Professional Documents

Culture Documents

Bangalore Residential Report

Uploaded by

Sudhakar GanjikuntaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bangalore Residential Report

Uploaded by

Sudhakar GanjikuntaCopyright:

Available Formats

BANGALORE RESIDENTIAL REPORT 2Q08

OVERVIEW Bangalores residential market continued to witness stabilization in rentals across all micro-markets, while capital values increased marginally in a few micro-markets since the last quarter. The state government announced various infrastructure projects like elevated roads to improve connectivity within the city, which would create new corridors with potential land parcels for residential developments. North Bangalore, especially, gained significant importance (with the Bangalore International Airport at Devanahalli becoming operational), with the state government providing the necessary support infrastructure by improving connectivity to the CBD. Many projects were launched in this micro-market over the last few years from reputed developers like Renaissance Holdings, Shobha Developers, Bearys Properties & Developers and Godrej Properties, among others. While a few of these projects are already operational, others are expected to come into the market by end-2009. RENTAL VALUES Rentals for mid-range residential developments in June recorded the highest values in the central locations due to a lack of new projects being launched by prime developers. The south east micro-market, however, continued to witness rental corrections in the range of 4-11% in this quarter. The excess supply of all grades of developments, the emergence of newer residential locations and the sudden shift in interest towards north Bangalore have impacted the eastern micro-markets to a large extent. The rising rate of inflation and the current cash crunch has led to stabilization in rentals across most areas, barring a few projects in both high-end and mid-range sectors since the first quarter. CAPITAL VALUES Capital values for mid-range projects also remained constant since the first quarter; showing marginal appreciation over the last six months in a few micro-markets like the central locations (1-3%). In case of the highend segment, central and off central locations witnessed a marginal increase due to limited availability of land parcels and new projects. OUTLOOK The coming quarter is not likely to witness any major changes in either capital or rental values in Bangalores residential sector. The current economic scenario and the volatile stock market situation have changed the outlook for investment options in this sector. The market now is suited for long term investors; more so for end-users rather than for investors looking at short-term capital gains. Developers too are getting cautious, constraining supply by holding back new project launches and slowing down existing projects due to a lack of funds for execution. As indicated in the previous quarter, Whitefield, Sarjapur Road, Outer Ring Road and Bannerghatta Road have an abundance of existing and upcoming residential developments of various grades, leading to excess supply. Capital values are likely to remain stagnant across all regions in the coming months, but are expected to weaken in the above mentioned micro-markets. KEY TRANSACTIONS

PROPERTY LOCATION TYPE Lease AREA. 2,250 sq.ft. 2,682 sq.ft. VALUE (INR) 80,000 pm 10,250,000

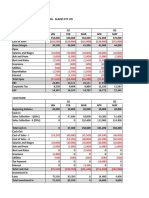

RESIDENTIAL RENTAL VALUES

LOCATION HIGH-END Central South Off Central East North MID-END Central East South East South North South West Off Central Off Central North West RENTAL VALUES / MTH

INR

% GROWTH

3 MONTH 6 MONTH

SHORT TERM TREND

150,000 - 400,000 80,000 - 100,000 100,000 - 120,000 100,000 - 500,000 100,000 - 200,000 100,000 - 120,000 20,000 - 30,000 20,000 - 25,000 30,000 - 50,000 20,000 - 30,000 20,000 - 35,000 5,0000 - 80,000 20,000 - 30,000 20,000 - 30,000

0% 0% 0% 0% 0% 0% -6% 0% 0% 0% 0% 0% 0% 0%

0% 0% 0% 0% 0% 0% -11% -4% 0% 0% 0% 0% 0% 0%

RESIDENTIAL CAPITAL VALUES

LOCATION HIGH-END Central South Off Central East North MID-END Central East South East South North South West Off Central Off Central North West

Note:

VALUES / SQ.FT.

INR

% GROWTH

3 MONTH 6 MONTH

SHORT TERM TREND

15,000 - 20,000 8,000 - 10,000 7,000 - 8,000 7,000 - 10,000 6,000 - 8,000 6,000 - 8,000 3,000 - 4,000 3,000 - 5,000 5,000 - 7,000 3,000 - 4,000 3,000 - 4,500 4,000 - 6,000 4,000 - 6,000 4,500 - 6,000

0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

3% 1% 1% 1% 2% 3% 1% 1% 1% 2% 1% 0% 1% 1%

For high-end projects, premium/luxury apartments/villas with an area of approximately 3,000 - 5,000sq.ft. have been considered For mid-range projects, apartments with an area of approximately 1,700 - 2,500 sq.ft. have been considered Key to Locations Central: Brunton Road, Artillery Road, Ali Askar Road, Cunningham Road Off Central: Cox Town, Frazer Town, Banaswadi, HRBR, Benson Town, Richards Town East: Marathhalli, Whitefield, Airport Road North: Hebbal, Bellary Road, Yelahanka, Dodballapur Road South: Koramangala, Jakkasandra South West: Jayanagar, J P Nagar, Kanakpura Road, Bannerghatta Road, BTM Layout, Banashankari South East: Sarjapur Road, Outer Ring Road, HSR Layout North West: Malleshwaram, Rajajinagar

LEGEND

Market Rising Market Falling Market Stagnant, likely to Strengthen Market Stagnant, likely to Weaken Market Stagnant

Unfurnished apartments Cunningham Road Apartment with terrace area (600 sq.ft.)

Bannerghatta Road Sale

For industry-leading intelligence to support your real estate and business decisions, go to Cushman & Wakefields Knowledge Center at www.cushmanwakefield.com/knowledge 4th Floor, Pine Valley, Embassy Golf Links Business Park, Intermediate Ring Road, Bangalore 560071. Tel: (+91080) 4046 5555 www.cushmanwakefield.com

This report contains information available to the public and has been relied upon by Cushman & Wakefield on the basis that it is accurate and complete. Cushman & Wakefield accepts no responsibility if this should prove not to be the case. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed by our principals. 2008 Cushman & Wakefield, Inc. All rights reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Bhagavatam Vol 5Document405 pagesBhagavatam Vol 5SarmaBvr100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Vendor: Oracle Exam Name: Oracle Benefits Cloud 2021 Implementation Essentials Exam Exam Code: 1Z0-1053-21 Product Questions: 60Document23 pagesVendor: Oracle Exam Name: Oracle Benefits Cloud 2021 Implementation Essentials Exam Exam Code: 1Z0-1053-21 Product Questions: 60Sudhakar GanjikuntaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 4 Bedroom FarmhouseDocument2 pages4 Bedroom FarmhouseSudhakar GanjikuntaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- RealUpgradeExperiences11itoR12 PDFDocument30 pagesRealUpgradeExperiences11itoR12 PDFnagendranathareddyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Olympiad Resource BooksDocument2 pagesOlympiad Resource BooksSudhakar GanjikuntaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- LJ HookerDocument2 pagesLJ HookerSudhakar GanjikuntaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Moac FileDocument24 pagesMoac FileSudhakar GanjikuntaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- TIBCO Cyberlogitec CsDocument2 pagesTIBCO Cyberlogitec CsSudhakar GanjikuntaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Mitra Samruddhi 8Document11 pagesMitra Samruddhi 8Sudhakar GanjikuntaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Question & Answer On Share PointDocument10 pagesQuestion & Answer On Share PointSudhakar GanjikuntaNo ratings yet

- Oracle Apps R12 ArchitectureDocument19 pagesOracle Apps R12 ArchitectureSudhakar GanjikuntaNo ratings yet

- Contract Farming Van GentDocument23 pagesContract Farming Van GentSudhakar GanjikuntaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- India Karnataka Market SummaryDocument2 pagesIndia Karnataka Market SummarySudhakar GanjikuntaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Ebs Release 12 UpgradeDocument21 pagesEbs Release 12 UpgradeSudhakar GanjikuntaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Oracle r12 Appstech Tca Technical Ver.1Document31 pagesOracle r12 Appstech Tca Technical Ver.1shanmugaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- DBI User Guide-1Document490 pagesDBI User Guide-1Sudhakar GanjikuntaNo ratings yet

- Certified Rac Scenarios For Oracle E-Business Suite CloningDocument4 pagesCertified Rac Scenarios For Oracle E-Business Suite CloningSudhakar GanjikuntaNo ratings yet

- Oracle DBA Apps CloningDocument20 pagesOracle DBA Apps CloningSudhakar GanjikuntaNo ratings yet

- Apps Technical Oracle-1Document6 pagesApps Technical Oracle-1Sudhakar GanjikuntaNo ratings yet

- 121 AdmpDocument58 pages121 Admponeeb350No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 13 13 Draft Agreement For Use of EquipmentDocument18 pages13 13 Draft Agreement For Use of EquipmentSudhakar GanjikuntaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Daily ActivityDocument15 pagesDaily ActivityPradeep ReddyNo ratings yet

- Property Title Registration System For Karnataka: 05.05.2010 IndexDocument16 pagesProperty Title Registration System For Karnataka: 05.05.2010 IndexSudhakar GanjikuntaNo ratings yet

- Step by Step Document To Create Standby Database9iDocument8 pagesStep by Step Document To Create Standby Database9iJayendra GhoghariNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 11th FYP Karnataka Perspective - Seminar 4.5.07Document18 pages11th FYP Karnataka Perspective - Seminar 4.5.07Bharath VenkateshNo ratings yet

- Sandal WoodDocument7 pagesSandal WoodSudhakar GanjikuntaNo ratings yet

- AP Land Use RegularityDocument36 pagesAP Land Use RegularitySudhakar GanjikuntaNo ratings yet

- Ilife BrochureDocument1 pageIlife BrochureSudhakar GanjikuntaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Sandal Wood 148Document9 pagesSandal Wood 148Sudhakar GanjikuntaNo ratings yet

- Pests and diseases of sandalwood plants in nurseries and their managementDocument8 pagesPests and diseases of sandalwood plants in nurseries and their managementSudhakar GanjikuntaNo ratings yet

- Vol. 49, No. 2, March 2017 PDFDocument19 pagesVol. 49, No. 2, March 2017 PDFStrathmore Bel PreNo ratings yet

- Real Estate - Understanding U.S. Real Estate DebtDocument16 pagesReal Estate - Understanding U.S. Real Estate DebtgarchevNo ratings yet

- Duty Free v1Document76 pagesDuty Free v1Vasu SrinivasNo ratings yet

- SME Credit Scoring Using Social Media DataDocument82 pagesSME Credit Scoring Using Social Media DatadavidNo ratings yet

- Credit History PDFDocument6 pagesCredit History PDFSohaib ArshadNo ratings yet

- Mechanics of Futures MarketsDocument42 pagesMechanics of Futures MarketsSidharth ChoudharyNo ratings yet

- 2122 s3 Bafs Notes STDocument3 pages2122 s3 Bafs Notes STKiu YipNo ratings yet

- Case - FMC - 02Document5 pagesCase - FMC - 02serigalagurunNo ratings yet

- CH 09Document22 pagesCH 09Yooo100% (1)

- FCA PBL (2)Document21 pagesFCA PBL (2)ttanishataNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Flyleaf BooksDocument32 pagesFlyleaf BooksAzhar MajothiNo ratings yet

- IRS Seminar Level 2, Form #12.032Document313 pagesIRS Seminar Level 2, Form #12.032Sovereignty Education and Defense Ministry (SEDM)100% (1)

- Kirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemDocument33 pagesKirsty Nathoo - Startup Finance Pitfalls and How To Avoid ThemMurali MohanNo ratings yet

- Aptivaa Model ManagementDocument18 pagesAptivaa Model Managementikhan809No ratings yet

- 8 Indicators TS 3.aflDocument24 pages8 Indicators TS 3.afludhaya kumarNo ratings yet

- Service Marketing 3 - (Marketing Mix)Document123 pagesService Marketing 3 - (Marketing Mix)Soumya Jyoti BhattacharyaNo ratings yet

- T3-Sample Answers-Consideration PDFDocument10 pagesT3-Sample Answers-Consideration PDF--bolabolaNo ratings yet

- FAR NotesDocument11 pagesFAR NotesJhem Montoya OlendanNo ratings yet

- Online Transfer Claim FormDocument2 pagesOnline Transfer Claim FormSudhakar JannaNo ratings yet

- Future and Option MarketDocument21 pagesFuture and Option MarketKunal MalodeNo ratings yet

- Insak personality test questions and English language examplesDocument5 pagesInsak personality test questions and English language examplesPai YeeNo ratings yet

- MilmaDocument50 pagesMilmaPhilip G Geoji50% (2)

- PFRS 16 Lease Accounting GuideDocument2 pagesPFRS 16 Lease Accounting GuideQueen ValleNo ratings yet

- IPP Report PakistanDocument296 pagesIPP Report PakistanALI100% (1)

- Comparison of Equity Mutual FundsDocument29 pagesComparison of Equity Mutual Fundsabhishekbehal5012No ratings yet

- 216 - JSAW Annual Report 2013 14Document137 pages216 - JSAW Annual Report 2013 14utalentNo ratings yet

- Revenue Recognition Guide for Telecom OperatorsDocument27 pagesRevenue Recognition Guide for Telecom OperatorsSaurabh MohanNo ratings yet

- Hair Salon Business Plan ExampleDocument20 pagesHair Salon Business Plan ExampleJamesnjiruNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet