Professional Documents

Culture Documents

Chapter 29 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)

Uploaded by

Falah Ud Din SheryarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 29 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)

Uploaded by

Falah Ud Din SheryarCopyright:

Available Formats

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.1

A (Private) Limited is not a subsidiary because P Limited has relinquished its voting power and therefore does not control the company. B Limited is a subsidiary of P Limited. P Limited owns more than 50% of the voting rights in B Limited and therefore it controls the company. C Limited is a subsidiary of P Limited. P Limited controls 60% of the voting rights in C Limited indirectly through its control of B Limited. The fact that it is a foreign company makes no difference. S Limited is a subsidiary of P Limited. Although P Limited does not own more than 50% of the voting rights in S Limited, P Limited controls S Limited through its power to appoint or remove the majority of the board of directors. R Limited is a subsidiary of P Limited. P Limited controls 35% of R Limited directly as it owns 35% of the share capital and 30% of R Limited together with the shares owned by S Limited, which P Limited controls. Therefore P Limited controls 65% of the voting power of R Limited. D Limited is not a subsidiary, as P Limited has no control through A Limited and only controls 20% through B Limited.

Kolitz & Sowden-Service, 2009

Chapter 29: Page 1

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.2

a) Pre-acquisition and post-acquisition dividends A pre-acquisition dividend is a dividend paid by a subsidiary company out of profits that have been earned by the subsidiary prior to the parent company acquiring control of the subsidiary. A post-acquisition dividend is a dividend paid by a subsidiary company out of profits that have been earned subsequent to the parent company acquiring control of the subsidiary. The dividend paid on 3 April 20X8 is a pre-acquisition dividend The dividend declared on 30 September 20X8 is a post acquisition dividend b) Accounting for pre-acquisition and post-acquisition dividends Prior to the 2008 amendment to IAS 27, parent entities recognised income from investments in subsidiaries only to the extent that dividends were paid out of post-acquisition accumulated profits; distributions received out of pre-acquisition profits were regarded as a recovery of the investment and were deducted from its cost. The amendment requires all dividends, received and receivable to be recorded as income. However, IAS 36 Impairment of Assets has also been amended to include a dividend in excess of the investees comprehensive income for the period as an indicator of possible impairment of the investment. The Amendments are effective for annual periods beginning on or after 1 January 2009.

Kolitz & Sowden-Service, 2009

Chapter 29: Page 2

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.3

PARENT LIMITED JOURNAL Date Description Jan 1 Investment in Subsidiary Limited Bank Purchase of 20 000 shares in Subsidiary Limited as per directors resolution dated Jan 3 Bank Dividend income 1 000 1 000

Debit 50 000

Credit 50 000

Dividend received from subsidiary company. June 30 Bank Dividend received from subsidiary 3 000 3 000

Dividend received from subsidiary company Jan 2 Bank Dividends income 5 000 5 000

Dividends received from Subsidiary Limited June 30 Bank Dividend income 10 000 10 000

Dividend received from subsidiary company June 30 Impairment of investment Investment in Subsidiary Limited 1 500 1 500

Investment written down to recoverable amount

Kolitz & Sowden-Service, 2009

Chapter 29: Page 3

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.3 continued

Workings

Purchase consideration Fair value of consideration transferred Fair value of identifiable net assets Share capital Retained earnings 30.6.20X3 Profit to 31.12.20X3 Land Deferred tax Gain on acquisition / Goodwill 50 000 47 780 20 000 8 000 2 500 24 000 (6 720) 2 220

(24 000 X 0,28)

Sale of land Selling price Cost Profit / (loss)

S Ltd 46 000 (28 000) 18 000

Group 46 000 (52 000) (6 000)

Cost

At acquisition

Selling price

28 000

52 000 18 000

46 000

Kolitz & Sowden-Service, 2009

Chapter 29: Page 4

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.4

a)

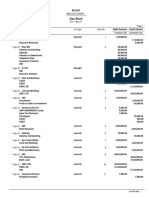

P LIMITED JOURNAL Date Description 20X5 July 1 Investment in S Limited Bank Purchase of all the shares in S Limited 20X6 June 30 Bank Dividend income 20 000 20 000

Debit 115 000

Credit

115 000

Dividend received from subsidiary 20X7 June 30 Impairment loss Investment in S Limited 3 000 3 000

Impairment of investment in S Limited 20X8 June 30 Bank Dividend income 12 000 12 000

Dividend received from subsidiary company June 30 Investment in S Limited Recovery of impairment loss 1 000 1 000

Reversal of impairment in S Limited

Kolitz & Sowden-Service, 2009

Chapter 29: Page 5

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.4 continued

b)

P LIMITED EXTRACT FROM STATEMENT OF FINANCIAL POSITION AT 30 JUNE 20X6 Investment in subsidiary C 115 000

P LIMITED EXTRACT FROM STATEMENT OF FINANCIAL POSITION AT 30 JUNE 20X7 Investment in subsidiary C 112 000

P LIMITED EXTRACT FROM STATEMENT OF FINANCIAL POSITION AT 30 JUNE 20X8 Investment in subsidiary C 113 000

Workings

Purchase consideration

Fair value of consideration transferred Fair value of identifiable net assets Share capital Retained earnings Goodwill

C 115 000 115 000 100 000 15 000 -

Analysis of retained earnings (not needed for answer) Total Balance 1.7.20X5 Profit 30.6.20X6 Dividend 30.6.20X6 Loss 30.6.20X7 Profit 30.6.20X8 Dividend 30.6.20X8 Balance 30.6.20X8 15 000 16 000 (20 000) 11 000 (3 000) 8 000 14 000 (12 000) 10 000 Before 15 000 (4 000) 11 000 11 000 Since 16 000 (16 000) (3 000) (3 000) 14 000 (12 000) (1 000)

11 000

Description Bank Balance Impairment reversal Balance

Investment in S Description C

115 000 Impairment 112 000 1 000 113 000

C

3 000

Kolitz & Sowden-Service, 2009

Chapter 29: Page 6

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.5

a) Journal entries in the accounting records of Pasta Limited

01/01/X5

Investment in S (Pvt) Limited Bank Purchase of 100% of shares Bank Dividend income Dividend received from pre-acquisition reserves Bank Dividend income Dividend received from pre and post acquisition reserves Bank Dividend income Pre-acquisition dividend on sale of property Impairment of investment Investment in S (Pvt) Limited Impairment of investment in S (Pvt) Limited

Dr 1 460 000

Cr 1 460 000

03/01/X5

10 000 10 000

30/06/X5

40 000 40 000

30/06/X6

90 000 90 000

60 000 60 000

Kolitz & Sowden-Service, 2009

Chapter 29: Page 7

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.5 continued

b) Journal entries in the accounting records of Sauce (Pty) Ltd

Dr 35 000 Cr 35 000

01/01/X5

Accumulated depreciation Equipment Reversal of accumulated depreciation Equipment Deferred tax Revaluation reserve Revaluation of equipment

10 000 2 900 7 100

30/06/X6

Depreciation Accumulated depreciation Depreciation for the year (45 000 / 4 yrs X 6/12) Tax expense Deferred tax Originating temporary difference on equipment Revaluation reserve Retained earnings Transfer of realised portion to retained earnings [(5 625 *4 325) X 0.71] or (7 100 / 4 X 6/12) *(35 000 / 4 yrs X 6/12)

5 625 5 625

906 906

888 888

30/06/X6

Depreciation Accumulated depreciation Depreciation for the year (45 000 / 4 yrs) Tax expense Deferred tax Originating temporary difference on equipment Revaluation reserve Retained earnings Transfer of realised portion to retained earnings [(11 250 *8 750) X 0.71] or (7 100 / 4) *(35 000 / 4 yrs) Cash Property Profit on disposal Sale of property

11 250 11 250

1 813 1 813

1 775 1 775

1 600 000 1 500 000 100 000

Kolitz & Sowden-Service, 2009

Chapter 29: Page 8

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.5 continued

Workings

W1 Purchase consideration

Fair value of consideration transferred Fair value of identifiable net assets: Share capital Retained earnings at acquisition Equipment Deferred tax Goodwill

(152 900 + 50 000)

1 460 000 1 210 000 1 000 000 202 900 10 000 (2 900) 250 000

W2 Sale of property Sauce Limited 1 600 000 (1 500 000) 100 000 Group 1 600 000 (1 500 000) 100 000

Selling price Cost

Cost

At Acquisition

Selling price

1 500 000

1 500 000 100 000

1 600 000

W3 Analysis of retained earnings of Sauce Limited (not required for answer) Total 152 900 50 000 202 900 (10 000) 192 900 30 000 (40 000) 888 183 788 (60 000) 100 000 (90 000) 1 775 135 563 Before 152 900 50 000 202 900 (10 000) 192 900 30 000 (10 000) 888 183 788 (30 000) 0 (60 000) Since

01/07/X4 01/07/X4 31/12/X4 03/01/X5 01/01/X5 30/06/X5 30/06/X5

Balance Profit At acquisition Dividend

(75 000 25 000)

Profit Dividend Transfer from RS

(45 000 15 000)

01/07/X5 30/06/X6 30/06/X6

Loss Profit on sale of property Dividend Transfer from RS Balance

100 000 (90 000) 1 775 195 563

30/06/X6

(60 000)

Kolitz & Sowden-Service, 2009

Chapter 29: Page 9

Solutions to Gripping IFRS : Graded Questions

Parent company accounting

Solution 29.5 continued

W4 Equipment

CA 01/07/X2 01/07/X2 31/12/X4 70 000 (35 000) TB 70 000 (43 750) TD DT (29%) NDR RE

Accumulated depreciation / Tax allowance Revaluation Accumulated depreciation / Tax allowance Transfer to RE Accumulated depreciation / Tax allowance

(70 000 X 020 X 2.5) / (70 000 X 0.25 X 2.5)

01/01/X5 01/01/X5 30/06/X5

(45 000 / *4 yrs X 6/12) *(2.5 + 1.5) / (70 000 X 0.25 X 6/12) ^(7 000/4yrs X 6/12) (45 000 / 2.5 yrs) / (70 000 X 0.25)

35 000 10 000 45 000 (5 625)

26 250 26 250 (8 750)

8 750 10 000 18 750 3 125

2 538 2 900 5 438 906

7 100

^(888) 39 375 (11 250) 17 500 (17 500) 21 875 6 250 6 344 1 813 (1 775)

888 1 775

01/07/X5 30/06/X6

28 125

28 125

8 157

4 437

Kolitz & Sowden-Service, 2009

Chapter 29: Page 10

You might also like

- InventoriesDocument48 pagesInventoriesFalah Ud Din SheryarNo ratings yet

- Corporate Laws Made Easy Volume 1Document52 pagesCorporate Laws Made Easy Volume 1Falah Ud Din SheryarNo ratings yet

- Corporate Law Made Easy - Volume 2Document95 pagesCorporate Law Made Easy - Volume 2Asif IqbalNo ratings yet

- Fixed Assets I As 16Document25 pagesFixed Assets I As 16Falah Ud Din SheryarNo ratings yet

- Ias 23 - Borrowing CostDocument11 pagesIas 23 - Borrowing CostATIFREHMANWARRIACHNo ratings yet

- Ias 40 Investment Property by A Deel SaleemDocument12 pagesIas 40 Investment Property by A Deel SaleemFalah Ud Din Sheryar100% (1)

- Introduction To Financial Statements and AuditDocument26 pagesIntroduction To Financial Statements and AuditFalah Ud Din SheryarNo ratings yet

- Ias 16 Property, Plant & Equipment: Adeel SaleemDocument20 pagesIas 16 Property, Plant & Equipment: Adeel SaleemAtif RehmanNo ratings yet

- Chapter 12 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document16 pagesChapter 12 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document21 pagesChapter 14 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 16 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 16 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 13 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document19 pagesChapter 13 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 11 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document20 pagesChapter 11 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 17 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document32 pagesChapter 17 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 15 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document19 pagesChapter 15 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 10Document89 pagesChapter 10kazimkoroglu100% (1)

- Chapter 2 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document23 pagesChapter 2 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document25 pagesChapter 30 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document47 pagesChapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document49 pagesChapter 7 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (2)

- Chapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document31 pagesChapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document40 pagesChapter 4 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document71 pagesChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document24 pagesChapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 27 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document13 pagesChapter 27 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 28 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document6 pagesChapter 28 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Steel Industry PitchDocument17 pagesSteel Industry Pitchnavinmba2010No ratings yet

- Market Research of FevicolDocument12 pagesMarket Research of FevicolShraddha TiwariNo ratings yet

- Organization & EthicsDocument11 pagesOrganization & EthicsAvijeet ChowdhuryNo ratings yet

- 1.1 Purpose: Intended Audience and Reading SuggestionsDocument11 pages1.1 Purpose: Intended Audience and Reading SuggestionsSwapneel JadhavNo ratings yet

- Synopsis of Derivative ProjectDocument11 pagesSynopsis of Derivative ProjectSHAIK YASINNo ratings yet

- 5th South Pacific ORL Forum Proposal UPDATEDocument10 pages5th South Pacific ORL Forum Proposal UPDATELexico InternationalNo ratings yet

- The Marketer's Guide To Travel Content: by Aaron TaubeDocument18 pagesThe Marketer's Guide To Travel Content: by Aaron TaubeSike ThedeviantNo ratings yet

- Advertisment and MediaDocument21 pagesAdvertisment and MediaMohit YadavNo ratings yet

- Daily Lesson Log: I. ObjectivesDocument5 pagesDaily Lesson Log: I. ObjectivesRuth ChrysoliteNo ratings yet

- Engineering Dept ScopeDocument3 pagesEngineering Dept ScopeSehrishNo ratings yet

- CIPC Turn Around Times PDFDocument12 pagesCIPC Turn Around Times PDFkyaq001No ratings yet

- PR and The Party - The Truth About Media Relations in ChinaDocument11 pagesPR and The Party - The Truth About Media Relations in ChinaMSLNo ratings yet

- Non-Routine DecisionsDocument5 pagesNon-Routine DecisionsVincent Lazaro0% (1)

- How To Use Transaction SOST & SCOT For Chec..Document2 pagesHow To Use Transaction SOST & SCOT For Chec..ghenno18No ratings yet

- AnuragDocument2 pagesAnuragGaurav SachanNo ratings yet

- E StatementDocument3 pagesE StatementBkho HashmiNo ratings yet

- Economic Growth TheoriesDocument10 pagesEconomic Growth TheoriesHarpreet Singh PopliNo ratings yet

- 2017 Virtus Interpress Book Corporate GovernanceDocument312 pages2017 Virtus Interpress Book Corporate GovernanceMohammad Arfandi AdnanNo ratings yet

- Esp Sales Executive Needs AnalysisDocument4 pagesEsp Sales Executive Needs AnalysisChitra Dwi Rahmasari100% (1)

- Banking Industry KYIDocument199 pagesBanking Industry KYIYasmeen MahammadNo ratings yet

- Table 2.5 SolutionDocument3 pagesTable 2.5 SolutionMarghoob AhmadNo ratings yet

- T3.Hull Chapter 10Document11 pagesT3.Hull Chapter 10Abhishek Gupta100% (1)

- Tri-R and Gardenia Reaction PaperDocument7 pagesTri-R and Gardenia Reaction PaperKatrina LeonardoNo ratings yet

- Day Book 2Document2 pagesDay Book 2The ShiningNo ratings yet

- 1 SM IntroductionDocument15 pages1 SM IntroductionAurangzeb KhanNo ratings yet

- Lecture 12 Structural Identification and EstimationDocument211 pagesLecture 12 Structural Identification and Estimationfarhad shahryarpoorNo ratings yet

- Ahrend Sen 2012Document12 pagesAhrend Sen 2012sajid bhattiNo ratings yet

- Chapter 30Document2 pagesChapter 30Ney GascNo ratings yet

- National Occupational Safety and Health Profile of OmanDocument105 pagesNational Occupational Safety and Health Profile of OmanKhizer ArifNo ratings yet

- ThrivullaDocument112 pagesThrivullaJobyThomasIssacNo ratings yet