Professional Documents

Culture Documents

SEC. 22. Definitions - When Used in This Title

Uploaded by

Edward Kenneth KungOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SEC. 22. Definitions - When Used in This Title

Uploaded by

Edward Kenneth KungCopyright:

Available Formats

SEC. 22.

Definitions - When used in this Title: (A) The term "person" means an individual, a trust, estate or corporation. (B) The term "corporation" shall include partnerships, no matter how created or organized, joint-stock companies, joint accounts (cuentas en participacion), association, or insurance companies, but does not include general professional partnerships and a joint venture or consortium formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal and other energy operations pursuant to an operating consortium agreement under a service contract with the Government . "General professional partnerships" are partnerships formed by persons for the sole purpose of exercising their common profession, no part of the income of which is derived from engaging in any trade or business. (C) The term "domestic", when applied to a corporation, means created or organized in the Philippines or under its laws. (D) The term "foreign", when applied to a corporation, means a corporation which is not domestic. (E) The term "nonresident citizen" means: (1) A citizen of the Philippines who establishes to the satisfaction of the Commissioner the fact of his physical presence abroad with a definite intention to reside therein. (2) A citizen of the Philippines who leaves the Philippines during the taxable year to reside abroad, either as an immigrant or for employment on a permanent basis. (3) A citizen of the Philippines who works and derives income from abroad and whose employment thereat requires him to be physically present abroad most of the time during the taxable year. (4) A citizen who has been previously considered as nonresident citizen and who arrives in the Philippines at any time during the taxable year to reside permanently in the Philippines shall likewise be treated as a nonresident citizen for the taxable year in which he arrives in the Philippines with respect to his income derived from sources abroad until the date of his arrival in the Philippines. (5) The taxpayer shall submit proof to the Commissioner to show his intention of leaving the Philippines to reside permanently abroad or to return to and reside in the Philippines as the case may be for purpose of this Section. (F) The term "resident alien" means an individual whose residence is within the Philippines and who is not a citizen thereof. (G) The term "nonresident alien" means an individual whose residence is not within the Philippines and who is not a citizen thereof. (H) The term "resident foreign corporation" applies to a foreign corporation not engaged in trade or business within the Philippines. (I) The term 'nonresident foreign corporation' applies to a foreign corporation not engaged in trade or business within the Philippines. (Z) The term 'ordinary income' includes any gain from the sale or exchange of property which is not a capital asset or property described in Section 39(A)(1). Any gain from the sale or exchange of property which is treated or considered, under other provisions of this Title, as 'ordinary income' shall be treated as

gain from the sale or exchange of property which is not a capital asset as defined in Section 39(A)(1). The term 'ordinary loss' includes any loss from the sale or exchange of property which is not a capital asset. Any loss from the sale or exchange of property which is treated or considered, under other provisions of this Title, as 'ordinary loss' shall be treated as loss from the sale or exchange of property which is not a capital asset. (GG) The term 'statutory minimum wage' shall refer to the rate fixed by the Regional Tripartite Wage and Productivity Board, as defined by the Bureau of Labor and Employment Statistics (BLES) of the Department of Labor and Employment (DOLE). (HH) The term 'minimum wage earner' shall refer to a worker in the private sector paid the statutory minimum wage, or to an employee in the public sector with compensation income of not more than the statutory minimum wage in the non agricultural sector where helshe is assigned.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Navy Leave ChitDocument2 pagesNavy Leave ChitBrandon FischerNo ratings yet

- Natural Law Legal PositivismDocument5 pagesNatural Law Legal PositivismlotuscasNo ratings yet

- Pil DigestsDocument8 pagesPil DigeststedmatorNo ratings yet

- Civpro Rule 18Document22 pagesCivpro Rule 18tedmatorNo ratings yet

- SonnetsDocument1 pageSonnetstedmatorNo ratings yet

- DigestsDocument2 pagesDigeststedmatorNo ratings yet

- CIVPRO Missing Digests PDFDocument2 pagesCIVPRO Missing Digests PDFtedmatorNo ratings yet

- Rep v. Sunvar DigestDocument5 pagesRep v. Sunvar DigesttedmatorNo ratings yet

- Legmed NotesDocument36 pagesLegmed NotesJane Zahren Polo AustriaNo ratings yet

- Why Discovery Garden Is The Right Choice For Residence and InvestmentsDocument3 pagesWhy Discovery Garden Is The Right Choice For Residence and InvestmentsAleem Ahmad RindekharabatNo ratings yet

- Summer Reviewer - Edited 2018Document256 pagesSummer Reviewer - Edited 2018Isabelle Poblete-MelocotonNo ratings yet

- Key provisions of the Philippine Civil Code on laws and jurisprudenceDocument7 pagesKey provisions of the Philippine Civil Code on laws and jurisprudenceIzay NunagNo ratings yet

- Government Subsidies and Income Support For The PoorDocument46 pagesGovernment Subsidies and Income Support For The PoorOdie SetiawanNo ratings yet

- Itlp Question BankDocument4 pagesItlp Question BankHimanshu SethiNo ratings yet

- LASC Case SummaryDocument3 pagesLASC Case SummaryLuisa Elena HernandezNo ratings yet

- EPIRA (R.a 9136) - DOE - Department of Energy PortalDocument4 pagesEPIRA (R.a 9136) - DOE - Department of Energy PortalJc AlvarezNo ratings yet

- Citizenship-Immigration Status 2016Document1 pageCitizenship-Immigration Status 2016rendaoNo ratings yet

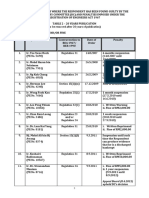

- LIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDocument1 pageLIST OF HEARING CASES WHERE THE RESPONDENT HAS BEEN FOUND GUILTYDarrenNo ratings yet

- Flores Cruz Vs Goli-Cruz DigestDocument2 pagesFlores Cruz Vs Goli-Cruz DigestRyan SuaverdezNo ratings yet

- Loan Classification Rescheduling AmendmentDocument8 pagesLoan Classification Rescheduling AmendmentConnorLokmanNo ratings yet

- Removal of Directors or Trustees: by The SEC - After Notice and Hearing and Only OnDocument2 pagesRemoval of Directors or Trustees: by The SEC - After Notice and Hearing and Only OnApple Ke-eNo ratings yet

- Twelve Reasons To Understand 1 Corinthians 7:21-23 As A Call To Gain Freedom Philip B. Payne © 2009Document10 pagesTwelve Reasons To Understand 1 Corinthians 7:21-23 As A Call To Gain Freedom Philip B. Payne © 2009NinthCircleOfHellNo ratings yet

- FSC-STD-40-003 V2-1 EN COC Certification of Multiple SitesDocument18 pagesFSC-STD-40-003 V2-1 EN COC Certification of Multiple SitesThanh Nguyễn thịNo ratings yet

- Biological Science - September 2013 Licensure Examination For Teachers (LET) - TuguegaraoDocument8 pagesBiological Science - September 2013 Licensure Examination For Teachers (LET) - TuguegaraoScoopBoyNo ratings yet

- Test 3 - Part 5Document4 pagesTest 3 - Part 5hiếu võ100% (1)

- GoguryeoDocument29 pagesGoguryeoEneaGjonajNo ratings yet

- Week.8-9.Fact and Opinion & Assessing EvidencesDocument13 pagesWeek.8-9.Fact and Opinion & Assessing EvidencesRodel Delos ReyesNo ratings yet

- 4 History of The Muslim - Study of Aqidah and FirqahDocument15 pages4 History of The Muslim - Study of Aqidah and FirqahLaila KhalidNo ratings yet

- Haryana GovtDocument1 pageHaryana GovtSudhanshu NautiyalNo ratings yet

- Companies View SampleDocument4 pagesCompanies View Samplesuresh6265No ratings yet

- Vol 4Document96 pagesVol 4rc2587No ratings yet

- CIE Registration Form SummaryDocument3 pagesCIE Registration Form SummaryOrdeisNo ratings yet

- Daniel Nyandika Kimori v V A O minor suit negligence caseDocument2 pagesDaniel Nyandika Kimori v V A O minor suit negligence casevusNo ratings yet

- معجم مصطلحات وادوات النحو والاعرابDocument100 pagesمعجم مصطلحات وادوات النحو والاعرابC1rt0uche123 CartoucheNo ratings yet

- Provisional Appointment For Driving Skill TestDocument1 pageProvisional Appointment For Driving Skill TestRahul Kumar SahuNo ratings yet

- John William Draper - History of America Civil War (Vol I)Document584 pagesJohn William Draper - History of America Civil War (Vol I)JSilvaNo ratings yet