Professional Documents

Culture Documents

Banking TermsDefinition PDF

Uploaded by

Charu ChopraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking TermsDefinition PDF

Uploaded by

Charu ChopraCopyright:

Available Formats

www.Oliveboard.

in

Banking Terms and Definitions What is a Repo Rate? Repo rate is the rate at which our banks borrow rupees from RBI. Whenever the banks have any shortage of funds they can borrow it from RBI. A reduction in the repo rate will help banks to get money at a cheaper rate. When the repo rate increases, borrowing from RBI becomes more expensive. What is Reverse Repo Rate? This is exact opposite of Repo rate. Reverse Repo rate is the rate at which Reserve Bank of India (RBI) borrows money from banks. RBI uses this tool when it feels there is too much money floating in the banking system. Banks are always happy to lend money to RBI since their money is in safe hands with a good interest. An increase in Reverse repo rate can cause the banks to transfer more funds to RBI due to this attractive interest rates. What is CRR Rate? Cash reserve Ratio (CRR) is the amount of funds that the banks have to keep with RBI. If RBI decides to increase the percent of this, the available amount with the banks comes down. RBI is using this method (increase of CRR rate), to drain out the excessive money from the banks. What is SLR Rate? SLR (Statutory Liquidity Ratio) is the amount a commercial bank needs to maintain in the form of cash, or gold or govt. approved securities (Bonds) before providing credit to its customers. SLR rate is determined and maintained by the RBI (Reserve Bank of India) in order to control the expansion of bank credit. SLR is determined as the percentage of total demand and percentage of time liabilities. Time Liabilities are the liabilities a commercial bank liable to pay to the customers on their anytime demand. SLR is used to control inflation and propel growth. Through SLR rate tuning the money supply in the system can be controlled efficiently. What is Bank Rate? Bank rate, also referred to as the discount rate, is the rate of interest which a central bank charges on the loans and advances that it extends to commercial banks and other financial intermediaries. Changes in the bank rate are often used by central banks to control the money supply.

www.Oliveboard.in

What is Inflation?

Inflation is as an increase in the price of bunch of Goods and services that projects the Indian economy. An increase in inflation figures occurs when there is an increase in the average level of prices in Goods and services. Inflation happens when there are fewer Goods and more buyers; this will result in increase in the price of Goods, since there is more demand and less supply of the goods.

What is Deflation?

Deflation is the continuous decrease in prices of goods and services. Deflation occurs when the inflation rate becomes negative (below zero) and stays there for a longer period.

What is PLR?

The Prime Interest Rate is the interest rate charged by banks to their most creditworthy customers (usually the most prominent and stable business customers). The rate is almost always the same amongst major banks. Adjustments to the prime rate are made by banks at the same time; although, the prime rate does not adjust on any regular basis. The Prime Rate is usually adjusted at the same time and in correlation to the adjustments of the Fed Funds Rate. The rates reported below are based upon the prime rates on the first day of each respective month. Some banks use the name "Reference Rate" or "Base Lending Rate" to refer to their Prime Lending Rate.

What is Deposit Rate?

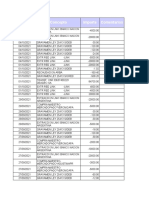

Interest Rates paid by a depository institution on the cash on deposit. Policy Rates: Bank Rate: 9.50% Repo Rate: 7.50% Reverse Repo Rate: 6.50% Reserve Ratios: CRR: 4.00% SLR: 23.0% Lending/Deposit Rates: PLR: 15.00%-14.75%. . Savings Bank rate: 4%. Note: Rates as on Oct 2013.

www.Oliveboard.in

What is FII?

FII (Foreign Institutional Investor) used to denote an investor, mostly in the form of an institution. An institution established outside India, which proposes to invest in Indian market, in other words buying Indian stocks. FII's generally buy in large volumes which has an impact on the stock markets. Institutional Investors includes pension funds, mutual funds, Insurance Companies, Banks, etc. FDI (Foreign Direct Investment) occurs with the purchase of the physical assets or a significant amount of ownership (stock) of a company in another country in order to gain a measure of management control (Or) A foreign company having a stake in a Indian Company.

What is FDI?

What is IPO?

IPO is Initial Public Offering. This is the first offering of shares to the general public from a company wishes to list on the stock exchanges.

What is Disinvestment? What is Fiscal Deficit?

The Selling of the government stake in public sector undertakings. It is the difference between the governments total receipts (excluding borrowings) and total expenditure. Fiscal deficit in 2009-10 is proposed at 6.8% of GDP.

What is Revenue deficit? What is GDP?

It defines that, where the net amount received (by taxes & other forms) fails to meet the predicted net amount to be received by the government. The Gross Domestic Product or GDP is a measure of all of the services and goods produced in a country over a specific period; classically a year.

What is GNP?

Gross National Product is measured as GDP plus income of residents from investments made abroad minus income earned by foreigners in domestic market.

What is National Income? What is Per Capita Income? What is Vote on Account?

National Income is the money value of all goods and services produced in a country during the year. The national income of a country, or region, divided by its population. Per capita income is often used to measure a country's standard of living. A vote-on account is basically a statement ,where the government presents an estimate of a sum required to meet the expenditure that it incurs during the first three to four months of an election financial year until a new government is in place, to keep the machinery running.

www.Oliveboard.in

Difference between Vote on Account and Interim Budget? What is SDR?

Vote-on-account deals only with the expenditure side of the government's budget, an interim Budget is a complete set of accounts, including both expenditure and receipts. The SDR (Special Drawing Rights) is an artificial currency created by the IMF in 1969. SDRs are allocated to member countries and can be fully converted into international currencies so they serve as a supplement to the official foreign reserves of member countries. Its value is based on a basket of key international currencies (U.S. dollar, euro, yen and pound sterling). SEZ means Special Economic Zone is the one of the part of governments policies in India. A special Economic zone is a geographical region that economic laws which are more liberal than the usual economic laws in the country. The basic motto behind this is to increase foreign investment, development of infrastructure, job opportunities and increase the income level of the people.

What is SEZ?

What is corporate governance

The way in which a company is governed and how it deals with the various interests of its customers, shareholders, employees and society at large. Corporate governance is the set of processes, customs, policies, laws, and institutions affecting the way a corporation (or company) is directed, administered or controlled.Is defined as the general set of customs, regulations, habits, and laws that determine to what end a firm should be run.

Functions of RBI?

The Reserve Bank of India is the central bank of India, was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934. The Reserve Bank of India was set up on the recommendations of the Hilton Young Commission. The commission submitted its report in the year 1926, though the bank was not set up for nine years.To regulate the issue of Bank Notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage." Banker to the Government: performs merchant banking function for the central and the state governments; also acts as their banker.Banker to banks: maintains banking accounts of all scheduled banks.

What is monetary policy?

A Monetary policy is the process by which the government, central bank, of a country controls (i) the supply of money, (ii) availability of money, and (iii) cost of money or rate of interest, in order to attain a set of objectives oriented towards the growth and stability of the economy.

www.Oliveboard.in

What is Fiscal Policy?

Fiscal policy is the use of government spending and revenue collection to influence the economy. These policies affect tax rates, interest rates and government spending, in an effort to control the economy. Fiscal policy is an additional method to determine public revenue and public expenditure.

What is Core Banking Solutions?

Core banking is a general term used to describe the services provided by a group of networked bank branches. Bank customers may access their funds and other simple transactions from any of the member branch offices. It will cut down time, working simultaneously on different issues and increasing efficiency. The platform where communication technology and information technology are merged to suit core needs of banking is known as Core Banking Solutions. E-Governance is the public sectors use of information and communication technologies with the aim of improving information and service delivery, encouraging citizen participation in the decision-making process and making government more accountable, transparent and effective.

What is EGovernance?

What is Right to information Act?

The Right to Information act is a law enacted by the Parliament of India giving citizens of India access to records of the Central Government and State overnments. The Act applies to all States and Union Territories of India, except the State of Jammu and Kashmir - which is covered under a State-level law. This law was passed by Parliament on 15 June 2005 and came fully into force on 13 October 2005.

Credit Rating Agencies in India?

The credit rating agencies in India mainly include ICRA and CRISIL. ICRA was formerly referred to the Investment Information and Credit Rating Agency of India Limited. Their main function is to grade the different sector and companies in terms of performance and offer solutions for up gradation. The credit rating agencies in India mainly include ICRA and CRISIL(Credit Rating Information Services of India Limited)

What is Cheque?

Cheque is a negotiable instrument instructing a Bank to pay a specific amount from a specified account held in the maker/depositor's name with that Bank.A bill of exchange drawn on a specified banker and payable on demand.Written order directing a bank to pay money.

What is demand Draft? A demand draft is an instrument used for effecting transfer of money. It is a Negotiable Instrument. Cheque and Demand-Draft both are used for Transfer of money. You can 100% trust a DD. It is a banker's check. A check may be dishonored for lack of funds a DD cannot. Cheque is written by an individual

www.Oliveboard.in

and Demand draft is issued by a bank. People believe banks more than individuals.

Diff between banking & Finance?

Finance is generally related to all types of financial, this could be accounting, insurances and policies. Whereas banking is everything that happens in a bank only.The term Banking and Finance are two very different terms but are often associated together. These two terms are often used to denote services that a bank and other financial institutions provide to its customers.

What is NASSCOM ?

The National Association of Software and Services Companies (NASSCOM), the Indian chamber of commerce is a consortium that serves as an interface to the Indian software industry and Indian BPO industry. Maintaining close interaction with the Government of India in formulating National IT policies with specific focus on IT software and services maintaining a state of the art information database of IT software and services related activities for use of both the software developers as well as interested companies overseas. Mr. Som Mittal President. Chairman-Pramod Bhasin

What is ASSOCHAM?

The Associated Chambers of Commerce and Industry of India (ASSOCHAM), India's premier apex chamber covers a membership of over 2 lakh companies and professionals across the country. It was established in 1920 by promoter chambers, representing all regions of India. As an apex industry body, ASSOCHAM represents the interests of industry and trade, interfaces with Government on policy issues and interacts with counterpart international organizations to promote bilateral economic issues. President-Swati Piramal

What is NABARD?

NABARD was established by an act of Parliament on 12 July 1982 to implement the National Bank for Agriculture and Rural Development Act 1981. It replaced the Agricultural Credit Department (ACD) and Rural Planning and Credit Cell (RPCC) of Reserve Bank of India, and Agricultural Refinance and Development Corporation (ARDC). It is one of the premiere agency to provide credit in rural areas. NABARD is set up as an apex Development Bank with a mandate for facilitating credit flow for promotion and development of agriculture, small-scale industries, cottage and village industries, handicrafts and other rural crafts.

www.Oliveboard.in

What is SIDBI?

The Small Industries Development Bank of India is a state-run bank aimed to aid the growth and development of micro, small and medium scale industries in India. Set up in 1990 through an act of parliament, it was incorporated initially as a wholly owned subsidiary of Industrial Development Bank of India.

What is SENSEX and NIFTY?

SENSEX is the short term for the words "Sensitive Index" and is associated with the Bombay (Mumbai) Stock Exchange (BSE). The SENSEX was first formed on 1-1-1986 and used the market capitalization of the 30 most traded stocks of BSE. Where as NSE has 50 most traded stocks of NSE.SENSEX IS THE INDEX OF BSE. AND NIFTY IS THE INDEX OF NSE.BOTH WILL SHOW DAILY TRADING MARKS. Sensex and Nifty both are an "index. An index is basically an indicator it indicates whether most of the stocks have gone up or most of the stocks have gone down.

What is SEBI?

SEBI is the regulator for the Securities Market in India. Originally set up by the Government of India in 1988, it acquired statutory form in 1992 with SEBI Act 1992 being passed by the Indian Parliament. Chaired by C B Bhave.

What is Mutual funds?

Mutual funds are investment companies that pool money from investors at large and offer to sell and buy back its shares on a continuous basis and use the capital thus raised to invest in securities of different companies. The mutual fund will have a fund manager that trades the pooled money on a regular basis. The net proceeds or losses are then typically distributed to the investors annually.

What is Asset Management Companies?

A company that invests its clients' pooled fund into securities that match its declared financial objectives. Asset management companies provide investors with more diversification and investing options than they would have by themselves. Mutual funds, hedge funds and pension plans are all run by asset management companies. These companies earn income by charging service fees to their clients.

What are nonperfoming assets?

Non-performing assets, also called non-performing loans, are loans,made by a bank or finance company, on which repayments or interest payments are not being made on time. A debt obligation where the borrower has not paid any previously agreed upon interest and principal repayments to the designated lender for an extended period of time. The nonperforming asset is therefore not yielding any income to the lender in the form of principal and interest payments.

What is Recession?

A true economic recession can only be confirmed if GDP (Gross Domestic Product)growth is negative for a period of two or more consecutive quarters.

www.Oliveboard.in

What is foreign exchange reservers?

Foreign exchange reserves (also called Forex reserves) in a strict sense are only the foreign currency deposits and bonds held by central banks and monetary authorities.However, the term in popular usage commonly includes foreign exchange and gold,SDRs and IMF reserve positions.

Account Agreement:

The contract governing your open-end credit account, it provides information on changes that may occur to the account.

Account History:

The payment history of an account over a specific period of time, including the number of times the account was past due or over limit.

Account Holder:

Any and all persons designated and authorized to transact business on behalf of an account. Each account holder's signature needs to be on file with the bank. The signature authorizes that person to conduct business on behalf of the account.

Adjustable-Rate Mortgages (ARMS):

Also known as variable-rate mortgages. The initial interest rate is usually below that of conventional fixed-rate loans. The interest rate may change over the life of the loan as market conditions change.

There is typically a maximum (or ceiling) and a minimum (or floor) defined in the loan agreement. If interest rates rise, so does the loan payment. If interest rates fall, the loan payment may as well. Adverse Action: Under the Equal Credit Opportunity Act, a creditor's refusal to grant credit on the terms requested, termination of an existing account, or an unfavorable change in an existing account. Amortization: The process of reducing debt through regular installment payments of principal and interest that will result in the payoff of a loan at its maturity. Annual Percentage Rate (APR): Annual Percentage Yield (APY): A percentage rate reflecting the total amount of interest paid on a deposit account based on the interest rate and the frequency of compounding for a 365day year. Annuity: A life insurance contract sold by insurance companies, brokers, and other financial institutions. It is usually sold as a retirement investment. An annuity is a long-term investment and can have steep surrender charges and penalties for withdrawal before the annuity's maturity date. (Annuities are not FDIC insured.) The cost of credit on a yearly basis, expressed as a percentage.

www.Oliveboard.in

Application:

Under the Equal Credit Opportunity Act (ECOA), an oral or written request for an extension of credit that is made in accordance with the procedures established by a creditor for the type of credit requested.

Automated Clearing House (ACH):

A computerized facility used by member depository institutions to electronically combine, sort, and distribute inter-bank credits and debits. ACHs process electronic transfers of government securities and provided customer services, such as direct deposit of customers' salaries and government benefit payments (i.e., social security, welfare, and veterans' entitlements), and preauthorized transfers.

Automated Teller Machine (ATM):

A machine, activated by a magnetically encoded card or other medium, that can process a variety of banking transactions. These include accepting deposits and loan payments, providing withdrawals, and transferring funds between accounts.

Automatically Protected:

As of May 1, 2011, up to two months of Federal benefits such as Social Security benefits, Supplemental Security Income benefits, Veterans benefits, Railroad Retirement benefits, and benefits from the Office of Personnel Management that are direct deposited to an account may be protected from garnishment. The amount automatically protected will depend upon the balance of the account on the day of review.

Automatic Bill Payment:

A checkless system for paying recurring bills with one authorization statement to a financial institution. For example, the customer would only have to provide one authorization form/letter/document to pay the cable bill each month. The necessary debits and credits are made through an Automated Clearing House (ACH).

Availability Date:

Bank's policy as to when funds deposited into an account will be available for withdrawal.

Availability Policy:

Bank's policy as to when funds deposited into an account will be available for withdrawal.

Balance Transfer:

The process of moving an outstanding balance from one credit card to another. This is usually done to obtain a lower interest rate on the outstanding balance. Transfers are sometimes subjected to a Balance Transfer Fee.

Bank Custodian:

A bank custodian is responsible for maintaining the safety of clients' assets held at one of the custodian's premises, a sub-custodian facility or an outside depository.

www.Oliveboard.in

Bank Examination:

Examination of a bank's assets, income, and expenses-as well as operations by representatives of Federal and State bank supervisory authority-to ensure that the bank is solvent and is operating in conformity with banking laws and sound banking principles.

Bank Statement:

Periodically the bank provides a statement of a customer's deposit account. It shows all deposits made, all checks paid, and other debits posted during the period (usually one month), as well as the current balance.

Banking Day:

A business day during which an office of a bank is open to the public for substantially all of its banking functions.

Bankrupt:

The legal proceedings by which the affairs of a bankrupt person are turned over to a trustee or receiver for administration under the bankruptcy laws. There are two types of bankruptcy:

Involuntary bankruptcy-one or more creditors of an insolvent debtor file a petition having the debtor declared bankrupt. Voluntary bankruptcy-the debtor files a petition claiming inability to meet financial obligations and willingness to be declared bankrupt. Beneficiary: A person who is entitled to receive the benefits or proceeds of a will, trust, insurance policy, retirement plan, annuity, or other contract. Billing Cycle: The time interval between the dates on which regular periodic statements are issued. Billing Date: The month, date, and year when a periodic or monthly statement is generated. Calculations have been performed for appropriate finance charges, minimum payment due, and new balance. Bond, U.S. Savings: Savings bonds are issued in face value denominations by the U.S. Government in denominations ranging from $50 to $10,000. They are typically long-term, low-risk investment tools. Business Day: Any day on which offices of a bank are open to the public for carrying on substantially all of the bank's business. Check Truncation: The conversion of data on a check into an electronic image after a check enters the processing system. Check truncation eliminates the need to return canceled checks to customers. Checking Account: A demand deposit account subject to withdrawal of funds by check.

www.Oliveboard.in

ChexSystems:

The ChexSystems, Inc. network is comprised of member financial institutions that regularly contribute information on mishandled checking and savings accounts to a central location. ChexSystems shares this information among member institutions to help them assess the risk of opening new accounts. ChexSystems only shares information with the member institutions; it does not decide on new account openings. Generally, information remains on ChexSystems for five years.

Closed-End Credit :

Generally, any credit sale agreement in which the amount advanced, plus any finance charges, is expected to be repaid in full by a specified date. Most real estate and automobile loans are closed-end agreements.

Closed-End Loan:

Generally, any loan in which the amount advanced, plus any finance charges, is expected to be repaid in full by a specified date. Most real estate and automobile loans are closed-end agreements.

Collective Investment Funds (CIFs):

A Collective Investment Fund (CIF) is a trust created and administered by a bank or trust company that commingles assets from multiple clients. The Federal securities laws generally require entities that pool securities to register those pooled vehicles (such as mutual funds) with the SEC. However, Congress created exemptions from these registration requirements for CIFs so long as the entity offering these funds is a bank or other authorized entity and so long as participation in the fund is restricted to only those customers covered by the exemption. If these limitations are met, CIFs are exempt from SEC registration and reporting requirements.

Co-Maker:

A person who signs a note to guarantee a loan made to another person and is jointly liable with the maker for repayment of the loan. (Also known as a Cosigner.)

Credit Repair Organization:

A person or organization that sells, provides, performs, or assists in improving a consumer's credit record, credit history or credit rating (or says that that they will do so) in exchange for a fee or other payment. It also includes a person or organization that provides advice or assistance about how to improve a consumer's credit record, credit history or credit rating. There are some important exceptions to this definition, including many non-profit organizations and the creditor that is owed the debt.

www.Oliveboard.in

Debit Card:

A debit card allows the account owner to access their funds electronically. Debit cards may be used to obtain cash from automated teller machines or purchase goods or services using point-of-sale systems. The use of a debit card involves immediate debiting and crediting of consumers' accounts.

Disclosures:

Certain information that Federal and State laws require creditors to give to borrowers relative to the terms of the credit extended.

Electronic Funds Transfer (EFT):

The transfer of money between accounts by consumer electronic systems-such as automated teller machines (ATMs) and electronic payment of bills-rather than by check or cash. (Wire transfers, checks, drafts, and paper instruments do not fall into this category.)

Equal Credit Opportunity Act (ECOA): Federal Emergency Management Agency (FEMA): Federal Deposit Insurance Corporation (FDIC): Home Equity Line of Credit (HELOC):

Prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age, or because an applicant receives income from a public assistance program. Federal agency responsible for the emergency evaluation and response to all disasters, natural and man-made. FEMA oversees the administration of flood insurance programs and the designation of certain areas as flood prone. A government corporation that insures the deposits of all national and State banks that are members of the Federal Reserve System.

A line of credit secured by the equity in a consumer's home. It can be used for home improvements, debt consolidation, and other major purchases. Interest paid on the loan is generally tax deductible (consult a tax advisor to be sure). The funds may be accessed by writing checks against the line of credit or by getting a cash advance.

Individual Retirement Account (IRA):

A retirement savings program for individuals to which yearly tax-deductible contributions up to a specified limit can be made. The amount contributed is not taxed until withdrawn. Withdrawal is not permitted without penalty until the individual reaches age 59 1/2.

Loan-to-Value Ratio (LTV):

The ratio of the loan principal (amount borrowed) to the appraised value (selling price). For example, on a $100,000 home, with a mortgage loan principal of $80,000, the loan-to-value ratio is 80 percent. The LTV will affect programs available to the borrower; generally, the lower the LTV, the more favorable the program terms offered by lenders.

www.Oliveboard.in

Personal Identification Number (PIN)

Generally a four-character number or word, the PIN is the secret code given to credit or debit cardholders enabling them to access their accounts. The code is either randomly assigned by the bank or selected by the customer. It is intended to prevent unauthorized use of the card while accessing a financial service terminal.

Point of Sale (POS)

1) The location at which a transaction takes place. 2) Systems that allow bank customers to effect transfers of funds from their deposit accounts and other financial transactions at retail establishments.

Private Mortgage Insurance (PMI):

Insurance offered by a private insurance company that protects the bank against loss on a defaulted mortgage up to the limit of the policy (usually 20 to 25 percent of the loan amount). PMI is usually limited to loans with a high loan-tovalue (LTV) ratio. The borrower pays the premium.

Real Estate Settlement Procedures Act (RESPA):

Federal law that, among other things, requires lenders to provide "good faith" estimates of settlement costs and make other disclosures regarding the mortgage loan. RESPA also limits the amount of funds held in escrow for real estate taxes and insurance.

Special Flood Hazard Area (SFHA) Truth in Lending Act (TILA):

An area defined on a Flood Insurance Rate Map with an associated risk of flooding. The Truth in Lending Act is a Federal law that requires lenders to provide standardized information so that borrowers can compare loan terms. In general, lenders must provide information on

what credit will cost the borrowers, when charges will be imposed, and what the borrower's rights are as a consumer. Uniform Commercial Code (UCC): A set of statutes enacted by the various States to provide consistency among the States' commercial laws. It includes negotiable instruments, sales, stock transfers, trust and warehouse receipts, and bills of lading. Uniform Gift to Minors A UGMA provides a child under the age of 18 (a minor) with a way to own Account: investments. The money is in the minor's name, but the custodian (usually the parent) has the responsibility to handle the money in a prudent manner for the minor's benefit. The parent cannot withdraw the money to use for his or her own needs.

www.Oliveboard.in

Wire Transfer:

A transfer of funds from one point to another by wire or network such the Federal Reserve Wire Network (also known as FedWire).

Operating Subsidiary:

National banks conduct some of their banking activities through companies called operating subsidiaries. These subsidiaries are companies that are owned or controlled by a national bank and that, among other things, offer banking products and services such as loans, mortgages, and leases. The Office of the Comptroller of the Currency supervises and regulates the activities of many of these operating subsidiaries.

Offset, Right of:

Banks' legal right to seize funds that a guarantor or debtor may have on deposit to cover a loan in default. It is also known as right of setoff

National Bank:

A bank that is subject to the supervision of the Comptroller of the Currency. The Office of the Comptroller of the Currency is a bureau of the U.S. Treasury Department. A national bank can be recognized because it must have "national" or "national association" in its name.

Money Market Deposit Account:

A savings account that offers a higher rate of interest in exchange for larger than normal deposits. Insured by the FDIC, these accounts have limits on the number of transactions allowed and may require higher balances to receive the higher rate of interest.

Manufactured (mobile) home:

A structure, built on a permanent chassis, transported to a site in one or more sections, and affixed to a permanent foundation. The term does not include recreational vehicles.

Lender:

An individual or financial institution that lends money with the expectation that the money will be returned with interest.

Accrued Interest Acquisition

Interest earned but not yet received. Purchase of controlling interest in a firm, generally through tender offer for the target shares.

Actuary

Insurance company official, responsible for estimating future claims and disbursement and for calculating necessary fund and premium levels.

ADS Advising Bank

Authorized Dealers A Bank usually located in the country of residence of an Exporter, used by an Importers bank to authenticate a Letter of Credit before it is passed on to the Exporter.

AEZs

Agricultural Export Zones

www.Oliveboard.in

Affidavit

A written statement, sworn to be true by the person signing it, before someone authorized by court of law.

Agent Bank

A participating bank in a syndicated loan that handles all the operations and deals with the borrower on behalf of the members of the syndicate.

AIDB AIFI ALCO ALM

All India Development Bank All India Financial Institution Asset-Liability Management Committee Asset/ liability management involves a set of techniques to create value and manage risks in a bank.

AMC AmericanDepository Receipt (ADR)

Asset Management Committee A certificate registered in the holders name or as a bearer security giving title to a specified number of shares in a non-US-based company deposited in a bank outside the USA. These certificates are traded on US stock exchanges.

American option Amortization

An option that can be exercised on or any time before the date of expiry. Process of full payment of debt in installments of principal and earned interest over a definite time.

Amount at risk

Balance of the sum payable not covered by reserves, potentially falling on the net worth (net assets) of the company.

www.oliveboard.in

Annuity

Fixed amount of cash to be received every year for a specified period of time.

APEDA

Agricultural and Processed Food Products Exports Development Authority.

Arbitrage

Simultaneous purchase and sale of identical or equivalent financial instruments or commodity futures so as to benefit from difference in their price relationship.

ARF ASB Asset/Liability Risk:

Automatic Refinance Facility Accounting Standards Board A risk that current obligations/ liabilities cannot be met with current assets. A fundamental risk in all organizations, which should manage the risk and maintain liquidity or become insolvent.

Assets Assignment

Things that one owns which have value in financial terms. Receipt of an exercise notice by an option writer (seller) that obligates him to sell (in the case of a call) or purchase (in the case of a put) the underlying security at the specified strike price.

Audit Risk Automated

The risk of giving an incorrect audit opinion. Banking Terminals that allow bank customers to perform many everyday banking tasks, e.g., deposits, withdrawals, bill payments and transfers between accounts.

Machines (ABMs)

Automated Teller Machines (ATMs)

A computerized machine used for banking transactions, e.g. depositing or withdrawing money, making balance/ transaction inquiries and transfers; operated through magnetic plastic cards with the held of personal identification numbers (PINs). The portion of a customers account balance having no restrictions from the bank and available for immediate withdrawals.

Available Balance

Average life

Weighted average of the maturities of various loans or bonds after taking into account agreed amortizations.

Back-end value

Amount paid to the remaining shareholders in the second stage of a twotier or partial tender offer.

www.oliveboard.in

Balance of Payment

Statement showing the countrys trade and financial transactions (all economic transactions), in terms of net outstanding receivable or payable from other countries, with the rest of the world for a period of time.

Balance Sheet

Statement of assets and liabilities of a company at any particular time. The assets on a balance sheet will always equal the liabilities plus the owners equity.

Balloon Payment Bank Credit

A large payment that may be charged at the end of a loan or lease. Includes Term Loans, Cash Credit, Overdrafts, Bills purchased & discounted, Bank Guarantees, Letters of Guarantee, Letters of credit.

Bank Debits

The sum of the value of all cheques and other instruments charged against the deposited funds of a banks customer.

Bank Rate

Interest rate paid by major banks if they borrow from RBI, the Central Bank of the country. The Bank Rate influences the rates of interest major banks/ financial institutions charge and pay their customers. A periodic record of a customers account that is issued at regular intervals, showing all transactions recorded for the period in question.

Bank Statement Bankers Acceptance

Negotiable time drafts, or bills of exchange, that have been accepted by a bank which, by accepting, assumes the obligation to pay the holder of the draft the face value of the instrument on the specified maturity date. Bankers Acceptances are generally used to finance export, import, shipment, or storage of goods.

Bankruptcy

A condition in which a firm (or individual) is unable to meet its (his) obligations and, hence, its (his) assets are surrendered to a court for administration.

Basis Point

One-hundredth of one percentage point (i.e. 0.01%), normally used for indicating spreads or cost of finance.

Bid/Bond Guarantee

A guarantee issued by a bank on behalf of a seller to a buyer to support the sellers bid or tender for a contract. If the sellers bid is accepted, the buyer can claim compensation under the guarantee.

BIFR

Board for Industrial and Financial Reconstruction.

www.oliveboard.in

Bill Discounting

Receiving payment on a bill of exchange prior to the bills maturity by surrendering the bill for the face value less applicable interest for the time remaining up to maturity.

Bill of Exchange

An order written by the seller of goods instructing the purchaser to pay the seller (or bearer of the bill) a specified amount on a specified future date.

Bill of Lading Blue Chips

A document which represents ownership of goods in transit. Shares in leading quoted companies that can be easily bought and sold without influencing their price (liquidity) and are regarded as low-risk investments.

Bond

A negotiable instrument evidencing debt, under which the issuer promises to pay the holder its face value plus interest as agreed.

Book Value Bought financing

The cost price of an asset less accumulated depreciation. Short-term financing arranged by a bank for offering continuing source of funds pending receipt of loan/bond issue proceeds.

BR Act Brand name capital

Banking Regulation Act. A firms reputation; the result of non-salvageable investment which provides customers with an implicit guarantee of product quality for which they are willing to pay a premium.

Break-even point

Refers to the price at which a transaction produces neither a gain nor a loss.

Bridge Loan

Temporary finance provided to a project until long-term arrangements are made.

BSE Bull Bull Market Bullet redemption

Bombay Stock Exchange One who expects prices to rise. A market in which prices keep rising. Repayment of a debt in one lump sum at the end of the maturity period. A common practice in Euro markets in respect of bond issues.

Bundling

Provision of more than one product or service to a customer at an inclusive price e.g. free life insurance with a loan.

www.oliveboard.in

Bust-up takeover

An acquisition followed by divestment of some or all of the operating units of the acquired firm which are presumably worth more in pieces than as a going concern.

Buy-back

A public company, which buys its own shares, by tender offer, in open market, or in a negotiated buy-back from a large block holder.

CIF Call Date

Cost, Insurance and Freight Date on which a bond may be redeemed before maturity at an option of the issuer.

Call Money Call Option

Loaned funds that are repayable upon the request of either party. An option that gives its holder the right to buy an asset at a fixed price during a certain period

Call Provision

A feature of a bond that entitles the issuer to retire the bond before maturity

Cap Capital

A ceiling on the interest rate on a floating-rate note. Funds invested in a firm by the owners for use in conducting the business.

Capital Adequacy Ratio A ratio of total capital divided by risk-weighted assets and risk-weighted (CAR) off-balance sheet items. A bank is expected to meet a minimum capital ratio specifically prescribed by the Regulator. Capital budget Capital Gain and Loss The list of planned capital expenditures prepared usually annually The difference between the price that is originally paid for a security and cash proceeds at the time of maturity (face value of bond) or at the time of sale (selling price of a bond or stock). When the difference is positive, it is a gain, but when it is negative, it is a loss. Capital investments Money used to purchase permanent fixed assets for a business, such as machinery, land or buildings as opposed to day-to-day operating expenses. Capital Market Capital Structure Market in which financial instruments are bought and sold. The composition of a firms long-term financing consisting of equity, preference shares, and long-term debt. Cash cows Business segments, having a high market share in low growth product

www.oliveboard.in

markets, which generate more cash flow than needed for reinvestment. Cash Credit (CC) An arrangement whereby the bank gives a short-term loan against the self-liquidating security. Cash Discount Cash flow forecast A discount given to buyers for cash rather than credit purchase. An estimate of when and how much money will be received and paid out of a business. It usually records cash flow on a month-by-month basis. Certificate of Deposit A negotiable instrument issued by a bank evidencing time deposit (CD) Cheque A written order on a bank instrument for payment of a certain amount of money. CIBIL CLB Clean-up merger Credit Information Bureau of India Ltd. Company Law Board Also called Take-out merger. The consolidation of the acquired firm into the acquiring firm after the acquirer has obtained control. CMS Collateral Cash Management Services. Property (real, personal or otherwise) pledged as security for a loan. Also, any supplementary promise of payment, such as a guarantee. Collusion A secret agreement between two or more persons to defraud another person of his or her right in order to achieve an unlawful objective. Commercial Risk Credit The risk of loss from providing credit to corporate counter-parties. Extension of credit can take the form of direct loans and contingencies/ guarantees. Commercial Paper (CP) Issue of short-term notes, without any underwriting, representing a promise to repay the amount at a specified future date. Commitment fee A fee charged by a bank in respect of an unused balance of a line of credit or sanction of loan designed to offset the banks cost of keeping the funds available. Compound Interest Conglomerate Interest payable (receivable) on interest. A combination of unrelated firms; any combination that is not vertical or horizontal

www.oliveboard.in

Consumer Price Index An index that measure movements in the average price of products and (CPI) Convertible Bond Convertible Security services. A bond that is convertible into common stock. Bond or preferred stock which is convertible into equity shares generally at the option of the holder Corporate Banking Corporate Governance Banking services for large firms. A system by which organizations are directed and controlled. Board of directors are responsible for the governance of their organizations. Corporate Tax A tax on the profits of firms, as distinct from taxation of the incomes of their owners. Coupon Rate Covenant CRAR CRAs Credit Crunch The stated interest rate on a bond. A definite provision in a loan contract. Capital to Risk-Weighted Assets Ratio. Credit Rating Agencies. Refers to a situation where supply of credit falls even though there is sufficient demand for it. Credit History Credit Risk A record of how a person or company has borrowed and repaid debts. The risk of loss from failure of the counterparty to perform as agreed (contracted). Credit Scoring System A statistical system used to determine whether or not to grant credit by assigning numerical scores to various characteristics relating to creditworthiness. Creditworthiness A creditors measure of a consumers or companys past and future ability and willingness to repay debts. CRISIL Cross default Credit Rating and Investment Services of India Limited Two loan agreements connected by a clause that allows one lender to recall the loan if the borrower defaults with another, and vice versa. Cumulative Dividends A feature of preferred stock that requires all past dividends on preferred stock to be paid before any equity dividends are paid. Currency basket Arrangements whereby two or more currencies are clubbed together with

www.oliveboard.in

defined weights, and whose exchange rate/ interest rate is determined by computing weighted average market rates. Currency Market Risk The risk of loss from having positions in any of the currency markets. The risk can be from outright positions. It can also reside in the balance sheet or in the income flows of a company. Current assets Short-term assets, constantly changing in value, such as stocks, debtors and bank balances. Current liabilities Short-term liabilities, due to be paid in less than one year, such as bank overdrafts, money owed to suppliers and employees. Current Yield The yield on a security resulting from dividing the interest payment or dividend on it by its current market price. D/A (documents against Refer to shipping documents presented to a bank on a collection basis to acceptance) be passed to the buyer when he or she accepts a bill of exchange. The bank holds the bill of exchange until it ends (maturity) when they ask the buyer to pay the seller. D/P (documents against Refer to shipping documents presented to a bank on a collection basis to payment) DCF Debenture be passed to the buyer (drawee) when payment is made. Discounted Cash Flow. An instrument for raising long-term debt. typically secured by tangible assets. Debt/equity ratio A comparative ratio of debt and equity used to measure the gearing/ health of a business. Default Generally, failure to satisfy an obligation when due, or the occurrence of one of the defined events of default agreed to by the parties under a contract. Default Risk The risk that a borrower may not repay principal and/or interest as originally agreed. Default Risk Premium The component of a required interest rate that is based on the lenders perceived risk of default. Depreciation An annual deduction of a part of the cost of an asset. In general, it means Debentures in India are

www.oliveboard.in

a decline in market value. DFI Direct Financing Direct taxes Development Financial Institution. Provision of funds for investment to the ultimate user of funds. Taxes which affect the consumer directly, such as income tax, corporate tax, capital gains tax etc. Discount The amount by which a bond or preferred stock sells below its par or face value. In foreign exchange market, it is the amount by which forward price is less than the spot price. In general, it means an extent of

reduction in the price / value of the asset/ product which is given when it is sold. Dividends Company earnings that may be paid out to shareholders according to the number of shares or stocks they hold. Dividends can be earned on stocks as also units of mutual funds. Documentary Credit Written undertaking by a bank on behalf of an importer authorizing an exporter to draw drafts on the bank up to a specified amount under specific terms and conditions. They are used to facilitate international trade. Also called Letter of Credit (LC). DRT Due diligence Debt Recovery Tribunal. While finalizing documentation, the lead manager and the legal counsel conduct a thorough review of the borrowing entity with reference to the financials, legality, and all such matters relevant in a public offering of securities. Earning Yield ECBs ECGC Effective rate of interest The ratio of earning per share to market price of the share. External Commercial Borrowings. Export Credit Guarantee Corporation. The percentage rate of return on an annual basis, reflecting the effect of intra-year compounding. Entrepreneur EOUs Equitable mortgage A person who conceives, starts and manages a business. Export-Oriented Units. A type of mortgage under which one still owns the property which is

www.oliveboard.in

security for the mortgage. The owner can occupy or live in the property. Equity The value of a business after all debts and other claims are settled. Also, the amount of cash a business owner invests in a business and/ or the difference between the price for which a property could be sold and the total debts registered against it. Escrow Account An account for which a bank acts as an uninterested third party (custodian / depository) to ensure compliance with the terms of the deal between two parties only upon the fulfillment of some stated conditions. The account becomes operative on the occurrence of the stated event. Banks hold such accounts in which funds accumulate to pay taxes, insurance on mortgage property, etc. Exchange Rate Exchange Rate Risk The rate at which one currency may be exchanged for another. The risk that changes in currency exchange rates may have an unfavourable impact on costs or revenues of economic units. Excise duties Duties levied on items manufactured within the country and paid by the manufacturer. Exports Face Value Factoring Products and services sold to other countries. The stated principal amount of a financial instrument. Sale of receivables to a financial institution usually on a non-recourse basis. Fixed assets Assets such as land, buildings, machinery or property used in operating a business that will not be consumed or converted into cash during the current accounting period. Fixed Rate A predetermined rate of interest applied to the principal of a loan or credit agreement. Foreign Exchange Various instruments used to settle payments for transactions between individuals or organizations using different currencies (e.g. notes, cheques, etc.) Foreign Exchange Rate Foreign Trade The value of a nations currency in terms of another nations currency. The exchange of goods between two nations.

www.oliveboard.in

Forfaiting

A form of export finance in which the forfaiter accepts, at a discount from the exporter, a bill of exchange or promissory note (note) from the exporters customer; the forfaiter in due course collects payment of the debt. Such notes are normally guaranteed by the customers bank. Maturities are normally up to three years.

Forward Contract

A contract in which one party agrees to buy, and the other to sell, a specified product at a specified price on a specified date in the future.

Forward Cover

Forward purchase or sale of foreign currency to offset an anticipated future cash flow.

FRNs Funded debt

Floating Rate Notes. Generally, a short-term debt that has been converted into long-term debt funding.

Futures

Contracts to buy something in the future at a price agreed upon in advance. First developed in the agriculture commodity markets but often involve foreign exchange, and Government bonds.

Going-concern value

The value of the firm as a whole over and above the sum of the values of each of its parts; the value of an organizations learning and reputation.

Goodwill

The excess of the purchase price paid for a firm over the book value received. Recorded on the acquirers balance sheet.

Gross Domestic Product (GDP)

The total of market value of the finished goods and services produced in a country in a given year. Industry & Services. Comprising three sectors viz. Agriculture,

Gross National Product (GNP)

The total market value of finished goods and services produced in the country in a given year, plus the income of domestic residents from investments made abroad, minus the income earned by foreigners abroad from the domestic market.

Gross Profit margin

The difference between the sales a business generates and the costs it pays out for goods. The undertaking of responsibility by one party for another partys debt or obligation to perform some specific act or duty. Although the original

Guaranty

www.oliveboard.in

debtor is responsible for the debt, the guarantor becomes liable in the event of a default. Haircut The difference between the market value of a security and its value when used as collateral. The haircut is intended to protect a collateral taker from losses due to declines in collateral values. Hedge One investment purchased against another investment in order to counter any loss made by either. Holding company A company which controls another company, usually by owing more than half of its shares. ICD Imports Indemnity Inter-Corporate Deposit. Goods and services that a country buys from other countries. If someone promises to compensate someone else for loss or damage, it is called an indemnity. Indirect financing The process by which deficit spending units obtain funds from financial intermediaries who, in turn, them from ultimate surplus spending units. Indirect taxes Taxes, which are charged on goods produced, imported or exported: Excise and Customs duties. Industry life cycle A conceptual model of the different stages of an industrys development. 1. Development stage: New product, high investment needs, losses; 2. Growth stage: Consumer acceptance, expanding sales, high

profitability, ease of entry; 3. Maturity stage: Sales growth slows, excess capacity, prices and profits decline key period for merger strategy; 4. Decline stage: Substitute products emerge, sales growth declines, pressure for mergers to survive. Inflation Inflation Premium A percentage rate of change in the price level. A premium for anticipated inflation that investors require in addition to the pure rate of interest. Initial Public Offering (IPO) The first offering to the public of common stock, e.g. of a former privately held firm, or a portion of the common stock of a hitherto wholly-owned

www.oliveboard.in

subsidiary. Insolvent Insufficient Funds The condition when one is unable to pay ones debt obligations when due. When an account balance is inadequate to cover a cheque that has been written and presented for payment. Insurance A contract whereby one party agrees to pay a sum to another party for a fee (premium) in the event that the latter suffers a particular loss. The person or firm that undertakes the risk is the insurer. The party desiring to be protected from loss is the insured party. Intangible assets Assets that cannot be touched. Examples are goodwill and patent rights.

Internal Rate of Return The rate of discount at which the net present value of an investment is (IRR) Lease zero. A contractual arrangement whereby one party (the lessor) grants the other party (the lessee) the right to use an asset in return for periodic rental payments. Lessee Lessor One who takes property on lease. A person, Corporation, or other legal entity that leases property to a lessee. Letter of Credit (LC) A formal document issued by a bank on behalf of a customer, stating the conditions under which the bank will honour the commitments of the customer. Lien Line of Credit A lenders claim on assets offered as security for a loan. A pre-approved credit facility (usually for one year) enabling a bank customer to borrow up to the specified maximum amount at any time during the relevant period of time. Liquidation Liquidity Divestment of all the assets of a firm so that the firm ceases to exist. The extent to which or the ease with which an asset may quickly be converted into cash with the least administrative and other costs. Loan Document A business contract by which a borrower and lender enter into an agreement. Loans are classified according to the lender or borrower

involved, whether or not collateral is required, the time of maturity,

www.oliveboard.in

conditions of repayment, and other variables. Loan Risk This is the risk of loss from loaning money and having the borrower fail to repay, either due to genuine reasons or willfully. Long-term Liabilities Money that one owes over a period longer than 12 months, such as mortgages, bank loans and other obligations. Margin A part of the value of security, which is not given as a loan by the bank or financial institution. Market Capitalization The total value, at market prices, of the securities at issue for a company or a stock market or sector of the stock market. Calculated by multiplying the number of shares issued by the market price per shares. NBFC NCD Net Present Value Non-Banking Finance Companies. Non-Convertible Debenture. Capital budgeting criterion, which compares the present value of cash inflows of a project discounted at the risk-adjusted cost of capital to the present value of investment outlays discounted at the risk-adjusted cost of capital. Net Worth Book value of a companys common stock, surplus, and retained earnings.

Non Performing Assets When due payments in credit facilities remain overdue above a specified (NPA) Non-Recourse Discounting period, then such credit facilities are classified as NPA. Purchase from the seller of accepted term Bills of Exchange at a discount to allow for funding of the advance from the discount date until the maturity date of the bills. When the discount is provided on a nonrecourse basis the financing bank has no recourse to the seller in the event of non-payment by the buyer or the buyers bank. NSE Obligation OD Off-Balance Sheet National Stock exchange of India Limited. The responsibility to perform some act or pay a sum of money when due. Overdraft Includes all banking transactions that do not appear on the balance sheet of a bank as an asset or as a debt. Includes all commitments for which a cash flow arises conditional on a specific event. For instance, a loan

www.oliveboard.in

guarantee will create an obligation only if there is a default. Derivatives are a form of off-balance sheet transactions. On-Line A computer system where input data are processed as received and output data are transmitted as soon as they become available to the point where they are required. Open-End Credit Commonly referred to as a Line of Credit. May be used repeatedly up to a certain limit; also called a Charge Account or Revolving Credit. Open-End Lease Often, referred to as a finance lease. A lease that may involve a balloon payment based on the value of the property when it is returned. Operating Cycle The length of time taken by a firm to produce its final product, sell it to customers, and collect proceeds of the sale in cash. Operating Lease Operating synergy Short-term, cancelable lease. Combining two or more entities results in gains in revenues or cost reductions because of complementarities or economies of scale or scope. Operational Risk Includes all risks not included in market risks and credit risks, such as losses arising from fraud, failure in computer systems and data entry errors. Opportunity Cost The rate of return that can be earned on the best alternative investment. In general, the gain or return on the next best investment opportunity or the next best use of resources, which is forgone by putting the resources to a given use. Option A formal contract which grants the holder of the option the right to buy or sell a certain quantity of an underlying interest or asset at a stipulated price within a specific period of time. Option Contract A contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset by (or on) a specific date for a specific price. For this right the purchaser pays a premium. Overdraft System The system in which the borrower is allowed to overdraw on his current account with the banker upto a certain specified limit during a given period.

www.oliveboard.in

Par Value

The value of a security when it is issued. For bonds and preferred stock, par value is equivalent to face value.

Partial Shipment

A load sent in more than one consignment.

In a Letter of Credit, the

buyer can say whether this is allowed or not allowed. Partnerships Shared ownership among two or more individuals, some of whom may, but do not necessarily, have limited liability with respect to obligations of the group. There is a written agreement among partners detailing the terms and conditions of participation in a business ownership arrangement. Pass Through Certificates Payback period Length of time required for an asset to generate cash flows just enough to cover the initial outlay. Plain Vanilla Transactions The most common and generally the simplest types of derivatives transaction. Transactions that have unusual or less common features are often called exotic or structured. Pledge If someone pledges goods, they let a second person take possession of the goods, but the person pledging the goods still owns them. It is often done as security for money owed or to make sure that something is done as promised. Power of Attorney A power of attorney is a document, which gives power to the person appointed by it to act for the person who signed the document. Prepayment Present Value Payment of the principal amount of a loan ahead of the scheduled date. The discounted value of a payment or stream of payments to be received in future, taking into consideration a specific interest or discount rate. Present Value represents a series of future cash flows expressed in todays value. Prime Lending Rate (PLR) Principal The rate of interest charged on loans by banks to their most creditworthy customers. Amount of debt that must be repaid. Also means a person who deals in Debt instruments backed by a portfolio of assets.

www.oliveboard.in

securities on his own account and not as a broker. Product Differentiation Development of a variety of product configurations to appeal to a variety of consumer tastes. Product Life Cycle A conceptual model of the stages through which products or lines of businesses pass. Includes development, growth, maturity, and decline. Each stage presents its own threats and opportunities. Product Mix Productivity Promissory Note The composite of products offered for sale by an organization. The amount of physical output for each unit of productive unit. A signed undertaking from one party containing a promise to pay a stated sum to a specified person or a company at a specified future date. PSB PSE PSU Purchasing Power Parity Public Sector Bank Public Sector Enterprise Public Sector Undertaking The concept that homogeneous goods cannot have more than one price measured in any one currency. If the price increases domestically, the domestic currency will depreciate so that the price denominated in foreign currency remains the same. Pure Conglomerate Merger Rating A combination of firms in non-related business activities that is neither a product-extension nor a geographic-extension merger. Refers to the credit quality of a counterparty. External ratings are given by rating agencies (ranging from AAA very safe asset to C). ratings are granted by the bank itself. Ratio Comparison of two figures used to evaluate business performances, such as debt/equity ratio return on investment, etc. Reconciliation Checking all bank account papers to make sure that the banks records and customers records are in sync. Recourse In the context of a sale of a loan by a bank to investors, they have the right to call the guarantee from the bank should the borrower be unable to meet its obligations Redemption Redemption means paying off all the money borrowed under an Internal

www.oliveboard.in

agreement. Resolution A formal document expressing the intention of a board of directors of a corporation. Revolving Letter of Credit A Letter of Credit in which the value of the Letter of Credit is automatically reinstated upon utilization. A Letter of Credit may revolve by value, time or both. Rights Issue Issue of securities offered to existing shareholders/ bond holders on a preemptive or priority basis. Risk Assessment Sale A process used to identify and evaluate risks and their potential effect. Transfer of ownership of some type of property from one person to another, for some consideration. Salvage The attempt to get repayment of some portion of a loan obligation which has already been written off the banks books. Scale Economies The reduction in per-unit costs achievable by spreading fixed costs over a higher level of production. SEBI SEBs Securitization Securities and Exchange Board of India. State Electricity Boards. The process of transformation of a bank loan into tradable securities. It often involves the creation of a separate corporate entity, the Special Purpose Vehicle (SPV), which buys the loans financing itself with securities that are sold to investors. Selective Credit Control (SCC) Senior Debt Control of credit flow to borrowers dealing in some essential commodities to discourage hoarding and black-marketing. Debt which, in the event of bankruptcy, must be repaid before subordinated debt receives any payment. Serial Bonds Series Bond Service Charge Service Provider SEZ Bonds that mature at specified intervals. Bond which may be issued in several series under the same indenture. A fee paid for using a service. The organization which provides the outsourced service. Specific Economic Zone.

www.oliveboard.in

SFC Short-term Loan SICA Sinking Fund

State Financial Corporation. Loan to a business for less than one year, usually for operating needs. Sick Industrial Companies (Special Provisions) Act. A fund to which a firm makes a periodic contribution to facilitate retirement of debt.

Special Purpose Vehicle

A legal corporate entity created to buy loans from banks. It finances itself with securities issued to investors.

Stakeholder

Any individual or group who has an interest in a firm; in addition to shareholders and bondholders, includes labour, consumers, suppliers, the local community, and so on.

Standby Letter of Credit

A guarantee issued by a bank, on behalf of a buyer that protects the seller against non-payment for goods shipped to the buyer. The buyer pays the seller directly for the goods and only if the buyer fails to pay does the seller claim under the Standby Letter of Credit.

Statement

All transactions in a bank account for a period of time. Statements are usually given once a month.

Statutory Audit

By law, certain companies need to have their accounts audited by suitably qualified accountants. This is called a statutory audit.

Stocks

Traded on a stock exchange, these are shares in a company. Essentially, one purchases shares in an exchange for owning a part of a company.

Swap

An agreement for an exchange of payments between two counterparties at some point(s) in the future and according to a specified formula.

SWOT

Acronym for Strengths, Weakness, Opportunities and Threats; an approach to formulating firm strategy via assessment of a firms capabilities in relation to the business environment.

Syndicate

Group of banks and financial institutions, which together contribute the necessary financing for a transaction.

Syndicated Loans

Loans to a company backed by a group of banks in order to share the risk in a large transaction among several financial institutions. usually a lead bank and several participating banks. There is

www.oliveboard.in

Synergy

The 2 + 2 = 5 effect. The output of a combination of two entities is greater than the sum of their individual outputs.

Systematic Risk

The risk that the failure of one participant in a payment or settlement system, or in financial markets generally, to meet its required obligations when due will cause other participants or financial institutions to be unable to meet their obligations (including settlement obligations in a payment and settlement system) when due.

Take-out Merger

The second-step transaction which merges the acquired firm into the acquirer and thus takes out the remaining target shares which were not purchased in the initial (partial) tender offer.

Tangible Assets Tax Avoidance

Physical assets such as plant, machinery, factories, and offices. Lawful agreement or re-arrangement of the affairs of an individual or company intended to avoid liability to tax.

Tax Evasion

Fraudulent or illegal arrangements made with the intention of evading tax, e.g. by failure to make full disclosure to the revenue authorities.

Tax Haven

An international banking and financial centre providing privacy and tax benefits.

Tax Incentives

Tax benefits. Most tax incentive measures fall into one or more of the following categories: tax exemption (tax holiday); deduction from the taxable base; reduction in the rate of tax; tax deferment, etc.

Term Loan

A loan intended for medium-term or long-term financing to supply cash to purchase fixed assets such as machinery, land or buildings or to renovate business premises.

Tier 1 Capital

Refers to core capital consisting of Capital, Statutory Reserves, Revenue and other reserves, Capital Reserves (excluding Revaluation Reserves) and unallocated surplus/ profit but excluding accumulated losses, investments in subsidiaries and other intangible assets

Tier 2 Capital

Comprises Property Revaluation Reserves, Undisclosed Reserves, Hybrid Capital, Subordinated Term Debt and General Provisions. Supplementary Capital. This is

www.oliveboard.in

Title Deeds Trade Creditors Trade Debtors Trade Deficit Transaction

Documents which prove who owns a property and under what terms. Organisations, which are owed money for goods and services supplied. Organisations, which owe money for goods and services supplied. The amount by which merchandise imports exceed merchandise exports. Action in a bank account. Could be a deposit, withdrawal, debit card payment, service charge or interest payment.

Trust

An entity created for the purpose of protecting and conserving assets for the benefit of a third party, the beneficiary- A contract affecting three parties, the settlor, the trustee and the beneficiary.

Trust Deed (Settlement Document that lays down the foundations of how the trustees are to Deed, Declaration of administer and manage the trust assets and how they are to distribute and Trust or Trust dispose of trust assets during the lifetime of the trust. Instrument) Trustee Trustees have a fiduciary duty to act in accordance with a trust deed and for the benefit of the beneficiary (ies). UCPDC Uniform Customs and Practice for Documentary Credit developed by the International Chamber of Commerce as the rules that govern the operation of Letter of Credit transactions worldwide. ICC publication No.500 contains details of the rules currently in use. Undervaluation When a firms securities sell for less than their intrinsic, or potential, or long-run value for one or more reasons. Underwriting The arrangement in which investment bankers undertake to ensure the full success of the issue of securities. Universal Bank A bank or a financial institution that has the legal authority to offer all financial services and may, thus, be engaged in securities dealing, insurance, underwriting, and the full range of more traditional banking services. Value Creation The difference between the value of an investment and the amount of money invested by shareholders. Variable Expenses Costs of doing business that vary with the volume of business, such as

www.oliveboard.in

advertising costs, manufacturing costs and bad debts. Variable Rate A variable rate loan or credit agreement, calls for an interest rate that may fluctuate over the life of the loan. The rate is often tied to an index that reflects changes in market rates of interest. A fluctuation in the rate causes changes in either the payments or the length of the term. VCF Venture Capital Venture Capital Fund. Commonly refers to funds that are invested by a third party in a business either as equity or as a form of secondary debt. Vertical Merger A combination of firms, which operate at different levels or stages of the same industry manufacturer mergers with a type company (backward integration). VRS Winding up Voluntary Retirement Scheme Winding up of a company is done by paying the companys creditors, and then distributing monies left (if any) among the members. Yield (1) A measure of the income generated by a bond. The amount of interest paid on a bond divided by the price. (2) The rate of discount which makes the present value of the stream of future returns plus the terminal value of the asset equal to the current market price of the asset. Zero Coupon Bond A bond issued at a discount (i.e. below par value), earning no interest but redeemable at its par value, thus providing a guaranteed capital gain.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IST 2021 Fee ChallanDocument1 pageIST 2021 Fee ChallanMuhammadNo ratings yet

- Questions and Answers About Direct PLUS Loans For Graduate and Professional StudentsDocument2 pagesQuestions and Answers About Direct PLUS Loans For Graduate and Professional Studentsistuff28No ratings yet

- L-5&6 642 ReserveDocument44 pagesL-5&6 642 ReserveNiloy AhmedNo ratings yet

- Preweek Handouts in Business Law May 2014 BatchDocument8 pagesPreweek Handouts in Business Law May 2014 BatchPhilip CastroNo ratings yet

- Financial Market EducationDocument31 pagesFinancial Market EducationArjun SinghNo ratings yet

- 0813897476 (1)Document2 pages0813897476 (1)Raja RazaliaNo ratings yet

- 14TH Annual Report: Year Ended - 3 (. O3.2Oo9Document19 pages14TH Annual Report: Year Ended - 3 (. O3.2Oo9ravalmunjNo ratings yet

- 111 c150042 CarlsonDocument33 pages111 c150042 CarlsonAbrar HussainNo ratings yet

- HKSE-Listed Heng Fai Enterprises Appoints Dr. Lam, Lee G. As Vice Chairman & Non-Executive DirectorDocument2 pagesHKSE-Listed Heng Fai Enterprises Appoints Dr. Lam, Lee G. As Vice Chairman & Non-Executive DirectorWeR1 Consultants Pte LtdNo ratings yet