Professional Documents

Culture Documents

Richmond AMERICAS Alliance MarketBeat Retail Q32013

Uploaded by

Anonymous Feglbx5Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Richmond AMERICAS Alliance MarketBeat Retail Q32013

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

MARKETBEAT

RETAIL SNAPSHOT

RICHMOND, VA

A Cushman & Wakefield Research Publication

Q3 2013

ECONOMIC OVERVIEW

Americans boosted their spending at retail businesses modestly in August, yet holiday sales are expected to climb less than in previous years. The real estate market continues its sustained growth, with residential sales in the Richmond area rising 9.0% in the third quarter compared with the same period in 2012. Residential sales tend to have a multiplier effect: When people buy a home, they typically buy furniture, appliances and garden supplies, which have a significant impact on total retail sales volume.

Golfsmith announced it would build a 24,000-sf store at West Broad Village, Tazza Kitchen opened in the former Caf Caturra space at 3332 Pump Road, and Two Guys Pizza opened next to Short Pump Regal Theatre. Zoup! Fresh Soup Company expects to open its first Virginia location in Glen Allen in the fourth quarter. There were closings as well. Blue Ridge Mountain Sports closed its stores in Towne Center West and Chesterfield Towne Center, Louis Vuitton closed at Stony Point Fashion Park, and Skilligalee restaurant closed after 43 years. The Skilligalee property, 1.3 acres at 5416 Glenside Drive just north of Broad Street, was sold for $890,000 to Nobility Investments, which owns the Hampton Inn and Suites just behind the restaurant. Martins announced it will close the grocery store in Gayton Crossing by the end of October. ECONOMIC INDICATORS

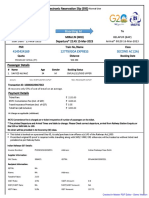

NATIONAL GDP Growth CPI Growth Consumer Spending Growth Retail Sales Growth REGIONAL Household Income Population Growth Unemployment

Source: Moodys Analytics

RETAIL MARKET OVERVIEW

It was another quarter highlighted by shopping center sales. Town Center at Twin Hickory in Glen Allen, anchored by a Food Lion, was acquired by New York-based Katz Properties for $16.0 million. Katz bought the 8.6-acre center from South Carolina-based Edens & Avant, which is developing the Martins-anchored Charter Colony retail center in Chesterfield County. The 42,000-square-foot (sf) Shops at Wellesley near Short Pump was purchased by Californiabased Capstone Advisors for $7.4 million. A Baltimore-based firm, Pratt Street Capital, paid $7.8 million for the 78,495-sf Glen Lea Shopping Centre on Mechanicsville Turnpike. Holladay Properties sold another piece of its holdings, the 10,000-sf Shoppes at Winding Brook I building, to Maryland-based WBPPM LLC for $2.85 million. The Bass Pro Shops-anchored development is off Exit 89 in Hanover County, across the road from a planned 392,000-sf outlet mall. In other sales, Delaware-based Exocorp Management & Consulting Inc. bought properties at 8131 and 8137 Brook Road from Lions Paw Development Co. for $1.975 million. Starbucks leases a 1,850-sf building, and GameStop is part of a 3,750-sf two-tenant building. Chadwicks Antiques and Heirlooms at 5806 Grove Ave. sold for $3.2 million. The new owners plan to add a floor and offer luxury condos on the upper floors in this popular shopping district. Australian investment firm QIC officially staked its claim to Short Pump Town Center. The firm acquired a 33 percent interest in the 1.3-million-square-foot (msf) center from Forest City Enterprises as part of a $2.05 billion transaction that included seven other shopping centers. The 10-year-old center is undergoing renovations and adding new tenants, including Athleta and Gordon Biersch Brewery.

2012 2.8% 2.1% 2.2% 5.3% 2012 $54,407 1.0% 6.4%

2013F 1.6% 1.4% 1.9% 4.5% 2013F $54,544 0.9% 6.0%

2014F 3.1% 1.8% 3.3% 5.8% 2014F $55,802 0.9% 5.7%

OVERALL RENTAL VS. VACANCY RATES

$14.25 $14.00 psf/yr $13.75 $13.50 $13.25 $13.00 2009 2010 2011 2012 YTD 2013 7.0% 6.8% 6.6% 6.4% 6.2% 6.0%

OVERALL NET RENTAL RATE

OVERALL VACANCY RATE

Thalhimer 11100 W. Broad St. Glen Allen, VA 23060 www.cushmanwakefield.com/knowledge

For more information, contact: Brad McGetrick, Director, Brokerage Services 804 697 3558 brad.mcgetrick@thalhimer.com

The market terms and definitions in this report are based on NAIOP standards. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed by our principals. 2013 Cushman & Wakefield, Inc. All rights reserved.

Coming soon to Willow Lawn are American Tap Room, Travinia Italian Kitchen & Wine Bar and Zos Kitchen. Nearby, Gumenick has broken ground on Libbie Mill, which will be anchored by Southern Season gourmet emporium. Both north and south are seeing new tenants and new construction. Roses opened a store in the former Showplace on Mechanicsville Turnpike and has announced a second location at Chestertowne Square in south Richmond. While Bermuda Square in Chester is being renovated and the Martins grocery expanded, Kroger plans to build a store in Colonial Heights and expand locations in Midlothian and the Village at Swift Creek. Downtown is not to be left out. Southern Railway Taphouse moved into the former Southern Railway Express in Shockoe Slip, Sweet Teas Southern Cuisine opened at 1800 E. Main St., F.W. Sullivans Canal Bar & Grille took over the former BlackFinn American Saloon in the Riverside on the James development, and Greenleafs Pool Room took space on the ground floor of the Residences at the John Marshall.

En Su Boca opened in a former adult bookstore on the Boulevard, in time to offer tacos and burritos to visitors at the new Redskins Training Camp nearby. Discussions continue on whether a new ballpark for the Flying Squirrels will be built on North Boulevard or in Shockoe Bottom. Leasing activity through the third quarter totaled 1,570,530 sf, up sharply from 2012s pace of 1,087,073 sf. Vacancy was 6.6%, down a bit from third-quarter 2012s 6.9%. Absorption was 331,106 sf yearto-date vs. 70,000 sf in the same period of 2012.

OUTLOOK

The key phrase is: Steady as it goes. Brokers are enjoying a lot of activity and dont expect it to soften. They report talking to a number of large retailers about entering the market and several new development plans are on the horizon.

MARKET HIGHLIGHTS

SIGNIFICANT Q3 2013 LEASE TRANSACTIONS West Broad Village The John Marshall Building SIGNIFICANT Q3 2013 SALE TRANSACTIONS Glen Lea Shopping Centre Town Center at Twin Hickory The Shops at Wellesley The Shoppes I (Winding Brook) 8131 & 8137 Brook Road SIGNIFICANT Q3 2013 CONSTRUCTION COMPLETIONS N/A SIGNIFICANT PROJECTS UNDER CONSTRUCTION Staples Mill Marketplace Libbie Mill Charter Colony SUBMARKET Short Pump Downtown SUBMARKET Laburnum/Rte 360 Far West End North Far West End I-95 Ashland/NW Staples Mill/Parham SUBMARKET TENANT Golfsmith USA Greenleafs Pool Room BUYER Pratt Street Capital Katz Properties Capstone Advisors WBPPM LLC PROPERTY TYPE Regional Mall Mixed-Use PURCHASE PRICE / $PSF $7,878,000 / $100 $16,000,000 / $242 $7,439,400 / $177 $2,850,000 / $285 SQUARE FEET 24,000 5,900 SQUARE FEET 78,493 66,000 42,000 10,000 5,600 BUILDING SQUARE FEET

Exocorp Management & Consulting, $1,975,000 / $353 Inc. MAJOR TENANT COMPLETION DATE

SUBMARKET Staples Mill / Parham Willow Lawn Midlothian Village

MAJOR TENANT Kroger Southern Season Martins

COMPLETION DATE Q1 2014 Q2 2014 Q2 2014

BUILDING SQUARE FEET 175,000 150,000 110,000

Thalhimer 11100 W. Broad St. Glen Allen, VA 23060 www.cushmanwakefield.com/knowledge

For more information, contact: Brad McGetrick, Director, Brokerage Services 804 697 3558 brad.mcgetrick@thalhimer.com

The market terms and definitions in this report are based on NAIOP standards. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed by our principals. 2013 Cushman & Wakefield, Inc. All rights reserved.

RICHMOND, VA SUBMARKET STATISTICS

SUBMARKET Amelia County Broad St Corridor Colonial Heights Cumberland County Dinwiddie County Downtown East End Far West End North Far West End South Goochland Hopewell I-95 Ashland/NW I-95 Chamberlayne/NE Jeff Davis Corridor King & Queen County King William County Laburnum/Rte 360 Louisa County Mechanicsville Midlothian E/Hull St Midlothian Village Midlothian West Near West End New Kent County Petersburg Powhatan Prince George Regency Short Pump South Chesterfield Staples Mill/Parham Sussex County Swift Creek Willow Lawn TOTAL MARKET INVENTORY 204,838 2,035,424 3,511,221 38,860 204,473 4,074,820 4,314,373 257,437 1,185,206 339,915 1,243,849 1,790,722 893,760 3,219,231 3,600 381,939 2,858,243 663,586 2,729,772 6,988,620 1,613,465 7,018,866 3,847,998 393,772 2,556,885 711,546 853,679 2,527,712 4,450,750 3,435,477 7,589,087 172,328 3,420,593 2,919,334 78,451,381 QUARTERLY CHANGE IN INVENTORY 2,448 50,341 (18,630) 0 13,184 (68,748) 12,350 (7,200) (7,384) 320 17,723 1,439 29,394 87,627 0 2,746 98,997 77,969 6,115 (31,260) 41,963 6,282 39,609 3,314 (4,503) 0 412 (44) 37,305 (7,790) (1,417) 769 (144,080) (7,035) 232,216 VACANCY RATE 9.1% 5.2% 4.8% 6.4% 0.7% 7.2% 7.3% 0.6% 12.7% 8.8% 12.9% 6.0% 6.8% 10.9% 0.0% 9.6% 4.9% 3.5% 5.7% 11.0% 11.5% 5.4% 3.2% 7.0% 10.1% 6.0% 1.9% 7.1% 3.7% 3.9% 5.3% 17.7% 4.9% 5.3% 6.6% DEMAND (OCCUPIED SQUARE FEET) 186,104 1,929,350 3,341,379 36,360 202,973 3,780,692 3,997,520 255,962 1,034,191 310,101 1,083,205 1,682,664 832,568 2,869,322 3,600 345,459 2,719,552 640,233 2,574,728 6,221,382 1,428,098 6,640,570 3,725,386 366,092 2,299,005 668,555 837,202 2,348,596 4,285,013 3,302,506 7,187,551 141,740 3,253,545 2,763,589 73,294,793 ASKING RENT $16.00 $16.43 $13.78 N/A N/A $13.96 $13.04 N/A $17.35 $12.17 $9.76 $12.02 $17.53 $9.94 N/A $8.96 $9.31 $11.83 $13.92 $11.36 $19.76 $14.88 $15.31 $11.02 $9.06 $12.60 $9.52 $10.76 $23.25 $12.77 $15.93 $5.00 $17.76 $10.11 $13.51 RENT GROWTH 0.0% 1.6% (2.9%) N/A N/A 1.9% 5.5 % N/A 9.9% 5.3% 0.0% 0.5% 7.2% 9.4% N/A (3.1%) (3.7%) 0.0% 6.0% 0.9% (7.6%) (3.9%) (0.4%) (8.5%) 2.9% 0.0% 6.3% (6.5%) 3.4% (0.5%) 1.1% 0.0% (0.1%) 8.3% 1.5% YTD ABSORPTION 12,007 3,927 (2,138) 1,100 21,818 1,562 44,700 (1,475) (41,698) (9,828) 11,971 (6,800) (1,467) 57,280 0 26,080 (12,093) 1,767 (36,263) 102,934 29,401 41,419 51,659 16,056 (13,497) 10,122 9,544 (1,186) 3,073 (9,019) 13,652 12,500 2,050 (8,052) 331,106

* RENTAL RATES REFLECT ASKING $PSF/YEAR

Thalhimer 11100 W. Broad St. Glen Allen, VA 23060 www.cushmanwakefield.com/knowledge

For more information, contact: Brad McGetrick, Director, Brokerage Services 804 697 3558 brad.mcgetrick@thalhimer.com

The market terms and definitions in this report are based on NAIOP standards. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed by our principals. 2013 Cushman & Wakefield, Inc. All rights reserved.

You might also like

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- Progress Ventures Newsletter 3Q2018Document18 pagesProgress Ventures Newsletter 3Q2018Anonymous Feglbx5No ratings yet

- CIO Bulletin - DiliVer LLC (Final)Document2 pagesCIO Bulletin - DiliVer LLC (Final)Anonymous Feglbx5No ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- 4Q18 Washington, D.C. Local Apartment ReportDocument4 pages4Q18 Washington, D.C. Local Apartment ReportAnonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- 4Q18 Houston Local Apartment ReportDocument4 pages4Q18 Houston Local Apartment ReportAnonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- 4Q18 North Carolina Local Apartment ReportDocument8 pages4Q18 North Carolina Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Philadelphia Local Apartment ReportDocument4 pages4Q18 Philadelphia Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 South Florida Local Apartment ReportDocument8 pages4Q18 South Florida Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Atlanta Local Apartment ReportDocument4 pages4Q18 Atlanta Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 New York City Local Apartment ReportDocument8 pages4Q18 New York City Local Apartment ReportAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- 4Q18 Boston Local Apartment ReportDocument4 pages4Q18 Boston Local Apartment ReportAnonymous Feglbx5No ratings yet

- 3Q18 Philadelphia Office MarketDocument7 pages3Q18 Philadelphia Office MarketAnonymous Feglbx5No ratings yet

- 4Q18 Dallas Fort Worth Local Apartment ReportDocument4 pages4Q18 Dallas Fort Worth Local Apartment ReportAnonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Industrial Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Industrial Q32018Anonymous Feglbx5No ratings yet

- 2018 U.S. Retail Holiday Trends Guide - Final PDFDocument9 pages2018 U.S. Retail Holiday Trends Guide - Final PDFAnonymous Feglbx5No ratings yet

- Wilmington Office MarketDocument5 pagesWilmington Office MarketWilliam HarrisNo ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Office Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Retail Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Office Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Retail Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Retail Q32018 FINALAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- (NAME) (NAME) : Day A.M P.M Undertime Day A.M P.M UndertimeDocument2 pages(NAME) (NAME) : Day A.M P.M Undertime Day A.M P.M UndertimeAngelica Joy Toronon SeradaNo ratings yet

- Smartplant Reference Data: Setup and User'S GuideDocument35 pagesSmartplant Reference Data: Setup and User'S Guidepareen9No ratings yet

- Moovo Press ReleaseDocument1 pageMoovo Press ReleaseAditya PrakashNo ratings yet

- SaraikistanDocument31 pagesSaraikistanKhadija MirNo ratings yet

- Architect / Contract Administrator's Instruction: Estimated Revised Contract PriceDocument6 pagesArchitect / Contract Administrator's Instruction: Estimated Revised Contract PriceAfiya PatersonNo ratings yet

- Solved Acme Realty A Real Estate Development Company Is A Limited PDFDocument1 pageSolved Acme Realty A Real Estate Development Company Is A Limited PDFAnbu jaromiaNo ratings yet

- ManeDocument2 pagesManeMukesh Manwani100% (2)

- 0607 WillisDocument360 pages0607 WillisMelissa Faria Santos100% (1)

- Full Download Introduction To Brain and Behavior 5th Edition Kolb Test Bank PDF Full ChapterDocument36 pagesFull Download Introduction To Brain and Behavior 5th Edition Kolb Test Bank PDF Full Chapternaturismcarexyn5yo100% (16)

- Blue Ocean StrategyDocument247 pagesBlue Ocean StrategyFadiNo ratings yet

- Experience Rafting and Camping at Rishikesh-1 Night-2 Days PDFDocument4 pagesExperience Rafting and Camping at Rishikesh-1 Night-2 Days PDFAMAN KUMARNo ratings yet

- K. A. Abbas v. Union of India - A Case StudyDocument4 pagesK. A. Abbas v. Union of India - A Case StudyAditya pal100% (2)

- BCI4001 Cyber Forensics and Investigation: LTPJC 3 0 0 4 4Document4 pagesBCI4001 Cyber Forensics and Investigation: LTPJC 3 0 0 4 4raj anaNo ratings yet

- EDUC 303 Essay ActivityDocument3 pagesEDUC 303 Essay ActivityImee MandasocNo ratings yet

- Lancesoft Offer LetterDocument5 pagesLancesoft Offer LetterYogendraNo ratings yet

- Wind River Energy Employment Terms and ConditionsDocument2 pagesWind River Energy Employment Terms and ConditionsyogeshNo ratings yet

- SSC CGL Updates - Validity of OBC CertificateDocument1 pageSSC CGL Updates - Validity of OBC CertificateKshitijaNo ratings yet

- CA CHP555 Manual 2 2003 ch1-13Document236 pagesCA CHP555 Manual 2 2003 ch1-13Lucas OjedaNo ratings yet

- Promises During The Elections and InaugurationDocument3 pagesPromises During The Elections and InaugurationJessa QuitolaNo ratings yet

- Pranali Rane Appointment Letter - PranaliDocument7 pagesPranali Rane Appointment Letter - PranaliinboxvijuNo ratings yet

- ASME B31.5-1994 Addend Refrigeration PipingDocument166 pagesASME B31.5-1994 Addend Refrigeration PipingFRANCISCO TORRES100% (1)

- 21st Century Teachers' Tales PHONICS For BEGINNERS, Short Vowels Sound - Volume 1Document48 pages21st Century Teachers' Tales PHONICS For BEGINNERS, Short Vowels Sound - Volume 1Rose de Dios43% (7)

- Η Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνDocument25 pagesΗ Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνKonstantinos MantasNo ratings yet

- Amalgamation of SocietiesDocument4 pagesAmalgamation of SocietiesKen ChepkwonyNo ratings yet

- The Daily Tar Heel For Nov. 5, 2014Document8 pagesThe Daily Tar Heel For Nov. 5, 2014The Daily Tar HeelNo ratings yet

- Bdo Cash It Easy RefDocument2 pagesBdo Cash It Easy RefJC LampanoNo ratings yet

- Making Money On Autopilot V3 PDFDocument6 pagesMaking Money On Autopilot V3 PDFGatis IvanansNo ratings yet

- FM09-CH 27Document6 pagesFM09-CH 27Kritika SwaminathanNo ratings yet

- 12779/GOA EXPRESS Second Ac (2A)Document2 pages12779/GOA EXPRESS Second Ac (2A)Altamash ShaikhNo ratings yet

- Lesson 4the Retraction Controversy of RizalDocument4 pagesLesson 4the Retraction Controversy of RizalJayrico ArguellesNo ratings yet