Professional Documents

Culture Documents

How Online Advertising Works: Whither The Click in Europe?

Uploaded by

Guntis StirnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How Online Advertising Works: Whither The Click in Europe?

Uploaded by

Guntis StirnaCopyright:

Available Formats

How Online Advertising Works: Whither the Click in Europe? A U.K.

& European Perspective on the Latent Impact of Display Advertising

FEBRUARY 2010

Gian M. Fulgoni Executive Chairman comScore, Inc. Marie Pauline Mrn Director, Product Management comScore, Inc. Mike Shaw Director, Marketing Solutions comScore, Inc.

Whither the Click: U.K. & European Perspective

How Online Advertising Works: Whither the Click in Europe?

BACKGROUND In todays economically challenging times, some advertisers and their agencies are seeking immediate returns, moving their campaign dollars from CPM campaigns that require payment based on the number of delivered ad impressions to CPC programs where payment is based on the number of clicks on an ad. However, the increasing sophistication of online audiences has led fewer and fewer consumers to click on ads, to the extent that DoubleClick reported in its 2008 Year-in-Review benchmark report that the average click-through rates across its image, flash, and rich media campaigns had fallen to just 0.08% in the United Kingdom and 0.1% in the U.S. Are low click rates evidence that display ad campaigns have not had any impact on consumer behavior? Or, does online display advertising work in a similar way to traditional offline advertising with multiple exposures over time being needed to effect a change in consumer behavior? A significant challenge in accurately determining answers to these questions is the phenomenon of cookie deletion, which has rendered inaccurate much of the cookie-based research conducted to date regarding the effectiveness of online advertising. Cookies are small pieces of code inserted into the browser of the computer of the user whose behavior is being examined in an attempt to uniquely identify the computer and thereby track its activity over time. While this is a conceptually appealing approach, research conducted by comScore and others has shown that the prevalence of anti-spyware software (now built into most browsers) allows Internet users to very easily delete their cookies as they see fit. In fact, a recent comScore white paper published in September 2009 , showed that 24% of U.K. Internet users delete their first party cookies in a given month and do so an average of 3 times per deleter. Third party cookies such as those used by ad servers are deleted by 33% of Internet users, who do so an average of almost 7 times per month. Because of cookie deletion, any attempt to track computer users over time using cookies will be subject to substantial error levels as the cookies are deleted, and this will typically understate the impact of the advertising being measured.

1

This paper reports the results of comScore research into online advertising effectiveness based on the use of comScores proprietary panel of 2 million Internet users, of which over 400,000 are resident in Europe. Instead of relying upon cookies to track behavior, comScore has obtained explicit permission from its panelists to install comScores patented monitoring software on their computers, thereby enabling

http://www.comscore.com/Press_Events/Press_Releases/2009/10/comScore_Submits_Proposal_to_ABCe_in_U.K._for_a_new_P erson-Centric_Measure_for_Web_Site_Server_Measurement

PAGE 2

Whither the Click: U.K. & European Perspective

comScore to accurately measure the full range of panelists Internet activities over time. The results presented in this paper will show the manner in which online display ads work in affecting European consumer behavior, revealing that there are indeed latency effects and branding effects even when click rates on the ads themselves are minimal. The results observed in Europe will also be compared to those from comScores seminal November 2008 U.S. study How Online Advertising Works: Whither the Click , which demonstrated the importance of looking beyond ad clicks when assessing the effectiveness of online display ad campaigns. Whither the Click? was subsequently published in the June 2009 issue of The Journal of Advertising Research as one of 21 Watertight Laws for Intelligent Advertising Decisions.

2

THE U.K. ONLINE DISPLAY ADVERTISING ENVIRONMENT The 2009 IAB Online Adspend report shows that online ad spending in the U.K. during the first half of 2009 actually surpassed that of TV for the first time, with online representing 23% of all media spending. With the BBC devoid of advertising and accounting for roughly 30% of all TV viewing in the U.K., perhaps it is not surprising that the U.K is the first major economy in which online ad spend has exceeded that of TV. The IAB also reports that Internet advertising was the only U.K. advertising medium to exhibit growth in H1 2009.

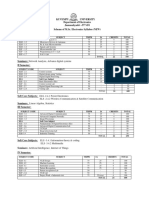

As can be seen below, search dominates online advertising in both the U.K. and in the U.S. Interestingly, display advertising spending (encompassing banners, rich media and video) comprises only 18% of online ad revenue in the U.K., compared with a much higher share of 34% in the U.S. The large disparity in these share numbers has two important implications: first, it suggests that there is still tremendous room for growth in display advertising in the U.K., both in absolute terms and as a percentage of total spend; and second, that a brand which advertises online using display ads in the U.K. will likely benefit from a higher share of display voice because it does not face as much pressure from competitive display advertising in the U.K. compared to the U.S.

Figure 1: Share of Online Advertising Revenues for H1 2009

U.K.

Display, 18% Search, 63% Email, 0.1% Lead Gen, 7% Classifieds, 19% Email, 1% Classifieds, 10% Display, 34% Search, 47%

U.S.

Source: IAB Online Adspend Study, First Half 2009

http://www.comscore.com/Press_Events/Press_Releases/2008/11/Value_of_Online_Advertising

PAGE 3

Whither the Click: U.K. & European Perspective

Click-through rates (CTR) in the U.K. and a variety of other countries, including the U.S., are very low. However, as will be shown in this paper low CTR are not in themselves a negative indication of the quality of the advertising or of the audience: rather, Doubleclicks 2008 Year-in-Review benchmarks indicate that individual countries CTR are inversely correlated to the relative online sophistication of their audiences: mature markets with high broadband penetration in Western Europe and the Americas consistently have very low average click-through rates, while the highest click-through rates can be found in emerging markets in Asia, the Middle East, and Africa. It can be hypothesized that the novelty of clicking on an ad wears off as Internet users gain experience. But, does this mean that the advertising is not effective? We will show that this is clearly not the case.

Figure 2: Worldwide Click-Through Rates

Norway Ireland Luxembourg United Kingdom Finland Australia Canada Sweden United States Hungary Switzerland Denmark France Italy Germany New Zealand Spain Turkey Austria Netherlands Belgium China Greece India Singapore Hong Kong United Arab Emirates Malaysia 0.07% 0.08% 0.08% 0.08% 0.09% 0.10% 0.10% 0.10% 0.10% 0.11% 0.11% 0.12% 0.12% 0.12% 0.13% 0.14% 0.14% 0.14% 0.15% 0.16% 0.17% 0.18% 0.18% 0.20% 0.20% 0.21% 0.26% 0.29%

Click-through rates across Static Image, Flash, and Rich Media formats Source: DoubleClick DART for Advertisers, a cross section of regions, January December 2008

PAGE 4

Whither the Click: U.K. & European Perspective

It is also important to note that when considering rich media units, not every click or interaction may provide a click-through: a click on the ad may expand the unit, play a video, or may even result in conversion activity within the ad unit itself. These interactive rich media ad units will certainly only become more common in regions with high broadband penetration, which are also the same regions where click-through rates are already low.

SUMMARY OF FINDINGS Results from a series of early ad effectiveness studies conducted by comScore primarily in the U.K. but also including a handful of studies conducted in several other countries in Western Europe (namely France, Germany and Spain) show that display advertising, despite a lack of clicks, can have a significant positive impact on consumer behavior. The following results were observed when comparing the

behavior of Internet users exposed to display ads with that of a comparable set of users who did not see the ads:

Visitation to the advertisers web site rose by 72% on average Likelihood of consumers conducting a trademark search query using the advertisers branded terms increased by 94% on average

Compared to the effects of display advertising using the same metrics in the U.S. (49% lift in site visitation and 40% lift in the number of trademark search queries), the aggregation of European studies shows consistently higher lifts. A comparison of the U.K. and U.S. Internet markets suggests that a number of factors could be driving the higher ad response in the U.K. These include 1) Less online ad clutter in the U.K. 2) Greater likelihood to conduct a search query in the U.K. 3) U.K. audiences are more receptive than their American counterparts to branding messages presented online 4) As has been controversially suggested by some, online advertising creative in Europe may be superior to that in the U.S.

THE COMSCORE ACTION LIFT STUDY RESEARCH DESIGN As noted above, comScore maintains a panel of Internet users who allow comScore to monitor their complete Internet browsing behavior and view this behavior in a real market setting rather than using an artificial research design. Part of this monitoring involves the automated capture by the comScore

technology of most forms of display advertising without needing to ask consumers whether they had seen the ad. As a result, comScore is able to identify those consumers who were exposed to a particular advertising campaign (the test, or exposed, group).

PAGE 5

Whither the Click: U.K. & European Perspective

From its panel, comScore also selects a control group of panelists not exposed to the campaign but who exhibit the following characteristics when compared to the exposed group:

Similar usage of the Internet overall prior to the start of the ad campaign Similar visitation to the sites where the ads were in rotation Similar total search behavior online prior to the start of the ad campaign Similar household demographic characteristics: connection speed Age, income, census region or residence, and Internet

Similar pre-campaign visitation of the advertisers site

With the exception of the exposure to the online display ad test campaign, the test and control groups are virtually identical in their demographics and online behavior prior to the start of the ad campaign being measured. Note that this also provides confidence that the groups are balanced with respect to the potential influence of other forms of media advertising. As a result, any differences that comScore

observes in the online behaviour of the exposed and unexposed groups following the start of the ad campaign can confidently be attributed to the impact of the ad campaign itself, allowing comScore to precisely isolate the effects of the specific online advertising campaign being evaluated. comScores passively collected behavioral data captures the view-through value of the overall campaign by measuring consumers' Internet activity irrespective of whether an ad is clicked on or not. As the basis for this paper, comScore has used its expanding European Action Lift campaign norms database. This database is built from comScore AdEffx studies conducted across the finance, media, telecoms, retail, automotive, travel, health, utilities and government sectors, and covers ad campaigns that delivered in excess of 1.3 billion display ad impressions.

Detailed Results

(I) THE IMPACT OF DISPLAY ADS ON VISITATION TO THE ADVERTISERS SITE Based on early results across nearly 20 European studies conducted by comScore, the average lift in the number of visitors to the advertiser site generated by display advertising (i.e. the percent change in site reach between the test and control groups after adjusting for any differences that existed prior to the start of the campaign) was 72%.

In a number of studies, where effects were monitored on a time-aligned basis (with first exposure to the campaign being the start event), differences in site reach across the control and test groups were monitored over a cumulative 3-week time period; for the remaining studies, lift in advertiser site reach was calculated during the post-campaign monitoring period (typically 3 weeks). Due to the differences in

PAGE 6

Whither the Click: U.K. & European Perspective

methodology, the individual studies and groups of studies are discussed below in further detail and the average lift value cited above was calculated simply to provide a comparative indication of the ads effects. The average lift values of each group of studies are similar: 73% over a 3-week time period from first exposure for the time-aligned studies, and 71% over the duration of the post-campaign period for the campaign/post-campaign studies.

By examining the average dynamics of the lift in site reach over time, we see that the effects of display ad exposure persist (that is, there continues to be lift effects in the time period following first exposure to an ad), but, as might be expected, those effects attenuate over time. Among the studies of this type included in this analysis, the average lift in the first week following initial exposure was 99%. This lift declined to an average of 75% over the first two weeks following the initial ad exposure, and to 73% over the first three weeks.

Figure 3: Lift in Advertiser Site Reach: Time-Aligned Studies

120% 100% 80% 60% 40% 20% 0% Average of time-aligned studies Week of first exposure Weeks 1-2 after first exposure Weeks 1-3 after first exposure For studies in which lifts in site reach were measured during and after the campaign time period, we also see that the lift effects persisted following the end of the campaign. More so than in the time-aligned studies, where there is a possibility of additional exposures to the campaign following the first exposure, the significant lift values that continued in the post-campaign period imply significant branding effects that are, by definition, beyond the click. 99% 75% 73%

PAGE 7

Whither the Click: U.K. & European Perspective

Figure 4: Lift in Advertiser Site Reach: Campaign/Post-Campaign Studies

80% 80% 60% 40% 20% 0% Average of Campaign/Post-Campaign Studies Campaign Period Post Period 71%

(II) THE IMPACT OF DISPLAY ADS ON TRADEMARK SEARCH QUERIES The average lift in the number of users conducting a search query using the advertisers branded terms (i.e. the percent change in search reach between the test and control groups after adjusting for any differences that existed prior to the start of the campaign) and which can be attributed to the impact of display advertising was 94%.

Once again, due to the differences in methodology, the individual studies and groups of studies are discussed below in further detail. The average lift for the time-aligned group is lower at 81% over a three week time period from first exposure, compared to a lift of 114% over the duration of the post-campaign period for the campaign/post-campaign studies.

By examining the average dynamics of search term usage over time, we again see that the effects of display ad exposure persist. Among the studies of this type included in this analysis, the average lift in search term reach during the first week following initial exposure was 91%. This lift dropped marginally to an average of 89% over the first two weeks following ad exposure, and to 81% over the first three weeks.

PAGE 8

Whither the Click: U.K. & European Perspective

Figure 5: Lift in Search Term Reach: Time-Aligned Studies

100% 95% 90% 85% 80% 75% 70% 65% 60% 55% 50% Average of time aligned studies Week of first exposure Week 1-2 after first exposure Week 1-3 after first exposure 91% 89% 81%

For studies in which lifts in site reach were measured during and after the campaign time period, we again see that the lift effects persisted after the end of the campaign. Overall, the decline in lift was only 16% (or 20 percentage points) from the campaign period to the end of the post-campaign monitoring period (typically three weeks).

Figure 6: Lift in Search Term Reach: Campaign/Post-Campaign Studies

150% 140% 130% 120% 110% 100% 90% 80% 70% 60% 50% 136% 114%

Campaign Period

Post Period

Average of Campaign/PostCampaign Studies Campaign Period Post Period

PAGE 9

Whither the Click: U.K. & European Perspective

Comparison with U.S. Results

The results from the comScore U.S. studies, first published in November 2008, also showed a significant impact of display advertising, specifically: Visitation to the advertisers web site rose by 49% on average up to three weeks after first exposure Likelihood of consumers conducting a search query using the advertisers brand terms increased by 40% on average up to three weeks after first exposure A comparison of the results of the current U.K. and European studies with the earlier U.S. studies shows a greater impact of display ads in Europe when measured in terms of the lift in visitation to the advertisers site and in terms of the lift in the number of trademark search queries.

Figure 7: Comparative Analysis of U.S. and European Campaign Results Lift in Advertiser Site Visitation

80% 70% 60% 50% 40% 30% 20% 10% 0% Europe U.S. 49% 72%

Lift in Trademark Search Queries

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 94%

40%

Europe

U.S.

EXPLAINING THE RESULTS Studies conducted in the U.K. account for 78% of all the campaign impressions being analysed in this paper. Consequently, comScore has focused on the characteristics of the U.K. market in an effort to understand the factors that could be driving the higher ad response observed in the European studies compared to those conducted in the U.S.

PAGE 10

Whither the Click: U.K. & European Perspective

There are a number of plausible explanations: (I) USERS ARE EXPOSED TO FEWER ONLINE AD IMPRESSIONS IN THE U.K. THAN THE U.S.

comScores Ad Metrix service automatically captures each instance of a display ad being delivered to the comScore panelists. The results of a comparison of the U.K. and U.S. ad markets in November 2009 show that the average U.K. Internet user is exposed to 1,575 display ad impressions each month compared with 1,773 impressions in the U.S., or about 11% fewer ads. It can be hypothesized that the fewer ads to which a user is exposed, the more concentrated the ad message will be for each campaign to which the user is exposed. Assuming each user has only a finite amount of time in which to act on the campaigns to which they are exposed, one might argue that there is an 11% greater chance in the U.K. than the U.S. that an individual campaign will cause some site visitation and/or search activity. (II) HIGHER SEARCH ACTIVITY IN THE U.K. THAN THE U.S.

In the U.K. the average number of searches per searcher per month is 148, which is about 38% higher than the corresponding U.S. level of 107 search queries per searcher (comScore qSearch, November 2009). With U.K. Internet users being more active searchers, it is possible that display advertising has an easier task in the U.K. in driving incremental search activity. (III) DIRECT RESPONSE RATES ARE LOWER IN THE U.K. THAN THE U.S.

Doubleclicks click-through data from their 2008 Performance Norms study shows that the average CTR is 25% lower in the U.K. (0.08%) than it is in the U.S. (0.1%). It is possible that users in the U.K. are interacting with advertising differently to U.S. users, and that this is reflected in a higher level of latent advertising impact. (IV) CREATIVITY OF THE U.K. & EUROPEAN ONLINE DISPLAY AD MARKET

In advertising circles, there is continued debate about creativity, and whether one region or country surpasses others in this regard. Given the more positive results observed for European studies

compared to those in the U.S., comScore explored whether this could partly be explained by higher levels of creativity involved in U.K. campaigns. Interestingly, the U.K. has a higher proportion of Gross Value Added (GVA, a measure of economic contribution) that is derived from creative industries than any other country in the world . Additionally, Michael Birch, the British-born co-founder of social media platform Bebo and now resident in San Francisco (so, with experience of interactive creativity on both sides of the Atlantic), is on record as saying that he believes "British people are still the most inventive in the world". Finally, Eyeblaster have delivered some compelling engagement metrics around display ads that suggest a considerable difference between the U.S. and European markets. As a global ad serving and campaign

3

Office of National Statistics (2006); UK GVA for creative is 8%

PAGE 11

Whither the Click: U.K. & European Perspective

management provider, Eyeblaster produces regular data around the rich media market and the extent to which consumers interact with rich media ads. Their global benchmark data to the end of Q2 2009 demonstrated that: o Among those exposed to rich media campaigns, European consumers are 30% more likely to actively engage with the ad than consumers in North America o Of those engaging with the ad, European consumers spend 22% more time engaging with the ad than consumers in North America Whilst this analysis is limited to rich media campaigns, it suggests that there may be something in the creativity of the campaign that is both enticing more users to engage, and keeping their attention longer when they do.

4

Eyeblaster Research Global Benchmark Report 2009

PAGE 12

Whither the Click: U.K. & European Perspective

ABOUT COMSCORE

comScore, Inc. (NASDAQ: SCOR) is a global leader in measuring the digital world. This capability is based on a massive, global cross-section of more than 2 million consumers who have given comScore permission to confidentially capture their browsing and transaction behavior, including online and offline purchasing. comScore panelists also participate in survey research that captures and integrates their attitudes and intentions. Through its proprietary technology, comScore measures what matters across a broad spectrum of behavior and attitudes. comScore analysts apply this deep knowledge of customers and competitors to help clients design powerful marketing strategies and tactics that deliver superior ROI. comScore services are used by nearly 900 clients, including global leaders such as AOL, Microsoft, Yahoo!, BBC, Carat, Cyworld, Deutsche Bank, France Telecom, Best Buy, The Newspaper Association of America, Financial Times, ESPN, Fox Sports, Nestl, Starcom, Universal McCann, the United States Postal Service, Verizon, ViaMichelin, Merck and Expedia.

For more information, please visit www.comscore.com or e-mail mmxinfo@comscore.com.

PAGE 13

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- G23 PartsDocument46 pagesG23 PartsGerman Parcero100% (1)

- The Role of Culture in Economic DevelopementDocument10 pagesThe Role of Culture in Economic DevelopementGuntis StirnaNo ratings yet

- Single Customer ViewDocument14 pagesSingle Customer ViewGuntis StirnaNo ratings yet

- OpenX Ad Networks Vs Ad ExchangesDocument11 pagesOpenX Ad Networks Vs Ad ExchangesanovcNo ratings yet

- E-Journey Digital Marketing and The Path To PurchaseDocument7 pagesE-Journey Digital Marketing and The Path To PurchaseGuntis StirnaNo ratings yet

- Real-Time Bidding in The United States and Worldwide, 2011-2016Document23 pagesReal-Time Bidding in The United States and Worldwide, 2011-2016Guntis StirnaNo ratings yet

- How To Talk Intelligently About Programmatic BrandingDocument13 pagesHow To Talk Intelligently About Programmatic BrandingGuntis StirnaNo ratings yet

- Display Advertising Ecosystem Map 2011/2012Document2 pagesDisplay Advertising Ecosystem Map 2011/2012Guntis StirnaNo ratings yet

- The Enabling City Tool KitDocument80 pagesThe Enabling City Tool KitGuntis StirnaNo ratings yet

- Re Imaging BarcelonaDocument26 pagesRe Imaging BarcelonaGerrie SchipskeNo ratings yet

- What Makes A City Human - Futures Paper March 00Document3 pagesWhat Makes A City Human - Futures Paper March 00Guntis StirnaNo ratings yet

- Right To The CityDocument58 pagesRight To The CityGuntis StirnaNo ratings yet

- Al Ain: The Foundations of Authentic Place BrandingDocument8 pagesAl Ain: The Foundations of Authentic Place BrandingGuntis StirnaNo ratings yet

- Country Brand Index 2011Document87 pagesCountry Brand Index 2011Guntis StirnaNo ratings yet

- Beales Étude Sur Le Ciblage Comportemental Sur Internet - Adwords-FranceDocument25 pagesBeales Étude Sur Le Ciblage Comportemental Sur Internet - Adwords-FrancePPC4bibleNo ratings yet

- Beliefs and Behaviors: Internet Users' Understanding of Behavioral AdvertisingDocument31 pagesBeliefs and Behaviors: Internet Users' Understanding of Behavioral AdvertisingGuntis StirnaNo ratings yet

- Global Green Economy Index 2011Document11 pagesGlobal Green Economy Index 2011Guntis StirnaNo ratings yet

- New Neighbour Hoods and MobilityDocument98 pagesNew Neighbour Hoods and MobilityGuntis StirnaNo ratings yet

- NAI Beales ReleaseDocument3 pagesNAI Beales ReleaseGuntis StirnaNo ratings yet

- Ad Attention in The Wild 5 2011 v2Document25 pagesAd Attention in The Wild 5 2011 v2Guntis StirnaNo ratings yet

- Marketing Charts Power Point The Marketing Data BoxDocument65 pagesMarketing Charts Power Point The Marketing Data BoxGuntis StirnaNo ratings yet

- Advice On The New Cookies RegulationsDocument10 pagesAdvice On The New Cookies RegulationsGuntis StirnaNo ratings yet

- Editorial Global Competitiveness Versus Community IdentityDocument5 pagesEditorial Global Competitiveness Versus Community IdentityGuntis StirnaNo ratings yet

- Citizens Guide LEED-NDDocument44 pagesCitizens Guide LEED-NDGuntis StirnaNo ratings yet

- Cities of OpportunityDocument86 pagesCities of OpportunityGuntis StirnaNo ratings yet

- Connected CouncillorsDocument40 pagesConnected CouncillorsGuntis StirnaNo ratings yet

- LiveRiga Brochure en PagesDocument21 pagesLiveRiga Brochure en PagesGuntis StirnaNo ratings yet

- Rīga - Zīmols Kura NavDocument57 pagesRīga - Zīmols Kura NavGuntis StirnaNo ratings yet

- Ity Randing: A Shared Vision On in UropeDocument20 pagesIty Randing: A Shared Vision On in UropeGuntis Stirna50% (2)

- Cisco Secure Firewall Threat Defense Virtual (Formerly FTDV/NGFWV)Document12 pagesCisco Secure Firewall Threat Defense Virtual (Formerly FTDV/NGFWV)Wagner MarlonNo ratings yet

- Jms 580Document10 pagesJms 580Arya RamadhanNo ratings yet

- 2-Ccna Security (Iins 210-260)Document513 pages2-Ccna Security (Iins 210-260)Sucy SusaNtyNo ratings yet

- Big Ip Virtual Editions DatasheetDocument14 pagesBig Ip Virtual Editions DatasheetasalihovicNo ratings yet

- Algebra 2 End of Course Test Preparation WorkbookDocument7 pagesAlgebra 2 End of Course Test Preparation Workbookafiwjkfpc100% (2)

- Python Inheritance - Is It Necessary To Explicitly Call The Parents Constructor and Destructor - Stack OverflowDocument2 pagesPython Inheritance - Is It Necessary To Explicitly Call The Parents Constructor and Destructor - Stack OverflowvaskoreNo ratings yet

- HotelDocument8 pagesHoteldhiren swainNo ratings yet

- Resigned Staff and Data BackupDocument18 pagesResigned Staff and Data BackupBryan ChooiNo ratings yet

- Basic StatisticsDocument20 pagesBasic StatisticsRiccardo VieroNo ratings yet

- Agnet & Mikael: Lorem Wine House North Sit AmetDocument28 pagesAgnet & Mikael: Lorem Wine House North Sit AmetMarli DarminNo ratings yet

- Wolf X Ray BrochureDocument56 pagesWolf X Ray BrochureItzelNo ratings yet

- PG Electronics 2020Document23 pagesPG Electronics 2020hmanghh2000No ratings yet

- CSC-1321 Gateway User GuideDocument48 pagesCSC-1321 Gateway User GuideMarkusKunNo ratings yet

- Syllabus MCA PythonDocument2 pagesSyllabus MCA PythonSudha MadhuriNo ratings yet

- Propiñan de Melyor: Javier Martos CarreteroDocument4 pagesPropiñan de Melyor: Javier Martos CarreteroAlejandro ParinoNo ratings yet

- Ctr-Asw-03 PARA CX300ADocument8 pagesCtr-Asw-03 PARA CX300Ayacsibit marlene Monagas SolorzanoNo ratings yet

- Uber Partner Agreement November 10 2014Document19 pagesUber Partner Agreement November 10 2014Prasad ShriyanNo ratings yet

- Mobile Applications Development Unit - 1Document25 pagesMobile Applications Development Unit - 1Arpit Gaur100% (1)

- Marc-Andre Giroux - Production Ready GraphQL (2020) PDFDocument186 pagesMarc-Andre Giroux - Production Ready GraphQL (2020) PDFNahid HossainNo ratings yet

- 3.2 Calculating Limits of Transcendental Functions and Indeterminate FormsDocument13 pages3.2 Calculating Limits of Transcendental Functions and Indeterminate Formscharlene quiambaoNo ratings yet

- Index of - Scimag - Repository - Torrent PDFDocument20 pagesIndex of - Scimag - Repository - Torrent PDFrishitNo ratings yet

- Modeling An API 661 Air Cooler - Intergraph CADWorx & AnalysisDocument2 pagesModeling An API 661 Air Cooler - Intergraph CADWorx & AnalysisdhurjatibhuteshNo ratings yet

- 1P108-00 02 E2215cs062 20160311 PDFDocument29 pages1P108-00 02 E2215cs062 20160311 PDFRachele DaniNo ratings yet

- CCNA1-CH15-Application LayerDocument68 pagesCCNA1-CH15-Application Layerkaramn3matNo ratings yet

- Blender Market - A Unique Market For Creators - ListDocument20 pagesBlender Market - A Unique Market For Creators - ListSteve Durov LarkNo ratings yet

- Page 1 For Layout of Design of C:/Program Files/Dx6/Data/Mydesign - Dx6 05:48 PM Mar 13, 2015Document1 pagePage 1 For Layout of Design of C:/Program Files/Dx6/Data/Mydesign - Dx6 05:48 PM Mar 13, 2015Sushanta Kumar BeheraNo ratings yet

- Vinafix - VN - Tra Ma IC Richtek 1Document42 pagesVinafix - VN - Tra Ma IC Richtek 1jjoaquimmartinsNo ratings yet

- 2023-06-26Document21 pages2023-06-26Cindy GaillatNo ratings yet

- An Overview of Computers and Programming LanguagesDocument34 pagesAn Overview of Computers and Programming Languagesabdalrahman alkiswaniNo ratings yet