Professional Documents

Culture Documents

Deeds of Trust Bain

Uploaded by

faceoneoneoneoneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deeds of Trust Bain

Uploaded by

faceoneoneoneoneCopyright:

Available Formats

UPDATED SPECIAL REPORT OF THE WASHINGTON STATE BAR ASSOCIATION LEGAL OPINIONS COMMITTEE Opinions on Deeds of Trust in Favor

of Agents, Trustees and Nominees [THIS SPECIAL REPORT UDATES AND REPLACES THE PRIOR SPECIAL REPORT ISSUED BY THE COMMITTEE ON July 12, 2011] March 14, 2013

RCW 61.24.005(2) defines the beneficiary of a deed of trust to mean [t]he holder of the instrument or document evidencing the obligations secured by the deed of trust, excluding persons holding the same as security for a different obligation. The statute does not expressly permit an agent, trustee, or nominee for the holder of the obligations to act as beneficiary, nor does the statute expressly prohibit it. In sophisticated commercial financings, it is common for a deed of trust to name a beneficiary that may not be the holder of the secured obligations. For example, the named beneficiary may be the agent bank for a bank group or an indenture trustee for a group of bondholders. In residential mortgage lending and some smaller commercial property financings, it is common for entities like Mortgage Electronic Registration Systems, Inc. (MERS), acting as nominee of the lender, to be named as beneficiary. There has recently been litigation in which borrowers of home loans have challenged the status of MERS acting as beneficiary of Washington deeds of trust on the theory that MERS is not the holder of the secured obligations and, therefore, cannot validly act as beneficiary of a Washington deed of trust. In Bain v. Metropolitan Mortgage Group, Inc., et al., 175 Wn.2d 83, 285 P.3d 34 (2012), the Washington Supreme Court responded to a question certified to it by the United States District Court for the Western District of Washington as to whether MERS was a lawful beneficiary under two deeds of trust where MERS was named as beneficiary but never held the notes evidencing the obligations secured by the deeds of trust. The Supreme Court stated that only the actual holder of the promissory note or other instrument evidencing the obligations secured by a deed of trust may be a beneficiary with the power to proceed with a nonjudicial foreclosure on real property, and concluded that MERS was an ineligible beneficiary under the Washington deed of trust act, RCW chapter 61.24, if it never held the promissory notes or other debt instruments that were secured by the deeds of trust in question. Although the Supreme Court stated that nothing in its opinion should be construed to suggest that an agent cannot represent the holder of a note, at least for some purposes, it found that there was no evidence in the record before it that MERS was acting on behalf of the note holder and thus could not act as beneficiary under contract or agency principles. The Supreme Court stated that nothing in its opinion should be interpreted as preventing the parties from proceeding with judicial foreclosures. However, the Supreme Court also stated that it did not consider that issue, which must await a proper case.

The Bain decision has created uncertainty as to the ability to foreclose or otherwise enforce a Washington deed of trust if the deed of trust names as beneficiary an agent, an indenture trustee, a nominee or any other representative or person other than the actual holder or holders of the instruments or documents evidencing the obligations secured by the deed of trust. Given the uncertainty created by the Bain decision, it may be appropriate to include a qualification drawing attention to this issue in certain opinions (e.g., an opinion covering a deed of trust that names an agent as beneficiary). Such a qualification could be expressed as follows and added to the Washington statutes listed in paragraph D-3 of the Illustrative Opinion Letter form previously published by the Committee:1 D-[3(v)] We call to your attention that RCW 61.24.005(2) defines the beneficiary of a deed of trust as [t]he holder of the instrument or document evidencing the obligations secured by the deed of trust, excluding persons holding the same as security for a different obligation and does not expressly provide for such holder or holders to appoint an agent, an indenture trustee, a nominee or any other representative to act as beneficiary. In Bain v. Metropolitan Mortgage Group, Inc., et al., 175 Wn.2d 83, 285 P.3d 34 (2012), the Washington Supreme Court responded to a question certified to it by the United States District Court for the Western District of Washington as to whether Mortgage Electronic Registration Systems, Inc. (MERS) was a lawful beneficiary under two deeds of trust where MERS was named as beneficiary but never held the notes evidencing the obligations secured by the deeds of trust. The Supreme Court stated that only the actual holder of the promissory note or other instrument evidencing the obligations secured by a deed of trust may be a beneficiary with the power to proceed with a nonjudicial foreclosure on real property, and concluded that MERS was an ineligible beneficiary under the Washington deed of trust act, RCW chapter 61.24, if it never held the promissory notes or other debt instruments that were secured by the deeds of trust in question. Although the Supreme Court stated that nothing in its opinion should be construed to suggest that an agent cannot represent the holder of a note, at least for some purposes, it found that on the record before it MERS was not a beneficiary by contract or under agency principles. The Supreme Court stated that nothing in its opinion should be interpreted as preventing the parties from proceeding with judicial foreclosures. However, the Supreme Court also stated that it did not consider that issue, which must await a proper case. The Bain decision has created uncertainty as to the ability to foreclose or otherwise enforce a Washington deed of trust if the deed of trust names as beneficiary an agent, an indenture trustee, a nominee or any other representative or person other than the actual holder or holders of the instruments or documents evidencing the obligations secured by the deed of trust. Our opinion, as to the enforceability of the [Deed of Trust], is qualified by the

Supplemental Report Covering Secured Lending Transactions, a Report of the Ad Hoc Committee on Third-Party Legal Opinions of the Business Law Section of the Washington State Bar Association (Supplemental Report), at pp. 6-7 (Oct. 2000).

effect of the Bain decision, and we express no opinion on the effect of the Bain decision. Additionally, the Committee observes that any given transaction may involve unique circumstances warranting an approach different than including the foregoing qualification. Indeed, the Committee is aware that some Washington practitioners confronting this issue in the context of a particular transaction structure have crafted language to be used in addition to or in replacement of the foregoing qualification, and that others have opted instead to make certain additional assumptions (e.g., at the time of any foreclosure, the then-current beneficiary of the Deed of Trust will also be the holder of the promissory note or other evidence of the secured obligation), in order to address the concerns raised by the Bain decision. The Committee takes no formal position on possible alternative or additional measures as the Committee believes that the unique circumstances of particular transactions may make these measures appropriate, but is not prepared to catalog all possible approaches.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- US Immigration Law HandbookDocument36 pagesUS Immigration Law Handbookfaceoneoneoneone100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- A Concise Etymological Dictionary of The English LanguageDocument688 pagesA Concise Etymological Dictionary of The English LanguagefaceoneoneoneoneNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Trust Fever PDFDocument9 pagesTrust Fever PDFAl'Hanan Abi'Al100% (3)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Commercial - Liens-Study GuideDocument74 pagesCommercial - Liens-Study GuideLewis Fountain100% (20)

- Commercial - Liens-Study GuideDocument74 pagesCommercial - Liens-Study GuideLewis Fountain100% (20)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- DeedinTrust Warranty 1Document2 pagesDeedinTrust Warranty 1faceoneoneoneoneNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Agrarian Law Midterm ReviewerDocument41 pagesAgrarian Law Midterm ReviewerEmmanuel Ortega100% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Smash Grammar 1Document80 pagesSmash Grammar 1alina_valceanu_prof8338100% (1)

- Top Secret Banker's ManualDocument75 pagesTop Secret Banker's Manualmelanie50% (2)

- Taxation On Estates and Trusts - REVISED 2022Document16 pagesTaxation On Estates and Trusts - REVISED 2022rav danoNo ratings yet

- Agreement For Purchase & Sale of Real Estate (Subject To Transaction)Document1 pageAgreement For Purchase & Sale of Real Estate (Subject To Transaction)Kapil Karoliya100% (1)

- Teotico vs. Del ValDocument3 pagesTeotico vs. Del ValKaren P. LusticaNo ratings yet

- Rule 68 Rules of CourtDocument4 pagesRule 68 Rules of CourtElla Qui0% (1)

- Wrongful ForeclosureDocument8 pagesWrongful Foreclosurefaceoneoneoneone100% (2)

- Filipino Composers Vs TanDocument1 pageFilipino Composers Vs TanMariaAyraCelinaBatacanNo ratings yet

- Dy Yieng Seangio vs. ReyesDocument1 pageDy Yieng Seangio vs. ReyesMarie Gabay Damocles100% (1)

- UP Commercial Law Reviewer 2008Document351 pagesUP Commercial Law Reviewer 2008Katrina Montes100% (11)

- Succession - Atty. Almazan CasesDocument23 pagesSuccession - Atty. Almazan CasesJo-Al GealonNo ratings yet

- Strata TitleDocument30 pagesStrata TitleIqram Meon100% (2)

- Real - Estate CpdprogramDocument164 pagesReal - Estate CpdprogramPRC BoardNo ratings yet

- 8.will FormatDocument3 pages8.will FormatPriyadharshini Chennan50% (2)

- Vitug vs. CA (Facts, Held, Issue)Document2 pagesVitug vs. CA (Facts, Held, Issue)preciousrain28No ratings yet

- Balanay V MartinezDocument3 pagesBalanay V MartinezboomonyouNo ratings yet

- Bridge FdcpaDocument19 pagesBridge FdcpafaceoneoneoneoneNo ratings yet

- Bridge FdcpaDocument19 pagesBridge FdcpafaceoneoneoneoneNo ratings yet

- Navigating Non-Judicial Foreclosures: Counselor'S CornerDocument2 pagesNavigating Non-Judicial Foreclosures: Counselor'S CornerForeclosure FraudNo ratings yet

- Handbook Law of Trusts PDFDocument686 pagesHandbook Law of Trusts PDFfaceoneoneoneone100% (1)

- IELTS Modal ExamDocument4 pagesIELTS Modal ExamfaceoneoneoneoneNo ratings yet

- Certificate of Authority: Foreign Profit CorporationDocument3 pagesCertificate of Authority: Foreign Profit CorporationfaceoneoneoneoneNo ratings yet

- U 1 Fruits From A Poisonous TreeDocument285 pagesU 1 Fruits From A Poisonous TreefaceoneoneoneoneNo ratings yet

- U 1 Fruits From A Poisonous TreeDocument285 pagesU 1 Fruits From A Poisonous TreefaceoneoneoneoneNo ratings yet

- From The Archives of Lester J Hendershot by Mark HendershotDocument54 pagesFrom The Archives of Lester J Hendershot by Mark Hendershottigerpang75% (4)

- Trusts - MyEvilTwin PDFDocument11 pagesTrusts - MyEvilTwin PDFfaceoneoneoneone100% (1)

- Trustacc 1Document22 pagesTrustacc 1faceoneoneoneoneNo ratings yet

- Trusus - DivideAndConquerDocument10 pagesTrusus - DivideAndConquerfaceoneoneoneoneNo ratings yet

- Dispatch of Merchants by William L Avery A M 4th July 1976Document161 pagesDispatch of Merchants by William L Avery A M 4th July 1976Chemtrails Equals TreasonNo ratings yet

- Jacobson On Contracts PDFDocument39 pagesJacobson On Contracts PDFfaceoneoneoneoneNo ratings yet

- Journey Beyond Perception Into RealityDocument49 pagesJourney Beyond Perception Into RealityalanbwilliamsNo ratings yet

- Trusts - MyEvilTwin PDFDocument11 pagesTrusts - MyEvilTwin PDFfaceoneoneoneone100% (1)

- RealDocument5 pagesRealanvit seemanshNo ratings yet

- Rental AgreementDocument3 pagesRental AgreementJamali SagarNo ratings yet

- Modifikasi Perilaku (Compatibility Mode)Document16 pagesModifikasi Perilaku (Compatibility Mode)Alham Tetra Cesario100% (1)

- Intellectual Property LawsDocument66 pagesIntellectual Property LawsMohammed RaeesNo ratings yet

- Lease AgreementDocument3 pagesLease AgreementPriyanshu GuptaNo ratings yet

- Wills OrdinanceDocument40 pagesWills OrdinanceAljay LabugaNo ratings yet

- SHTT Case 2Document7 pagesSHTT Case 2PhanHiềnLươngNo ratings yet

- GRANDE ALEGRIA - CINDY BERRY PDF PianoDocument9 pagesGRANDE ALEGRIA - CINDY BERRY PDF PianoPedro Henrique MarquesNo ratings yet

- TPA - Important SectionsDocument2 pagesTPA - Important SectionsRitesh AroraNo ratings yet

- Translated Copy of JANIE MAHARANI SUYONODocument1 pageTranslated Copy of JANIE MAHARANI SUYONOYuniarso Adi NugrohoNo ratings yet

- Paper IV - Family Law II Micro Both Side FinalDocument18 pagesPaper IV - Family Law II Micro Both Side Finalrajkumarimitchell400No ratings yet

- Civil Case FinalDocument14 pagesCivil Case FinalPulkit AgarwalNo ratings yet

- The Patents Act 1970 An OverviewDocument21 pagesThe Patents Act 1970 An OverviewAnsh MishraNo ratings yet

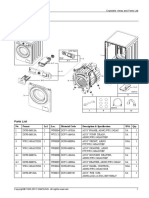

- 02 VESDA Filter Cartridge VSP-005 TDS AQ LoresDocument1 page02 VESDA Filter Cartridge VSP-005 TDS AQ LoresJhon SanabriaNo ratings yet

- Demandletter TopmodeloftheworldDocument3 pagesDemandletter Topmodeloftheworldejcastaneda1998No ratings yet

- Chapter Five: Intellectual Property and Other Legal IssuesDocument27 pagesChapter Five: Intellectual Property and Other Legal IssuesBereket AsfawNo ratings yet

- GB Pant Vs State of UP 2000 SCDocument11 pagesGB Pant Vs State of UP 2000 SCFawaz ShaheenNo ratings yet