Professional Documents

Culture Documents

Qdesempenho

Uploaded by

rivendellOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Qdesempenho

Uploaded by

rivendellCopyright:

Available Formats

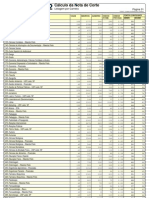

QUADRO DE DESEMPENHO - FUNDOS DE PREVIDNCIA ICATU SEGUROS

JUL-13

jul/13

Previdencia Renda Fixa

Icatu Seg Classic Conservador FIC FIRF(*)

Icatu Seg Moderado B FIC FI RF

Icatu Seg Moderado C FIC FI RF

Icatu Seg Moderado E FIC FI RF

Icatu Seg Classic FIC FI RF

Icatu Seg Moderado FIC FI RF

Icatu Seg Inflao FI RF

Icatu Seg IPCA FIC FI RF

Icatu Seg FIC Privilege RF

ICATU Seg FIC Classic RETORNO REAL

Previdencia Multimercados

Icatu Seg FI Privilege Multimercado

ICATU SEG FIC FIM BRASIL TOTAL

Previdencia Balanceados

Icatu Seg Composto 10B FIC FI Multimercado

Icatu Seg Composto 10C FIC FI Multimercado

Icatu Seg Composto 10E FIC FI Multimercado

Icatu Seg Composto 20B FIC FI Multimercado

Icatu Seg Composto 20C FIC FI Multimercado

Icatu Seg Composto 20E FIC FI Multimercado

Icatu Seg Composto 49B FIC FI Multimercado

Icatu Seg Composto 49C FIC FI Multimercado

Icatu Seg Composto 49E FIC FI Multimercado

Icatu Seg FIC FI Composto I Mult

Icatu Seg FIC FI Composto 20 Multimercado

Icatu Seg Privilege Composto 49 FIM

Previdencia Data Alvo

Icatu Seg Minha Aposentadoria 2010 FIC FI Multi

Icatu Seg Minha Aposentadoria 2020 FIC FI Multi

Icatu Seg Minha Aposentadoria 2030 FIC FI Multi

Icatu Seg Minha Aposentadoria 2040 FIC FI Multi

Icatu Seg Foco Minha Aposentadoria 2020 FIC FI Multi

Icatu Seg Foco Minha Aposentadoria 2030 FIC FI Multi

Icatu Seg Foco Minha Aposentadoria 2040 FIC FI Multi

Indicadores Financeiros

CDI

Dlar Comercial

TR

Poupana

IGP-M

IGP-M + 6% a.a.

IMA - C (Ref: IGPM)

IMA - B (Ref: IPCA)

IMA-B 5 + (Ref.: IPCA)

Ibovespa Fechamento

IBX Fechamento

ltimos 12

Meses

ltimos 24

Meses

ltimos 36

Meses

ltimos 60

Meses

'Acum. 2013

2012

2011

2010

2009

jul/13

jun/13

mai/13

6.28%

4.27%

5.30%

5.48%

6.02%

3.81%

-0.80%

-0.83%

6.34%

5.62%

16.35%

12.11%

14.34%

15.40%

16.59%

11.85%

24.43%

31.03%

17.30%

23.69%

28.32%

21.35%

25.00%

26.95%

28.89%

21.40%

44.53%

46.10%

30.05%

-

53.71%

40.15%

47.25%

51.33%

55.21%

41.27%

-

3.57%

2.41%

3.00%

2.90%

3.20%

1.92%

-7.61%

-11.13%

3.38%

-0.56%

7.61%

5.61%

6.66%

7.33%

7.89%

5.68%

28.23%

32.08%

8.22%

15.68%

10.70%

8.71%

9.78%

10.55%

11.10%

9.01%

11.47%

12.86%

11.44%

7.84%

8.86%

6.89%

7.96%

8.72%

9.27%

7.35%

20.79%

19.21%

9.50%

-

8.93%

7.14%

8.20%

8.84%

9.39%

7.53%

7.82%

20.22%

1.55%

-

0.65%

0.47%

0.56%

0.58%

0.63%

0.43%

1.07%

1.40%

0.66%

0.78%

0.46%

0.30%

0.38%

0.11%

0.15%

-0.02%

-4.63%

-4.22%

0.17%

-0.88%

0.49%

0.34%

0.42%

0.40%

0.44%

0.26%

-2.88%

-6.43%

0.47%

-1.34%

R$ 60,612,935

R$ 200,986,140

R$ 170,079,285

R$ 176,305,070

R$ 257,526,261

R$ 3,422,450

R$ 339,706,559

R$ 245,567,779

R$ 315,925,937

R$ 63,086,276

1.00%

3.00%

2.00%

1.50%

1.00%

2.50%

1.50%

1.50%

0.70%

1.00%

5.89%

-13.90%

16.80%

8.38%

29.48%

-

56.32%

-

2.74%

-25.42%

8.48%

37.21%

11.38%

-7.75%

9.37%

1.21%

9.58%

-

0.61%

2.35%

-0.07%

-11.03%

0.21%

-10.38%

R$ 25,963,838

R$ 6,123,604

0.70%

2.50%

2.81%

3.87%

4.09%

2.14%

3.19%

3.36%

-0.29%

0.77%

1.00%

4.66%

2.71%

1.44%

9.82%

12.12%

12.61%

8.23%

10.52%

10.82%

2.75%

5.01%

5.56%

13.51%

9.69%

5.77%

16.43%

20.13%

20.91%

12.41%

15.95%

16.63%

0.17%

3.32%

4.21%

22.44%

15.75%

4.77%

34.81%

41.92%

43.50%

29.58%

36.45%

37.91%

13.94%

19.58%

21.51%

47.22%

34.96%

-

0.45%

1.05%

1.18%

-0.68%

-0.09%

0.01%

-4.38%

-3.78%

-3.66%

1.63%

-0.04%

-3.42%

6.07%

7.14%

7.39%

6.42%

7.57%

7.69%

7.32%

8.44%

8.69%

7.60%

6.58%

8.83%

5.80%

6.94%

7.18%

2.95%

3.99%

4.28%

-5.45%

-4.51%

-4.17%

7.56%

4.94%

-4.11%

6.39%

7.50%

7.72%

5.74%

6.82%

7.10%

3.58%

4.60%

4.85%

8.41%

6.59%

5.16%

12.22%

13.36%

13.59%

17.38%

18.60%

18.92%

33.33%

34.82%

35.20%

14.35%

15.15%

3.05%

0.53%

0.62%

0.64%

0.63%

0.73%

0.75%

0.95%

1.05%

1.06%

0.67%

0.63%

1.13%

-1.05%

-0.96%

-0.94%

-1.89%

-1.83%

-1.82%

-4.66%

-4.57%

-4.54%

-0.78%

-1.52%

-4.54%

-0.02%

0.07%

0.10%

-0.11%

-0.03%

-0.01%

-0.50%

-0.40%

-0.38%

0.27%

-0.05%

-0.33%

R$ 33,459,778

R$ 61,411,977

R$ 36,358,016

R$ 68,324,171

R$ 117,308,865

R$ 88,643,786

R$ 43,262,973

R$ 107,591,383

R$ 89,982,687

R$ 3,467,798

R$ 12,298,004

R$ 34,903,539

3.00%

2.00%

1.75%

3.00%

2.00%

1.75%

3.00%

2.00%

1.75%

1.00%

2.50%

1.25%

3.93%

4.17%

1.58%

-1.02%

3.19%

0.87%

-1.44%

14.10%

22.15%

21.64%

14.46%

19.69%

19.70%

13.42%

24.40%

32.52%

27.09%

15.63%

28.21%

23.80%

13.70%

46.40%

61.86%

58.93%

41.84%

52.51%

50.03%

36.81%

0.98%

-1.81%

-6.47%

-9.41%

-2.35%

-6.90%

-9.57%

7.98%

16.42%

22.40%

21.26%

15.31%

21.60%

20.33%

9.68%

9.02%

2.87%

-1.81%

7.72%

1.88%

-2.14%

8.48%

11.74%

12.71%

10.63%

10.30%

11.75%

9.77%

9.53%

20.16%

33.81%

38.00%

18.18%

30.29%

35.78%

0.54%

0.84%

1.18%

1.39%

0.74%

1.08%

1.32%

-0.31%

-1.60%

-4.01%

-5.89%

-1.66%

-3.90%

-5.84%

-0.28%

-1.50%

-3.04%

-3.56%

-1.64%

-3.11%

-3.53%

R$ 3,142,113

R$ 56,704,014

R$ 83,667,704

R$ 32,726,859

R$ 10,137,949

R$ 16,929,699

R$ 10,663,836

1.75%

1.75%

1.75%

1.75%

2.50%

2.50%

2.50%

7.24%

11.73%

0.03%

6.20%

5.18%

11.44%

0.12%

2.56%

0.65%

-14.02%

-2.58%

18.28%

47.16%

0.84%

13.66%

12.20%

26.04%

30.50%

30.47%

35.32%

-18.00%

0.99%

31.48%

30.34%

1.91%

21.96%

21.57%

44.72%

54.04%

47.07%

53.31%

-28.56%

-5.91%

60.34%

46.20%

3.96%

40.23%

27.76%

70.86%

92.81%

97.65%

109.19%

-18.94%

2.76%

4.16%

12.08%

0.02%

3.57%

2.02%

5.52%

-7.76%

-6.61%

-10.35%

-20.87%

-9.47%

8.40%

8.94%

0.29%

6.48%

7.81%

14.25%

34.65%

26.68%

34.21%

7.40%

11.55%

11.60%

12.58%

1.21%

7.45%

5.10%

11.38%

12.10%

15.11%

14.48%

-18.11%

-11.39%

9.74%

-4.31%

0.69%

6.90%

11.32%

17.97%

23.50%

17.04%

21.85%

1.04%

2.62%

9.90%

-25.49%

0.71%

6.92%

-1.71%

4.14%

9.88%

18.95%

23.52%

82.66%

72.84%

0.71%

3.37%

0.02%

0.52%

0.46%

1.00%

1.27%

1.29%

1.51%

1.64%

1.74%

0.59%

3.93%

0.00%

0.50%

0.55%

1.02%

-5.76%

-2.79%

-3.95%

-11.31%

-9.07%

0.58%

6.50%

0.00%

0.50%

0.00%

0.49%

-2.07%

-4.52%

-6.27%

-4.30%

-0.88%

Patrimnio Lquido

Tx Adm. (a.a.)

Este documento foi elaborado pela Icatu Seguros com fins meramente informativos. Apesar do cuidado utilizado tanto na obteno quanto no manuseio das informaes apresentadas, a Icatu Seguros no se responsabiliza pela publicao acidental de informaes incorretas, nem

tampouco por decises de investimentos tomadas com base nas informaes contidas neste documento, as quais podem inclusive ser modificadas sem comunicao. Fundos de investimento no contam com garantia do administrador do fundo, do gestor da carteira, de qualquer

mecanismo de seguro ou, ainda, do fundo garantidor de crditos - FGC. A rentabilidade obtida no passado no representa garantia de rentabilidade futura. Para avaliao da performance dos fundos recomendvel uma anlise de perodo mnimo de 12(doze) meses. Ao

investidor recomendada a leitura cuidadosa do prospecto e do regulamento do fundo ao aplicar seus recursos. A rentabilidade divulgada no lquida de impostos.

(*) Para atender a nova classificao de fundos Previdenciarios da Anbima, foi necessario alterar a razo social e a classe CVM do respectivo fundo. A antiga razo social do fundo era ICATU SEG DI FUNDO DE INVESTIMENTO REFERENCIADO CLASSIC.

You might also like

- Recur SoDocument24 pagesRecur SorivendellNo ratings yet

- Tabela 3º Aberto e Jovens 2022 - São PauloDocument24 pagesTabela 3º Aberto e Jovens 2022 - São PaulorivendellNo ratings yet

- Recrutamento - QuestionPro SurveyDocument2 pagesRecrutamento - QuestionPro SurveyrivendellNo ratings yet

- Goodman Entra No Mercado Brasileiro em Parceria Com A WTorreDocument4 pagesGoodman Entra No Mercado Brasileiro em Parceria Com A WTorrerivendellNo ratings yet

- 36 cp109 - Utensilios - UHEP4ODocument4 pages36 cp109 - Utensilios - UHEP4OEdson JuniorNo ratings yet

- Universidade Federal Do Rio Grande Do Sul Escola de Educação FísicaDocument41 pagesUniversidade Federal Do Rio Grande Do Sul Escola de Educação FísicarivendellNo ratings yet

- Trecho 100 CervejaDocument12 pagesTrecho 100 CervejarivendellNo ratings yet

- Wellynthon Enoturismo Siepetur2012Document12 pagesWellynthon Enoturismo Siepetur2012rivendellNo ratings yet

- 1880 Quinta-Feira 22 46sto: Diario Oficial 1 Parte IIDocument1 page1880 Quinta-Feira 22 46sto: Diario Oficial 1 Parte IIrivendellNo ratings yet

- Ata CS Uva e Vinho 14 de Setembro de 2012Document2 pagesAta CS Uva e Vinho 14 de Setembro de 2012rivendellNo ratings yet

- Regulamento Do MastersDocument3 pagesRegulamento Do MastersrivendellNo ratings yet

- Inovacao em Pauta 6 OpiniaoDocument2 pagesInovacao em Pauta 6 OpiniaorivendellNo ratings yet

- UVIBRA - União Brasileira de VitiviniculturaDocument7 pagesUVIBRA - União Brasileira de VitiviniculturarivendellNo ratings yet

- Corte 2012Document2 pagesCorte 2012diogomusicNo ratings yet

- Feliciano e Cura GayDocument1 pageFeliciano e Cura GayrivendellNo ratings yet

- Regulamento DesafioDocument2 pagesRegulamento DesafiorivendellNo ratings yet

- ResumodeatividadesDocument12 pagesResumodeatividadesrivendellNo ratings yet

- Guia Pratico de Investimento Estrangeiro Portfolio BovespaDocument97 pagesGuia Pratico de Investimento Estrangeiro Portfolio BovespaRacquell Silva NarducciNo ratings yet

- Consumo Humano Individual de Vinho Por Ano - Per Capita - 1998-2007Document1 pageConsumo Humano Individual de Vinho Por Ano - Per Capita - 1998-2007rivendellNo ratings yet

- LivretoPlanseq TrabalhodomesticocidadaoDocument8 pagesLivretoPlanseq TrabalhodomesticocidadaorivendellNo ratings yet

- Introdução A SEODocument44 pagesIntrodução A SEOAndré MarquesNo ratings yet

- Cartilha Da Empregada DomesticaDocument36 pagesCartilha Da Empregada DomesticaritaleocadioNo ratings yet

- Contract U16 PDocument11 pagesContract U16 PrivendellNo ratings yet

- Câmara Setorial de Uva e Vinho1Document3 pagesCâmara Setorial de Uva e Vinho1rivendellNo ratings yet

- DIEESE - Trabalho Doméstico 2011Document16 pagesDIEESE - Trabalho Doméstico 2011rivendellNo ratings yet

- Apresentacao PRATADocument83 pagesApresentacao PRATArivendellNo ratings yet

- Guia Pratico de Investimento Estrangeiro Portfolio BovespaDocument97 pagesGuia Pratico de Investimento Estrangeiro Portfolio BovespaRacquell Silva NarducciNo ratings yet

- SP IPT Ed 1713Document159 pagesSP IPT Ed 1713rivendellNo ratings yet

- SYM CIOfDocument6 pagesSYM CIOfrivendellNo ratings yet

- AmexDocument17 pagesAmexGessycaalimaNo ratings yet

- Meninos do RecifeDocument178 pagesMeninos do RecifeAmurabi OliveiraNo ratings yet

- Código Civil Português PDFDocument2 pagesCódigo Civil Português PDFThiago Pires0% (1)

- TJRJ Concurso Público 2014 prova para Comissário de JustiçaDocument16 pagesTJRJ Concurso Público 2014 prova para Comissário de JustiçaVitor Silva RootsNo ratings yet

- Concurso Público Prova Engenheiro CivilDocument18 pagesConcurso Público Prova Engenheiro CivildanieloliveiraesilvaNo ratings yet

- CAT Comunicação Acidente Do TrabalhoDocument1 pageCAT Comunicação Acidente Do TrabalhoRosa Luiza Miranda0% (2)

- Publico PT 03 12Document48 pagesPublico PT 03 12GidalfoLopesNo ratings yet

- Casa Container TCCDocument16 pagesCasa Container TCCPablo BateraNo ratings yet

- Estratégias de Coping em Funcionários PúblicosDocument65 pagesEstratégias de Coping em Funcionários PúblicosLívia SantosNo ratings yet

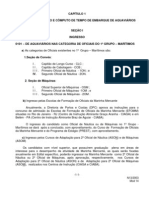

- Ingresso de aquaviários nas categorias de oficiais e subalternos da Marinha MercanteDocument24 pagesIngresso de aquaviários nas categorias de oficiais e subalternos da Marinha MercanteBraine EwaldNo ratings yet

- EFEITOS DA HIDROTERAPIA EM CRIANCAS AssinadoDocument36 pagesEFEITOS DA HIDROTERAPIA EM CRIANCAS AssinadomolinapamelafuenteNo ratings yet

- Lista de exercícios de probabilidade e estatísticaDocument3 pagesLista de exercícios de probabilidade e estatísticaJully SchimidtNo ratings yet

- AgostinhoRetratação PDFDocument12 pagesAgostinhoRetratação PDFvitoria silvaNo ratings yet

- Quando o Diabo Usa A Palavra de Deus Contra NósDocument9 pagesQuando o Diabo Usa A Palavra de Deus Contra NósDAVID ALEXANDRE ROSA CRUZNo ratings yet

- Anais Do VI Simpósio de Pós-Graduação em Educação e V Semana de Arte - Pesquisa em Educação: Processos Criativos em Tempo de ReinvençãoDocument26 pagesAnais Do VI Simpósio de Pós-Graduação em Educação e V Semana de Arte - Pesquisa em Educação: Processos Criativos em Tempo de ReinvençãoMaria LuizaNo ratings yet

- ECA CurriculumDocument121 pagesECA CurriculumthokolanaNo ratings yet

- Ebook 49 Arco Editora - 2022 - Olhares Plurais e Multidisciplinares Na Pesquisa e Extensão - Versão 1Document78 pagesEbook 49 Arco Editora - 2022 - Olhares Plurais e Multidisciplinares Na Pesquisa e Extensão - Versão 1Nathalia UlianaNo ratings yet

- Prova de avaliação de Economia A com questões sobre necessidades humanas, consumo e estrutura de despesasDocument4 pagesProva de avaliação de Economia A com questões sobre necessidades humanas, consumo e estrutura de despesasAnabela Carnide JordãoNo ratings yet

- Quem é o dono do samba? Discursos sobre origem e apropriaçãoDocument118 pagesQuem é o dono do samba? Discursos sobre origem e apropriaçãoAndré de MenezesNo ratings yet

- Introdução à Filosofia no Curso de Ensino de BiologiaDocument4 pagesIntrodução à Filosofia no Curso de Ensino de BiologiaAruny Agi Aruny0% (1)

- Cópia de FERNANDO PESSOADocument12 pagesCópia de FERNANDO PESSOAFindoNo ratings yet

- Oficinas de Aprendizagem LibrasDocument76 pagesOficinas de Aprendizagem LibrasBenjamin Hoffman100% (8)

- Dicionario Magico PDFDocument82 pagesDicionario Magico PDFCastelloNoktuoSammarcoNo ratings yet

- Avaliação Geografia História Betim 4o AnoDocument5 pagesAvaliação Geografia História Betim 4o AnoFabiana MatiasNo ratings yet

- PG 25Document7 pagesPG 25maribatista9400No ratings yet

- Funções reais: monotonia, extremos e operações algébricasDocument208 pagesFunções reais: monotonia, extremos e operações algébricasduraorute1793100% (4)

- CLC 7 Ficha 9 EnunciadoDocument2 pagesCLC 7 Ficha 9 EnunciadoSónia Baptista50% (2)

- Apostila de Sociologia - Instituições SociaisDocument147 pagesApostila de Sociologia - Instituições SociaisDaniel LuizNo ratings yet

- NBR 14863 - Reservatorio de Aco Inoxidavel para Agua Potavel PDFDocument4 pagesNBR 14863 - Reservatorio de Aco Inoxidavel para Agua Potavel PDFMatheus J. NascimentoNo ratings yet

- A Igreja preparada para o arrebatamentoDocument6 pagesA Igreja preparada para o arrebatamentoAlex MouraNo ratings yet