Professional Documents

Culture Documents

WorldCom Base Report Version 1

Uploaded by

Mohammad ArefOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WorldCom Base Report Version 1

Uploaded by

Mohammad ArefCopyright:

Available Formats

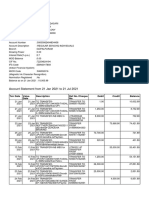

WorldCom Case Study Analysis People Involved in scandal:

CEO: Bernard Ebbers CFO: Scott Sullivan Controller: David Myers Director of accounting: Buford Yates Account Department Manager: Vinson Account Department Manager: Normand

The treatment of line costs as capital expenditures was discovered by WorldComs internal

auditor, Cynthia Coop and Glyn Smith. Investors lost about 180 Billions $. 1983 WorldCom started as LDDS Company (Long Distance Discount Service).

Past jobs for CEO: Basket Ball Coach, motel business owner, he is notorious as penny puncher. LDDS started to attract investors quickly. LDDS started to buy other companies, after 10 years LDDS capital is 6 billions and named as WorldCom. WorldCom bought MCI that total revenue is 18 Billions while WorldCom is only 7 billion. WorldCom is a good place to work and the CEO rocks, in 1999 CEOs salary was 935 k, received about 27 million incentives as stock options. WorldCom started aggressive acquisitions of competitors as a strategy in addition to cost control. CEO was mean with the employees and in the same time was spending money improvidently on his personal life. As someone said it might be easier to talk about what he didnt buy, examples, 132 yachts, hockey team, yakhut building company, 500 000 acres in Canada and golf course. All the money needed to buy the former mentioned items was provided by Banks loans (JP Morgan and Citi bank) secured by WorldCom stocks. Loans total is 408 millions. CEO expected that the future of WorldCom is still better. In 2000, Telecom industry business is storming (Check Why?): In June 99 WorldCom share price is 62 $ At end of 2000 WorldCom share price is 18 $ In 2001 WorldCom share price is 10 $. In 2001, CEO spoke to public claiming that the good days yet to come. Banks started to ask the CEO to pay back the loans, CEO in trouble, in order to pay he started to sell his WorldCom stocks, investors took this as a sign of poor performance particularly for the future. SEC (security and exchange commission) started to review WorldCom financial statement because they look great while the industry is shaking. March 2002, CEO still denies that WorldCom facing any problems. At April 2002, BOD asked CEO to resign, WorldCom share price is 2$.

Scandal: 11 Billion accounting fraud, total assets is overstated, bankruptcy with 5.7 billion in debt, companies lease for phone lines are booked as CAPEX, when you capitalize something, you recognize the expense over much longer period. Ordinarily, this expense is considered as OPEX which deducted on monthly bases, thus it lower the monthly income of the company. This made WorldCom looks healthier. Phone lines move to the balance sheet as assets and expense them on 7, 10 or 15 years through depreciation and amortization instead of having them on income statement as expenses, so the expense of the given period is fewer and the income is greater, WorldCom overstated its profits by 3.8 Billion (disguised expenses). WorldCom created illusionary earnings. Trial held at 2005 Ebbers CEO 25 years in prison Sullivan CFO 5 years in prison Myers Controller 1 year in prison Yates Dir of Acctg 1 year in prison Vinson Acctg Dept Manager 5 months in prison 5 months house arrest Normand Acctg Dept Manager 3 years probation Above 6 individuals agreed to pay a total of $24-34M to settle securities class action case.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Calculating Landed Costs1Document2 pagesCalculating Landed Costs1Siva KumaranNo ratings yet

- KVM Virtualization in RHEL 7 Made EasyDocument15 pagesKVM Virtualization in RHEL 7 Made Easysanchetanparmar100% (1)

- Executive Incentives/Dr. Heba AjlouniDocument19 pagesExecutive Incentives/Dr. Heba AjlouniMohammad ArefNo ratings yet

- Align IT With StrategyDocument19 pagesAlign IT With StrategyJanitvhNo ratings yet

- Forecasting Model For Stratford FestivalDocument2 pagesForecasting Model For Stratford Festivalrkexcel1No ratings yet

- A Dynamic Incease in Revenue at The MAC Belfast Case StudyDocument4 pagesA Dynamic Incease in Revenue at The MAC Belfast Case StudyMohammad ArefNo ratings yet

- Ahli BankDocument136 pagesAhli BankMohammad ArefNo ratings yet

- How Cooking The Books WorksDocument9 pagesHow Cooking The Books WorksMohammad ArefNo ratings yet

- World ComDocument8 pagesWorld ComMohammad ArefNo ratings yet

- AuditingDocument5 pagesAuditingMohammad ArefNo ratings yet

- 110 Studymat SM Case StudiesDocument7 pages110 Studymat SM Case StudiesMohammad ArefNo ratings yet

- Capital StructureDocument4 pagesCapital StructureMohammad ArefNo ratings yet

- SitesDocument1 pageSitesMohammad ArefNo ratings yet

- Replacing A Failed Boot Disk (HP-UX 11.23)Document3 pagesReplacing A Failed Boot Disk (HP-UX 11.23)Mohammad ArefNo ratings yet

- Mass Storage IO Performance Improvements PDFDocument13 pagesMass Storage IO Performance Improvements PDFMohammad ArefNo ratings yet

- C F I S - O: Orporate Raud AND THE Mpact OF Arbanes XleyDocument41 pagesC F I S - O: Orporate Raud AND THE Mpact OF Arbanes XleyMohammad ArefNo ratings yet

- Check SendmailDocument1 pageCheck SendmailMohammad ArefNo ratings yet

- Mem Leak UtilDocument3 pagesMem Leak UtilMohammad ArefNo ratings yet

- Server Tuning On HP-UX PDFDocument7 pagesServer Tuning On HP-UX PDFMohammad ArefNo ratings yet

- Ignite NotesDocument1 pageIgnite NotesMohammad ArefNo ratings yet

- Unix Script AuditDocument10 pagesUnix Script AuditMohammad ArefNo ratings yet

- HP UX NotesDocument7 pagesHP UX NotesMohammad ArefNo ratings yet

- WWW Spritian Com 2012 04 26 How To Remove Reduce A Dead Mirr PDFDocument7 pagesWWW Spritian Com 2012 04 26 How To Remove Reduce A Dead Mirr PDFMohammad ArefNo ratings yet

- HPUX Ip FilterDocument160 pagesHPUX Ip Filterphani_zenNo ratings yet

- Advanced Performance Tuning..Document135 pagesAdvanced Performance Tuning..Satish MadhanaNo ratings yet

- Loyality in JMTMDocument26 pagesLoyality in JMTMMohammad ArefNo ratings yet

- HP UX Tips Tricks PDFDocument17 pagesHP UX Tips Tricks PDFMohammad ArefNo ratings yet

- TCP - Ip Performance WP c02020743 PDFDocument89 pagesTCP - Ip Performance WP c02020743 PDFMohammad ArefNo ratings yet

- SPCDocument27 pagesSPCMohammad ArefNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Basics of Accounting in Small Business NewDocument50 pagesBasics of Accounting in Small Business NewMohammed Awwal NdayakoNo ratings yet

- Worksheet Preparation ExercisesDocument2 pagesWorksheet Preparation ExercisesDalemma FranciscoNo ratings yet

- VUL Mock Exam 2 (October 2018)Document11 pagesVUL Mock Exam 2 (October 2018)Alona Villamor Chanco100% (1)

- P DZupavm Hy TCBJG 4Document6 pagesP DZupavm Hy TCBJG 4sandeepNo ratings yet

- Claim ApplicationDocument2 pagesClaim ApplicationAwkiNo ratings yet

- Hes Private Equity Class SyllabusDocument8 pagesHes Private Equity Class SyllabuseruditeaviatorNo ratings yet

- Quizzer #8 PPEDocument13 pagesQuizzer #8 PPEAseya CaloNo ratings yet

- SIB 675 - Assignment 2upDocument6 pagesSIB 675 - Assignment 2upMelissa TothNo ratings yet

- In Savings Account SoscDocument9 pagesIn Savings Account SoscAbhishek MitraNo ratings yet

- Merger of JSW Steel Limited & Ispat Industries LimitedDocument2 pagesMerger of JSW Steel Limited & Ispat Industries Limitedpriteshvadera12345No ratings yet

- Audit of Receivables: Cebu Cpar Center, IncDocument10 pagesAudit of Receivables: Cebu Cpar Center, IncEvita Ayne TapitNo ratings yet

- TP Vii PDFDocument17 pagesTP Vii PDFshekarj100% (3)

- Turkey Kriz: The Fall and Fall of LiraDocument26 pagesTurkey Kriz: The Fall and Fall of Lirasonam27No ratings yet

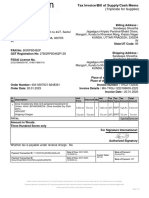

- Invoice DocumentDocument1 pageInvoice DocumentrameshNo ratings yet

- Private Equity & Venture Capital: in The Middle East & AfricaDocument16 pagesPrivate Equity & Venture Capital: in The Middle East & AfricaLewoye BantieNo ratings yet

- Ministry of Education: Teaching Syllabus For Financial Accounting (SHS 1 - 3)Document79 pagesMinistry of Education: Teaching Syllabus For Financial Accounting (SHS 1 - 3)Kingsford DampsonNo ratings yet

- Strategic Business Management July 2017 Mark PlanDocument23 pagesStrategic Business Management July 2017 Mark PlanWong AndrewNo ratings yet

- Unit 4 Dividend DecisionsDocument17 pagesUnit 4 Dividend Decisionsrahul ramNo ratings yet

- 2016 SMIC Annual ReportDocument120 pages2016 SMIC Annual ReportPatricia ReyesNo ratings yet

- Cases - Effective Small Business Management An Entrepreneurial Approach (10th Edition)Document22 pagesCases - Effective Small Business Management An Entrepreneurial Approach (10th Edition)RizkyArsSetiawan0% (1)

- Service Tax Challan ProformaDocument4 pagesService Tax Challan ProformaMurali EmaniNo ratings yet

- Module Fs AnalysisDocument12 pagesModule Fs AnalysisCeejay RoblesNo ratings yet

- AFAR 3 (Test Questions)Document4 pagesAFAR 3 (Test Questions)Lalaine BeatrizNo ratings yet

- B.K.chaturvedi Committee Report On NHDPDocument31 pagesB.K.chaturvedi Committee Report On NHDPAneebNo ratings yet

- 50 Questions To Ask A FranchisorDocument3 pages50 Questions To Ask A FranchisorRegie Sacil EspiñaNo ratings yet

- Tax SssssssDocument3 pagesTax SssssssJames Francis VillanuevaNo ratings yet

- Electronic Fund TransferDocument15 pagesElectronic Fund Transferjunefourth0614No ratings yet

- Financial Statement Analysis As A Tool For Investment Decisions and Assessment of Companies' PerformanceDocument18 pagesFinancial Statement Analysis As A Tool For Investment Decisions and Assessment of Companies' PerformanceCinta Rizkia Zahra LubisNo ratings yet

- Epreuve Écrite D'anglais (BTS 2009)Document2 pagesEpreuve Écrite D'anglais (BTS 2009)Inoussa SyNo ratings yet

- Hedging With Futures PDFDocument35 pagesHedging With Futures PDFmichielx1No ratings yet