Professional Documents

Culture Documents

Philippine Income Taxation For Basic Knowledge

Uploaded by

Anonymous BvmMuBSwOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Philippine Income Taxation For Basic Knowledge

Uploaded by

Anonymous BvmMuBSwCopyright:

Available Formats

Corporate Income Taxation What is a corporation?

It is an artificial being created by operation of law, having the rights of succession and the powers, attributes and properties, expressly authorized by law or incident to its existence. (Sec. 2, BP No. 68 Corporation Code) What is a corporation? NIRC Provides a broader definition of Corporation with respect to taxation. Section 22(B),NIRC - corporation shall include partnerships, no matter how created or organized, joint-stock companies, joint accounts ( cuentas en participacion ), associations or insurances companies, but does not include General professional partnerships, Joint venture & consortium formed for the purpose of undertaking construction projects or Joint venture & consortium formed for the purpose of engaging petroleum, coal geothermal and other energy operations pursuant to an operating or consortium agreement under a service contract with the Government. Partnership The General Rule is that GR: taxable no matter how created or organized. Article 1767 (1), New Civil Code. By the contract of partnership two or more persons bind themselves to contribute money, property, or industry to a common fund, with the intention of dividing the profits among themselves. Taxable/Business/Ordinary Partnership All other partnerships no matter how created or organized. Includes unregistered joint ventures and business partnerships. Taxable as an entity- ordinary corporate income tax. Joint ventures are not taxable as corporations when its purpose if a)undertaking construction projects; b)engaged in petroleum, coal and other energy operation under a service contract with the government. Partners are considered stockholders; therefore, their distributive share is taxed as dividends. Jose Gatchalian vs CIR is a case wherein 15 individuals contributed money to buy a sweepstakes ticket worth Php 2.00 which won the third price of Php 50,000.00. Defendant-Collector made an assessment against Jose Gatchalian and Co. requesting thepayment of the sum of P1,499.94 to the deputy provincial treasurer of Pulilan, Bulacan. Plaintiffs, however through counsel made a request for exemption According to the stipulation facts the plaintiffs organized a partnership of a civil nature because each of them put up money to buy a sweepstakes ticket for the sole purpose of dividing equally the prize which they may win, as they did in fact in the amount of P50,000. (Jose Gatchalian vs CIR, G.R. No. L-45425 April 29, 1939) Partnership

Another case is the case of Lorenzo Oa vs CIR wherein Ona became the administrator of the property left by his deceased wife and which he used the property in business by leasing or selling them and investing the income derived therefrom and the proceeds from the sales thereof in real properties and securities which gradually increased their properties. the Court ruled in this case that: For tax purposes, the co-ownership of inherited properties is automatically converted into an unregistered partnership the moment the said common properties and/or the incomes derived therefrom are used as a common fund with intent to produce profits for the heirs in proportion to their respective shares in the inheritance as determined in a project partition either duly executed in an extrajudicial settlement or approved by the court in the corresponding testate or intestate proceeding.(Lorenzo Oa vs CIR, GR No. L -19342, May 25, 1972) A father and son, purchased a lot and building for P 835,000.00. At the time of the purchase, the building was leased to various tenants, whose rights under the lease contracts with the original owners, the purchaser, petitioners herein, agreed to respect. Petitioners divided equally the income of operation and maintenance. The gross income from rentals of the building amounted to about P 90,000.00 annually. Thus an assessment was made by CIR against the Reyes, the court said that; When a father and son purchased a lot and building, entrusted the administration of the building to an administrator and divided equally the net income, there is a taxable partnership (Reyes vs. Commissioner, 24 SCRA 198) Exception: General Professional Partnerships Established solely for purpose of exercising common profession and not part of income derived from engaging in trade or business. As an entity, it is not subject to income tax. Partners are liable for income tax on their distributive share (computed by dividing net income of GPP). Each partner shall report his distributive share as part of his gross income However, the partners in this case shall be liable for income tax in their separate and individual capacities Joint Venture With regards to Joint accounts or Joint ventures formed for profit, the general Rule is that they are taxable. Batangas Transpo and Laguna Bus, two distinct corporations, engaged in the business of land transportation by means of motor busses and operating distinct and separate lines in which one was designated as manager. Ex. Joint Emergency operation although no legal personality may have been created by the joint emergency operation, nevertheless said joint venture or joint management operated the business affairs of the 2 companies as though they

constituted a single entity, company or partnership, thereby obtaining substantial economy and profits in the operation. (Collector vs Batangas Transportation Co., G.R. No. L-9692,January 6, 1958) Joint Venture Exception: Joint venture undertaking construction activity (BIR Ruling No. 317-92); and Ayala Land, Inc. (ALI) and Appleyard Properties, Inc. (API) entered into a Memorandum of Agreement (MOA) for the construction of an office building on that lot owned by ALI located along Ayala Avenue, Makati, to be known as 6750 Ayala Office Tower (Building). They also agree to a joint venture wherein they will lease out to third party tenants the specific floors separately owned by them. The Memorandum of Agreement entered into by and between ALI and API in 1990 providing for the construction of the aforementioned office tower has not by itself created a taxable joint venture. However, the joint venture to be subsequently entered into by and between ALI and API, for the leasing of the Building floors or portions thereof separately owned by them will create, a joint venture subject to tax under Section 24(a) of the Tax Code, as amended, separate and distinct from ALI and API. Joint venture engaged in energy-related activities with operating contract with the government Joint Stock Companies Is taxable as it is a form of partnership, although possessing some of the characteristics of a corporation. As a partnership, it possess the element of personal liability where each member remains financially responsible for the acts of the company. Cost of Goods Sold Trading and Merchandising Concern Invoice cost plus import duties and freight in transporting goods to the place where actually sold, including insurance while in transit Manufacturing concern Cost of production of finished goods (raw materials, direct labor and manufacturing overhead, freight cost, insurance premiums, and other costs to bring the raw materials to the factory) Kinds of Corporate Taxpayers : 1. Domestic corporation corporations created or organized in the Philippines or under its laws.(Section 22 (c), NIRC) 2. Foreign corporation corporations created or organized under the laws of a foreign country.

1) Resident foreign corporation; or 2) Non-resident foreign corporation Domestic Corporations Source: Tax Base: Within and Without Taxable Income January 01, 2009 (Sec.

Tax Rate: 35% effective July 01, 2005; 30% effective 27 (A)(1), R.A. No. 9337)

Proprietary Educational Institutions & Hospitals (non-profit) Proprietary educational institution any private school maintained & administered by private individuals or groups with an issued permit to operate from DECS, or CHED or TESDA Taxable at 10% on taxable income, except on certain passive income (which are subject to final tax) Predominance Test: if GI from unrelated trade/business/other activity > 50% of the total GI from all sources, ENTIRE taxable income shall be subject to the REGULAR corporate tax rate(35% Effective 2006) Distinguish from non-profit non-stock educational institutions which are exempt from tax on revenues and assets Actually, Directly and Exclusively used for educational purposes (See above for discussion) Proprietary educational institutions and hospitals which are non profit shall pay a tax of 10% of their taxable income if gross income from unrelated trade, activities of business does not exceed 50% of the total income and 35% of taxable income if gross income from unrelated trade, activities of business exceed 50% of the total income (Sec. 27 (B), R.A. No. 9337) Domestic Corporations Proprietary educational institution is any private school maintained and administered by private individuals or groups with an issued permit to operate from the DECS, CHED, or TESDA, as the case maybe, in accordance with existing laws and regulations.(Sec. 27 (B), NIRC) Unrelated trade, business or other activity means any trade, business or other activity, the conduct of which is not substantially related to the exercise of performance by such educational institution or hospital of its primary purpose or function.(Sec. 27 (B), NIRC) Foreign corporations : 1. Resident foreign corporation a foreign corporation engaged in trade or business within the Philippines (Sec. 22(H), NIRC). 2. Non-resident foreign corporation a foreign corporation not engaged in trade or business within the Philippine. (Sec. 22(I), NIRC) Both are taxable from income within the Philippines only.

Resident Foreign Corporation Source: Tax Base: Within Taxable Income January 01, 2009 (Sec.

Tax Rate: 35% effective July 01, 2005; 30% effective 28 (A)(1), R.A. No. 9337)

In general, a resident foreign corporation is taxed in the same manner as a domestic corporation on its income derived from all sources within the Philippines. The following shall be subject to a different tax rate: 1. International carriers doing business in the Philippines shall be taxed at two and one-half per cent (2 1/2 %) of gross Philippine billings; 2. Income derived by offshore banking units from foreign currency transactions with local commercial banks and branches of foreign banks and interest derived from foreign currency loans to residents shall be subject to a final tax at the rate of ten per cent (10%) of such income; 3. interest income derived by a resident foreign corporation from a depository bank under the expanded foreign currency deposit system shall be subject to a final income tax at the rate of 10% of such interest income. 4. Regional operating headquarters shall pay a tax of ten per cent (10%) of their taxable income. A Regional operating headquarter refers to a branch established in the Philippines by multinational companies which are engaged in any of the following services: general administration and planning; business planning and coordination; sourcing and procurement of raw materials and components; corporate finance advisory services; marketing control and sales promotion; training and personnel management; logistic services; research and development services and product development; technical support and maintenance; data processing and communication; and business development21 . Dividends received by a resident foreign corporation from a domestic corporation shall not be subject to tax. Gross Philippine Billings (GPB) Refers to the amount of gross revenue derived from carriage of persons, excess baggage, cargo and mail originating from the Philippines in a continuous and uninterrupted flight, irrespective of the place of sale or issue and the place of payment of the ticket or passage document.(Section 28 (A)(3)(a), NIRC) Non-Resident Foreign Corporation Source: Tax Base: Within Gross Income January 01, 2009 (Sec.

Tax Rate: 35% effective July 01, 2005; 30% effective 28 (B)(1), R.A. No. 9337)

Non-resident foreign corporation is taxed based on its gross income in the taxable year from all sources within the Philippines.

The test of taxability is the source, and the source of an income is that activity which produced the income.(PHILAMLIFE vs. CTA, CA-G.R. SP No. 31283, 25 April 1995) (PHILAMLIFE), a domestic corporation entered into a Management Services Agreement with American International Reinsurance Co., Inc. (AIRCO), a nonresident foreign corporation with principal place of business in Pembroke, Bermuda whereby, AIRCO shall perform for PHILAMLIFE various management services. Section 37 (a) of National Internal Revenue Code, it includes royalties for the supply of scientific, technical, industrial, or commercial knowledge or information; and the technical advice, assistance or services rendered in connection with the technical management and administration of any scientific, industrial or commercial undertaking, venture, project or scheme. Non-Resident Foreign Corporation The following non-resident foreign corporations shall be subject to a different tax rate: Non-resident Cinematographic Film Owner, Lessor or Distributor 25% of its gross income from all sources within the Philippines. Non-resident Owner or Lessor of Vessels Chartered by Philippine Nationals - 41/2% of gross rentals, lease or charter fees from leases or charters to Filipino citizens or corporations, as approved by the Maritime Industry Authority. Non-resident Owner or Lessor of Aircraft, Machineries and Other Equipment - 71/2% of gross rentals or fees. The income of non-resident foreign corporations from transactions with depository banks under the expanded foreign currency deposit system shall be exempt from income tax. Minimum Corporate Income Taxation (MCIT) Minimum Corporate Income Tax (MCIT)1. MCIT Rate = 2% of gross income (GI)When to begin/apply MCIT? Beginning on the 4 th taxable year immediately following the year in which such corporation commenced its business operation (Commencement of Business Operation:Upon Issuance of BIR Certificate ofRegistration) Imposed when on the 4 th taxable year, 2% of the corporations GI is greater than 35% of its TI.Example: for 2006 calendar year GI = P500,000 2% of GI = P10,000TI = P27,000 35% of TI = P9,4502006 IT = P10,000 Rationale: This is designed to prevent corporations from escaping being taxed by including frivolous expenses in their statement of income (Ex. Over statement of depreciation expense) 2. Carry Forward of Excess Minimum Tax

Excess of MCIT over the normal income tax shall be carried forward & credited against normal income tax for the 3 succeeding years Example: (proceeding from above example)Situation A: If regular income tax (35% of taxable income) is greater than MCIT (2% of GI) Pay Regular Income Tax For 2007 calendar year:GI = P500,000 2% of GI = P10,000TI = P50,000 35% of TI = P17,500 Income Tax payable for 2007= 17,500 (Regular Income Tax) 550 (MCIT Carry Forward from 2006: 10,000-9450)= 16,950NOTE: You can deduct MCIT Carry Forward only if Regular Income Tax is greater than MCIT Y Situation B: If regular income tax is less than MCIT Pay MCIT For 2007 calendar year:GI = P500,000 2% of GI = P10,000TI = P20,000 35% of TI = P7,000Income Tax payable for 2007= 10,000NOTE: MCIT carry forward as of 2007 is already3,550 (550 from 2006 and 3,000 from 2007).So if in 2008, Regular Income Tax is already greater than MCIT, you may deduct 3,550from payable Regular Income Tax. 3. Relief from MCIT MCIT may be suspended by the Sec of Finance when corporations losses are dueto:(a) prolonged labor dispute(b) force majeure(c) legitimate business reverses 4. Gross Income (for purposes of applying MCIT) Gross Income = Gross Sales ( - ) Sales returns, discounts & allowances( - ) Cost of Goods sold If taxpayer is engaged in sale of service: Gross Income = Gross Receipts( - ) Sales returns, discounts and allowances( - ) Cost of Services *means all direct costs and expenses necessarily incurred to provide the services required by the customers including: a) salaries and employee benefits of personnel, consultants and specialists directly rendering the service; b) costs of facilities directly utilized in providing the service such as depreciation or rental of equipment used and costs of supplies

Purpose: to prevent the prevailing practice of corporations of over-claiming deductions in order to reduce their income tax payments. Covers only Domestic and Resident Foreign Corporations. Applicable on the 4th year of operation Excess MCIT carried over to the next 3 succeeding years Minimum Corporate Income Taxation (MCIT) Secretary of Finance may suspend MCIT upo recommendation of BIR Commissioner in any of the following cases: 1) Sustained losses from prolonged labor dispute lossess arising from a strike staged by employees which lasted for more than 6 months within the taxable period nad caused the temporary shutdown of business operations 2) Force Majeure Act of God, may also include armed conflicts like war or insurgency

3) Legitimate Business reverses substantial loss due to fire, robbery, theft or for other economic reason as determined by Sec of Finance Paid on Quarterly and Yearly Basis Improperly Accumulated Earnings Tax (IAET) 10% Imposed as a form of penalty to corporations retaining earnings for more than the reasonable needs of business in order to recoup the lost taxes. Accumulation of earnings or profits is reasonable if it is necessary for the purpose of the business, considering all the circumstances of the case. Immediacy Test provides that reasonable needs of the business means the immediate needs of the business Improperly Accumulated Earnings Tax (IAET) Imposed as a form of penalty to corporations retaining earnings for more than the reasonable needs of business in order to recoup the lost taxes. Does not apply to the following: Publicly held corporations; is a stock corporation in which the shares of stock are available to the public. The shares are traded on the open market through a stock exchange. Banks and other non-bank financial intermediaries; Non-bank financial intermediary is a collection of institutions, which range from leasing, factoring and venture companies as well as those who conduct contractual savings and institutional investors. They compete with banks and force them to be more efficient in delivery of services. They are also actively involved in the securities markets and allocation of long-term financial resources. Insurance companies Taxable Partnerships General Professional Partnership Non-taxable joint ventures Enterprises duly registered with the Philippine Economic Zone Authority (PEZA)

Auxiliary; aiding or supporting in an inferior capacity or position. In the law of corporations, a corporation or company owned by another corporation that controls at least a majority of the shares. A subsidiary corporation or company is one in which another, generally larger, corporation, known as the parent corporation, owns all or at least a majority of the shares. As the owner of the subsidiary, the parent corporation may control the activities of the subsidiary. This arrangement differs from a merger, in which a corporation purchases another company and dissolves the purchased company's organizational structure and identity.

You might also like

- 07 - CLWTAXN Notes On Income TaxationDocument10 pages07 - CLWTAXN Notes On Income TaxationMichael Allen RodrigoNo ratings yet

- The Source of An Income Is The Property, Activity or Service That Produced The IncomeDocument10 pagesThe Source of An Income Is The Property, Activity or Service That Produced The IncomeMarianne Hope VillasNo ratings yet

- Tax Rev Midterms CoverageDocument11 pagesTax Rev Midterms CoverageRegi Mabilangan ArceoNo ratings yet

- Cases For January 25Document32 pagesCases For January 25PJANo ratings yet

- Tax Lecture - CorporationsDocument7 pagesTax Lecture - CorporationsMagic ShopNo ratings yet

- Report On Tanhhx 1Document28 pagesReport On Tanhhx 1Eks WaiNo ratings yet

- Ii. Corporate Taxpayers Corporation Under The NIRCDocument7 pagesIi. Corporate Taxpayers Corporation Under The NIRCRon RamosNo ratings yet

- Tax Case Digest - Cir vs. Batangas Transportation Co.Document2 pagesTax Case Digest - Cir vs. Batangas Transportation Co.YourLawBuddyNo ratings yet

- I.A. Meaning of Taxation Obligation To Pay Tax Vs Obligation To Pay DebtDocument33 pagesI.A. Meaning of Taxation Obligation To Pay Tax Vs Obligation To Pay DebtVincent Jan TudayanNo ratings yet

- Villanueva V City of IloiloDocument48 pagesVillanueva V City of Iloiloamun dinNo ratings yet

- Taxation Case DigestDocument25 pagesTaxation Case DigestHenrick YsonNo ratings yet

- 139 Scra 436Document23 pages139 Scra 436Irish PDNo ratings yet

- 4 CorporationDocument15 pages4 CorporationrhieelaaNo ratings yet

- Income Taxation Taxation of CorporationsDocument52 pagesIncome Taxation Taxation of CorporationsBianca Denise AbadNo ratings yet

- Tax1 Assigned CasesDocument5 pagesTax1 Assigned CasesflorencemanulatNo ratings yet

- GNotes Income Tax 100814 Part1Document42 pagesGNotes Income Tax 100814 Part1Migz DimayacyacNo ratings yet

- Digests: Taxation Law IDocument16 pagesDigests: Taxation Law IChelle DedzNo ratings yet

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- Taxation Law I Case Digests 2Document45 pagesTaxation Law I Case Digests 2Christopher G. Halnin75% (4)

- Week 6 7 DigestDocument65 pagesWeek 6 7 Digestjovelyn davoNo ratings yet

- Case Digest On Taxation IDocument65 pagesCase Digest On Taxation IAndrew MarfilNo ratings yet

- Afisco Insurance Corporation v. CA 302 SCRA 1Document2 pagesAfisco Insurance Corporation v. CA 302 SCRA 1Kayee KatNo ratings yet

- Taxation of CorporationsDocument73 pagesTaxation of CorporationsMAWIIINo ratings yet

- Taxation of CorporationsDocument73 pagesTaxation of CorporationsMAWIIINo ratings yet

- Tax CasesDocument18 pagesTax Casesflavio galacheNo ratings yet

- Inc Tax Digests Income2Document33 pagesInc Tax Digests Income2Clark Edward Runes UyticoNo ratings yet

- Case DigestsDocument158 pagesCase DigestsJustin Imadhay100% (4)

- Case Digest - TaxDocument11 pagesCase Digest - TaxRejean EscalonaNo ratings yet

- Tax Rev Digest CasesDocument12 pagesTax Rev Digest CaseskhristineNo ratings yet

- Tax 2 Digest (0202) GR 151135 070204 Contex Vs CirDocument2 pagesTax 2 Digest (0202) GR 151135 070204 Contex Vs CirAudrey Deguzman67% (3)

- Taxation Cases 2Document16 pagesTaxation Cases 2Joji Marie PalecNo ratings yet

- Case DigestDocument30 pagesCase DigestLe Obm SizzlingNo ratings yet

- Week 7Document14 pagesWeek 7Richelle GraceNo ratings yet

- Word Work File L - 1330700490Document13 pagesWord Work File L - 1330700490Alyza Montilla BurdeosNo ratings yet

- Commissioner of Internal RevenueDocument3 pagesCommissioner of Internal RevenueKath LeenNo ratings yet

- Joint Ventures NOT Taxable As CorporationsDocument2 pagesJoint Ventures NOT Taxable As CorporationsanneNo ratings yet

- Compilation of Cases - Partnership, Agency and TrustDocument148 pagesCompilation of Cases - Partnership, Agency and Trustearl0917No ratings yet

- Paseo Realty and Development Corp. Vs - Court of Appealsg.R. No. 119286 October 13, 2004FACTSDocument8 pagesPaseo Realty and Development Corp. Vs - Court of Appealsg.R. No. 119286 October 13, 2004FACTSShynnMiñozaNo ratings yet

- Chamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlDocument6 pagesChamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, Et AlMathew Beniga GacoNo ratings yet

- Tax Digest CompilationDocument37 pagesTax Digest CompilationVerine SagunNo ratings yet

- Taxable Corporatio Ns by Enrico D. Tabag, CPA, MBADocument83 pagesTaxable Corporatio Ns by Enrico D. Tabag, CPA, MBATrisha RafalloNo ratings yet

- Property or Industry To A Common Fund, and That They Intended To Divide The Profits Among ThemselvesDocument11 pagesProperty or Industry To A Common Fund, and That They Intended To Divide The Profits Among ThemselvesRonnie SolitarioNo ratings yet

- National Internal Revenue CodeDocument23 pagesNational Internal Revenue Codeuserfriendly12345No ratings yet

- VAT Tax 2 Case DigestsDocument7 pagesVAT Tax 2 Case DigestsJustin Andre SiguanNo ratings yet

- Taxation CasesDocument23 pagesTaxation CasesJoji Marie PalecNo ratings yet

- Pascual Vs Cir Tax2Document3 pagesPascual Vs Cir Tax2Rodel Cadorniga Jr.No ratings yet

- Chamber of Real Estate and Builders' Association, Inc. vs. Executive SecretaryDocument10 pagesChamber of Real Estate and Builders' Association, Inc. vs. Executive SecretaryLemUyNo ratings yet

- Partnership TaxationDocument6 pagesPartnership TaxationAndrew LastrolloNo ratings yet

- Tax - PDF of Prof. Mamalateo'sDocument18 pagesTax - PDF of Prof. Mamalateo'sRenante Rodrigo100% (1)

- VAT Digests and NotesDocument20 pagesVAT Digests and NotesJoseph FullNo ratings yet

- 7.) Pascual and Dragon V CIRDocument2 pages7.) Pascual and Dragon V CIRRusty SeymourNo ratings yet

- Afisco Insurance Corporation vs. Court of Appeals: Taxation Law IDocument30 pagesAfisco Insurance Corporation vs. Court of Appeals: Taxation Law INatasha MilitarNo ratings yet

- Manila Gas Corp. v. Collector of InternalDocument8 pagesManila Gas Corp. v. Collector of InternalalfredNo ratings yet

- Purpose and Scope of TaxationDocument6 pagesPurpose and Scope of TaxationMaria ThereseNo ratings yet

- Afisco Insurance Corp EtDocument5 pagesAfisco Insurance Corp EtRoseanne MateoNo ratings yet

- Cir V Court of Appeals GR No 115349 April 18 1997Document3 pagesCir V Court of Appeals GR No 115349 April 18 1997Jhon Anthony BrionesNo ratings yet

- Limitations On The Exercise of Taxing Power A. Inherent LimitationsDocument12 pagesLimitations On The Exercise of Taxing Power A. Inherent LimitationsAngeliqueGiselleCNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Date/Time Place Law Violated Victim/S Data Suspect/S Data RemarksDocument1 pageDate/Time Place Law Violated Victim/S Data Suspect/S Data RemarksAnonymous BvmMuBSwNo ratings yet

- ConflictDocument8 pagesConflictarcheee2345No ratings yet

- 1 SEMESTER SY 2016-2017 CLJ5 (TUE & THU/5:00-6:30 PM) Prof: Michael Evans C Pastor, LLBDocument5 pages1 SEMESTER SY 2016-2017 CLJ5 (TUE & THU/5:00-6:30 PM) Prof: Michael Evans C Pastor, LLBAnonymous BvmMuBSwNo ratings yet

- in An Affidavit Complaint Submitted by Police Station 1 Station CommanderDocument3 pagesin An Affidavit Complaint Submitted by Police Station 1 Station CommanderAnonymous BvmMuBSwNo ratings yet

- EmpmgrDocument5 pagesEmpmgrpaxi80No ratings yet

- PowerPoint Presentation Field ManualDocument16 pagesPowerPoint Presentation Field ManualAnonymous BvmMuBSwNo ratings yet

- MatterDocument1 pageMatterAnonymous BvmMuBSwNo ratings yet

- Mock Trial 123234234Document13 pagesMock Trial 123234234Anonymous BvmMuBSwNo ratings yet

- MatterDocument1 pageMatterAnonymous BvmMuBSwNo ratings yet

- 03156621the TigrisDocument1 page03156621the TigrisAnonymous BvmMuBSwNo ratings yet

- Pba RosterDocument7 pagesPba RosterAnonymous BvmMuBSwNo ratings yet

- The Philippines Is An Island Nation Rich in Both Culture and History. TheDocument2 pagesThe Philippines Is An Island Nation Rich in Both Culture and History. TheAnonymous BvmMuBSwNo ratings yet

- Science 7 MakakalikasanDocument6 pagesScience 7 MakakalikasanAnonymous BvmMuBSwNo ratings yet

- Grade 7 AssignDocument4 pagesGrade 7 AssignAnonymous BvmMuBSw100% (2)

- Doc 3Document2 pagesDoc 3Anonymous BvmMuBSwNo ratings yet

- 054681254cases in Hearsay RuleDocument38 pages054681254cases in Hearsay RuleAnonymous BvmMuBSwNo ratings yet

- 03156621the TigrisDocument1 page03156621the TigrisAnonymous BvmMuBSwNo ratings yet

- Grade 7 Doc 2Document2 pagesGrade 7 Doc 2Anonymous BvmMuBSwNo ratings yet

- Doc 4Document1 pageDoc 4Anonymous BvmMuBSwNo ratings yet

- The Crime Scene SketchDocument3 pagesThe Crime Scene SketchAnonymous BvmMuBSwNo ratings yet

- Cheat Codes On Sims4Document11 pagesCheat Codes On Sims4Anonymous BvmMuBSwNo ratings yet

- Grade 7 AssignDocument4 pagesGrade 7 AssignAnonymous BvmMuBSw100% (2)

- Faq Patrol Plan 2030Document10 pagesFaq Patrol Plan 2030Anonymous BvmMuBSwNo ratings yet

- HitmanDocument1 pageHitmanAnonymous BvmMuBSwNo ratings yet

- PNP Ops Manual 2013Document222 pagesPNP Ops Manual 2013ianlayno100% (2)

- (Ten Print, Mug Shot, Booking) : Last Quarter 2014Document2 pages(Ten Print, Mug Shot, Booking) : Last Quarter 2014Anonymous BvmMuBSwNo ratings yet

- Credit Transactions - 1st Meeting - Loan and Deposit - 4th YrDocument115 pagesCredit Transactions - 1st Meeting - Loan and Deposit - 4th YrAnonymous BvmMuBSwNo ratings yet

- If Ever YouDocument5 pagesIf Ever YouAnonymous BvmMuBSwNo ratings yet

- Guidelines For Creating Bonsai Soil.: by Randy Clark Charlotte, NCDocument8 pagesGuidelines For Creating Bonsai Soil.: by Randy Clark Charlotte, NCAlessioMasNo ratings yet

- PeaceDocument1 pagePeaceAnonymous BvmMuBSwNo ratings yet

- Collecting, Analyzing, & Feeding Back DiagnosticDocument12 pagesCollecting, Analyzing, & Feeding Back DiagnosticCaroline Mariae TuquibNo ratings yet

- MegaMacho Drums BT READ MEDocument14 pagesMegaMacho Drums BT READ MEMirkoSashaGoggoNo ratings yet

- Bharti Airtel Strategy FinalDocument39 pagesBharti Airtel Strategy FinalniksforloveuNo ratings yet

- Army Aviation Digest - Apr 1971Document68 pagesArmy Aviation Digest - Apr 1971Aviation/Space History LibraryNo ratings yet

- OB and Attendance PolicyDocument2 pagesOB and Attendance PolicyAshna MeiNo ratings yet

- Payment of Wages 1936Document4 pagesPayment of Wages 1936Anand ReddyNo ratings yet

- VRARAIDocument12 pagesVRARAIraquel mallannnaoNo ratings yet

- DP-1520 PMDocument152 pagesDP-1520 PMIon JardelNo ratings yet

- Worksheet in Bio 102: Microbiology and Parasitology (WEEK 17)Document3 pagesWorksheet in Bio 102: Microbiology and Parasitology (WEEK 17)DELOS SANTOS JESSIECAHNo ratings yet

- Peanut AllergyDocument4 pagesPeanut AllergyLNICCOLAIONo ratings yet

- Chemical & Ionic Equilibrium Question PaperDocument7 pagesChemical & Ionic Equilibrium Question PapermisostudyNo ratings yet

- PRESENTACIÒN EN POWER POINT Futuro SimpleDocument5 pagesPRESENTACIÒN EN POWER POINT Futuro SimpleDiego BenítezNo ratings yet

- Tec066 6700 PDFDocument2 pagesTec066 6700 PDFExclusivo VIPNo ratings yet

- Scoring Rucric Lecture Eassess2.docx NewDocument6 pagesScoring Rucric Lecture Eassess2.docx NewMaica Ann Joy SimbulanNo ratings yet

- An Analysis of Students' Error in Using Possesive Adjective in Their Online Writing TasksDocument19 pagesAn Analysis of Students' Error in Using Possesive Adjective in Their Online Writing TasksKartika Dwi NurandaniNo ratings yet

- TB 60 Repair Parts PDFDocument282 pagesTB 60 Repair Parts PDFvatasa100% (2)

- Wordbank 15 Coffee1Document2 pagesWordbank 15 Coffee1akbal13No ratings yet

- Sharat Babu Digumarti Vs State, Govt. of NCT of Delhi (Bazee - Com Case, Appeal) - Information Technology ActDocument17 pagesSharat Babu Digumarti Vs State, Govt. of NCT of Delhi (Bazee - Com Case, Appeal) - Information Technology ActRavish Rana100% (1)

- PM 50 Service ManualDocument60 pagesPM 50 Service ManualLeoni AnjosNo ratings yet

- Bichelle HarrisonDocument2 pagesBichelle HarrisonShahbaz KhanNo ratings yet

- Lab Science of Materis ReportDocument22 pagesLab Science of Materis ReportKarl ToddNo ratings yet

- Outlook of PonDocument12 pagesOutlook of Ponty nguyenNo ratings yet

- The Future of FinanceDocument30 pagesThe Future of FinanceRenuka SharmaNo ratings yet

- Population Second TermDocument2 pagesPopulation Second Termlubna imranNo ratings yet

- Transactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinDocument12 pagesTransactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinConstantin MarilenaNo ratings yet

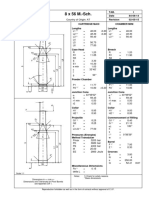

- 8 X 56 M.-SCH.: Country of Origin: ATDocument1 page8 X 56 M.-SCH.: Country of Origin: ATMohammed SirelkhatimNo ratings yet

- APJ Abdul Kalam Success StoryDocument1 pageAPJ Abdul Kalam Success StorySanjaiNo ratings yet

- Thermodynamics WorksheetDocument5 pagesThermodynamics WorksheetMalcolmJustMalcolmNo ratings yet

- Legrand Price List-01 ST April-2014Document144 pagesLegrand Price List-01 ST April-2014Umesh SutharNo ratings yet

- HDO OpeationsDocument28 pagesHDO OpeationsAtif NadeemNo ratings yet