Professional Documents

Culture Documents

DEPRECIATION

Uploaded by

Nikhil MallviyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DEPRECIATION

Uploaded by

Nikhil MallviyaCopyright:

Available Formats

Institute of Professional Education and Research (IPER)

Report on

Depreciation Policy of TATA CONSULTANCY SERVICES LIMITED

SUBMITTED TO: SUBMITTED BY: PROF. ABHISHEK JAIN MALLVIYA RASHI GOUR NIKHIL

TATA CONSULTANCY SERVICES 2 |Page

RISHU PANDEY

SUMMARY

In respect of Capital Assets that are not in the ownership of the company, the company follows the policy of depreciating them over their useful life or in 2 years whichever is less. Thus all the assets that have been taken on lease will be depreciated completely in a maximum of 2 years. In respect of all other assets, the company follows a policy of providing for depreciation on a straight line basis at the rates mentioned in Schedule XIV of Companies Act 1956 or on the basis of estimated useful life of the asset whichever is higher. Freehold land is not depreciated, while leasehold land is amortized over the life of the lease. The policy of depreciating the Computer Equipments was 50% till March 31, 2013 which was reduced to 25% in the financial year 2012-2013. The company has not explicitly mentioned these changes in any of the applicable annual reports in Schedule Q. Thus the disclosures of policy changes are not clear. While Depreciation and amortisation expense 1079.92(in crore)(2013) 917.94(in crore)(2012),Its is clear that Depreciation and amortisation expense in 2013 is more then 2012

Fixed Assets Fixed assets are stated at cost, less accumulated depreciation/amortisation. Costs include all expenses incurred to bring the assets to its present location and condition. Fixed assets exclude computers and other assets individually costing ` 50,000 or less which are not capitalized except when they are part of a larger capital investment programme

TATA CONSULTANCY SERVICES 3 |Page

--In the event of unabsorbed depreciation and carry forward of losses, deferred tax assets are recognized only to the extent that there is virtual certainty that sufficient future taxable income will be available to realize such assets. In other situations, deferred tax assets are recognized only to the extent that there is reasonable certainty that sufficient future taxable income will be available to realize these assets

DEPRECIATION POLICY OF THE FY`13: SCHEDULE Q- NOTES TO ACCOUNTS: a) Depreciation: Depreciation other than on freehold land and capital work-in-progress is charged so as to write-off the cost of assets, on the following basis:

Type of asset Leasehold land and buildings Freehold buildings Factory buildings Leasehold improvements Plant and machinery Computer equipment Vehicles Office equipment Electrical installations Furniture and fixtures Intellectual property / distribution rights Rights under licensing agreement

Method Straight line Written down value Straight line Straight line Straight line Straight line Written down value Written down value Written down value Straight line Straight line Straight line

Rate / Period Lease period 5.00% 10.00% Lease period 33.33% 25.00% 25.89% 13.91% 13.91% 100% 24 60 months License period

TATA CONSULTANCY SERVICES 4 |Page

Fixed assets purchased for specific projects are depreciated over the period of the project.

Government grants Government grants are recognized when there is reasonable assurance that the Group will comply with the conditions attached to them and the grants will be received. Government grants whose primary condition is that the Group should purchase, construct or otherwise acquire capital assets are presented by deducting them from the carrying value of the assets. The grant is recognized as income over the life of a depreciable asset by way of a reduced depreciation charge. Other government grants are recognized as income over the periods necessary to match them with the costs for which they are intended to compensate, on a systematic and rational basis.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Agrifinance 110818232145 Phpapp02Document18 pagesAgrifinance 110818232145 Phpapp02Nikhil MallviyaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Ldi Fidd HR N.:i:,,..,.,, - .,,",.."" NT R T&/DDocument7 pagesLdi Fidd HR N.:i:,,..,.,, - .,,",.."" NT R T&/DNikhil MallviyaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Program in CDocument10 pagesProgram in CNikhil MallviyaNo ratings yet

- WirelessDocument41 pagesWirelessNikhil MallviyaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Product Life Cycles and The Boston MatrixDocument25 pagesProduct Life Cycles and The Boston MatrixAllison Nadine MarchandNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Management Information SystemDocument29 pagesManagement Information SystemNikhil MallviyaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Knowledge Management & Bi in Banking: Presented By: Ashish Toppo Nikhil Mallviya Prajit MohananDocument9 pagesKnowledge Management & Bi in Banking: Presented By: Ashish Toppo Nikhil Mallviya Prajit MohananNikhil MallviyaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- IndiamartdemogrDocument7 pagesIndiamartdemogrNikhil MallviyaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- IBM's ECRM InitiativesDocument13 pagesIBM's ECRM InitiativesNikhil Mallviya0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Investors PresentationDocument23 pagesInvestors Presentationabhisek_bhtNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hair Care Sector AnalysisDocument19 pagesHair Care Sector AnalysisJatin BhagatNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Indian IT IndustryDocument5 pagesIndian IT IndustrychecknaveenNo ratings yet

- Chap 015Document39 pagesChap 015Nikhil MallviyaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- SadmDocument7 pagesSadmNikhil MallviyaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Global EcoDocument33 pagesGlobal EcoNikhil MallviyaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Lession 2 Facility LayoutDocument35 pagesLession 2 Facility LayoutNikhil MallviyaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 16Document8 pages16Nikhil MallviyaNo ratings yet

- The Discipline of TeamsDocument11 pagesThe Discipline of TeamsNikhil MallviyaNo ratings yet

- Team Effectiveness:: Principles & GuidelinesDocument7 pagesTeam Effectiveness:: Principles & GuidelinesNikhil MallviyaNo ratings yet

- Pointer CDocument192 pagesPointer CNikhil MallviyaNo ratings yet

- 7Document11 pages7Nikhil MallviyaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Emerging Trends in HRMDocument5 pagesEmerging Trends in HRMhardeepcharmingNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- HRD Practices and Philosophy of Management in Indian OrganizationsDocument9 pagesHRD Practices and Philosophy of Management in Indian OrganizationsPooja SinghNo ratings yet

- WirelessDocument41 pagesWirelessNikhil MallviyaNo ratings yet

- Questionnaire - RetailDocument11 pagesQuestionnaire - RetailNikhil MallviyaNo ratings yet

- Comparitive Study of The Lifetime Plans of The Celllular Companies in BhopalDocument61 pagesComparitive Study of The Lifetime Plans of The Celllular Companies in Bhopalajay197No ratings yet

- Arcwp29 MitraDocument150 pagesArcwp29 MitraNikhil MallviyaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Cost SheetDocument4 pagesCost SheetNikhil MallviyaNo ratings yet

- 09 Chapter 2Document101 pages09 Chapter 2Nikhil MallviyaNo ratings yet

- Nikhil MalviyaDocument5 pagesNikhil MalviyaNikhil MallviyaNo ratings yet

- H2 English Maharashtra WZ PDFDocument108 pagesH2 English Maharashtra WZ PDFShashank ChoudharyNo ratings yet

- MacEcon Mod 3 PretestDocument3 pagesMacEcon Mod 3 PretestAleihsmeiNo ratings yet

- First Practice 2022-1 Valoracion AduaneraDocument3 pagesFirst Practice 2022-1 Valoracion AduaneraRhancel MinayaNo ratings yet

- A Project Report On FMCG CompanyDocument8 pagesA Project Report On FMCG CompanySumit RaghvanNo ratings yet

- CH 10 - Dividend & InterestDocument25 pagesCH 10 - Dividend & InterestPrashant ChandaneNo ratings yet

- Research Report For ReferenceDocument107 pagesResearch Report For ReferenceKaustubh ShindeNo ratings yet

- Wise Transaction Invoice Transfer 751293515 1421066003 Fr-1Document2 pagesWise Transaction Invoice Transfer 751293515 1421066003 Fr-1Larbi doukara OussamaNo ratings yet

- Bussiness Proposal and Plan On Itegrated Catfish Farming Summary Proposed BussinessDocument4 pagesBussiness Proposal and Plan On Itegrated Catfish Farming Summary Proposed Bussinessillinaira2006No ratings yet

- Scam 1992: The Story of Harshad Mehta: A Project Report ONDocument3 pagesScam 1992: The Story of Harshad Mehta: A Project Report ONPahulpreet SinghNo ratings yet

- Assignment 5.2 Note PayableDocument2 pagesAssignment 5.2 Note PayableKate HerederoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Quality Management System Procedure: (Laboratory Name)Document3 pagesQuality Management System Procedure: (Laboratory Name)jeric bañaderaNo ratings yet

- PRP 111 Chapter 9 Notes Week 9Document8 pagesPRP 111 Chapter 9 Notes Week 9Selen BİLGİNER HALEFOĞLUNo ratings yet

- Accounting Activity 4Document2 pagesAccounting Activity 4Ar JayNo ratings yet

- Final Future Union - The Rubicon Report - Conflict Capital (Full Report)Document100 pagesFinal Future Union - The Rubicon Report - Conflict Capital (Full Report)New York Post100% (2)

- Nas 20Document10 pagesNas 20santosh pandeyNo ratings yet

- 2020 CLC DC Chi Tiet Lt2 Ta Acbsp enDocument9 pages2020 CLC DC Chi Tiet Lt2 Ta Acbsp enNguyễn Ngọc MinhNo ratings yet

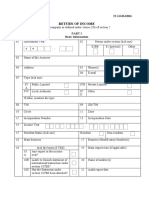

- Return of Income: Basic InformationDocument8 pagesReturn of Income: Basic InformationSudmanNo ratings yet

- Causes of Business CycleDocument17 pagesCauses of Business CycletawandaNo ratings yet

- Attitude Research of FevicolDocument7 pagesAttitude Research of FevicolShraddha TiwariNo ratings yet

- Airbnb Marketing ProcessDocument2 pagesAirbnb Marketing ProcessHuong DuongNo ratings yet

- Agency: Chapter 1. Nature, Form and Kinds of AgencyDocument10 pagesAgency: Chapter 1. Nature, Form and Kinds of Agencyeugenebriones27yahoo.comNo ratings yet

- Chapter 1 QuizDocument9 pagesChapter 1 QuizRyan SalipsipNo ratings yet

- Wibi LeadsDocument50 pagesWibi LeadsBayu WibiNo ratings yet

- Loreal Key Success Factor LASTESTDocument11 pagesLoreal Key Success Factor LASTESTasish moharanaNo ratings yet

- Ch-1 Indian Economy in The Eve of Independance (Choice Based Questions)Document9 pagesCh-1 Indian Economy in The Eve of Independance (Choice Based Questions)social sitesNo ratings yet

- IPoM Junio 2023Document44 pagesIPoM Junio 2023Cristian NeiraNo ratings yet

- Comp - XM-XXXDocument4 pagesComp - XM-XXXFrankNo ratings yet

- histretSP 2022Document45 pageshistretSP 2022MarianaNo ratings yet

- ADD MATHS Project 2018 Index NumberDocument25 pagesADD MATHS Project 2018 Index NumberLoh Chee WeiNo ratings yet

- Elasticity and Its Applications - 5 - 6 - 920220823223838Document26 pagesElasticity and Its Applications - 5 - 6 - 920220823223838Aditi SinhaNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- You Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherFrom EverandYou Can't Joke About That: Why Everything Is Funny, Nothing Is Sacred, and We're All in This TogetherNo ratings yet

- The Importance of Being Earnest: Classic Tales EditionFrom EverandThe Importance of Being Earnest: Classic Tales EditionRating: 4.5 out of 5 stars4.5/5 (44)

- The House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedFrom EverandThe House at Pooh Corner - Winnie-the-Pooh Book #4 - UnabridgedRating: 4.5 out of 5 stars4.5/5 (5)