Professional Documents

Culture Documents

2012 Building & Sales Report

Uploaded by

Glen EgbertOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012 Building & Sales Report

Uploaded by

Glen EgbertCopyright:

Available Formats

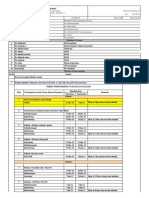

2012 Building & Sales Report Permits, Construction & Development

Dear Town Council & Planning & Zoning Commission, This report has been prepared to give provide you an indication of the local building construction, inventory, and sales rates during the last several years.

Total permits includes all permits issued by the Planning & Zoning Department and includes residential and commercial building, fence, signs, temporary uses, conditional use, and variances. !cavation permits issued by the ngineering Department are not included this year. Total permits are up 1"# from last year, and down $%# of the &%%' total of 1%( permits, and resemble the number of permits issued in &%%) and &%%*. The bul+ of the permits continued to be the staff issued permits, including signs, fences, and temporary use permits. The ma,ority of Temporary -se permits continue to be .tinerant /erchant Permits.

Page1

0ew construction in both residential and commercial building permits pic+ed up slightly this year, with & new single1family homes, and ( new commercial 2non1 residential3 structures.

Page1

The graph below indicates the buildable lot growth within incorporated Pinedale for the last decade or so. Acres indicates the acreage of buildable lots 2new subdivisions3 added to the Town inventory, while No. of Lots indicates the number of buildable lots added, which includes lot divisions. 4uildable lots are defined as platted subdivision lots that could be individually developed. 4uildable lots do not include anne!ations, bloc+s, or other large undivided parcels.

Page1

5ubdivision activity in &%1& consisted of lot splits. 6hile substantial growth was not seen, it was more postive than the prior & years, with 7 lots being created. The following graph gives an indication of the current supply for the ( primary 8oning districts in Pinedale. .t shows the actual number of 8oned lots in Pinedale, how many are developed for each district, how many are vacant, and how many are actually for sale. .nside the Town limits as of 9ebruary &%1( there were 1%&% residentially 8oned lots about &7# of those were vacant and only 7.7# of the total were actually for sale. Commercially, there are about &7% lots, &$# of those are vacant and 7.&# were for sale. :n the .ndustrial side there are 1( lots, (1# are vacant and ).)# are for sale 21 lot3.

Page1

Residential Sales & Inventory

The following graphs indicate the number of parcels for sale and how many have actually sold on a countywide basis. Page1

&%1& mar+ed a year that could be called ;<ope with <esitation;= This is clearly illustrated in the following two graphs which show a slight improvement from last year. >esidential sales continued at a higher rate than &%%*1&%1% but weren?t @uite as strong as last year?s 1&) home sales. &%1& saw 1%( home sales which were down 1"# from last year. &'# of these sales were foreclosures or short sales. There are currently 11 foreclosures on the mar+et. Aou will also notice from the graph the number of listings 2inventory3 has increased slightly from last year but is still in the ballpar+ of prior years. The current sales rate put us at 1.7 year supply which indicates a buyer?s mar+et and low housing demand which results in falling prices. .n &%%", we had a (.$ year supply, and last year it was 1.1" years, we are not @uite to a balanced mar+et yet but will continue to move in that direction.

Page1

Bacant land sales are basically the same as last year, minimal. 5ales are down 7%# from the high in &%%". 5ales have stabili8ed in the &%?s for the last $ years 2&&, &', &*, &$3, and the speculative mar+et has dried up with over &%% lots being ta+en off the mar+et, which has reduced the supply significantly. The loss of gas companies pulling out last summer 2Culy3 created a renters mar+et with tons of openings and a drop in prices. The rentals have filled bac+ up and it is bac+ to a landlord mar+et. The mar+et is not too tight and has opened up a bit from last year. .n &%11, there were less than 1% listings, this year there are over (% listings. Prices have dropped slightly too, last year only & listings were under D1%%%Emo this year there is at least 1&.

Page1

/5. is simply used to compare the si8e of an inventory to the rate of sale. /5. is a great indicator of how balanced a mar+et is, but it is not fool proof.

Commercial Indicators

Fnecdotal evidence from local business indicates a significant slow down for &%1&. Bisitors numbers are down slightly at the Bisitor Center 2&%11G &*,'(' &%1&G &*,%))3 and vacancy rates are up at local hotels and motels from last year. Despite this slow down other numbers are loo+ing positive, the vacancy rate is split in half from last year and reinvestment in downtown is also up significantly with many ,obs added. Downtown continued to ;churn; with turnover in some businesses , ;churning; in Pinedale seems to be a combination of high rents and the start1up of businesses with no or ill1defined business plan and lac+ of accurate mar+et analysis.

2011: Businesses Gained: 2 (Outlet Zone, Franklin Street Gifts) Businesses Lost: 2 (Sophie's Boutique, Outlet Zone)

Page1

Jobs Lost*: 2 Estimated Facade Improvements*: $40,000

(Co !o" $#0,000, $%C $&0,000) Vacancies: &# !uil'in(s on )ine Street (B*B +a,aha, $olf's Ca!in, -.Clain !uil'in(, )atio, %aun'ro,at, /arro er Buil'in(, -eat %o.ker, )ine Creek -otel, part of 0io 1er'e !uil'in(, 2o, Bro n !" Blue )lanet, )ine'ale Collision, Sun'an.e -otel, )enton Buil'in() 2012 : Businesses Gained in District*: 4 (/eart * Soul Baker", 3 Clippin( alon(, 4S3 )ri'e, %as 0einas, 5an'elion 5en, 3pplian.e Store) Businesses Lost: 2 (Franklin Street Gifts, 2he Barn 5oor) Jobs Gained*: 2467 Estimated Facade/ enovation Improvements*: $4#8,000 (/eart * Soul $40,000, $0BC $#70,000, %os Ca!os $20,000, )ine'ale )roperties $8000) Vacancies: 9 !uil'in(s on )ine Street (-.Clain !uil'in(, %aun'ro,at, /arro er Buil'in(, -eat %o.ker, )ine Creek -otel, )ine'ale Collision, )enton Buil'in() *These numbers are VERY rough estimates from observation. In some cases I have to guess so there could be a significant variation between reality and what is reported here.

Summary

&%1( is e!pected to be another similar year, hopefully there will be some more substantial improvements in real estate sales and construction. The big pro,ect of course is how 5enior <ousing will unfold in Pinedale. Tourism and /ain 5treet will continue to ramp up which will continue to show improvements in visitors and reinvestment in town. 5incerely Hate Dahl Planning & Zoning Fdministrator Page1

Page1

You might also like

- Glen Egbert ResumeDocument1 pageGlen Egbert ResumeGlen EgbertNo ratings yet

- Egbert - CVDocument3 pagesEgbert - CVGlen EgbertNo ratings yet

- Glen Egbert: EducationDocument3 pagesGlen Egbert: EducationGlen EgbertNo ratings yet

- Glen Egbert's ResumeDocument3 pagesGlen Egbert's ResumeGlen EgbertNo ratings yet

- Egbert - CVDocument3 pagesEgbert - CVGlen EgbertNo ratings yet

- Glossary and Index of Terms-1Document20 pagesGlossary and Index of Terms-1Glen EgbertNo ratings yet

- Recommendations For A Supplementary Secondary Online ProgramDocument13 pagesRecommendations For A Supplementary Secondary Online ProgramGlen EgbertNo ratings yet

- Glen Egbert: Educator, TechnologistDocument3 pagesGlen Egbert: Educator, TechnologistGlen EgbertNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Deed of Assignment and Transfer of RightsDocument2 pagesDeed of Assignment and Transfer of RightsEmilio Soriano100% (1)

- "Rohan Square ": Members PresentDocument26 pages"Rohan Square ": Members PresentPon Malai KrishNo ratings yet

- The Transfer of Property Act 1882Document83 pagesThe Transfer of Property Act 1882CA Sairam BalasubramaniamNo ratings yet

- CONTRACT OF LEASE Dok-Alternatibo CorrectedDocument2 pagesCONTRACT OF LEASE Dok-Alternatibo CorrectedJeLow BrigoleNo ratings yet

- Mud House of BangladeshDocument4 pagesMud House of BangladeshSanjana BhandiwadNo ratings yet

- Real Estate BrokersDocument15 pagesReal Estate BrokersAerwin Abesamis0% (1)

- Modern Art Building (4-Storey Office Building) Quezon City, 1987 C-E Construction CorporationDocument31 pagesModern Art Building (4-Storey Office Building) Quezon City, 1987 C-E Construction CorporationkarrenskiNo ratings yet

- 1.boq - RC Work For Office (Part 3) - LattanavongDocument2 pages1.boq - RC Work For Office (Part 3) - LattanavongKu BờmNo ratings yet

- Additional bottom reinforcement RC flat slabDocument7 pagesAdditional bottom reinforcement RC flat slabbarsathNo ratings yet

- Alabama Tenants HandbookDocument26 pagesAlabama Tenants HandbookzorthogNo ratings yet

- Io N On Ly.: Statement of Encumbrance On PropertyDocument2 pagesIo N On Ly.: Statement of Encumbrance On PropertyJayanth RamNo ratings yet

- Mock Bar Examination in Land Title and DeedsDocument9 pagesMock Bar Examination in Land Title and DeedsalbemartNo ratings yet

- ▒ 한국과 미국 임대아파트 평면의 특징 비교 @신경주 (한양대) 071200Document10 pages▒ 한국과 미국 임대아파트 평면의 특징 비교 @신경주 (한양대) 071200HyunghoonGwakNo ratings yet

- Nagaraj Rent AgreementDocument5 pagesNagaraj Rent AgreementSeshuNo ratings yet

- Future Interest FlowchartDocument1 pageFuture Interest FlowchartwittclayNo ratings yet

- Affordable Housing - Nikol Kathwada - RiddhiDocument76 pagesAffordable Housing - Nikol Kathwada - RiddhiShrey PatelNo ratings yet

- IM - Quantum Point & Omega Centre Sep 2023Document7 pagesIM - Quantum Point & Omega Centre Sep 2023Manoj KumarNo ratings yet

- Pow Machinery Shed - RiceDocument33 pagesPow Machinery Shed - RiceDA 3No ratings yet

- Tenant electricity bill responsibilitiesDocument14 pagesTenant electricity bill responsibilitiesNas AyuniNo ratings yet

- Deed of Sale With Assumption of MortgageDocument2 pagesDeed of Sale With Assumption of MortgageAnonymous DD0GH5100% (14)

- 10 Progress Report PDFDocument72 pages10 Progress Report PDFMary BainoNo ratings yet

- Weatherford Town Square (Imperium Holdings)Document4 pagesWeatherford Town Square (Imperium Holdings)Imperium Holdings, LPNo ratings yet

- How To Contact Chase - Servicing & Mortgage Files - Chase Home Finance LLCDocument4 pagesHow To Contact Chase - Servicing & Mortgage Files - Chase Home Finance LLC83jjmackNo ratings yet

- New Illinois Condo Conversion LawDocument6 pagesNew Illinois Condo Conversion LawChicagoMTONo ratings yet

- Report on 5 Warehouses for LeaseDocument6 pagesReport on 5 Warehouses for LeaseMirza MešanovićNo ratings yet

- Torbela v. RosarioDocument3 pagesTorbela v. RosarioJoseph DimalantaNo ratings yet

- Rent AgreementDocument1 pageRent AgreementJohn FernendiceNo ratings yet

- DEED OF DONATION-Brigada EskwelaDocument1 pageDEED OF DONATION-Brigada EskwelaALDRIN OBIAS86% (7)

- Upc - PrequalificationDocument170 pagesUpc - PrequalificationMANo ratings yet

- Real Estate Exam 4 Practice QuestionsDocument3 pagesReal Estate Exam 4 Practice QuestionsJuan Carlos NocedalNo ratings yet