Professional Documents

Culture Documents

Ex8 8200 PDF

Uploaded by

Elijah PhilpottsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ex8 8200 PDF

Uploaded by

Elijah PhilpottsCopyright:

Available Formats

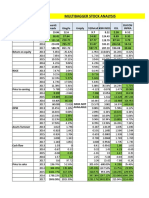

Fi 8200 Homework No.

8 (Please do the following assignment independently; due on 11/11)

You are to use market information taken from the WSJ/WSJ-online and cmegroup.com for trading as of Monday, November 4. 1. Your firm has decided to enter a $50 million notional, 1-year, pay fixed/receive floating interest rate swap having two semi-annual settlement dates. Before soliciting quotes from various swap dealers, your CFO has requested you to independently evaluate the swap. (Assume a 360-day year and that there are 180 days in each six-month interval.) Also, do NOT use your *Swap* software on this question. A. "Price" the swap (Act/360) using only current LIBOR spot rates (see the section Money Rates in the WSJ.) You do not need futures prices to answer this problem. B. Based on your answer in (A), what is the "value" of the swap. C. Assume that instantaneously after entering the swap, interest rates increase by 30 basis points. (In other words assume that the rates you got out of the WSJ in part (A) each increase by 30 basis points or 0.30%). What is the new value of the swap? D. Repeat part A, but instead assume that the swap is to have 4 quarterly settlement dates. Assume 90 days in each interval. To get your 270-day zero coupon/spot rate, you may interpolate between the six and one year LIBOR rates.

2. A. Using your *Swap* software along with Libor spot rates and Eurodollar futures data, price a swap with a 3-year tenor, semi-annual payments and an actual/365, fixed rate day count. Assume that interest volatility is 0.80%. Record both the unadjusted and convexity adjusted rates. Then compare these rates with the interest rate swap rates reported in the WSJ-online (under Market Data Center, click on Bonds, Rates, & Credit Markets and look under Libor Swaps). B. Repeat the above question using instead a 5-year tenor. C. Repeat the above question using instead an 10-year tenor. D. Give the unadjusted and convexity-adjusted values of a $30mm, pay floating/receive fixed swap with semiannual payments that matures on June 15, 2019. The swaps fixed rate is 1.8000% (act/365) and the 6-month the Libor rate in effect for the current period is 0.41126%. (If you can, try to verify this Libor rate at: www.wsj.com (see Market Data center for the appropriate date, or www.bbalibor.com/rates/historical) (see questions 3 and 4 on next page.)

The next 2 questions deal with the financial crisis: 3. Read the article I will distribute in class Ten Bad Ideas Born of the Financial Crisis. Discuss and feel free to express your own views. 2 pages should suffice. 4. In January 2011, as you may recall, the Financial Crisis Inquiry Commission submitted their highly anticipated Final Report of the National Commission on the Causes of the Financial and Economic Crisis in the United States. (a very large copy of the report (662 pages) can be found at http://www.gpo.gov/fdsys/pkg/GPOFCIC/pdf/GPO-FCIC.pdf) While this report received significant attention in the media, several commissioners dissented including Peter Wallison. Wallison has prepared a separate report that has received less attention titled Dissent from the Majority Report of the Financial Crisis Inquiry Commission. His Dissent report begins on page 441 of the main report in the link above. (I will also send a copy of just that part of it to you via email.) Please read this dissenting report (ok to just focus on pages 1-15, but feel free to read on), and provide a 2 page summary.

You might also like

- LBO TrainingDocument18 pagesLBO TrainingCharles Levent100% (3)

- Notes On BTMMDocument206 pagesNotes On BTMMconrad92% (13)

- Scalping Trading - Top 5 Strategies (Making Money With The Ultimate Guide To Fast Trading in Forex and Options) by Andrew C. EllisDocument52 pagesScalping Trading - Top 5 Strategies (Making Money With The Ultimate Guide To Fast Trading in Forex and Options) by Andrew C. Ellisgfgfgfg94% (18)

- DBQuantWeeklyDashboard - 2016 09 19 PDFDocument11 pagesDBQuantWeeklyDashboard - 2016 09 19 PDFcastjamNo ratings yet

- Pitele de CapitalDocument14 pagesPitele de CapitalFelix RemeteaNo ratings yet

- Retail Financial ProjectionDocument10 pagesRetail Financial ProjectionAmit Kumar GargNo ratings yet

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Document10 pagesCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashNo ratings yet

- Solutions For End-of-Chapter Questions and Problems: Chapter EightDocument25 pagesSolutions For End-of-Chapter Questions and Problems: Chapter EightSam MNo ratings yet

- WorldcomDocument5 pagesWorldcomHAN NGUYEN KIM100% (1)

- Multi Bagger AnalysisDocument3 pagesMulti Bagger AnalysisKrishnamoorthy SubramaniamNo ratings yet

- Butler Lumber Final First DraftDocument12 pagesButler Lumber Final First DraftAdit Swarup100% (2)

- Cross Currency SwapDocument23 pagesCross Currency SwapcathmichanNo ratings yet

- EOC08 EdittedDocument12 pagesEOC08 EdittedFilip velico100% (1)

- Concept Check Quiz: First SessionDocument27 pagesConcept Check Quiz: First SessionMichael MillerNo ratings yet

- Commodity TradingDocument0 pagesCommodity TradingNIKNISHNo ratings yet

- 5) Exam Is Due Back Before Midnight (EST) On Nov 5: WWW - Federalreserve.govDocument3 pages5) Exam Is Due Back Before Midnight (EST) On Nov 5: WWW - Federalreserve.govTrevor TwardzikNo ratings yet

- HW NongradedDocument4 pagesHW NongradedAnDy YiMNo ratings yet

- Assignment 1Document2 pagesAssignment 1Khurram Sadiq (Father Name:Muhammad Sadiq)No ratings yet

- Additional QuestionsDocument3 pagesAdditional QuestionsHotel Bảo LongNo ratings yet

- ECO201 Pricniples of Macroeconomics Final ExaminationDocument5 pagesECO201 Pricniples of Macroeconomics Final ExaminationGinoh K.No ratings yet

- SwapsDocument29 pagesSwapsDnyaneshNo ratings yet

- Acct Theory Investments 1 and Cash Spring 2017Document3 pagesAcct Theory Investments 1 and Cash Spring 2017Joshna KNo ratings yet

- Práctica Dirigida 3 2021Document5 pagesPráctica Dirigida 3 2021Winny Vento HerreraNo ratings yet

- BBG EnvironmentDocument6 pagesBBG EnvironmentMiss_Z0eNo ratings yet

- 04-Loans-005 - Reflecting Non-Cash MovementsDocument4 pages04-Loans-005 - Reflecting Non-Cash MovementsKeszeg Beáta ZsuzsánnaNo ratings yet

- Money Banking Financial Markets and Institutions 1st Edition Brandl Solutions Manual 1Document7 pagesMoney Banking Financial Markets and Institutions 1st Edition Brandl Solutions Manual 1jason100% (49)

- Capital Markets Bloomberg AssignmentDocument5 pagesCapital Markets Bloomberg Assignmentqwerty4324No ratings yet

- Banc One Case My SolutionDocument5 pagesBanc One Case My SolutionБорче Шулески67% (3)

- Week 8: Finance: Investment Analysis and Portfolio ManagementDocument2 pagesWeek 8: Finance: Investment Analysis and Portfolio ManagementHw SolutionNo ratings yet

- Problems and Questions - 3Document6 pagesProblems and Questions - 3mashta04No ratings yet

- Fin 1107 - Midterm - DalDocument3 pagesFin 1107 - Midterm - DalDyan LuceroNo ratings yet

- EOC08 UpdatedDocument25 pagesEOC08 Updatedtaha elbakkushNo ratings yet

- 1.) Research Paper (220 Points) (Course Final Assessment)Document5 pages1.) Research Paper (220 Points) (Course Final Assessment)ladycontesaNo ratings yet

- Understanding in Ation-Indexed Bond Markets: Appendix: John Y. Campbell, Robert J. Shiller, and Luis M. ViceiraDocument11 pagesUnderstanding in Ation-Indexed Bond Markets: Appendix: John Y. Campbell, Robert J. Shiller, and Luis M. Viceiraluli_kbreraNo ratings yet

- Forecasting Debt and InterestDocument16 pagesForecasting Debt and InterestRnaidoo1972No ratings yet

- A Couple of Terms Related To Financial ManagementDocument23 pagesA Couple of Terms Related To Financial ManagementMou DeyNo ratings yet

- Corporate Finance Academic Year 2011-2012 TutorialsDocument21 pagesCorporate Finance Academic Year 2011-2012 TutorialsSander Levert100% (1)

- SPL AssignmentDocument2 pagesSPL AssignmentArchana MantriNo ratings yet

- Tiếng anh tài chính ngân hàng: a.payments b.events c.transactionsDocument5 pagesTiếng anh tài chính ngân hàng: a.payments b.events c.transactionsBích NgọcNo ratings yet

- Project (Take-Home) Fall - 2021 Department of Business AdministrationDocument5 pagesProject (Take-Home) Fall - 2021 Department of Business AdministrationAftab AliNo ratings yet

- Pricing and Valuation of Forward Commitments: LiteratureDocument6 pagesPricing and Valuation of Forward Commitments: LiteratureAlvianNo ratings yet

- MCD 2090 Tutorial Questions T9-Wk9Document6 pagesMCD 2090 Tutorial Questions T9-Wk9kazuyaliemNo ratings yet

- Financial Markets Tutorial and Self Study Questions All TopicsDocument17 pagesFinancial Markets Tutorial and Self Study Questions All TopicsTan Nguyen100% (1)

- Ebit Eps AnalysisDocument4 pagesEbit Eps Analysispranajaya2010No ratings yet

- Web Chapter 20 An Introduction To Security ValuationDocument8 pagesWeb Chapter 20 An Introduction To Security ValuationVicky N RockNo ratings yet

- Accounting Textbook Solutions - 60Document19 pagesAccounting Textbook Solutions - 60acc-expertNo ratings yet

- TV M AssignmentDocument2 pagesTV M AssignmentAnn Marie San MiguelNo ratings yet

- ACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionDocument14 pagesACCT 3331 Exam 2 Review Chapter 18 - Revenue RecognitionXiaoying XuNo ratings yet

- Problem ForexDocument8 pagesProblem ForexKushal SharmaNo ratings yet

- Willison TowerDocument2 pagesWillison TowerOdiseGrembiNo ratings yet

- Canada UFEDocument26 pagesCanada UFESam MkandwireNo ratings yet

- Mini-Case 1.1: Inventory PlanningDocument11 pagesMini-Case 1.1: Inventory PlanningMuhammad Shazwan NazrinNo ratings yet

- Tutorial 8Document2 pagesTutorial 8Sean AustinNo ratings yet

- 14.02 Principles of Macroeconomics: Read Instructions FirstDocument11 pages14.02 Principles of Macroeconomics: Read Instructions Firstamrith vardhanNo ratings yet

- SC Eoc08Document25 pagesSC Eoc08vanessagreco17No ratings yet

- Fin 611course Project Part 2Document3 pagesFin 611course Project Part 2peter muliNo ratings yet

- Compare 4 Loans at Once: Inspira 2.0 Civic 2.0 2007Document7 pagesCompare 4 Loans at Once: Inspira 2.0 Civic 2.0 2007director960No ratings yet

- 6 Additional Q in 5th Edition Book PDFDocument28 pages6 Additional Q in 5th Edition Book PDFBikash KandelNo ratings yet

- TM Interest Rate SwapDocument16 pagesTM Interest Rate SwapTran ManhNo ratings yet

- ProblemsDocument3 pagesProblemstamanna bavishiNo ratings yet

- SmithsonDocument9 pagesSmithsonNan DongdongNo ratings yet

- Chapter 008Document25 pagesChapter 008Muhammad Bilal TariqNo ratings yet

- Choose Any Listed Company of Your ChoiceDocument2 pagesChoose Any Listed Company of Your ChoiceArslan GoharNo ratings yet

- MGT 3078 Exam 1Document2 pagesMGT 3078 Exam 18009438387No ratings yet

- Wire SharkDocument5 pagesWire SharkElijah PhilpottsNo ratings yet

- PS 4 Fall 08 AnsDocument5 pagesPS 4 Fall 08 AnsElijah Philpotts100% (1)

- Program of Study MS Bus EconDocument1 pageProgram of Study MS Bus EconElijah PhilpottsNo ratings yet

- Design, Creative, and CollateralDocument1 pageDesign, Creative, and CollateralElijah PhilpottsNo ratings yet

- Bajaj Auto Financial Analysis: Presented byDocument20 pagesBajaj Auto Financial Analysis: Presented byMayank_Gupta_1995No ratings yet

- OI Report Betting On World AgricultureDocument82 pagesOI Report Betting On World Agriculturehoneyjam89No ratings yet

- EC1 Module-2 2023Document5 pagesEC1 Module-2 2023Reymond MondoñedoNo ratings yet

- FIN621 MidTerm 1100MCQsDocument236 pagesFIN621 MidTerm 1100MCQsMohammad AnasNo ratings yet

- EfficientHedgingBarriers PrintDocument47 pagesEfficientHedgingBarriers Printytmusik4No ratings yet

- FI/CO Frequently Used Reports: ControllingDocument9 pagesFI/CO Frequently Used Reports: ControllingfinerpmanyamNo ratings yet

- KskdraftDocument356 pagesKskdraftadhavvikasNo ratings yet

- Preweek Auditing Problems 2014 PDFDocument41 pagesPreweek Auditing Problems 2014 PDFalellieNo ratings yet

- Pfrs 3 and 10 EXAM - FINALDocument12 pagesPfrs 3 and 10 EXAM - FINALElizabeth DumawalNo ratings yet

- JP Morgan ChaseDocument4 pagesJP Morgan ChaseReckon IndepthNo ratings yet

- Complex GroupsDocument12 pagesComplex GroupsRaquibul HasanNo ratings yet

- KwetuCyber CafeDocument41 pagesKwetuCyber CafeVDJ FREDDYE kE (VJ FREDDYE)No ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- Required: Chapter 10 / Segmented Reporting, Investment Center Evaluation, and Transfer PricingDocument3 pagesRequired: Chapter 10 / Segmented Reporting, Investment Center Evaluation, and Transfer Pricingdwcc ms2No ratings yet

- Morningstar Report-636d1777e26a17cb5799148fDocument21 pagesMorningstar Report-636d1777e26a17cb5799148fdantulo1234No ratings yet

- Module 12Document2 pagesModule 12Grace GraceyNo ratings yet

- Past Paper Question 1 With AnswerDocument6 pagesPast Paper Question 1 With AnswerChitradevi RamooNo ratings yet

- Barclays Bank UK PLC Pillar 3 ReportDocument10 pagesBarclays Bank UK PLC Pillar 3 ReporttaohausNo ratings yet

- Finance-Accounting Nam 3 CNTH11Document65 pagesFinance-Accounting Nam 3 CNTH11Nongstan Jie Jie ĐỗNo ratings yet

- Session 7 - Equity - For Students and MoodleDocument74 pagesSession 7 - Equity - For Students and Moodless9723No ratings yet

- RWJ Chapter 4 DCF ValuationDocument47 pagesRWJ Chapter 4 DCF ValuationAshekin MahadiNo ratings yet

- S16 - Scenario Manager - NPVDocument9 pagesS16 - Scenario Manager - NPVSRISHTI ARORANo ratings yet

- Fama On Bubbles: Tom Engsted January 2015Document11 pagesFama On Bubbles: Tom Engsted January 2015torosterudNo ratings yet

- L3 Capital ManagementDocument35 pagesL3 Capital ManagementZhiyu KamNo ratings yet

- Mirabaud IPL Note 16 Apr 07Document5 pagesMirabaud IPL Note 16 Apr 07api-3754205No ratings yet