Professional Documents

Culture Documents

European Natural Gas Vehicle Market

Uploaded by

rizkiekanandaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

European Natural Gas Vehicle Market

Uploaded by

rizkiekanandaCopyright:

Available Formats

European Natural Gas Vehicle Market

Multi Stakeholder appraisal of the opportunities and challenges facing the European Natural Gas Vehicle Market In-depth interviews with Major Fleet Companies, Howard Tenens and KBC Logistics, and infrastructure developers GAZPROM and EDP Gs as well as key vehicle manufacturer, MAN Diesal

European Natural Gas Vehicle Market

Fleet Operators Thoughts

INTRODUCTION

The Natural Gas Vehicle Industry in Europe has grown substantially in the last ve years. Gas Suppliers, Natural Gas Utilities and Fleet Operators alike are investing millions of Euros to develop a protable and sustainable NGV infrastructure in Europe. The market has evolved from a centric Compressed Natural Gas (CNG) industry led by leaders Germany and Italy, to a European wide shift in interest to the opportunities presented by Liqueed Natural Gas for Heavy Duty Trucking. New Euro VI regulations have meant that HGVs have had to lower their emissions, resulting in more and more Fleet Owners considering the benets of LNG and dual fuel. Support at the European Commission has never been stronger, with clear policy initiatives, such as the Clean Air for Transport Package, leading a 2013 strategy for increasing NGV refuelling infrastructure across Europe. Government nanced projects such as Blue Corridors Network, are also in full swing with key OEMs, Iveco, Scania, Volvo as well as Leading suppliers such as Shell and Gazprom taking part. Nonetheless there are two hurdles still hampering the industrys growth: there is still a clear lack of infrastructure to support Fleet Companies who want to make the switch. Secondly, nancial support and policy from the government is still in early development. So the need to set a business model and future strategy in order to be competitive in this market, has never been more paramount. In this interview piece, we speak with a range of stakeholders from across the value chain to identify the main opportunities and challenges for natural gas vehicles in Europe. Remember all our interviewees will be speaking at the Natural Gas Vehicle Conference and Exhibition (25-26 November, Amsterdam). The conference will focus on how to drive a sustainable and protable infrastructure for natural gas fuel in Europe. Interviewee Proles: Paul Gowland Group Fleet Engineer Howard Tenens Paul Gowland is Group Fleet Engineer at Howard Tenens, a family owned Haulage company. Paul looks after ten sites handling all engineering requirements. Howard Tenens has been proactive in the early adoption of dual fuel vehicles, introducing its rst in 2008.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Dave Ashford Director, Transport and Compliance Manager KBC Logistics Limited. Dave Ashford is Director, Transport and Compliance Manager at KBC Logistics Limited. KBC Logistics is a haulier operating on routes from local ports to regional distribution centres. The companys haulage range extends north to the Midlands and as far west as South Wales. KBC Logistics operates a 24-7 business model, which means that its trucks almost never stop rolling. This maximises protability and underlines the business case for LNG conversion.

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

www.ngvevent.com/eu

FC Business Intelligence 2011

European Natural Gas Vehicle Market

Fleet Operators Thoughts

David Graebe Head of Gas for Transport GAZPROM Germania David Graebe is Head of Gas for Transport at GAZPROM Germania. GAZPROM is one of the largest producers of natural gas in the world and is active across the industry value chain. David has responsibility for helping GAZPROM to develop its natural gas for vehicles business in Europe. Robert Staimer E ciency Advisor MAN Truck & Bus AG Robert Staimer, is an E ciency Adviser at MAN, one of Europes leading manufacturers of trucks and buses. MAN has a 255-year history and is the third leading OEM in its eld in Europe, boasting a turnover of 8.8bn in 2012. Globally there are roughly 7,500 CNG engines and vehicles manufactured by MAN on the road. Recently, MAN restructured its sales division to focus on e ciency issues. Robert advises the salesforce as well as customers on vehicle pricing, technologies, costs and environmental benets. Pedro Avila Technical Director EDP Gs - Distribuio Pedro Avila is Technical Director at EDP Gs Distribuio, which distributes gas across a 4,000km network in the north east of Portugal. Beginning operations in 1997, EDP Gs now has approximately 300,000 clients and is growing fast, adding approximately 20,000 clients per year. Recently EDP Gs went through a process of unbundling its distribution arm from its commercial supply activities, in line with EU energy market reform rules. For that reason, the role of the Distribution System Operator (DSO) is limited to the promotion of natural gas in transportation but not its implementation, leaving this role to other market agents, in particular energy suppliers. On the other hand, it is important for DSOs to increase the amount of gas distributed across their infrastructure. The use of natural gas in the transport sector has good potential to meet this purpose.

Interview with Paul Gowland - Group Fleet Engineer at Howard Tenens

Paul Gowland is Group Fleet Engineer at Howard Tenens, a family owned Haulage company. Paul looks after ten sites handling all engineering requirements. Howard Tenens has been proactive in the early adoption of dual fuel vehicles, introducing its rst in 2008.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

As a eet operator what were the main benets that drew you to using natural gas as a fuel?

All of us have got to reduce our carbon footprint and we want to be known as a responsible operator. We reviewed all of our fuel options and came to the conclusion that natural gas was the most viable. In the future we could replace that with biomethane. Its good for the environment, its good for the company, and its good for our customers. We can encourage new business as a result of being able to o er our clients a low cost option of improving their carbon footprint, because they dont have to invest in all the machinery and all the infrastructure.

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

Howard Tenens made a commitment to all of its customers to reduce the carbon footprint of storing and transporting their products. Weve had lots of di erent customers, for example Coca Cola, who need to reduce their carbon footprint and are looking for like-minded companies to transport their goods around the country. Of course, the Howard Tenens board decided that this is a good opportunity. The environment is one thing but its a good investment for the company as well. Were happy to be at the forefront and associated with taking the risk and working through any problems. We seem to be winning that war at the moment.

Could you tell us a little bit about the process you went about switching your eet to NGV? Which vehicle type did you choose and why? How have you developed supporting infrastructure to fuel your NGV eet?

Ive only been with Howard Tenens for three years and when I joined the company it was already two years in to exploring gas dual fuel vehicles. When I joined the only vehicle available in the UK was the Mercedes and only one particular company was converting the vehicles. Since my introduction to the company weve found an alternative supplier of conversion equipment and by working closely with them weve managed to convince DAF to supply us with vehicles. Howard Tenens trialled the rst CNG DAF in the country last year. We also have a deal with MAN who put the rst MAN CNG vehicle in to the UK last year. This alternative gas company are now supplying a vast range of vehicles to run on CNG dual fuel, which is benecial to the UK. Our theory of how to make things better in the industry is weve got to work at it and work together. Were working closely with the manufacturers and the conversion specialists to try and put more CNG vehicles in to operation, by giving people more choice of what type of vehicle they can have. Whereas ve years ago there was one particular make capable of running on CNG, there are now ve or six di erent truck manufacturers who can all have their equipment converted to CNG operation. This is important because operators do sometimes have a preference for a particular vehicle. Theres a lot more chance now of more companies being able to get the type of vehicle that they like and have it converted to dual fuel. This should also be good for the CNG industry because theres more availability of di erent types of vehicles. Were also prepared to trial vehicles and if there are any pitfalls they will hit us rst and we can iron out these faults out before theyre o ered to other people. We looked at the infrastructure of where we can refuel our vehicles and its pretty limited in the UK at the moment. Its getting better but theres still a long way to go. Its early days yet for this type of fuel medium in the country. What we have done is build two gas stations of our own and were building a third one commencing in January next year, all of which are open to the public. Other haulage companies can use them and they can get the benets of running on gas as well.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

Have there been any major challenges / hurdles you have faced in the process and how have you addressed those challenges?

The biggest problem that weve had and also other operators would have is the refuelling infrastructure - it was and still is limited. So thats why weve built 3 stations of our own and weve made them available to other operators to help them get started in operating gas vehicles. But we do need other organisations; people who can actually supply gas, to start introducing more gas stations. I suppose in reality that will happen. The more gas vehicles are manufactured the

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

more need there will be to refuel them, so one will follow the other. Its just a case of it starts o slowly at rst. We were one of the lead operators to take up gas. Other companies are now starting to pick it up and with more vehicles requiring fuel the suppliers of stations will see that need and hopefully start building some new ones.

Are you able to share any information on the overall cost of your NGV project? And when you are expecting to receive a pay back from that investment?

As a company weve invested probably about 2m to 2.5m so far in this scheme. To convert a basic heavy goods vehicle it costs anywhere between 20,000 and 35,000. We do expect to make a prot on it though. The positive angle is that not only do we save Co2 emissions but its a slightly lower priced fuel as well, so there are advantages for the operator. Operators can make fuel savings as well as carbon savings. After youve paid for all the infrastructure and the substantial cost of vehicle conversion, it takes a number of years of continuous use for the payback time to be reached. Payback time depends on how much you use the vehicle. If the vehicle is double shifted so it gets more use and you use more fuel, the payback time reduces. For a vehicle that does long distances trunking up and down the motorway then as an average you might expect a return on your investment in two years. Its always dependent on the exact amount of use the operators place on their eet though. If you only use the vehicle for a few hours a day then it takes a longer time to pay back. Payback time can spread to three or four years for light duty vehicles with low mileage, in which case I think the price of buying and converting a vehicle might put people o . Payback time also depends on how the vehicles are nanced. In recent years, as the transport industry has tried to survive in the di cult economic climate, hauliers have started to utilise the vehicles a lot more. That reduces the time the vehicle is stood so assets will pay for themselves faster, make prots for the company and help the business to grow as well. One of the benets that people might not now about is if you get a vehicle converted to dual fuel, at the end of the life of the vehicle (say ve years) you can remove that equipment and ret it to another vehicle. So there is an afterlife for the equipment and it lasts maybe fteen years. One kit could potentially service three vehicles over a fteen year period. At the moment gas is cheaper than diesel, however theres always going to be the question in the back of most operators minds that if it takes o and becomes very popular, the government could tax it more. Like everyone else weve got no control over that. If they put diesel prices up or gas prices up were stuck with whats been handed out to us and we have to try and accommodate it. If the government leave the tax on gas alone it will encourage more people to switch because gas will be cheaper than diesel. If they put the price up then the margins of prot will become smaller and therefore the investment will become harder to make back.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

Looking to the future do you see an increased use of NGV within your eet operations? And if so what plans do you have in mind?

Natural gas is an integral part of our haulage rm. We recently won support from the Department for Transport and by the end of 2013, 75% per cent of our heavy eet (over eighteen tons that is) will be converted to dual fuel - thats a huge investment. Weve just purchased forty-one new vehicles and theyre all going through the conversion process at the moment.

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

Is there any advice you would o er other eet operators considering making the switch to NGV?

The main thing is to be very clear about the duty cycle of the vehicles. Its easy to be impressed by the glossy gures and expect to see fantastic returns. However, you get better returns from high mileage vehicles. Operators thinking about converting need to be very clear about what duty cycle the type of vehicles theyre going to buy will work on. They then need to explore whether CNG or LNG works best for them and to talk to as many companies as possible to nd out about what they o er. They should also speak to operators and get rst hand experience, because at the end of the day its a huge commitment to any haulage company. Fortunately most haulage companies will help each other. Were out there to be seen and to be talked to by other operators. Well always help and answer questions to anyone interested in dual fuel vehicles to make sure they get some advice. Wed also encourage them to talk to others to get a rounded picture of whats going on.

Interview with Dave Ashford, Director, Transport and Compliance Manager at KBC Logistics Limited.

Dave Ashford is Director, Transport and Compliance Manager at KBC Logistics Limited. KBC Logistics is a haulier operating on routes from local ports to regional distribution centres. The companys haulage range extends north to the Midlands and as far west as South Wales. KBC Logistics operates a 24-7 business model, which means that its trucks almost never stop rolling. This maximises protability and underlines the business case for LNG conversion.

As a eet operator what were the main benets that drew you to consider using natural gas as a fuel?

Dave Ashford: There are a number of reasons we decided to move in to the natural gas environment. The main one was cost savings, although were nding the return on investment is stretching somewhat because of the current price of gas. Theres an issue with UK production at the moment, which is causing us to get our gas from Europe, which is linked to the cost of fuel and thereby has increased our gas prices from ten to fteen per cent in the last few weeks. Another reason is that want to be seen as being environmentally conscious and we want our clients to see that were thinking about the environmental impact of commercial vehicles and trying to reduce our carbon footprint. Were reducing the amount of Co2 were producing by a considerable amount.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Could you tell us if you are working on any specic projects to integrate natural gas fuel into your operations, or are you mainly just considering the options?

Dave Ashford: Weve actually taken the plunge and invested in seven trucks that run on LNG, almost 25% of our eet now is dual fuel. Its really early days for us though and we had lots of issues to start o with but were now just starting to see the benets of it. We bought our rst LNG truck in November last year, I think we bought the second one in February and then weve just put another ve on over the last couple of months. So now we have actually got seven vehicles on the road running on dual fuel LNG systems, installed by Hardsta . Theyre all 6x2 tractor units running at 44 tons (44,000 kilos).

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

Have there been any major challenges / hurdles you have faced when deciding to peruse using natural gas fuel, what have been your biggest challenges and how have you addressed these to date?

Dave Ashford: One of the challenges we had was actually choosing the right vehicles, because theres such a lack of choice. There are only two marques available for conversion: the Volvo 460, which is as rare as hens teeth on the second hand market, or the Mercedes 430. In addition, only two companies carry out the conversions as far as were aware at the moment: Clean Air Power and Hardsta . Because we couldnt get hold of the Volvos we went for the Mercedes, which are more readily available on the second hand market. It doesnt really give you a lot of choice. It would be nice if there were other companies that decided to move in to the dual fuel LNG market place to give us a little bit more choice. Another issue is that weve had to look at changing the vehicles that we run because DAFs arent available in LNG. We had a 90% DAF eet before we started looking at LNG and now weve had to change everything. This gives rise to all sorts of problems: my workshops were all geared up for DAFs, we had a large amount of parts for DAFs, we know how the DAFS work, and we know how to repair the DAFs etc. So that was a bit of hurdle for us when we decided to branch in to natural gas.

What do you think are the biggest obstacles facing eet operators who are considering using natural gas to fuel their eets?

Dave Ashford: The biggest obstacle would be the infrastructure because theres a big catch 22 situation going on; a chicken and egg thing in the UK. Youll approach a company for a gas station and say, I need natural gas in my yard. Then theyll say, OK well how many vehicles have you got? When you answer that youve only got two theyll tell you, well were not going to put a station in your yard for two vehicles. But youre not going to invest several hundred thousand pounds in another ve vehicles until you know you can get a gas station. The infrastructure for diesel, on the other hand, is already in place and has been in place in the UK for the best part of a century. Obviously with gas being brand-new the infrastructure still needs investment. We were very lucky in that we managed to source a gas station to go in our yard, which went in a couple of weeks ago. Up until then we were running around with very expensive bits of kit on diesel with very small diesel tanks, which was causing all sorts of issues. Now weve actually got a tank in our yard because we took the time, invested and negotiated to get someone to back us. One company stepped up and said theyd put a tank in our yard and all they wanted was a guarantee that we would buy the gas from them, which is what weve done. So they supply the tank, they ll it up every week and we pay for the gas. At the moment its completely altered the way we use the vehicles. They come in to the yard and they take a few seconds to ll up because we havent got issues with the tanks warming up. It ts in with our business perfectly because run a back to base 24-7 business. So the trucks come back to base as soon as theyve nished work, we ll them up with diesel and gas and o they trot. So far - touch wood - everythings working on gas and were seeing some fairly good returns.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

Are you expecting to receive a pay back from any investment you have made, or plan to make in NGVs? If so, when will you expect to see that investment?

Dave Ashford: We bought three-year-old trucks and paid 26,000 per truck to have them converted to gas. We spoke to our local authority and started with a 20,000 grant, which helped towards the conversions for the rst two trucks.

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

After that weve done everything, weve spent about 400,000, so 20,000 gave us a little bit of a leg up but it didnt really make a lot of di erence to our ideas for moving forward. If we hadnt received that start we probably still would have gone ahead, it just made life a little bit easier to start o with. Fuel is probably 30% of our costs, maybe even more now. I spend probably around 40,000 to 50,000 pounds per week on diesel. Obviously thats coming down because were spending probably 3000 per week on gas. Last week we spent 3700 pounds on gas and thats probably saved us 5000 pounds worth of diesel. On the gas trucks we save around sixty to seventy pounds per day per truck and were running seven trucks on gas, however the way gas prices are going now thats going to be reduced considerably. It depends on the kind of work theyre doing too, whether its mainly motorway or urban makes a big di erence. We do try and utilise the gas trucks on motorway work when theyre most e cient. The upfront cost is quite a lot higher for buying LNG but we were hoping to get a return within 18 months. Now it will be closer to two years if were lucky. Savings will depend a lot on what happens with the cost of gas in the UK. I went to the Gasrec opening in May at junction 18 M1. The transport minister was there and lots of big names in the business were trying to get an answer out of the government as to whether theyre going to stick with the gas prices as they are or whether they are going to start moving in a higher duty on gas as it becomes more and more popular. If this happens we could end up having the same sort of situation we saw with LPG in the car and light van market. As soon as it took o the government started sticking a load of tax on it and making it not quite so viable. By the time you take the cost of the conversion and the infrastructure and everything else out, theres not a lot in it to be made. Im just hoping that the government see the light with this; they see the environmental benets and keep the cost down to encourage operators like us to invest further.

Looking to the future do you see an increased use of NGV within your eet operations? And if so what plans do you have in mind?

Dave Ashford: Weve got plans to invest in another ten over the next ten to twelve months. However, were having a little bit of a rethink because the savings on the gas are coming down as the price of gas is going up. The cost of the gas changing at the moment is nothing to do with the government; its more to do with issues with the production in Avonmouth. Most of our gas used to come from Avonmouth but there is a bit of a setback with production there so were having to import it from Zeebrugge at the moment. The way the tax is levied on gas coming from Europe is di erent to that produced in the UK or shipped in from the US, so were getting taxed at a higher rate. Were looking at up to another ten pence per kilo over the next couple of weeks, which is enormous, its over ten per cent of the cost. Were going to stick with it because weve invested 400,000 as a business, which is getting on for seven to eight per cent of our annual turnover, just on gas vehicles.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Is there any advice or further comments you have to others who are considering bring natural gas fuel into their operations? What have you learnt about the process so far?

Dave Ashford: It wouldnt be for everybody, it would need to suit your business plan. You need to have a high mileage operation and you need to have your own infrastructure. The only time the gas really starts to become protable is if you can use it 100% of the time. In other words youd need to have a gas supply in your own base or very locally. When we started with gas our nearest gas lling station was about fty to sixty miles away, the next one after that was about 110 miles, or if you go west youre looking at 140 miles. So my trucks were running out of gas before I could get to ll them up. Thats ne because they run on diesel but obviously then the tanks warm up when you do nally get to put gas in them it takes ages to ll them because youve got to bring the temperature down. So for other operators I would say you need to look at this really carefully and

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

you have to look at your business model to see whether gas suits what you do. As it happens our business model is perfect for running on gas provided the gas is the right price. A normal haulage operator would struggle to get a return. Theyd probably break even or maybe make a small prot but the whole idea of them doing it would be purely for environmental reasons or for image rather than for prot. For us, were not going to make a fortune out of running on gas. We might make some small savings but this year and next year theyre going to be limited because of the investment costs and teething issues that weve had. Basically our learning curve with running on gas made a little bit of a hole in what prots were likely to make. However, its not always necessary about prot: its about raising the company prole, showing the marketplace that youre responsible and trying to reduce your carbon footprint. Hopefully other businesses will look at it from that perspective and not just about saving money.

Interview with David Graebe, Head of Gas for Transport at GAZPROM Germania.

David Graebe is Head of Gas for Transport at GAZPROM Germania. GAZPROM is one of the largest producers of natural gas in the world and is active across the industry value chain. David has responsibility for helping GAZPROM to develop its natural gas for vehicles business in Europe.

What experience do you have building refuelling stations and who are you working with now to increase the availability of fuel in Europe for NGVs?

David Graebe: The NGV business in Russia dates back to the 1980s. Today GAZPROM operates roughly 200 CNG lling stations in the country. With regards to Europe, the development of the NGV market by GAZPROM reaches back to the year 2006, when GAZPROM Germania opened its rst CNG lling station in Berlin. Thereafter we grew organically by adding more CNG stations to the German network. Currently GAZPROM Germania operates eight CNG lling stations and another six through its subsidiary VEMEX in the Czech Republic. GAZPROM cooperates with the major automotive OEMs, like Volkswagen, IVECO and Mercedes Benz, as well as with major oil companies like Total and BP (through its German brand Aral, which is the biggest petrol station provider in Germany), but also with small and medium sized private station operators. Our experience in building CNG lling stations teaches us that an integrated model creates the most convenience for customers. This means that NGV drivers can turn up to a normal station, refuel CNG together with petrol and go to the shop to use the facilities there. We have learnt that convenience means creating infrastructure that is made to t the requirements of the customer as well as the vehicles.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

What markets for NGVs are you targeting and why?

David Graebe: Apart from GAZPROMs presence in the Russian market we are currently present in Western Europe, where customers are putting a lot of emphasis on new and e cient, but also environmentally friendly vehicles. The further east you go retrotting solutions become a good option to enjoy the benets of natural gas fuelled vehicles without having to invest in a brand new car. We are therefore not limited to the current geographic scope, but look at the whole of Europe for realizing refuelling infrastructure projects. With CNG we target operators of eets of small and medium NGVs, light duty vehicles and buses. For LNG as a fuel for vehicles the target groups are buses and heavy-duty vehicles. Using natural gas as fuel can help those customers to comply with environmental regulations, realize cost savings and reduce CO2 emissions at the same time. In addition, GAZPROM is looking in to developing the

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

market for LNG for bunkering, primarily because of the legislative situation in the Baltic Sea where from 2015 onwards the Emissions Control Areas (ECAs) are coming in to force. So ship operators need to make a choice either to continue to use expensive marine gas oil (MGO) or to switch to LNG. In terms of geography we are directing our e orts based on the availability of Russian gas, which is marketed by GAZPROM and its subsidiaries or a liated companies across Europe. We see natural gas for vehicles as a new distribution channel to increase the volumes of natural gas that GAZPROM can sell. Right now the transport market is dominated by oil products, which o ers a great potential for replacement of conventional fuels by environmentally friendly natural gas.

What strategic partnerships do you think are necessary for advancing NGV projects?

David Graebe: On the one hand we work closely with OEMs in the automotive industry to ensure customers get the right solutions. For example, last year with the Polish bus manufacturer Solbus we did a road show through Poland, demonstrating the benets of LNG-fuelled city buses in real-life operations. Solbus provided the vehicles and we provided the refuelling. April this year we cooperated with Volvo and the German NGV Association to carry out a eld-test of a Volvo 460 LNG truck for a municipal waste company. This allowed them to test out the truck and learn more about the realities of LNG as fuel. However, it is also important to work with governments to educate them about natural gas as an economic, environmentally friendly, abundant and already existing alternative to conventional fuels. For example, GAZPROMs dedicated NGV company, GAZPROM Gasomotornoe Toplivo recently assisted the Russian government with creating a legislative framework to increase the use of natural gas vehicles in Russia. In Europe we also address this topic through the national and international NGV associations, such as erdgas mobil or NGVA Europe to create greater awareness at national and European level.

What has been the most signicant challenge you have faced so far in developing a network of refuelling stations?

David Graebe: One of the things we are trying to avoid is the so-called chicken and egg issue in order to provide customers as well as the automotive industry with a transport solution consisting of the right vehicle and the right fuel. When it eventually comes to realizing projects in real life, we know that every location has its specic challenges that need to be managed. Fortunately we have the ability to do so.

2nd Annual

How have you overcome these barriers so far what have you learnt about advancing in the industry?

David Graebe: By now building CNG stations has become quite standard for GAZPROM Germania because we know which legislative and operational processes we need to follow. Even in a mature CNG lling station market like Germany however, in some places where there is a high tra c load it may still not economically viable to build a CNG lling station because the pipeline is too far away from the site. Here we see LCNG as possible solution. We can supply the station with LNG and the station can provide CNG to vehicles. With respect to LNG, one of the major challenges is certainly to establish a Europe-wide supply chain for LNG lling station projects. The supply is currently limited to import terminals in places like Barcelona, Zeebrugge or Rotterdam and liquefaction facilities in Russia. If you want to supply LNG to the heart of Europe, for example to Hungary, you have to send a truck from the coast to the mainland. That quickly gets uneconomic, so we have to create hubs and liquefaction capacities located in the proximity of customer demand. This is a developing area where permitting and regulations for the industry have yet to be developed.

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

I think another key issue is keeping customers interested, regardless of the availability of funding and other incentives. Press coverage is useful, but we need to communicate more. GAZPROM and other gas companies have been getting on the road with Blue Corridor Rallies to show that driving NGVs through Europe today is actually possible, but to also show what yet remains to be done. Last year we travelled more than 6,700 km from Moscow through Warsaw, Prague, Paris and other major European cities to Brussels with a eet of up to fteen NGVs, including an LNG truck and bus, our mobile LNG lling station and various CNG vehicles. We conducted roundtable discussions at every large city, communicating and demonstrating the benets of NGVs. In Brussels we staged a large event to raise awareness among politicians of the European Commission and the European Parliament, inviting them to come and see the vehicles and recognise that NGVs are a reality.

Looking forward, what is your outlook for the industry and how do you see GAZPROMs role developing over the next few years?

David Graebe: NGV is one of the key priorities for the GAZPROM group of companies. We will continue to expand in to the NGV marketplace and consider investments wherever it is economically viable. Eventually we aim to be one of the key players in the European and Russian NGV market.

Interview with Robert Staimer, E at MAN

ciency Adviser

Robert Staimer is an E ciency Adviser at MAN, one of Europes leading manufacturers of trucks and buses. MAN has a 255-year history and is the third leading OEM in its eld in Europe, boasting a turnover of 8.8bn in 2012. Globally there are roughly 7,500 CNG engines and vehicles manufactured by MAN on the road. Recently, MAN restructured its sales division to focus on e ciency issues. Robert advises the salesforce as well as customers on vehicle pricing, technologies, costs and environmental benets.

As an OEM what where the main benets and considerations that drew you to incorporating natural gas fuel in your vehicles?

Robert Staimer: Operating CNG vehicles is in most cases a win-win situation. The operators benet commercially and there are environmental benets as well. The main reason for incorporating natural gas fuel in to our vehicles is awareness that di erent customers have di erent demands. We want to be in a position where we can actually o er tailored solutions in terms of drive technologies for our customers. Some are sticking with diesel but more and more customers are asking for CNG or hybrids because its a really attractive alternative.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Were also aware that there will be a shortage of oil reserves in the decades ahead. Gas reserves will take us far further than oil will ever take us and if you add biomethane you nd yourself on a completely renewable path, which is extremely attractive in terms of sustainability.

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

What experience do you have in delivering natural gas vehicles and who are you working with now on any NGV projects you have running?

Robert Staimer: We have experience with CNG vehicles dating back over decades. We built the rst gas vehicle in 1943 and today we are a market leader in the CNG bus sector in Europe. We have and still are expanding and extending our product portfolio. Particularly with the low-entry level range of CNG vehicles, and well continue to develop more.

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

What strategic partnerships do you think are necessary for advancing NGV projects?

Robert Staimer: In the UK weve teamed up with a consortium called the GBA (Gas Bus Alliance). The reason for this is that while we can answer questions about vehicle operations, in order to convince operators to switch over to CNG you need to answer a wide range of questions, so its necessary to team up with the specialists in each eld. For example, some gas companies can o er an operator a short or long term supply contract for GNG supply. They can be extremely exible and o er a xed term contract, freezing the price for the next three to ve years, which is a huge benet for operators. Alternative they can o er a guarantee to stay under the price of diesel by a certain percentage, depending on the amount of gas the operator uses annually. This gives the operator a clear indication of what the price will be and puts the business on a stable foundation.

Have there been any major challenges / hurdles you have faced in the process of developing and selling natural gas vehicles?

Robert Staimer: Were seeing a similar issue that occurred in the passenger car industry where there was a chicken and egg problem. Customers wouldnt buy CNG without knowing where they could refuel their vehicles, while on the other hand lling station operators wouldnt invest money in CNG stations until they knew how many customers would be using it. To some extent we have to overcome the same problem, though our business is di erent because city buses go back to a depot at night where they can be refuelled. Its still something that needs to be addressed though. The other main challenge is political uncertainty surrounding taxation and funding, which can hinder business.

How have you overcome these barriers so far what have you learnt about advancing in the industry?

Robert Staimer: In order to address the need for refuelling infrastructure, we think the best approach is to team up with the lling station operators and gas suppliers. This is exactly what weve done in the UK, are currently doing in Germany and are planning to do in other countries as well. We are convinced that you can help a customer switch from a standard technology, for example diesel, to another technology by o ering a business solution. Some of the keystones of this business solution can only be provided if you partner up.

2nd Annual

Looking forward, what is your outlook for the industry and how do you see MANs role developing over the next few years?

Robert Staimer: Were deeply convinced that we will have more CNG business in the future. If you look at all the technologies available today, CNG holds a huge advantage. Unlike other technologies, for example electromobility, we know that CNG is reliable, its time tested, its a ordable and it holds a huge environmental benet. If you also consider that you can operate your vehicle with biomethane, like many customers in the UK and Scandinavia, it makes the business unbeatable. That said, we recognise the discussion in the electromobility eld and we also recognise that electromobility for heavy goods vehicles (HGVs) is on the way. For the time being though batteries cannot full demands in terms of cost, reliability and longevity. Were watching the industry closely and were carrying out our own research. The core slogan of our company is, consistently e cient and were sticking to that. If you introduce a new technology that is nice to have, it doesnt help if the average customer cant pay for it. With CNG technology though, we believe it is absolutely ticking all the boxes.

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

Interview with Pedro Avila, Technical Director at EDP Gs - Distribuio

Pedro Avila is Technical Director at EDP Gs Distribuio, which distributes gas across a 4,000km network in the north east of Portugal. Beginning operations in 1997, EDP Gs now has approximately 300,000 clients and is growing fast, adding approximately 20,000 clients per year. Recently EDP Gs went through a process of unbundling its distribution arm from its commercial supply activities, in line with EU energy market reform rules. For that reason, the role of the Distribution System Operator (DSO) is limited to the promotion of natural gas in transportation but not its implementation, leaving this role to other market agents, in particular energy suppliers. On the other hand, it is important for DSOs to increase the amount of gas distributed across their infrastructure. The use of natural gas in the transport sector has good potential to meet this purpose.

What are the steps EDP Gs has taken to become more active in the Natural Gas Vehicle market in Europe?

Pedro Avila: Weve been working with the three essential components of the process (software importers of vehicles, hardware constructors and installers of lling stations and o cial entities), in order to promote and give full information about the emergence of natural gas for vehicles. The development of infrastructure for NGVs is just beginning however.

What experience do you have in NGV projects and who are you working with now to increase the availability of fuel in Europe for NGVs?

Pedro Avila: Twelve years ago, before the unbundling of the Distribution System Operators (DSOs), we constructed the rst gas fuel station in Portugal, located in Braga. The lling station was a project between the urban transportation authority in Braga (who used the station to fuel buses) and EDP Gs. Since the rst lling stations were constructed, the market has stalled and we havent seen a lot of development. Now, the situation in Europe is changing though, with new Euro 6 pollution regulations, the higher environmental care for citizens, and automotive manufacturers o ering a wider range of gas vehicles. Looking at this new environment we think that natural gas can play a greater role in mobility solutions.

What markets for NGVs are you targeting and why?

Pedro Avila: Two signicant target markets are urban buses, the waste management industry and eets like logistics operators. Because we have a distribution network, CNG is a readily available fuel and we want to increase the utilisation of this network.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

What strategic partnerships do you think are necessary for advancing NGV projects?

Pedro Avila: There are three key stakeholder groups to partner with in order to be successful. First of all are the manufacturers who need more information, especially regarding pricing, technology and maintenance (after sales). The other key stakeholder group is lling station operators. We work with major lling station operators in other countries and in Portugal we are partnering with companies that can work on the development of new lling stations. Finally, its important to partner with enterprises that can benet from using NGVs, to educate them about gas as a cost-e ective green solution. Natural gas in the transport sector represents an unbeatable fuel in terms of cost and environment. It is green, reduces costs and can also be used by companies to boost their

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

reputation. Often green projects are expensive and businesses will only invest small amounts. With NGVs they can be good to the environment while making cost savings as well.

What has been the most signicant challenge you have faced so far in developing the market?

Pedro Avila: Because of the unbundling of DSOs, EDP Gs Distribuio cannot build and operate commercial lling stations, though we have gas stations for our own eet. One of the major challenges is to attract more big private operators to develop lling stations. At present lling stations are funded by public enterprises or o cial bodies rather than private companies, which limits development. Consumers perceive the private business sector as implementing solutions because they are protable while government solutions are seen as being adopted because of subsidies and incentives.

How have you overcome these barriers so far what have you learnt about advancing in the industry?

Pedro Avila: We are promoting the solution in forums, meetings and conferences. Another issue that needs to be addressed is the short-term investment outlook of many companies since the economic crisis. NGV projects can create cost savings, however the payback period is four, ve or even six years. Today some enterprises dont have this medium to long term perspective on investment.

Looking forward, what is your outlook for the industry and how do you see EDP Gss role developing over the next few years?

Pedro Avila: The industry is facing major challenges, especially because now there are an increasing number of energetic alternatives for mobility and, on the other hand, the thermal engines e ciency; diesel and gasoline, is improving. Given the wide range of options available, including electric vehicles and hydrogen vehicles, I think CNG faces signicant challenges. Ten years ago there were one or two solutions for fuel, now there are many new options and its a very competitive space. The increased e ciency of thermal engines has a positive aspect (it potentiates these engines compared to others), but on the other hand, due to reduction in consumption, the competitiveness of natural gas decreases, because the saving will be less in absolute terms, although in relative terms the di erence to diesel/gasoline remains. As a result its di cult to convince consumers to invest the CAPEX required for NGVs. In addition, manufacturers know the savings that customers can make on fuel for NGVs, so they capture some of these savings by increasing the purchase price. Its di erent for medium and heavy load vehicles because there are large potential savings to be made by consumers. I think these savings will remain in the future. Though the e ciency of [diesel] engines for large and heavy vehicles is improving, medium and heavy load vehicles consume a lot of fuel so there is a strong rationale to adopt gas. If you found the information in this interview piece useful then remember that all of our interviewees are speaking at the Natural Gas Vehicle Conference and Exhibition, 25-26 November, in Amsterdam.

2nd Annual

Natural Gas Vehicle Conference and Exhibition

November 25-26, Mvenpick Hotel, Amsterdam, The Netherlands

Develop a Protable and Sustainable Market for Heavy Duty Natural Gas Vehicles in Europe

www.ngvevent.com/eu

European Natural Gas Vehicle Market

Fleet Operators Thoughts

Brand New Features to 2013:

Guaranteed Strong Fleet Presence All New Fleet Track: Learn How to Successfully Integrate NGVs into Your Fleet All New Technical Tour around an LNG Refuelling Station Opportunity to Test Drive LNG trucks Network with Europes leading Natural Gas Utilities, Natural Gas Producers, Fleet Operators, OEMs and Infrastructure Equipment Suppliers

You might also like

- Manual 5035Document68 pagesManual 5035matrabaeNo ratings yet

- Designing Coal Processes BrochureDocument4 pagesDesigning Coal Processes BrochureJorge GaitanNo ratings yet

- Kinetic Engine Drives Catalyst DevelopmentDocument7 pagesKinetic Engine Drives Catalyst DevelopmentrizkiekanandaNo ratings yet

- Mini TabDocument19 pagesMini Tabsqaiba_gNo ratings yet

- Symposium Catalyst PosterDocument1 pageSymposium Catalyst PosterrizkiekanandaNo ratings yet

- Watch TimeDocument158 pagesWatch Timerizkiekananda100% (4)

- Gas Chromatography: Separate Mixtures with High ResolutionDocument18 pagesGas Chromatography: Separate Mixtures with High ResolutionrizkiekanandaNo ratings yet

- Catalyst Manufacturing Science and Engineering Consortium (CMSEC)Document11 pagesCatalyst Manufacturing Science and Engineering Consortium (CMSEC)rizkiekanandaNo ratings yet

- Care & Feeding For Martin Instruments: International EditionDocument20 pagesCare & Feeding For Martin Instruments: International Editionrizkiekananda100% (1)

- Carbon CaptureDocument2 pagesCarbon CapturerizkiekanandaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Case Study 2 F3005Document12 pagesCase Study 2 F3005Iqmal DaniealNo ratings yet

- Yamaha Nmax 155 - To Turn The Vehicle Power OffDocument1 pageYamaha Nmax 155 - To Turn The Vehicle Power Offmotley crewzNo ratings yet

- KDL 23S2000Document82 pagesKDL 23S2000Carlos SeguraNo ratings yet

- Ieee Research Papers On Software Testing PDFDocument5 pagesIeee Research Papers On Software Testing PDFfvgjcq6a100% (1)

- MSDS Summary: Discover HerbicideDocument6 pagesMSDS Summary: Discover HerbicideMishra KewalNo ratings yet

- PRE EmtionDocument10 pagesPRE EmtionYahya JanNo ratings yet

- CFEExam Prep CourseDocument28 pagesCFEExam Prep CourseM50% (4)

- Advance Bio-Photon Analyzer ABPA A2 Home PageDocument5 pagesAdvance Bio-Photon Analyzer ABPA A2 Home PageStellaEstel100% (1)

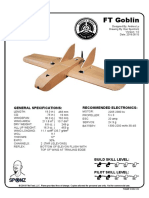

- FT Goblin Full SizeDocument7 pagesFT Goblin Full SizeDeakon Frost100% (1)

- AnkitDocument24 pagesAnkitAnkit MalhotraNo ratings yet

- Account STMT XX0226 19122023Document13 pagesAccount STMT XX0226 19122023rdineshyNo ratings yet

- Flare Finance Ecosystem MapDocument1 pageFlare Finance Ecosystem MapEssence of ChaNo ratings yet

- Ju Complete Face Recovery GAN Unsupervised Joint Face Rotation and De-Occlusion WACV 2022 PaperDocument11 pagesJu Complete Face Recovery GAN Unsupervised Joint Face Rotation and De-Occlusion WACV 2022 PaperBiponjot KaurNo ratings yet

- DHPL Equipment Updated List Jan-22Document16 pagesDHPL Equipment Updated List Jan-22jairamvhpNo ratings yet

- Asian Construction Dispute Denied ReviewDocument2 pagesAsian Construction Dispute Denied ReviewJay jogs100% (2)

- RTL8316C GR RealtekDocument93 pagesRTL8316C GR RealtekMaugrys CastilloNo ratings yet

- Weibull Statistic and Growth Analysis in Failure PredictionsDocument9 pagesWeibull Statistic and Growth Analysis in Failure PredictionsgmitsutaNo ratings yet

- 9IMJan 4477 1Document9 pages9IMJan 4477 1Upasana PadhiNo ratings yet

- Open Compute Project AMD Motherboard Roadrunner 2.1 PDFDocument36 pagesOpen Compute Project AMD Motherboard Roadrunner 2.1 PDFakok22No ratings yet

- EU Letter To Liz Truss 2016Document2 pagesEU Letter To Liz Truss 2016MadeleineNo ratings yet

- Milton Hershey's Sweet StoryDocument10 pagesMilton Hershey's Sweet Storysharlene sandovalNo ratings yet

- EWAIRDocument1 pageEWAIRKissy AndarzaNo ratings yet

- CORE Education Bags Rs. 120 Cr. Order From Gujarat Govt.Document2 pagesCORE Education Bags Rs. 120 Cr. Order From Gujarat Govt.Sanjeev MansotraNo ratings yet

- Internship Report Recruitment & Performance Appraisal of Rancon Motorbikes LTD, Suzuki Bangladesh BUS 400Document59 pagesInternship Report Recruitment & Performance Appraisal of Rancon Motorbikes LTD, Suzuki Bangladesh BUS 400Mohammad Shafaet JamilNo ratings yet

- Teleprotection Terminal InterfaceDocument6 pagesTeleprotection Terminal InterfaceHemanth Kumar MahadevaNo ratings yet

- Introduction To Elective DesignDocument30 pagesIntroduction To Elective Designabdullah 3mar abou reashaNo ratings yet

- Ralf Behrens: About The ArtistDocument3 pagesRalf Behrens: About The ArtistStavros DemosthenousNo ratings yet

- Chapter 1: The Investment Environment: Problem SetsDocument5 pagesChapter 1: The Investment Environment: Problem SetsGrant LiNo ratings yet

- Gary Mole and Glacial Energy FraudDocument18 pagesGary Mole and Glacial Energy Fraudskyy22990% (1)

- 21st Century LiteraciesDocument27 pages21st Century LiteraciesYuki SeishiroNo ratings yet