Professional Documents

Culture Documents

Difference Between Receipts and Payments Account and Income and Expenditure Account

Uploaded by

sarvesh.bhartiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Difference Between Receipts and Payments Account and Income and Expenditure Account

Uploaded by

sarvesh.bhartiCopyright:

Available Formats

Difference Between Receipts and Payments Account and Income and Expenditure Account: Learning Objectives: 1.

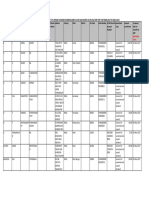

What is the difference between receipt and payment account and income and expenditure account? Receipts & Payment Account 1 It is a summary of the cash book Income & Expenditure Account 1 It takes the place of profit and loss account in non-trading concerns. 2 Does not commence with any balance It includes re!enue items only

2 It begins with an opening balance and ends with a closing balance. It records all sums recei!ed and paid whether they relate to re!enue or capital items " It include all sums actually recei!ed during the year whether they relate to the past# current or next year. % &he receipts are shown on the debit side and the payments on the credit side. ' It simply ends with a closing balance of cash and does not show the result for the period. ( It is not accompanied by a balance sheet.

" It includes the items relating to year for which it is prepared. $ro!ision is made for all outstanding expenses and accrued income. % Income is shown on the credit side and expenses on the debit side. ' It definitely shows whether there has been an excess of income o!er expenditures or !ice !ersa. ( It is always accompanied by a balance sheet.

Difference/Distinction Between Receipts And Payments Accounts And Income And Expenditure Account Append below are the main differences/distinction between:

Receipts & Payments Account Receipts are shown on debit side and payment shown on credit side Starts with the opening balance of cash in hand and at ban !nly cash transactions ta es place "apital as well as re#enue items appear $he difference of two sides is the cash in hand and at ban at the end of the periods All receipts and payments are shown irrespecti#e of the year to which they relate

Income & Expenditure Account Expenses are shown on debit side and Incomes are shown on credit side It has no opening balance !ther transactions also ta e place !nly re#enue items appear

$he difference between is surplus or deficit for the period

either

!nly those expenses and incomes are shown which related to the period for which the account is prepared

Concept Of Receipts And Payments Account, Its Features And Limitations Concept Of Receipts And Payments Account Receipt and payment account is a summary of cash receipts and payments during the accounting period. It records all cash receipts and cash payments including capital receipts and revenue revenue receipts irrespective of accounting period. All cash receipts are recorded on debit side or receipts side and all cash payments are recorded on credit or payments side of receipts and payments account. Features Of Receipts And Payments Account The essential features of receipts and payments account are as follows: 1. Summary f !as" #ransactions

All cash receipts and payments made by the concern during the accounting period are recorded in this boo . !herefore, receipts and payments account can be ta en as a summary of cash transactions. $. !as" And Ban% Items In ne !o&umn

All receipts either cash or ban are recorded in receipts column of receipts side "here all cash and ban payments are recorded in one column of payment column of receipts and payments account. !he cash and ban transactions are merged to avoid contra entries of cash and ban transactions. '. (o Distinction Between !apita& And Re)enue All cash receipts and cash payments irrespective of capital and revenue nature are recorded in receipts and payments account. #o distinct is made for capital receipts , revenue receipts, capital e$penditures and revenue e$penditures. *. penin+ And !&osin+ Ba&ance f !as"

Receipts and payments account starts from opening balance of cash and ban ends "ith the

closing balance of cash and ban . ,. Recordin+ f !as" Receipts And Payments

All cash and che%ue receipts are recorded on debit side "here as all cash and che%ue payments are recorded on credit side of receipts and payments account. -. I+nores (on.cas" #ransactions Receipts and payments account does not record non&cash transactions. Limitations Of Receipts And Payments Account The receipts and payments accounts suffers from the following limitations' (. Receipts and payments account does not differentiate capital and revenue e$penses and incomes. ). Receipts and payments account fails to sho" e$penses and incomes on accrual basis. *. Receipts and payments account fails to sho" surplus and deficiency. +. Receipts and payments account fails to sho" non&cash transactions such as depreciation of fi$ed assets, pilferage etc.

You might also like

- SHCIL BranchesDocument30 pagesSHCIL BranchesRattanMittal100% (1)

- Pioneer Broadband InvoiceDocument1 pagePioneer Broadband InvoiceHemanth Kumar100% (2)

- 02-Final Palagan Directory - NCR - 05-01-2017Document100 pages02-Final Palagan Directory - NCR - 05-01-2017alka sharmaNo ratings yet

- Uttar PradeshDocument48 pagesUttar PradeshNeelNo ratings yet

- District Administration Gurugram: SubjectDocument6 pagesDistrict Administration Gurugram: SubjectAnuj SoniNo ratings yet

- Chandigarh Circle and BranchesDocument124 pagesChandigarh Circle and BranchesDeepika BhasinNo ratings yet

- Freeship Eligible 2021-2022Document57 pagesFreeship Eligible 2021-2022mt. mary schoolNo ratings yet

- Bus Route ExamDocument61 pagesBus Route ExamRohit ChhabraNo ratings yet

- Westprop PDFDocument367 pagesWestprop PDFPINAZ DHAN PARDIWALANo ratings yet

- ICAI North Partnership Firms DataDocument180 pagesICAI North Partnership Firms DataRajat NagpalNo ratings yet

- Delhi CrisilDocument3 pagesDelhi CrisilriteshNo ratings yet

- 27thjun2021 Exclusive Free Epaper HiresDocument28 pages27thjun2021 Exclusive Free Epaper HiresShakti PrasadNo ratings yet

- Computation of Total Income For ItrDocument2 pagesComputation of Total Income For Itravisinghoo7No ratings yet

- Sustainability - Report ONGC PDFDocument116 pagesSustainability - Report ONGC PDFsurbhi guptaNo ratings yet

- Wipro Limited and SubsidiariesDocument34 pagesWipro Limited and SubsidiariesLyca SorianoNo ratings yet

- Departmental DirectoryDocument379 pagesDepartmental DirectorymanishNo ratings yet

- Direct Import Payment - RL 01.04.2016Document3 pagesDirect Import Payment - RL 01.04.2016Prakash PandeyNo ratings yet

- I Tax Administrative Handbook 2023Document375 pagesI Tax Administrative Handbook 2023SANJPODDNo ratings yet

- Neetug18 Provmeritlist PDFDocument1,104 pagesNeetug18 Provmeritlist PDFC G ChavanNo ratings yet

- Elan Epic Cost Sheet - LGF07-1292sqftDocument4 pagesElan Epic Cost Sheet - LGF07-1292sqftAmit GolaNo ratings yet

- DLF New Town Gurgaon Soicety Handbook RulesDocument38 pagesDLF New Town Gurgaon Soicety Handbook RulesShakespeareWallaNo ratings yet

- Unclaimed Deposits As On March 31 2020Document149 pagesUnclaimed Deposits As On March 31 2020AartiNo ratings yet

- Fare+Stage+&+Fare+Charts of DTCDocument186 pagesFare+Stage+&+Fare+Charts of DTCkdineshc100% (2)

- Dist Development&PanchayatOfficers Haryana PDFDocument13 pagesDist Development&PanchayatOfficers Haryana PDFYogesh GargNo ratings yet

- TELEPHONE DIRECTORY Updated On 03 Feb 2015 PDFDocument57 pagesTELEPHONE DIRECTORY Updated On 03 Feb 2015 PDF117rcc100% (1)

- List of 4%, 5%, 6%, 8%, 10% Kisan Abadi Plots Registered Up To 10-11-2020Document97 pagesList of 4%, 5%, 6%, 8%, 10% Kisan Abadi Plots Registered Up To 10-11-2020Surendra Sharma100% (1)

- B Cat ListDocument46 pagesB Cat Listkprk414No ratings yet

- Unclaimed Dividend Data As On 23.9.2016Document1,775 pagesUnclaimed Dividend Data As On 23.9.2016Swapnilsagar VithalaniNo ratings yet

- List of Director General of Police, Igp and SP of ChhsttiagarhDocument6 pagesList of Director General of Police, Igp and SP of ChhsttiagarhMohan BhargavaNo ratings yet

- La-Dimora Brochure PDFDocument23 pagesLa-Dimora Brochure PDFGaurav AggarwalNo ratings yet

- Ministry of Home Affair 2016Document372 pagesMinistry of Home Affair 2016Byron heart100% (1)

- Delhi State Government Officials-ANNEXURE-21Document17 pagesDelhi State Government Officials-ANNEXURE-21Sheetal HandooNo ratings yet

- Scheduled Caste Migrants To Pondicherry Not Eligible For Reservation, Says Madras High CourtDocument41 pagesScheduled Caste Migrants To Pondicherry Not Eligible For Reservation, Says Madras High CourtLive Law100% (1)

- Sarva Shiksha Abhiyan Chhattisgarh: AWP & B - 2005 - 06 (State Component)Document277 pagesSarva Shiksha Abhiyan Chhattisgarh: AWP & B - 2005 - 06 (State Component)Somesh ChauhanNo ratings yet

- Invest in Indian Startups - AngelListDocument51 pagesInvest in Indian Startups - AngelListSher Singh YadavNo ratings yet

- List of Cable OperatorsDocument4 pagesList of Cable OperatorsgauravNo ratings yet

- LIC Address Book 2013Document219 pagesLIC Address Book 2013som indoraNo ratings yet

- Telephone Directory GanderbalDocument5 pagesTelephone Directory GanderbalAasif Abdullah100% (2)

- Balance Sheet of Maruti Suzuki IndiaDocument415 pagesBalance Sheet of Maruti Suzuki IndiaMahesh VaiShnavNo ratings yet

- Ajay Offer LetterDocument3 pagesAjay Offer LetterTarunkumar LadNo ratings yet

- TDI InfrastructureDocument62 pagesTDI InfrastructureTDIInfrastructureNo ratings yet

- Contact Us - Pey Jal Nigam Uttarakhand, Government of Uttarakhand, IndiaDocument5 pagesContact Us - Pey Jal Nigam Uttarakhand, Government of Uttarakhand, IndiaNishant KumarNo ratings yet

- Client G SRIKANTHDocument3 pagesClient G SRIKANTHMallikarjun ReddyNo ratings yet

- Contact Details: SL Location Name Designation SL For User Id & Password Related IssueDocument6 pagesContact Details: SL Location Name Designation SL For User Id & Password Related Issuearbaz khanNo ratings yet

- Water Resorce Department Scoor ListDocument623 pagesWater Resorce Department Scoor Listkhemraj deoreNo ratings yet

- Group8 - Ratio Analysis of Yes BankDocument14 pagesGroup8 - Ratio Analysis of Yes Bankavinash singhNo ratings yet

- DST 01Document717 pagesDST 01Rolly Molly GunjanNo ratings yet

- 753 Scheme ResultDocument351 pages753 Scheme ResultChristopher TaylorNo ratings yet

- List of Contractors CE WCDocument92 pagesList of Contractors CE WCAnonymous XhkjXCxxsT0% (1)

- M3M Urbana Gurgaon 9999950877Document4 pagesM3M Urbana Gurgaon 9999950877Reias IndiaNo ratings yet

- Directory of Institution - Standalone Institution 18022020094844861AMDocument11 pagesDirectory of Institution - Standalone Institution 18022020094844861AMRajeev PandeyNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateAartiNo ratings yet

- Commercial Office Space - Cyber CityDocument8 pagesCommercial Office Space - Cyber CityankurNo ratings yet

- Class 12 Busniess StudiesDocument98 pagesClass 12 Busniess StudiesVaishnavi SajidhasNo ratings yet

- Rohini As A Real EstateDocument23 pagesRohini As A Real EstateSainyam JainNo ratings yet

- List CommissionersDocument37 pagesList CommissionersShailendra ChaudharyNo ratings yet

- Eclerx Services Limited: (DD Mon Yyyy)Document20 pagesEclerx Services Limited: (DD Mon Yyyy)sahilNo ratings yet

- IGL Bill PaymentDocument1 pageIGL Bill Paymentsourabhbasu0% (1)

- Directory of Officers - Uttar Pradesh (East)Document12 pagesDirectory of Officers - Uttar Pradesh (East)purnima raiNo ratings yet

- Receipt and Payment AccountDocument3 pagesReceipt and Payment Accountsarvesh.bhartiNo ratings yet

- Lecture 1Document11 pagesLecture 1sarvesh.bhartiNo ratings yet

- New FormateDocument17 pagesNew Formatesarvesh.bhartiNo ratings yet

- Introduction To Food Technology, General Aspect of Food IndustryDocument11 pagesIntroduction To Food Technology, General Aspect of Food Industrysarvesh.bhartiNo ratings yet

- Comparative Analysis of Mutualfund of HDFCDocument5 pagesComparative Analysis of Mutualfund of HDFCsarvesh.bhartiNo ratings yet

- JEE PaperDocument30 pagesJEE Papersarvesh.bhartiNo ratings yet

- List of Punjabi SingersDocument4 pagesList of Punjabi Singerssarvesh.bhartiNo ratings yet

- New-Synposis of ProjectDocument9 pagesNew-Synposis of Projectsarvesh.bhartiNo ratings yet

- Riyaz ResumeDocument2 pagesRiyaz Resumesarvesh.bhartiNo ratings yet

- Oninon Pottato GarlicDocument16 pagesOninon Pottato Garlicsarvesh.bhartiNo ratings yet

- Technical Specifications of Tata LPT - 709: Model GVW (KG) Wheelbase (MM) EngineDocument2 pagesTechnical Specifications of Tata LPT - 709: Model GVW (KG) Wheelbase (MM) Enginesarvesh.bhartiNo ratings yet

- Bba Project ADocument19 pagesBba Project Asarvesh.bharti0% (1)

- True Shine Mayor ComputerDocument1 pageTrue Shine Mayor Computersarvesh.bhartiNo ratings yet

- Ko Tak Term PlanDocument8 pagesKo Tak Term Plansarvesh.bhartiNo ratings yet

- Integrated Producers: Who Convert Iron Ore Into Steel. The Major Players Are Steel AuthorityDocument2 pagesIntegrated Producers: Who Convert Iron Ore Into Steel. The Major Players Are Steel Authoritysarvesh.bhartiNo ratings yet

- Happy To Help Rs 1332.25 23.01.14: Vodafone No. 8551813555Document1 pageHappy To Help Rs 1332.25 23.01.14: Vodafone No. 8551813555sarvesh.bhartiNo ratings yet

- Automotive Spare Parts and ComponentsDocument57 pagesAutomotive Spare Parts and Componentssarvesh.bhartiNo ratings yet

- A Project Report: Saket C. MotghareDocument4 pagesA Project Report: Saket C. Motgharesarvesh.bhartiNo ratings yet

- Balance Sheet of Tata MotorsDocument10 pagesBalance Sheet of Tata Motorssarvesh.bhartiNo ratings yet

- Airline-Reservation-System VB & MisDocument58 pagesAirline-Reservation-System VB & MisSatish Singh ॐ100% (4)

- Balance Sheet of Tata MotorsDocument10 pagesBalance Sheet of Tata Motorssarvesh.bhartiNo ratings yet

- Kerala Nut Food BrochureDocument1 pageKerala Nut Food BrochureJohn Paul SunnyNo ratings yet

- "Project Name": A P S ODocument3 pages"Project Name": A P S Osarvesh.bhartiNo ratings yet

- Test CitiesDocument1 pageTest Citiessarvesh.bhartiNo ratings yet

- VedicReport1 2 20144 59 57PMDocument42 pagesVedicReport1 2 20144 59 57PMsarvesh.bhartiNo ratings yet

- VedicReport1 2 20144 59 57PMDocument42 pagesVedicReport1 2 20144 59 57PMsarvesh.bhartiNo ratings yet

- Vicks AnswersDocument6 pagesVicks Answerssarvesh.bharti100% (1)

- Internet Marketing Project ReportDocument60 pagesInternet Marketing Project Reportsarvesh.bharti100% (1)

- Mark Project InternetMarketingDocument164 pagesMark Project InternetMarketingsarvesh.bhartiNo ratings yet

- Mono Copier Toner Powder: Item Code Printer Name Cartridge No CompatibilityDocument1 pageMono Copier Toner Powder: Item Code Printer Name Cartridge No Compatibilitysarvesh.bhartiNo ratings yet

- Cashew PicDocument2 pagesCashew Picsarvesh.bhartiNo ratings yet

- E9 Đề khảo sát Trưng Vương 2022 ex No 1Document4 pagesE9 Đề khảo sát Trưng Vương 2022 ex No 1Minh TiếnNo ratings yet

- The Consulting Industry and Its Transformations in WordDocument23 pagesThe Consulting Industry and Its Transformations in Wordlei ann magnayeNo ratings yet

- Multi Core Architectures and ProgrammingDocument10 pagesMulti Core Architectures and ProgrammingRIYA GUPTANo ratings yet

- GSM Radio ConceptsDocument3 pagesGSM Radio ConceptsMD SahidNo ratings yet

- Instruction Manual Twin Lobe CompressorDocument10 pagesInstruction Manual Twin Lobe Compressorvsaagar100% (1)

- Zkp8006 Posperu Inc SacDocument2 pagesZkp8006 Posperu Inc SacANDREA BRUNO SOLANONo ratings yet

- Starbucks Progressive Web App: Case StudyDocument2 pagesStarbucks Progressive Web App: Case StudyYesid SuárezNo ratings yet

- El TontoDocument92 pagesEl TontoRobertNo ratings yet

- CSCU Module 08 Securing Online Transactions PDFDocument29 pagesCSCU Module 08 Securing Online Transactions PDFdkdkaNo ratings yet

- Free PDF To HPGL ConverterDocument2 pagesFree PDF To HPGL ConverterEvanNo ratings yet

- Reservoir Bag Physics J PhilipDocument44 pagesReservoir Bag Physics J PhilipJashim JumliNo ratings yet

- Commercial BanksDocument11 pagesCommercial BanksSeba MohantyNo ratings yet

- Material Safety Data Sheet: - AdsealDocument12 pagesMaterial Safety Data Sheet: - Adsealwuhan lalalaNo ratings yet

- Polyembryony &its ImportanceDocument17 pagesPolyembryony &its ImportanceSURIYA PRAKASH GNo ratings yet

- Topic 6 Nested For LoopsDocument21 pagesTopic 6 Nested For Loopsthbull02No ratings yet

- 506 Koch-Glitsch PDFDocument11 pages506 Koch-Glitsch PDFNoman Abu-FarhaNo ratings yet

- Fike ECARO-25 Frequently Asked Questions (FAQ)Document8 pagesFike ECARO-25 Frequently Asked Questions (FAQ)Jubert RaymundoNo ratings yet

- Yojananov 2021Document67 pagesYojananov 2021JackNo ratings yet

- Tugas Inggris Text - Kelas 9Document27 pagesTugas Inggris Text - Kelas 9salviane.theandra.jNo ratings yet

- 5070 s17 QP 22 PDFDocument20 pages5070 s17 QP 22 PDFMustafa WaqarNo ratings yet

- Fh84fr6ht GBR EngDocument6 pagesFh84fr6ht GBR EngEsmir ŠkreboNo ratings yet

- Ezpdf Reader 1 9 8 1Document1 pageEzpdf Reader 1 9 8 1AnthonyNo ratings yet

- ERP22006Document1 pageERP22006Ady Surya LesmanaNo ratings yet

- NSTP SlabDocument2 pagesNSTP SlabCherine Fates MangulabnanNo ratings yet

- Firing OrderDocument5 pagesFiring OrderCurtler PaquibotNo ratings yet

- Space Saving, Tight AccessibilityDocument4 pagesSpace Saving, Tight AccessibilityTran HuyNo ratings yet

- A Vision System For Surface Roughness Characterization Using The Gray Level Co-Occurrence MatrixDocument12 pagesA Vision System For Surface Roughness Characterization Using The Gray Level Co-Occurrence MatrixPraveen KumarNo ratings yet

- So Tim Penilik N10 16 Desember 2022 Finish-1Document163 pagesSo Tim Penilik N10 16 Desember 2022 Finish-1Muhammad EkiNo ratings yet

- Gifted Black Females Attending Predominantly White Schools Compressed 1 CompressedDocument488 pagesGifted Black Females Attending Predominantly White Schools Compressed 1 Compressedapi-718408484No ratings yet

- DS SX1280-1-2 V3.0Document143 pagesDS SX1280-1-2 V3.0bkzzNo ratings yet