Professional Documents

Culture Documents

Day Z Summer Interview 2005

Uploaded by

Amit RanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Day Z Summer Interview 2005

Uploaded by

Amit RanaCopyright:

Available Formats

Bank: Day Zero Summer Interview Feedbacks 2005

bank:

Day Zero Summer Interview Feedback - 2005

HSBC........................................................................ 2 DPWN ...................................................................... 4 DBS........................................................................... 6 DB............................................................................. 8 CITIGROUP ............................................................ 9 MERRILL LYNCH...............................................14 Boston Consulting Group .......................................18 Temasek Holdings................................................. 20 Goldman Sachs........................................................21 LEHMAN .............................................................. 23 BARCLAYS CAPITAL ......................................... 26 Baring Pvt Equity................................................... 29 Freudenberg ........................................................... 30

Bank: Day Zero Summer Interview Feedbacks 2005

HSBC

Rounds of interview: Sameer Shetty: There were two rounds of interview. First round was of 35 minutes duration. The questions were mostly personal, nothing related to academics. Discussions on resume and the list of 40 questions was the core of the interview etc. Deepti Pichai: Two rounds of interview Mudit Mehta: Two rounds of interview Questions in each round & what were their replies. Sameer Shetty Round 1: It was not a stress interview at all. The interview was very peaceful. Why do you want to join I banking? Do not answer that I like finance etc Say that iBank involves new challenges, leadershipand prove how you as person, through your resume points, from achievements would be suitable for the job. What do you bring to the table? Why HSBC, and why not consulting? Questions based on projects that I had done One question on a literary event that I had participated in Performance at IIT why it was just average Deepti Pichai What sets u apart from others? Talked about extracurricular activities, volunteering, organizing events, and at the same time I did well in my academics...and I liked competition and challenges Some question about music Question about interest rates in US and instability of US $ ...told them something I had read from newspaper Ask us questions...asked about the change in worldwide ad campaign, questioned the reasoning behind their acquiring an Iranian investment bank Round 2 What sets u apart? Why investment banking ? Why markets? Mudit Mehta Tell me something about yourself. What are the recent occurrences/trends in financial markets? Cite an incident when your passion to perform has put you in a fix when working in a team. What do you bring to the table? Why should we select you? Why a career in investment banking interests you? Why HSBC? Will you be able to work in a foreign environment? Where do you rank in our priority list? Link your past experiences/achievements to the reasons for why investment banking.

Bank: Day Zero Summer Interview Feedbacks 2005

Have at least a cursory knowledge of financial markets Prepare personal questions very well. HSBC does not ask any puzzles etc. Do not be overtly aggressive- it is a comparatively softer British Bank Classify Questions as "Mathematics, Finance and HR" No academic questions were asked. General idea about finance and economics is enough. What went right & what went wrong? Sameer Shetty Had prior experience in finance so could convince them that I am the suitable person for the job. Also could justify why grades at IIT low. Deepti Pichai Confident, knew what was happening in the company, asked intelligent questions Could have answered the eco question better..tip-be up to date on major economic news Mudit Mehta I could impress them with my knowledge of financial markets. I had solid answers for investment banking and reasons for interest HSBC. Most harped on topic Sameer Shetty Concentrate on resume and the list of 40 questions. Questions like why iBank, why HSBC, should be well prepared. They are not looking for people with great financial backgrounds. What they want is an enthusiastic person who is ready to work hard and committed. There is no strategy to be followed, just be focused on what you want to talk, show commitment for whatever you say and let your resume highlight those points as well. Deepti Pichai What is unique about u? This was the most harped question. Try to convince them that you are most appropriate person for the job. Additional Information: GS: Personal interview followed by a telephonic interview with an MD in London. The MD asked 3 puzzles on the phone- extremely weird interview. Be very polite and courteous to him even if it is difficult to show the courtesy on phone. ML: quick mix of personal questions and puzzles, fast maths questions like root of 75. Be ready with a good answer for why ML and do not get flustered when they put pressure Lehman: Total fin interview- if you have any fin points on your resume, prepare them well, and corp fin and fin acc Citigroup: Cool personal interview followed by a personal plus finance interview. Need good reasons for why investment banking and strong foothold in finance.

Bank: Day Zero Summer Interview Feedbacks 2005

DPWN

Rounds of interview Aditi Shinde One round-Telephonic (1 Hour) Sai Krishna Telephonic interview before placement 3 to 4 days before the placement procedure starts for a duration of 1 hour. Applied for the projects described in the PPT. Link your work experience to the project requirements described in the project description. A good SOP and resume was important to get a call. Questions in each round & what was your reply? Aditi Shinde Questions based on my work ex, gave me scenarios about HR issues being faced by the company, such as implementation of new HR-IT system, payroll system etc. Questioned me about the answers, which I had written in the application. Asked me about my hobbies etc. (Do not recollect the answers clearly) Sai Krishna The interview depends a lot on the stream of the project you choose. First half an hour was HR based interview. Next half an hour was project related. Why you should be selected for the interview, how are you suited for the respective project? Plenty of resume based questions. You need to justify the points in the resume. The answers were based on the work experience, you justify that you have worked on similar projects and you will take the project successfully. Classify Questions as "Mathematics, Finance and HR" Aditi Shinde HR-IT Sai Krishna IT, HR What went right & what went wrong? Aditi Shinde Do not think anything went wrong, was relaxed throughout, no stress from the interviewer Sai Krishna The interview was very relaxed. What went right could justify my candidature by backing up with prior project experience.

Bank: Day Zero Summer Interview Feedbacks 2005

Most harped on topic Aditi Shinde The HR perspective, how would employees react to such a proposal? Will this suggestion be practically implementable? Sai Krishna Resume based questions. Prior work experience based questions. Additional Information (For IBANK): Read vault guided properly and should have a general idea about the corporate finance. Read the book properly before going to the interview.

Bank: Day Zero Summer Interview Feedbacks 2005

DBS

Rounds of interview Arjun Gaur One round of GD with eight people and then one 40-minute interview GD was same in summers and finals (happened in year before) ... problem statement was that you are a CEO and you came back from vacation and find 15 problems ... which do u solve first sort of ... so case study for the GD .. Pretty crack able if you keep your head cool about standard ethics, empathy, and logical business sense. Remember the points in solving a case study. Vijay Jacob One interview and one GD. GD was very cool, no fighting, amicable consensus was reached. It was more of a group activity. Questions in each round & what was your reply? Arjun Gaur Interview round was as all other firms .. after ten day zero rounds this was my first day one round ... it went much on the same lines ... the only difference was that i knew, i wanted to sign out with them ... this was i think i crucial difference in my unsaid verbal signals for the willingness to work with them .. Otherwise same gyan questions about group work, acad and negative/positives ... apparently i gave out a deal breaker negative but they were okay with it and stretched it for 10 minutes .... then there was a lucky break from one helpful soul who came in from outside room and had a message for them and at that point i knew this was done, no doubts .. Thanks to that person ... can never forget these helpful angels around. Vijay Jacob Interview was mostly personal, not many technical questions were asked. They were harping on questions like tell me about you, strengths, and weakness. The interview was very chill. Some questions were asked about Organizational behavior to judge the personality type. Various personality test questions were asked. Classify Questions as "Mathematics, Finance and HR" Arjun Gaur There was no tehnical question; my cv was shouting acads and quant from all directions, so nobody whom i interviewed with had any issues with the skill levels... there wasnt much HR questions, maybe few, but ibank qbank does the trick if u work on it, otherwise u'll be caught on wrong foot with the HR questions ... because summers is such a disconnect with business people interviewing non-business background people ... the technical questions are joke ... only being quizzed on option or some fin fundae is problem since they

Bank: Day Zero Summer Interview Feedbacks 2005

are not covered by the time interviews happen ... they need to be read before summers ...both my lehman and GS had option ques apparently junta was prepared a lot on these stupid basic derivatives and i was left staring blankly :D Vijay Jacob No technical questions were asked. It was an all personal interview. What went right & what went wrong? Arjun Gaur wrong - not being interested, asking the wrong question at the end, not having a question to ask, actually ask any strategy/macro questions and they'll be happy to give global reply ... what else .. dont compare the interviewing firm with its competitor ... dont tell them they are not number one priority...dont tell citi that gs is good ... dont talk fundaes... always ask for their opinions and what they think about an issue ... if u make rapport and demonstrate listening ability, then that should be good ...

Most harped on topic Arjun Gaur Harped upon - how will u fit amongst angrez junta ... why our firm ...group contribution ... actually it depends upon what u say in first few minutes ... since they are asking impromptu, whatever u say that sounds worth asking, they'll go in that ... juicier it is, more fun they'll have asking .. its a long tough day for them and they never miss few bakras here n there ... Vijay Jacob They were asking about my risk appetite. How far can I go in making a dealhow can you justify that you are not risk aversive. I gave them the example from my scuba diving stint. It showed that I like taking risks. Additional Information ML Lots of puzzles DB - Not many personal questions, it was too aggressive. Go prepared with the fin fundas.

Bank: Day Zero Summer Interview Feedbacks 2005

DB

Rounds of interview Deepakk Goyal There were two rounds of interview. Questions in each round & what was your reply? Deepakk Goyal Puzzles - correct reply Yield curve - draw graph Motivation - money Statistics - correct reply Classify Questions as "Mathematics, Finance and HR" Deepakk Goyal All such questions were asked. Maths, Fin & HR diff questions by 6 diff groups (consisting of 10-12 individuals) who interviewed me What went right & what went wrong? Deepakk Goyal Pretty much everything went ok Most harped on topic Deepakk Goyal Most harped on - why I-banking is good and why DB is good

Bank: Day Zero Summer Interview Feedbacks 2005

CITIGROUP

I) SANDEEP SINGH-Citigroup, London Background-Worked in a startup for 9 months. From IIT Kharagpur Four rounds of interview-mainly focused on communication skills, previous academic records and poise while answering 1st round-mostly HR, Why investment banking, in your preference list, where does Citigroup figure, Will you be willing to take the offer 2nd round-mostly technical-focusing on macro and micro economics 3rd round-general questions 4th round-almost lasted for an hour-whats expected to be done, Investment banking type questions such as what derivatives are-they generally told what each meant and asked questions based on that Eg: told definition of Swap and asked to price it based on some situation Most harped topic-Why finance, why investment banking, given an offer would you join (this was not a question asked in the end but in the beginning itself-they try to judge you based on your response to it) What went right-communication skills, confidence, the way he tackled the questions What went wrong At Lehman brothers first he was asked whether location would be a constraint. He said no but towards the end when they were inclined to making him an offer at Singapore he backed away saying he didnt prefer the Asia Pacific region (the guys who interviewed him were from Asia Pacific). So he lost out At BCG when solving cases you are supposed to ask a lot of questions and make it very interactive. He assumed things in his own and tried solving the case. So he didnt get through. Preparation Read on investment banking; be aware of basics, Vault guide for investment banking. Look up on the various roles being offered. Be clear about how the roles differ from each other. What are the basic products of the organization. Corp Fin is very important. When the summers happen you will be half way through the course. So they would expect you to know something. Bottom line Strong previous academic records, confidence, communication skills

II) ANUJ VIVEK-Citigroup, London Pre-interview-most companies including Citigroup have a one page SOP to be written Four rounds of interview Shortlist-Academics 1st round-hobbies, HR interview, favorite movie, why favorite-10 to 15 minutes

Bank: Day Zero Summer Interview Feedbacks 2005

2nd round-puzzles, projects, generally how you come across as a person 3rd round-choice between New York and London, pitch for New York 4th round-general questions What went wrong Basically something about the resume-headings didnt match contents Merrill Lynch-financial events, prospects of e-commerce, deep into hobbies (basketballsomething about American basketball), mainly GK Lehman Brothers-puzzles, financial status of US-salient features, basic stuff about bonds, could not solve the puzzles-they were mathematic and he thought they were consult kind and kept asking questions Deutsche Bank-technical aspects, bond mathematics HSBC-market capitalization, name of COO-went wrong BCG-Favorite subject QM-could not answer all questions, not enough practice for case Goldman Sachs-was not interested in IBD-was asked what he would do if he were given one crore-was not prepared to tackle it Be aware of Finance basics-bond maths, simple options, features; puzzles; good analysis of each of the companies-important aspects-why do you want to join them (very important) At Citigroup, they are looking for people who are genuinely interested in their company What got him through High number of shortlists

III) SONIA AGARWAL-Citigroup, Singapore 1 round of interview What got her the shortlist-topper all her life (IIIT Calcutta), lot of extra curricular activities (sports, debating) 1st round-basics of CorpFin, up to whatever they had studied, nothing from the advance topics, sell me Bisleri, Blackberry, more like pitching a sale to them kind of questions Other shortlists: Barclays-strong extra curricular activities, no technical questions, very general conversationHR based. GS-expected a lot of technical stuff, they know everything about you, on the night of dinner before the interview, the HR reeled off details about her after asking her name, genuinely interested, but lack of financial preparation was the biggest drawback. HSBC-arbit general economics, US economy.

Bank: Day Zero Summer Interview Feedbacks 2005

BCG-lack of case preparation, though they asked questions like tell me about yourself etc in the beginning. Whether you handle them well or not does not matter in the end, its all about the case and how you approach it. What got her through Citigroup They liked her energy and enthusiasm with which she tackled the interview, her liveliness, the way she talked and her connectivity with them. She showed that she could fit in for a Sales and trading job. Saying something like I want to do Trading even without knowing what trading is a no-no. You should show genuine enthusiasm in the interview. Preparation Worked on her CV and all the points in it but nothing else which proved to be a drawback at GS as they expected you to know technical (finance) stuff

IV) BHARAT KUMAR KODASE- Citigroup, New York 4 rounds of interview 1st round-favorite subject-micro economics-asked about prisoners dilemma 2nd round-questions on probability 1. 3 doors-treasure behind one-you open one of them-what is the probability that the treasure is behind one of the other two if not behind this one 2. given two curves change to normal 3rd and 4th rounds-general questions Merrill Lynch-quick maths, trigonometry, resume points-did not convert because he had some problem with the quick math questions Goldman Sachs-many students would have done finance courses before coming here. So if they ask questions in finance and you dont know them, tell them you dont know. He went for two rounds. He was asked how to get 23 using some given numbers. He did not answer that properly. LB- Having coding knowledge also sometimes helps. JP Morgan-they were basically checking his communication skills Reasons for shortlist-CGPA (9.22), IIT-M Reasons for final convert Flexibility-accepting whichever desk they offer at whichever place. Though they ask for your preferences that is just a formality Preparation Points in the resume, some math and puzzles, answer to tell me about yourself should be neither too dumb nor too flashy, be frank

Bank: Day Zero Summer Interview Feedbacks 2005

Most harped topic A lot of probability, favorite subject (have something different not the usual quantitative)maybe something like BGS or Micro economics which is a good mix of both math and talking Finally a lot of luck is involved (he wanted this specifically mentioned).

V) ANKIT KHARE-Citigroup, New York 4 rounds 1st round-common interview for the three desks at Singapore, New York and London-He was interviewed by a sales guy from Singapore. Why Citigroup, why investment banking, and questions on football (resume bullet point)-why not cricket, various leagues, world cup, favorite player. He was asked to sell blackberry to the interviewer and was then given feedback that it was the worst sales job. Then he was asked to run through his resume and speak about his strengths. 2nd round- a guy from New York interviewed him-the New York desk was basically Math and they were looking for people who were interested in doing research analysis and strategy. Why you are interested in math, probability question-gave a random number generator and asked him to generate a Gaussian process-helped him a lot in solving step by step. Then he was given n vectors and asked to formulate a correlation matrix of n*n. Was asked what he wanted to do i.e., sales and trading, research and in which city he wanted to do. When he said New York he was asked why NY. What do you know about Citigroup-absolutely no idea about Citigroup and investment banking 3rd round-American lady from NY who kept noting down the answers he said without even looking at him. He was asked to run through his resume, was asked about his bachelor training project, other projects, positions of leadership held and what he learnt from them. He was asked whether he had faced a difficult person at IIM-B and if yes, how he had coped with him. Then he was asked very simple probability questions. 4th round- There was another interview the next morning conducted by two traders from NY who were very jovial and chatted with him. They asked his CGPA at IIM-B which he said he was not allowed to disclose. They asked him which course he had done very well-economicsasked Nash equilibrium, Stackleberg Other shortlists LB-Why investment banking, why LB, what positions of responsibilities have you held (very important) and questions on the project. Not much about extra curricular activities. Why from EE in UG to MBA in PG-he said he always wanted top do an MBA and so they said he must have been following all finance related stuff for the past few years and asked harping him on that. Questions on markets which he could not answer. What new things would you like to bring to LB Merrill Lynch-Why ML-very quickly cut and asked the next question, stress interviewinterviewer was a very young Pakistani who was trying to be very aggressive and put him off guard. Unlike the other two companies (Citigroup and ML) where the interviewers were very polite, this was a very aggressive interview. Some point about social service on resume-what scope would you have for philanthropy in ML-was not prepared for this question.

Bank: Day Zero Summer Interview Feedbacks 2005

Quick math-137/37, square root of some power of 2 (the value was not given in 2^x). A cube of 10*10*10 in which cubes of 1*1*1 are placed-how many cubes Reason for shortlist-JEE rank (152), Delhi Resume was mathematically strong but otherwise not a very high CGPA, not much of extra curricular activities and not much of positions of responsibilities held (reason for not getting a single consult shortlist), but very good projects. Reason for final convert Attempting to solve problems-when he was given a question and did not know how to solve, the interviewer said he would move on to the next question but he insisted on trying to solve the problem-he was given a lot of time and was cool through out though he was taking a risk trying to solve something he did not know. The investment banks look for special people who can take risks very important. He was very motivated towards joining Citigroup as it is the biggest investment bank. Preparation Background check on the company, what is investment banking, divisions they have and what they do, little on options, behavioral questions-be prepared with the answers-will not be able to come up with answers on the spot. Book called 7 day MBA-chapter in finance.

Bank: Day Zero Summer Interview Feedbacks 2005

MERRILL LYNCH

I) ABHISHEK GUPTA-Merrill Lynch, Hong Kong 3 rounds of interview Shortlist-Cat percentile (100) 1st round-CAT percentile, specific points on resume-interviewer from same school-so talked about that-10 minutes 2nd round-finance interview-equity cash, futures, options, more into options-structuring, how to make spreads, macroeconomics-1 hour 3rd round-guesstimate, puzzle, geography (resume point)-distance between London and Morocco, top 5 rivers according to decreasing order of their length, approximate areas of various countries-general chit chat-half an hour Reasons for offer-CAT percentile, IITD, Business experience (major initiatives in family business), work with NGOs, community level work Major areas in interview-finance knowledge, portfolio of his own, worked in real estate Other shortlists and converts Deutsche Bank-equity itself for 10 minutes while ML didnt quiz him much on that, then about fixed income, bonds etc.-always a high pressure interview Initially 5 minutes with Amit Boradia (common IITD), he saw resume and made good comments on it Immediately called again-high pressure interview-first 2 people were asking, then people started entering and by the end of an hour there were 9 people surrounding him asking questions-midway with answering one question on emerging markets when someone would ask some personal question like something done in his school etc-they check how you react especially under pressure Citigroup-tell me about yourself-Delhi (interviewer also from Delhi), his business experience, real estate background (shared with interviewer), interviewer asked him to tell him some puzzles that could be asked to his batch mates (told puzzles and answers) Credit Suisse First Boston(CSFB)-all resume based-video conferencing-asked point by point-guy from Equity Research-they were not looking at answers to all questions-but they expected some interest in finding out answers if you dint know the answers-for Eg. If you dont know some answer they say very casually that you can get back later with the answers. If you get back with the answers, they appreciate it highly-He made some mistake in answering some answer relating to geography. Then he mailed them back within an hour of the video

Bank: Day Zero Summer Interview Feedbacks 2005

conferencing saying that he had been wrong and the right answer was so and so. He got a reply highly appreciating him for following up on it. JP Morgan-Light quants, lot of economics What went wrong Lehman Brothers-a lot of quantitative stuff-mostly probability-more quantitative than the rest of the banks-he was not too strong so could not make it through-for people with strong Maths background, there were things more complex than probability asked. Preparation Tell me about yourself-in 10 out of the 12 interviews he attended, he was asked this. Have a very good answer-prepare and learn it even a month before the interviews start. One should be very thorough with the answer to this. It is very important, gives confidence to the interviewee and a good start to the interview. Day zero is purely momentum and due to the high stress levels, it requires a lot of confidence. Economist.com, Business standard, Volt guides of every bank you have an interview withgood to know about whichever bank is interviewing you. Basically, questions like why you want to work for us, what area you want to work in-be very clear about all this. IBD Vs Markets-be clear about the difference. Even within markets, be clear about various areas such as fixed income, forex, credit, equity

II) NUPUR NETAN-Merrill Lynch, Hong Kong 2 rounds of interview 1st round-very resume and SOP based, question on bond valuation-20 minutes 2nd round-puzzles, eco related (eco honors graduate from SRCC), particular about which part of markets she wanted to work on-the interviewer was pitching for his desk and locationwanted someone for his team Most harped topic-finance and economics What went right Got right most of the finance related questions at ML, and was interested in the particular part of market they had come down for What went wrong Had 8 to 9 shortlists-was nervous, could not answer the finance related questions posed by them

Bank: Day Zero Summer Interview Feedbacks 2005

Reason for offer Very positive, answered all questions, day zero is highly stressful for people with more than one shortlist-every interviewer asks whether it was a long, tiring day etc.-should say no, it has been very exciting and portray yourself to be very enthusiastic Preparation Newspapers, courses done during graduation (eco graduate), corporate finance (read up some advanced topics in the course), talked to a lot of seniors with day zero summers and got inputs from them

III) ROHIT SINGH-Merrill Lynch 1st round-resume bullet point on derivatives (Course on investment in 2nd term-chapter on options, bond pricing), Corp Fin-Net Present Value, Guesstimate question-How many mineral water bottles are sold in India per year-no idea, Low GPA at IIT-so why, Why did you choose B over C, Why do you want to join ML (very very important)-go through their websites, What else did you do at IIT-some elections-how did you win the elections, what did you in the post One guy kept asking all these questions while another kept throwing very simple arithmetic questions expecting quick answers What are the other shortlists you have-where do you stand with the other companies-be cool and confident 2nd round-4 to 5 probability questions (no pen and paper-very simple cards, dice questions) 4 people interviewed-one guy asked probability, others kept throwing simple arithmetic questions Point on dramatics in resume-script of the play, what problems did you face-basically trying to find out whether you had written the truth Bond pricing, significance of each of the ratios in financial accounting What they are looking for-good in arithmetic, good in whatever you have studied till then at IIM B, Coding(Visual Basic, Excel, Visual Basic in Excel) Why short listed: Not a strong resume, but very good SOP Why given offer: Very enthusiastic about the interview(very important), easier because he had fewer shortlists, look and act smart, be very polite, if a foreigner interviews you and you are unable to follow the accent, dont be shy in asking him to repeat the question Very quick in calculations Interview started badly (he had mention 1.5 million took JEE instead of 0.15 million in the resume-so was harped on that). Why others were not given the offer They did not know much about Merrill Lynch

Bank: Day Zero Summer Interview Feedbacks 2005

Other short lists Citigroup-two HR ladies asked him three questions-tell me about yourself, why do you want to do investment banking and why Citigroup and kept on writing down the answers without even looking at him-lasted for 10 minutes Preparation Investments book-chapter on options and futures Three questions-tell me about yourself, why investment banking, why that particular company 2 to 3 stories about each of your resume bullet points Other information Manas and Abhishek got through because they solved the guesstimate questions they were asked IV) MANAS GUPTA-Merrill Lynch 2 rounds of interview 1st round-What do you know about ML, your impression of ML-they generally wanted to know whether he had attended their PPT, and whether he had liked it Was quizzed on his background-Mechanical engineer from IIT-D, was asked about Bernoulli theorem and the like. What attracted him towards ML Guesstimate-How many tables are there in India?-they were looking at his logical reasoning, not really whether he was getting the answer right. And while he was solving the guesstimate, he was simultaneously asked some very quick Math questions like some square root of some numbers etc. Then he asked the interviewer some question on some recent acquisition done by ML 2nd round- He again asked the trader what their trading is based on etc. etc. Reason for shortlist-8.8, NTSE, National Science Olympiad, co-coordinated Tech events in college Reason for offer-confidence, ease with which he spoke 32 people were short listed. They had a fair idea of what kind of people they wanted even when the shortlists were made. JP Morgan Macroeconomics-some questions on the exchange rate Puzzle-he started solving it-but the interviewer asked him to think aloud and solve it-never mug up the answer or say it directly even if you know it-show them that you can think Why investment banking Was not asked any tech questions Barclays If you are with trading and take up a position and then realize that, that position is making a loss, what would you do?

Bank: Day Zero Summer Interview Feedbacks 2005

Boston Consulting Group

I) Mayank Jain -BCG, Mumbai Background- 23 months work-ex in Sapient (Tech + IT Consulting). BE from Delhi Institute of Technology Interviews They had told in ppt itself that the interview will have a personal questions based component and a case based component. Each interview started with a sufficiently long introduction of the interviewer himself. There were plenty of things where you could find common ground with them to give direction to your conversation. Some questions they asked were: 1. So did you enjoy working at Sapient? Tell me something about your work experience? 2. Tell me something that differentiates you from other candidates. 3. Are you good at convincing people? How would you do it! Cases: 1. Telecom industry in India, how to increase ARPU, decrease capex. Was asked to make a sustainable business model for mobile services company because he had experience of working with telecom sector clients at Sapient. They also wanted him to suggest a strategy for acquiring new customers and reducing cost of acquiring them. 2. Super cop, logo cop. Disposable coffee glass manufacturing companies in Europe, how to increase market share of super cop and drive logo cop out. What are the risks involved in your plan? 3. An organizational restructuring case: The case was about a private sector bank in India which had grown from Rs 10,000 cr revenues to Rs 30,000 cr in 3 years! The size had increased from 30 branches to over 100 and the management wanted to see how the bank could be restructured to become more efficient in view of these changes. The initial structure was a matrix with branches grouped based on geography (NEWS). The bank had 4 different products and there were product heads as well as geography based heads in the organization giving rise to matrix structure. The trick was to introduce tiers in organization structure. 4. This was a formality. Some oil company in Australia had found oil near its shore which would produce oil for next 10 years. Had to decide whether they should sell it to US, India or Japan. And the winner was Japan

Bank: Day Zero Summer Interview Feedbacks 2005

5. This was about local train ticket checking system. How to make it efficient (as in reduce the number of checks made) and still make same revenues and discourage people from traveling ticket-less. What questions did you ask to the panel? 1. Asked them to walk me through a sales pitch scenario, as in how they could convince a client that BCG is the best choice to solve their problems. 2. What are differences between ibd and a consultants role in an M&A project? 3. What was that they liked most about their jobs?

Bank: Day Zero Summer Interview Feedbacks 2005

Temasek Holdings

II) Abhiram K A, Temasek Holdings, Singapore Background 25 months work-ex at Wipro, BCom(Hons) , CA Pre-interview- There was a PPT after the shortlist which was followed by an interactive dinner which is speculated to be evaluative, an opportunity to make a connection with the person who is going to interview you. Interview There was one 15 min interview in which a HR person and an Associate were present. I was first asked to give a brief introduction of myself where they let me speak for a fair length of time. Spoke about my work-ex and the nature of work I did in my company. They asked me about what kind of work I would like to do and why I had decided to work in equity. I mainly spoke about the nature of the diversity in work that was on offer and how that appealed to me. III) Dharini Kannan, Temasek Background Fresher, B.E There were 3 rounds of interviews: 1st round- Technical questions mainly revolved around Finance. Was asked a few consult-type case scenarios. On quantitative aspects was asked about Probability, Statistics, General puzzles. 2nd round More in-depth questions were asked on Finance. Towards the end of this round there were a few HR questions as well. 3rd round This was a purely HR Round. Questions in each round and response : The first round finance questions were on Finance basics. The tough Fin questions asked were on Bonds, Foreign Exchange, Currency, Arbitrage. Questions on Macroeconomic questions were also asked. HR First set of questions were personal questions. Why Temasek? Why should I be picked? For each of these questions I gave a customized answer and not a general one. Most harped upon topic? Lots of HR questions. Preparation : Anything that is mentioned in the PPT should be known. The 1 page write up given by Ibank was very useful.

Bank: Day Zero Summer Interview Feedbacks 2005

Goldman Sachs

IV) Kamesh Raghavendra, Goldman Sachs Background : BTech (Comp. Sc. & Engg.), IIT Madras 2 rounds of interview 1st round- It was a 20 min interview in which typical HR, personality based questions were asked along with a couple of puzzles. 2nd round- Technical questions, questions on probability, math and finally HR. Night before the interviews there was a dinner hosted by GS. People were divided into two tables based on IBD and Markets as per shortlist. This dinner is an opportunity to show why you want the job through interaction with the company person. There was one IIM A alumni who took the interview. People with Markets shortlist typically consisted of IITians, freshers from computer science or electronics background. People with IBD shortlist typically consisted of Commerce, Arts, Engineering, Work Ex Common Questions : Why ibanking? Resume related questions. V) Soudabi N, Goldman Sachs Background : BTech, IITM 2 rounds Before the dinner there is a dinner which is unofficially evaluated. An opportunity to get attention. 1st round- Interview was with a junior person in the company. I had done a minor during IIT in financial management. Questions were asked on options. 2nd round- It was a video conference, held in the CPP classroom with a panel of 3-4. It was pretty confusing. Resume questions, Why MBA types. Macroeconomic fundamentals were also tested. A question on bonds and how to value them. Observation: When asked to speak about myself they let me speak for as long as I wanted. The idea is to speak on what you want to be asked upon. What was the most harped upon topic? Was asked most commonly Do you follow the markets?, Which industries would you like to invest in?. List the qualities of an investment bank. A very common question What will happen if interest rates in US increase? basically on macroeconomic factors.

Bank: Day Zero Summer Interview Feedbacks 2005

What went wrong? Personally felt I did not answer the question on qualities of an investment bank too well. Some of the negative feedback that I got later on was that I was not confident. Another feedback was that I was too talkative. Tip : Arrogance doesnt help but it is important to be confident. They are mainly looking for a match, someone who can fit into the culture of the company. Work Ex is not too important unless relevant. Acads in resume need to be strong unless balanced by good extracurrics.Make sure you can talk about atleast one point on your resume. VI) Venkatraghavan S, Goldman Sachs Background: 24 months workex Motorola, BEng (Hons), NTU 3 rounds of interview 1st round- 2 personality based questions. Questions on leadership, experience. Not too many questions on academics. 2nd round- Questions on accountancy bonds price value. 3rd round- Quant question was asked but was already selected by then Tip : Prepare for questions like why Goldman Sachs? Communication skills are important. Nice guy with good personality will make it through. Needed for making sales pitches.

Bank: Day Zero Summer Interview Feedbacks 2005

LEHMAN

1) SANDEEP THARIAN LEHMAN LONDON 3 Rounds of interview- mainly focused on resume based questions, final round being a videoconferencing and not an elimination round. Reason for shortlist - He was short listed based on his resume showing all rounder traits. 1st Round people skills related questions. One person constantly tried to interrupt and make nervous. He was asked to derive 1^2 + 2^2 + 3^2 + ----------. He was also asked to derive i + i^2 + i^3 + --------. 2nd Round - There was no finance, no HR, no puzzles in 2nd round. He showed some magic tricks also which really worked in his favor. Goldman Sachs 1st Round HR, interests, hobbies related questions 2nd round a little technical interview and bond pricing, company valuation were asked. He was asked about preference for markets or IBD. BCG Case analysis. He stresses on hypothesis testing approach to crack cases. Summers process 2 rotations one in equities and one in fixed income. He got a PPO from Lehman because of his interaction. He told about a guy who was more knowledgeable than him in finance but still didnt get PPO as he interacted too little. Why Lehman flexible, friendly, value for Indians, Why not GS it is haughty, has too much internal competition, evaluation is done on the basis of networking which is not so in Lehman. He got offers from both but took up Lehman. 2) Anushree - LEHMAN LONDON Summers preparation She stresses on gyaan sessions like Macro-Economics and Indian Capital markets and vault guides for the preparation. She was not prepared for Lehman fully. One needs to sound interesting in an interview. Focus on current scenario, bond pricing, Indian economic scenario, Probability and some basic engineering math like Taylor series, etc. Read newspaper regularly. Citi They started with a stupid question tell something interesting when you are stuck in a plane. They asked about college life and cultural activities. The important thing is - know about company, what it is good at, what they are planning in the near future. 1st round no math questions but only HR questions. 2nd round why Citi Group?, what role do you want?

Bank: Day Zero Summer Interview Feedbacks 2005

Lehman 1st Round full finance interview, 1 probability question. Why to invest in stock markets even if they are overvalued? She convinced them that markets are undervalued based on current economic scenario. They asked lots of macro-economics, US interest rates and their effect on market forex rate, exchange rate, inflation rate, etc. They also asked about money supply, money demand, etc. She told them about preferences in the end when they offered. What went right lack of nervousness. HSBC Why HSBC?, What desk?, and any role? All HR questions. Why PPO willingness to learn, interaction with team, interest shown in work, learning curve, ask relevant questions, show you have made an effort to understand. Interact with everybody (as many desks as possible). Try to know what role do you fit in, what desk you like, etc. 3) Gaurav Arora - LEHMAN HONG KONG Summers preparation 10 day MBA, vault guides, CNBC videos, Indian stock markets, global macro-economics, form groups of 2-3 and study. Know about life of I-banker from blogs on google. BCG 5 rounds. No HR expect Introduce yourself. 2 line description of cases. You need to ask relevant questions as they will keep giving you hints. Lehman 1st round asked questions mainly about 3 years work experience in TI. 2nd round asked some derivatives questions like generate a binary option using regular options. They asked about location preference and appreciate your clarity of thought if you tell some preference. Why PPO maintain good rapo within team, dont be too humble, be a good fit within teams. I-banking is mostly about networking, drinking socially, and odd hours. 4) Amit Gupta LEHMAN LONDON He was asked mostly HR + CV questions. He had shown 2 finance projects on CV but still no solid finance question was asked. He suggests reading about China and macro-economics from economist. Lehman 1st round he was asked about Black Sholes model as he had done a project on it in IIT. They also asked Why You, 2nd round They started pitching to him. Why PPO He did some discriminatory analysis (gave a unique view) on a model used by them. Make some friend; ask a lot of questions (intellectually stimulating), be assertive, put forward your point by thinking but defend it logically once put forward. Citi They asked about Black Scholes model derivation. His HR questions didnt go right. He was tentative, unconvincing and uncomfortable. Make sure you know for what location and

Bank: Day Zero Summer Interview Feedbacks 2005

desk, company is hiring. In Lehman and GS, it doesnt matter but in ML and Citi, it can matter. GS he was asked to sell mobile, sell pen and general HR questions. When asked about bank A vs bank B, dont put global gyaan. He was asked questions about CAPM model also. He suggests making some 5-6 stories ready which can come handy anywhere. For the firms, company fit is most important. Listen to what they are speaking, be humble, they try to see your soft side.

Vineet LEHMAN He was asked about which sectors in stock market to invest (he suggests site.securities.com for this), India vs China, which stocks to invest, and about Macro-Economics. He suggests knowing about oil and gold from economist website. He also suggests revising Financial Accounting before the interview. Citi mostly personal questions were asked. He was given a conflict management situation and asked to resolve conflict and convince one person with whom you have a bad relations. Lehman puzzles, personal questions were asked. Why trading?, they sometimes also ask about latest news about the company which can be normally found on company website. GS Couldnt answer why IBD convincingly. JPM asked questions about NCFM exam on derivatives. DB they want aggressive people and look for diversity in CV. Paritosh Gupta LEHMAN He was asked mostly from the 40 HR questions. HSBC no finance Lehman basic finance Citi more finance like benchmark rates in US Why Lehman it doesnt promote internal competition. Its one firm, one people. Barclays it stressed people out and asked ultra-financial questions.

Bank: Day Zero Summer Interview Feedbacks 2005

BARCLAYS CAPITAL

Name Summers Company Total No. of Interview Rounds Other Shortlists Hariprasad Pichai Barclays Capital GFRM Credit Risk Management (Asia Pacific) 2 + 1 HR round JP Morgan

Pre-Interview Preparation Well prepared on my CV. Resume preparation was crucial. Nothing specific to the role applied to other than the usual dose of summers prep. (A) Questions in Each Round Round 1: 20-25 Minutes (Interview was mostly based on resume, profile fit and very few technical questions) Question set 1: Tell us something about yourself -> Work-ex related questions Started with the routine personal pitch and walked them through sections on my CV. Follow-up questions: Why did you want to do an MBA after two years in tech firms (!)? Panel started with the initial avb shortlist and ran through the academic achievements. Why did I get to Bschool? Biggest risks that you faced when executing projects? The first one was a prepared answer saying that it was always in the pipeline. They did not grill much into this. I had worked on data center products where the impact of even minimal downtime could potentially affect millions of user mailboxes / databases. Was able to summarize (without a lot of technical jargon) as to what the impact would be and the responsibilities handled during the course of developing such products. Follow-follow-up questions Had worked on anti-spam filters involving Bayesian statistics and content-based filtering. Was quizzed on some related quant questions. Answered the quant questions first and then veered them to business implications relating to false positives, compliance issues relating to email audit, retention and other operational risks that could impact the firm Question set 2. Which ones would you prefer to work on: company analysis, market analysis? This was more of a bouncer as it popped up while I was answering questions from my resume. I clearly stated a preference for company analysis citing the knowledge I had at that point in time. Panel was testing for credit risk / market risk roles.

Bank: Day Zero Summer Interview Feedbacks 2005

Question set 3. Questions on company balance sheets I had looked into and risk factors in their businesses Started with Finacc project as the IIMB alum on the panel asked me to start with that. Also, both the firms I had worked for earlier were either acquired or recently merged entities. I was able to clearly present a lot of key financial points and motives behind these deals. I had this question and sub-questions going for quite a few minutes in detail. Key project risk factors, market risk factors what should one hedge for etc., were all part of follow-up questions. Round 2: 20-25 Minutes (Interview was totally a profile fit and a general interview) This round in retrospect was a double-check kind of interview. I went to the panel that looked at emerging markets and was asked a lot of short questions on why Barclays, what are your views on certain markets, why do you think you would fit into this role etc., Certain key questions: Q1. How did you think your previous round went? Why do you think you are here? Just did a quick walkthrough of the kind of interview and answered confidently. The previous panel had indicated the desk roles available and I just paraphrased whatever was told in the earlier round. Q2. Why did you not apply into Rates (which is the desk I look after) instead? I simply reiterated my SoP answers and just stuck to the same line as to how I think the role I applied to was a better fit.

Questions I asked them (was made to ask) in this round

Barclays expansion plan in APac (panelists had mentioned earlier that they were heading up a new desk focused on APac) Debt-focus of Barclays (clichd, but worked because the panel was from the equity-derivatives team) Round 3: 10 Minutes (Just a basic HR discussion) This was more of a sanity check and HR talked more than I did in this round, explaining the role and cross-checking if I was really interested. (B) What Went Right and Wrong Right: Was able to confidently put forth my views. Certain key questions such as the risk parameters one would apply for the companies that I worked were answered well. Asked some key questions on Barclays and just did not walk out of the interview after their grilling. Being straightforward and not hedging answers helped. Wrong: One would like to think nothing went wrong in a successful interview, but maybe a little more prep on market conditions would have been helpful. Macro-eco fundamentals were very weak.

Bank: Day Zero Summer Interview Feedbacks 2005

(C) Most Harped on Topic None. The first round was the more crucial round as they were trying to check profile fit apart from the usual grilling. It was a relatively more personal interview, even when compared across other Barcap applicants. (D) Other Comments Post-interview, they were particularly keen to clear the prevalent misconception about picking only people with prior work experience. Final interns who were picked up across B and A were a mix of work-ex and freshers. I would classify the overall process as one based on personal points rather than technical knowledge. Possible questions on risk management roles would still involve how one thinks through the various factors potentially influencing a company / market / industry / economy as the case maybe.

Amit Kumar Nath Name Summers Company Total No. of Interview Rounds Other Shortlists Barclays 3 NA

(A) Questions in Each Round:(Interview was Finance and Puzzles) There were 2 formal interview rounds and an informal round regarding preference of location and desk etc. Amit had specified the desk (Forex Trading) in which he wanted to work so there were questions related to that desk like outlook of the dollar in the coming week, month, year. Then what are the parameters that need to be taken into account while giving the outlook etc. Amit knew answers to all the technical questions that were asked. He could not solve the puzzles that were asked in the second round. (B) Most Harped on Topic: Interviews primarily focused on the choice of answers in the online application form. Be extremely thorough of the choices mentioned and the reasons for the same. Prepare related questions from those topics and be prepared with those.

Bank: Day Zero Summer Interview Feedbacks 2005

Baring Pvt Equity

Rajagopal Sevilimedu Name Summers Company Total No. of Interview Rounds Other Shortlists Baring Pvt Equity 3 Barclays, BCG, Citigroup, GS, HSBC Global

(A) Questions in Each Round: (Round 1: 30 Minutes) Q:1 Run me through your resume (HR) A:1 He did. Takeaways: More of a personal interview round, wherein the panel wanted to know more about you and the different dimensions of your personality and how well you can talk about what is already mentioned in your CV. Round 2: 30 Minutes Q:1 Where is the Auto Industry in India headed? (General) A:1 Talked about all that he knew of: Which are the different players in the market, their respective market shares in the different segments (small, mid-size and big cars), new products in the market, rules and regulations etc. Takeaways: The panel wanted to see how many different dimensions of an industry segment that a candidate can bring out in the given timeframe. Round 3: 60 Minutes Q:1 Case: If Barings were to open a chain of hair saloons in India, how would you assess the investment opportunity? (Strategy) A:1 He used the Porters framework to approach the problem. Takeaways: Can you create an organization that can cater to the entire market. The panel wants to look at if someone comes to u for money for this business venture, will you be convinced of the business model. Think about whether it is worth investing in or not, and the reasons for the same. How many different dimensions do you look at etc. (B) What Went Right and Wrong: Right: Raj maintained an excellent rapport with the panelists right from the beginning and through the interview process. Wrong: Nothing (C) Most Harped on Topic: None

Bank: Day Zero Summer Interview Feedbacks 2005

Freudenberg

Name Summers Company Total No. of Interview Rounds Other Shortlists Abhisek Chakrabarti Freudenberg 1 Deutsche Bank

(A) Questions in Each Round: Round 1: 20 Minutes (Interview was Technical and HR) Q:1 Tell us something about yourself. A:1 Abhisek talked about his background, and highlighted what he had prepared for this question. Q:2 Why Freudenberg? A:2 I have a mechanical engineering background and since Freudenberg has one one of its businesses into auto component manufacturing, this will help me in understanding the product that they are selling and in the long run, help me in selling the same. (Freudenberg has a group of companies). One of their companies is called Vibra Coustic, which specializes in handling anti-vibration components in the car such as suspension etc. that extends the automobiles life. Abhisek had written a paper on vibration. He went into specifics and explained. Takeaways: This was the first 5 minutes of the interview. This left a good impression as the panel was convinced that he had done his preparation well. Q:3 What would you like to work in? Sales or marketing? (This was the next 15 min) A:3 Marketing as in sales, what is more important is the one-on-one communication aspect while marketing is more creative and I am more of a creative person. I strategise well and that is my strength. Though I have good interpersonal skills as well but I prefer marketing. Q:4 In our specific business areas, how can you differentiate between sales and marketing? A:4 Sales is where you go and talk to a client such as Ford and sell the product. While a marketing person will devise the product strategy, find out what the client wants in terms of price, quality etc. Q:5 At this point, Mr. Viju Parmeshwar (Head of Freudenberg India) told him that in a B2B scenario, sales and marketing are actually the same function and there is no difference between the two. A:5 Abhisek said that he was not aware of the same and thanked him for letting him know of that.

Bank: Day Zero Summer Interview Feedbacks 2005

Q:6 What is the one think at work that you cannot live without? A:6 Regularly challenging tasks. Takeaways: At this point, they were finding out whether the person is well verse with the company or not. The key is to find a niche for yourself and find out the finer details and mention the same in your interview. Secondly, looking whether the candidate is sure what he wants to do and if he really wants to work in a company like Freudenberg. (B) What Went Right and Wrong: Right: Everything went right. Left a good impression in the first 5 minutes and was relatively easier after that. Wrong: Lack of knowledge of the B2B area and he focused too much on the company and not on marketing. (C) Most Harped on Topic: Nothing as such. Just that they want to be sure that the candidate has prepared well and knows about the company. Other Comments: Basically, the first 5 minutes of the interview were spent in asking questions about the candidates and how much they know about the company. If you fared well there and showed awareness of the company, they gave you a chance for the next 15 minutes. It is an old fashioned company that believes that you will come and join the company and work for a long period of time.

Name Summers Company Total No. of Interview Rounds Other Shortlists (A) Questions in Each Round: Round 1: 20 Minutes (Interview was HR)

Mayank Jain Freudenberg 1 DB, DBS & Citigroup

The following questions were asked: Will you do marketing? Are you genuinely interested in marketing? How do you think this role is different from FMCG? Questions on his extra-curriculars from his resume. He had won a marketing game in VISTA and they asked him about that.

Bank: Day Zero Summer Interview Feedbacks 2005

(B) What Went Right and Wrong: Right: He told them what they wanted to hear. Marketing is my first and only love, I would like the exposure abroad, how Germany is like a dream for mechanical engineers and this relates to my previous education. Wrong: Nothing. The interview was about 20 minutes with 4 people in the panel. Everybody was asking questions. But address the whole group, rather than just one of them! All what you have to do is to appear confident. Their India CEO was here, with some senior person from Germany. So listen to them very respectfully and carefully. Other Comments: Confidence. Talk well as it is a marketing job after all. Speak to the German person as it seems that he plays an important role in the decision-making process. Try to connect past experiences with interest and enthusiasm. Be extremely respectful. They are very senior people.

Name Summers Company Total No. of Interview Rounds Other Shortlists

Rahul Parihar Freudenberg 1 None

Pre-Interview Preparation: Was very well prepared with his CV and knew what aspects to highlight in the interview. (A) Questions in Each Round: Round 1: 60 Minutes (Interview was Technical and HR) Q:1 Tell us something about yourself A:1 Rahul made a dramatic beginning to his introduction, mentioning that he was a record holder in DU. I have a poster in my room which reads Keep Running and I firmly believe in it, he mentioned all that he did in his engineering days. He emphasized on the theme of overcoming hardships in life and harped on points mentioned in his CV. He was the only electronics engineer to be shortlisted for the following reasons: He had relevant work-ex in Delphi Automotive Systems He immediately showed interest after the PPT Takeaways: This company looks for people who are genuinely interested in working for them and show interest for the same. Q:2 If you are from electronics, why do you want to work in manufacturing? A:2 I have always been interested in the auto sector and technical stuff and have never been too keen on programming languages. Even in my engineering I had a PPO from Siemens and Whirlpool but I went to Delphi because I wanted to go for manufacturing even though other companies were paying better. I have first-hand experience in assembly line (which added credibility to his credentials).

Bank: Day Zero Summer Interview Feedbacks 2005

Q:3 What did u do in Shanghai in your 5 month stint there? What other projects? A:3 Set up an entire assembly line in Shanghai Worked in Noida for 10 months in a programme management team and designed a special purpose machine, which earned company savings Takeaways: Do not beat around the bush, be direct and to-the-point. Q:4 Why do u think GM is not doing well? What will happen to Ford? They are having issues and why are Toyota and Honda better? A:4 Companies that are doing well are the ones that have a reducing cycle time, operational efficiencies, good supply chain etc. Q:5 Given a chance, would you work with Delphi again? Why? A:4 I will as I can put my learnings to practice because I found issues with the processes there and not with people. (B) What Went Right and Wrong: Right: Well prepared for the interview. He had only 1 Day 0 shortlist and he got everything right by bringing into focus things highlighted in his CV. Wrong: He had a tendency to get carried away too far on topics that he wanted to talk about, not a good idea. (C) Most Harped on Topic: Delphi and his experience there. Other Comments: You may find it intimidating when you enter the room as it is the seniormost panel that will be there, with at least 30 years of experience. Make sure you speak slowly, and that they understand what you say, and speak to everyone Name Summers Company Total No. of Interview Rounds Other Shortlists Raman Gupta Freudenberg 1 GS, DB, Citibank, Barclays

Pre-Interview Preparation: Was very well prepared with his CV and knew what aspects to highlight in the interview. (A) Questions in Each Round: Round 1: 30 Minutes (Interview was Technical and HR) Q:1 Did you attend our PPT? A:1 No

Bank: Day Zero Summer Interview Feedbacks 2005

Q:2 Do you know what we are looking for? A:2 Yes, you are primarily looking for mechanical engineers (mentioned in their PPT) Q:3 We are also looking for a LT perspective and when we are taking you, we think you will be here for a long-term. They started telling about the company and the company policies. Takeaways: The Freudenberg theme revolves around the long-term perspective they want employees to join. They judge the candidates whether they will stick around for at least five years. Not looking for jazzy people, but simple people with conceptual clarity, and who are good at their work. Down to earth people who are willing to commit themselves to the organization. Q:4 How do u see urself as a production incharge after 5 years? (make or break question)? A:4 Given my background and my interest, I will be a good fit for a finance job but if you think that I am capable of a production job, I will take that challenge up and am sure to do a good job. Q:5 What did u do in PWC? (Filler question, Just to know) A:5 Raman explained his profile. (Raman was confident that he will not be taken so he was very cool in the interview and was not thinking much) (B) What Went Right and Wrong: Right: Confidence and the fact that Raman was not rigid in joining only for a finance job. Wrong: Nothing as such. (C) Most Harped on Topic: Long-term perspective Other Comments: If you are really interested, it is a good company to work in. It is run extremely professionally and there is no racism, which was Ramans apprehension initially. They give you good training and invest a lot in the candidates. Most important is to attend their PPT and show that you are genuinely interested. Name Summers Company Total No. of Interview Rounds Other Shortlists (A) Questions in Each Round: Round 1: 30 Minutes (Interview was all HR) Shankar M Freudenberg 1 Citibank

Bank: Day Zero Summer Interview Feedbacks 2005

Q:1 Where are you from and why did you choose your area of engineering (Mechanical engineering)? You did your schooling from Chennai and college in rural area. Why? A:1 He talked about his reasons for the same. Q:2 What are your long-term objectives? A:2. To gain an industry exposure and start my own firm. Q:3 What is the difference between leader and manager? A:3 Leader is a visionary and manager is an implementor (Basically globe) Q:4 What are the leadership roles that you have taken and give examples? A:4 He explained from his past experiences. Q:5 Where did u fail and what did u learn? A:5 At varying instances, there were different mistakes. Initially, I realized that there was lack of delegation on my part and later, there was too much delegation, so I learnt how to maintain a fine balance between the two. Q:6 What stream of MBA are you interested in? What field will you be interested in at the job offer? (They were looking for industrial marketing) A:6 My first interest is in the area of operations. I understand that marketing is important for the company and its success, but my interest is in operations but not at the cost of neglecting the marketing aspect. Q:7 Do you have any locational preference? A:7 Any location is fine with me. Q:8 If you are sent to any new location, what will be your prior preparations? A:8 I will find out about our operations in that region and get a basic understanding about the people there, their culture and the objective of my visit. (B) What Went Right and Wrong: Right: He was very frank and did not make up any answer and they appreciated that. Wrong: He could have been more diplomatic on occasions. (C) Most Harped on Topic: They laid an importance on how much we have spent on leadership roles in the past. Other Comments: None

Bank: Day Zero Summer Interview Feedbacks 2005

Name Summers Company Total No. of Interview Rounds Other Shortlists

Srishail Laxman Chavan Freudenberg 1 None

Pre-Interview Preparation: Did good research on the organization Visit website, find about the division they were here to recruit for. Searched recent articles on the automobile industry About the Organization: Freudenberg manufactures high technology products, have a highly diversified business and produce for top automobile organizations, agriculture applications, lubrications and have a software division of their own. (A) Questions in Each Round: Round 1: 60 Minutes Q:1 Tell us something about yourself (HR) A:1 Srishail notably mentioned that he belonged to Karnataka from a particular place, which one of the panelists happened to know about, so he went on to talk about the specialty of that place etc. Worked for 3 years, briefly discussed what he did there. Worked in a manufacturing set up at Honda. Takeaways: It was an icebreaker question. More of a personal interview round, wherein the panel wanted to know more about you. Q:2 Why do you want to join the manufacturing sector? Why not Consulting? Why not Investment Banking? (Functional) A:2 I have prior experience in the manufacturing sector. Automobile organizations are shifting their manufacturing centers from US and Europe to India and China. Mahindra is investing in its auto component and Tatas are already doing the same. While all auto makers have their supplier base in these countries, they will further have their production centers in these countries in the next five years. Since the industry (auto company supplier) is in its initial phase, if I am able to enter this industry at this time, it will give me better opportunities to grow. Takeaways: The panel wanted to check a proper fit between the candidates goals and the organizations long-term goals. Q:3 What is your motivation? (HR) A:3 Work is my motivation. For me, work is not about enjoyment or fun, it is a duty which I am obliged to perform. Takeaways: Again, it boils down to why do you want to join manufacturing sector? Q:4 Few Questions on the resume were asked. Why do you think you were given that award at Honda?

Bank: Day Zero Summer Interview Feedbacks 2005

A:4 When I joined the organization, Honda made 150 scooters annually and when I was leaving, they were producing 200,000 scooters annually. They felt that people who have been a part of this growth process should be rewarded for their contributions. (B) What Went Right and Wrong: Right: Well prepared for the interview. He had guessed the kind of questions that may be asked and was well prepared with the answers. Wrong: He had a set of things that he wanted to convey. During the interview, at times he went slightly overboard and mentioned the same anyway, even though it was not related to the questions that were asked. Further, he was the last person to be interviewed on that day, so he was feeling a bit tired by the time his turn came. (C) Most Harped on Topic: None Other Comments: This was the first time that Freudenberg came to campus for summers, the organizations CEO, Southeast Asia Head and the Global HR Head were here. Though they came with an open mind, basically looking at whether the candidates will fit into the organization, they were majorly concerned whether the people will stay in their organization or not. They mentioned in the PPT itself that they are spending a lot of resources in coming here, and their intention was to look at candidates who were willing to have a long-term commitment with them, so the batch is well advised to shoot out answers from a long-term perspective.

You might also like

- Fuqua Case Book 2014Document256 pagesFuqua Case Book 2014Anonymous xjY75jFNo ratings yet

- Case Competition Information SessionDocument35 pagesCase Competition Information SessionDavid DeetlefsNo ratings yet

- FS Consulting Capital Markets - Case Study 1 (Regulatory Change)Document1 pageFS Consulting Capital Markets - Case Study 1 (Regulatory Change)FabrizioNo ratings yet

- IBD Technical Interview Prep - 10nov15Document1 pageIBD Technical Interview Prep - 10nov15PogotoshNo ratings yet

- Login to careerclap.com and build your profileDocument9 pagesLogin to careerclap.com and build your profileAnonymous 1aCZDEbMMNo ratings yet

- WSO-2022-IB-Working-Conditions-Survey - (Parts-1 And-2)Document20 pagesWSO-2022-IB-Working-Conditions-Survey - (Parts-1 And-2)Iris T.No ratings yet

- Spring Week GuideDocument32 pagesSpring Week Guidevimanyu.tanejaNo ratings yet

- Investment Banking Resume II - AfterDocument1 pageInvestment Banking Resume II - AfterbreakintobankingNo ratings yet

- BITSoM Consulting Casebook 2023-24Document143 pagesBITSoM Consulting Casebook 2023-24rahulsuryavanshi.iift2325No ratings yet

- Bocq Advisory - Financial Modeling TrainingDocument7 pagesBocq Advisory - Financial Modeling TrainingThomas DldesNo ratings yet

- Investment Banking Interview Guide: Course OutlineDocument20 pagesInvestment Banking Interview Guide: Course OutlineTawhid SyedNo ratings yet

- Kevin Buyn - Denali Investors Columbia Business School 2009Document36 pagesKevin Buyn - Denali Investors Columbia Business School 2009g4nz0No ratings yet

- Practitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeDocument25 pagesPractitioner's Guide To Cost of Capital & WACC Calculation: EY Switzerland Valuation Best PracticeМаксим ЧернышевNo ratings yet

- 2013 J.P. Morgan The Deal Competition - Competition InstructionsDocument3 pages2013 J.P. Morgan The Deal Competition - Competition Instructionshelpperman89773456No ratings yet

- ICON Casebook 2023-24 - Volume 13 (B)Document193 pagesICON Casebook 2023-24 - Volume 13 (B)ShubhamNo ratings yet

- LBO Fundamentals: Structure, Performance & Exit StrategiesDocument40 pagesLBO Fundamentals: Structure, Performance & Exit StrategiesSouhail TihaniNo ratings yet

- M - I Merger Model GuideDocument65 pagesM - I Merger Model GuideCherie SioNo ratings yet

- McKay ISBDocument45 pagesMcKay ISBRohan Jain100% (1)

- Empirical Studies in FinanceDocument8 pagesEmpirical Studies in FinanceAhmedMalikNo ratings yet

- ACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFDocument7 pagesACCT421 Detailed Course Outline, Term 2 2019-20 (Prof Andrew Lee) PDFnixn135No ratings yet

- Merrill LynchDocument95 pagesMerrill LynchPrajval SomaniNo ratings yet

- Project Finance Vs Private Equity 6 Key DifferencesDocument4 pagesProject Finance Vs Private Equity 6 Key DifferencesOwenNo ratings yet

- Equity ResearchDocument4 pagesEquity ResearchDevangi KothariNo ratings yet

- Investment Banking - Session 1Document28 pagesInvestment Banking - Session 1Grishma Rupera100% (1)

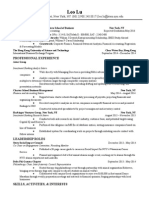

- Lu Leo ResumeDocument2 pagesLu Leo ResumeLeo LuNo ratings yet

- Investor Day IB FINALDocument24 pagesInvestor Day IB FINALamadeo1985No ratings yet

- FInance CareerPro BrochureDocument17 pagesFInance CareerPro Brochuregourabbiswas1987No ratings yet

- Ivycasesystemchapter PDFDocument29 pagesIvycasesystemchapter PDFalexandre1411No ratings yet

- KORS Equity Research ReportDocument21 pagesKORS Equity Research ReportJeremy_Edwards11No ratings yet

- Case Study BriefingDocument5 pagesCase Study BriefingZohaib AhmedNo ratings yet

- Investment Banking Resume III - AfterDocument1 pageInvestment Banking Resume III - AfterbreakintobankingNo ratings yet

- VFC Meeting 8.31 Discussion Materials PDFDocument31 pagesVFC Meeting 8.31 Discussion Materials PDFhadhdhagshNo ratings yet

- Gensol Engg Initial (JP Morgan)Document14 pagesGensol Engg Initial (JP Morgan)beza manojNo ratings yet

- M&A Review QuestionsDocument2 pagesM&A Review Questionsowen sherryNo ratings yet

- TTS - Trading Comps PrimerDocument6 pagesTTS - Trading Comps PrimerKrystleNo ratings yet

- Breaking into Wallstreet GuideDocument3 pagesBreaking into Wallstreet GuidezzzzzzNo ratings yet

- 2023 WSO IB Working Conditions SurveyDocument46 pages2023 WSO IB Working Conditions SurveyHaiyun ChenNo ratings yet

- Ratio InterpretationDocument15 pagesRatio InterpretationAsad ZainNo ratings yet

- Goldman Sachs Presentation To Credit Suisse Financial Services ConferenceDocument20 pagesGoldman Sachs Presentation To Credit Suisse Financial Services ConferenceEveline WangNo ratings yet

- Graduate investment banking CV templateDocument1 pageGraduate investment banking CV templateChristopher HoNo ratings yet

- EX-99 MORGAN STANLEY DISCUSSION ON GIANT INTERACTIVEDocument48 pagesEX-99 MORGAN STANLEY DISCUSSION ON GIANT INTERACTIVEpriyanshuNo ratings yet

- DENALI JPMorgan Board PresentationDocument26 pagesDENALI JPMorgan Board PresentationjwkNo ratings yet

- Nyu Stern 2011 811191422Document137 pagesNyu Stern 2011 811191422Chika OfiliNo ratings yet

- Siddhant Jena: Qualifications College/Institution Grade/Marks (%) /C.G.P.A Year of PassingDocument2 pagesSiddhant Jena: Qualifications College/Institution Grade/Marks (%) /C.G.P.A Year of Passingsiddhant jenaNo ratings yet

- Consulting Interview PreparationDocument37 pagesConsulting Interview PreparationkoelschmanNo ratings yet

- Precedent Transaction Template - NewDocument5 pagesPrecedent Transaction Template - NewAmay SinghNo ratings yet

- BIWS Excel ShortcutsDocument3 pagesBIWS Excel ShortcutsGranttNo ratings yet

- IB Interview Guide, Module 4: Key ConceptsDocument94 pagesIB Interview Guide, Module 4: Key ConceptsCarloNo ratings yet

- Kellogg Valuation HelpDocument56 pagesKellogg Valuation HelpJames WrightNo ratings yet

- Internship Offer by GOLDMAN SACHSDocument5 pagesInternship Offer by GOLDMAN SACHSNitesh mishraNo ratings yet

- J. P Morgan - Tata Steel LTDDocument15 pagesJ. P Morgan - Tata Steel LTDvicky168No ratings yet

- Fuqua CaseBook 2010 2011 PDFDocument146 pagesFuqua CaseBook 2010 2011 PDFmanecoNo ratings yet

- Wall Street Prep Premium Exam Flashcards QuizletDocument1 pageWall Street Prep Premium Exam Flashcards QuizletRaghadNo ratings yet

- INDUSTRY INSIDER: PRIVATE EQUITY AND VENTURE CAPITALDocument46 pagesINDUSTRY INSIDER: PRIVATE EQUITY AND VENTURE CAPITALBo LiNo ratings yet

- PDFDocument124 pagesPDFadsfNo ratings yet

- Operations Due Diligence: An M&A Guide for Investors and BusinessFrom EverandOperations Due Diligence: An M&A Guide for Investors and BusinessNo ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- Template - Label Writing Template - A4Document1 pageTemplate - Label Writing Template - A4Amit RanaNo ratings yet

- Brady Client Services: A Resource Like No OtherDocument12 pagesBrady Client Services: A Resource Like No OtherAmit RanaNo ratings yet

- Visual ManagementDocument58 pagesVisual ManagementAmit RanaNo ratings yet

- Annual Investor Forum 2016 - FinalDocument110 pagesAnnual Investor Forum 2016 - FinalAmit RanaNo ratings yet

- 4 Tata Motors Summer Training ReportDocument71 pages4 Tata Motors Summer Training ReportAmit RanaNo ratings yet

- HUL Final Placements 2009 Application InstructionsDocument4 pagesHUL Final Placements 2009 Application InstructionsAmit RanaNo ratings yet

- Sahaj Web Solutions - B PlanDocument2 pagesSahaj Web Solutions - B PlanAmit RanaNo ratings yet

- BMP71 Printer BrochureDocument18 pagesBMP71 Printer BrochureAmit RanaNo ratings yet

- Family TreeDocument1 pageFamily TreeAmit RanaNo ratings yet

- Lower Pcs Pre 2016 SRA-Set-ADocument22 pagesLower Pcs Pre 2016 SRA-Set-Anaveen_suyalNo ratings yet

- FDI in Indian Retail Sector - Santosh KumarDocument21 pagesFDI in Indian Retail Sector - Santosh KumarAmit RanaNo ratings yet

- 1 Ana Sandeep AccentureDocument22 pages1 Ana Sandeep AccentureAmit RanaNo ratings yet

- Case Study RelianceDocument3 pagesCase Study RelianceAmit RanaNo ratings yet

- TransshipmentDocument21 pagesTransshipmentsachin_gdglNo ratings yet

- Site AnalysisDocument71 pagesSite AnalysisAmit RanaNo ratings yet

- Traditional ChulhaDocument9 pagesTraditional ChulhaAmit RanaNo ratings yet

- Software Assignment On CheatsDocument9 pagesSoftware Assignment On CheatsAmit RanaNo ratings yet

- ToxiologyDocument45 pagesToxiologyAmit RanaNo ratings yet

- Business Plan TemplateDocument11 pagesBusiness Plan TemplateTống Ngọc MaiNo ratings yet

- ProduProduction Flow Analysisction Flow AnalysisDocument49 pagesProduProduction Flow Analysisction Flow AnalysisAmit RanaNo ratings yet

- Communication Case StudyDocument8 pagesCommunication Case StudyAmit RanaNo ratings yet

- Communication Case StudyDocument8 pagesCommunication Case StudyAmit RanaNo ratings yet

- Indigenous Reptilian, UFOs, MARS, Reptoid Predation Found On Mars, Benevolent Hybrid Reptilian HumansDocument554 pagesIndigenous Reptilian, UFOs, MARS, Reptoid Predation Found On Mars, Benevolent Hybrid Reptilian HumansMindSpaceApocalypse100% (4)

- Benchmark 2.11 Clarification Readings (1) - 1Document6 pagesBenchmark 2.11 Clarification Readings (1) - 1Lauren SaddlerNo ratings yet

- Shock Andromeda 2Document10 pagesShock Andromeda 2Alvaro ArriagadaNo ratings yet

- The Last Question by Isaac AsimovDocument11 pagesThe Last Question by Isaac AsimovClydee27100% (1)