Professional Documents

Culture Documents

Jordan Goodman - How To Retire Rich (Part 1)

Uploaded by

atik103Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jordan Goodman - How To Retire Rich (Part 1)

Uploaded by

atik103Copyright:

Available Formats

J ordan E.

Goodmans

HOW TO RETIRE RICH:

Creating Your Own

Personal Fortune Formula

Workbook

Volume One

2003 Jordan E. Goodman

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 2

Table of Contents Volume One

DECISION MAKING BEFORE YOU RETIRE

Session 1: Breaking the Myths of Retirement Planning . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3

Session 2: Are You Ready to Retire? The 10 Key Qualifying Questions . . . . . . . . . . . . . . . . . .4

Session 3: How to Prepare for Retirement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

IMPLEMENTING YOUR PERSONAL PLAN

Session 4: The Truth About Social Security . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .14

Session 5: Maximizing Your Pension Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .19

Session 6: Understanding Defined Contribution Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .24

Session 7: Understanding Self-Employed Pension Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . .27

Session 8: Getting the Most from Individual Retirement Accounts . . . . . . . . . . . . . . . . . . . .31

Many of the tables and financial figures listed in this guidebook are based on current government

statistics. Often, they change on an annual basis;, thus, to obtain the most recent information, you

should check them with the appropriate government agency.

DECISION MAKING BEFORE YOU RETIRE

Session 1: Breaking the Myths of Retirement Planning

What have been your lifelong dreams? Do you plan to pursue them once you re t i re? How close do

you think you are from retiring? According to the American Association of Retired Persons

(AARP), over 40% of Americans over 60, re g a rdless of their current economic circumstances, will

experience poverty at some point in their later years. In this session J ordan Goodman intro d u c e s

you to the tools, strategies, and concepts that he provides in this program that will assist in pre-

venting you from becoming one of those sad statistics. To launch you into the program, J ord a n

p rovides you with a Retirement Readiness Checklist that will assist you in establishing just how

ready you are to re t i re.

1. Listed below are 11 myths that are perpetuated today regarding retirement. Go through the

list and mark which myths you currently believe to be true.

Retirement Myths:

When I retire, I wont work. True ____ False ____

Ill need a great deal of money to retire. True ____ False ____

The government will take care of me. True ____ False ____

My company will take care of me. True ____ False ____

Medical insurance will take care of me. True ____ False ____

Social Security payouts will end by my retirement. True ____ False ____

I wont live long. Not much past 75 years old. True ____ False ____

I will have to downsize housing when I retire. True ____ False ____

Education is only for the young. True ____ False ____

When I leave my job, my self-worth will decrease. True ____ False ____

My life will slow down once I retire. True ____ False ____

2. Jordan discusses the significance of setting short-, medium-, and long-term goals for yourself.

In preparation for the long-term goal of retirement, what systems do you currently have in

place to prepare for your retirement?

3. Listed below is your Retirement Readiness Checklist. Take some time to go through this list,

checking the items that apply, to ascertain just how prepared you are for retirement:

Retirement Readiness Checklist:

___ Have you set a desired retirement age for yourself?

___ Do you currently have any savings in place toward your retirement?

___ Do you have an idea of what youd ideally like to do when you retire?

___ Do you plan on continuing with the lifestyle you currently enjoy when you retire?

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 3

___ Have you calculated how much money you would need to save for retirement in order

to maintain your desired lifestyle?

___ Do you have solid insurance plans in place for your retirement?

___ Have you calculated how much your desired lifestyle goals will cost?

___ Do you know how much you currently have in your savings?

___ Have you considered what you would like to do with your time during retirement?

___ Do you know what kind of return you expect to get on your investments?

If you checked any of the above readiness questions, you are on your way to some solid retire-

ment planning. If you did not check off any of the above, youve got quite a journey ahead of

you. In either case, this program will assist you in clarifying your desires and needs, along with

creating a solid, comprehensive retirement plan for yourself.

Session 2: Are You Ready to Retire? The 10 Key Qualifying Questions

A re you pre p a red financially, physically, and emotionally to end your career? Without corre c t

p reparation for such an extreme transformation in your life, you could find yourself stru g g l i n g

during a time in which you deserve to experience a great deal of comfort, joy, and ease. In this

session Jordan outlines the 10 questions that you should ask yourself before considering re t i re-

ment.

4. The 10 Key Qualifying Questions:

Can you afford to retire?

What kind of lifestyle do you want when you retire?

Do you plan on supplementing your income when you retire?

Is there a way that you can make residual income throughout your retirement?

How can you fully prepare for retirement?

What lifelong dreams do you want to pursue? Can you aff o rd to pursue them if you re t i re now?

Do you have hobbies and a variety of interests that you wish to pursue to keep you busy

throughout your retirement?

How is your health? Are you adequately insured for any health issues that may arise?

Is now the right time for you to retire?

Is your social life based on your job environment, or have you developed a fulfilling social

life outside of your work?

J ordan E. Goodmans HOW TO RETIRE RICH Volume One 4

5. Life Goals Inventory List:

In each of the areas of your life listed below, write out any goals that you have desired pur-

suing. If you have accomplished a goal, then make a () beside that goal. Be sure to make

the list as complete as possible. You may wish to revisit this list often, adding items to it,

and checking items off it as you complete them.

Travel

J

J

J

J

Education

J

J

J

J

Spirituality

J

J

J

J

Career

J

J

J

J

Friendships

J

J

J

J

Relationships

J

J

J

J

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 5

Home

J

J

J

J

Car

J

J

J

J

Adventure

J

J

J

J

Hobbies

J

J

J

J

Health/Fitness

J

J

J

J

Recreation

J

J

J

J

Other

J

J

J

J

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 6

Session 3: How to Prepare for Retirement

T h e re are several steps that you can take to make the transition into re t i rement as easy as possi-

ble. In this session J ordan will discuss what pre p a r a t o ry actions you need to take now in order to

e n s u re that you are financially pre p a red to re t i re. You will find several budgeting and fore c a s t i n g

worksheets below. J ordan encourages you to take the necessary time to go through the worksheets

and get a definitive forecast of what you will need for your re t i rement. You can then begin to take

p roactive steps toward funding it.

Listed below are some action steps that J ordan suggests you take in order to pre p a re for your

re t i rement. Make the commitment now to go through the list and begin your re t i rement planning.

Doing so will save you a great deal of stress and anxiety in the future .

6. Keep a diary of your current spending.

7. After several weeks of doing this, you can produce average monthly figures for expenses.

A Monthly Budgeting Wo r k s h e e t is provided on the next page to assist you in your

i n v e s t i g a t i o n .

8. Go through a completed Monthly Budgeting Worksheet and strike out any current expenses

that you will not have once youve retired (perhaps mortgage, commuting costs, financial sup-

port of dependents, etc.).

9. Take some time to add the new expenses and cost estimates for items that you may wish to

purchase during your retirement (education, travel, entertainment, etc.). The Retirement

Expenses Worksheet, page 9, may be helpful

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 7

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 8

Monthly Budgeting Worksheet

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 9

Retirement Expenses Worksheet

10. Now that youve created your new Retirement Expenses Worksheet, take into account the

impact that inflation will have on your retirement plans, and consequently work it into your

the Retirement Expenses Worksheet. This Impact of Inflation chart will assist you in calcu-

lating inflation

into your

preparatory

plans.

11. In order to successfully plan for your retirement,

you need to know where your largest sources of

income will be coming from. Take note of the items

listed in the Largest Sources of Income List.

12. This Capital

Accumulation

Worksheet will

assist you in gaining

a clearer picture of

how your capital

will accumulate

come time for

retirement.

13. The Annual

Savings Worksheet,

on the next page,

will further assist

you in projecting

exactly how much

money you will have

saved for retirement

when the day

arrives.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 10

Capital Accumulation Worksheet

Impact of Inflation

Largest Sources of Income List

, see bottom of page 9.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 11

Annual Savings Worksheet

14. Now that you have completed these worksheets, here are some simple ideas you can imple-

ment in your life that may assist you in saving more toward your retirement.

J Brown bag for lunch

J Energy-proof your home

J Control holiday costs

J Pay off credit cards or get lower-interest cards

J Consolidate all your debt at much lower interest rates; contact the Debt Relief Clearing

House (800-779-4499 or www.debtreliefonline.com)

J Set up a monthly automatic investing program with a mutual fund

J ordan E. Goodmans HOW TO RETIRE RICH Volume One 12

15. If you find that you come up short in your financial preparedness, you may wish to practice

dollar cost averaging (putting aside a fixed monthly sum of money for your future). The fol-

lowing tables will give you a clear indication of how practicing this investing technique is a

very effective way to save money toward your retirement.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 13

Investing $10,000 All at the Same Time

Investing $10,000 in a Dollar Cost Averaging Strategy

16. Reverse mortgages and federally insured home equity conversion mortgages are some other

tools that you can utilize to assist you in your retirement savings plan:

Assets: your home, particularly if you paid it off

Reverse Mortgages:

Single-purpose mortgage (usually for one-time necessities, like repair)

Federally insured home equity conversion mortgages (an annuity payment is the best

way as opposed to a lump sum of cash)

You can contact the American Association of Retired Persons (AARP) to get a free

Home Made Money: A Consumers Guide to Reverse Mortgages, published by the AARP,

601 E St. NW, Washington, D.C. 20049; 800-209-8085. www.aarp.org/revmort.

IMPLEMENTING YOUR PERSONAL PLAN

Session 4: The Truth about Social Security

I n this session J ordan discusses in detail the current Social Security system. He dispels common

myths about Social Security, explains how it may be altered in the future, and, finally, how you

can best work with the system to gain the best benefits for your re t i re m e n t .

17. Listed below are some of the ways that Jordan suggests your Social Security may be altered

in the future:

There may be a means test to allocate a smaller benefit to higher-income people

Minimum age will go up to age 67.

You will be encouraged to retire later (a special credit given to those who delay retire-

ment).

You may pay higher taxes on Social Security benefits.

The percentage of your retirement pay that Social Security is designed to replace may be

reduced from 24% to 20% or less.

Social Security payroll taxes will increase from the current 7.65% for employees to as

much as 15% to 20%.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 14

18. Below you will find two tables to assist you in projecting what your approximate monthly

Social Security benefits might be, based upon your age and annual income.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 15

Approximate Monthly Benefits If You Retire at

Full Retirement Age and Had Steady Lifetime Earning

Age to Receive Full Social Security Benefits

19. You may be able to avoid some unpleasant tax surprises if you follow the advice below:

20. In order to be eligible for Supplemental Security Income (SSI), the government will review

your assets, excluding your home and car (they WILL note bank accounts, investments, and

cash that you have). The benefits that you receive would depend upon how much you earn

and where you live. In order to be eligible you must be:

A U.S. citizen

Living in the United States

At least 65 years of age

Blind or disabled

To see if you qualify, contact your local SSI office at 800-772-1213, www.ssa.gov.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 16

21. In order to gain insight as to whether you are eligible to acquire Disability Benefits, you

must provide the following information to the government:

Whether you are working or not

The severity of your condition (it must be severe)

A list of disabling impairments

Whether your disability interferes with being able to do the work you did previously

Whether you are capable of doing any other type of work

22. If you are eligible, the chart below will assist you in establishing your approximate monthly

benefits:

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 17

Approximate Monthly Benefits If You Become Disabled in 2002

and Had Steady Lifetime Earnings

23. If you are eligible for Survivors Benefits, the table below can assist you in calculating your

approximate Monthly Survivors benefits:

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 18

Approximate Monthly Survivors Benefits for Your Family

If You Had Steady Lifetime Earnings and Die in 2002

Session 5: Maximizing Your Pension Benefits

Pensions can also be a source of income when you re t i re. There are two types of benefit plans you

could be eligible for. I n this session J ordan discusses pensions and how they can best work to

your benefit when you re t i re .

There are two types of pensions:

Defined benefit pensions: Your employer puts in the money and invests it for you, then

stipulates when you collect it and how much youll get.

Defined contribution pensions: You put money in and decide where you wish to invest it.

You decide when to collect it.

Which plan are you currently enrolled in? If you dont know, then take the time to investi-

gate your plan and learn about which plans are being offered to you.

There are three types of defined benefit pension plans:

Flat benefit formula plan: Pays a flat dollar amount each month after retirement. The

more years you work for a company, the higher the payment.

Career average formula plan: the income you earn over an entire career with a company

determines your monthly payment. It is averaged out and multiplied by the number of

years that you worked for the company.

Final pay formula plan: You get the highest monthly income. Your income is averaged for

the last few years, when you were earning your peak salary. You would then gain a per-

centage based on those earnings and the number of years youve been employed by the

company.

If you have a defined benefit pension plan with your organization, which of the above three

types of plans are you currently enrolled in?

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 19

You may also accumulate pay credits if you have a cash balance plan. To give you a greater

understanding of how a cash balance plan works in relation to a traditional pension plan, we

have provided you with two case studies, to show the outcome of each plan.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 20

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 21

Often people are not protected when their pension plans terminate. To assist you in avoiding

such mishaps, we have listed below the ten common causes of error.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 22

If your company goes out of business and the pension plan terminates, the federally backed

Pension Benefit Guaranty Corporation (PBGC) will step in as a trustee for the plan. Listed

below are the maximum monthly payout guarantees that it provides:

When the PBGC takes over your plan:

The PBGC reviews your plans record to determine what benefit each person will receive.

If you are already retired and receiving benefits, the PBGC will continue paying you with-

out interruption during its review. These payments will be an estimate of the benefits that

the PBGC can pay under the insurance program, and they may be less than what you were

receiving from your plan.

If you have not yet retired, the PBGC will pay you an estimated benefit when you become

eligible.

Once the PBGC completes its review, it informs you in writing what your pension amount

will be and what rights you have to appeal the decision.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 23

PBGC Maximum Monthly Guarantees

There are a variety of payout options that you have on your defined benefit pension plans.

These are:

A pre-retirement survivors annuity:

Qualified joint and survivor annuity: Pays a fixed amount until you and your dependent

dies. This is the safest because it ensures that you or your spouse will get a monthly

income. Offers lowest payment level, but it covers both you and your spouse for the rest of

your lives.

Life only annuity: It stops when you die, thus your spouse gets none of it at that time.

Lump sum annuity: You have to know the rate of return that the employer will use in

making the calculations.

Term certain annuities: For 10 or 20 years a higher payment, but after 10-20 years, no

more payment.

Session 6: Understanding Defined Contribution Plans

Defined contribution pension plans are discussed in this session. J ordan outlines the types of

plans and how they work. They are much more widely available than defined benefit pension

plans, and can be very successful investment agents for your re t i rement. He discusses these plans

in detail, including the 401(k) plan, the 457 plan, and the 403(b) plan (off e red by religious, educa-

tional, or charity

g roups).

Jordan suggests

that you partici-

pate in your

employers contri-

bution plan.

Listed here are

two tables to

illustrate the pro-

jected maximum

pretax elective

deferral sums and

the catch-up elec-

tive deferral

sums.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 24

Qualified Employer-Sponsored Retirement Plans:

Maximum Pretax Elective Deferral

Qualified Employer-Sponsored Retirement Plans:

Catch-up Elective Deferral

The rules for taking money out of the 401(k) plan are:

If you take money from your 401(k) you will pay an early withdrawal penalty of 10% and

be taxed during the year of withdrawal, unless yours is a hardship withdrawal (no penal-

ty). To qualify, you cannot have a loan against your 401(k), and you must use the money to

pay for college tuition, room and board, a down payment for a house, or if you face evic-

tion or foreclosure on your primary residence.

J ordan E. Goodmans HOW TO RETIRE RICH Volume One 25

New Minimum Withdrawal Rules

Jordan discusses asset allocation options (high-risk, moderate-risk, low-risk funds and self-

directed):

High-Risk funds:

Stocks of aggressive growth

Sector funds

Small company growth funds

Special situation funds

Moderate-Risk funds:

Classic growth funds

Equity income funds that own stocks that pay dividends

Index funds

Low-Risk funds:

Balanced funds (

1

/2 stocks,

1

/2 bonds)

Flexible and asset allocation funds

Utility funds

GICs (guaranteed investment funds) fixed returns like CDs

Below are some guidelines for dividing your investment pie:

Age 20 mid 40s: 50% to 80% in higher risk and moderate, 20% to 30% in low risk

Age 40 50s: 40% in high risk, 40% to 50% in moderate risk, remainder in low risk

Age 60s and beyond: 20% to 30% high risk, 20% to 30% moderate, and rest in low risk

The 403(b) Plans that are offered to people in the not-for-profit sector:

Offer a tax sheltered annuity (TSA) inside this retirement account (church staff, university

professors, etc.)

Money is automatically available to you

Like a 401(k), you put money aside on a pre-tax basis through earnings

They are portable you can roll over your money to new employer plans

Employer contributions are optional; in some cases there is a 25% to 100% match

The 457 plans are more restrictive than 401(k) and 403(b) plans. They:

Are offered by government organizations

Can rollover into an IRA once you leave your job

Will max out in 2006 at $30,000 per year

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 26

The three main defined contribution plan mistakes to avoid are:

Failing to rebalance your portfolio once or twice a year

Cashing out when you change jobs (youll take a 10% penalty and pay taxes on it)

Putting all your eggs in one basket

Its important that you take note of what the management fees are when choosing a plan.

The difference with the addition of 1% more fee:

$25,000 with average annual return of 7%, annual expenses 0.5%, accumulates $227,000

$25,000 with average annual return of 7%, annual expenses 1.5%, accumulates $163,000

24. What are your current defined contribution plan investment contributions? Is there a way

that you can contribute to any of these plans so that you can maximize your opportunities?

Session 7: Understanding Self-Employed Pension Plans

I n this session J ordan will break down self-employed pension plans and explain how you can best

plan for your re t i rement if you have such a plan. I f you are self-employed, you actually have more

o p p o rtunities to make the most of re t i rement pension opportunities.

There are several self-employed pension plans that are available:

KEOGH PLAN:

Named after US Representative Eugene Keogh who first introduced the idea in the 1960s.

Defined contribution:

Money Purchase Plan:

Requires that you choose a fixed percentage of your earnings and contribute that per-

centage every year to the plan no matter whether you make a lot of money or lose

money.

The percentage that you contribute every year can be as low as 1% or it can be as high

as 25%, up to a maximum of $40,000 (for 401(k)s and 403(b)s its a lot less than that).

Requires you to contribute this money on an annual basis no matter how profitable

your business is. If you do not contribute, the IRS will penalize you. If you think you

might have trouble making that fixed obligation payment every year, you should prob-

ably do a profit sharing Keogh plan instead of the money purchase Keogh.

Profit Sharing Plan:

Up to 25% of your earnings, up to $40,000 per year.

You can contribute the full amount one year and nothing the next, depending on how

your business performs. This flexibility often makes people much more interested in

doing a profit sharing than a money purchase Keogh.

J ordan E. Goodmans HOW TO RETIRE RICH Volume One 27

The Combination Option:

You can do a Keogh that combines both money purchase and profit sharing plans that

offers you the option of contributing the maximum of $40,000 but does not lock you

in to a maximum contribution.

You can start with a profit sharing plan and then add a money purchase plan with a

set annual contribution limit such as 8% or 10%.

In good years you can add money to the profit sharing plan up to the maximum of

$40,000; in lean years you pay only the minimum.

Keogh plans are available:

If youre the sole employee of your business but also if you have others working for you in

a small business.

Rules for other employees regarding contribution limits, how much of their salary you can

contribute, and other matters differ slightly from those for the single workers. But in gen-

eral you must contribute at least the same percentage of income for your employees as for

yourself.

Defined benefit Keogh:

Allows you to contribute much more than the $40,000 per year of a defined contribution

Keogh.

Each year the amount of money you add can be significantly greater or less than the

amount you invested in the previous years.

You would have to get an actuary who can project your defined benefit amount in retire-

ment to help you figure this out. But if you do that, you can potentially put away a lot

more money into a defined benefit Keogh than you can with the $40,000 limit of a defined

contribution Keogh.

Are usually established by high-income people in their 50s with very successful businesses

who have so far neglected to set up any kind of a pension plan. These plans allow them to

catch up by investing a greater amount of capital all at once to create a large pension ben-

efit in retirement.

Other rules about Keoghs:

Unlike an IRA, you cannot open a Keogh account right up to the April 15th tax-filing

deadline. You must establish a Keogh by December 31st of the year in which you file for

the deduction. This is a key point to remember because one of the biggest advantages of a

Keogh is that all your contributions are tax deductible. Although you must open the

account by the end of the year, you can make a contribution or add to an existing Keogh

up to April 15th and claim the deduction in the previous year. Just make sure you open

that account by December 31st.

In general its difficult to withdraw cash from a Keogh before you reach age 59

1

/2 if you are

the employer. Employees and owners enrolled in the Keogh plan can borrow up to half

their vested balance up to $50,000, but it must be repaid through payroll deductions over

the next five years.

There is definitely a certain amount of paperwork that goes along with establishing and

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 28

maintaining a Keogh account. If you deal with a reputable mutual fund company, broker-

age firm, insurance company or bank, the people there should be able to help you com-

plete most these necessary forms, although they may charge you a little bit for the service.

Accountants and financial planners will prepare Keogh documents.

The main form you have to prepare is called the IRS Form 5500, which is the annual

report required if your Keogh plans assets exceed $100,000. If theyre under $100,000, you

do not have to file the Form 5500.

SIMPLIFIED EMPLOYEE PENSION (SEP) PLAN:

This plan combines some of the best features of both the IRA and Keogh and its much

easier to establish than a Keogh because it involves a lot less paperwork.

Like an IRA, a SEP establishes an account for each participant, both you and all the

employees in your company. As in a profit sharing Keogh, you can contribute to a SEP one

y e a r, but not the next if you desire. If you have a bad year, you dont have to contribute to

the SEP.

As with other pension plans, you must pay a 10% penalty plus income tax if you withdraw

money from a SEP before age 59

1

/2.

In the same way that you cannot borrow against an IRA, you cannot borrow against a

SEP asset. However, the government does not require annual filings of set plan assets as it

does for Keoghs.

You can invest the money in a SEP just as you can with any IRA, in a mutual fund, bank,

credit union, brokerage firm, insurance company, or many other financial instutions.

Eligibility for a SEP is attained if an employee is at least 21 years old, has worked for the

firm at least 3 of the past 5 years, and has earned a certain minimum, currently $450,

though that number goes up each year with inflation a little bit.

Half of your firms employees must agree to participate before the plan can become effec-

tive. You just cant offer a SEP for you only and not have any of the employees in it.

However, if you are the sole employee of the firm, you can set up a SEP just for yourself.

Like a Keogh, a SEP allows a self-employed person to contribute up to $40,000 of his or

her annual income.

Other rules for SEPs are very similar to IRAs. You can set one up until the April 15th tax

deadline; therefore, if you miss the December 31st deadline for opening a Keogh, you

could open a SEP instead.

SIMPLE IRA:

Simple stands for Savings Incentive Match for Employees.

Typically set up for firms with 100 or fewer employees.

Employees can put $8,000 into an account. This amount will be going up to $10,000 in the

year 2005.

If youre over age 50, you can put in an additional $1,000. Thats going to go up to $2,500

J ordan E. Goodmans HOW TO RETIRE RICH Volume One 29

additional contribution by the year 2006. So, in fact, the maximum you can put into these

if youre over age 50 would be $9,000 or $12,500 in 2006 which is similar to what you can

put in a 401(k).

Employers are required to contribute by either matching 100% of their employees contri-

butions up to 3% of their annual salary.

For employees who put nothing in on their own, employers must chip in 2% of pay on the

employees behalf.

All employees are eligible to participate in a SIMPLE IRA if they earned at least $5,000

during the two preceding years and are expected to earn at least $5,000 in the current

year.

The plan administration costs are usually minimal.

Small-business owners cant often stash away much for themselves; theyre limited to the

same $8,000, plus up to 3% of an employees salary.

SEP IRA (Simplified Employee Pension IRA):

Very similar to a regular IRA, but it has higher contribution limits.

Contributions can vary each year at the employers discretion, but the maximum you can

put in is $40,000.

Is fully funded by the employer, who is required to establish accounts for all employees

who have worked for at least 3 of the last 5 years and earned at least $450 in the last year.

Employees are 100% vested immediately, so all the money that goes into their plans is

immediately available to them if they were to leave the company.

If youre self-employed, you can put away up to $40,000 in a SEP IRA. This can be a very

good option if you have between 1 and 10 employees.

There are no reporting requirements, and you have very limited administrative responsi-

bilities.

The cost of administering the plan is very low and the plan offers tremendous flexibility in

how you contribute and where you invest.

A SEP IRA may be best for you if you have a small company and want to have maximum

flexibility and limited administrative responsibilities.

There are three basic steps that you need to take to set up a Simplified Employee Pension Plan:

1. You must execute a formal written agreement to provide benefits to all eligible employees.

2. You must give each eligible employee certain information about the SEP.

3. A SEP IRA must be set up by or for each eligible employee.

One of the perks for setting up this plan is that you will receive a tax credit for the 50% of

the setup cost for the first three years, with a maximum credit of $500,000 annually.

J ordan E. Goodmans HOW TO RETIRE RICH Volume One 30

Session 8: Getting the Most from Individual Retirement Accounts

I ndividual re t i rement accounts, or I RAs, are discussed in detail in this session. J ordan gives you

an overview of I RAs, along with an explanation of when contributions are deductible, rules, re g u-

lations, and how tos of using them to grow your re t i re m e n t .

Listed below are the facts about when your IRA contributions are deductible:

If you earn less than $30,000 in adjustable gross income as a single or $50,000 as a couple

filing jointly, you can deduct your IRA contribution even if you are eligible for a qualified

retirement plan such as a 401(k), 457 plan, Keogh, etc.

There is a tax credit for those who meet a certain age, typically over age 18, and an

income requirement of $25,000 or less for singles, $50,000 or less for joint filers who are

married. This credit is in addition to any deduction or exclusion that may otherwise apply

and varies from 10% to 15% of the first $2,000 of your contribution, depending on your

income and filing status.

If you participate in your employers plan, the portion of your IRA contribution that you

can deduct depends on your adjusted gross income each year. It phases out between dif-

ferent income levels, and over a certain amount you are not able to deduct it at all.

If you have adjusted gross income of your spouse and you filing jointly of below $150,000,

you will be able to take a deduction. That deduction is phased out if your income is

between $150,000 and $160,000 in adjusted gross income. Anything over that level, you

will get no deductions whatsoever.

Because of recent tax laws, the amount that you could put into IRAs has been raised and

will be raised even more in coming years. Right now you can contribute $3,000 per person

to an IRA. Both you and your spouse can both put in $3,000. That is going up to $4,000 by

the year 2007.

In 2008, you and your spouse will be able to put $5,000 in your IRA. In future years, the

limit is indexed for inflation in $500 increments.

There is also a catch-up provision for IRAs. From the years 2003 through 2005 an addi-

tional $500 can be put into an IRA if youre age 50 or older. From the years 2006 to 2010

you can put an additional $1,000 into an IRA. (For example, its the year 2006 and youre

over age 50, youll be able to put a total of $6,000 into your IRA, $5,000 for the regular

amount, plus $1,000 for the catch-up contribution). This is a lot of money that can be

growing either tax-deferred or tax-free.

Nondeductible IRAs:

If you earn more than the maximum level allowed and are eligible for a qualified plan at

work (you have a 401(k) or 43(b) or Keogh plan), you can still make a nondeductible con-

tribution to an IRA.

You and your spouse can each invest $3,000 a year out of your earnings, though this

amount has changed under the recent laws, and is going up over several years. If your

spouse does not work, you can contribute $3,000 for him or her into a spousal IRA.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 31

When you add a nondeductible contribution to your IRA, you must file IRS Form 8606,

because the tax treatment of those funds will be very different from the treatment of

deductible contributions when you withdraw the money at retirement.

When you make an after-tax nondeductible contribution you will not be taxed on any dis-

tribution of your original capital, though you will be taxed on the accumulated earnings.

Be sure to keep these accounts separate, a nondeductible IRA and a deductible IRA,

because the tax treatment is so different when you take the money out.

Although a nondeductible IRA is not as financially rewarding up front as a deductible IRA,

it can still be a very potent long-term tax shelter in which to accumulate a retirement nest

egg. Because all dividends and capital gains are tax-deferred until at least age 59

1

/2 and

possibly until 70

1

/2, you gain the advantage of tax-sheltered compounding. In the long run,

that shelter is worth far more to you than the one-time tax reduction resulting from a

deductible IRA contribution.

You have until the April 15th tax deadline to open your IRA account (if youre eligible, you

can deduct your contribution on the previous years tax return).

Its far better to make your IRA deposit soon after January 1st of the year in which you

claim the deduction so you have the full year of tax shelter growing with your money.

You can continue to contribute to your IRA until you reach age 70

1

/2, at which point you

must start withdrawing capital according to the IRS schedule. The sooner you open an

IRA the better because the values of compounding really add up over time (if you put

$3,000 a year into an IRA and your money earned 7% annually, in five years the money

would grow to a little over $18,000. In 15 years it would be over $80,000, in 25 years over

$203,000, and after 35 years at earning 7% a year, you would have over $443,000).

So remember:

- $3,000 per year each for you and for your unemployed spouse

- IRS Form 8606

- Have until April 15 deadline

- Contribute until you reach age 70

1

/2 at which point you have to start withdrawing

- Put $3,000/yr at 7% annually:

At 5 years you would have: $18,459

At 15 years $80,664

At 25 years: $203,029

At 35 years: $443,740

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 32

Roth IRAs:

Named after Delaware Senator William Roth, who came up with the idea of the expanded

IRA, it was put into action in the 1997 tax law.

You and your spouse can each put in up to $3,000 a year, even after youve reached the age

of 70

1

/2.

You can withdraw all principal and earnings totally tax-free after age 59

1

/2 as long as the

assets have remained in the IRA for at least five years after the first contribution.

The assets can also be withdrawn tax free if you suffer a major disability.

If you died before starting withdrawals from a Roth, the proceeds go to your beneficiaries

tax-free. This is very different from a regular IRA, because if you die with money still in

the IRA growing tax-deferred, theres a big tax on that money as it goes to your beneficiar-

ies.

Unlike regular IRAs, you dont have to take distributions from Roth IRAs starting at age

70

1

/2. In fact, you dont have to take distributions at all in your lifetime if you prefer.

Therefore, you can pass on money to your relatives free of taxes as long as you keep the

money in the Roth IRA.

You do not receive a deduction for contributing to a Roth IRA. But the value of having

that money growing tax-free and having completely tax-free withdrawals far exceeds the

tax break you get from an up-front deduction.

You are permitted to withdraw assets without the usual 10% early withdrawal penalty

under certain circumstances. If you use the money for the purchase of a first home up to

$10,000, if you use the money for college expenses, or if you become disabled, you can

take out money from the Roth IRA without having that 10% early withdrawal penalty.

You can contribute the full $3,000 if you are a married couple with adjusted gross income

of $150,000 or less, or if you are single with adjusted gross income of $95,000 or less.

If you earn between $150,000 and $160,000 for a married couple filing jointly, the ability

to open a Roth IRA becomes phased out. And the same is true for singles with income

between $95,000 and $110,000. If your income is over those limits in a particular tax year,

$160,000 for couples, $110,000 for singles, unfortunately you are not allowed to make a

Roth contribution.

You can also roll over assets from a traditional IRA into a Roth IRA if you follow cert a i n

rules. Your adjusted gross income must be $100,000 or less in a particular year. That

allows you to roll over money from existing nondeductible and deductible IRA balances

into your Roth without owing the 10% prepayment penalty. However, when you under-

take such a rollover you must pay income tax on all previously untaxed contributions and

e a rn i n g s .

When transferring IRA funds:

Be extremely careful when transferring these rollovers. The money should be transferred

directly between the two investment companies or you will be hit with a large tax penalty.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 33

The rollover rules:

Company plans including 401(k)s, 43(b)s and government 457 plans can be rolled over

into IRAs or into other 401(k), 403(b) or 457 plans.

After-tax funds, thats the nontaxable amount inside your IRA, still cannot be rolled over

into a 403(b) plan as they could under prior law.

457 plans do not accept after-tax contributions, so you cannot roll after tax money into

one of these.

If after-tax funds are rolled into one 401(k) plan and then into another 401(k) plan, the

transfer must be direct, trustee to trustee, directly from one institution to another. They

cant write you a check. And the receiving plan must agree to keep a separate accounting

of both taxable and after-tax funds and the income earned on those funds. This is why you

want to keep these funds separate, because when the money comes out, there is different

tax treatment depending on how it went in, in the first place.

IRAs can keep a separate accounting of after-tax funds rolled into them as the IRA owner

does that and reported on IRS Form 8606.

Rolling over after-tax money to an IRA represents an opportunity to keep the after-tax plan

money growing tax deferred inside the IRA. But it also poses challenges if you need to tap

this after-tax money in the near future. So you really should plan to keep it until youre

going to take the money in retirement. Know that once you roll over after-tax plan money

into an IRA, you must keep a separate accounting of these funds because it represents the

basis in your IRA. Think of it much the same way you would if you made a nondeductible

contribution to your IRA. You would have to keep track of the nondeductible contribu-

tions so that when you withdraw funds from your IRA you know how much of the with-

drawal will be nontaxable.

You cannot simply withdraw the money tax-free from the IRA. Suppose for example you

rolled $20,000 of after-tax money from your 401(k) into your IRA. You cannot then take

$20,000 tax-free from your IRA. The reason is once the money is in your IRA, it is handled

the same as a nondeductible IRA contribution.

If you do need access to some or all of that after-tax money, then dont roll it over to an

IRA, because youre not going to be able to withdraw it tax-free unless you withdraw the

entire IRA balance. If you have no need for the money and plan to leave it in the IRA

intact for your beneficiaries, then it pays to roll over the after-tax money to your IRA,

which can continue to grow tax-deferred. You must still make the annual required distri-

butions when you turn age 70

1

/2.

To maximize the IRA tax shelter you want to keep the money in there as long as possible. If

you start taking the money out at age 59

1

/2 y o u re going to lose a lot of tax-deferred com-

pounding compared to when you have to start taking it out at age 70

1

/2. If you take the

money out before age 59

1

/2, you owe a 10% early withdrawal penalty and you must pay

state and federal income taxes on your distribution in the year you receive it. However,

t h e re are a few exceptions to this penalty rule. You can make IRA distributions without

penalty if you have these circumstances: if you die the IRA proceeds are distributed to your

b e n e f i c i a ry or estate. If you become permanently disabled, you can get the money out with-

out penalty. Or if the amount distributed is paid out as an annuity over your lifetime or

your life expectancy.

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 34

If you have made the maximum use of your IRA tax shelter and have not touched the

money at all until the time youve turned 70

1

/2, you then have to start withdrawing the

money, at least a minimum amount that the IRS has set up. Theyve set up whats called

the minimum distribution allowance rules. You have to receive the first payment by April

1st of the year after youve turned 70

1

/2. Your second distribution must be taken by

December 31st of that same year.

The IRS requires you withdraw a certain amount of your account each year based on a

uniform actuarial table. This has been greatly simplified, and so they can tell you very eas-

ily exactly how much you need to be taking out every year. Its basically based on your life

expectancy. Financial institutions like banks, mutual funds, and brokerages will report to

the IRS each year how much money youre taking out in distributions, so its easy for the

IRS to see that youre taking out enough. If you dont take out enough, the IRS will impose

a penalty of 50% of the difference between what you withdrew and what you should have

withdrawn.

The rules also make it easier for you to select and change the beneficiary of your IRA

account. You can even select a new beneficiary after payouts have begun, and your heirs

can even change the beneficiary after youve died. This is important because the payout

rate is based on the beneficiary s life expectancy. So if the beneficiary is changed to a much

younger person, say your grandchildren instead of your children, the payout can take place

over many more years and there f o re allow the account to grow tax deferred for many more

years than if the beneficiary were middle-aged and had a lower life expectancy.

Another way to draw on your IRA is to take out the entire balance in a lump sum.

However, this subjects you to an enormous tax, which leaves less money for you to invest

to generate income that youll need to live on during retirement.

Another way to get the money out is to buy an annuity with your IRA proceeds. An annu-

ity makes monthly payments to you for the rest of your life, or if you choose, a joint and

survivor option for both the rest of your life and that of your spouse.

As with any other asset, when you open an IRA, you have to designate a beneficiary who

will receive the accounts proceeds if and when you die. If youre married, most likely

youre going to name your spouse as beneficiary. Once you die, your spouse will roll your

IRA assets into his or her IRA. However, if you name someone who is not a spouse to

receive your IRA proceeds, you must spell out in the plan to whom you want the money

distributed.

The IRA withdrawal rules are as follows. You can withdraw before age 59

1

/2 without penalty if

you:

Die

Become disabled

Have a lifetime annuity

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 35

Notes:

J ordan E. Goodmans HOW TO RETIRE RICHVolume One 36

N i g h t i n g a l e - C o n a n t

1 - 8 0 0 - 5 2 5 - 9 0 0 0

w w w. n i g h t i n g a l e . c o m

You might also like

- The Ten Great Cosmic PowersDocument154 pagesThe Ten Great Cosmic PowersArun Kumar Upadhyay100% (28)

- Terence McKenna - Alchemy LecturesDocument40 pagesTerence McKenna - Alchemy Lecturesatik103No ratings yet

- The Healing BreathDocument48 pagesThe Healing BreathEugenia Saparipa100% (2)

- CAM RVSD 05 ENG WebDocument54 pagesCAM RVSD 05 ENG WebSri Sakthi SumananNo ratings yet

- Caduseus, The Symbol of HealingDocument9 pagesCaduseus, The Symbol of HealingLuiz Gustavo CostaNo ratings yet

- Adrian P. Cooper - The Quantum MatrixDocument56 pagesAdrian P. Cooper - The Quantum Matrixsattshoffer100% (6)

- Terence McKenna - Alchemy LecturesDocument40 pagesTerence McKenna - Alchemy Lecturesatik103No ratings yet

- Testimonies Medical DoctorsDocument3 pagesTestimonies Medical Doctorsatik103No ratings yet

- Peter Wilberg - Black Sun - The Occult Power Within All That IsDocument21 pagesPeter Wilberg - Black Sun - The Occult Power Within All That IsSiguardDraconis100% (7)

- Transmission of Distant Pranic Healing EffectsDocument5 pagesTransmission of Distant Pranic Healing Effectsatik103No ratings yet

- Al Baker & Co - Our MysteriesDocument14 pagesAl Baker & Co - Our MysteriesantifreeNo ratings yet

- 10 Sup Pace PremDocument24 pages10 Sup Pace Prematik103100% (6)

- A .K. Dutt - Silk and Flower MagicDocument30 pagesA .K. Dutt - Silk and Flower MagicVoichita Todor100% (1)

- Goal Setting, Plan Ur LifeDocument56 pagesGoal Setting, Plan Ur Lifeahmed98% (88)

- Summey-Dawson - The Weekend Millionaire's Real Estate Investing ProgramDocument89 pagesSummey-Dawson - The Weekend Millionaire's Real Estate Investing Programatik103100% (7)

- Animal Conciousnes Daniel DennettDocument21 pagesAnimal Conciousnes Daniel DennettPhil sufiNo ratings yet

- Jonn Mumford - KundaliniDocument270 pagesJonn Mumford - KundaliniRagghu RangswamyNo ratings yet

- The Mind Box - Part 1Document100 pagesThe Mind Box - Part 1Catherine Muthoni Muriithi100% (15)

- Reality BendingDocument20 pagesReality BendingIvana IvancNo ratings yet

- Wheel of LifeDocument1 pageWheel of Lifeatik103100% (2)

- Bishop - Ultimate LoverDocument0 pagesBishop - Ultimate LoverTara Tess100% (1)

- Donald Moine - What It Takes SuperSellersDocument8 pagesDonald Moine - What It Takes SuperSellersatik103100% (3)

- Standards and EthicsDocument3 pagesStandards and Ethicsatik103No ratings yet

- What To Talk AboutDocument1 pageWhat To Talk Aboutatik103No ratings yet

- Management Leadership WheelDocument1 pageManagement Leadership Wheelatik103No ratings yet

- Priority List: Take Action! Create An Absolute Must ListDocument1 pagePriority List: Take Action! Create An Absolute Must Listatik103No ratings yet

- Coaching SuitabilityDocument1 pageCoaching Suitabilityatik103No ratings yet

- Growcoaching HintsDocument24 pagesGrowcoaching Hintsatik103No ratings yet

- GlobalcoachingstudyexecutivesummaryDocument0 pagesGlobalcoachingstudyexecutivesummaryatik103No ratings yet

- Job Performance WheelDocument1 pageJob Performance Wheelatik103No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Balmer LawrieDocument1 pageBalmer LawrieKolkata Jyote MotorsNo ratings yet

- Individual PaperDocument25 pagesIndividual PaperSandra Lim UyNo ratings yet

- E-Verify Participation PosterDocument1 pageE-Verify Participation PosterBarkley SquareNo ratings yet

- Form T: Wages Slip/Leave CardDocument2 pagesForm T: Wages Slip/Leave CardMuhammad AfzaalNo ratings yet

- sb5 Issues and AnswersDocument4 pagessb5 Issues and Answersapi-54402032No ratings yet

- Internship ReportDocument36 pagesInternship ReportAnnan AkbarNo ratings yet

- Chapter 5 - Business Risk - JavinezDocument32 pagesChapter 5 - Business Risk - JavinezRovelyn JavinezNo ratings yet

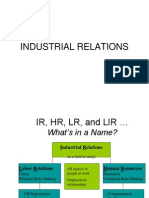

- Ir 2Document15 pagesIr 2Kuthubudeen T MNo ratings yet

- Group 'C'Document11 pagesGroup 'C'Gyalmu LamaNo ratings yet

- Mihir Resume12Document3 pagesMihir Resume12Mihir JhaNo ratings yet

- Writ Petition Challenging Retrospective Amendment To Payment of Gratuity Act, 1972Document52 pagesWrit Petition Challenging Retrospective Amendment To Payment of Gratuity Act, 1972pawan4759100% (2)

- Soliman v. TuazonDocument5 pagesSoliman v. TuazonpaulaazurinNo ratings yet

- Biodata TemplateDocument1 pageBiodata TemplateMichaelViloriaNo ratings yet

- Standard of Nursing ServicesDocument43 pagesStandard of Nursing ServicesMichael Hall100% (2)

- Lecture 3 - Performance ManagementDocument43 pagesLecture 3 - Performance Managementmaiesha tabassumNo ratings yet

- (This Paper Consists of 6 Pages) Time Allowed: 60 Minutes: A. Watched B. Stopped C. PushedDocument5 pages(This Paper Consists of 6 Pages) Time Allowed: 60 Minutes: A. Watched B. Stopped C. PushedNguyễn Việt QuânNo ratings yet

- BD HSG Idiomatic ExpressionsDocument6 pagesBD HSG Idiomatic ExpressionsheobilNo ratings yet

- HR Manual July 2020 CILDocument766 pagesHR Manual July 2020 CILdhanu sreeNo ratings yet

- Challenges Faced by Management at Ufone PakistanDocument23 pagesChallenges Faced by Management at Ufone PakistanHareem Sattar0% (2)

- The Robots Are Coming The Robots Are ComingDocument5 pagesThe Robots Are Coming The Robots Are Comingapi-272551013No ratings yet

- Human Resource Management in The United Arab Emirates: November 2016Document19 pagesHuman Resource Management in The United Arab Emirates: November 2016Behejat ChowdhuryNo ratings yet

- Tesda Circular s.2016 Re Revised Process Cycle Time and Requirements For Program RegistrationDocument51 pagesTesda Circular s.2016 Re Revised Process Cycle Time and Requirements For Program Registrationteabagman100% (3)

- Induction and Orientation Lect 5Document28 pagesInduction and Orientation Lect 5imadNo ratings yet

- InterStaff Resume FormatDocument4 pagesInterStaff Resume FormatRael GibendiNo ratings yet

- Identities and Inequalities Exploring The Intersections of Race Class Gender and Sexuality 3rd Edition Newman Test BankDocument13 pagesIdentities and Inequalities Exploring The Intersections of Race Class Gender and Sexuality 3rd Edition Newman Test Bankjasonnunezxjyspzitmf100% (25)

- Bio Science PDFDocument14 pagesBio Science PDFPhilBoardResultsNo ratings yet

- 2010 Statistics On Businesses in The UK - Office of National StatisticsDocument410 pages2010 Statistics On Businesses in The UK - Office of National Statisticsprincessz_leoNo ratings yet

- T&H Shopfitters v. T&H Shopfitters Workers UnionDocument12 pagesT&H Shopfitters v. T&H Shopfitters Workers UnionJillian Gatchalian ParisNo ratings yet

- Coolie - Project ReportDocument16 pagesCoolie - Project Reportsidrocks21No ratings yet

- Himson EngineeringDocument109 pagesHimson EngineeringMohit JariwalaNo ratings yet