Professional Documents

Culture Documents

Percentage Tax in Philippines

Uploaded by

NL R Q DOOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Percentage Tax in Philippines

Uploaded by

NL R Q DOCopyright:

Available Formats

Percentage Tax in Philippines

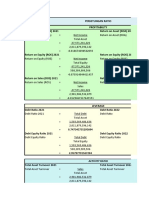

Percentage tax is a business tax imposed on persons or entities who sell or lease goods, properties or services in the course of trade or business whose gross annual sales and/or receipts do not exceed Peso 750,000 and who are not Value Added Tax (VAT)-registered. Who are required to File Percentage Tax Returns Tax Structure in Philippines

Capital Gains Tax in Philippines Corporate Tax in Philippines Customs Duty in Philippines Income Tax in Philippines Tax Structure in Philippines Value-Added Tax in Philippines

Any person who is not a VAT-registered

person (persons exempt from VAT under Sec. 109z of the Tax Code). Domestic carriers and keepers of garages, except owners of bancas and owners of animal drawn twowheeled vehicle. Operators of international air and shipping carriers doing business in the Philippines. Franchise grantees of electric, gas or water utilities. Franchise grantees of radio and/or television broadcasting companies whose gross annual receipts for the preceding year do not exceed Ten Million Pesos (P 10,000,000.00) and did not opt to register as VAT taxpayers. Operators of communication equipment sending overseas dispatch, messages, or conversations from the Philippines, except on services involving the following. Government of the Philippines - for messages transmitted by the Government of the Republic of the Philippines or any of its political subdivisions and instrumentalities. Diplomatic services - for messages transmitted by any embassy and consular offices of a foreign government. International organizations - for messages transmitted by a public international organization or any of its agencies based in the Philippines enjoying privileges, exemptions and immunities which the government of the Philippine is committed to recognize pursuant to an international agreement. News Services - for messages from any newspaper, press association, radio or television newspaper broadcasting agency, or new sticker services to any other newspaper, press association, radio or television, newspaper, broadcasting agency or new sticker services, or to bonafide correspondents, which messages deal exclusively with the collection of news items for, or the dissemination of news items through public press, radio or television broadcasting or a new sticker service furnishing a general news service similar to that of the public press. Banks and non-bank financial intermediaries and finance companies. Life insurance premiums. Agents of foreign insurance companies. Proprietor, lessee, or operator of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, jai-alai and race tracks. Every stock broker who effected a sale, barter, exchange or other disposition of shares of stock listed and traded through the Local Stock Exchange (LSE) other than the sale by a dealer in securities. Corporate issuer / stock broker, whether domestic of foreign, engaged in the sale, barter, exchange or other disposition through Initial Public Offering (IPO) seller in secondary public offering of shares of stock in closely held corporations.

You might also like

- Introduction To Business TaxesDocument32 pagesIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- RR 2-98Document21 pagesRR 2-98Joshua HorneNo ratings yet

- TaxationDocument5 pagesTaxationThonieroce Apryle Jey Morelos100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- LeopoldDocument2 pagesLeopoldNL R Q DONo ratings yet

- GCG MC No. 2012-07 - Code of Corp Governance PDFDocument31 pagesGCG MC No. 2012-07 - Code of Corp Governance PDFakalamoNo ratings yet

- DRRM H Concept NoteDocument3 pagesDRRM H Concept Noteralph falculan100% (1)

- Business Tax IntroductionDocument5 pagesBusiness Tax IntroductionJessica MalijanNo ratings yet

- General Zoology SyllabusDocument4 pagesGeneral Zoology SyllabusNL R Q DO100% (3)

- Taxation Reviewer VatDocument8 pagesTaxation Reviewer VatDaphne BarceNo ratings yet

- Adzu Tax02 A Learning Packet 2 Value Added TaxDocument9 pagesAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- Vat On Sale of ServicesDocument55 pagesVat On Sale of ServicesJohnAllenMarilla67% (3)

- Weitzman Theorem ProofDocument3 pagesWeitzman Theorem ProofSaurav DuttNo ratings yet

- Business Taxation 1Document81 pagesBusiness Taxation 1Prince Isaiah Jacob100% (1)

- Handouts 56Document11 pagesHandouts 56Omar CabayagNo ratings yet

- Philippine National AIDS CouncilDocument47 pagesPhilippine National AIDS CouncilNL R Q DONo ratings yet

- (DOH HPB) Self Appraisal Checklist For Province-Wide Health Promotion ProgramsDocument4 pages(DOH HPB) Self Appraisal Checklist For Province-Wide Health Promotion ProgramsNL R Q DONo ratings yet

- (DOH HPB) Self Appraisal Checklist For Province-Wide Health Promotion ProgramsDocument4 pages(DOH HPB) Self Appraisal Checklist For Province-Wide Health Promotion ProgramsNL R Q DONo ratings yet

- (DOH HPB) Self Appraisal Checklist For Province-Wide Health Promotion ProgramsDocument4 pages(DOH HPB) Self Appraisal Checklist For Province-Wide Health Promotion ProgramsNL R Q DONo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- CS Form No. 211 Medical CertificateDocument2 pagesCS Form No. 211 Medical CertificatemilesmineNo ratings yet

- Different Kinds of Taxes in The PhilippinesDocument5 pagesDifferent Kinds of Taxes in The PhilippinesJosephine Berces100% (1)

- Vat On Sale of Services and Use orDocument53 pagesVat On Sale of Services and Use orJohnAllenMarillaNo ratings yet

- Other Percentage TaxesDocument40 pagesOther Percentage TaxesKay Hanalee Villanueva NorioNo ratings yet

- B. Introduction To VAT FinalDocument102 pagesB. Introduction To VAT FinalNatalie SerranoNo ratings yet

- Percentage Tax Excise Tax Documentary Stamp: Taxation LawDocument23 pagesPercentage Tax Excise Tax Documentary Stamp: Taxation LawB-an JavelosaNo ratings yet

- GIDA Profiling Tool Version 2 2018Document7 pagesGIDA Profiling Tool Version 2 2018NL R Q DO0% (1)

- Sweetheart Loan - Florendo Vs CADocument2 pagesSweetheart Loan - Florendo Vs CAErmeline TampusNo ratings yet

- Ranjani-211420631111 RemovedDocument91 pagesRanjani-211420631111 RemovedSangeethaNo ratings yet

- Unang YakapDocument66 pagesUnang YakapJeyneh Serafin100% (2)

- Hotel ProjectDocument38 pagesHotel ProjectMelat MakonnenNo ratings yet

- O o o O: Percentage Tax DescriptionDocument3 pagesO o o O: Percentage Tax Descriptionscartoneros_1No ratings yet

- Jude Feliciano: What Are VAT Exempt Transactions in The Philippines?Document10 pagesJude Feliciano: What Are VAT Exempt Transactions in The Philippines?Michelle NacisNo ratings yet

- PT, Excise and DST NotesDocument10 pagesPT, Excise and DST NotesFayie De LunaNo ratings yet

- LawDocument43 pagesLawMARIANo ratings yet

- Other Percentage Taxes: Three Percent (3%) Percentage TaxDocument9 pagesOther Percentage Taxes: Three Percent (3%) Percentage TaxShanelle NapolesNo ratings yet

- Module Part 2 - Business Taxation Dec. 14Document60 pagesModule Part 2 - Business Taxation Dec. 14Maybelyn PaalaNo ratings yet

- Percentage Tax Who Are Required To File?Document4 pagesPercentage Tax Who Are Required To File?Angelyn SamandeNo ratings yet

- 06 Value Added TaxDocument43 pages06 Value Added TaxGolden ChildNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesMacatol KristineNo ratings yet

- Taxing Powers, Scope and Limitations of Nga and LguDocument7 pagesTaxing Powers, Scope and Limitations of Nga and LguArthur MericoNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesSunny DaeNo ratings yet

- VAT Exempt SalesDocument29 pagesVAT Exempt SalesNEstandaNo ratings yet

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesJustin Laraño RabagoNo ratings yet

- 04 Business Taxation: Clwtaxn de La Salle UniversityDocument51 pages04 Business Taxation: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- TAXATION 2 Chapter 9 Exempt SalesDocument5 pagesTAXATION 2 Chapter 9 Exempt SalesKim Cristian MaañoNo ratings yet

- Vat On Sale of Services AND Use or Lease of PropertyDocument67 pagesVat On Sale of Services AND Use or Lease of PropertyZvioule Ma FuentesNo ratings yet

- Chapter 18 22 Taxation 2Document67 pagesChapter 18 22 Taxation 2Zvioule Ma FuentesNo ratings yet

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesKristine CamposNo ratings yet

- Chapter 4 Value Added Tax Sale of Services EtcDocument6 pagesChapter 4 Value Added Tax Sale of Services EtcMary Grace BaquiranNo ratings yet

- VATable TransactionsDocument2 pagesVATable TransactionsAngelo D. AventuradoNo ratings yet

- Overseas Communication TaxDocument1 pageOverseas Communication TaxlyzleejoieNo ratings yet

- BIR Form 2551Q: Quarterly Percentage TaxDocument8 pagesBIR Form 2551Q: Quarterly Percentage TaxAngelyn SamandeNo ratings yet

- Kinds of Taxes in The PhilippinesDocument11 pagesKinds of Taxes in The PhilippinesARCHIE AJIASNo ratings yet

- VAT On Sale of ServicesDocument12 pagesVAT On Sale of ServicesitsmeglennieeNo ratings yet

- Other Percentage TaxDocument19 pagesOther Percentage TaxDiossaNo ratings yet

- MODULE 2 Value Added TaxDocument21 pagesMODULE 2 Value Added TaxLenson NatividadNo ratings yet

- Tax 30222Document5 pagesTax 30222Ronariza BondocNo ratings yet

- VAT Exempt Transactions and ServicesDocument19 pagesVAT Exempt Transactions and ServicesJane Ibale CarbonquilloNo ratings yet

- Business Tax: Francis Ysabella S. BalagtasDocument6 pagesBusiness Tax: Francis Ysabella S. BalagtasFrancis Ysabella BalagtasNo ratings yet

- Joan REPORTING TAX 1Document6 pagesJoan REPORTING TAX 1Jasmin CaoileNo ratings yet

- Asia Pacific Marketing Forum - Doing Business in The PhilippinesDocument10 pagesAsia Pacific Marketing Forum - Doing Business in The PhilippinesDan CastilloNo ratings yet

- Tax 302 - Vat-Exempt TransactionsDocument6 pagesTax 302 - Vat-Exempt TransactionsiBEAYNo ratings yet

- Whether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATDocument7 pagesWhether Donation Is Taxable/Nontaxable Zero Rated/VAT Exempt/VAT Taxable 2 Problems On Donation 2 Problems On VATJape PreciaNo ratings yet

- VAT Group 3Document39 pagesVAT Group 3Andrea GranilNo ratings yet

- Business TaxationDocument33 pagesBusiness Taxationrose querubinNo ratings yet

- Philippine Economic Zone Authority (PEZA Registered) Can Avail of 2 TAXDocument6 pagesPhilippine Economic Zone Authority (PEZA Registered) Can Avail of 2 TAXDaryl Noel TejanoNo ratings yet

- Percentage TaxDocument17 pagesPercentage TaxPrincess Jay NacorNo ratings yet

- Donor'S Tax: People's Televisin Network, IncDocument7 pagesDonor'S Tax: People's Televisin Network, IncJherom brillantesNo ratings yet

- 15Document10 pages15mariyha PalangganaNo ratings yet

- Module 4 Lesson 10 Taxation Read... in Phil. His.Document5 pagesModule 4 Lesson 10 Taxation Read... in Phil. His.John Mark Candeluna EreniaNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307Document5 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded) : BIR Form No. 1601-E/2307i1958239No ratings yet

- Felipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)Document5 pagesFelipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)AustinNo ratings yet

- Other Percentage Taxes: Prof. Jeanefer Reyes CPA, MPADocument29 pagesOther Percentage Taxes: Prof. Jeanefer Reyes CPA, MPAmark anthony espirituNo ratings yet

- F. Percentage Taxes: Concept and NatureDocument17 pagesF. Percentage Taxes: Concept and NatureMitzi Caryl EncarnacionNo ratings yet

- SALN 2012 GuideDocument12 pagesSALN 2012 GuideakalamoNo ratings yet

- SALN 2012 GuideDocument12 pagesSALN 2012 GuideakalamoNo ratings yet

- SALN 2012 GuideDocument12 pagesSALN 2012 GuideakalamoNo ratings yet

- SALN 2012 GuideDocument12 pagesSALN 2012 GuideakalamoNo ratings yet

- How To Install AGUSAN DEL SUR QR Code App and Generate A QR IDDocument19 pagesHow To Install AGUSAN DEL SUR QR Code App and Generate A QR IDNL R Q DONo ratings yet

- Joomla ComponentsDocument1 pageJoomla ComponentsNL R Q DONo ratings yet

- CHT Summit CriteriaDocument9 pagesCHT Summit CriteriaNL R Q DONo ratings yet

- IV Therapy PDFDocument64 pagesIV Therapy PDFNL R Q DONo ratings yet

- Revised Web IV TherapyDocument28 pagesRevised Web IV TherapyNL R Q DONo ratings yet

- Nursingbulletin Laws Affecting The Practice of NursingDocument4 pagesNursingbulletin Laws Affecting The Practice of Nursingseigelystic100% (43)

- A - Updated GYC Commercial Aerocity Yamuna Price List 19 11 2020-1Document1 pageA - Updated GYC Commercial Aerocity Yamuna Price List 19 11 2020-1Zama KazmiNo ratings yet

- Account Titles and Its ElementsDocument3 pagesAccount Titles and Its ElementsJeb PampliegaNo ratings yet

- Value Based Questions in Economics Class XIIDocument8 pagesValue Based Questions in Economics Class XIIkkumar009No ratings yet

- MMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MDocument55 pagesMMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MRuby ButiNo ratings yet

- RSK CVDocument2 pagesRSK CVRanveer Singh KissoondoyalNo ratings yet

- CH 07 Account Receivables and Inventory MGTDocument61 pagesCH 07 Account Receivables and Inventory MGTElisabeth LoanaNo ratings yet

- 2.2. PPE IAS16 - Practice - EnglishDocument12 pages2.2. PPE IAS16 - Practice - EnglishBích TrâmNo ratings yet

- Foundation Broad Cost LeaderDocument6 pagesFoundation Broad Cost LeaderGuisse MariamNo ratings yet

- Chapter 5Document9 pagesChapter 5AMIR EFFENDINo ratings yet

- Acct Statement XX5203 16122023Document3 pagesAcct Statement XX5203 16122023sa6307756No ratings yet

- Company Law SummerisedDocument15 pagesCompany Law SummerisedOkori PaulNo ratings yet

- Q 1Document4 pagesQ 1sam heisenbergNo ratings yet

- (C501) (Team Nexus) Assignment 1Document14 pages(C501) (Team Nexus) Assignment 1Mohsin Md. Abdul KarimNo ratings yet

- A. Balance Sheet: Hytek Income Statement Year 2012Document3 pagesA. Balance Sheet: Hytek Income Statement Year 2012marc chucuenNo ratings yet

- Roadmap of Indian Accounting Standards (IND As) - Taxguru - inDocument3 pagesRoadmap of Indian Accounting Standards (IND As) - Taxguru - interter terterNo ratings yet

- August 29, 2014 Strathmore TimesDocument28 pagesAugust 29, 2014 Strathmore TimesStrathmore TimesNo ratings yet

- Course Outline S1 2022Document5 pagesCourse Outline S1 2022Woon TNNo ratings yet

- Syllabus - GEC004-Math in The Modern WorldDocument2 pagesSyllabus - GEC004-Math in The Modern WorldRachel PetersNo ratings yet

- NMR 8 Suryanto Dan Dai 2016 PDFDocument15 pagesNMR 8 Suryanto Dan Dai 2016 PDFanomimNo ratings yet

- Summative Test in Math (Part Ii) Quarter 1Document1 pageSummative Test in Math (Part Ii) Quarter 1JAY MIRANDANo ratings yet

- Iesco Online Billl PDFDocument2 pagesIesco Online Billl PDFAsad AliNo ratings yet

- Hindustan Petroleum Corporation - FullDocument64 pagesHindustan Petroleum Corporation - FullSathyaPriya RamasamyNo ratings yet

- Bangladesh University of Professionals: Course Name: Bank Management Course Code: FIN 4204 Topic NameDocument6 pagesBangladesh University of Professionals: Course Name: Bank Management Course Code: FIN 4204 Topic NameAnika TabassumNo ratings yet

- L2 Business PlanDocument26 pagesL2 Business PlanMohammad Nur Hakimi SulaimanNo ratings yet

- Proyeksi INAF - Kelompok 3Document43 pagesProyeksi INAF - Kelompok 3Fairly 288No ratings yet