Professional Documents

Culture Documents

Credit & Collections

Uploaded by

Mercury2012Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit & Collections

Uploaded by

Mercury2012Copyright:

Available Formats

CREDITS

and

COLLECTIONS

by

Richard P. Ettinger

President and Chairman of the Boord

Prentice-Hall, Inc.

Member of the New York Bar

and

David E. Golieb

Chairman of the Boord, J. A. Deknatel and

Son, Inc.; Member of the Boord of Directors,

Patchogue-Plymouth Mills Corporation; Chair-

man of the Boord of Governors, Notional Institute

of Credit, New York Chapter; and Post Pres-

ident of the New York Credit Men's Association

THIRD EDITION

NEW YORK

PRENTICE-HALL, INC.

2 WHAT IS CREDIT?

and money is very slight in practical business affairs. We speak

of money as ordinarily being more generally acceptable than

credit, but if we consider that this money is turned into credit

as soon as it is received (by depositing it in a bank to prevent

loss by fire or theft), we immediately realize that in everyday

life credit is in some forms at least the equal of money. Yet this

is not always so. Let us, therefore, understand at the very outset

that credit is only as good and as strong as the person or insti-

tution upon whom it places the obligation to make the future

payment in money. .

The word "credit" is used to apply to (1) the credit trans-

action, (2) the credit standing of the borrower or buyer, and (3)

the credit instruments that are part of the transaction. To avoid

confusion in understanding what credit is, the student must

distinguish among these three terms. The credit transaction is

the actual exchange of money or goods for the promise to pay in

the future. A borrower's or buyer's credit standing is the busi-

ness world's judgment of his ability and willingness to fulfill his

promise to pay. Credit instruments are the evidence of the

("' credit transaction. For example, a dollar lllll and a promissory

note are both forms of credit instruments, for both are promises

to pay. Thus, we speak of buying goods on "credit"; of a mer-

chant's "credit"; and of making a payment by a "credit."

.) Nature of credit. Is credit wealth? Weare certain that many

()..'('f: people believe it is. Herein lies a great difficulty, for it is this

'oJ\:h +OY'V' conception of credit that leads to undue expansion of credit,

,.[ cre11' \; speculative business, collapse, and consequent misery. It is easy

Vj I to demonstrate that credit is not wealth. Three men, A, B, and

\fl C, can give one another credit, which, if wealth, would fill the

coffers of the world. With this credit they could gain control of

one another's property, but soon this would be exhausted in

supplying their wants, and then their credit would be as useless

as a kettle with nothing to put in it. "No more wealth, no more

capital, no more goods exist after credit is given than before.

Nevertheless, the use of credit does lead to an increase of wealth,

for it brings the productive agents of a country into the posses-

sion of those men who are most competent to utilize them. Just

as the railroad has rendered the rich prairies of Nebraska and

Kansas available to the farmer, so does credit render available

WHAT IS CREDIT? 7

Government today usually exercises its control of credit. The

Federal Reserve Act is the principal law that delegates power to

control credit.

The Federal Reserve Act. This Act instituted a system of

banks known as the Federal Reserve System. Under the system

twelve Federal reserve banks have been established. All na-

tional banks are required to belong to the system; state banks

may belong if they meet the requirements of the Federal Re-

serve Act. Banks that belong to the system are "member" banks. 1\ II

The twelve Federal reserve banks are bankers' banks-their pri- 7\

mary purpose is to supply credit to member banks. The member ere \ .. 1\

banks, in turn, distribute the credit to their customers. Federal 't1i

reserve banks are operated under the management of local offi- Cl enrt.

cers and boards of directors, but they are all subject to the au- (In. (Are..

thority of the Board of Governors of the Federal Reserve

tern. II

One of the powers of the Federal Reserve System is the au- va

thority to advance money to member banks on notes that they

have accepted from their customers. This power is one of severa \ W

that the Federal Reserve System may use to control credit E)

Since it is the one that most directly affects the businessman

we shall show how it operates. But first the student must under

stand what is meant by the term "discount."

Suppose A accepts a note from B, to whom he has sold good

on credit. A needs cash. He goes to his bank and arranges for a

advance by the bank on B's note. A endorses the note and A

well as B are then responsible for the payment of the note whe

due. The bank then makes available to A the face amount of th

note less interest. This process is called "discounting"; the rat

of interest deducted is the "discount rate."

When the Federal reserve banks advance money to member (-tHt*)

banks on notes that they have discounted for their customers, --

the member bank endorses t e note an is Ia Ie or Its payment.

The Federal reserve banks deduct interest in advance. ThIS wb

process of advancing money to a bank on notes that it has dis- -I::he.f'{J"b-

counted is called "rediscounting"; the rate of interest deducted d' sU::Uvtt tL

is the "rediscount rate." The plan means that, even in times of1..\' L _ \ .

. h b . f d f \,V\e. I .... ,

pamc, t e usmessman can secure necessary un s rom a mem- e.rdor<.::ef (

ber bank, for the member bank in turn can rediscount his paper I

l\')

o..\\tSwl

d

\-t,W -\:xi t.'(' _' Thl"::.

l\()werl ff\

c

2o"LA. .

CHAPTER 2

Credit Instruments

C

REDIT transactions involve the use of credit instruments.

These instruments show definitely that credit has been ex-

tended. Credit instruments may be divided broadly into those of

general acceptability and those of limited acceptability. A credit

instrument that is universally acceptable is properly called

money or currency. Federal reserve notes, banknotes, and silver

certificates, all of which are mere promises to pay, belong to this

group. Much has been written about this kind of credit and the

effect of an increase or decrease in the supply or demand for

money upon prices, interest, and business in general-matters

of the most vital significance to the successful businessman. It

is not our purpose to treat these matters here. It is sufficient to

note that credit instruments of general or unlimited accepta-

bility serve as a substitute for money in the country that issues

them.

--credit instruments of limited acceptability include all other

forms of evidence that credit has been extended. These may be

divided into promises to pay and orders to pay. The chief prom-

ises to pay are: open or book accounts (known as book credit),!

promissory notes, and bonds. The chief orders to pay are:

checks, trade acceptances, drafts, bills of exchange, and money

orders.

Negotiable instrument. The term "negotiable" is frequently

used in connection with credit instruments. It is, therefore,

necessary for the student to understand what is meant by a

negotiable instrument. Negotiability means that the instrument

can be passed freely from one person to another in such a man-

ner as to constitute the transferee the holder. If payable to

1 Some authors use the term credit instrument in the strict sense that it is

a written promise, or order, to pay a definite or determinable sum of money to

bearer, or to a specified person or his order. They do not, then, consider book

accounts as credit instruments since these, strictly speaking, do not involve any

written promise or order to pay.

9

You might also like

- Bankers Acceptance CondensedDocument5 pagesBankers Acceptance CondensedLuka Ajvar100% (1)

- 12408original Issue Discount (OID) DefinedDocument13 pages12408original Issue Discount (OID) DefinedTheplaymaker508100% (1)

- I F A U: Nstructions or N NsecuredDocument4 pagesI F A U: Nstructions or N NsecuredLeslie Barnes100% (1)

- Bankers AcceptancesDocument36 pagesBankers AcceptancesAlexhCreditorNo ratings yet

- The Negotiable Instruments LawDocument18 pagesThe Negotiable Instruments Lawcode4sale100% (1)

- The Birth Certificate InfoDocument1 pageThe Birth Certificate InfoexousiallcNo ratings yet

- Bankers AcceptanceDocument1 pageBankers AcceptanceVarad LaghateNo ratings yet

- LOAN Defined: Deposit of Money "Promissory Note" by Customer W/ BankerDocument8 pagesLOAN Defined: Deposit of Money "Promissory Note" by Customer W/ Bankerin1orNo ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeChetan SapraNo ratings yet

- Treasury management functions and capital vs money marketsDocument8 pagesTreasury management functions and capital vs money marketsMichelle T100% (1)

- 31 Usc 5312 We Are A Financial InstitutionDocument3 pages31 Usc 5312 We Are A Financial InstitutionMichael Focia100% (1)

- Loan Accounting Reveals True Creditor PDFDocument1 pageLoan Accounting Reveals True Creditor PDFDouglas StehlingNo ratings yet

- Holy Smoke, My Promissory Note's A Security!Document2 pagesHoly Smoke, My Promissory Note's A Security!johngault100% (2)

- Preauthorzed Letter of CreditDocument1 pagePreauthorzed Letter of Creditlakeshia1lovinglife10% (1)

- EFT ScamDocument1 pageEFT ScamTonya Banks0% (1)

- Bill of ExchangeDocument3 pagesBill of ExchangeNisot Ihdnag100% (5)

- Our Commercial Flow Chart Rev2Document1 pageOur Commercial Flow Chart Rev2Dark Heineken100% (1)

- (1874) The Currency-Specie PaymentsDocument40 pages(1874) The Currency-Specie PaymentsHerbert Hillary Booker 2nd50% (2)

- New Pacific Timber vs SenerisDocument13 pagesNew Pacific Timber vs SenerisiicaiiNo ratings yet

- Notice of DishonorDocument3 pagesNotice of Dishonorbill100% (2)

- Trust May 2011 NotesDocument3 pagesTrust May 2011 Notespaula_morrill1778No ratings yet

- US Internal Revenue Service: p1212 - 1997Document15 pagesUS Internal Revenue Service: p1212 - 1997IRSNo ratings yet

- Bailor and Bailee Relationship PDFDocument16 pagesBailor and Bailee Relationship PDFJohnnyLarson100% (1)

- Bank Draw Down Request 1031 Fedwire Definition Info The DifferenceDocument2 pagesBank Draw Down Request 1031 Fedwire Definition Info The DifferenceMikeDouglas0% (1)

- SAR Page 3 TextDocument1 pageSAR Page 3 TextMikeDouglasNo ratings yet

- 2nd LTR To LenderDocument1 page2nd LTR To LenderBob WrightNo ratings yet

- LegForms Group 4Document25 pagesLegForms Group 4SmurfNo ratings yet

- 3 Day Notice To ReportDocument1 page3 Day Notice To ReportMarsha MainesNo ratings yet

- Lawful Money Defined: What It Is and How It Differs From Fiat CurrencyDocument4 pagesLawful Money Defined: What It Is and How It Differs From Fiat CurrencyLedoNo ratings yet

- Bankers AcceptanceDocument2 pagesBankers AcceptanceKudzanai Allen Paraffin100% (5)

- Oracle Receivables Automatic Receipts and Remittance GuideDocument29 pagesOracle Receivables Automatic Receipts and Remittance GuideShagun PanjwaniNo ratings yet

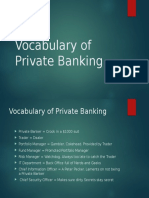

- Private BankingDocument2 pagesPrivate BankingAnwar Ludin0% (1)

- 7 Points For An AffidavitDocument1 page7 Points For An AffidavitmoNo ratings yet

- Living Trust Funding Worksheet - MarriedDocument14 pagesLiving Trust Funding Worksheet - MarriedRocketLawyerNo ratings yet

- IndorsementDocument1 pageIndorsementJason HenryNo ratings yet

- Private BankerDocument2 pagesPrivate Bankerapi-772861790% (1)

- Freedom Papers Section 2Document47 pagesFreedom Papers Section 2John Downs100% (5)

- TrustDocument30 pagesTrustWho moved my Cheese?100% (2)

- Bill of exchange, promissory note and cheque regulationsDocument10 pagesBill of exchange, promissory note and cheque regulationsThéotime HabinezaNo ratings yet

- Bill of Exchange and ChecksDocument8 pagesBill of Exchange and ChecksSmurf82% (17)

- Public Vs PrivateDocument1 pagePublic Vs PrivateYaw Mensah Amun RaNo ratings yet

- Banker NotesDocument134 pagesBanker NotesEdward MokweriNo ratings yet

- 3 Levels of CreditorDocument1 page3 Levels of CreditorSheldon Jungle100% (3)

- $$$$ Collect Your Own Attorney Fees$$$ - What A Private Attorney General Is AND Why It Matters.Document48 pages$$$$ Collect Your Own Attorney Fees$$$ - What A Private Attorney General Is AND Why It Matters.83jjmackNo ratings yet

- Structured Adjustable Rate Mortgage Loan Trust Mortgage Pass-Through Certificates, Series 2004-19 December 26, 2012Document33 pagesStructured Adjustable Rate Mortgage Loan Trust Mortgage Pass-Through Certificates, Series 2004-19 December 26, 2012Himanshu KhannaNo ratings yet

- 2018 Sav1455 RedemptionDocument5 pages2018 Sav1455 Redemptiondouglas jonesNo ratings yet

- How the word BIBLE relates to banking instruments, laws and equityDocument1 pageHow the word BIBLE relates to banking instruments, laws and equityKurozato CandyNo ratings yet

- Edwin Vieira, Jr. - What Is A Dollar - An Historical Analysis of The Fundamental Question in Monetary Policy PDFDocument33 pagesEdwin Vieira, Jr. - What Is A Dollar - An Historical Analysis of The Fundamental Question in Monetary Policy PDFgkeraunenNo ratings yet

- Intellectual Property Securitization: Intellectual Property SecuritiesFrom EverandIntellectual Property Securitization: Intellectual Property SecuritiesNo ratings yet

- The Feasts of Yahuah 2022Document1 pageThe Feasts of Yahuah 2022Mercury2012No ratings yet

- Discounting PDFDocument1 pageDiscounting PDFMercury2012No ratings yet

- Acts of Congress Cited by Popular NameDocument318 pagesActs of Congress Cited by Popular NameMercury2012No ratings yet

- UntitledDocument59 pagesUntitledMercury2012No ratings yet

- Discount PDFDocument1 pageDiscount PDFMercury2012No ratings yet

- Arbitrary Act or Decision PDFDocument1 pageArbitrary Act or Decision PDFMercury2012No ratings yet

- Three Elements of Jurisdiction for Valid Court RulingsDocument1 pageThree Elements of Jurisdiction for Valid Court RulingsMercury2012No ratings yet

- Money - A Fast Start PDFDocument1 pageMoney - A Fast Start PDFMercury2012No ratings yet

- Three Standards of Proof PDFDocument1 pageThree Standards of Proof PDFMercury2012No ratings yet

- Form 180.bias Invest - AllegationsDocument1 pageForm 180.bias Invest - AllegationsMercury2012No ratings yet

- Benefit Seeking PDFDocument1 pageBenefit Seeking PDFMercury2012No ratings yet

- 3 Month Training ProgramDocument8 pages3 Month Training ProgramMercury2012No ratings yet

- BreachDocument1 pageBreachMercury2012No ratings yet

- Bank Credit - Credits and Collections PDFDocument1 pageBank Credit - Credits and Collections PDFMercury2012No ratings yet

- Form 081.illegal Warrantless Search - Allegations PDFDocument1 pageForm 081.illegal Warrantless Search - Allegations PDFMercury2012No ratings yet

- Framing The Deep Issue FormulaDocument1 pageFraming The Deep Issue FormulaMercury2012No ratings yet

- The Negro Law of South Carolina (1848)Document68 pagesThe Negro Law of South Carolina (1848)Rlynne100% (7)

- Form 081.illegal Warrantless Search - Allegations PDFDocument1 pageForm 081.illegal Warrantless Search - Allegations PDFMercury2012No ratings yet

- Status, TimeDocument1 pageStatus, TimeMercury2012No ratings yet

- A Charge, Delivered To The African LodgeDocument17 pagesA Charge, Delivered To The African LodgeMercury2012No ratings yet

- City Org ModelDocument1 pageCity Org ModelMercury2012No ratings yet

- Speed of Movement PDFDocument1 pageSpeed of Movement PDFMercury2012No ratings yet

- Rights and Duties of Neutrals (1916)Document272 pagesRights and Duties of Neutrals (1916)Mercury2012No ratings yet

- Lifecycl PDFDocument1 pageLifecycl PDFMercury2012No ratings yet

- 3 Month Training ProgramDocument8 pages3 Month Training ProgramMercury2012No ratings yet

- 21 Points To Solve Commercial DisputeDocument4 pages21 Points To Solve Commercial DisputeMercury2012No ratings yet

- Developing The Theory of The CaseDocument1 pageDeveloping The Theory of The CaseMercury2012No ratings yet

- Overview of CDocument64 pagesOverview of CMercury2012No ratings yet

- Elements to Create a Binding ContractDocument1 pageElements to Create a Binding ContractMercury2012No ratings yet

- Overview of CDocument64 pagesOverview of CMercury2012No ratings yet

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollRogie Apolo67% (3)

- Private Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Document6 pagesPrivate Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Esteban Enrique Posan BalcazarNo ratings yet

- 6-Ratios Prop Indices LogsDocument4 pages6-Ratios Prop Indices LogsPushkar0% (1)

- 2 PDFDocument5 pages2 PDFSubrat SahooNo ratings yet

- Pepsi PaperDocument6 pagesPepsi Paperapi-241248438No ratings yet

- INTERMEDIATE ACCOUNTING-Unit01Document24 pagesINTERMEDIATE ACCOUNTING-Unit01Rattanaporn TechaprapasratNo ratings yet

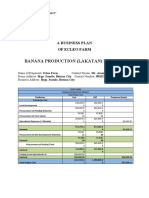

- Banana Production (Lakatan) Project: A Business Plan of Ecleo FarmDocument20 pagesBanana Production (Lakatan) Project: A Business Plan of Ecleo Farmmarkgil1990No ratings yet

- Annual Report of The Secretary of WarDocument1,017 pagesAnnual Report of The Secretary of Warzandro antiolaNo ratings yet

- Top Law Firm in Dubai, UAE - RAALCDocument20 pagesTop Law Firm in Dubai, UAE - RAALCraalc uaeNo ratings yet

- MBA Financial Management AssignmentDocument4 pagesMBA Financial Management AssignmentRITU NANDAL 144No ratings yet

- Executive Order 1035 Streamlines Gov't Land AcquisitionDocument5 pagesExecutive Order 1035 Streamlines Gov't Land Acquisitionahsiri22No ratings yet

- CDP CDP Complaint-1Document20 pagesCDP CDP Complaint-1Scott JohnsonNo ratings yet

- LGU-NGAS TableofContentsVol1Document6 pagesLGU-NGAS TableofContentsVol1Pee-Jay Inigo UlitaNo ratings yet

- Income Statement Format (KTV) KTV KTVDocument30 pagesIncome Statement Format (KTV) KTV KTVDarlene Jade Butic VillanuevaNo ratings yet

- Introduction To Investment MGMTDocument6 pagesIntroduction To Investment MGMTShailendra AryaNo ratings yet

- 1 Partnership FormationDocument7 pages1 Partnership FormationJ MahinayNo ratings yet

- Accountancy and Auditing 2-2011Document7 pagesAccountancy and Auditing 2-2011Muhammad BilalNo ratings yet

- Travel Agency Business Plan: Adventure Excursions Unlimited Executive SummaryDocument33 pagesTravel Agency Business Plan: Adventure Excursions Unlimited Executive SummaryjatinNo ratings yet

- Saka 1h Presentation 2019 - 2 5d67a0eea24d1 PDFDocument18 pagesSaka 1h Presentation 2019 - 2 5d67a0eea24d1 PDFAnurag RayNo ratings yet

- Tempest Accounting and AnalysisDocument10 pagesTempest Accounting and AnalysisSIXIAN JIANGNo ratings yet

- North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformDocument84 pagesNorth Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformTax Foundation100% (1)

- Banking Legal and Regulatory Aspects Janbi Model QuestionsDocument8 pagesBanking Legal and Regulatory Aspects Janbi Model QuestionsKhanal PremNo ratings yet

- Mahmood Textile MillsDocument33 pagesMahmood Textile MillsParas RawatNo ratings yet

- The Greatest Trade of The CenturyDocument280 pagesThe Greatest Trade of The Centurysalsa94No ratings yet

- CB Insights - Fintech Report Q1 2019 PDFDocument81 pagesCB Insights - Fintech Report Q1 2019 PDFsarveshrathiNo ratings yet

- Chapter 29 PDFDocument11 pagesChapter 29 PDFSangeetha Menon100% (1)

- Walmart's $16 Billion Acquisition of FlipkartDocument2 pagesWalmart's $16 Billion Acquisition of FlipkartAmit Dharak100% (1)

- 2 Forex Question CciDocument50 pages2 Forex Question CciRavneet KaurNo ratings yet

- Final Accounts Problems and Solutions - Final Accounts QuestionsDocument20 pagesFinal Accounts Problems and Solutions - Final Accounts QuestionshafizarameenfatimahNo ratings yet

- CSEC POB June 2016 P1 With AnswersDocument8 pagesCSEC POB June 2016 P1 With AnswersJAVY BUSINESSNo ratings yet