Professional Documents

Culture Documents

Adhunik Consolidating in Steel Business PDF

Uploaded by

laloo01Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adhunik Consolidating in Steel Business PDF

Uploaded by

laloo01Copyright:

Available Formats

Adhunik consolidating in steel business; mining, power growth drivers: Agarwal

Source: IRIS (06-NOV-13) 1

Rating: 5 / 5 stars.Comments |

Post Comment

In an interview with Meena Konar of Myiris.com, Manoj Kumar Agarwal, Managing Director at Adhunik Group says, ''The coming quarter looks very promising for the company's earnings and profitability.'' How do you see your company's earnings performance for the coming quarter? Iron and steel sector has been facing difficult times for the last few quarters. We are seeing slight recovery in the sector with raw material prices coming down. Demand is steady. We expect demand to pick after the coming elections. In mining business as well we are gradually increasing manganese ore production, enhancing capacity of pellets will be operational in next 6 months time. Volumes from Suliepat iron ore mines are expected to pick up. In power business, both units have stabilised and steadily operating at 75%. We also expect power rates to pick up after elections. Our captive mines will be operational in next few quarters. Hence all three sectors are well placed to capture the upside. The coming quarter looks very promising for the companys earnings and profitability. Currently, steel contributes around 60% of revenues and 25% of profitability whereas mining business contributes 40% of revenues and 75% of profitability. Power has just begun its operations. However, going forward, power will also contribute significantly and with volume growth in mining, all three verticals are expected to contribute equally to our overall sales. How do you see the overall industry outlook? Indian Steel Industry has witnessed difficult times in the recent past where raw material prices had risen to unprecedented levels and finished goods prices were not adequate to cover the increase in raw material price. However gradually, situation has improved with coking coal prices sharply coming down along with that of iron ore and coal prices which will be reflected in coming quarters. Demand has been steady in last few quarters and is expected to regain momentum going forward with the expectation of gradual recovery of economy that would positively impact the Auto and Infrastructure sectors. The mining sector, in recent times, has become a crisis hit industry. Regaining confidence depends on how the industry responds to its rising costs, increasingly volatile commodity prices and other challenges such as resource nationalism. The recent mining scam in the various ore-rich states of India has generated controversy, which spans encroachment of forest areas, underpayment of government royalties, and conflict with tribals regarding land-rights etc. The power sector too has witnessed few bottlenecks like fuel shortage, high import cost of coal, shortage of coal supply uncertainty over coal linkages, delays in land acquisition, environmental & other regulatory clearances, ambiguity over new FSAs and issues of price pooling which has resulted in lesser capacity addition. Power distribution is perhaps the weakest link in the Indian power sector, with ATC losses estimated at an alarming rate of about 25% coupled with a weak financial health of state discoms. Rise in

power tariffs have been another stumbling block. Majority of discoms face several hurdles to announce an increase in tariffs because of the state governments, who because of their political motive have kept tariffs low and as a result downplayed for the sector. However, recent government measures have put forward the hopes of revival of the sector. A radically new approach to the sector will soon provide one of the biggest avenues to participate in the development of Indias infrastructure. What growth opportunities are you seeing? Steel is a key product to industries like automotive, construction, transport and power. These are critical infrastructure segments on which the socio-economic development of any country depends. With the need of infrastructural development, the basic raw material, i.e., steel is bound to grow by leaps & bounds. The demand for steel is ever-increasing. According to the World Steel Association, steel demand in India is expected to grow by 5.9% to 75.8 mt in 2013 on the back of monetary easing which in turn would support investment activities. The demand growth should further be accelerated to 7% in 2014. Besides, the Government has also announced a slew of measures to kick start the investment cycle which should create healthy demand for steel. The Indian Mining sector was opened up to Foreign Direct Investment in 1993 post the announcement of the New Mineral Policy. About 80% of the total mining activities are coal and the balance 20% is in various metals like iron, gold, copper, lead, bauxite, zinc and uranium. With 20,000 mineral deposits all over the country, India is self-sufficient in the case of 36 minerals. Demand is expected to increase on the back of increasing levels of consumption, growing infrastructure and progress in the economy. The Government is closely monitoring the overall strategy ofdevelopment and misuse of minerals. With a planned expenditure of USD 1 trillion in infrastructure by 2017, the sector has enormous potential. India aims to add 88,000 MW by the end of the 12th five-year plan. Historically, India has experienced shortages in energy and peak power requirements. Energy deficit averaged 8.1% and the peak power deficit averaged 12.3% during Fiscal 2002 to Fiscal 2007, primarily as a consequence of slow progress in the development of additional generation capacity. The GoI has recognized the power sector as a key infrastructure sector to be developed to sustain India's economic growth and has taken various steps to reform the power sector to attract private participation. Estimates show that India needs to build capacity fast given that every 1% increase in GDP requires power capacity to grow by 0.9%. Feeding India's growing population with consistent power and the low per capita consumption of in India compared to the world average presents a significant potential for sustainable growth in the demand for electric power in India. What are your capex and expansion plans for the coming year? We are consolidating in steel business while mining and power are growth drivers for the Group. In steel business, we are working to upgrade and modernize some of our facilities to improve efficiency and utilization thereby decreasing costs. We envisage moving up the value chain to produce high value added steel like auto steel and structural steel and intend to ramp up our captive iron ore mine to ensure greater cost efficiencies. We will demonstrate the quality of our products by emerging as a preferred vendor to the leading domestic and global OEMs. In the mining business, the future approach will be multipronged. On one hand, the utilization of the Patratu Coal mine and ramping up the Suleipat iron ore mine will ensure consolidation and utilization of mining assets. Simultaneously, there will be focus on volume increase in manganese ore and ramping up of the iron ore beneficiation & pellet project. We will enhance throughput leading to higher revenues. We are working on increasing installed capacity of our pellet plant from 1.2 MTPA to 1.6 MTPA. The Company is also tying up with Orissa Mineral Corporation for the supply of iron ore fines that will enable it to enhance value from waste material. In power, with the commissioning of our 540 MW power plant in Jharkhand, we have successfully moved up the value chain from being a captive generator of power to entering into long term PPAs with power

companies. Henceforth, we would continue our sustained efforts in the power sector to become one of the leading players. Gradually we will increase utilization to achieve 85%-90% utilization rates. Apart from the envisaged 1,080 MW in Jharkhand, we have signed MoUs with Governments of Bihar, Chhattisgarh and Orissa for setting up 1,000 MW in each state. We are working on Super Critical Thermal Power Plants at Janjgir-Champa in Chhattisgarh and Bhagalpur in Bihar for 2x660 MW power plants at each site location. The expected outlays for the said projects are more than Rs. 16,000 crore, which we plan to implement in the 12th Plan. However, we will secure raw material supplies before making big investment in these projects. Adhunik Group has entered the next phase of growth and has emerged as one of the fastest growing alloy, special and construction steel manufacturing companies in the country with significant presence in the mining and power sectors through its subsidiaries. It has completed almost all major capital expenditure for both backward and forward integration and emerged as an integrated manufacturer of special steel with downstream utilization of products. Would you like to convey any message to the shareholders of the company? The Group is contemplating on merging its three companies in India, i.e. AML (Adhunik Metaliks) & ZSL (Zion Steel) into OMML (Orissa Manganese and Minerals), considering the inherent synergies offered by a system that is fully integrated at the product level. AML will reverse merge into OMML and OMML will emerge as single integrated entity post merger. This will provide a much wider product portfolio and a high level of integration to the merged company's operations. The amalgamated entity will be an integrated unit in the true sense as it would be capturing the entire value chain viz. minerals to metal. Merger will also be tax efficient as OMML has healthy profits whereas AML has unabsorbed depreciations. The Group's entry into the power vertical was apt for diversification for existing steel and mining. Steel business provides large income but low margin, mining business provides mid incomes but high margin, power business will provide high revenues but assured margins. It is a prudent mix of all three businesses to counter the challenges of a volatile external environment. Straddling these 3 sectors led us to chart out separate strategies for each of these businesses which operate in common ecosystems but are continuously facing varied regulatory environments and economic conditions. The challenge of facing these conditions and ensuring greater returns to all our stakeholders remains our top priority.

- See more at: http://www.myiris.com/newsCentre/storyShow.php?fileR=20131106114328717&dir= 2013/11/06#sthash.TRv27iJb.dpuf

You might also like

- Mineclosure GuidelineDocument11 pagesMineclosure GuidelineAmit KumarNo ratings yet

- Broad Status Report: Thermal Power ProjectsDocument120 pagesBroad Status Report: Thermal Power Projectslaloo01No ratings yet

- Brochure and Registration Form of CDM 14-10-15Document5 pagesBrochure and Registration Form of CDM 14-10-15laloo01No ratings yet

- What Is Tertiary Treatment PlantDocument8 pagesWhat Is Tertiary Treatment Plantlaloo01No ratings yet

- Uttar Pradesh Caste Certificate - Jati Praman Patra - IndiaFilingsDocument8 pagesUttar Pradesh Caste Certificate - Jati Praman Patra - IndiaFilingslaloo01No ratings yet

- Coal Cons NormsDocument1 pageCoal Cons Normsvicky_hyd_13No ratings yet

- Studies On The Impact of Foreign Direct Investment in The Power ... - Publish Your Master's Thesis, Bachelor's Thesis, Essay or Term PaperDocument9 pagesStudies On The Impact of Foreign Direct Investment in The Power ... - Publish Your Master's Thesis, Bachelor's Thesis, Essay or Term Paperlaloo01No ratings yet

- Overhauling Manual PDFDocument118 pagesOverhauling Manual PDFlaloo01No ratings yet

- Overhauling Manual PDFDocument118 pagesOverhauling Manual PDFlaloo01No ratings yet

- FOREWORD (NOTIFICATION) - Department of Personnel & TrainingDocument237 pagesFOREWORD (NOTIFICATION) - Department of Personnel & Traininglaloo01No ratings yet

- Human RespirationDocument58 pagesHuman Respirationlaloo01No ratings yet

- Place Homework Into The Basket. 2. Pick Up Powerpoint GuideDocument51 pagesPlace Homework Into The Basket. 2. Pick Up Powerpoint Guidelaloo01No ratings yet

- 2 STP (1) (Compatibility Mode)Document62 pages2 STP (1) (Compatibility Mode)Somaia Al-AkrasNo ratings yet

- ! Energy Efficiency HandbookDocument195 pages! Energy Efficiency HandbookHarish Gupta (JSHL)No ratings yet

- Aycl CMDDocument7 pagesAycl CMDlaloo01No ratings yet

- Functional Competency Directory FOR Contracts & Material RolesDocument7 pagesFunctional Competency Directory FOR Contracts & Material Roleslaloo01No ratings yet

- Approved Offline FormDocument4 pagesApproved Offline Formlaloo01No ratings yet

- Commercial. Competency PDFDocument6 pagesCommercial. Competency PDFlaloo01No ratings yet

- NTPC - Cement Manufacturers AssociationDocument53 pagesNTPC - Cement Manufacturers Associationlaloo01No ratings yet

- CPCB Tel Directory 2016Document24 pagesCPCB Tel Directory 2016laloo0150% (2)

- Chapter Addresses As On 21.11.2015Document2 pagesChapter Addresses As On 21.11.2015laloo01No ratings yet

- NTPC Cuts Power Cost by Nearly 14% - The Financial ExpressDocument2 pagesNTPC Cuts Power Cost by Nearly 14% - The Financial Expresslaloo01No ratings yet

- Darjeeling Heritage Trai... Arjeeling Tourism India - 2Document1 pageDarjeeling Heritage Trai... Arjeeling Tourism India - 2laloo01No ratings yet

- Class 9 Science SyllabusDocument5 pagesClass 9 Science Syllabuslaloo01No ratings yet

- Chandrapura Thermal Power Station DVC BokaroDocument1 pageChandrapura Thermal Power Station DVC Bokarolaloo01No ratings yet

- E - Khabar Vol 2 Issue 9 Oct13Document14 pagesE - Khabar Vol 2 Issue 9 Oct13laloo01No ratings yet

- New Application Form For Members (April 2015)Document2 pagesNew Application Form For Members (April 2015)laloo01No ratings yet

- NTPC Arm To Supply 250 M... Next Month - The HinduDocument2 pagesNTPC Arm To Supply 250 M... Next Month - The Hindulaloo01No ratings yet

- CERC Delhi Vacancy28 Last Date Dec 14Document7 pagesCERC Delhi Vacancy28 Last Date Dec 14laloo01No ratings yet

- France For Investing in Several Sectors in BiharDocument2 pagesFrance For Investing in Several Sectors in Biharlaloo01No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Green Supply Chain Management PDFDocument18 pagesGreen Supply Chain Management PDFMaazNo ratings yet

- Stars 1.06Document22 pagesStars 1.06ratiitNo ratings yet

- Class 11 CH 2 NotesDocument10 pagesClass 11 CH 2 NotesJay KakadiyaNo ratings yet

- Analysis Working Capital Management PDFDocument5 pagesAnalysis Working Capital Management PDFClint Jan SalvañaNo ratings yet

- Starting A Caf or Coffee Shop BusinessDocument11 pagesStarting A Caf or Coffee Shop Businessastral05No ratings yet

- Quiz - 1Document3 pagesQuiz - 1Faiz MokhtarNo ratings yet

- IC-02 Practices of Life Insurance-1Document268 pagesIC-02 Practices of Life Insurance-1ewrgt4rtg4No ratings yet

- Hire PurchaseDocument16 pagesHire PurchaseNaseer Sap0% (1)

- Principles of Managerial Finance Brief 6Th Edition Gitman Test Bank Full Chapter PDFDocument58 pagesPrinciples of Managerial Finance Brief 6Th Edition Gitman Test Bank Full Chapter PDFdebbiemitchellgpjycemtsx100% (10)

- Group 2Document54 pagesGroup 2Vikas Sharma100% (2)

- Corporate BrochureDocument23 pagesCorporate BrochureChiculita AndreiNo ratings yet

- UWTSD BABS 5 ENT SBLC6001 Assignment and Case Study Apr-Jul 2019Document16 pagesUWTSD BABS 5 ENT SBLC6001 Assignment and Case Study Apr-Jul 2019Hafsa IqbalNo ratings yet

- Contract CoffeeDocument5 pagesContract CoffeeNguyễn Huyền43% (7)

- Βιογραφικά ΟμιλητώνDocument33 pagesΒιογραφικά ΟμιλητώνANDREASNo ratings yet

- Ch03 - The Environments of Marketing ChannelsDocument25 pagesCh03 - The Environments of Marketing ChannelsRaja Muaz67% (3)

- Operations Management Syllabus for Kelas Reguler 60 BDocument4 pagesOperations Management Syllabus for Kelas Reguler 60 BSeftian MuhardyNo ratings yet

- 03-F05 Critical Task Analysis - DAMMAMDocument1 page03-F05 Critical Task Analysis - DAMMAMjawad khanNo ratings yet

- 01-9 QCS 2014Document8 pages01-9 QCS 2014Raja Ahmed HassanNo ratings yet

- SAVAYA The Martinez-Brothers PriceListDocument2 pagesSAVAYA The Martinez-Brothers PriceListnataliaNo ratings yet

- Ctpat Prog Benefits GuideDocument4 pagesCtpat Prog Benefits Guidenilantha_bNo ratings yet

- Reporting Outline (Group4 12 Abm1)Document3 pagesReporting Outline (Group4 12 Abm1)Rafaelto D. Atangan Jr.No ratings yet

- SGI Monthly Newsletter Title Under 40 CharactersDocument13 pagesSGI Monthly Newsletter Title Under 40 Charactersgj4uNo ratings yet

- Lesson 6 Internal ControlDocument24 pagesLesson 6 Internal ControlajithsubramanianNo ratings yet

- Catalogue 2012 Edition 6.1 (2012-11) PDFDocument382 pagesCatalogue 2012 Edition 6.1 (2012-11) PDFTyra SmithNo ratings yet

- My Project Report On Reliance FreshDocument67 pagesMy Project Report On Reliance FreshRajkumar Sababathy0% (1)

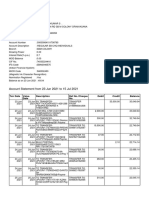

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- Paper 5 PDFDocument529 pagesPaper 5 PDFTeddy BearNo ratings yet

- Understanding consumer perception, brand loyalty & promotionDocument8 pagesUnderstanding consumer perception, brand loyalty & promotionSaranya SaranNo ratings yet

- Notices, Circulars and MemoDocument11 pagesNotices, Circulars and MemoSaloni doshiNo ratings yet

- Steelpipe Sales Catalogue 4th Edition May 12Document61 pagesSteelpipe Sales Catalogue 4th Edition May 12jerome42nNo ratings yet