Professional Documents

Culture Documents

Property Tax Panchkula

Uploaded by

Manoj SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Tax Panchkula

Uploaded by

Manoj SinghCopyright:

Available Formats

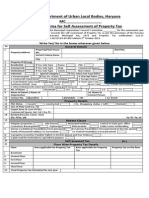

Proforma for Self Assessment of Property Tax

I hereby furnish the following details to the Municipal Corporation Panchkula __________ for the assessment year__________ as an obligation towards the self assessment of Property Tax as per the provisions of the Haryana Municipal Corporation Act, 1994/Haryana Municipal Act, 1973 and Property Tax notification no.S.O. 85/HA.16/1994/S 87 dated 11th October 2013. Sr No . 1 2 Property Address

General Details (Write Yes/ No in the boxes given below)

Municipality: Municipal Corporation Panchkula _________________ Property/ House No. Sector/ Colony Name City Pin Code Ward No.

3 4 5 6 7

9 10 11 12 13 15 16

Property ID (if any) Residential [ ] If Yes, Sub-Type House [ ] Flat [ ] Commercial [ ] If Yes, Sub-Type Shop [ ] Commercial Space [ ] Institutional [ ] If Yes, Sub-Type Comm. [ ] Non Comm. [ ] Educational [ ] Industrial [ ] 8. Special Category [ ] If Yes, Select Sub-Type below Private Hospitals [ ] If Yes, No. of Beds [ ] Marriage Palaces [ ] Stand Alone Cinema Halls [ ] Cinema Halls In Malls/ Multiplex [ ] Banks [ ] Storage Godown [ ] Grain Market/ Subzi mandi/ Timber Market/ Sub-Market Yard- Notified by HSAMB [ ] If Yes, Shops[ ], Booth [ ] Clubs [ ] Hotels Upto 3 star [ ] Hotels Above 3 star [ ] Other Institutions like stand-alone hostels, paying guest houses etc [ ] Private Office Buildings [ ] Restaurants [ ] No. of Floors G.F. [ ] F.F [ ] S.F [ ] T.F [ ] Basement [ ] Name of Owner / Name of Name of Contact Organization Person Contact No. (i)Landline (ii) Mobile +91 Email:

Property Details (Write Yes/ No in the boxes given below)

Plot Status Vacant [ ] Constructed [ ] Size of Plot/ Land (Sq. Yd) Carpet Area (in case of Flats, Commercial Spaces, Spl. Cat.) (Sq. ft.) Rented Area (for Comm. Only) (Sq. ft/Sq. yd) 14. Occupancy status Self [ ] Rented [ ]

Sq. ft/ Sq. yd

17 18 19 20 21 22

Rebate Clause (Write Yes/ No in the boxes given below)

Religious properties [ ] Orphanage [ ] Alm houses [ ] Municipal buildings [ ] Cremation/ Burial ground [ ] Dharamshala [ ] Central or State govt. office [ ] Public Sector Undertaking [ ] Owner is a Defence/ Paramilitary Force personnel [ ] Ex-Service/ Paramilitary Force personnel or his/ her spouse [ ] Family of Deceased Soldiers/ Ex-Servicemen [ ] Ex-Central Paramilitary Force personnel [ ] Is property owned by Freedom Fighter or his/her spouse and War Widows [ Is plot used for horticulture/ agriculture purpose [ ] Property Tax Residential Commercial Industrial Institutional ] (Rs.) Rebate

Self-assessed Tax (Write Yes/ No in the boxes given below)

Total

Balance

Fire Tax (@10% of property tax Total No. of Total other than residential properties) (22+23) Years Tax 23 Period of Settlement of Arrears from to Arrear Amount 24 Tax if already paid G8 No. and Date Balance to be (please attach proof) Paid/ Adjusted 25 Total Amount Payable It is certified that the particulars filled in this form are true and correct to the best of my knowledge, nothing has been concealed. I further declare that I shall be responsible for discrepancy as per provision made in the new property tax notification dated 11.10.2103 and Haryana Municipal Corporation Act, 1994. Place: Date : . Signature of Property Owner Instructions Overleaf

Proforma created by WebMentors for Urban Local Bodies and Municipal Corporation Panchkula

You might also like

- Self Declaration For Propertytax Self Assessment Pro Form ADocument2 pagesSelf Declaration For Propertytax Self Assessment Pro Form Aarchagg100% (1)

- Pannew 1Document2 pagesPannew 1Anonymous czrvb3hNo ratings yet

- A. Registration Checklist: 1. DTI Registration Type 2. LGU RegistrationDocument2 pagesA. Registration Checklist: 1. DTI Registration Type 2. LGU RegistrationenggNo ratings yet

- Statement of Inter-State Sales/Used Form Vat-49Document1 pageStatement of Inter-State Sales/Used Form Vat-49Sanchit JainNo ratings yet

- FATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For IndividualsDocument1 pageFATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For IndividualsSunil ParikhNo ratings yet

- Application For Business License and PermitDocument2 pagesApplication For Business License and PermitEdward Aguirre PingoyNo ratings yet

- Vat 100 PDFDocument3 pagesVat 100 PDFViswaksenuduVinodNo ratings yet

- Pre Requisite-SellerandServiceProviders GeM 4.0Document4 pagesPre Requisite-SellerandServiceProviders GeM 4.0Saurabh dasNo ratings yet

- 49A 49AA in Excel FormatDocument7 pages49A 49AA in Excel Formatneedhikhurana@gmail.comNo ratings yet

- Part A: (For Individuals, Provide in Order of First Name, Middle Name, Surname)Document10 pagesPart A: (For Individuals, Provide in Order of First Name, Middle Name, Surname)Vitesh Tandel AolNo ratings yet

- Nach Form Mirae PDFDocument8 pagesNach Form Mirae PDFKaushalNo ratings yet

- Bir Form 1701 Primer: Page 1 of 22Document22 pagesBir Form 1701 Primer: Page 1 of 22Alexander Cooley0% (1)

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- Form ITR-VDocument2 pagesForm ITR-VSumit ManglaniNo ratings yet

- Pan49aa - PAN Application - PIODocument3 pagesPan49aa - PAN Application - PIORonak MorjariaNo ratings yet

- 49 BPDocument74 pages49 BPsamNo ratings yet

- Bis IndividualDocument1 pageBis Individualapi-296021444No ratings yet

- Addendum To Application FormDocument3 pagesAddendum To Application FormKrishna KalyanNo ratings yet

- FACTA-CRS Non Individual Declaration FormDocument1 pageFACTA-CRS Non Individual Declaration FormGSTMS ANSARINo ratings yet

- 1901 (Encs) 2000Document4 pages1901 (Encs) 2000Alvin John Benavidez Salvador50% (2)

- 1901 (Encs) 2000Document4 pages1901 (Encs) 2000Alvin John Benavidez SalvadorNo ratings yet

- NTN FormDocument1 pageNTN FormAdeel NaveedNo ratings yet

- Pan 49 ADocument4 pagesPan 49 ARajasekhar KollaNo ratings yet

- BIR Form 1904Document1 pageBIR Form 1904keith10567% (6)

- Application For Dealership PDF - 2Document8 pagesApplication For Dealership PDF - 2Tafadzwa Matthew Gwekwerere P.B.CNo ratings yet

- Fomu Ya Tin Number KampuniDocument5 pagesFomu Ya Tin Number KampunitemaNo ratings yet

- BIR Form 1903Document2 pagesBIR Form 1903Earl LarroderNo ratings yet

- Unified Bus Permit Application FormDocument2 pagesUnified Bus Permit Application FormTinah De Lara ParangueNo ratings yet

- GST Registration FormDocument9 pagesGST Registration Formpankaj singlaNo ratings yet

- VAT FormDocument8 pagesVAT FormSonila JainNo ratings yet

- RGD Revised Form A 002Document8 pagesRGD Revised Form A 002Brew-sam ABNo ratings yet

- FATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For EntitiesDocument6 pagesFATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For Entitiesvikas9saraswatNo ratings yet

- Fatca - NSDL Non Ind. V. 21.3 (PG 1-4)Document4 pagesFatca - NSDL Non Ind. V. 21.3 (PG 1-4)digitaltarun99No ratings yet

- Bir Form 1901 BlankDocument4 pagesBir Form 1901 BlankLecel Llamedo100% (1)

- Please Select Title, As ApplicableDocument3 pagesPlease Select Title, As ApplicableCA Amit MehtaNo ratings yet

- Financial Statement AssignmentDocument16 pagesFinancial Statement Assignmentapi-275910271No ratings yet

- Fatca Form (1) (1) 1118-1266-5014-2191-0731-1231Document4 pagesFatca Form (1) (1) 1118-1266-5014-2191-0731-1231Harsh NarwareNo ratings yet

- New Pan Card Application Form 49aDocument2 pagesNew Pan Card Application Form 49ahindeazadNo ratings yet

- Form Vat-01Document6 pagesForm Vat-01Manish MahajanNo ratings yet

- The West Bengal Value Added Tax Rules, 2005 Form 1 Application For New RegistrationDocument20 pagesThe West Bengal Value Added Tax Rules, 2005 Form 1 Application For New RegistrationABHIJIT MONDALNo ratings yet

- Application For Non-Creamy Layer Certificate v0.1Document4 pagesApplication For Non-Creamy Layer Certificate v0.1gouri10No ratings yet

- FATCA Individuals PDFDocument2 pagesFATCA Individuals PDFfordd greenNo ratings yet

- Individual Tax Residency Self-Certification FormDocument2 pagesIndividual Tax Residency Self-Certification FormEmadNo ratings yet

- TIN Application ProcedureDocument3 pagesTIN Application ProcedureJuan Dela CruzNo ratings yet

- (Your Name, Address) (Developer's Name & Address) (Date) : ImportantDocument1 page(Your Name, Address) (Developer's Name & Address) (Date) : ImportantJose JoseNo ratings yet

- FATCA Cams PDFDocument1 pageFATCA Cams PDFPushpakVanjariNo ratings yet

- Ret Wall DesignDocument20 pagesRet Wall DesignManoj SinghNo ratings yet

- Concrete BasicsDocument56 pagesConcrete Basicsengcecbepc100% (6)

- Sewer Hydraulics TablesDocument18 pagesSewer Hydraulics TablesManoj SinghNo ratings yet

- Sewer Haunching CalculationsDocument4 pagesSewer Haunching CalculationsManoj SinghNo ratings yet

- Bondo and Siaya Note FinalDocument3 pagesBondo and Siaya Note FinalManoj Singh100% (1)

- Resume Jagjit SinghDocument2 pagesResume Jagjit SinghManoj SinghNo ratings yet

- Slope HL TablesDocument3 pagesSlope HL TablesManoj SinghNo ratings yet

- Sewerage Design Manual 2013 IndiaDocument976 pagesSewerage Design Manual 2013 IndiaManoj Singh93% (15)

- Table 4.5. Sewer Gradient Required To Generate Self-Cleansing Velocities in Different Sized Pipes (Running Full) (Pg. No. 50)Document4 pagesTable 4.5. Sewer Gradient Required To Generate Self-Cleansing Velocities in Different Sized Pipes (Running Full) (Pg. No. 50)Manoj SinghNo ratings yet

- Cruz Vs FilipinasDocument1 pageCruz Vs FilipinasJan Christopher Elmido100% (1)

- The Warrior Archetype - The Art of ManlinessDocument7 pagesThe Warrior Archetype - The Art of ManlinessArtEconomyNo ratings yet

- League of NationsDocument7 pagesLeague of NationsAbdul HaseebNo ratings yet

- 11 Humss Challenges Encountered by Probationers in CommunityDocument61 pages11 Humss Challenges Encountered by Probationers in Communitycashew.3199914No ratings yet

- Purchase Order Suprabha Protective Products Pvt. LTDDocument2 pagesPurchase Order Suprabha Protective Products Pvt. LTDMaa Diwri PacksysNo ratings yet

- People v. DionaldoDocument4 pagesPeople v. DionaldoejpNo ratings yet

- Report of The African Court On Human and Peoples Rights in The Protection of Human Rights in Africa FinalDocument10 pagesReport of The African Court On Human and Peoples Rights in The Protection of Human Rights in Africa FinalRANDAN SADIQNo ratings yet

- IPC Project ListDocument2 pagesIPC Project ListfishNo ratings yet

- UntitledDocument74 pagesUntitledmichael ayolwineNo ratings yet

- AbortionDocument2 pagesAbortionJosselle KilitoyNo ratings yet

- Travel Insurance: Insurance Product Information DocumentDocument4 pagesTravel Insurance: Insurance Product Information DocumentPetluri TarunNo ratings yet

- CsabaDocument39 pagesCsabaMarie-Pier Bolduc0% (1)

- Khorāsān Sun Persian Xwarenah Is Derived FromDocument5 pagesKhorāsān Sun Persian Xwarenah Is Derived FromAlbanBakaNo ratings yet

- Leln PDFDocument15 pagesLeln PDFMiguel Angel MartinNo ratings yet

- People V MangalinoDocument2 pagesPeople V MangalinoBananaNo ratings yet

- Society and Culture Midterm ExamsDocument4 pagesSociety and Culture Midterm ExamsGoog YubariNo ratings yet

- SEC Vs Baguio Country Club CorporationDocument1 pageSEC Vs Baguio Country Club CorporationMaica Mahusay0% (1)

- Recognition of Foreign Divorce in The PhilippinesDocument9 pagesRecognition of Foreign Divorce in The PhilippinesRaffy Pangilinan0% (1)

- Term Paper About LGBTDocument7 pagesTerm Paper About LGBTcdkxbcrif100% (1)

- The Cold War ReviewDocument25 pagesThe Cold War Reviewegermind90% (21)

- M.A. in Social Work Colleges in North IndiaDocument2 pagesM.A. in Social Work Colleges in North Indiasandeepkumarmsw8442No ratings yet

- Sample Demand For Full Satisfaction of Judgment in CaliforniaDocument3 pagesSample Demand For Full Satisfaction of Judgment in CaliforniaStan Burman100% (3)

- Tarikh Besday 2023Document4 pagesTarikh Besday 2023Wan Firdaus Wan IdrisNo ratings yet

- Nghe Unit 3 Avcđ 3Document1 pageNghe Unit 3 Avcđ 334-Thu Thảo-12A6No ratings yet

- Ic Chapter 6Document10 pagesIc Chapter 6GuruduttNo ratings yet

- Upper-Intermediate TestsDocument3 pagesUpper-Intermediate Testsvsakareva0% (3)

- Tagolino V HRET Case DigestDocument4 pagesTagolino V HRET Case DigestJose Ignatius D. PerezNo ratings yet

- Syquia v. Almeda LopezDocument8 pagesSyquia v. Almeda Lopezmark anthony mansuetoNo ratings yet

- Airport Activities VocabularyDocument3 pagesAirport Activities VocabularyTY FlamencoSNo ratings yet

- Barangan CtsDocument2 pagesBarangan CtsMary Ann PateñoNo ratings yet