Professional Documents

Culture Documents

(Economy) Calculating Income Tax, Tax Exemption Vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal PDF

Uploaded by

Ravikanth ReddyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Economy) Calculating Income Tax, Tax Exemption Vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal PDF

Uploaded by

Ravikanth ReddyCopyright:

Available Formats

7/8/13

HOME ECONOMY

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

NOTES IAS/IPS/UPSC FORUM CONTACT SUBSCRIBE

Flipkart.com Buy Books Online,

Pay on Delivery! Search

Search b4 asking!

Search

Book 4 Economy?

UPSC IAS IPS Strategy

Intro2IAS Books Prelim-MainsInterview Mains2013 Doubts Backup SSC CGL GK / GA Maths Reasoning English SBI PO GA/Computer/Marketing Reasoning (High) English (Descriptive)

2 Aug Delhi Subordinate Service: Warder, [Economy] Calculating Income Matron (500+) 31 July Tax, Tax FCI mgmt Trainee (~460) Exemption vs Tax 31 July Deduction, Rajiv Rajasthan state service (~725) 27 July Gandhi Equity Saving Scheme Kashi Gramin Bank(470+) 15 July UP Review Officer (~450) 15 July Tamilnadu class4 (5500+) 13 July Medical Officer,ITBP(600+) 8 July Accountants,Bihar (70) 7 July LIC Sales Executives(10,000+) 7 July Airforce Officers (AFCAT) 7 July

What are the Income tax slabs in Budget 2012? How to Calculate income tax? 3% educational cess What is the difference between Tax exemption and tax deduction? #1: Tax exemption #2: tax deduction Union budget 2012: provisions of Tax Deduction and Tax Exemption What is Tax Planning? Who is TaxConsultant ? Black Money and AgroIncome Recent Comments

Dc { Thanks a lot Sir. U r great :) } [Strategy]

Indian Diaspora for General Studies Mains Paper 2 Free Study material, Previous Questions for UPSC Civil Service IAS IPS exam

HOME

ECONOMY

Last Date to Apply

Subscribe (FREE!)

Enter your email address: Subscribe

me { thank u :) small request I am a newbie i mean to

mains i am preparing stuff thing is i am clueless how am i... } [Strategy] Indian Diaspora for General Studies Mains Paper 2 Free Study material, Previous Questions for UPSC Civil Service IAS IPS exam

AS { Your are considered for only those interview

posts for which you have applied. } [Analysis] SSC CGL Tier 1 held on April-21-2013, download question paper

Abirami { Best article read so far in Mrunal Site..

Way to go sir.. } [Economy] Bretton Woods and Fixed Exchange Rate system : Meaning Explained

vivek giri { thank you sir... when will your full fledged

article about upsc mains will came } [Strategy] Indian Diaspora for General Studies Mains Paper 2 Free Study material, Previous Questions for UPSC Civil Service IAS IPS exam 1/15

mrunal.org/2012/05/income-tax.html

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal UPSC Civil Service IAS IPS exam

Income

How does RGESS save Rs.5000 In Tax? Case #1: dont invest in RGESS Case #2: investmen t maximum in RGESS

Aaditya { @ Anyone who can reply. I have this

doubt, in earlier syllabus i.e before 2013 it was clearly mentioned International Affairs and Institutions, but this... } [Strategy] Indian Diaspora for General Studies Mains Paper 2 Free Study material, Previous Questions for UPSC Civil Service IAS IPS exam

Nikhil { Is it advisable to say that you are preparing

for civil services in the interview? Please let me no } [Result] SBI PO Written Exam (Phase-1) Result released, Group Discussion & Interview starts from 3rd July

Manish_delhi { brilliant article...thank you sir }

[Strategy] Indian Diaspora for General Studies Mains Paper 2 Free Study material, Previous Questions for UPSC Civil Service IAS IPS exam

RBI RBI Officer Prelims RBI Officer Phase II RBI Assistant Others RAS CDS CAT (IIM) LIC AAO CSIR State PSC CAPF SSC (FCI) SPIPA ACIO UPSC tips India Yearbook 5 Levels 100 Days Newspaper? Art of Aptitude? Quotes Essay Tips IR Stat R.T.I Analysis CSAT'12 GSM-12 Edu Tech Auto NoteMaker Hindu Reader OneNote Archive

The important questions : Food for Thought

swati { can somebody explain what is to be included

in investment models in gs 3 paper economics section. } [Diplomacy] India ASEAN 20 years of Dialogue Partnership, FTA in Service Investment, Vision 2020

You may have read this statement in newspaper, tv-channels.

kyushu shikoku { @deepak thanks for the effort

to answer the queries...by the way do you intend to continue with this job Are you satisfied with it? } [Studyplan] Assistant Central Intelligence Officer (ACIO): Topicwise booklist, Strategy

Rajiv Gandhi Equity Saving What does it mean? Scheme Before we can talk about (RGESS) that, lets see the basics will give of Income Tax maximum calculation, Exemption benefit of and Tax Deduction. Rs. 5,000 What in tax- are the Income saving. tax slabs in Budget 2012?

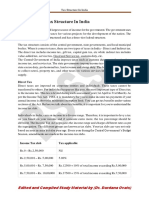

You know about this already: Income tax slab (in Rs.) 0 to 2,00,000 2,00,001 to 5,00,000 5,00,001 to 10,00,000 Above 10,00,000 Tax No tax 10% 20% 30%

raka { +1 ... this job is good for aspirants .. cool

posting .. les work .. } [Studyplan] CSIR Combined Administrative Service Exam (CASE): Booklist, Strategy, Studymaterial Download PDFs

Gargi Sagar { Thank you for yet another gr8

article. Will you also cover rest of the papers and their questions the same way as done above... } [Strategy] Indian Diaspora for General Studies Mains Paper 2 Free Study material, Previous Questions for UPSC Civil Service IAS IPS exam

Mrunal { yes server was having some problem, it is

fixed now. } [Diplomacy] India ASEAN 20 years of Dialogue Partnership, FTA in Service Investment, Vision 2020

shilpa { friends plz post ur gd topics if u have finished

ur interview and gd- especially the candidates who have interview on 3rd at various centres } [Result] SBI PO Written Exam (Phase-1) Result released, Group Discussion & Interview starts from 3rd July

raka { oh .. i first heard about this post when i read

an article about neha nautiyal IAS .. she was holding this job when she... } [Studyplan] CSIR Combined Administrative Service Exam (CASE): Booklist, Strategy, Studymaterial Download PDFs Older

(We are skipping senior citizen provisions) Time for a very simple question:

if your income is Rs.15

2/15

mrunal.org/2012/05/income-tax.html

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

15 lakhs is above Rs.10 lakhs, lakhs, so you fall in 30% how incomemuch tax slab. 30% of income 15 lakhs equals to 4.5 lakhs income tax. tax do Sorry 4.5 lakhs you have is Incorrect Answer . to pay? Infact youre income tax will be quite less than Rs.4.5 lakhs. Why? Because income tax is not calculated like that.

Then how to calculate income tax?

Suitcase approach Imagine there are four suitcases labeled one, two, three, four. You have to fill up each suitcase with your cash. But there are some conditions you have to fill these suitcases in serial order: 1,2,3 then 4 First suitcase can contain maximum two lakh rupees only. Once it is fully packed, you move to the next suitcase. Second suitcase can hold maximum three lakh rupees Third suitcase can contain maximum five lakh rupees Fourth suitcase can contain any amount of money. No maximum limit. Step #1: Distribute money in suitcases Now start distributing your 15 lakh rupees into these four suitcases suitcase number

mrunal.org/2012/05/income-tax.html

Money packed

3/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

One Two Three Four Total

2,00,000 3,00,000 5,00,000 5,00,000 15 lakhs

Step #2: Make a new column and apply those four tax slabs suitcase Money number packed One Two Three Four Total Tax slab

2,00,000 0% 3,00,000 10% 5,00,000 20% 5,00,000 30% 15 lakhs

Step #3: Calculate the income tax to be paid for each suitcase suitcase Money number packed One Two Three Four Total Tax slab Tax to be paid Zero

2,00,000 0%

3,00,000 10% 30,000 5,00,000 20% 1,00,000 5,00,000 30% 1,50,000 15 lakhs 2,80,000

The total sum of income tax on all four suitcases =2,80,000 lakhs So, if your income is 15 lakhs, you have to pay 2.8 lakhs as income tax. But we forgot some important things: educational cess, tax exemption, tax deduction.

3% educational cess

Cess means tax on the tax. Union budget 2012, has provision of 3% educational cess.

mrunal.org/2012/05/income-tax.html

4/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

educational cess. Meaning 3% of 2.8 lakhs, equal to Rs.8400 Hence the total incometax that you to pay = 2.8 lakhs +8400= Rs.2,88,400 Now time for two most important parts in the income tax calculation.

What is the difference between Tax exemption and tax deduction? #1: Tax exemption

Income tax= the tax on your income, but you dont have to pay income tax on certain type of income. For example Policemen and Army jawans get uniform maintenance allowance: Suppose Rs.1000 to wash and iron their uniforms and to polish their boots every month. Rs.1000 every month multiplied with 12 months equals to Rs.12,000 every year, apart from the regular salary. But Budget-2012 says this Uniform Allowance income is exempted from taxation. So, If an army jawan earns Rs. 2,12,000, then his taxable income is 2 lakhs minus Rs. 12000 exempted= Rs. 2,00,000. Now calculate his income tax on Rs. 200,000 based on our suitcase approach. (ans. Zero tax, because Cash finished at first suitcase.) Crux: Tax exemption is given on INCOME.

#2: tax deduction

mrunal.org/2012/05/income-tax.html

If you spend your

5/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

If you spend your income on certain activities, you wont have to pay income tax on that much amount of your income. E.g.50% deduction, if you invest in Rajiv Gandhi Equity Savings Scheme. (RGESS) Suppose you earn nine lakh rupees a year and invest Rs.20,000 in RGESS, Thus , your taxable income = nine lakh rupees minus 50% of Rs.20,000 (invested in RGESS) = 9 lakhs-10,000 = Rs. 8,90,000 Now calculate the income tax on Rs.8,90,000 using our suitcase approach. Crux: Tax Deduction is given on SPENDING

Union budget 2012: provisions of Tax Deduction and Tax Exemption

Here are a few examples. Note: Im not filling up the minute details and you

mrunal.org/2012/05/income-tax.html

6/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

minute details and you dont have to mug this list. Tax Exemption (on INCOME / Salary) Tax Deduction (on SPENDING) Rajiv Gandhi Equity Saving scheme. Tax saving mutual funds (ELSS) Five year tax-saver bank Fixed deposits Public provident fund (PPF) National Savings Certificate (NSC) or National Service Scheme (NSS) Employer contribution into New Pension Scheme (NPS) Life insurance/Unit Linked Insurance Plan (ULIP) premium Employees contribution towards Employee provident fund (EPF) Home loan principal amount payment. Post office tax saving deposit or tax saving bonds Pension scheme/Retirement plans (Secion 80CCC) Tuition fees paid for children education Medical Treatment of family (upto Rs.40k)

Transport / Conveyance Allowence Child education allowence Leave travel allowance (LTA) Medical Allowance Uniform / Dress allowance Gift from relatives Agricultural income House Rent income

What is TaxPlanning?

It means use of TaxExemption and TaxDeduction provisions in such a way that you can save maximum amount of tax.

mrunal.org/2012/05/income-tax.html 7/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

Who is TaxAdviser / TaxConsultant?

These are extremely knowledgeable and experienced Chartered Accountants, MBA and Tax Lawyers. They make customized taxsaving plans according to your requirements. Big players in Tax Consulting = Ernst & Young, KPMG, Price waterhouse Coopers (PwC). Recall that Vodafone Essar deal: Saving Capital Gains tax in Caymens Island. These Big Players help in such huge tax-saving deals.

Black Money and Agro-Income

In above table, you can see that Agriculture income is exempted from income-tax. Lot of film stars forge documents and show they own farm-lands and theyre farmers. Game is simple. They take 5 crores from film producers or 50 lakhs to dance in Dubai. But on paper they show only few lakhs as legit payment received and pay income tax on that part only. Remaining money is shown as income from that agricultural land and thus totally exempted from income-tax. So this is also one

mrunal.org/2012/05/income-tax.html

8/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

So this is also one type of TaxPlanning, just illegal. Black money = income on which tax is not paid. Coming back to the opening sentence of this article:

How does RGESS save Rs.5000 In Tax?

You already know the main provisions of Rajiv Gandhi Equity saving scheme Only first-time investors, with annual

mrunal.org/2012/05/income-tax.html 9/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

investors, with annual income less than Rs.10 lakh can invest in the scheme. One person can invest maximum Rs.50,000 only

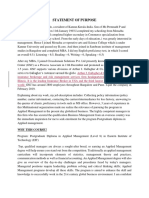

Ya but still how is Rs.5000/- saved? Youve to compare two cases to find that out.

Case #1: dont invest in RGESS

Your income is Rs.9 lakhs, and you dont invest in RGESS and dont get any other tax deduction or tax exemptions. The total taxable income is Rs. 9 lakhs. suitcase Money number packed One Two Three Four Total Tax slab Tax to be paid Zero

2,00,000 0%

3,00,000 10% 30,000 4,00,000 20% 80,000 0 9 lakhs 30% 0 1,10,000

Thus, in case#1: youre paying Rs. 1.1 lakh as income tax

Case #2: investment maximum in RGESS

Your income is Rs.9 lakhs, and you invest to the maximum limit (Rs.50,000/-). Thus, the taxable income is = Rs. 9 lakhs minus 50% of Rs.50,000 ;because RGESS gives 50% Deduction. =9 lakhs 25,000 =Rs. 8,75,000 Now calculate income tax for Rs.8,75,000 using same suitcase approach

mrunal.org/2012/05/income-tax.html 10/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

suitcase Money number packed One Two Three Four Total

Tax Tax to slab be paid 0 30000 75000 0 105000

200000 0 300000 10 375000 20 0 875000 30

Thus, in case#2, you pay 1,05,000 as income tax. Difference between Case #1 minus Case #2 =1,10,000 minus 1,05,000 = Rs. 5,000 Therefore all the newspapers, magazines and TV channels shout all the time that youll save Rs.5,000 by investing in RGESS. But here is a fine-print. This Rs.5000-magic works only if you fall under the 20% tax slab. If your income is rupees two lakhs and you invest Rs.50,000 in RGESS, you will not save any tax. Why? Because you fall in zero% tax slab. Your annual are not taxable in the first place! Similarly, if you are in the 10% tax slab, you will get different answers.

Homework:

(No, theyll not ask this in your exam, this is only for brain exercise)

mrunal.org/2012/05/income-tax.html

Calculate the maximum possible Shortcut tip: tax saving You can get max with deduction of 25,000 (that if of is 50% RGESS, Deduction Rs.50000 invested in your RGESS) annual And your given income 4 income is lakhs fall under 10%. Rs.4 So, 10% of lakhs.

11/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

So, 10% of lakhs. 25,000=Rs.2500 saved in tax. Why does this shortcut method work? Think about it.

Anyways, whether you can save 5000 or 7000 that is not the important question for UPSC, IBPS (Bank PO) or MBA admission interviews.

The important questions are following

Why did Pranab come up with Rajiv Gandhi Equity saving scheme? Why are only firsttime investors allowed to save money in the scheme? Why is Pranab not allowing people with annual income of Rs.10 lakh or above, to invest in this scheme? Why did Pranab say this move will improve the depth of domestic capital market? What is No-Frills demat account and why is Pranab talking about it? If you were in place of Pranab, How will you design the Tax Exemptions and Tax Deductions for the Aam-Aadmi and how will you help the Indian Economy?

mrunal.org/2012/05/income-tax.html

12/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

Previous Posts

[Economic Survey Ch13] Human Development (Part 4 of 4): Physically Disabled, Elderly, Nomadic, Denotified Tribes, Drug junkies and Beggars [Economic Survey Ch13] Human Development (Part 3 of 4): Women and Child Development, Saksham, Priyadarshini, Dhanlaxmi & yes ofcourse SABLA [Economic Survey Ch13] Human Development (Part 2 of 4): SC, ST, OBC, Minorities: welfare schemes, 12th FYP targets [Economic Survey Ch13] Human Development (Part 1 of 4): HDI-2012, HDR-2013, Poverty lines, Aajeevika, Tendulkar, Sreesanth, Saxena, Sengupta [Economic Survey Ch12] Sustainable Development, Climate Change (Part 3 of 3): PAT, RPO, REC, Cap-ntrade [Economic Survey Ch12] Sustainable Development, Climate Change (Part 2 of 3): SVAGRIHA, Bachat Lamp Yojana, SEEP [Economic Survey Ch12] Sustainable Development, Climate Change (Part 1 of 3)

mrunal.org/2012/05/income-tax.html 13/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

(Part 1 of 3)

[Economic Survey Ch11] Infrastructure (Part 2 of 2) Electricity, Renewable Energy, Bagasse Cogeneration [Economic Survey Ch11] Infrastructure (Part 1 of 2): Coal, Gas, Fuel Sharing Agreement (FSA), gas hydrate, oil shale [Economic Survey Ch10] (Part 5 of 5) Railways: Anubhuti, Spart, Project Unigauge, Budget, World Heritage

10 comments to

Subscribe (free!)

Print || PDF (Need Chrome)!

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme

naveen lohar

Reply to this comment give answer please

Mahendra

Reply to this comment Really Nice one to understand the income tax

Mahendra

Reply to this comment Thanks for info!

kaushal jha

Reply to this comment hi mrunal sir,rajiv gandhi equity savings scheme.max benefit is 50000rs??????????

ashok

Reply to this comment sir kindly give the explanation of the above question also

mrunal.org/2012/05/income-tax.html

ashok

14/15

7/8/13

[Economy] Calculating Income Tax, Tax Exemption vs Tax Deduction, Rajiv Gandhi Equity Saving Scheme Mrunal

ashok

Reply to this comment sir kindly give the explanation for abve also

s.k.t

Reply to this comment GUYS IMPORTANT DO NOTE DOWN THE CHANGES IN THE RGESS IMPORTANT FOR THE UPSC EXAM *1)THE INCOME LEVEL OF AN INVESTOR HAS BEEN RAISED FROM 10 TO 12 LAKH PER ANNUM AND THE TAX BENEFIT WHICH WAS 50% FOR INITIAL MIN komal INVESTMENT OF 50,000 HAS Reply this comment BEEN to INCREASED FOR 3 YRS FROM 1 YR(EARLIER) how to calculate for 6 lakhs *=ANY DOUBT IN THE EARLIER PROVISION OF THE SCHEME REFER TO OUR JASPAL BRILLIANTS(MRUNAL) Reply to this comment ART AND THEN COMPARE IT Sir..for RGESS, now the max limit is 12 lakhs (for earlier 10L) and this 12L is gross total income (and not net notal income , hence no role of JASPAL deductions play in RGESS) , Reply to this comment am i right? Correct me if i am wrong.. And also as the max limit is now 12L, then the max possible tax saving from RGESS would now be more than rs 5000? Am i right sir?

Leave a Reply

Name (required) Email (will not be published) (required)

Post Comment Notify me of follow-up comments by email. Notify me of new posts by email.

mrunal.org/2012/05/income-tax.html

15/15

You might also like

- Simply Learn Hebrew! How To Lea - Gary Thaller PDFDocument472 pagesSimply Learn Hebrew! How To Lea - Gary Thaller PDFsuper_gir95% (22)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Step-By-step Guide To File Your Income Tax Return Online - Economic TimesDocument3 pagesStep-By-step Guide To File Your Income Tax Return Online - Economic TimesBiswa Prakash NayakNo ratings yet

- Wells Fargo StatementDocument4 pagesWells Fargo Statementandy0% (1)

- E-Filing of Income Tax ReturnDocument61 pagesE-Filing of Income Tax ReturnSilvi Khurana100% (2)

- Impact of Goods & Service TaxDocument76 pagesImpact of Goods & Service TaxTasmay Enterprises100% (2)

- Tax Accounting Equation (TAE)Document14 pagesTax Accounting Equation (TAE)Joko Ismuhadi Soewarsono100% (1)

- Testing Schedule For Commissioning of Condensate Extraction PumpsDocument13 pagesTesting Schedule For Commissioning of Condensate Extraction PumpsJackSparrow86100% (1)

- GST Book by CA Suraj Agrawal SirDocument478 pagesGST Book by CA Suraj Agrawal SirVipin AgarwalNo ratings yet

- ID FD PA Fans StructuresDocument17 pagesID FD PA Fans StructuresMohan RajNo ratings yet

- Application Performance Management Advanced For Saas Flyer PDFDocument7 pagesApplication Performance Management Advanced For Saas Flyer PDFIrshad KhanNo ratings yet

- GST Project Report SummaryDocument68 pagesGST Project Report SummaryItz Prince ShaîkhNo ratings yet

- TCW The Global CityDocument40 pagesTCW The Global CityAllen Carl100% (1)

- GSTDocument75 pagesGSTHarsh Parasiya50% (2)

- EconomyDocument86 pagesEconomySridhar HaritasaNo ratings yet

- Chapter I: Introduction of Study: Goods and Service Tax (GST)Document73 pagesChapter I: Introduction of Study: Goods and Service Tax (GST)Prajakta KambleNo ratings yet

- Project On Mutual FundsDocument11 pagesProject On Mutual FundsVivek MishraNo ratings yet

- V Sem It Course Plan 2011Document4 pagesV Sem It Course Plan 2011Rohith MaheswariNo ratings yet

- Pre Discussion On Taxation: Q1 What Happens If We Do Not Pay Tax?Document1 pagePre Discussion On Taxation: Q1 What Happens If We Do Not Pay Tax?Tarunvir KukrejaNo ratings yet

- Income Tax PlainingDocument57 pagesIncome Tax PlainingrohitNo ratings yet

- Guidance Note On Annual Return of GSTDocument124 pagesGuidance Note On Annual Return of GSTABC 123No ratings yet

- TdsDocument4 pagesTdsAdityaNo ratings yet

- Vijay L. Kelkar Committee On Fiscal Consolidation: Presented By:-Ankush Singh BagalDocument25 pagesVijay L. Kelkar Committee On Fiscal Consolidation: Presented By:-Ankush Singh BagalAnkush SInghNo ratings yet

- Indian Tax Structure ExplainedDocument7 pagesIndian Tax Structure ExplainedHarshita MarmatNo ratings yet

- Deepanshu FileDocument54 pagesDeepanshu FileMayankRohillaNo ratings yet

- Commission Structure & Earning Potential - GST Suvidha Kendra PDFDocument4 pagesCommission Structure & Earning Potential - GST Suvidha Kendra PDFvikasNo ratings yet

- MBA Project Report 100Document50 pagesMBA Project Report 100ब्राह्मण जीNo ratings yet

- Prof Simply Simple Understanding Goods Services Tax (GST) Version 2Document17 pagesProf Simply Simple Understanding Goods Services Tax (GST) Version 2sanjayjograNo ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaNo ratings yet

- How To Calculate Ur Income TaxDocument3 pagesHow To Calculate Ur Income TaxrazeemshipNo ratings yet

- Term Paper On Tax ManagementDocument7 pagesTerm Paper On Tax Managementdajev1budaz2100% (1)

- 10381-Article Text-11945-1-10-20191109Document9 pages10381-Article Text-11945-1-10-20191109aditya mulkalwarNo ratings yet

- A Study On Impact of GST On Retailers in Chennai CityDocument3 pagesA Study On Impact of GST On Retailers in Chennai CityKrishna Nandhini VijiNo ratings yet

- Tooba DocumentDocument97 pagesTooba Documentjitendra kumarNo ratings yet

- Field Exposure On One Year Post Graduate Diploma in Accountancy (With Computrized Accounts & Taxation) Sudesh KumarDocument84 pagesField Exposure On One Year Post Graduate Diploma in Accountancy (With Computrized Accounts & Taxation) Sudesh KumarSudeshKumarNo ratings yet

- GST RevisionDocument10 pagesGST RevisionSumit rautelaNo ratings yet

- IPCC Taxation Guideline Answer Nov 2015 ExamDocument16 pagesIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaNo ratings yet

- Narendra VijayDocument2 pagesNarendra VijayThe Cultural CommitteeNo ratings yet

- Impact of GST on Indian StartupsDocument16 pagesImpact of GST on Indian StartupsRishabh SinghNo ratings yet

- Impact of GST On Indian Economy: Keywords: GST, Consumer, Producer, Centre, StateDocument4 pagesImpact of GST On Indian Economy: Keywords: GST, Consumer, Producer, Centre, StateSonam KumariNo ratings yet

- Tax Saving FY 2021-22 - FDocument30 pagesTax Saving FY 2021-22 - Fsapreswapnil8388No ratings yet

- Tax Deducted at SourceDocument5 pagesTax Deducted at SourceRajinder KaurNo ratings yet

- Practical Question Bank: Faculty of Commerce, Osmania UniversityDocument4 pagesPractical Question Bank: Faculty of Commerce, Osmania Universitymekala sailajaNo ratings yet

- Summer Training Report on GST and Accounting ServicesDocument48 pagesSummer Training Report on GST and Accounting ServicesRishabh DevNo ratings yet

- TDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Document5 pagesTDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Nishit MarvaniaNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- Current Income Tax Convergence Impacts SMEs in IndiaDocument5 pagesCurrent Income Tax Convergence Impacts SMEs in IndiaSarika PatilNo ratings yet

- Service TaxvatDocument306 pagesService Taxvatapi-206947225No ratings yet

- Theory and Precatice of GSTDocument3 pagesTheory and Precatice of GSTakking0146No ratings yet

- Handbook On GST On Service SectorDocument276 pagesHandbook On GST On Service SectorABC 123100% (1)

- Imp QstnsDocument72 pagesImp QstnsAvishekNo ratings yet

- GST 2Document37 pagesGST 2jprapti317No ratings yet

- Impact of GST On Businesses-A Case Study by Numberz: Figure 1 Bifurcation For Indirect Taxes in IndiaDocument5 pagesImpact of GST On Businesses-A Case Study by Numberz: Figure 1 Bifurcation For Indirect Taxes in IndiaKunal MittalNo ratings yet

- SWAYAM BAJPAI - OrganizedDocument65 pagesSWAYAM BAJPAI - Organizedjitendra kumarNo ratings yet

- Indian Income Tax Calculator: Automatic TAX Calculator /TITLEDocument23 pagesIndian Income Tax Calculator: Automatic TAX Calculator /TITLEshankarinsideNo ratings yet

- I.T.S-Mnagement & I.T. Institute Mohan Nagar, Ghaziabad Learning Objectives & Lesson PlanDocument5 pagesI.T.S-Mnagement & I.T. Institute Mohan Nagar, Ghaziabad Learning Objectives & Lesson PlanSourav SharmaNo ratings yet

- Monika Kadam: Account SettingsDocument26 pagesMonika Kadam: Account SettingsAlok SinghNo ratings yet

- Analysis and Acceptance of GST in IndiaDocument19 pagesAnalysis and Acceptance of GST in IndiashubhamNo ratings yet

- GST Impact on E-commerce GiantsDocument28 pagesGST Impact on E-commerce GiantsNitinNo ratings yet

- Tax Saving Schemes: in Partial Fulfilment of The Requirements For The Award of The Degree inDocument8 pagesTax Saving Schemes: in Partial Fulfilment of The Requirements For The Award of The Degree inMOHAMMED KHAYYUMNo ratings yet

- Anubhav Paul Intern ReportDocument61 pagesAnubhav Paul Intern ReportAnshul VermaNo ratings yet

- 39 RemovedDocument56 pages39 RemovedMartial ChiefNo ratings yet

- BudgetDocument21 pagesBudgetshweta_narkhede01No ratings yet

- Individual Txation FY 203 24Document44 pagesIndividual Txation FY 203 24Smarty ShivamNo ratings yet

- Banking & Economy Question PDF 2018 (April To June) - June Updated by AffairsCloud PDFDocument62 pagesBanking & Economy Question PDF 2018 (April To June) - June Updated by AffairsCloud PDFNishok INo ratings yet

- Audit TP QuestionsDocument4 pagesAudit TP QuestionsmonizaNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Beldens Wash-Down Cord SetsDocument72 pagesBeldens Wash-Down Cord SetschapsboiNo ratings yet

- Trader Application Form 5A PDFDocument2 pagesTrader Application Form 5A PDFRavikanth ReddyNo ratings yet

- 1756 pm017 - en PDocument35 pages1756 pm017 - en PRavikanth ReddyNo ratings yet

- Trader Application Form 5A PDFDocument2 pagesTrader Application Form 5A PDFRavikanth ReddyNo ratings yet

- Sakshi Telugu Daily Telangana, Tue, 13 Feb 18Document1 pageSakshi Telugu Daily Telangana, Tue, 13 Feb 18Ravikanth ReddyNo ratings yet

- Sakshi Telugu Daily Telangana, Tue, 13 Feb 182Document1 pageSakshi Telugu Daily Telangana, Tue, 13 Feb 182Ravikanth ReddyNo ratings yet

- Sakshi Telugu Daily Telangana, Tue, 13 Feb 18Document1 pageSakshi Telugu Daily Telangana, Tue, 13 Feb 18Ravikanth ReddyNo ratings yet

- Sakshi Telugu Daily Telangana, Tue, 13 Feb 18Document1 pageSakshi Telugu Daily Telangana, Tue, 13 Feb 18Ravikanth ReddyNo ratings yet

- Sakshi Telugu Daily Telangana, Tue, 13 Feb 181Document1 pageSakshi Telugu Daily Telangana, Tue, 13 Feb 181Ravikanth ReddyNo ratings yet

- Sakshi Telugu Daily Telangana, Tue, 13 Feb 18Document1 pageSakshi Telugu Daily Telangana, Tue, 13 Feb 18Ravikanth ReddyNo ratings yet

- Sakshi Telugu Daily Telangana, Tue, 13 Feb 18Document1 pageSakshi Telugu Daily Telangana, Tue, 13 Feb 18Ravikanth ReddyNo ratings yet

- Sakshi Telugu Daily Telangana, Tue, 13 Feb 18Document1 pageSakshi Telugu Daily Telangana, Tue, 13 Feb 18Ravikanth ReddyNo ratings yet

- Sakshi Telugu Daily Telangana, Tue, 13 Feb 18Document4 pagesSakshi Telugu Daily Telangana, Tue, 13 Feb 18Ravikanth ReddyNo ratings yet

- Sakshi Mon, 9 Oct 17Document2 pagesSakshi Mon, 9 Oct 17Ravikanth ReddyNo ratings yet

- Determining Electric Load: MotorDocument6 pagesDetermining Electric Load: MotorFernandoNo ratings yet

- Tips For Energy ConservationDocument11 pagesTips For Energy Conservationsunjoy1234No ratings yet

- Test Paper - Marking ScheduleDocument15 pagesTest Paper - Marking ScheduleRavikanth ReddyNo ratings yet

- Rice Production Manual - Farm Power Sources in 40 CharactersDocument7 pagesRice Production Manual - Farm Power Sources in 40 CharactersRavikanth ReddyNo ratings yet

- 24 03 2017 Page 1Document1 page24 03 2017 Page 1Ravikanth ReddyNo ratings yet

- An Analysis of Different Methods For Major Energy Saving in Thermal Power PlantDocument9 pagesAn Analysis of Different Methods For Major Energy Saving in Thermal Power PlantRavikanth ReddyNo ratings yet

- Sakshi Telugu Mon, 9 Oct 17Document2 pagesSakshi Telugu Mon, 9 Oct 17Ravikanth ReddyNo ratings yet

- Advt 11march2011Document1 pageAdvt 11march2011Amar KhadeNo ratings yet

- Sakshi Telugu Daily Telangana, Mon, 9 Oct 17Document3 pagesSakshi Telugu Daily Telangana, Mon, 9 Oct 17Ravikanth ReddyNo ratings yet

- SYLLABUSDocument6 pagesSYLLABUSRavikanth ReddyNo ratings yet

- HT SWGR Test SCHDocument24 pagesHT SWGR Test SCHlrpatraNo ratings yet

- Mensuration Formulas Area Perimeter ShapesDocument12 pagesMensuration Formulas Area Perimeter ShapessanjeevNo ratings yet

- UAE Cooling Tower Blow DownDocument3 pagesUAE Cooling Tower Blow DownRamkiNo ratings yet

- Statement of Purpose EitDocument3 pagesStatement of Purpose EitSajith KvNo ratings yet

- Introduction To Alternative Building Construction SystemDocument52 pagesIntroduction To Alternative Building Construction SystemNicole FrancisNo ratings yet

- SyllabusDocument8 pagesSyllabusrickyangnwNo ratings yet

- Research Methods LessonDocument26 pagesResearch Methods LessonCarole Janne EndoyNo ratings yet

- Information BulletinDocument1 pageInformation BulletinMahmudur RahmanNo ratings yet

- Simple Future Vs Future Continuous Vs Future PerfectDocument6 pagesSimple Future Vs Future Continuous Vs Future PerfectJocelynNo ratings yet

- Understanding Abdominal TraumaDocument10 pagesUnderstanding Abdominal TraumaArmin NiebresNo ratings yet

- Executive Support SystemDocument12 pagesExecutive Support SystemSachin Kumar Bassi100% (2)

- The Secret Path Lesson 2Document22 pagesThe Secret Path Lesson 2Jacky SoNo ratings yet

- Intracardiac Echo DR SrikanthDocument107 pagesIntracardiac Echo DR SrikanthNakka SrikanthNo ratings yet

- Preterm Labour: Muhammad Hanif Final Year MBBSDocument32 pagesPreterm Labour: Muhammad Hanif Final Year MBBSArslan HassanNo ratings yet

- Unofficial Transcript - Printer FriendlyDocument4 pagesUnofficial Transcript - Printer Friendlyapi-251794642No ratings yet

- The Butterfly Effect movie review and favorite scenesDocument3 pagesThe Butterfly Effect movie review and favorite scenesMax Craiven Rulz LeonNo ratings yet

- App Inventor + Iot: Setting Up Your Arduino: Can Close It Once You Open The Aim-For-Things-Arduino101 File.)Document7 pagesApp Inventor + Iot: Setting Up Your Arduino: Can Close It Once You Open The Aim-For-Things-Arduino101 File.)Alex GuzNo ratings yet

- Lucy Wang Signature Cocktail List: 1. Passion Martini (Old Card)Document5 pagesLucy Wang Signature Cocktail List: 1. Passion Martini (Old Card)Daca KloseNo ratings yet

- Walter Horatio Pater (4 August 1839 - 30 July 1894) Was An English EssayistDocument4 pagesWalter Horatio Pater (4 August 1839 - 30 July 1894) Was An English EssayistwiweksharmaNo ratings yet

- Surrender Deed FormDocument2 pagesSurrender Deed FormADVOCATE SHIVAM GARGNo ratings yet

- 100 Bedded Hospital at Jadcherla: Load CalculationsDocument3 pages100 Bedded Hospital at Jadcherla: Load Calculationskiran raghukiranNo ratings yet

- Myrrh PDFDocument25 pagesMyrrh PDFukilabosNo ratings yet

- Adorno - Questions On Intellectual EmigrationDocument6 pagesAdorno - Questions On Intellectual EmigrationjimmyroseNo ratings yet

- AccentureDocument11 pagesAccenturecentum1234No ratings yet

- Jillian's Student Exploration of TranslationsDocument5 pagesJillian's Student Exploration of Translationsjmjm25% (4)

- DODAR Analyse DiagramDocument2 pagesDODAR Analyse DiagramDavidNo ratings yet

- Alphabet Bean BagsDocument3 pagesAlphabet Bean Bagsapi-347621730No ratings yet

- 12A1HDocument11 pages12A1HAlvaro SolisNo ratings yet