Professional Documents

Culture Documents

Ma Case Writeup

Uploaded by

Mayank VyasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ma Case Writeup

Uploaded by

Mayank VyasCopyright:

Available Formats

A case study on

11/19/2013

Submitted to:-Prof. S.Abhijith

Presented By: Group 7(Sec A) Madhusudan 13031 Masood Ahmed 13032 Mayank Vyas 13033 M. Sohail Wasim 13034 Mona Kabra 13035

INTRODUCTION OF THE CASE

This case talks about Sheridan Carpet Company that produces high grade carpeting material for use in automobiles and recreational vans. It was the industries practice to announce the prices of their products prior to the 6 month seasons. Sheridan was the largest company in its segment of the automobile carpet industry. Most of Sheridans competitors were smaller than Sheridan and they awaited Sheridans price announcement before setting their own selling prices. Sheridan produced a carpet named Carpet 104 which had especially dense nap & required special machine to produce. Sheridan had raised the price of this carpet from $3.90 to $5.20 per square yard from Jan. 2000 so as to increase the margin of carpet 104 up to that of other carpets in the line. Although Sheridan increased the price of the carpet 104 to $5.20 but the competitors kept the price at $3.90 only. This led to a loss of market share of Sheridan. Estimates of Marketing Manager, Mel Walters for 2001-1

SALES( in sq. yards)

IndustrySheridan-

6,30,000 1,50,000 (@$3.90) 65,000 (@$5.20)

There were also some concerns about the pricing which were discussed by the marketing manager and the chief accountant. The concerns were: 1) Whether the competitors would also reduce price if Sheridan reduces it. 2) Whether the decision related to pricing of carpet 104 affect the sales of the other carpets of the company.

But they concluded that the competitors could not reduce the prices further because they were in poor financial condition and the sale of other carpets will not be affected because 104 was a specialized item.

ANALYSIS OF ISSUES IN THE CASE

ISSUE- Sheridans salesperson are employed on salary basis. SOLUTION- The salesperson of Sheridan were employed on a salary basis so irrespective of the no. of units of carpet they sell their salaries were the same. Now that Sheridan wants to increase margin on carpet 104 they should employ the sales person on commission on per unit sales basis. In this way they will be able to reduce costs.

ISSUE- Additional costs due to special machine required to produce carpet 104. SOLUTION- The production of carpet 104 required special machinery and it was produced in a department whose equipment could not be used to produce other carpets. Thus, there was an additional cost which the company had to bear for the production of carpet 104.

ISSUE- Low margin on carpet 104 SOLUTION- The carpet 104 gave low margin to the company so to improve the margin they decided to increase the selling price of the carpet. Another step that can be taken to increase the margin is to reduce the overheads on the production of carpet 104. For eg. the selling expenses can be reduced by giving salesperson salaries based on no. of units they sell instead of a fixed monthly salary. Also the materials spoilage cost should be reduced by using more efficient methods of material handling and production.

ISSUE- Increase in price of carpet 104 SOLUTION- The Company increased the price of carpet 104 from $3.90 to $5.20. The main reason behind this was that the company needed large funds in the next few years for equipment replacement and plant expansion.

ISSUE- Non availability of adequate information. SOLUTION- The breakage of supervision cost in the indirect overhead is not given The breakage of selling & administration expense is not given. The administrative expense is applicable to all the variety of carpets produced and not only to carpet 104. So only a proportional amount of administrative expense should be allocated to carpet line 104.

ISSUE- Non-application of relevant costing method. SOLUTION- Relevant costing method includes relevant costs for taking any decision in organisation. Relevant cost is a cost that differs between alternatives in a decision. This term is synonymous with avoidable cost and differential cost. Isolating relevant cost is desirable for atleast two reasons:1. Only rarely will enough information be available to prepare a detailed income statement for both alternatives 2. Mingling irrelevant cost with relevant cost may cause confusion and distract attention from the information that is really critical. By using relevant costing method in the case we eliminated indirect departmental overhead that gave us a better picture to estimate the price of the carpet 104.

PROBLEM OF THE CASE

The major problem faced by the marketing manager and the chief accountant of Sheridan Carpet Company is that whether to keep the price of the Carpet 104 at $3.90 as per what the competitors have priced their product or to keep it as $5.20 so that they can increase their margin on Carpet 104.

SOLUTION

Sheridan is the largest company in its segment and they provide superior value than competitors products. According to us, the decision to raise the price from $3.90 to $5.20 is good. After raising the price though company has lost some market share but they have gained more margin which will help in equipment replacement and plant expansion. After expansion and equipment replacement, we recommend to decrease some margin to gain market share again.

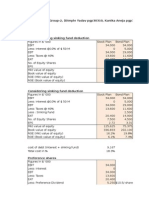

ANNEXURE: The solution of the problem in excel sheet.

**********END**********

You might also like

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Destin Brass FinalDocument10 pagesDestin Brass FinalKim Garver100% (2)

- Baria Planning Case SolutionDocument6 pagesBaria Planning Case SolutionUsha88% (8)

- Destin Brass Products Co Case WorksheetDocument2 pagesDestin Brass Products Co Case WorksheetManishNo ratings yet

- Destin Brass Case Study SolutionDocument5 pagesDestin Brass Case Study SolutionAmruta Turmé100% (2)

- Sherman Motor CompanyDocument5 pagesSherman Motor CompanyshritiNo ratings yet

- Joint Cost SignatronDocument8 pagesJoint Cost SignatronGloryNo ratings yet

- Superior ManufacturingDocument5 pagesSuperior ManufacturingCordel TwoKpsi TaildawgSnoop Cook100% (4)

- Micoderm v0.2Document21 pagesMicoderm v0.2Glory100% (1)

- Forner Carpet Case StudyDocument7 pagesForner Carpet Case StudySugandha GuptaNo ratings yet

- Salem CaseDocument4 pagesSalem CaseChris Dunham100% (3)

- Frequent FliersDocument4 pagesFrequent Fliersarchit_shrivast908467% (3)

- Shuman Automotive CaseDocument5 pagesShuman Automotive CaseAndyChrzaszcz50% (2)

- Prestige Telephone Company (Online Case Analysis)Document21 pagesPrestige Telephone Company (Online Case Analysis)astha50% (2)

- Solutions Huron AutomotiveDocument13 pagesSolutions Huron Automotiveshreyansh1200% (1)

- Stuart DawDocument2 pagesStuart DawMike ChhabraNo ratings yet

- Destin BrassDocument5 pagesDestin Brassdamanfromiran100% (1)

- Accounting For Frequent Fliers CaseDocument15 pagesAccounting For Frequent Fliers CaseGlenPalmer50% (2)

- Presentation 1Document3 pagesPresentation 1Debdyuti Datta GuptaNo ratings yet

- Midwest OfficeDocument4 pagesMidwest OfficeSaurabh MalhanNo ratings yet

- American Lawbook Corporation (A)Document9 pagesAmerican Lawbook Corporation (A)Adwitiya Datta20% (5)

- Salem Telephone Company Case StudyDocument4 pagesSalem Telephone Company Case StudyTôn Thiện Đức100% (4)

- Managerial Accounting - Hallstead Jewelers CaseDocument2 pagesManagerial Accounting - Hallstead Jewelers Casesxzhou23100% (1)

- Polar SportsDocument7 pagesPolar SportsShah HussainNo ratings yet

- 520 Greenlawn Commercial Questions f12 PDFDocument1 page520 Greenlawn Commercial Questions f12 PDFAshish Kothari0% (2)

- Destin Brass Case Study SolutionDocument5 pagesDestin Brass Case Study SolutionKaushal Agrawal100% (1)

- Huron Automotive Company - ExcelDocument6 pagesHuron Automotive Company - Excelanubhav110957% (7)

- Polar Sports, IncDocument15 pagesPolar Sports, IncJennifer Jackson91% (11)

- Cambridge Software Corporation - Q1Document2 pagesCambridge Software Corporation - Q1kkayathwalNo ratings yet

- Operation Research Group Project:: Delwarca Software Remote Support UnitDocument10 pagesOperation Research Group Project:: Delwarca Software Remote Support UnitRohanNo ratings yet

- Hausser Food ProductsDocument4 pagesHausser Food ProductsHumphrey Osaigbe100% (1)

- Sheridan Case SolutionDocument3 pagesSheridan Case SolutionHumphrey Osaigbe0% (1)

- This Study Resource Was: Group 4 Case Report - Czech MateDocument5 pagesThis Study Resource Was: Group 4 Case Report - Czech MateMajo Bulnes'100% (1)

- Huron AutomotiveDocument8 pagesHuron Automotiveanubhav1109No ratings yet

- Forner Carpet CompanyDocument6 pagesForner Carpet CompanyShaunakJindalNo ratings yet

- DelwarcaDocument6 pagesDelwarcadev4c-1No ratings yet

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezNo ratings yet

- Jackson Automotive Systems ExcelDocument5 pagesJackson Automotive Systems Excelonyechi2004No ratings yet

- Industrial Grinders NVDocument6 pagesIndustrial Grinders NVCarrie Stevens100% (1)

- Polar Sports, Inc - AnalysisDocument15 pagesPolar Sports, Inc - Analysisjordanstack0% (1)

- Prestige Data ServicesDocument2 pagesPrestige Data ServicesSubrata Dass100% (4)

- Hallstead JewelersDocument9 pagesHallstead Jewelerskaran_w350% (4)

- Destin Brass AnalysisDocument2 pagesDestin Brass AnalysisGlenn HengNo ratings yet

- Questions 1 and 2: Costing of A 100-Unit Batch of CS-29 CarburetorsDocument3 pagesQuestions 1 and 2: Costing of A 100-Unit Batch of CS-29 Carburetorsshephard007100% (3)

- Superior Manufacturing CaseDocument4 pagesSuperior Manufacturing Casenand bhushan100% (1)

- Industrial Grinders N VDocument9 pagesIndustrial Grinders N Vapi-250891173100% (3)

- Compagnie Du FroidDocument18 pagesCompagnie Du FroidSuryakant Kaushik0% (3)

- SecA Group8 DelwarcaDocument7 pagesSecA Group8 DelwarcaKanishk RohilanNo ratings yet

- Halstead JewlersDocument8 pagesHalstead JewlersZeeshan Ali100% (1)

- Cabot Pharma. Case ReportDocument3 pagesCabot Pharma. Case ReportdrdeathNo ratings yet

- SpyderDocument3 pagesSpyderHello100% (1)

- Destin Brass Costing ProjectDocument2 pagesDestin Brass Costing ProjectNitish Bhardwaj100% (1)

- Shuman Group 1Document29 pagesShuman Group 1xjaye2333% (3)

- Chapter 8 - PricingDocument10 pagesChapter 8 - PricingrasmimoqbelNo ratings yet

- Case Study No. 10 Gordon Engineering CompanyDocument2 pagesCase Study No. 10 Gordon Engineering CompanyRonJacintoReyes50% (2)

- GAC Case StudyDocument3 pagesGAC Case StudyMuhammad Zakky AlifNo ratings yet

- General Appliance CorporationDocument4 pagesGeneral Appliance CorporationFahmi A. MubarokNo ratings yet

- Birch Paper CompanyDocument1 pageBirch Paper CompanyAmit KumarNo ratings yet

- 4a - Decision Making and Marginal CostingDocument23 pages4a - Decision Making and Marginal CostingCindy ClollyNo ratings yet

- Mayank VyasDocument10 pagesMayank VyasMayank VyasNo ratings yet

- Book 1Document1 pageBook 1Mayank VyasNo ratings yet

- BNS Learning Diary-5 13033Document2 pagesBNS Learning Diary-5 13033Mayank VyasNo ratings yet

- 2013 - 15 - Ethics - Class - Transcript - Section - A - Surabhi Rathi (13055) & Mayank Vyas (13033)Document37 pages2013 - 15 - Ethics - Class - Transcript - Section - A - Surabhi Rathi (13055) & Mayank Vyas (13033)Mayank VyasNo ratings yet

- A4 Term Paper ProposalDocument2 pagesA4 Term Paper ProposalMayank VyasNo ratings yet

- Acc EmntsDocument10 pagesAcc EmntsMayank VyasNo ratings yet

- JurišováDocument9 pagesJurišováMayank VyasNo ratings yet

- Chapter 11 Working CapitalDocument14 pagesChapter 11 Working CapitalMayank VyasNo ratings yet

- Acclimited 120821052457 Phpapp01Document64 pagesAcclimited 120821052457 Phpapp01Mayank VyasNo ratings yet

- A4 Term Paper ProposalDocument2 pagesA4 Term Paper ProposalMayank VyasNo ratings yet

- LogisticsDocument6 pagesLogisticsMayank VyasNo ratings yet

- Acc Cement UpdatedDocument6 pagesAcc Cement UpdatedMayank VyasNo ratings yet

- Adarsh Housing Society Scam: Submitted To:-Prof - Govinda SharmaDocument2 pagesAdarsh Housing Society Scam: Submitted To:-Prof - Govinda SharmaMayank VyasNo ratings yet

- NanotechnologyDocument4 pagesNanotechnologyMayank VyasNo ratings yet

- Sec A - GRP 9Document27 pagesSec A - GRP 9Mayank VyasNo ratings yet

- Case StudyDocument7 pagesCase Studyarumugamsindhu0No ratings yet

- Simple Numbers, Straight Talk, Big Profits 4 Keys To Unlock Your Business Potential by Greg Crabtree, Beverly Blair HarzogDocument172 pagesSimple Numbers, Straight Talk, Big Profits 4 Keys To Unlock Your Business Potential by Greg Crabtree, Beverly Blair HarzogHanh Nguyen VanNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- Public Education and What The Costs ImplyDocument8 pagesPublic Education and What The Costs ImplyKiran BhattyNo ratings yet

- Norwegian Labor and Employment LawDocument18 pagesNorwegian Labor and Employment Lawamin mohNo ratings yet

- Film EditorDocument7 pagesFilm Editorapi-236966471No ratings yet

- Latest Mact PDFDocument202 pagesLatest Mact PDFJayalakshmi RajendranNo ratings yet

- Dear Sir or MadamDocument3 pagesDear Sir or MadamHolz Daughter100% (1)

- On SipDocument16 pagesOn SipVeshesh SrivastavaNo ratings yet

- How To Calculate UAE Gratuity Pay - GulfNewsDocument3 pagesHow To Calculate UAE Gratuity Pay - GulfNewsALPHYL BALASABASNo ratings yet

- International Institute of Professional Studies, DAVVDocument5 pagesInternational Institute of Professional Studies, DAVVGulshan GurnaniNo ratings yet

- Case Study CompensationDocument3 pagesCase Study CompensationSyeda Amna IftikharNo ratings yet

- Sample Test Business EnglishDocument5 pagesSample Test Business EnglishGiang VõNo ratings yet

- Albert. Capitalism vs. Capitalism Ch. 1 and 6 PDFDocument26 pagesAlbert. Capitalism vs. Capitalism Ch. 1 and 6 PDFJesus JimenezNo ratings yet

- Gist of Important Judgments Relating To TDSDocument41 pagesGist of Important Judgments Relating To TDSAbishek SekarNo ratings yet

- Private Schooling in The U.S.: Expenditures, Supply, and Policy ImplicationsDocument53 pagesPrivate Schooling in The U.S.: Expenditures, Supply, and Policy ImplicationsRead One ajaNo ratings yet

- Chapter 9 Managing Compensation: Multiple ChoiceDocument19 pagesChapter 9 Managing Compensation: Multiple Choicedatijik203No ratings yet

- An Overview of Dominican Labor Law by Fabio J. Guzmán Guzman Ariza & AsociadosDocument8 pagesAn Overview of Dominican Labor Law by Fabio J. Guzmán Guzman Ariza & AsociadosLicda Margarita Maria PiñaNo ratings yet

- SWM Ho Icm 70 10 08 2023Document24 pagesSWM Ho Icm 70 10 08 2023Thukaram McaNo ratings yet

- Salaires Et Dépenses Des Chancelleries de Maurice Dans Le MondeDocument5 pagesSalaires Et Dépenses Des Chancelleries de Maurice Dans Le MondeION NewsNo ratings yet

- Person IVDocument9 pagesPerson IVamyr felipe0% (1)

- Economic Impacts of TourismDocument32 pagesEconomic Impacts of Tourismhaffa100% (1)

- Copy1 Juris Batch2Document104 pagesCopy1 Juris Batch2Mariel Cabubungan100% (1)

- MBA HRM PptsDocument149 pagesMBA HRM PptsTamire santhosh mohan100% (1)

- 1580978220CTFL Specification Based Techniques - Assignment PDFDocument16 pages1580978220CTFL Specification Based Techniques - Assignment PDFVinay WalvekarNo ratings yet

- Chapter 8 - Answer TutorialDocument3 pagesChapter 8 - Answer TutorialNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Finalchapter 24Document10 pagesFinalchapter 24Jud Rossette ArcebesNo ratings yet

- Oi Lseeds DPRDocument25 pagesOi Lseeds DPRMaaLalta Kisan Producer Company LimitedNo ratings yet

- Shandaken Payroll AuditDocument15 pagesShandaken Payroll AuditDaily FreemanNo ratings yet

- 10 Jobs That Pay Beginners WellDocument4 pages10 Jobs That Pay Beginners WellTaha BenaliNo ratings yet