Professional Documents

Culture Documents

Chapter 8 Marketing of Islamic Financial Products

Uploaded by

adilagidiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 8 Marketing of Islamic Financial Products

Uploaded by

adilagidiCopyright:

Available Formats

8

Marketing of Islamic nancial products

Said M. Elfakhani, Imad J. Zbib and Zafar U. Ahmed

Introduction Islamic nancial products oer new opportunities for institutions to address previously unexplored consumer and business segments. Institutions oering Islamic nancial services have increased in number and availability thanks to a growing demand by certain segments of the worlds 1.3 billion Muslims for sharia-compliant products. Currently, more than 265 Islamic banks and other nancial institutions are operating across the world, from Jakarta (Indonesia) to Jeddah (Saudi Arabia), with total assets of more than $262 billion, as detailed in Tables 8.1 to 8.3. Table 8.1 lists some major Islamic banks in the Middle East. Table 8.2 ranks the largest Islamic banks in the Arab world. Table 8.3 lists the leading Islamic debt managers (20042005). Islamic banks aim at addressing the needs of new segments by creating a range of Islamically acceptable products, the development of which pose signicant challenges arising from the need for sharia compliance in addition to regulatory complexities. Marketing such products is another challenge in light of competition from conventional banks and the need for innovative products. Table 8.1

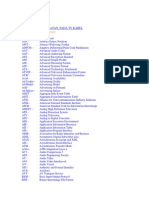

Country Algeria Bahrain

Prominent Islamic banks in the Middle East

Islamic nancial institutions Banque Al Baraka DAlgrie (1991) ABC Islamic Bank (1995) Al Amin Co. for Securities and Investment Funds (1987) Albaraka Islamic Investment Bank (1984) Al Tawfeek Company for Investment Funds (1987) Arab Islamic Bank (1990) Bahrain Islamic Bank (1979) Bahrain Islamic Investment Co. (1981) Citi Islamic Investment Bank (1996) Faysal Investment Bank of Bahrain (1984) Faysal Islamic Bank of Bahrain (1982) First Islamic Investment Bank (1996) Gulf Finance House (1999) Islamic Investment Co. of the Gulf (1983) Islamic Leasing Company Alwatany Bank of Egypt, Cairo (1980) (one Islamic branch) Arab Investment Bank (Islamic Banking operations), Cairo Bank Misr (Islamic Branches), Cairo (window opened 1980) Egyptian Saudi Finance Bank (1980) Faisal Islamic Bank of Egypt, Cairo (1977) International Islamic Bank for Investment and Development, Cairo (1980) Islamic Investment and Development Company, Cairo (1983) Nasir Social Bank, Cairo (1971)

Egypt

116

Marketing of Islamic nancial products Table 8.1

Country Iraq Jordan

117

(continued)

Islamic nancial institutions Iraqi Islamic Bank for Investment and Development (1993) Beit El-Mal Saving and Investment Co. (1983) Islamic International Arab Bank (1998) Jordan Islamic Bank for Finance and Investment (1978) International Investment Group (1993) Kuwait Finance House, Safat (1977) The International Investor (1992) Al Baraka Bank Lebanon (1992) Arab Finance House (2004) Al Baraka Islamic Bank, Mauritania (1985) Al-Jazeera Investment Company, Doha (1989) Qatar International Islamic Bank (1990) Qatar Islamic Bank (SAQ) (1983) Al Baraka Investment and Development Company, Jeddah (1982) Al Rajihi Banking and Investment Corporation (1988) Islamic Development Bank, Jeddah (1975) Bank Al Tamwil Al Saudi Al Tunisi (1983) Abu Dhabi Islamic Bank (1977) Dubai Islamic Bank, Dubai (1975) Islamic Investment Company of the Gulf, Sharjah (1977) Saba Islamic Bank (1996) Tadhom Islamic Bank (1996) Yemen Islamic Bank for Finance and Investment (1996)

Kuwait

Lebanon Mauritania Qatar

Saudi Arabia

Tunisia UAE

Yemen

Note:

date in brackets is the date of formation.

Source: Lewis and Algaoud (2001).

Contemporary environment The introduction of Islamic nancial products across the world has been in response to the growing need of a signicant segment of the marketplace that refused to deal with interest-based instruments. This development has helped nance the operations of small and medium enterprises that were unable to gain access to credit facilities owing to their lack of collateral and the small size of these loans, making costs higher. Conventional banks rely extensively on the creditworthiness of clients before granting a loan, while Islamic banks emphasize the projected cash ows of a project being funded, culminating in the emergence of various Islamic nancial services as a signicant contributor to the development of local economies and meeting consumers needs. In certain societies, conventional banks are viewed as depriving the society of economic balance and equity because the interest-based system is security-oriented rather than growth-oriented, thereby depriving resources to a large number of potential entrepreneurs who do not possess sucient collateral to pledge with banks. There are many

118

Handbook of Islamic banking Ranking of top Islamic banks in the Arab world

Type of operation Islamic window Islamic window Islamic window Islamic bank Islamic window Islamic window Islamic window Islamic bank Islamic window Islamic window Islamic window Islamic bank Islamic bank Islamic bank Islamic bank Islamic bank Islamic bank N.A.

Table 8.2

Bank

National Commercial Bank (Jeddah, Saudi Arabia) Riyadh Bank (Riyadh, Saudi Arabia) Arab Banking Corporation (Manama, Bahrain) Al Rajihi Banking & Investment Corp. (Riyadh, Saudi Arabia) National Bank of Egypt (Cairo, Egypt) Saudi British Bank (Riyadh, Saudi Arabia) Gulf International Bank (Manama, Bahrain) Kuwait Finance House (Safat, Kuwait) Saudi International Bank (London, UK) Banque Du Caire (Cairo, Egypt) United Bank of Kuwait (London, UK) Dubai Islamic Bank (Dubai, UAE) Faisal Islamic Bank of Bahrain (Manama, Bahrain) Faisal Islamic Bank of Egypt (Cairo, Egypt) Jordan Islamic Bank for Finance and Investment (Amman, Jordan) Qatar Islamic Bank (Doha, Qatar) Al Baraka Islamic Investment Bank (Manama, Bahrain) Bank of Oman, Bahrain & Kuwait (Ruwi, Oman)

Source: The Banker, November 1997.

Table 8.3

Manager

Top Islamic debt managers (July 2004May 2005)

Amt, US$ m. 866 753 582 551 433 427 350 285 279 263 4789 Iss. 28 3 4 19 2 9 1 3 27 3 99 Share (%) 15.00 13.05 10.08 9.54 7.5 7.39 6.06 4.94 4.84 4.56 82.96

HSBC Citigroup RHB Capital Bhd AmMerchant Bank Bhd Dubai Islamic Bank Commerce International Merchant Bankers Bhd UBS United Overseas Bank Ltd Aseambankers Malaysia Bhd Government bond/no bookrunner Total

Source: Islamic Financial News (available in Executive Magazine, June 2005, Issue 72).

individual consumers and entrepreneurs in Islamic societies who believe that the interestbased conventional banking system leads to a misallocation of resources. It is believed that conventional banks are more interested in the pledge of collateral and in securing interest payment regardless of the protability of the project funded.

Marketing of Islamic nancial products

119

Islamic banking is now a global phenomenon and is gaining regulatory approval to operate alongside conventional Western-style institutions. For example, the British regulatory body, the Financial Services Authority (FSA), has been playing a proactive role in promoting Islamic banking across the UK, leading to the establishment of the Islamic Bank of Britain. In order to respond to this expansion, Islamic bankers began developing new products to reach out to this broader client base. Among the innovations have been the development of xed-return instruments such as Islamic bonds (sukuk) and the creation of the global Islamic money market. Corporate and sovereign sukuk issues totalled $6.7 billion in 2004, up from $1.9 billion in 2003. Funds generated within certain rich Muslim countries such as the six member Gulf Cooperation Council countries (consisting of Saudi Arabia, United Arab Emirates, Oman, Kuwait, Qatar and Bahrain) have motivated Western banks to establish Islamic subsidiaries (windows) and cater for this new need. Banks such as Citibank, Chase Manhattan, HSBC, Deutsche Bank, ABN Amro, Socit Gnrale, BNP Paribas, Bank of America, Standard Chartered and Barclays have been oering Islamic nancial products through their subsidiaries to tap into this lucrative market. A subsidiary of Citigroup now operates what is eectively the worlds largest Islamic bank in terms of transactions. About $6 billion worth of Islamic nancial products have been marketed by Citibank worldwide since 1996. Islamic nancial products Islamic nancial systems are based on ve major tenets founded on the sharia bans and commandments (Iqbal, 1997). They are the prohibition of riba, prot and loss sharing, the absence of gharar (speculation and gambling-like transactions), disallowing the derivation of money on money, and the avoidance of haram (forbidden) activities. These have been examined in earlier chapters. Financial instruments based on these principles have been developed to facilitate everyday banking activities by providing halal (sharia-compliant) methods of lending or borrowing money and still oering some acceptable returns for investors. Listed below are some popular Islamic nancial products being marketed worldwide by Islamic banks and nancial institutions. Murabaha Murabaha (trade with mark-up cost) is one of the most widely used instruments for shortterm nancing and accounts for nearly 75 per cent of Islamic nancial products marketed worldwide. Referring to cost-plus sale , murabaha is the sale of a commodity at a price that includes a set prot of which both the vendor (marketer) and the consumer are aware. Ijara Ijara (leasing) permits the client to purchase assets for subsequent leasing for a certain period of time and at a mutually agreed upon amount of rent, and represents approximately 10 per cent of Islamic nancial products marketed worldwide. Mudaraba Mudaraba or trust nancing is a contract conducted between two parties, a capital owner (rabb al-mal)and an investment manager (mudarib), and is similar to an investment fund.

120

Handbook of Islamic banking

The rabb al-mal (benecial owner or sleeping partner) lends money to the mudarib (managing trustee or labour partner), who then has to return the money to the rabb al-mal in the form of principal with prots shared in a pre-agreed ratio. Musharaka Musharaka literally means sharing derived from shirkah. Shirkat-ul-milk means a joint ownership of two or more persons of a particular property through inheritance or joint purchase, and shirkat-ul-aqd means a partnership established through a contract. Musharaka is basically a joint contract by which all the partners share the prot or loss of the joint venture, which resembles mudaraba, except that the provider of capital or nancier takes equity stakes in the venture along with the entrepreneur. Muqarada Muqarada (bonds) allows a bank to issue Islamic bonds to nance a specic project. Investors who buy muqarada bonds take a share of the prots generated by the project as well as assuming the risks of losses. Salam Salam literally means futures. A buyer pays in advance for a designated quantity and quality of a certain commodity to be delivered at a certain agreed date and price. It is limited to fungible commodities and is mostly used for the purpose of agricultural products by providing needed capital prior to delivery. Generally, Islamic banks use a salam contract to buy a commodity and pay the supplier in advance for it, specifying the chosen date for delivery. The bank then sells this commodity to a third party on a salam or instalment basis. With two salam contracts, the second should entail delivery of the same quantity and description as the rst contract and is concluded after the rst contract (El-Gamal, 2000). Istisnaa Istisnaa is a contract in which a party (for example a consumer) demands the production of a commodity according to certain specications and then the delivery of it from another party, with payment dates and price specied in the contract. The contract can be cancelled at any time by any party given a prior notication time before starting the manufacturing process, but not later than that. Such an arrangement is widely used for real estate mortgage. Consider a family who would like to buy a $100 000 house and want to nance this purchase with the help of an Islamic bank. It may make an up-front payment equalling 20 per cent ($20 000), leaving the bank to invest 80 per cent, or $80 000, in the house. The familys monthly payment will comprise paying back rent to the bank plus a purchase of a certain portion of shares from the bank, until they eectively buy it out. The rent payments are legitimate because they are used to get a tangible asset that the family does not completely own, and are not paid to return borrowed money with interest. Sales contracts In the qh literature, there are frequently used sales contracts called baimuajal and bai salam or conducting credit sales, that are similar to mortgage instruments. Baimuajal refers to the sale of commodities or real estate against deferred payment and permits the

Marketing of Islamic nancial products

121

immediate delivery of the product, while payment is delayed or pushed forward for an agreed-upon period without extra penalty, that could be made as a lump sum or in instalments. The distinguishing feature of this contract from any regular cash sale is the deferral of the payment. Baisalam is also a deferred-delivery sale, and resembles a forward contract where the delivery of the product takes place in future in exchange for a spot payment. Strategic marketing approaches Besides using the regular marketing tools employed by conventional banks, Islamic banks have also developed their own marketing strategies to attract their target clientele. Some of these strategies are discussed next. Focus on believers The main niche for Islamic banks is target adherents to Islamic faith. They appeal to Muslim consumers basic capital needs. Islamic banks have been able to introduce a variety of nancial products that are compliant with sharia, while at the same time oering alternatives to conventional interest-based lending. Sharia supervision A Sharia Supervisory Board (SSB) guides sharia compliance on behalf of the clients. The SSB is made up of distinguished Islamic legal scholars who assume responsibility for auditing sharia compliance of a bank, including its marketing strategies, thereby functioning as a customer advocate representing the religious interest of investors (DeLorenzo, 2000). Special attributes of Islamic banks Hegazy (1995) investigated bank selection criteria for both Islamic and conventional banks, and concluded that the selection attributes for Islamic banks are dierent from conventional banks. For example, the most important factor used by Muslim consumers seeking Islamic nancial products was the advice and recommendations made by relatives and friends. Convenience of location, friendliness of the personnel, and the banks vision of serving the Islamic community regardless of the expected protability were also found to play important roles in the decision-making processes of individual and business clients. Identifying such features allows Islamic banks and institutions to develop appropriate marketing strategies to ensure high levels of customer satisfaction and retention by striving to develop appropriate marketing strategies (Metawa and Almossawi, 1998). Competing with conventional banks Marketing of Islamic nancial products is faced with various types of competitive pressures from conventional banks. In this environment, Islamic banks have to formulate and implement successful marketing strategies in which a key ingredient is a clear understanding of the behaviour, attitudes and perceptions of their clients. This is achieved through identifying behavioural proles encompassing banking habits, selection criteria used by target markets, risk-tolerance levels, awareness, preferences and usage patterns of various Islamic bank products (Metawa and Almossawi, 1998). Also Islamic banks oer many of the conventional banking services such as ATM machines, and credit cards to their clients at competitive prices.

122

Handbook of Islamic banking

Conveying trust and piety Among the more important attractions Islamic banks aim to portray are the characteristic traits of trust and piety. As Islamic-based institutions, the banks foster a God-abiding, trustworthy and pious image, that is well recognized and appreciated by religious consumers, oering a sense of reassurance that their investments are lawful (halal). Conveying credibility and experience Like conventional banks, Islamic banks aim to convince customers of their investment experience. An inexperienced customer, seeking a way to invest his/her savings, strongly appreciates evidence of credibility and past investment performance. In this way, the perhaps daunting task of investing is made easier and within reach. Complementing regular banks Islamic banks marketing strategy can be complementary to that of conventional banks. Services not oered by Islamic banks may be acquired from regular conventional banks while maintaining a sense of religious peace and trust by continuing the relationship with the Islamic banks. Marketing challenges Islamic banks share the same marketing challenges faced by regular (conventional) banks. However, they also have their own challenges that are related to their business line and constraints. Some of these challenges are discussed next. Competition from conventional banks The biggest challenge to Islamic banks, most less than three decades old, is to compete with a well developed and mature conventional banking industry evolving over the past many centuries. They need to know how to market their products successfully. While there are areas where Islamic and conventional banks pursue similar marketing strategies, there are also areas where Islamic banks pursue dierent strategies. Many individual and business consumers wish to have a guaranteed return on their investments and would thus have recourse to conventional banks based on zero-default interest payment, a factor that does not have a corresponding substitute in Islamic banks (Awad, 2000). Dealing with non-Islamic nancial institutions Islamic banks often operate in a business environment where laws, institutions, attitudes, rules, regulations and norms serve an economy based on interest. They are faced with the problem of investing short-term deposits and paying returns on them to depositors, while conventional banks have no constraint, dealing with overnight or short-term deposits as well as charging interest on overdrafts. Delineating an appropriate target market is a prerequisite for the successful execution of marketing strategies by Islamic nancial institutions. Maintaining competitive prots Low prot ratios could hurt Islamic banks as they rely solely on the prot and loss sharing (PLS) principle to market their nancial products. PLS is a form of partnership, whereby owners and investors serve as business partners by sharing prots and losses on the basis of their capital share, labour and managerial expertise invested. There can be no guaranteed

Marketing of Islamic nancial products

123

rate of return in such a case, although some investments (such as mark-up) provide more stable returns than others (such as mudaraba). The justication for the PLS nanciers share in prot is their eorts and the risks undertaken, making it legitimate in Islamic sharia. Supervision and transparency Islamic institutions need to have some kind of regulatory supervision in day-to-day operations in order to protect their depositors and clients. Because of the dierences in their nature and operations, Islamic banks require more strict supervision of the rms operations after the disbursement of funds. Banks supervision, scrutiny and examination, and sometimes participatory management in the conduct of rms operations, are important components of the Islamic nancial marketing system set in place, because of the greater risks that the Islamic banks shoulder. In most countries there are no coherent standards of Islamic marketing regulations, and the lack of uniformity in accounting principles and sharia guidelines makes it dicult for central bankers to regulate such an industry (Awaida, 1998). Thanks to the new standards adopted, such as auditing rules in Bahrain, new international standards are now applied by all Islamic banks, enhancing their transparency signicantly. Regulatory hurdles Because Islamic banking operates on a risk-sharing basis, it may not be necessary to have the same obligation as conventional banks to carry certain levels of capital. However, some regulators take the view that, since Islamic banks are conducting new and unexplored nancial pursuits with illiquid assets, they should perhaps have a greater safety margin than conventional banks (Awaida, 1998). In these cases an additional burden is placed on Islamic banks. Need for adequate human resources Marketing success hinges on having a highly-qualied and trained marketing team. Many problems in Islamic banks arise because of insucient training of their marketing personnel (Kahf, 1999). Greater professionalism and competence instituted by proper training programmes are key ingredients for forging successful relationships with clients (Metawa and Almossawi, 1998). Developing new products Islamic banks must strive to provide specic products tailored to satisfy dierent segments of individual and business consumers. They can do so by employing strategies ranging from re-engineering products to focusing on some specic services (see Metawa and Almossawi, 1998), vis--vis conventional banks, which is seen as one of the biggest challenges to a broader acceptance of new Islamic nancial products (Montagu-Pollock and Wright, 2002). Developing successful marketing strategies Success in marketing relies on the information retrieved from complete and up-to-date consumer proles. The availability of such a database is needed for making plausible and eective decisions regarding the marketing of Islamic nancial products. Moreover, Islamic nancial institutions need recourse to periodic customer surveys to investigate whether clients are aware of new products and to ascertain how many of those products are being used on a regular basis and what benets are sought by consumers.

124

Handbook of Islamic banking

Islamic institutions ought to pursue integrated promotion strategies that allow consumers to have adequate information about various products oered that, if properly carried out, will speed up the consumers learning about various Islamic products and attract new potential segments. Specic promotional and educational activities may need to be undertaken to increase the level of customer awareness and to narrow the gap in customer usage of these products caused by lack of proper awareness (Metawa and Almossawi, 1998). Balancing prot and development Islamic banks have presented themselves as providers of capital for entrepreneurs and business adventurers. In fact, most of their products (for example, murabaha, mudaraba, musharaka, salam and istisnaa) are investment banking-type products. To the disappointment of many Muslim consumers, most of the banks have focused on consumers loans and mortgages using variations of the above-named products rather than nancing new ventures and capital expansion projects. Islamic banks argue that they were pressured to perform to oer a viable alternative to conventional banks during the formative years of their operations. Hence they focused on short-term lending rather than supporting long-term protsharing activities. Now that these banks are more stable and mature, there is a the potential for them to carry out their intended responsibilities to fund longer-term projects. Promoting new client proles Islamic banks generally target the following segments: younger generation, female consumers, educated consumers, wealthy consumers, and non-Muslim consumers. Each of these segments requires dierent marketing strategies, and a certain percentage of annual revenue should be set aside to cover them. Most Islamic banks devote insucient funds for marketing in comparison with the millions of dollars invested by conventional banks to promote an image. The idea of an Islamic bank, as seen today, was non-existent not so many years ago and there are still many questions among customers, Muslims and nonMuslims alike. Industrial marketing: business to business marketing A large contribution to Islamic bankings increasing global success may have been made by major global multinationals (MNCs), operating throughout the Muslim world, which have begun to turn to Islamic nancial products as an alternative source of funding for everything from trade nance to equipment leasing. Examples include IBM, General Motors and Xerox, which have raised money through a US-based Islamic Leasing Fund set up by the United Bank of Kuwait, while international oil giants such as Enron and Shell have used Islamic banks to nance their global operations across the Arab Gulf region and Malaysia. Islamic nancial institutions are marketing their products across 15 major non-Muslim countries, encompassing the US, Canada, Switzerland, the UK, Denmark and Australia (Martin, 1997, 2005). Although Islamic nancial institutions employ classical marketing tools encompassing the four Ps of marketing-mix (product, price, promotion and place/distribution), their marketing strategies employ dierent orientations. This is due to the unique attributes of Islamic nancial products, on one hand, and the distinctive psychographic (lifestyle and personality) proles of its consumer market, on the other, as reected in consumers

Marketing of Islamic nancial products

125

religious belief structures inuencing their behavioural attitudes and dispositions. For instance, these institutions avoid using sexy models in their promotional campaigns while promoting their products. Many do not aggressively market their Islamic products, but rather depend largely on word of mouth for promotion and distribution of yers among attendees of mosques, Islamic educational institutions and Islamic centres. Similarly, Citibank does not necessarily employ an aggressive promotional campaign for the successful execution of its marketing strategy, but rather relies on its globally renowned brand for generating awareness among its consumer and business segments. Non-Muslims as a target market Another factor contributing to the current surge in the Islamic nancial industry is the innovative, competitive and risk-sharing nature of Islamic nancial products, providing non-Muslims with attractive and viable alternatives to conventional Western banking instruments. Hence, global nancial professionals such as Montagu-Pollock and Wright (2002) believe that the crux of the industry lies in non-Muslim companies and investors taking an interest in tapping it like any other pool of liquidity, or investing in it for no other reason than something that presents a good investment opportunity. Dudley (1998) believes that the future of Islamic banking lies in the idea not to sell Islamic products to Muslims, but rather to sell them to anybody, on the basis of its inherent advantages over other nancial alternatives. Critical evaluation A vocal and assertive segment of ultrareligious Muslim consumers has serious reservations about non-Islamic banks involvement in marketing Islamic nancial products. They have demonstrated resentment towards the entry of Western and traditional banks in the foray of Islamic banking industry as their vast and traditional operations are contrary to the tenets of Islamic piety. In their opinion, this would not be dissimilar to the Johnny Walker Whisky Company introducing Halal Zamzam bottled water, as a part of its brand extension strategy, to the dismay of a large Muslim population. On another front, funds of these regular banks are drawn, at least partially, from earnings sources that are Islamically doubtful, and are carried over into the Islamic nancial products. Purifying or cleansing these assets originating from prohibited earnings is an almost insurmountable challenge, as well as shifting the burden of purication to Muslim users. Hence regular banks, practising both Islamic and non-Islamic banking, generally concentrate on more liberal segments of Muslim consumers, who are more lenient about the Western versus Islamic bank distinction, and ignore the ultrareligious segments who resent conventional banks entering the Islamic nancial industry, as they cannot meet their strict religious criteria. The bottom line is that the regular and non-Islamic banks are perceived as not having entered this industry to serve Muslim Umma, but to make money under the pretext of Islamic banking. Ultrareligious Muslims do not wish to ban these banks from serving Islamic nancial products when these products are sought by fund users (Muslims and non-Muslims); they simply do not themselves deal with them. Future scenarios Islamic banking cannot rest on its laurels. With the advent of the Islamic windows of conventional banks and on-line banking, strong competition has to be faced. The current

126

Handbook of Islamic banking

marketing challenge for Islamic institutions is to orchestrate strategies promoting competitive, dynamic and sustainable Islamic nancial products in order to respond to the requirements of local economies and the international nancial market, via innovation of products (Aziz, 2005). Innovation is the key to sustainable and competitive marketing advantage for the future growth of Islamic nancial markets. Both innovation speed and innovation magnitude have benecial eects on an institutions nancial performance. Hence Islamic nancial marketers should be responsive to the evolving needs of Islamic investors and borrowers (Edwardes, 1995). Although Islamic banks have been able to grow quickly, their growth has been constrained by a lack of innovation. Developing new Islamic nancial products in compliance with the sharia is challenging. Failure to provide the full range and the right quality of products according to sharia will defeat the very purpose behind Islamic banks existence and will lead to diculties in retaining current customers and attracting new ones. However, a successful implementation of quality systems, involving sharia scholars and modern corporate nance experts in a Total Quality Management (TQM) exercise, for instance, can help enhance institutional creativity, leading to innovations. The Islamic banks can learn from successful conventional banks by employing appropriate Customer Relationship Management (CRM) strategies. There should also be intensive collaborative eorts among Islamic nancial engineers and sharia scholars to accelerate the pace of innovation. Islamic institutions should also promote knowledge and awareness of their products among their employees by employing internal marketing strategies. This awareness is an important tool as Islamic banks strive to develop close relationships with individual and business clients. They might thereby gain a competitive advantage based on superior customer relationships (Rice and Essam, 2001) and at the same time gain insights, through customer collaboration and feedback, into new customer needs and wants. Education and awareness programmes in the general Islamic community will generate a higher demand for Islamic nancial products that could then be customized to the requirements of better informed consumers. This would also help Islamic banks craft specic strategies aimed at capturing unexplored market segments. Collaboration eorts between Islamic banks and conventional banks could bring Islamic products to the mass-market and ultimately develop global distribution capabilities. The IT revolution might also help the Islamic institutions, creating new information portals enabling them to deliver products to consumers through dierent distribution channels at reduced cost and competitive prices (Aziz, 2004). Thus advances need to be made on a number of fronts. A qualied and skilled workforce well versed in both sharia and modern corporate nancial management is indispensable for innovation. Widening the product range calls for substantial and continuous investment in research and development (R&D). In this context, an industry-sponsored research and training institute, Islamic Banking and Finance Institute Malaysia (IBFIM), deserves special mention, for it has been established to undertake collaborative research with academics at the Malaysian universities aimed at developing unique and innovative Islamic nancial oerings across Malaysia (www.ibm.com). Tomorrows successful marketers of Islamic nancial products will be those who identify and anticipate the evolving needs of the Islamic consumer and pioneer product innovations and improvements to meet those needs (Edwardes, 1995) and should also be able to address non-Muslim nancing needs.

Marketing of Islamic nancial products References

127

Awad, Y. (2000), Reality and problems of Islamic banking, unpublished MBA dissertation, AUB Librairies, American University of Beirut. Awaida, H. (1998), Islamic banking in perspective, unpublished MBA dissertation, AUB Libraries, American University of Beirut. Aziz Akhtar, Z. (2004), The future prospects of Islamic nancial services industry, speech by Governor of the Central Bank of Malaysia, at the IFSB interactive session, Bali, 31 March. Aziz Akhtar, Z. (2005), Islamic nance: promoting the competitive advantage, Governors keynote address at the Islamic Bankers Forum, Putrajaya, Malaysia, 21 June. DeLorenzo, Y.T. (2000), Sharia supervision of Islamic mutual funds, Proceedings of the 4th Harvard Forum on Islamic Finance, Cambridge: Harvard Islamic Finance Information Program, Center for Middle Eastern Studies, Harvard University, http://www. azzadfund.com (accessed July 2002). Dudley, N. (1998), Islamic banks aim for the mainstream, Euromoney, 349, 113. Edwardes, Warren (1995), Competitive pricing of Islamic nancial products, New Horizon, May, 39, 46. El-Gamal, Mahmoud A. (2000), A Basic Guide to Contemporary Islamic Banking and Finance, Indiana: Islamic Banking & Finance America. Hegazy, I.A. (1995), An empirical comparative study between Islamic and commercial banks selection criteria in Egypt, International Journal of Contemporary Management, 5 (3), 4661. Iqbal, Z. (1997), Islamic nancial systems, Finance & Development, 34 (2), 424. Kahf, Monzer (1999), Islamic banks at the threshold of the third millennium, Thunderbird International Business Review, 41, 44560. Lewis, Mervyn K. and Latifa M. Algaoud (2001), Islamic Banking, Cheltenham, UK and Northampton, MA, USA: Edward Elgar Publishing. Martin, J. (1997), Islamic banking raises interest, Management Review, 86 (10), 25. Martin, J. (2005), Islamic banking goes global, Middle East, 357, 50. Metawa, Saad A. and M. Almossawi (1998), Banking behavior of Islamic bank customers: perspectives and implications, The International Journal of Bank Marketing, 16 (7), 299313. Montagu-Pollock, M. and C. Wright (2002), The many faces of Islamic nance, Asiamoney, 13 (7), 31. Rice, G. and M. Essam (2001), Integrating quality management, creativity and innovation in Islamic banks, paper presented at the American Finance House Lariba 8th Annual International Conference, Pasadena, CA, 16 June.

You might also like

- WWW - Ib.academy: Study GuideDocument122 pagesWWW - Ib.academy: Study GuideHendrikEspinozaLoyola100% (2)

- CDT 2019 - Dental Procedure Code - American Dental AssociationDocument195 pagesCDT 2019 - Dental Procedure Code - American Dental AssociationJack50% (2)

- Islamic Financial Market in MalaysiaDocument3 pagesIslamic Financial Market in MalaysiaSaiful Azhar Rosly100% (6)

- Stock Market Anomalies-JMI Working PaperDocument5 pagesStock Market Anomalies-JMI Working PaperadilagidiNo ratings yet

- Filipino HousesDocument4 pagesFilipino HousesjackNo ratings yet

- PsychFirstAidSchools PDFDocument186 pagesPsychFirstAidSchools PDFAna ChicasNo ratings yet

- Life in The Past - Year 6 WorksheetsDocument11 pagesLife in The Past - Year 6 WorksheetstinaNo ratings yet

- Islamic Finance in a Nutshell: A Guide for Non-SpecialistsFrom EverandIslamic Finance in a Nutshell: A Guide for Non-SpecialistsRating: 5 out of 5 stars5/5 (1)

- Republic Vs CA - Land Titles and Deeds - GR No. 127060Document3 pagesRepublic Vs CA - Land Titles and Deeds - GR No. 127060Maya Sin-ot ApaliasNo ratings yet

- DLL Week 5Document3 pagesDLL Week 5Nen CampNo ratings yet

- Principles of Islamic Finance: New Issues and Steps ForwardFrom EverandPrinciples of Islamic Finance: New Issues and Steps ForwardNo ratings yet

- Professional Education Pre-Licensure Examination For TeachersDocument12 pagesProfessional Education Pre-Licensure Examination For TeachersJudy Mae ManaloNo ratings yet

- Islamic Banking in The Middle EastDocument6 pagesIslamic Banking in The Middle EastHameed WesabiNo ratings yet

- UAE & Financial SectorDocument6 pagesUAE & Financial SectorTehreem MujiebNo ratings yet

- Islamic Banking PPT - 1Document25 pagesIslamic Banking PPT - 1Govinda ChhanganiNo ratings yet

- Marketing of Islamic Financial Products: January 2007Document18 pagesMarketing of Islamic Financial Products: January 2007AHMED MOHAMED YUSUFNo ratings yet

- Islamic Banking WikiDocument15 pagesIslamic Banking WikiNaffay HussainNo ratings yet

- Evolution of Islamic Financial SystemDocument14 pagesEvolution of Islamic Financial SystemDanish KhanNo ratings yet

- Chapter 1: Introduction: Shariah Principles and Avoid Prohibited Activities Such As Gharar (Excessive Uncertainty)Document76 pagesChapter 1: Introduction: Shariah Principles and Avoid Prohibited Activities Such As Gharar (Excessive Uncertainty)Vki BffNo ratings yet

- Iib MagazineDocument58 pagesIib Magazineعزالدين محمد أحمدNo ratings yet

- Screening of Sukuk Bonds As Islamic Interbank and Investment ToolDocument44 pagesScreening of Sukuk Bonds As Islamic Interbank and Investment Tooleaboulola100% (1)

- Islamic Banking Versus Commercial Banking:: Prospects & OpportunitiesDocument37 pagesIslamic Banking Versus Commercial Banking:: Prospects & OpportunitiesHanis HazwaniNo ratings yet

- Developing Banking Products For Islamic Corporate ClienteleDocument23 pagesDeveloping Banking Products For Islamic Corporate Clientelekhalid OmerNo ratings yet

- Ernst & Young-The World Islamic Banking Competitiveness Report 2011-2012Document110 pagesErnst & Young-The World Islamic Banking Competitiveness Report 2011-2012Hoss BedouiNo ratings yet

- A) Sukuk Powerhouse of The WorldDocument5 pagesA) Sukuk Powerhouse of The WorldNeha SahityaNo ratings yet

- Banking Finance Sectorial OverviewDocument15 pagesBanking Finance Sectorial OverviewOladipupo Mayowa PaulNo ratings yet

- Islamic Finance: Opportunities, Challenges, and Policy OptionsDocument10 pagesIslamic Finance: Opportunities, Challenges, and Policy OptionsInternational Monetary FundNo ratings yet

- Topic 2: An Introduction To Islamic Finance & Banking: ESC Rennes School of Business 2009/2010 DR Khalid ElbadraouiDocument120 pagesTopic 2: An Introduction To Islamic Finance & Banking: ESC Rennes School of Business 2009/2010 DR Khalid ElbadraouichelluchanakyaNo ratings yet

- The Rise of Islamic FinanceDocument3 pagesThe Rise of Islamic FinanceRon RobinsNo ratings yet

- Islamic FinanceDocument5 pagesIslamic FinanceHossein DavaniNo ratings yet

- Darwis Abd Rasak, Mohd Azhar Abdul KarimDocument21 pagesDarwis Abd Rasak, Mohd Azhar Abdul KarimCk ThamNo ratings yet

- Islamic Banking WikipediaDocument18 pagesIslamic Banking Wikipediacitybird97aNo ratings yet

- Dubai Islamic BankDocument6 pagesDubai Islamic BankNeha SahityaNo ratings yet

- University of Wollongong: Economics Working Paper Series 2006Document21 pagesUniversity of Wollongong: Economics Working Paper Series 2006Elghamourou SalaheddineNo ratings yet

- Islamic Banking OverviewDocument21 pagesIslamic Banking OverviewmudasirNo ratings yet

- Corporate Governance in Islamic Financial InstitutionsDocument28 pagesCorporate Governance in Islamic Financial InstitutionsAwAtef LHNo ratings yet

- Global Islamic Finance MagazineDocument88 pagesGlobal Islamic Finance MagazineDavid SmithNo ratings yet

- Testimony of Islamic Fin Tremendous GrowthDocument2 pagesTestimony of Islamic Fin Tremendous Growthproffina786No ratings yet

- Islamic Banking in Morocco: The Factors of A Promising FutureDocument8 pagesIslamic Banking in Morocco: The Factors of A Promising FuturemekdadNo ratings yet

- History of Islamic BankingDocument19 pagesHistory of Islamic BankingQasim MunawarNo ratings yet

- Liquidity Management Through Sukuk Report 2016Document24 pagesLiquidity Management Through Sukuk Report 2016Miaser El MagnoonNo ratings yet

- Development of Islamic Finance in Malaysia A Conceptual1594Document21 pagesDevelopment of Islamic Finance in Malaysia A Conceptual1594Mohd HapiziNo ratings yet

- 3b Asyraf Wajdi DusukiDocument21 pages3b Asyraf Wajdi DusukispucilbrozNo ratings yet

- Classical Islamic BankingDocument75 pagesClassical Islamic BankingNida_Basheer_206No ratings yet

- JurnalDocument19 pagesJurnalghalih sugihantoroNo ratings yet

- A Growth Model For Islamic BankingDocument10 pagesA Growth Model For Islamic BankingAhmed SharifNo ratings yet

- Risk Management in Islamic Banking: An Emerging Market ImperativeDocument24 pagesRisk Management in Islamic Banking: An Emerging Market ImperativeHasif powerNo ratings yet

- SUKUK BOND: The Global Islamic Financial Instrument Salman Ahmed Shaikh & Shan SaeedDocument11 pagesSUKUK BOND: The Global Islamic Financial Instrument Salman Ahmed Shaikh & Shan SaeedASHYA SAFFA BINTI AHMADNo ratings yet

- Code 101 Session IDocument37 pagesCode 101 Session IManjur AlamNo ratings yet

- WWW - Pakassignment.Blogsp: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atDocument16 pagesWWW - Pakassignment.Blogsp: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atPakassignmentNo ratings yet

- 8th Annual Islamic Finance SummitDocument2 pages8th Annual Islamic Finance SummitbereftNo ratings yet

- A Critical Assessment On Product Development & Innovation Within The Islamic Financial Services IndustryDocument15 pagesA Critical Assessment On Product Development & Innovation Within The Islamic Financial Services IndustryOppi TidjaniNo ratings yet

- Islamic Finance Panacea For The Global Financial SystemDocument8 pagesIslamic Finance Panacea For The Global Financial Systemjiachek89No ratings yet

- Prospects and Problems of Shariah-Compliant Finance: Executive SummaryDocument8 pagesProspects and Problems of Shariah-Compliant Finance: Executive SummarysyedtahaaliNo ratings yet

- Islamic Finance Acca PaperDocument6 pagesIslamic Finance Acca PaperAmmar KhanNo ratings yet

- Islamic Trade Finance Group-7 FinalDocument11 pagesIslamic Trade Finance Group-7 FinalKaushik HazarikaNo ratings yet

- DUBAIISLAMICBANKDocument31 pagesDUBAIISLAMICBANKMubashir Hassan KhanNo ratings yet

- Challenges Faced by Banking Sector in UAEDocument12 pagesChallenges Faced by Banking Sector in UAESyed Ahsan Ali ShahNo ratings yet

- Islamic BankingDocument57 pagesIslamic BankingMalik Yousaf AkramNo ratings yet

- SSRN Id3218475Document22 pagesSSRN Id3218475farhanahNo ratings yet

- Toward Inclusive Islamic Finance GIZDocument54 pagesToward Inclusive Islamic Finance GIZceoNo ratings yet

- Finance Gears Up : Mohammed El QorchiDocument7 pagesFinance Gears Up : Mohammed El QorchiAleem BayarNo ratings yet

- Islamic Financial Contract - FInalDocument64 pagesIslamic Financial Contract - FInalRianovel MareNo ratings yet

- Apakah Keuangan Islam Itu?Document25 pagesApakah Keuangan Islam Itu?Priyonggo SusenoNo ratings yet

- Contemporary Islamic Finance: An Introductory Analysis: MR - Najeebzada DR - Salim Ur RahmanDocument17 pagesContemporary Islamic Finance: An Introductory Analysis: MR - Najeebzada DR - Salim Ur RahmanInzemam Ul HaqNo ratings yet

- Cable Television AcronymsDocument13 pagesCable Television AcronymsCosmas HerryNo ratings yet

- LENOVO ThinkPad Edge E135 1A3 - Red PDFDocument4 pagesLENOVO ThinkPad Edge E135 1A3 - Red PDFadilagidiNo ratings yet

- DEA Spreadsheet 2011Document19 pagesDEA Spreadsheet 2011eesacNo ratings yet

- Fascinating Numbers: Some Numbers of 3 Digits or More Exhibit A Very Interesting PropertyDocument2 pagesFascinating Numbers: Some Numbers of 3 Digits or More Exhibit A Very Interesting PropertyAnonymous JGW0KRl6No ratings yet

- Ogayon Vs PeopleDocument7 pagesOgayon Vs PeopleKate CalansinginNo ratings yet

- ThesisDocument58 pagesThesisTirtha Roy BiswasNo ratings yet

- Gigold PDFDocument61 pagesGigold PDFSurender SinghNo ratings yet

- Unit 2 Foundations of CurriculumDocument20 pagesUnit 2 Foundations of CurriculumKainat BatoolNo ratings yet

- Openfire XXMPP Server On Windows Server 2012 R2Document9 pagesOpenfire XXMPP Server On Windows Server 2012 R2crobertoNo ratings yet

- Midterm Decision Analysis ExercisesDocument5 pagesMidterm Decision Analysis ExercisesAYLEN INJAYANo ratings yet

- Mathematicaleconomics PDFDocument84 pagesMathematicaleconomics PDFSayyid JifriNo ratings yet

- Introduction To Sociology ProjectDocument2 pagesIntroduction To Sociology Projectapi-590915498No ratings yet

- 9.2 Volumetric Analysis PDFDocument24 pages9.2 Volumetric Analysis PDFJoaquinNo ratings yet

- Vrushalirhatwal (14 0)Document5 pagesVrushalirhatwal (14 0)GuruRakshithNo ratings yet

- Entrepreneur: Job/Career InvolvementDocument5 pagesEntrepreneur: Job/Career InvolvementYlaissa GeronimoNo ratings yet

- Welcome To The Jfrog Artifactory User Guide!Document3 pagesWelcome To The Jfrog Artifactory User Guide!RaviNo ratings yet

- New Document (116) New Document (115) New Document (1Document9 pagesNew Document (116) New Document (115) New Document (1Manav PARMARNo ratings yet

- Collocations and IdiomsDocument6 pagesCollocations and IdiomsNguyen HuyenNo ratings yet

- Strategi Pencegahan Kecelakaan Di PT VALE Indonesia Presentation To FPP Workshop - APKPI - 12102019Document35 pagesStrategi Pencegahan Kecelakaan Di PT VALE Indonesia Presentation To FPP Workshop - APKPI - 12102019Eko Maulia MahardikaNo ratings yet

- Implementation of 7s Framenwork On RestuDocument36 pagesImplementation of 7s Framenwork On RestuMuhammad AtaNo ratings yet

- Ubi Jus Ibi RemediumDocument9 pagesUbi Jus Ibi RemediumUtkarsh JaniNo ratings yet

- BSCHMCTT 101Document308 pagesBSCHMCTT 101JITTUNo ratings yet

- Managing Ambiguity and ChangeDocument7 pagesManaging Ambiguity and ChangeTracey FeboNo ratings yet

- 115 FinargDocument294 pages115 FinargMelvin GrijalbaNo ratings yet

- Angel Number 1208 Meaning Increased FaithDocument1 pageAngel Number 1208 Meaning Increased FaithKhally KatieNo ratings yet