Professional Documents

Culture Documents

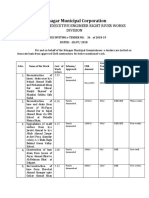

OIL - Sunidhi

Uploaded by

darshanmaldeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OIL - Sunidhi

Uploaded by

darshanmaldeCopyright:

Available Formats

Oil India

Realisations improve yet higher write offs impact bottom-line, Outperform

November 13, 2013

Oil & Gas

Sector Outlook - Neutral

16.4%

16.0%

14.0%

12.7%

12.6%

11.1%

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

Revenue

EBIDTA

PBT

Stock Recommendation

APAT

Outperform

CMP (`)

462

Price Target (`)

590

Upside (%)

28%

52 Week H / L `

630/415

BSE 30

20282

Key Data

No.of Shares, Mn.

601.1

Mcap, ` Bn

277722.1

Mcap,USD Bn @ `60

4628.7

2 W Avg Qty (BSE+NSE) Mn

0.3

Share holding, Sept'13

Promoters

68.4

FII

10.2

DII

6.6

Public & Others

14.8

Performance

1M

3M

6M

12 M

Stock Return %

-0.3

-3.6

-17.5

-1.9

1.0

-10.8

-16.0

-7.8

Relative Return %

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

-5.0%

-10.0%

-15.0%

Crude production hampered due to bandhs and blockades: OILs crude production

jumped by 1.4% QoQ yet was lower by 4.6% YoY at 0.92mmt due to bandhs and

blockades in Assam which resulted in loss of over 3,456mt production in Q2FY14.

Natural gas production was marginally higher QoQ at 0.67bcm. Crude sales however

jumped 7.1% QoQ at 0.93mmt due to higher off take from Numaligarh refinery. Net

crude realisations jumped by 14.1% QoQ at US$52.3/bbl with additional benefit

from rupee depreciation. Thus the revenues jumped by 35.2% QoQ at `28.3bn.

Dry well write offs increase: Dry well write offs in Q2FY14 stood at `2.8bn against

`1.0bn in Q1FY14 and `1.2bn in Q2FY13 thus impacting performance. Subsidy

sharing for Q2FY14 stood at `22.3bn remaining same in dollar terms at US$56.0/bbl

yet higher by 12.7% QoQ due to rupee depreciation. Overall, despite higher write

offs, higher crude realisation coupled with rupee depreciation led to 48.4% QoQ

jump in PAT at `9.0bn.

Difficult to meet production targets for FY14E, overseas ventures to add value in

future: We believe OIL would not be able meet its crude production guidance for

FY14E. However, the management has indicated that the situation in Assam would

improve going ahead which we believe would aid FY15E crude and natural gas

production. OILs overseas ventures are expected to add value going ahead with

ramp up in Carabobo, Venezuela production, successful discovery in Gabon and

ongoing production in the US shale gas asset. With expected natural gas price hike

from FY15E onwards, OILs earnings are likely to jump substantially. We believe the

stock is available at attractive valuations of 8.1x and 6.3x FY14E EPS of `56.8 and

FY15E EPS of `73.7. We have valued OIL at 8.0x and have arrived at a price target of

`590. Maintain Outperform.

Oil India

NIFTY

Rohit Nagraj

rohit.n@sunidhi.com

Phone: +91-022-61131320

Oct-13

Nov-13

Sep-13

Jul-13

Aug-13

Jun-13

May-13

Apr-13

Feb-13

Mar-13

Jan-13

Dec-12

Financials Revenues

`mn

Nov-12

Result Update

CAGR Growth (FY2013-15E)

18.0%

Although, OILs Q2FY14 crude net realisations improved to US$52.3/bbl the

performance was marred by higher dry well write offs at `2.8bn. performance was

also supported by favourable exchange rate and higher crude sales which jumped by

7.1% QoQ at 0.93mmt. Subsidies for the quarter went up by 12.7% QoQ at `22.3bn.

The company has guided for crude and natural gas production of 3.95mmt and

2.7bcm respectively for FY14E of which it is likely to fall short of in crude production

as it has achieved only 1.82mmt production in H1FY14. Bandhs and blockades

resulted in crude production loss of over 3,456mt during the quarter. We believe it

would be difficult for the company to recover production loss of H1FY14 in H2FY14E

and hence estimate crude production at 3.7mmt for FY14E. The company is making

progress in its international ventures with production ramp-up in Carabobo,

Venezuela, discovery in Gabon and ongoing production in its shale gas asset in the

US. We believe these investments in overseas projects would yield value in future.

We thus maintain Outperform on the stock with a slightly revised target price of

`590.

EBIDTA

`mn

APAT

`mn

EPS

`

P/E

x

EV/EBIDTA

x

ROAE

%

FY11

83,206

42,721

28,877

48.0

9.6

4.0

19.7

FY12

98,632

45,798

34,469

57.3

8.1

3.7

20.7

FY13

99,476

46,147

35,893

59.7

7.7

3.6

19.4

FY14E

FY15E

103,746

126,096

45,993

62,524

34,133

44,300

56.8

73.7

8.1

6.3

3.1

1.9

16.9

19.6

Source: Company, Sunidhi Research

Oil India Ltd

Quarterly Snapshot

(` mn)

Q1FY12

Q2FY12

Q3FY12

Q4FY12

Q1FY13

Q2FY13

Q3FY13

Q4FY13

Q1FY14

23,661

12.8

364

1.5

6,760

28.6

1,121

4.7

3,004

12.7

12,412

32.4

52.5

2,784

9,627

88

3,026

12,566

4,070

32.4

8,496

0

8,496

51.0

35.9

33,571

41.9

68

0.2

8,784

26.2

4,147

12.4

3,502

10.4

17,070

37.5

50.8

5,901

11,170

5

5,955

17,119

5,734

33.5

11,385

0

11,385

34.0

33.9

25,898

(22.9)

376

1.5

7,172

27.7

1,457

5.6

2,611

10.1

14,282

(16.3)

55.1

2,887

11,395

11

3,756

15,140

5,000

33.0

10,140

0

10,140

(10.9)

39.2

18,021

(30.4)

119

0.7

5,189

28.8

3,490

19.4

3,577

19.9

5,647

(60.5)

31.3

2,841

2,806

1

3,389

6,194

1,746

28.2

4,448

0

4,448

(56.1)

24.7

24,396

35.4

29

0.1

7,707

31.6

1,259

5.2

3,376

13.8

12,025

112.9

49.3

2,025

10,000

3

3,772

13,769

4,469

32.5

9,299

0

9,299

109.1

38.1

25,194

3.3

(140)

(0.6)

7,810

31.0

1,783

7.1

3,093

12.3

12,649

5.2

50.2

2,560

10,089

2

4,025

14,112

4,567

32.4

9,546

0

9,546

2.6

37.9

25,168

(0.1)

63

0.3

7,607

30.2

2,039

8.1

3,179

12.6

12,280

(2.9)

48.8

2,224

10,056

1

3,857

13,912

4,509

32.4

9,403

0

9,403

(1.5)

37.4

24,718

(1.8)

(226)

(0.9)

7,315

29.6

4,199

17.0

3,670

14.8

9,759

(20.5)

39.5

2,394

7,366

20

3,694

11,040

3,394

30.7

7,646

0

7,646

(18.7)

30.9

20,978

(15.1)

(161)

(0.8)

6,826

32.5

2,634

12.6

3,539

16.9

8,140

(16.6)

38.8

2,665

5,475

9

3,517

8,982

2,891

32.2

6,091

0

6,091

(20.3)

29.0

Q1FY12

Q2FY12

Q3FY12

Q4FY12

Q1FY13

Q2FY13

Q3FY13

Q4FY13

Q1FY14

0.97

0.64

0.97

0.51

0.99

0.68

0.97

0.54

0.96

0.68

0.95

0.54

0.97

0.64

0.97

0.50

0.95

0.63

0.94

0.49

0.96

0.69

0.94

0.55

0.92

0.68

0.92

0.54

0.87

0.65

0.88

0.51

0.90

0.66

0.87

0.52

0.92

(4.6)

1.4

0.67

(3.6)

1.4

0.93

(1.8)

7.1

0.53

(3.3)

1.5

Crude Gross Real. (US$/bbl)

116.3

Crude Net Real. (US$/bbl)

59.6

Subsidy Sharing (`mn)

17,807

Source: Company, Sunidhi Research

112.5

86.3

8,444

110.1

57.0

18,530

119.7

38.9

28,737

109.8

53.8

20,155

108.6

52.6

20,782

108.6

52.6

19,488

111.4

55.4

18,497

101.9

45.9

19,821

108.3

(0.3)

6.3

52.3

(0.6)

14.1

22,337

7.5

12.7

Revenues

Growth in rev. (%)

Cost Of goods sold

% of net sales

Royalty & Cess

% of net sales

Others

% of net sales

Employee Cost

% of net sales

EBITDA

Q-o-Q growth (%)

EBITDA Margin (%)

Dep. and amort.

EBIT

Interest expenses

Other Income

EBT

Provision for tax

Effective tax rate (%)

Net Profit

Prior Period Adj.

Adj. Net Profit

Q-o-Q growth (%)

Adj. PAT Margin (%)

Operating Metrics

Crude production (MMT)

Gas production (BCM)

Crude Sales (MMT)

Gas Sales (BCM)

Sunidhi Research |

Q2FY14 YoY (%) QoQ (%)

28,364

12.6

35.2

35.2

0.0

0.0

257

(283.7)

(259.4)

0.9

0.0

0.0

8,122

4.0

19.0

28.6

0.0

0.0

2,096

17.6

(20.4)

7.4

0.0

0.0

3,377

9.2

(4.6)

11.9

0.0

0.0

14,513

14.7

78.3

78.3

0.0

0.0

51.2

0.0

0.0

4,654

81.8

74.6

9,859

(2.3)

80.1

93.8

(65.6)

3,474

(13.7)

(1.2)

13,330

(5.5)

48.4

4,293

(6.0)

48.5

32.2

0.0

0.0

9,036

(5.3)

48.4

0.0

0.0

9,036

(5.3)

48.4

48.4

0.0

0.0

31.9

0.0

0.0

Q2FY14 YoY (%) QoQ (%)

Oil India Ltd

Crude production impacted due to ongoing bandhs and blockades in Assam

Crude production jumped marginally by 1.4% QoQ at 0.92mmt yet was affected due to ongoing

bandhs and blockades in Assam. Crude sales which were affected in Q1FY14 due to lower off take

by Numaligarh refinery recovered in Q2FY14 and jumped by 7.1% QoQ at 0.93mmt. Natural gas

production too jumped marginally by 1.4% QoQ at 0.67bcm during Q2FY14. Gas sales jumped in

line with production by 1.5% QoQ at 0.53bcm.

Natural Gas Production and Sales

Crude Prod.

616 600 641

677 676

691 675

648 657 666

2Q FY14

1Q FY14

4Q FY13

Q3FY13

Q2FY13

Q1FY13

Q4FY12

Q3FY12

Q2FY12

Q1FY12

Natural Gas Prod.

Crude Sales

Source: Company, Sunidhi Research

639 626

508 543 544 498 485 548 536 511 522 530

423 443 479 465

Q1FY11

2Q FY14

Q3FY11

Q2FY11

Q1FY11

0.70

553 583

Q4FY11

0.87

0.93

0.88

1Q FY14

0.92

Q3FY13

0.97

Q4FY12

0.94

0.95

Q3FY12

0.94

0.97

Q2FY12

Q2FY13

0.97

Q1FY13

0.95

0.91

Q1FY12

0.75

0.80

Q4FY11

0.80

0.95

0.85

0.78

mmt

0.90

4Q FY13

0.92

0.90

0.87

800

700

600

500

400

300

200

100

0

Q3FY11

0.95

mmscm

0.99

0.97

0.960.97

0.96

0.95

0.940.930.94

0.92

1.00

Q2FY11

Crude Production and Sales

Natural Gas Sales

Source: Company, Sunidhi Research

Crude discount kept unchanged at US$56.0/bbl yet rupee depreciation benefits overall

performance

Higher crude prices coupled with rupee depreciation led to 44.5% jump in crude average

realisations in rupee terms at `22,347/mt. Net crude realisations for Q2FY14 stood at US$52.3/bbl

while gross realisation were at US$108.3/bbl. Subsidy sharing for the quarter jumped by 12.7%

QoQ at `22.3bn.

25.0

Source: Company, Sunidhi Research

Sunidhi Research |

18.5

17.8

22.3

18.5

19.8

8.4

7.3

4.0

5.6

2Q FY14

1Q FY14

4Q FY13

Q3FY13

Q2FY13

Q4FY12

Q3FY12

0.0

Q1FY11

2Q FY14

1Q FY14

4Q FY13

Q3FY13

Q2FY13

Q1FY13

Q3FY12

Q2FY12

Q1FY12

Q4FY11

Q3FY11

5.0

Q2FY11

0.0

Q1FY11

10.0

Net realisation

20.2 20.8 19.5

15.0

20.0

Gross realisation

16.1

Q2FY12

45.9

20.0

Q1FY12

38.9

40.0

52.3

Q4FY11

53.8 52.6 52.6 55.4

Q3FY11

60.0

28.7

30.0

` bn

80.0

86.3

86

78 75

63.2 67.1

59.6

57.0

52.9

49.7

Q4FY12

US$ / bbl

100.0

35.0

120

116 112

110

110 109 109 111

108

104

102

120.0

Q2FY11

140.0

Subsidy sharing

Q1FY13

Crude gross and net realisations

Source: Company, Sunidhi Research

Oil India Ltd

PAT Trend

11.4

12.0

10.1

9.2 9.1

10.0

9.3 9.5 9.4

8.5

` bn

8.0

6.0

9.0

7.6

6.1

5.6

5.0

4.4

4.0

2.0

2Q FY14

1Q FY14

4Q FY13

Q3FY13

Q2FY13

Q1FY13

Q4FY12

Q3FY12

Q2FY12

Q1FY12

Q4FY11

Q3FY11

Q2FY11

Q1FY11

0.0

Source: Company, Sunidhi Research

Change in estimates

Based on H1FY14 performance, we have lowered our crude production assumption for OIL to

3.7mmt for FY14E keeping our assumption for FY15E unchanged at 3.91mmt. Also, we have raised

our rupee-dollar assumption for FY14E and FY15E to `59.5/US$ and `60.0/US$ respectively.

Similarly, the subsidy sharing has also been raised for FY14E and FY15E by 6.4% and 12.1%

respectively. These changes have resulted in increasing our earnings estimates for FY15E by 3.8%

to `44.3bn

(`bn)

Previous

Revenue

104.1

EBITDA

46.7

PAT

34.4

Operating metrics

Crude production(mmt)

3.79

Gas production(bcm)

2.73

Oil realisation gross ( US$/bbl)

104.0

Oil realisation net ( US$/bbl)

52.1

Subsidy sharing(`bn)

80.4

Gas realisation (US$/mmbtu)

3.9

Exchange rate (`/US$)

56.0

FY14E

Revised % change

103.7

(0.4)

46.0

(1.6)

34.1

(0.7)

3.70

2.73

105.8

54.4

85.6

3.6

59.5

(2.4)

1.7

4.5

6.4

(6.1)

6.2

Previous

122.7

61.1

42.7

3.91

2.95

104.0

50.8

79.3

6.8

54.5

FY15E

Revised % change

126.1

2.8

62.5

2.3

44.3

3.8

3.91

2.95

104.0

53.1

88.9

6.8

60.0

0.0

4.6

12.1

10.1

Source: Company, Sunidhi Research

Valuations and outlook

Difficult to meet production targets for FY14E, overseas ventures to add value in future: We

believe OIL would not be able meet its production guidance for FY14E. However, the management

has indicated that the situation in Assam would improve going ahead which we believe would aid

FY15E crude and natural gas production. OILs overseas ventures are expected to add value going

ahead with ramp up in Carabobo, Venezuela production, successful discovery in Gabon and

ongoing production in the US shale gas asset. With expected natural gas price hike from FY15E

onwards, OILs earnings are likely to jump substantially.

We believe the stock is available at attractive valuations of 8.1x and 6.3x FY14E EPS of `56.8 and

FY15E EPS of `73.7. We have valued OIL at 8.0x and have arrived at a price target of `590.

Maintain Outperform.

Production guidance

Crude (mmt)

Gas (bcm)

Grand total (O+OEG)

FY13A

3.70

2.64

6.34

FY14E

3.95

2.74

6.69

FY14E our

assumption

3.79

2.73

6.52

Source: Company, Sunidhi Research

Sunidhi Research |

Oil India Ltd

Valuations Summary

Balance Sheet (` mn)

Year End-March

FY11

FY12

FY13

FY14E

FY15E

48.0

139.9

259.5

15.0

31.2

57.3

164.6

294.8

19.0

33.1

59.7

69.1

319.6

30.0

50.2

56.8

66.7

353.0

20.0

35.2

73.7

84.3

400.3

22.5

30.5

9.6

1.8

4.0

3.2

8.1

1.6

3.7

4.1

7.7

1.4

3.6

6.5

8.1

1.3

3.1

4.3

6.3

1.2

1.9

4.9

51.3

34.7

19.7

21.2

46.4

34.9

20.7

20.2

46.4

36.1

19.4

18.7

44.3

32.9

16.9

15.8

49.6

35.1

19.6

19.9

0.0

(0.7)

262.9

4.4

0.0

(0.6)

394.3

4.2

0.0

(0.6)

1,452.7

4.8

0.0

(0.6)

26.8

4.6

0.0

(0.7)

23.9

4.7

5.0

14.5

10.6

18.5

7.2

19.4

0.9

0.8

4.1

4.3

(0.3)

(4.9)

21.5

35.9

29.8

1.5

21.6

40.9

15.1

1.8

19.5

38.9

12.8

1.5

23.3

33.1

10.7

1.4

22.0

25.3

11.2

1.5

22.0

25.3

9.9

FY11

FY12

FY13

FY14E

FY15E

Revenues

83,206

98,632

99,476

103,746

126,096

Op. Expenses

40,485

52,834

53,329

57,752

63,573

Year End-March

EBITDA

Other Income

Depreciation

EBIT

Interest

42,721

8,739

8,197

43,263

131

45,798

14,167

8,852

51,112

94

46,147

15,088

8,376

52,858

26

45,993

16,219

9,120

53,092

1,375

62,524

16,819

10,021

69,322

2,200

PBT

Depreciation

Interest Exp

Others

CF before W.cap

43,132

51,019

52,832

51,717 67,122

4,790

5,142

5,671

6,041

6,441

131

94

26

1,375

2,200

(8,739) (14,167) (15,088) (16,219) (16,819)

39,314

42,088

43,442

42,914 58,944

Per share (`)

EPS

CEPS

BVPS

DPS

Payout (%)

Valuation (x)

P/E

P/BV

EV/EBITDA

Dividend Yield (%)

Return ratio (%)

EBIDTA Margin

PAT Margin

ROAE

ROACE

Leverage Ratios (x)

Long term D/E

Net Debt/Equity

Interest Coverage

Current ratio

Growth Ratios (%)

Income growth

EBITDA growth

PAT growth

Turnover Ratios

F.A Turnover x

Inventory Days

Debtors Days

Payable days

Income Statement(` mn)

Year End-March

Prov., Write offs

Year End-March

Equity and Liabilities

Share Capital

Reserves and Surplus

Total Shareholders funds

Minority Interest

Non-Current Liability

Long Term Borrowings

Deferred Tax Liabilities (Net)

Long Term Liab./ Provisions

Current Liabilities

Short Term Borrowings

Trade Payables

Other Current Liabilities

Short Term Provisions

Grand Total

Assets

Non Current Assets

Fixed Assets

Net producing properties

Expl./ dev. wells-in-prog. (Net)

Deferred Tax Assets

Non-Current Investments

Long Term Loans and Advances

Other non-current assets

Current Assets

Current Investments

Inventories

Trade Receivables

Cash and Cash Equivalents

Short Term Loans and Advances

Other Current Assets

Grand Total

FY11

FY12

FY13

2,405

153,614

156,019

0

2,405

174,809

177,213

0

6,011

186,103

192,115

0

88

11,491

3,251

0

10,767

4,038

0

12,186

4,481

10,055

3,435

18,049

9,924

212,311

101

3,469

19,682

11,543

226,813

10,219

2,925

14,161

15,363

251,449

13,323

32,586

8,757

0

6,304

3,595

194

15,690

34,352

6,209

0

7,831

3,110

137

21,316

35,843

10,480

0

8,579

5,269

1,039

2,600

5,004

9,322

117,675

8,203

18,311

5,333

10,518

109,355

8,949

9,992

6,443

9,027

121,329

13,587

4,751

7,019

8,905

212,311

226,813

251,809

FY15E

FY15E

FY15E

FY14E

FY15E

6,011

6,011

206,170 234,645

212,181 240,657

0

0

0

12,186

4,481

0

12,186

4,481

27,500 22,000

3,175

3,425

14,661 15,161

24,756 26,764

298,941 324,674

23,441

35,534

14,723

0

8,579

5,269

1,039

25,391

35,250

21,216

0

8,579

5,269

1,039

9,992

9,992

6,340

7,706

7,205

8,757

164,328 178,985

13,587 13,587

8,905

8,905

298,941 324,674

Cash flow Statement

FY15E

FY15E

Inc/dec. in W.cap

16,540

746

(5,438)

12,069

(160)

PBT

43,132

51,019

52,832

51,717

67,122

Op CF after W.cap

55,855

42,833

38,005

54,983

58,784

Tax

14,255

16,549

16,939

17,584

22,821

Less Taxes

12,973

17,273

15,520

17,584

22,821

PAT

Minority

Prior Period Adj.

Sh. of Associates

Ex. ordinary

Adj. PAT

28,877

0

0

0

0

28,877

34,469

0

0

0

0

34,469

35,893

0

0

0

0

35,893

34,133

0

0

0

0

34,133

44,300

0

0

0

0

44,300

Exceptional & Prior Period Adj.

Net CF From Operations

Inc/(dec.) in F.A + CWIP

others

CF from Invst. Activities

Loan Raised/(repaid)

0

0

0

0

0

42,882

25,561

22,485

37,399 35,963

(9,889) (3,307) (12,753) (12,100) (14,600)

11,029

12,640

14,339

16,219 16,819

1,140

9,333

1,587

4,119

2,219

9,768 (10,042)

10,477

16,922 (5,500)

Source: Company, Sunidhi Research

Sunidhi Research |

Equity Raised

Dividend

Others

CF from Fin Activities

Net inc /(dec.) in cash

Op. bal of cash

Cl. balance of cash

0

0

0

0

0

(10,497) (13,275) (20,992) (14,067) (15,825)

(11,047) (19,897) (1,582) (1,375) (2,200)

(11,776) (43,214) (12,097)

1,480 (23,525)

32,245 (8,320)

11,975

42,998 14,657

85,429 117,675 109,355 121,329 164,328

117,675 109,355 121,329 164,328 178,985

Oil India Ltd

Sunidhis Rating Rationale

The price target for a large cap stock represents the value the analyst expects the stock to reach over next 12 months. For a stock to be

classified as Outperform, the expected return must exceed the local risk free return by at least 5% over the next 12 months. For a stock to

be classified as Underperform, the stock return must be below the local risk free return by at least 5% over the next 12 months. Stocks

between these bands are classified as Neutral.

(For Mid & Small cap stocks from 12 months perspective)

BUY

Absolute Return >20%

ACCUMULATE

Absolute Return Between 10-20%

HOLD

Absolute Return Between 0-10%

REDUCE

Absolute Return 0 To Negative 10%

SELL

Absolute Return > Negative 10%

Apart from Absolute returns our rating for a stock would also include subjective factors like macro environment, outlook of the industry

in which the company is operating, growth expectations from the company vis a vis its peers, scope for P/E re-rating/de-rating for the

broader market and the company in specific.

SUNIDHI SECURITIES & FINANCE LTD

Member: National Stock Exchange (Capital, F&O & Debt Market) & The Stock Exchange, Mumbai

SEBI Registration Numbers: NSE: INB 230676436 BSE: INB 010676436

Maker Chamber IV, 14th Floor, Nariman Point, Mumbai: 400 021

Tel: (+91-22) 6636 9669 Fax: (+91-22) 6631 8637 Web-site: http://www.sunidhi.com

Disclaimer: "This Report is published by Sunidhi Securities & Finance Ltd.("Sunidhi") for private circulation. This report is meant for informational

purposes and is not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. While utmost care has been

taken in preparing this report, we claim no responsibility for its accuracy. Recipients should not regard the report as a substitute for the exercise of

their own judgment. Any opinions expressed in this report are subject to change without any notice and this report is not under any obligation to

update or keep current the information contained herein. Past performance is not necessarily indicative of future results. This Report accepts no

liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this report. Sunidhi and its associated companies,

directors, officers and employees may from time to time have a long or short position in the securities mentioned and may sell or buy such securities,

or act upon information contained herein prior to the publication thereof. Sunidhi may also provide other financial services to the companies

mentioned in this report."

Sunidhi Research |

You might also like

- 3M India Q4FY21 ResultsDocument7 pages3M India Q4FY21 ResultsdarshanmaldeNo ratings yet

- NESTLE INDIA INITIATING COVERAGE ADDDocument78 pagesNESTLE INDIA INITIATING COVERAGE ADDdarshanmaldeNo ratings yet

- Aavas Edelweiss 2.08.19Document15 pagesAavas Edelweiss 2.08.19darshanmaldeNo ratings yet

- ABF Motilal BrokerageDocument8 pagesABF Motilal BrokerageTatsam VipulNo ratings yet

- Laurus Labs Stock VisualisationDocument42 pagesLaurus Labs Stock VisualisationdarshanmaldeNo ratings yet

- Aarti Industries - Q1FY20 - Result Update - Axis DirectDocument6 pagesAarti Industries - Q1FY20 - Result Update - Axis DirectdarshanmaldeNo ratings yet

- Aavas Edelweiss 2.08.19Document15 pagesAavas Edelweiss 2.08.19darshanmaldeNo ratings yet

- Varroc Engineering - Update - Kotak Institutional - 040522Document8 pagesVarroc Engineering - Update - Kotak Institutional - 040522darshanmaldeNo ratings yet

- Garware Technical FibresDocument28 pagesGarware Technical FibresdarshanmaldeNo ratings yet

- Aavas Q4FY21 ResultsDocument16 pagesAavas Q4FY21 ResultsdarshanmaldeNo ratings yet

- Aavas Financiers ICDocument30 pagesAavas Financiers ICPankaj SankholiaNo ratings yet

- Aavas Financiers - MNCL - 090522Document6 pagesAavas Financiers - MNCL - 090522darshanmaldeNo ratings yet

- Aarti Industries - Q2FY22 Result Update - 02-11-2021 - 13Document8 pagesAarti Industries - Q2FY22 Result Update - 02-11-2021 - 13darshanmaldeNo ratings yet

- Aarti Industries - Upgrade To Buy - 2QFY20 Result - EdelDocument13 pagesAarti Industries - Upgrade To Buy - 2QFY20 Result - EdeldarshanmaldeNo ratings yet

- Aarti Industries - Company Update - 170921Document19 pagesAarti Industries - Company Update - 170921darshanmaldeNo ratings yet

- Aarti Industries - Pick of The Week - 04122021 - 06!12!2021 - 08Document5 pagesAarti Industries - Pick of The Week - 04122021 - 06!12!2021 - 08darshanmaldeNo ratings yet

- Aarti Industries Set to Benefit from China Disruption and Domestic GrowthDocument9 pagesAarti Industries Set to Benefit from China Disruption and Domestic GrowthdarshanmaldeNo ratings yet

- Aarti Industries - 3QFY20 Result - RsecDocument7 pagesAarti Industries - 3QFY20 Result - RsecdarshanmaldeNo ratings yet

- Aarti Industries - 1QFY19 RU - KR ChokseyDocument7 pagesAarti Industries - 1QFY19 RU - KR ChokseydarshanmaldeNo ratings yet

- Blue Dart Express (NOT RATED) - BOBCAPS SecDocument3 pagesBlue Dart Express (NOT RATED) - BOBCAPS SecdarshanmaldeNo ratings yet

- Container Corporation of India (CCRI IN, Buy) - 1QFY20 Result - NomuraDocument7 pagesContainer Corporation of India (CCRI IN, Buy) - 1QFY20 Result - NomuradarshanmaldeNo ratings yet

- Aarti Industries - Initiating Coverage - Axis Capital - 220922Document27 pagesAarti Industries - Initiating Coverage - Axis Capital - 220922darshanmaldeNo ratings yet

- Dilip Buildcon LTD ARO 2020-21 - YES SecuritiesDocument5 pagesDilip Buildcon LTD ARO 2020-21 - YES SecuritiesdarshanmaldeNo ratings yet

- Aarti Industries Q4FY21 Result UpdateDocument5 pagesAarti Industries Q4FY21 Result UpdatedarshanmaldeNo ratings yet

- Yes Bank 1QFY20 Result Update - 190718 - Antique ResearchDocument4 pagesYes Bank 1QFY20 Result Update - 190718 - Antique ResearchdarshanmaldeNo ratings yet

- Jubilant Foodworks Limited: Financial HighlightsDocument2 pagesJubilant Foodworks Limited: Financial HighlightsdarshanmaldeNo ratings yet

- Apollo Tyres (APTY IN, Buy) - 1QFY20 Result - NomuraDocument7 pagesApollo Tyres (APTY IN, Buy) - 1QFY20 Result - NomuradarshanmaldeNo ratings yet

- Aarti Ind-Nov05 18Document3 pagesAarti Ind-Nov05 18darshanmaldeNo ratings yet

- Parag Milk Foods - SPADocument4 pagesParag Milk Foods - SPAdarshanmaldeNo ratings yet

- Va Tech WabagDocument5 pagesVa Tech WabagdarshanmaldeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BMST5103Document38 pagesBMST5103yusufNo ratings yet

- Bimodal ITDocument3 pagesBimodal ITandreasang89No ratings yet

- Research ProposalDocument34 pagesResearch ProposalSimon Muteke100% (1)

- 9708 w14 Ms 21 PDFDocument7 pages9708 w14 Ms 21 PDFTan Chen Wui0% (1)

- Spencer Trading BooksDocument2 pagesSpencer Trading BookscherrynestNo ratings yet

- An Assignment On Niche Marketing: Submitted ToDocument3 pagesAn Assignment On Niche Marketing: Submitted ToGazi HasibNo ratings yet

- 3 Strategic Use of Information Technology PDFDocument138 pages3 Strategic Use of Information Technology PDFherrajohnNo ratings yet

- Cost and Management Accounting I For 3rd Year Business Education StudentsDocument86 pagesCost and Management Accounting I For 3rd Year Business Education StudentsAmir Kan100% (2)

- IGCSE ICT Chapter 5 Question BankDocument9 pagesIGCSE ICT Chapter 5 Question BankMndzebele Siphelele100% (1)

- 1-Industry Overview (TDP-101) PDFDocument35 pages1-Industry Overview (TDP-101) PDFtonylyf100% (7)

- SSS-TQM-UII 2 Juron and ShewartDocument5 pagesSSS-TQM-UII 2 Juron and Shewartதோனி முருகன்No ratings yet

- Malaysia and Singapore Company Sina Weibo V Badge Application FeesDocument2 pagesMalaysia and Singapore Company Sina Weibo V Badge Application FeesTQ2020No ratings yet

- Analyzing A Case StudyDocument9 pagesAnalyzing A Case StudyRana Fathiya KusumaNo ratings yet

- CaseDocument2 pagesCaseAman Dheer KapoorNo ratings yet

- THM CH 3Document15 pagesTHM CH 3Adnan HabibNo ratings yet

- China Green (Holdings) LimitedDocument17 pagesChina Green (Holdings) LimitedcageronNo ratings yet

- KPJ Annual Report (Pp. 44 To Form), 2008Document114 pagesKPJ Annual Report (Pp. 44 To Form), 2008h3gd7h2tNo ratings yet

- Parties & Their Role in Project FinanceDocument15 pagesParties & Their Role in Project FinanceBlesson PerumalNo ratings yet

- HR Pepsi CoDocument3 pagesHR Pepsi CookingNo ratings yet

- Group 3 Case STUDY 1Document7 pagesGroup 3 Case STUDY 1Rhoel YadaoNo ratings yet

- Srinagar Municipal Corporation: Office of The Executive Engineer Right River Works DivisionDocument7 pagesSrinagar Municipal Corporation: Office of The Executive Engineer Right River Works DivisionBeigh Umair ZahoorNo ratings yet

- Eazi Buyer Pack 2023 08Document3 pagesEazi Buyer Pack 2023 08Junaid AnthonyNo ratings yet

- Sustaining Competitive AdvantageDocument4 pagesSustaining Competitive AdvantagensucopyNo ratings yet

- Unit 9: Entrepreneurship and Small Business ManagementDocument36 pagesUnit 9: Entrepreneurship and Small Business ManagementShahrear AbirNo ratings yet

- Pooya, A., Mehran, A.K. and Ghouzhdi, S.G., 2020.Document19 pagesPooya, A., Mehran, A.K. and Ghouzhdi, S.G., 2020.Eduardo CastañedaNo ratings yet

- Assurance SP Reviewer PremidDocument14 pagesAssurance SP Reviewer PremidMica Bengson TolentinoNo ratings yet

- Module 5Document28 pagesModule 5nucleya nxsNo ratings yet

- Social Media Marketing Secrets 2020 3 Books in 1 B088QN6CFRDocument324 pagesSocial Media Marketing Secrets 2020 3 Books in 1 B088QN6CFRmusfiq100% (1)

- Lazy River Scalping StrategyDocument10 pagesLazy River Scalping StrategyPanayiotis Peppas0% (1)

- 8th Mode of FinancingDocument30 pages8th Mode of FinancingYaseen IqbalNo ratings yet