Professional Documents

Culture Documents

Turning Risk Into Results - AU1082 - 1 Feb 2012 PDF

Uploaded by

Aarti AhujaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Turning Risk Into Results - AU1082 - 1 Feb 2012 PDF

Uploaded by

Aarti AhujaCopyright:

Available Formats

Turning risk

into results

How leading companies

use risk management

to fuel better performance

ii

Introduction: managing risk

for better performance ....................... 1

Substantial investments made by companies often do not

address more strategic business risk areas. As a result, senior

executives may not perceive risk management as strategic to

the enterprise.

Mature risk management

drives nancial results ........................ 2

Our research suggests that companies with more mature risk

management practices generated the highest growth in revenue,

EBITDA and EBITDA/EV.

Where companies are

looking to drive results ............................ 4

Organizations achieve results from risk in three interrelated

ways: risk management, cost reduction and value creation.

Our RISK vision

Contents

What differentiates

top performers? .................................. 5

Our study found that while most organizations perform the

basic elements of risk management, the top nancial performers

do more.

How leading companies

turn risk into results ............................ 6

Our study ndings suggest that ve components are critical to

transforming risk and driving better business performance.

Conclusion: embracing risk

for better business performance ....... 13

Companies that succeed in turning risk into results will create

competitive advantage. This is the time for senior business

executives to evaluate existing risk investments and consider how

to move beyond compliance to strategic business value.

Results. Improvements. Strategies. Knowledge.

11

Introduction

Managing risk

for better performance

From Enron and WorldCom to the more recent nancial crisis, events

of the last decade have fundamentally shifted how organizations

think about risk. Companies around the world have made substantial

investments in personnel, processes and technology to help mitigate

and control business risk. Historically, these risk investments have

focused primarily on nancial controls and regulatory compliance.

However, these investments have often not addressed more strategic

business risk areas. As a result, senior executives may not perceive risk

management as strategic to the enterprise. Senior executives also may

not have sufcient condence in their ability to identify and address the

risks that could impact the nancial performance or even the viability

of their organization.

A strategic question presents itself: Do organizations with more

mature risk management practices outperform their peers nancially?

Our research and experience tend to suggest yes!

Our point of view is that

companies with more

mature risk management

practices outperform

their peers nancially.

Our client experience,

research and study

results strengthen

that perspective.

Randall Miller

Global Advisory Risk Leader

Ernst & Young

2

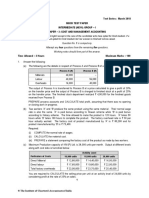

8.3%

10.6%

7.4%

Mature risk management

drives nancial results

* 2011 YTD reported as of 18 November 2011.

Compound annual growth rates 200411* by risk maturity level

In our extensive experience with our clients, we see that companies with more mature risk

management practices outperform their peers nancially. Our research suggests this translates

to competitive advantage: we found that companies with more mature risk management

practices generated the highest growth in revenue, EBITDA and EBITDA/EV.

Six questions for the C-suite

1. What does the concept of risk management encompass? Is this the responsibility of

select functions or an enterprise-wide responsibility?

2. Does your organization see risk as an opportunity or a threat?

3. Is your approach to risk focused solely on compliance, or does it provide strategic value that

improves performance?

4. How condent are you that the organization is managing the risks that really matter?

5. Do you know which risks, if managed well, will increase or decrease the value of and

results for your organization?

6. How do you know that you are you getting the most from your risk management strategy?

Revenue

16.8%

Top 20%

Middle 60%

Bottom 20%

2

EBITDA

20.3%

9.5%

EBITDA/EV

4.1%

2.5%

2.1%

33

Summary of key ndings

Using a global, quantitative survey (based on 576 interviews

with companies around the world and a review of more than

2,750 analyst and company reports), we assessed the

maturity level of risk management practices and then

determined a positive relationship between risk management

maturity and nancial performance.

We identied the leading risk management practices that

differentiated the various maturity levels and organized them

into specic risk components.

Our ndings suggest that:

The top-performing companies (from a risk maturity

perspective) implemented on average twice as many of the

key risk capabilities as those in the lowest-performing group.

Companies in the top 20% of risk maturity generated three

times the level of EBITDA as those in the bottom 20%.

Financial performance is highly correlated with the level of

integration and coordination across risk, control and

compliance functions.

Effectively harnessing technology to support risk

management is the greatest weakness or opportunity for

most organizations.

4

Where companies are

looking to drive results

Our experience indicates that organizations achieve results from risk in three

interrelated ways. Some companies focus on mitigating overall enterprise risk, while

others focus on efciency, reducing the overall cost of controls. Still others look to

create value, often through a combination of risk mitigation and cost reduction.

Risk mitigation

In a worst-case scenario, an organizations risks can proliferate at a far faster rate than

its ability to provide coverage. Organizations need to have the ability to identify and

address key risk areas and the agility to quickly close the gaps through:

Identifying and understanding the risks that matter

Differentially investing in the risks that are mission critical to the organization

Effectively assessing risks across the business and driving accountability and ownership

Demonstrating the effectiveness of risk management to investors, analysts and regulators

Cost reduction

For many organizations, nding cost efciencies in every facet of the organization

continues to be critical to survival in this volatile economic environment. Opportunities

for cost reduction may include:

Implementing a new risk operating model to materially improve the cost structure

Reducing cost of control spend through improved use of automated controls

Streamlining or eliminating duplicative risk activities

Improving process efciency through automated centers, business activities and

continuous monitoring

Value creation

Many organizations are looking for ways where risk and control management can help

improve business performance. Opportunities may include:

Achieving superior returns from risk investments

Accepting and owning the right risks to achieve competitive advantage

Improving controls around key processes

Using analytics to optimize the risk portfolio and improve decision-making

Using risk management savings to fund strategic corporate initiatives

Cost

reduction

Value

creation

Risk

mitigation

Value

creation

Risk

mitigation

Cost

reduction

Cost

reduction

Risk

mitigation

Value

creation

5

What differentiates

top performers?

Our study found that while most organizations perform the basic elements of risk management, the top performers do more. We

found specic risk practices that were consistently present in the top performers (i.e., top 20% based on risk maturity) that were not

present in the bottom 20%. These risk practices can be organized into the following challenge areas, as depicted in the chart below.

Our study ndings suggest that these components are critical to transforming risk and driving better business performance.

The RISK Agenda: research study leading practices

Enhance risk strategy Embed risk management

Improve controls and processes Optimize risk management functions

Turning

risk into

results

1here is a lormal meLhod lor delninq accepLable levels

ol risk wiLhin Lhe orqanizaLion.

SLress LesLs are used Lo validaLe risk Lolerances.

Leadership has puL in place an ellecLive risk

manaqemenL proqram.

Planninq and risk reporLinq cycles are coordinaLed

so LhaL currenL inlormaLion abouL risk issues is

incorporaLed inLo business planninq.

Lines ol business have esLablished key risk indicaLors

(KRls) LhaL predicL and model risk assessmenL.

SellassessmenL and oLher reporLinq Lools are

sLandardized across Lhe business.

ConLrols have been opLimized Lo improve ellecLiveness,

reduce cosLs and supporL increased business perlormance.

Key risk and conLrol meLrics have been esLablished and

updaLed Lo address impacLs on Lhe business.

CompleLion ol riskrelaLed Lraininq is incorporaLed

inLo individual perlormance.

Risk moniLorinq and reporLinq Lools are sLandardized

across Lhe orqanizaLion.

lnLeqraLed Lechnoloqy enables Lhe orqanizaLion Lo

manaqe risk and eliminaLes or prevenLs redundancy

and lack ol coveraqe.

OrqanizaLions conducL Lwoway, open communicaLions

abouL risk wiLh exLernal sLakeholders.

CommunicaLion is LransparenL and Limely, providinq

sLakeholders wiLh Lhe relevanL inlormaLion LhaL conveys

Lhe decisions and values ol Lhe orqanizaLion.

1he board or manaqemenL commiLLee plays a leadinq

role in delninq risk manaqemenL ob|ecLives.

A common risk lramework has been adopLed and

implemenLed across Lhe orqanizaLion.

lssue Lrackinq, moniLorinq and reporLinq are reqularly

perlormed usinq CRC solLware.

OrqanizaLions Lalk abouL Lheir risk manaqemenL and

conLrol lramework in Lheir annual reporL.

OrqanizaLions provide assurance Lo Lheir cusLomers and

oLher sLakeholders usinq independenL reporLs (e.q., SOCR).

Enable risk management Communicate risk coverage

Risk idenLilcaLion and assessmenL are reqularly

perlormed usinq CRC solLware.

1he reporLinq sysLem noLiles all sLakeholders allecLed

by a risk, noL |usL Lhose in Lhe luncLion or area where

Lhe risk was idenLiled.

6

How leading companies

turn risk into results

Companies that succeed in turning risk into results will create competitive advantage through more efcient

deployment of scarce resources, better decision-making and reduced exposure to negative events. Now is the

time for senior business executives to begin applying a broad risk lens to the business.

Strengthen risk governance and oversight

Dene risk strategy and oversight with

accountability for risk management at the

board and executive levels

Improve controls

and processes

Integrate risk and performance management

Embed an enterprise approach to risk

assessment and monitoring into business

planning and performance management

Coordinate multiple risk functions

Improve leverage across multiple risk

functions to expand coverage, reduce

cost and enhance value to the business

Enhance business-level performance

Enable the organization to differentially

manage key risks with optimized processes

and controls at the business level

Audit committee and

management expectations

Company goals, strategies

and business initiatives

Applying a broad

risk lens to the business

Optimize risk

management

functions

Embed risk

management

Enhance risk

strategy

Desired results

Cost: reduce overall

cost of control spend by

30%; leverage automated

controls more effectively

Risk: align risks to

corporate strategy;

embed risk culture across

the enterprise and reduce

risk overlap through

improved coordination

Value: differentially

invest in the risks that

matter to drive EBITDA;

improve controls around

key business processes

Traditional risk

management functions

Internal Audit, Compliance, IT Risk Management, Information

Security, Legal, Tax, Transactions, SOX Compliance

Enable risk management, communicate risk coverage

The RISK Agenda Results lens

When it comes to strategy development and execution, its important for risk to

enable business performance not simply protect the business.

Michael Herrinton

Americas Advisory Risk Leader

Ernst & Young LLP

7

Case in point

Enhance risk strategy

Global 50 company uses strong risk governance

to strengthen stakeholder communication

A Global 50 consumer products company wanted to increase transparency and communications with stakeholders. To do this, it

began by establishing a Risk Committee at the Board level. Although the board itself acts as a risk committee, no one on the board

had been specically assigned to risk. They then established a Risk Committee at the executive level and brought in a Chief Risk

Ofcer (CRO). And they identied risk champions at the business level.

What top performers are doing right

Our research and study results show that top-performing

companies have the following risk management practices

in place:

Two-way open communications about risk occur with

external stakeholders.

Communication is transparent and timely, providing

stakeholders with the relevant information that conveys

the decisions and values of the organization.

The board or management committee plays a leading

role in dening risk management objectives.

A common risk framework has been adopted and

implemented across the organization.

The RISK Agenda: research study leading practices

Enhance risk strategy Embed risk management

Improve controls and processes Optimize risk management functions

Turning

risk into

results

Enable risk management Communicate risk coverage

Effective risk management starts at the top with clarity around

risk strategy and governance. It is critical that the proper

oversight and accountability exist at the board and executive

levels. At the management level, executives need to play a

crucial role in assessing and managing risk. An enhanced

governance structure, board-level reporting and communications

result in improved visibility, accountability and transparency.

Additionally, effective reporting and oversight ultimately

improve strategic decision-making.

Enhancing risk strategy enables organizations to more effectively

anticipate risk. However, even with the most robust preventative

risk strategy in place, unforeseen events can still occur that may

affect performance. So, while it is imperative to proactively

identify strategies that mitigate risk before an event occurs, it is

equally important to develop reactive strategies that enable the

organization to respond quickly if a risk does materialize.

To establish better external communication, the company developed a governance structure and increased its overall risk agenda by:

Aligning risk to strategy. This can occur at different levels. The most basic level is to put additional assumptions around the

overall strategic plan, which typically looks three to ve years out. The organization listed these additional assumptions, and

then asked the three basic questions to develop a risk prole and identify the strategic risks: 1) What has to go right to achieve

our strategy? 2) What could go wrong? and 3) How would we know?

Embedding risk principles into the business unit planning cycle. The organization asked the same three questions of the

business units as they put together their 12-month forecasts to identify the operational risks.

Developing a risk governance structure also included establishing the organizations risk appetite, dening the risk universe,

determining how the business would measure risk and establishing enabling technology to help manage risk.

Asking the three questions at both the strategic and operational levels enabled the organization to document 80% of the risks that

have an impact on performance. Establishing a risk governance structure, identifying roles and responsibilities, and developing a

mandate and scope for each risk committee increased internal stakeholder communication.

By identifying the strategic and operational risks that were impacting the organizations performance, and by establishing a

coordinated approach to risk across the enterprise, this consumer products company was able to communicate its risk strategy

condently and openly with external stakeholders, strengthening relationships and building greater trust in the market.

8

The value of good risk management

We dont understand the value of our risk initiatives, complained a company executive team. They are costing us a lot of money,

implementation is so slow that it is hampering our agility and theres confusion at the board level in terms of the reports they receive.

We just cant get a handle on what everyone is doing and how well they are doing it. Why? Because risk was not embedded into the

business, roles and responsibilities were not clearly identied and there was no coordination among risk functions. As a result, the

executive team had no visibility into the organizations health from a risk perspective.

To resolve the issue, the client set about to embed risk management into the business by:

Developing a value tree. The organization had already identied the top 10 to 15 risks. It had also identied the top ve

performance indicators. However, it did not understand the link between the two. The value tree helped the organization link

the top ve performance indicators to the top risks.

Linking risk to the strategic planning cycle. The organization had already identied its top risks, but it needed to take the next

step and link those risks to its strategic planning cycle.

Inserting risk principles into the business planning cycle. By linking risk to the business planning cycle, the organization was

able to prioritize and link the key risks to its operations.

Reviewing the capital agenda. The organization had spent a great deal of time reducing operational spend, but it had not addressed

the capital spend. The goal was to achieve efciencies of 15% to 20%. The organization reviewed how it allocated capital.

Embedding risk principles into M&A. The organization was growing through M&A and expansion into emerging markets. To

maximize the strategic value of these initiatives, the CRO embedded risk principles into M&A and emerging market activities.

The organization also had to shift the General Counsels approach to risk. The General Counsel believed that risk was something that

shouldnt be documented that once it was written down it would become a liability. By creating a direct link between risk and 10-K

statements, the organization was able to get much needed buy-in from the General Counsel.

Embed risk management

What top performers are doing right

Our research and study results show that top-performing companies

have the following risk management practices in place:

There is a formal method for dening acceptable risk

thresholds within the organization.

Stress tests are used to validate risk tolerances.

Leadership has put in place an effective risk management program.

Planning and risk reporting cycles are coordinated so that

current information about risk issues is incorporated into

business planning.

The RISK Agenda: research study leading practices

Enhance risk strategy Embed risk management

Improve controls and processes Optimize risk management functions

Turning

risk into

results

Enable risk management Communicate risk coverage

8

Risk is inherent in every business, but organizations that embed

risk management practices into business planning and performance

management are more likely to achieve strategic and operational

objectives. Top-performing companies understand that risk

needs to be embedded as part of an organizations DNA.

Several years ago, many organizations were focused on mitigating

risks, controlling costs, keeping the business out of trouble and

protecting the brand. Today, more and more organizations are

focused on developing risk management strategies that enable

the business. For the rst time, we are clearly seeing organizations

identify the links among business, technology and risk strategies

how they all t together.

Case in point

9

Optimize risk management functions

Many executives have no idea what the return on their risk investment is. If they

say that their return is neutral, I tell them that I dont think thats good enough.

Jonathan Blackmore

Advisory Risk Partner

Europe, Middle East, India and Africa

Ernst & Young

Use consistent methods and practices. Applying a disciplined

approach to risk management across the organization will help

risk functions speak the same language when reporting to

the board.

Implement common information and technology. Sharing

information and technology tools is critical to aligning key

business risks and creating visibility to risk management

activities throughout the organization.

As an organization changes and grows, its risk, control and

compliance activities often become fragmented, siloed,

independent and misaligned. This has an impact on both the

governance oversight and the business itself. Often, there are

multiple communications to management and the board that

overlap and cause confusion. And, a lack of coordination among

functions can increase costs and fatigue on the business.

By taking the following steps, an organization can reduce its risk

burden (overlap and redundancy), lower its total costs, expand

coverage and drive efciency:

Align mandate and scope. Aligning monitoring and control

functions to the risks that matter most to the business can

optimize the value of the organizations risk management

functions.

Coordinate infrastructure and people. A continual evaluation

of capability levels and gaps, consistency of roles and

responsibilities, and investment in skills development

promotes efciency.

The RISK Agenda: research study leading practices

Enhance risk strategy Embed risk management

Improve controls and processes Optimize risk management functions

Turning

risk into

results

Enable risk management Communicate risk coverage

9

What top performers are doing right

Our research and study results show that top-performing

companies have the following risk management practices

in place:

Completion of risk-related training is incorporated into

individual performance.

Risk monitoring and reporting tools are standardized across

the organization.

Integrated technology enables the organization to manage risk

and eliminates or prevents redundancy and lack of coverage.

Overlap and duplication of risk activities have been identied

and are being addressed.

10

Case in point

A leading pharmaceuticals company creates

action plan for self-funding risk initiatives

Tired of the state of their organizations risk environment, senior executives of a pharmaceutical company gathered the leaders of

each risk function Internal Audit, SOX, Legal and Regulatory, Compliance and ERM. The executives then listed a series of issues

relative to overall risk management:

Confusion around risk coverage at the Board level

Burden on the business units

Lack of coordination and communication in the development of more than 13 separate risk assessments

Development of seven different risk calendars

Timing of risk activities that didnt align to the rhythm of the business

Gaps in addressing key risks

Overlaps in roles and responsibilities within risk functions

They then gave their risk leaders three days to identify as a team their current state, establish a future state and develop an action

plan with a ROI that would self-fund all future risk initiatives. Accompanying this challenge was an ultimatum: if they couldnt come

back to the executive team with a viable solution, they would be replaced with risk leaders who could. Individually, the executive

team indicated that each risk leader would receive top marks for their current efforts. However, because each spent so much time

building silos rather than breaking them down, as a group the risk leaders received a failing grade. The organization had

reengineered nance, supply chain and plant operations. It was time to reengineer risk management.

Knowing that they couldnt tackle everything at once, the risk team put together a business plan that produced quick xes to

simple issues and generated early wins. In particular, the risk team focused on six specic actions:

1. Creating a single planning calendar that aligned with the business cycle

2. Reviewing mandate, scope and processes for each function to identify gaps and overlaps that they needed to address

3. Coordinating risk assessments that met the needs of most of the risk functions, thereby reducing the number of risk

assessments from 13 to 2

4. Adopting a common framework, nomenclature and risk universe

5. Developing risk mitigation strategies

6. Using common technology tools to collect information into a single repository that all risk functions could access

In addition to these six actions, the risk team also focused on creating a single view of risk that broke down the silos, improving

communication and coordination.

As a result of their efforts, the risk team was able to create a single view of risk that focused on the risks that mattered most, placed

less pressure on the business, created greater agility and responsiveness to risk-related issues, and was self-funding.

11

Case in point

Improve controls and processes

Consolidating multiple sets of controls and compliance requirements into a single

framework enabled by GRC technology removes duplication and simplies

compliance sometimes reducing the effort by half.

Bernie Wedge

Americas IT Risk and Assurance Leader

Ernst & Young LLP

What top performers are doing right

Our research and study results show that top-performing companies

have the following risk management practices in place:

Lines of business have established key risk indicators (KRIs)

that predict and model risk assessment.

Self-assessment and other reporting tools are standardized

across the business.

Controls have been optimized to improve effectiveness,

reduce costs and support increased business performance.

Key risk metrics have been established at the business level.

Although organizations understand the value of building controls

and processes that focus on risk, many organizations still

struggle to create optimal control environments that balance

cost with risk.

By optimizing controls around key business processes, harnessing

automated versus manual controls, and continuously monitoring

critical controls and KPIs, organizations can improve performance

and reduce the cost of controls spend.

The RISK Agenda: research study leading practices

Enhance risk strategy Embed risk management

Improve controls and processes Optimize risk management functions

Turning

risk into

results

Enable risk management Communicate risk coverage

Global 200 consumer products company streamlines

controls and costs

A Global 200 consumer products company determined that its cost of control was too high. The companys over-controlled

environment was hindering Finances ability to effectively respond to changes in the competitive landscape. The company wanted to

reduce its cost of controls to help drive a 50% reduction in its 100 million controls costs spend.

To achieve its goal, the consumer products company implemented three big ideas:

1. Establish a global Controls Center of Excellence (CCoE) that designs and mandates a common set of controls

2. Embrace controls developed by the CCoE by using standard SAP prevent controls

3. Use embedded controls in SAP to provide assurance

The global CCoE enabled the company to automate more than 90% of its prevent controls and decommission duplicate and ineffective

legacy controls. By using SAP, the company minimized the use of manual detect controls, driving a more efcient, effective and

paperless controls environment. Finally, by leveraging the embedded controls in SAP, as well as analytic tools and dashboards,

management was able to receive real-time, transparent assurance that the control environment was working effectively.

12

Enable risk management,

communicate risk coverage

Now more than ever, organizations need to have a comprehensive and coordinated

governance, risk and compliance management approach. Technology can play an

important role in enabling change and in nding the right balance among risk, cost

and value across the enterprise.

Paul van Kessel

Global IT Risk and Assurance Leader

Ernst & Young

Organizations also need to leverage their technology for maximum

benet. This does not mean risk initiatives should be technology-

led. Rather, technology should be an enabler of change. Current

GRC tools have the ability to enable an entire risk agenda. This

can include minimizing redundancies, improving risk coverage

and automating controls. However, organizations need to ensure

that any risk-focused IT strategy aligns with broader risk and

business strategies.

Making a move from being risk-averse to risk-ready may require a

signicant shift. Organizations will want an executive champion to

lead it, as well as tone-from-the-top support and executives who

lead by example. Ultimately, risk management is about changing

the culture of the business. It is about changing the lens through

which leaders view the decisions they make. To help shift the

perspective within an organization, executives may want to ask

the following questions:

Where are we as a business?

What is our appetite for change?

What kind of organization are we?

The answers to these questions provide the basis upon which risk

management decisions can be made.

As part of any change management effort, organizations will also

want to communicate openly and often with all stakeholders. For

greater assurance, organizations should provide stakeholders

with independent, third-party verication.

The RISK Agenda: research study leading practices

Enhance risk strategy Embed risk management

Improve controls and processes Optimize risk management functions

Turning

risk into

results

Enable risk management Communicate risk coverage

12

What top performers are doing right

Our research and study results show that top-performing companies

have the following risk management practices in place:

Issue tracking, monitoring and reporting are regularly performed

using GRC software.

Risk dashboards are automated and include governance, risk

and compliance indicators.

Risk identication and assessment are regularly performed

using GRC software.

13

Conclusion

Embracing risk for better

business performance

Our research ndings and study results support Ernst & Youngs experience with our clients that turning risk into results requires

a multifaceted approach:

Enhance risk strategy. Effective risk management starts at the top with effective strategy and governance. It is critical that the

proper oversight and accountability exist at the board and executive levels. Of equal importance is the need for ownership of risk

throughout the organization. At the management level, executives need to play a crucial role in assessing and managing risk.

Embed risk management. Risk is inherent in every business, but organizations that embed risk management practices into

business planning and performance management are more likely to achieve strategic and operational objectives. Conducting an

enterprise risk assessment can help to prioritize and identify opportunities for improvement.

Optimize risk management functions. By aligning and coordinating risk activities across all risk and compliance functions,

organizations can reduce their risk burden (overlap and redundancy), lower their total costs, expand coverage and drive efciency.

Improve controls and processes. By optimizing controls around key business processes, harnessing automated versus manual

controls and continuously monitoring critical controls and KPIs, organizations can improve performance and reduce the cost

of controls spend.

Enable risk management, communicate risk coverage. Moving your organization from being risk-averse to risk-ready will require

an executive champion to lead it, as well as tone-from-the-top support and executives who lead by example. You will want to

communicate openly and often with all stakeholders, provide third-party assurance and leverage technology for maximum benet.

Creating competitive advantage

Both our research and our deep experience serving companies around the world indicate that companies that succeed in turning risk

into results will create competitive advantage. This is the time for senior business executives to evaluate existing risk investments

and consider how to move beyond compliance to addressing the issues around strategic business value and the approach outlined

in this study can serve as an invaluable road map.

13

Risk is now becoming the fourth dimension of business. People were the

rst dimension. Process became the second dimension during the height

of the manufacturing era. Evolving technology formed the third dimension.

Embedding risk as the fourth dimension of business has the potential to

fundamentally transform how organizations connect risk to reward.

Ernst & Young

Assurance | Tax | Transactions | Advisory

About Ernst & Young

Ernst & Young is a global leader in assurance, tax,

transaction and advisory services. Worldwide,

our 152,000 people are united by our shared

values and an unwavering commitment to quality.

We make a difference by helping our people,

our clients and our wider communities achieve

their potential.

Ernst & Young refers to the global organization

of member firms of Ernst & Young Global

Limited, each of which is a separate legal entity.

Ernst & Young Global Limited, a UK company

limited by guarantee, does not provide services

to clients. For more information about our

organization, please visit www.ey.com.

About Ernst & Youngs Advisory Services

The relationship between risk and performance

improvement is an increasingly complex and

central business challenge, with business

performance directly connected to the

recognition and effective management of risk.

Whether your focus is on business transformation

or sustaining achievement, having the right

advisors on your side can make all the difference.

Our 20,000 advisory professionals form one of

the broadest global advisory networks of any

professional organization, delivering seasoned

multidisciplinary teams that work with our clients

to deliver a powerful and superior client

experience. We use proven, integrated

methodologies to help you achieve your strategic

priorities and make improvements that are

sustainable for the longer term. We understand

that to achieve your potential as an organization

you require services that respond to your specic

issues, so we bring our broad sector experience

and deep subject-matter knowledge to bear in a

proactive and objective way. Above all, we are

committed to measuring the gains and identifying

where the strategy is delivering the value your

business needs. Its how Ernst & Young makes

a difference.

2012 EYGM Limited.

All Rights Reserved.

EYG no. AU1082

In line with Ernst & Youngs commitment to minimize

its impact on the environment, this document has

been printed on paper with a high recycled content.

This publication contains information in summary form and is

therefore intended for general guidance only. It is not intended

to be a substitute for detailed research or the exercise of

professional judgment. Neither EYGM Limited nor any other

member of the global Ernst & Young organization can accept

any responsibility for loss occasioned to any person acting

or refraining from action as a result of any material in this

publication. On any specific matter, reference should be made

to the appropriate advisor. The opinions of third parties set out

in this publication are not necessarily the opinions of the global

Ernst & Young organization or its member firms. Moreover, they

should be viewed in the context of the time they were expressed.

Contacts

Global

Paul van Kessel +31 88 40 71271 paul.van.kessel@nl.ey.com

Randall Miller +1 312 879 3536 randall.miller@ey.com

Americas

Mike Herrinton +1 703 747 0935 michael.herrinton@ey.com

Bernie Wedge +1 404 817 5120 bernard.wedge@ey.com

Europe, Middle East, India and Africa (EMEIA)

Jonathan Blackmore +27 11 772 3023 jonathan.blackmore@za.ey.com

Manuel Giralt Herrero +34 91 572 7479 manuel.giraltherrero@es.ey.com

Asia-Pacic

Rob Perry +61 3 9288 8639 rob.perry@au.ey.com

Troy Kelly +852 2629 3238 troy.kelly@hk.ey.com

Japan

Yoshihiro Azuma +81 3 3503 3500 azuma-yshhr@shinnihon.or.jp

Giovanni Stagno +81 3 3503 1159 stagno-gvnn@shinnihon.or.jp

You might also like

- Managing Risk in Extraordinary TimesDocument8 pagesManaging Risk in Extraordinary TimesKunle Akintunde100% (1)

- How Mature Is Your Risk Management - HBRDocument6 pagesHow Mature Is Your Risk Management - HBRJancarlo Mendoza MartínezNo ratings yet

- Seven Steps To Enterprise Risk ManagementDocument10 pagesSeven Steps To Enterprise Risk ManagementPranabDash2013No ratings yet

- Ibm ErmDocument7 pagesIbm ErmpokingdeviceNo ratings yet

- 10 Minutes Building Enterprise Risk Management EngDocument8 pages10 Minutes Building Enterprise Risk Management Engvuongkh1No ratings yet

- Essential Guide To Risk Management - Ernst & YoungDocument6 pagesEssential Guide To Risk Management - Ernst & Youngshecat260471No ratings yet

- Enterprise Risk Management - Integrated Framework: Applying COSO'sDocument49 pagesEnterprise Risk Management - Integrated Framework: Applying COSO'sTutu BazatuNo ratings yet

- Fraud Risk Assessment FormDocument2 pagesFraud Risk Assessment FormShelvy SilviaNo ratings yet

- A Practical Guide To Creating A Leading Practice Risk Appetite StatementDocument13 pagesA Practical Guide To Creating A Leading Practice Risk Appetite Statementraul.riveraNo ratings yet

- IRM Operational Risks BookletDocument28 pagesIRM Operational Risks Bookletyusufiwa100% (1)

- 3Document22 pages3Aliza ArdanaNo ratings yet

- Prasad KodaliDocument9 pagesPrasad KodalijtnylsonNo ratings yet

- BearingPoint 2005 Scenario Analysis For Basel II - Operational Risk ManagementDocument10 pagesBearingPoint 2005 Scenario Analysis For Basel II - Operational Risk ManagementerkingulerNo ratings yet

- Operational Risk ProfileDocument23 pagesOperational Risk ProfileDigong SmazNo ratings yet

- bcbs292 PDFDocument61 pagesbcbs292 PDFguindaniNo ratings yet

- Maintaining an Entity's Risk ProfileDocument10 pagesMaintaining an Entity's Risk ProfileAnushka SeebaluckNo ratings yet

- ERM Risk AppetiteDocument9 pagesERM Risk AppetiteAbid StanadarNo ratings yet

- A Structured Approach To Building Predictive Key Risk IndicatorsDocument6 pagesA Structured Approach To Building Predictive Key Risk IndicatorsmbelgedeshuNo ratings yet

- BCG Art of Risk Management Apr 2017 Tcm9 153878Document21 pagesBCG Art of Risk Management Apr 2017 Tcm9 153878Alma LanderoNo ratings yet

- Managing Risks in GovernmentDocument20 pagesManaging Risks in GovernmentMuhammad Ismail100% (1)

- Operational RiskDocument136 pagesOperational RiskNaveed Ahmed SethiNo ratings yet

- Risk Management Framework For MCX (Stock Exchange)Document4 pagesRisk Management Framework For MCX (Stock Exchange)Anuj GoyalNo ratings yet

- The Gathering Storm Climate Change and Data Center ResiliencyDocument25 pagesThe Gathering Storm Climate Change and Data Center Resiliencyxuyen tranNo ratings yet

- Emerging Risk MitigationDocument36 pagesEmerging Risk MitigationgatotgNo ratings yet

- Ior Kri Event Slides AcDocument15 pagesIor Kri Event Slides AcAnonymous iMq2HDvVqNo ratings yet

- Project SchedulingDocument18 pagesProject SchedulingVijaya AlukapellyNo ratings yet

- Risk Management v0.1Document47 pagesRisk Management v0.1Ashwini BalaNo ratings yet

- Bci Supply Chain Resilience REPORT 2018Document40 pagesBci Supply Chain Resilience REPORT 2018Shahnewaj SharanNo ratings yet

- Understand MyselfDocument38 pagesUnderstand MyselfNenad PetrövicNo ratings yet

- Risk Management Process GuideDocument15 pagesRisk Management Process GuideleonciongNo ratings yet

- Insurance IAIS ICP 10 Internal ControlDocument53 pagesInsurance IAIS ICP 10 Internal ControlCarlos Pires EstrelaNo ratings yet

- 38 Principles+for+Sound+Management+of+Operational+RiskDocument21 pages38 Principles+for+Sound+Management+of+Operational+RiskIsaac_BassmanNo ratings yet

- Final Erm PlaybookDocument112 pagesFinal Erm PlaybookKunal BNo ratings yet

- Risk Management MethodsDocument7 pagesRisk Management MethodsJere Jean ValencerinaNo ratings yet

- Risk ManagemtnDocument233 pagesRisk ManagemtnClaudia Silvia AndreiNo ratings yet

- Enterprise Risk Management-Tools and Techniques For Implementation - Part IIDocument43 pagesEnterprise Risk Management-Tools and Techniques For Implementation - Part IISandy100% (1)

- Board RAS Summary TemplateDocument10 pagesBoard RAS Summary Templateamit100% (1)

- How To Quantify and Manage Inherent Risk For Third PartiesDocument16 pagesHow To Quantify and Manage Inherent Risk For Third Partiesmukesh mohanNo ratings yet

- Risk Appetite GuideDocument20 pagesRisk Appetite GuideSyed Abbas Haider Zaidi100% (1)

- ADM4355A Course OutlineDocument15 pagesADM4355A Course OutlineCatherine LiNo ratings yet

- ERM PresentationDocument13 pagesERM PresentationBhargav Rishabh BaruahNo ratings yet

- RM GuidelinesDocument62 pagesRM GuidelinesHe BinNo ratings yet

- LR 2 Risk ManagementDocument23 pagesLR 2 Risk ManagementMoybul AliNo ratings yet

- Risk Culture - IRM 2Document30 pagesRisk Culture - IRM 2AdeelSiddiqueNo ratings yet

- Operational Risk: Risk Management in BankingDocument14 pagesOperational Risk: Risk Management in BankingMinelaSNo ratings yet

- Third Party Risk Management Solution - WebDocument16 pagesThird Party Risk Management Solution - Webpreenk8No ratings yet

- Ey Conduct Risk BarometerDocument24 pagesEy Conduct Risk BarometerKumar SambhavNo ratings yet

- FSA Risk Assessment FrameworkDocument76 pagesFSA Risk Assessment FrameworkSwethaBalla100% (1)

- Effective ChallengeDocument10 pagesEffective Challengeabcd_xyzxyzNo ratings yet

- The Influence of Corporate Governance in Risk ManagementDocument10 pagesThe Influence of Corporate Governance in Risk Managementsharukh taraNo ratings yet

- Risk Management Standards1880Document34 pagesRisk Management Standards1880Direct55No ratings yet

- Use Risk Impact/Probability Chart Manage ICT Congress RisksDocument2 pagesUse Risk Impact/Probability Chart Manage ICT Congress RisksJonathanA.RamirezNo ratings yet

- Explained Risk AppetiteDocument30 pagesExplained Risk Appetiteeftychidis100% (3)

- Threat And Risk Assessment A Complete Guide - 2020 EditionFrom EverandThreat And Risk Assessment A Complete Guide - 2020 EditionNo ratings yet

- Accenture Managing Risk in Extraordinary TimesDocument8 pagesAccenture Managing Risk in Extraordinary Timesee1993No ratings yet

- Integrating risk and performance for business successDocument7 pagesIntegrating risk and performance for business successDaryan DiazNo ratings yet

- Risk Management Principles for OrganizationsDocument11 pagesRisk Management Principles for OrganizationsSonnyNo ratings yet

- FM Global Risk Management PracticeDocument10 pagesFM Global Risk Management Practicechujiyo100% (1)

- Fiction and Nonfiction Power PointDocument74 pagesFiction and Nonfiction Power PointAarti AhujaNo ratings yet

- Paper 8Document29 pagesPaper 8Aarti AhujaNo ratings yet

- HTML ProgramsDocument4 pagesHTML ProgramsAarti AhujaNo ratings yet

- Marketing MixDocument2 pagesMarketing MixAarti AhujaNo ratings yet

- CCD MarkettingDocument47 pagesCCD Markettingmack2coolNo ratings yet

- Exchange Traded FundsDocument9 pagesExchange Traded FundsAarti AhujaNo ratings yet

- 50 Brain Teasers and Lateral Thinking PuzzlesDocument3 pages50 Brain Teasers and Lateral Thinking PuzzlesJustin PuscasuNo ratings yet

- What Is GlobalizationDocument1 pageWhat Is GlobalizationAarti AhujaNo ratings yet

- Reference Groups and Their Impact on Consumer BehaviorDocument13 pagesReference Groups and Their Impact on Consumer Behaviornightking_1No ratings yet

- 634589005318183750Document46 pages634589005318183750Aarti AhujaNo ratings yet

- CCD and Barista Final Study 31st March 2013Document17 pagesCCD and Barista Final Study 31st March 2013Aarti AhujaNo ratings yet

- Glob & CSR ImpDocument36 pagesGlob & CSR ImpAarti AhujaNo ratings yet

- Laura MayesDocument43 pagesLaura MayesAarti AhujaNo ratings yet

- ProjectDocument63 pagesProjectAarti AhujaNo ratings yet

- Globalization and Its Impact On Agriculture and Industry ?: Best Answer - Chosen by VotersDocument7 pagesGlobalization and Its Impact On Agriculture and Industry ?: Best Answer - Chosen by VotersAarti AhujaNo ratings yet

- SQL: The Query Language: R &G - Chapter 5Document25 pagesSQL: The Query Language: R &G - Chapter 5Adam PerryNo ratings yet

- Objectives For Final ProjDocument18 pagesObjectives For Final ProjAarti AhujaNo ratings yet

- Executive SummaryDocument53 pagesExecutive SummaryAarti Ahuja100% (1)

- Brand Implementation As Strategic Corporate Responsibilty Enn BN NDocument9 pagesBrand Implementation As Strategic Corporate Responsibilty Enn BN NAarti AhujaNo ratings yet

- Basic Concepts of Operation ResearchDocument11 pagesBasic Concepts of Operation ResearchAarti AhujaNo ratings yet

- Debate TopicsDocument1 pageDebate TopicsAarti AhujaNo ratings yet

- Logic Is A Language For ReasoningDocument22 pagesLogic Is A Language For ReasoningAarti AhujaNo ratings yet

- HTTPDocument24 pagesHTTPAarti AhujaNo ratings yet

- Derivatives Project ReportDocument92 pagesDerivatives Project Reportkamdica83% (23)

- QuestionnairefvgrvDocument6 pagesQuestionnairefvgrvAarti AhujaNo ratings yet

- Turning Risk Into Advantage: A Case Study: KPMG's Evolving World of Risk ManagementDocument12 pagesTurning Risk Into Advantage: A Case Study: KPMG's Evolving World of Risk ManagementAarti AhujaNo ratings yet

- Importance of Customer Satisfaction & RetentionDocument62 pagesImportance of Customer Satisfaction & RetentionAarti AhujaNo ratings yet

- Turning Risk Into Advantage: A Case Study: KPMG's Evolving World of Risk ManagementDocument12 pagesTurning Risk Into Advantage: A Case Study: KPMG's Evolving World of Risk ManagementAarti AhujaNo ratings yet

- Exchange Traded FundsDocument9 pagesExchange Traded FundsAarti AhujaNo ratings yet

- Indian CG Scorecard PDFDocument91 pagesIndian CG Scorecard PDFJill MehtaNo ratings yet

- Taxguru - In-How To Write A Reply To Show Cause Notice Under GSTDocument4 pagesTaxguru - In-How To Write A Reply To Show Cause Notice Under GSTMSFNo ratings yet

- Principles of Accounting Needles 12th Edition Test BankDocument70 pagesPrinciples of Accounting Needles 12th Edition Test BankCharles Lussier100% (30)

- Ap - CashDocument13 pagesAp - CashDiane PascualNo ratings yet

- Hot Topics HK CADocument2 pagesHot Topics HK CAMubashar HussainNo ratings yet

- Opap 2010 Annual ReportDocument115 pagesOpap 2010 Annual ReportkasipetNo ratings yet

- Paper 3 Cost and Management Accounting PDFDocument6 pagesPaper 3 Cost and Management Accounting PDFMEGHANANo ratings yet

- Bookkeeping Service BusinessDocument11 pagesBookkeeping Service BusinessPrincess BersaminaNo ratings yet

- Annual Report Messer Group GMBH 2020Document140 pagesAnnual Report Messer Group GMBH 2020Curt CNo ratings yet

- PR P4-5a 29 November 2016Document8 pagesPR P4-5a 29 November 2016Amiratul Ratna Putri50% (2)

- Tender for MS Grill Repair and Replacement WorksDocument30 pagesTender for MS Grill Repair and Replacement WorksDhaval ParmarNo ratings yet

- Emily Schlager ResumeDocument1 pageEmily Schlager Resumeapi-252519261No ratings yet

- Maths Project: Planning A Home BudgetDocument10 pagesMaths Project: Planning A Home Budgetadil rizviNo ratings yet

- CPAT Reviewer - Key Audit MattersDocument3 pagesCPAT Reviewer - Key Audit MattersZaaavnn VannnnnNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Regulation of Co-Operative Banks in IndiaDocument47 pagesRegulation of Co-Operative Banks in IndiaNeed NotknowNo ratings yet

- Skema Audit InternalDocument4 pagesSkema Audit InternaligoeneezmNo ratings yet

- Estas Questões São Independentes Do Texto Apresentado Na PARTE IDocument11 pagesEstas Questões São Independentes Do Texto Apresentado Na PARTE Ijanastarr99No ratings yet

- Auditing A Practical Approach Canadian 2nd Edition Moroney Test BankDocument21 pagesAuditing A Practical Approach Canadian 2nd Edition Moroney Test Bankronaldgonzalezwjkpizoctd100% (17)

- Commission On Audit: Republic of The Philippines Regional Office No. VII Cebu CityDocument31 pagesCommission On Audit: Republic of The Philippines Regional Office No. VII Cebu Citysandra bolokNo ratings yet

- Auditing Harold) PDFDocument251 pagesAuditing Harold) PDFSuada Bőw Wéěžý100% (1)

- Uddhav Galande Income Tax Project (MBA (Finance)Document55 pagesUddhav Galande Income Tax Project (MBA (Finance)Uddhav GalandeNo ratings yet

- B2-Internal Control, Audit and Compliance in CGDocument6 pagesB2-Internal Control, Audit and Compliance in CGWedaje AlemayehuNo ratings yet

- Basics of Accounting eBookDocument1,190 pagesBasics of Accounting eBookArun Balaji82% (11)

- Auditing Theory Audit of The Inventory and Warehousing CycleDocument15 pagesAuditing Theory Audit of The Inventory and Warehousing CycleMark Anthony Tibule100% (2)

- I General: Internal Audit ChecklistDocument32 pagesI General: Internal Audit Checklistlaltamater83% (12)

- Accounting Principles Warren Chapter 1Document17 pagesAccounting Principles Warren Chapter 1AbdinourNo ratings yet

- Act Constitutiv in EnglezaDocument10 pagesAct Constitutiv in EnglezaFlori OpreaNo ratings yet

- At-5909 Risk AssessmentDocument7 pagesAt-5909 Risk Assessmentshambiruar100% (2)

- BE309 Final Exam Due March 5Document3 pagesBE309 Final Exam Due March 5GrnEyz79100% (1)