnership with you as we continue the fight against poverty. May God richly reward your work. Thank you very much, and may God bless you all.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Being Mortal: Medicine and What Matters in The EndDocument15 pagesBeing Mortal: Medicine and What Matters in The EndEsteban0% (19)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Faust Part Two - Johann Wolfgang Von GoetheDocument401 pagesFaust Part Two - Johann Wolfgang Von GoetherharsianiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Guide To FractionsDocument18 pagesA Guide To FractionsAnnelyanne RufinoNo ratings yet

- Network Scanning TechniquesDocument17 pagesNetwork Scanning TechniquesjangdiniNo ratings yet

- Press Release - Revised Presidential Itinerary To Lower EasternDocument2 pagesPress Release - Revised Presidential Itinerary To Lower EasternState House KenyaNo ratings yet

- WatsuDocument5 pagesWatsuTIME-TREVELER100% (1)

- Eurokids Parent Manual (ECity) - PDF-EJ and ESDocument18 pagesEurokids Parent Manual (ECity) - PDF-EJ and ESsabarin_72100% (2)

- The Old Man and The SeaDocument6 pagesThe Old Man and The Seahomeless_heartNo ratings yet

- Software Quality Metrics MethodologyDocument17 pagesSoftware Quality Metrics MethodologySumit RajputNo ratings yet

- RCPI V VerchezDocument2 pagesRCPI V VerchezCin100% (1)

- Medical Surgical Nursing Nclex Questions 5Document18 pagesMedical Surgical Nursing Nclex Questions 5dee_day_8No ratings yet

- PRESS RELEASE: CONSULTATIVE MEETING OF POLITICAL PARTY LEADERS Tuesday, 16th March, 2021Document2 pagesPRESS RELEASE: CONSULTATIVE MEETING OF POLITICAL PARTY LEADERS Tuesday, 16th March, 2021State House Kenya0% (1)

- Despatch From Cabinet - 25th February, 2021Document7 pagesDespatch From Cabinet - 25th February, 2021State House Kenya50% (2)

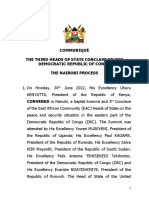

- Communiqué: The Third Heads of State Conclave On The Democratic Republic of Congo - The Nairobi ProcessDocument5 pagesCommuniqué: The Third Heads of State Conclave On The Democratic Republic of Congo - The Nairobi ProcessState House Kenya100% (1)

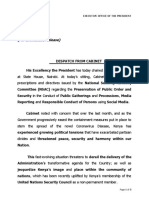

- Executive Office of The PresidentDocument5 pagesExecutive Office of The PresidentState House Kenya75% (4)

- Notification of Presidential Action (I) - 15/10/2020: Nomination and Appointment of Ambassadors & High Commissioners.Document2 pagesNotification of Presidential Action (I) - 15/10/2020: Nomination and Appointment of Ambassadors & High Commissioners.State House Kenya100% (1)

- Press Release: Extraordinary Summit To Review The Surge of Covid-19 InfectionsDocument2 pagesPress Release: Extraordinary Summit To Review The Surge of Covid-19 InfectionsState House Kenya100% (1)

- Statement by His Excellency President Uhuru Kenyatta During The Generation Unlimited High-Level Virtual Event, Connecting Half The World To Opportunities. Date: Tuesday 1ST September, 2020.Document11 pagesStatement by His Excellency President Uhuru Kenyatta During The Generation Unlimited High-Level Virtual Event, Connecting Half The World To Opportunities. Date: Tuesday 1ST September, 2020.State House Kenya100% (1)

- (For Immediate Release) : Huduma NambaDocument1 page(For Immediate Release) : Huduma NambaState House Kenya100% (2)

- Taking of The Oath of Secrecy by The Director-General of Nairobi Metropolitan ServicesDocument1 pageTaking of The Oath of Secrecy by The Director-General of Nairobi Metropolitan ServicesState House KenyaNo ratings yet

- Council of Governors Resolutions of The Covid-19 Virtual Conference Held On Monday, 31ST August 2020.Document3 pagesCouncil of Governors Resolutions of The Covid-19 Virtual Conference Held On Monday, 31ST August 2020.State House Kenya50% (2)

- Outcomes of Cabinet Meeting Chaired by President Uhuru Kenyatta at State House, Nairobi On Thursday 10th September, 2020.Document3 pagesOutcomes of Cabinet Meeting Chaired by President Uhuru Kenyatta at State House, Nairobi On Thursday 10th September, 2020.State House KenyaNo ratings yet

- The National Covid-19 Conference.Document2 pagesThe National Covid-19 Conference.State House KenyaNo ratings yet

- H. E. The President'S Engagements During The Virtual United Nations General Assembly, 18 September - 02 OCTOBER, 2020Document2 pagesH. E. The President'S Engagements During The Virtual United Nations General Assembly, 18 September - 02 OCTOBER, 2020State House Kenya100% (1)

- Cabinet Secretaries, Chief Administrative Secretaries and Principal Secretaries As of 14TH January 2020Document4 pagesCabinet Secretaries, Chief Administrative Secretaries and Principal Secretaries As of 14TH January 2020State House Kenya88% (8)

- Enhanced National Response To The Coronavirus (Covid-19) Pandemic: Classification of Critical and Essential Services.Document1 pageEnhanced National Response To The Coronavirus (Covid-19) Pandemic: Classification of Critical and Essential Services.State House Kenya100% (4)

- PRESIDENTIAL PROCLAMATION - With respect to - THE DEATH OF H.E. DANIEL TOROITICH ARAP MOI, C.G.H. - Second President of the Republic of Kenya - solemnly issued at State House, Nairobi on the 4th day of February, 2020.Document4 pagesPRESIDENTIAL PROCLAMATION - With respect to - THE DEATH OF H.E. DANIEL TOROITICH ARAP MOI, C.G.H. - Second President of the Republic of Kenya - solemnly issued at State House, Nairobi on the 4th day of February, 2020.State House Kenya100% (4)

- Communication From The Head of Public Service Dr. Joseph Kinyua On The 2020 Calendar of Cabinet and Its Standing Committees.Document2 pagesCommunication From The Head of Public Service Dr. Joseph Kinyua On The 2020 Calendar of Cabinet and Its Standing Committees.State House KenyaNo ratings yet

- Gazette Vol. 111 27-8-19Document2 pagesGazette Vol. 111 27-8-19State House Kenya67% (3)

- The Covid-19 Emergency Response FundDocument2 pagesThe Covid-19 Emergency Response FundState House Kenya100% (3)

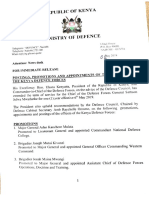

- Postings, Promotions and Appointments of The Officers of The Kenya Defence ForcesDocument3 pagesPostings, Promotions and Appointments of The Officers of The Kenya Defence ForcesState House Kenya0% (1)

- Presidential Proclamation With Respect To The Death of H.E. Pierre Nkurunziza, President of The Republic of Burundi.Document2 pagesPresidential Proclamation With Respect To The Death of H.E. Pierre Nkurunziza, President of The Republic of Burundi.State House KenyaNo ratings yet

- Standard Request For Proposals (RFP), RFP No. Sh/rfp/ofl/001/2018-2019Document53 pagesStandard Request For Proposals (RFP), RFP No. Sh/rfp/ofl/001/2018-2019State House Kenya100% (1)

- Press Release - APPOINTMENT OF GOVERNMENT SPOKESPERSONDocument2 pagesPress Release - APPOINTMENT OF GOVERNMENT SPOKESPERSONState House Kenya0% (1)

- Abridged Executive Order No. 4 of 2019Document2 pagesAbridged Executive Order No. 4 of 2019State House KenyaNo ratings yet

- Sale of Boarded Motor Vehicles, Tender No. SH/01/2018-2019Document14 pagesSale of Boarded Motor Vehicles, Tender No. SH/01/2018-2019State House KenyaNo ratings yet

- Tender No: SH/01/2019-2020 For Pre-Qualification/registration of Suppliers For Supply/provision of Goods and Services - Financial Years 2019/2021Document16 pagesTender No: SH/01/2019-2020 For Pre-Qualification/registration of Suppliers For Supply/provision of Goods and Services - Financial Years 2019/2021State House Kenya100% (4)

- Tender No. SH/003/2019-2021 For Supply of Fresh Cut Flowers and Flower ArrangementsDocument71 pagesTender No. SH/003/2019-2021 For Supply of Fresh Cut Flowers and Flower ArrangementsState House KenyaNo ratings yet

- Tender 002 Fuels, Oils and Lubricants-2018Document35 pagesTender 002 Fuels, Oils and Lubricants-2018State House KenyaNo ratings yet

- Cancellation of Procurement ProceedingsDocument1 pageCancellation of Procurement ProceedingsState House KenyaNo ratings yet

- Autobiography of A 2nd Generation Filipino-AmericanDocument4 pagesAutobiography of A 2nd Generation Filipino-AmericanAio Min100% (1)

- Philippines My Beloved (Rough Translation by Lara)Document4 pagesPhilippines My Beloved (Rough Translation by Lara)ARLENE FERNANDEZNo ratings yet

- Definition Environmental Comfort in IdDocument43 pagesDefinition Environmental Comfort in Idharis hambaliNo ratings yet

- TreeAgePro 2013 ManualDocument588 pagesTreeAgePro 2013 ManualChristian CifuentesNo ratings yet

- Total Recall and SkepticismDocument4 pagesTotal Recall and Skepticismdweiss99No ratings yet

- Iyengar S., Leuschke G.J., Leykin A. - Twenty-Four Hours of Local Cohomology (2007)Document298 pagesIyengar S., Leuschke G.J., Leykin A. - Twenty-Four Hours of Local Cohomology (2007)wojtekch100% (1)

- PPG ReviewerDocument8 pagesPPG Reviewerryanbaldoria.immensity.ictNo ratings yet

- Acc 106 Ebook Answer Topic 4Document13 pagesAcc 106 Ebook Answer Topic 4syifa azhari 3BaNo ratings yet

- Complexity. Written Language Is Relatively More Complex Than Spoken Language. ..Document3 pagesComplexity. Written Language Is Relatively More Complex Than Spoken Language. ..Toddler Channel TVNo ratings yet

- Consolidated PCU Labor Law Review 1st Batch Atty Jeff SantosDocument36 pagesConsolidated PCU Labor Law Review 1st Batch Atty Jeff SantosJannah Mae de OcampoNo ratings yet

- Partnership & Corporation: 2 SEMESTER 2020-2021Document13 pagesPartnership & Corporation: 2 SEMESTER 2020-2021Erika BucaoNo ratings yet

- Chargezoom Achieves PCI-DSS ComplianceDocument2 pagesChargezoom Achieves PCI-DSS CompliancePR.comNo ratings yet

- Pengaruh Kompetensi Spiritual Guru Pendidikan Agama Kristen Terhadap Pertumbuhan Iman SiswaDocument13 pagesPengaruh Kompetensi Spiritual Guru Pendidikan Agama Kristen Terhadap Pertumbuhan Iman SiswaK'lala GrianNo ratings yet

- Read Online 9789351199311 Big Data Black Book Covers Hadoop 2 Mapreduce Hi PDFDocument2 pagesRead Online 9789351199311 Big Data Black Book Covers Hadoop 2 Mapreduce Hi PDFSonali Kadam100% (1)

- FORTRESS EUROPE by Ryan BartekDocument358 pagesFORTRESS EUROPE by Ryan BartekRyan Bartek100% (1)

- Project Report Format CSE DEPTDocument16 pagesProject Report Format CSE DEPTAnkush KoundalNo ratings yet

- An Improved Version of The Skin Chapter of Kent RepertoryDocument6 pagesAn Improved Version of The Skin Chapter of Kent RepertoryHomoeopathic PulseNo ratings yet

- Introduction To Professional School Counseling Advocacy Leadership and Intervention Ebook PDF VersionDocument62 pagesIntroduction To Professional School Counseling Advocacy Leadership and Intervention Ebook PDF Versionmary.krueger918100% (50)

- Extraction of Non-Timber Forest Products in The PDFDocument18 pagesExtraction of Non-Timber Forest Products in The PDFRohit Kumar YadavNo ratings yet

- Catibayan Reflection AR VRDocument6 pagesCatibayan Reflection AR VRSheina Marie BariNo ratings yet