Professional Documents

Culture Documents

Bank Settlement Process

Uploaded by

Faisal KhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Settlement Process

Uploaded by

Faisal KhanCopyright:

Available Formats

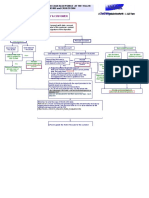

A typical Payment Settlement Process

Bob

Jake

Bob wants to send money $100 to Jake and uses (for example) a Mobile to Mobile (P2P) payment solution to send money instantly. ! Both are using two different banks. How does this work?

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

Bob

Jake

Lets use the example above, Bob wants to send his friend Jake money. Assuming they are using some real-time mobile solution that sends money across instantly. ! Both Bob & Jake are using two different banks. So the question usually asked is how is the money instantly transferred across? ! In Bob's bank? how does the core banking software move money and how is this money, suddenly posted in Jake's bank account, which might be using a different core banking software?

Faisal Khan (Payments Consultant) http://about.me/faisal.khan (c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

SWITCH

X Bank Used by Bob

Y Bank Used by Jake

Settlement Bank Z for the P2P System (Switch)

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

In most cases, a settlement bank is used. The settlement bank will usually settle all the net transactions at the end of the day (at a particular anointed time and will settle the net funds for all the participating member banks). In this example, let us consider three banks:

!

X-Bank (which is the bank Bob uses) Y-Bank (which is the bank Jake uses) Bank Z - which is the settlement bank for all these participating banks using the switch.

Faisal Khan (Payments Consultant) http://about.me/faisal.khan (c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

SWITCH

-$100

+$100

X Bank Settlement Bank Z for the P2P System (Switch)

Y Bank

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

At a particular time, (lets take this clock for example), when Bob sends money across to Jake, at 9:40:00 AM, a message is generated on a switch (think of a switch as a nancial router/ authority that both the banks agree-to/listen-to). This message (and lets not get into the technical details of the message) simply says, in a secure, irrevocable manner that: ! "Y-Bank, please pay Jake US$ 100, as I have already taken US$ 100 from Bob, from his X-Bank". ! ! Remember, nothing more than a message is sent across. No money actually moves. Just an "instruction" (or message).

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

SWITCH

-$100

+$100

X Bank

Y Bank

Bob Bank Account: Debit US$ 100 Bank-X Settlement Account: Credit US$ 100

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

Jake Bank Account: CREDIT US$ 100 Bank-Y Settlement Account: DEBIT US$ 100

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

Here is where the magic that seemed so confusing, actually happens - how does the money move? ! The short answer is - its doesn't move (yet!) ! X-Bank will deduct money from Bob's account (US$ 100) and credit this money in its own bank Settlement Account. Think of this settlement account as an SWITCH IOU Account, or a safekeeping account. ! Y-Bank will take money from its own Settlement Account or Switch IOU Account, and credit the money to Jake's account. ! The assumption here was, that when both these banks decided to do business with the switch and each other, they decided they would need a Settlement Account and this account will be funded by the bank's own money, which would be used to fund the transfers, pending the actual net settlement of funds.

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

In simple words, we will loan the money to whomsoever needs it immediately, because I have already been assured by the switch that the money is available, and you will settle with me later on.

! ! !

If you assume that both X-Bank and Y-Bank started the day with US$ 1,000 in their settlement accounts, then this is how the ledger would reect as the transaction was done: Before Transaction: X-Bank Settlement Account: US$ 1,000.00 Bob's Bank Account: US$ 100.00 Y-Bank Settlement Account: US$ 1,000.00 Jake's Bank Account: US$ 0.00

! ! ! !

(Lets assume Bob has US$ 100 only and Jake has zero money, at the start of the transaction). After the transaction is done, this is how the accounts will look like: X-Bank Settlement Account: US$ 1,100.00 Bob's Bank Account: US$ 0.00 Y-Bank Settlement Account: US$ 900.00 Jake's Bank Account: US$ 100.00

Faisal Khan (Payments Consultant) http://about.me/faisal.khan (c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

SWITCH

X Bank Used by Bob

Y Bank Used by Jake

Settlement Bank Z for the P2P System (Switch)

End of Day Settlement Time (Batch Processing)

Faisal Khan (Payments Consultant) http://about.me/faisal.khan (c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

During the day, a lot many transactions can happen, back and forth for different accounts between each participating member bank. As a switch operator or payment system operator, they too will have a Settlement Bank to use.

!

Participating banks appoint a time when they will do net settlements (transfers In/ Out) with the Settlement Bank of the Switch Operator. This is usually done during banking hours for RTGS type of a transfer.

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

Settlement Bank Z! for the P2P System (Switch)

X Bank! Used by Bob

Y Bank! Used by Jake

Bank-X Settlement Account: Debit US$ 100 - 1 Transaction bank-z settlement Account: CREDIT US$ 100 - 1 TRANSACTION

Bank-Y Settlement Account: credit US$ 100 - 1 Transaction bank-z settlement account: debit US$ 100 - 1 TRANSACTION

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

So, the nal ledger of accounts would looks something like this:

!

Before Transaction:

!

X-Bank Settlement Account: US$ 1,000.00 Bob's Bank Account: US$ 100.00 Y-Bank Settlement Account: US$ 1,000.00 Jake's Bank Account: US$ 0.00 Bank-Z: Settlement Account for X-Bank: US$ 0.00 Bank-Z: Settlement Account for Y-Bank: US$ 0.00

!

After the transaction is done, this is how the accounts will look like:

!

X-Bank Settlement Account: US$ 1,100.00 Bob's Bank Account: US$ 0.00 Y-Bank Settlement Account: US$ 900.00 Jake's Bank Account: US$ 100.00 Bank-Z: Settlement Account for X-Bank: US$ 0.00 Bank-Z: Settlement Account for Y-Bank: US$ 0.00

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

and the end of the batch process day, this is how the ledges would look like (expanding it to show how the transfer are made)

X-Bank Settlement Account: US$ 1,00.00 Bob's Bank Account: US$ 0.00 Y-Bank Settlement Account: US$ 900.00 Jake's Bank Account: US$ 100.00 Bank-Z: Settlement Account for X-Bank: US$ 100.00 Bank-Z: Settlement Account for Y-Bank: US$ 0.00

! !

and transfer to the nal Bank (Y-Bank): X-Bank Settlement Account: US$ 1,00.00 Bob's Bank Account: US$ 0.00 Y-Bank Settlement Account: US$ 900.00 Jake's Bank Account: US$ 100.00 Bank-Z: Settlement Account for X-Bank: US$ 0.00 Bank-Z: Settlement Account for Y-Bank: US$ 100.00

! !

Final transfer to Y-Bank X-Bank Settlement Account: US$ 1,00.00 Bob's Bank Account: US$ 0.00 Y-Bank Settlement Account: US$ 1000.00 Jake's Bank Account: US$ 100.00 Bank-Z: Settlement Account for X-Bank: US$ 0.00 Bank-Z: Settlement Account for Y-Bank: US$ 0.00

Faisal Khan (Payments Consultant) http://about.me/faisal.khan (c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

A typical Payment Settlement Process

Now you will notice...

!

X-Bank's Settlement Account and Y-Bank's Settlement Account have both been topped up back to their initial investment of US$ 1,000

!

Bob's Bank Account is US$ 0.00 Jake's Bank Account is US$ 100.00

!

and the Settlement accounts at Bank-Z for X-Bank and Y-Bank are US$ 0.00 each as all has been settled.

Faisal Khan (Payments Consultant) http://about.me/faisal.khan

(c) Copyright 2013-2014. Faisal Khan & Company. All Rights Reserved.

You might also like

- STP Quick Guide for USD MT202 Customer TransfersDocument2 pagesSTP Quick Guide for USD MT202 Customer TransferscodeblackNo ratings yet

- Customer Information File User Manual PDFDocument314 pagesCustomer Information File User Manual PDFFahim KaziNo ratings yet

- Clear 2 PayDocument2 pagesClear 2 PayJyoti KumarNo ratings yet

- Swift PMPG Guidelines IntradayliquiditylitfDocument46 pagesSwift PMPG Guidelines IntradayliquiditylitfSamuel BedaseNo ratings yet

- SEPA PAYMENTS MESSAGESDocument14 pagesSEPA PAYMENTS MESSAGESPranay SahuNo ratings yet

- All About Swift Software in BanksDocument15 pagesAll About Swift Software in BanksDeepthi RavichandhranNo ratings yet

- SEPA Payment Initiation Format (PAIN.001)Document9 pagesSEPA Payment Initiation Format (PAIN.001)Rajendra PilludaNo ratings yet

- SWIFT Messages: Each Block Is Composed of The Following ElementsDocument10 pagesSWIFT Messages: Each Block Is Composed of The Following ElementsMAdhuNo ratings yet

- Doxim Loan OriginationDocument4 pagesDoxim Loan OriginationVincentXuNo ratings yet

- SWIFT - Bankers World Online UserGuideDocument38 pagesSWIFT - Bankers World Online UserGuideRaul BatistaNo ratings yet

- FSTEP Islamic - Treasury - OperationDocument89 pagesFSTEP Islamic - Treasury - Operationalhoreya100% (1)

- Eracom HSMDocument43 pagesEracom HSMEngineerrNo ratings yet

- Core Banking SolutionsDocument13 pagesCore Banking Solutionssharmil_jainNo ratings yet

- Electronic Delivery of Financial ServicesDocument19 pagesElectronic Delivery of Financial ServicesShailesh ShettyNo ratings yet

- Swiftready Label - For Corproates Cash ManagementDocument17 pagesSwiftready Label - For Corproates Cash ManagementFreeman JacksonNo ratings yet

- Finacle OriginationDocument6 pagesFinacle OriginationAnand KumarNo ratings yet

- SwiftDocument28 pagesSwiftShailendra SenNo ratings yet

- Accounting Concept of Currency Chest TransactionDocument1 pageAccounting Concept of Currency Chest TransactionAjoydeep DasNo ratings yet

- National Electronic Fund TransferDocument18 pagesNational Electronic Fund TransferKuldeep KushwahaNo ratings yet

- Financial Gateway 9.2Document5 pagesFinancial Gateway 9.2MayankSinghNo ratings yet

- Very Easy Money Transfer: E-ChequeDocument15 pagesVery Easy Money Transfer: E-ChequeKartheek AldiNo ratings yet

- ISO 20022 library models standardDocument4 pagesISO 20022 library models standardsri_vas4uNo ratings yet

- SEPA Direct Debit RulesDocument8 pagesSEPA Direct Debit Rulesh1760472No ratings yet

- 05 - Transactions in Office AccountsDocument18 pages05 - Transactions in Office AccountsSreepada k100% (1)

- Swift Iso20022 Thirdpartytoolkit FinalDocument16 pagesSwift Iso20022 Thirdpartytoolkit Finalanurag jadhav100% (1)

- SWIFT - PresentationVisit Us at Management - Umakant.infoDocument50 pagesSWIFT - PresentationVisit Us at Management - Umakant.infowelcome2jungleNo ratings yet

- SWIFT FIN Payment Format Guide For European AcctsDocument19 pagesSWIFT FIN Payment Format Guide For European AcctsShivaji ManeNo ratings yet

- Volante Technologies Simplifying Messaging ConnectivityDocument20 pagesVolante Technologies Simplifying Messaging ConnectivityLuis YañezNo ratings yet

- Fusionbanking Equation Swo PDFDocument12 pagesFusionbanking Equation Swo PDFJoseph Muzite0% (1)

- EK381342 Account ClosingDocument25 pagesEK381342 Account Closingsergei5555No ratings yet

- Process of Cash AcceptanceDocument5 pagesProcess of Cash AcceptanceJayakrishnaraj AJDNo ratings yet

- MT100 Format ExplanationDocument9 pagesMT100 Format Explanationnach_1983No ratings yet

- Deutsche Bank Outlines New Payment System Going Around The US DollarDocument28 pagesDeutsche Bank Outlines New Payment System Going Around The US DollarAnthony Allen Anderson100% (4)

- STANDARD Cash Management Solutions Presentation-08202019Document88 pagesSTANDARD Cash Management Solutions Presentation-08202019Anonymous CMaI3m9i5100% (1)

- SwiftDocument20 pagesSwiftHash AshesNo ratings yet

- Secure Mobile Banking SRSDocument7 pagesSecure Mobile Banking SRSAkanksha SinghNo ratings yet

- Message Specification V1.3 BDocument41 pagesMessage Specification V1.3 Bsuy uy100% (1)

- Sneha Rajendra NairDocument3 pagesSneha Rajendra NairSonia DograNo ratings yet

- NEFT Vs RTGS PaymentsDocument4 pagesNEFT Vs RTGS PaymentsrajeevjprNo ratings yet

- FTDocument337 pagesFTMadjid MansouriNo ratings yet

- Bank Portfolio ManagementDocument6 pagesBank Portfolio ManagementAbhay VelayudhanNo ratings yet

- BNY MellonDocument3 pagesBNY MellonRajat SharmaNo ratings yet

- Netsuite Electronic Payments: Securely Automate EFT Payments and Collections With A Single Global SolutionDocument5 pagesNetsuite Electronic Payments: Securely Automate EFT Payments and Collections With A Single Global SolutionJawad HaiderNo ratings yet

- Decoding Payments Message Standards: October 2019Document19 pagesDecoding Payments Message Standards: October 2019osirazNo ratings yet

- SWIFT MessagesDocument5 pagesSWIFT MessagesRajesh GuptaNo ratings yet

- BASE24 DR With AutoTMF and RDF WhitepaperDocument38 pagesBASE24 DR With AutoTMF and RDF WhitepaperMohan RajNo ratings yet

- Cyclos ReferenceDocument126 pagesCyclos ReferenceEnric ToledoNo ratings yet

- Pain 001 001 03 SixDocument38 pagesPain 001 001 03 SixAntonio Di BellaNo ratings yet

- SWIFT MessagesDocument521 pagesSWIFT Messagesashish_scribd_23No ratings yet

- Routing Mapping Payments As Transactions v3Document235 pagesRouting Mapping Payments As Transactions v3Jj018320No ratings yet

- International Remittances: Business Process Outsourcing Consulting System Integration Universal Banking SolutionDocument11 pagesInternational Remittances: Business Process Outsourcing Consulting System Integration Universal Banking Solutionakther_aisNo ratings yet

- 01 21-RBIremittanceDocument11 pages01 21-RBIremittancemevrick_guyNo ratings yet

- ISO 20022 Payments Initiation - Maintenance 2019 - 2020 Message Definition Report - Part 2Document287 pagesISO 20022 Payments Initiation - Maintenance 2019 - 2020 Message Definition Report - Part 2kafihNo ratings yet

- Swift 4Document86 pagesSwift 4Freeman JacksonNo ratings yet

- Comparison Between Retail and CorporateDocument10 pagesComparison Between Retail and CorporateAkshay RathiNo ratings yet

- Certificate in in in in Banking Technology Banking Technology Banking Technology Banking TechnologyDocument8 pagesCertificate in in in in Banking Technology Banking Technology Banking Technology Banking Technologybiplab_71No ratings yet

- SWIFT messaging network enables global bank fund transfers & paymentsDocument2 pagesSWIFT messaging network enables global bank fund transfers & paymentsDeen Mohammed ProtikNo ratings yet

- Confirmation Matching - User Guide: Release R15.000Document25 pagesConfirmation Matching - User Guide: Release R15.000Yousra HafidNo ratings yet

- The SEPA Regulation GuidanceDocument23 pagesThe SEPA Regulation GuidanceBaatar SukhbaatarNo ratings yet

- How Do (Bank) Wire Transfers WorkDocument4 pagesHow Do (Bank) Wire Transfers WorkFaisal KhanNo ratings yet

- How Does Cross-Border Remittances / Money Transfer WorkDocument30 pagesHow Does Cross-Border Remittances / Money Transfer WorkFaisal KhanNo ratings yet

- Payment System PresentationDocument22 pagesPayment System PresentationFaisal Khan0% (1)

- Concept of Mobile WalletDocument12 pagesConcept of Mobile WalletFaisal KhanNo ratings yet

- Trusted Platform ModuleDocument14 pagesTrusted Platform Moduleramu278No ratings yet

- Terminals & Connectors: Delphi Packard Metri-Pack 150 Series Sealed ConnectorsDocument1 pageTerminals & Connectors: Delphi Packard Metri-Pack 150 Series Sealed ConnectorsTrần Long VũNo ratings yet

- Biography On Mahatma Gandhi MitaliDocument11 pagesBiography On Mahatma Gandhi Mitaligopal kesarwaniNo ratings yet

- Election of 2000 WorksheetDocument3 pagesElection of 2000 Worksheetvasanthi sambaNo ratings yet

- Civil Appeal 14 of 2015Document21 pagesCivil Appeal 14 of 2015JamesNo ratings yet

- Credit Bureau Development in The PhilippinesDocument18 pagesCredit Bureau Development in The PhilippinesRuben Carlo Asuncion100% (4)

- Life of St. Dominic de GuzmanDocument36 pagesLife of St. Dominic de Guzman.....No ratings yet

- Study of Non Performing Assets in Bank of Maharashtra.Document74 pagesStudy of Non Performing Assets in Bank of Maharashtra.Arun Savukar60% (10)

- Case StudyDocument15 pagesCase Studysonam shrivasNo ratings yet

- The Medical Act of 1959Document56 pagesThe Medical Act of 1959Rogelio Junior RiveraNo ratings yet

- Group Ii - Answers To Guide Questions No. 4Document30 pagesGroup Ii - Answers To Guide Questions No. 4RayBradleyEduardoNo ratings yet

- Admin Cases PoliDocument20 pagesAdmin Cases PoliEunice Iquina100% (1)

- Santhosh Kumar .A: Covering LetterDocument4 pagesSanthosh Kumar .A: Covering LetterenvsandyNo ratings yet

- PI200 User Guide 230 V 50 HZDocument26 pagesPI200 User Guide 230 V 50 HZEsneider Rodriguez BravoNo ratings yet

- VAT Guide For VendorsDocument106 pagesVAT Guide For VendorsUrvashi KhedooNo ratings yet

- Supreme Court of India Yearly Digest 2015 (692 Judgments) - Indian Law DatabaseDocument15 pagesSupreme Court of India Yearly Digest 2015 (692 Judgments) - Indian Law DatabaseAnushree KapadiaNo ratings yet

- AACC and Proactive Outreach Manager Integration - 03.04 - October 2020Document59 pagesAACC and Proactive Outreach Manager Integration - 03.04 - October 2020Michael ANo ratings yet

- PARAMUS ROAD BRIDGE DECK REPLACEMENT PROJECT SPECIFICATIONSDocument156 pagesPARAMUS ROAD BRIDGE DECK REPLACEMENT PROJECT SPECIFICATIONSMuhammad irfan javaidNo ratings yet

- CS Form No. 211 Medical CertificateDocument1 pageCS Form No. 211 Medical CertificateAlvin Apilado Mingaracal90% (10)

- SENSE AND SENSIBILITY ANALYSIS - OdtDocument6 pagesSENSE AND SENSIBILITY ANALYSIS - OdtannisaNo ratings yet

- Bagatsing V RamirezDocument3 pagesBagatsing V RamirezAnonymous iOYkz0wNo ratings yet

- Form OAF YTTaInternationalDocument5 pagesForm OAF YTTaInternationalmukul1saxena6364No ratings yet

- Fourth Grade-Social Studies (Ss4 - 4)Document7 pagesFourth Grade-Social Studies (Ss4 - 4)MauMau4No ratings yet

- Honeywell Acumist Micronized Additives Wood Coatings Overview PDFDocument2 pagesHoneywell Acumist Micronized Additives Wood Coatings Overview PDFBbaPbaNo ratings yet

- Gallagher Bill to Sanction Chinese Firms Supporting PutinDocument18 pagesGallagher Bill to Sanction Chinese Firms Supporting PutinJennifer Van LaarNo ratings yet

- IC33 - 8 Practice TestsDocument128 pagesIC33 - 8 Practice TestskujtyNo ratings yet

- Organized Group Baggage HandlingDocument2 pagesOrganized Group Baggage HandlingFOM Sala Grand TuyHoaNo ratings yet

- Digital Forensic Tools - AimigosDocument12 pagesDigital Forensic Tools - AimigosKingNo ratings yet

- 90 Cameron Granville V ChuaDocument1 page90 Cameron Granville V ChuaKrisha Marie CarlosNo ratings yet

- Jaya Holdings Annual Report 2010Document112 pagesJaya Holdings Annual Report 2010wctimNo ratings yet