Professional Documents

Culture Documents

Eastern Telecoms v. Eastern Telecoms Employees Union

Uploaded by

lovesresearchOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eastern Telecoms v. Eastern Telecoms Employees Union

Uploaded by

lovesresearchCopyright:

Available Formats

EASTERN TELECOMMUNICATIONS PHILIPPINES, INC., Petitioner, v. EASTERN TELECOMS EMPLOYEES UNION, Respondent. February 8, 2012 MENDOZA, J.

THIRD DIVISION WHEN IS BONUS DEMANDABLE General rule: The grant of a bonus is basically a management prerogative which cannot be forced upon the employer. Exceptions: 1. A bonus becomes a demandable or enforceable obligation when it is made part of the wage or salary or compensation of the employee. TEST: If it is additional compensation which the employer promised and agreed to give without any conditions imposed for its payment, such as success of business or greater production or output, then it is part of the wage. But if it is paid only if profits are realized or if a certain level of productivity is achieved, it cannot be considered part of the wage. Where it is not payable to all but only to some employees and only when their labor becomes more efficient or more productive, it is only an inducement for efficiency, a prize therefore, not a part of the wage.(Metro Transit Organization, Inc. v. National Labor Relations Commission) 2. A bonus may be granted on equitable consideration when the giving of such bonus has been the companys long and regular practice. TEST: To be considered a "regular practice," however, the giving of the bonus should have been done over a long period of time, and must be shown to have been consistent and deliberate. The test or rationale of this rule on long practice requires an indubitable showing that the employer agreed to continue giving the benefits knowing fully well that said employees are not covered by the law requiring payment thereof. (Philippine Appliance Corporation v. Court of Appeals) ANTECEDENT FACTS Eastern Telecommunications Phils., Inc. (ETPI) is a corporation engaged in the business of providing telecommunications facilities, particularly leasing international date lines or circuits, regular landlines, internet and data services, employing approximately 400 employees. Eastern Telecoms Employees Union (ETEU) is the certified exclusive bargaining agent of the companys rank and file employees with a strong following of 147 regular members. It has an existing collective bargaining agreement with the company to expire in the year 2004 with a Side Agreement signed on September 3, 2001. The labor dispute was a spin-off of the companys plan to defer payment of the 2003 14th, 15th and 16th month bonuses sometime in April 2004. Eventually, the company decided not to pay any of these until the case filed by the union is finally resolved. Later included in the issues for resolution is the grant of the 14th month bonus for 2004. The companys main ground in postponing the payment of bonuses is due to allege continuing deterioration of companys financial position which started in the year 2000. However, ETPI while postponing payment of bonuses sometime in April 2004, such payment would also be subject to availability of funds. The union invoked the Side Agreement of the existing Collective Bargaining Agreement for the period 2001-2004 between ETPI and ETEU which stated as follows: "4. Employment Related Bonuses. The Company confirms that the 14th, 15th and 16th month bonuses (other than 13th month pay) are granted." PROCEDURE The Union filed a preventive mediation complaint with the NCMB on July 3, 2003, the purpose of which complaint is to determine the date when the bonus should be paid. In said conference, the company decided to change its position due to the unions filing of the issue to the NCMB, from deferred payment in April 2004 to non-payment until the issue is resolved through compulsory arbitration. On April 26, 2004, ETEU filed a Notice of Strike on the ground of unfair labor practice for failure of ETPI to pay the bonuses in gross violation of the economic provision of the existing CBA. The Secretary of Labor and Employment certified the labor dispute for compulsory arbitration. The issues for resolution are (1) unfair labor practice and (2) the grant of 14th, 15th and 16th month bonuses for 2003, and 14th month bonus for 2004. The NLRC issued its Resolution dismissing ETEUs complaint and held that the payment of these additional benefits was basically a management prerogative, and contingent upon the realization of profits, and that ETPI was not guilty of the ULP charge. NLRC also denied the Unions subsequent MR. Aggrieved, ETEU filed a petition for certiorari before the CA, ascribing grave abuse of discretion on the NLRC for disregarding its evidence which allegedly would prove that the subject bonuses were part of the union members wages, and for ruling that ETPI is not contractually bound to give said b onuses to the union members. CA granted the petition. CA declared that the Side Agreements of the 1998 and 2001 CBA created a contractual obligation on ETPI to confer the subject bonuses to its employees without qualification or condition. It also found that the grant of said bonuses has already ripened into a company practice and their denial would amount to diminution of the employees benefits. ETPI could not seek refuge under Article 1267 of the Civil Code because this provision would apply only when the difficulty in fulfilling the contractual obligation was manifestly beyond the contemplation of the parties, which was not the case therein. However, it found that the allegation of ULP was devoid of merit. ARGUMENTS OF THE UNION Eastern Telecommunications Philippines, Inc. (ETPI) had consistently and voluntarily been giving out 14th month bonus during the month of April, and 15th and 16th month bonuses every December of each year (subject bonuses) to its employees from 1975 to 2002, even when it did not realize any net profits. By reason of its long and regular concession, the payment of these monetary benefits had ripened into a company practice which could no longer be unilaterally withdrawn by ETPI. This practice had been expressly confirmed in the Side Agreements of the 1998-2001 and 2001-2004 Collective Bargaining Agreements (CBA), therby making such a

contractual obligation of ETPI to the union members. The unjustified and malicious refusal of the company to pay the subject bonuses was a clear violation of the economic provision of the CBA and constitutes unfair labor practice (ULP). Such refusal was nothing but a ploy to spite the union for bringing the matter of delay in the payment of the subject bonuses to the National Conciliation and Mediation Board (NCMB).

ARGUMENTS OF THE COMPANY It questioned the authority of the NLRC to take cognizance of the case contending that it had no jurisdiction over the issue which merely involved the interpretation of the economic provision of the 2001-2004 CBA Side Agreement. The subject bonuses were not part of the legally demandable wage and the grant thereof to its employees was an act of pure gratuity and generosity on its part, involving the exercise of management prerogative and have always been dependent on the financial performance and realization of profits. It claimed that it had been suffering serious business losses since 2000 and to require the company to pay the subject bonuses during its dire financial straits would in effect penalize it for its past generosity. It cannot be compelled to act liberally and confer upon its employees additional benefits over and above those mandated by law when it cannot afford to do so. It posits that so long as the giving of bonuses will result in the financial ruin of an already distressed company, the employer cannot be forced to grant the same. It alleged that the non-payment of the subject bonuses was neither flagrant nor malicious and, hence, would not amount to unfair labor practice. The bonus provision in the 2001-2004 CBA Side Agreement was a mere affirmation that the distribution of bonuses was discretionary to the company, premised and conditioned on the success of the business and availability of cash. It submitted that said bonus provision partook of the nature of a "one-time" grant which the employees may demand only during the year when the Side Agreement was executed and was never intended to cover the entire term of the CBA. Therefore, it cannot ripen into a company practice. Even if it had an unconditional obligation to grant bonuses to its employees, the drastic decline in its financial condition had already legally released it therefrom pursuant to Article 1267 of the Civil Code. ISSUE Whether or not the 14th, 15th and 16th month bonuses for the year 2003 and 14th month bonus for the year 2004 can be considered part of the wage, salary or compensation making them enforceable obligations RULING YES. DISPOSITION: Petition is DENIED. REASONING ON THE UNCONDITIONAL GRANT OF BONUSES From a legal point of view, a bonus is a gratuity or act of liberality of the giver which the recipient has no right to demand as a matter of right. The grant of a bonus is basically a management prerogative which cannot be forced upon the employer who may not be obliged to assume the onerous burden of granting bonuses or other benefits aside from the employees basic salaries or wages. A bonus, however, becomes a demandable or enforceable obligation when it is made part of the wage or salary or compensation of the employee. Metro Transit Organization, Inc. v. National Labor Relations Commission: Whether or not a bonus forms part of wages depends upon the circumstances and conditions for its payment. If it is additional compensation which the employer promised and agreed to give without any conditions imposed for its payment, such as success of business or greater production or output, then it is part of the wage. But if it is paid only if profits are realized or if a certain level of productivity is achieved, it cannot be considered part of the wage. Where it is not payable to all but only to some employees and only when their labor becomes more efficient or more productive, it is only an inducement for efficiency, a prize therefore, not a part of the wage. It is indubitable that ETPI and ETEU agreed on the inclusion of a provision for the grant of 14th, 15th and 16th month bonuses in the 1998-2001 CBA Side Agreement, as well as in the 2001-2004 CBA Side Agreement, which was signed on September 3, 2001. The provision in the agreement reveals that the same provides for the giving of 14th, 15th and 16th month bonuses without qualification. The records are also bereft of any showing that the ETPI made it clear before or during the execution of the Side Agreements that the bonuses shall be subject to any condition. Indeed, if ETPI and ETEU intended that the subject bonuses would be dependent on the company earnings, such intention should have been expressly declared in the Side Agreements or the bonus provision should have been deleted altogether. In the absence of any proof that ETPIs consent was vitiated by fraud, mistake or duress, it is presumed that it entered into the Side Agreements voluntarily, that it had full knowledge of the contents thereof and that it was aware of its commitment under the contract. By virtue of its incorporation in the CBA Side Agreements, the grant of 14th, 15th and 16th month bonuses has become more than just an act of generosity on the part of ETPI but a contractual obligation it has undertaken. Moreover, the continuous conferment of bonuses by ETPI to the union members from 1998 to 2002 by virtue of the Side Agreements evidently negates its argument that the giving of the subject bonuses is a management prerogative. Notwithstanding the business losses of P 149,068,063.00 incurred in 2000, it continued to distribute 14th, 15th and 16th month bonuses for said year and it entered into the 2001-2004 CBA Side Agreement on September 3, 2001 whereby it contracted to grant the subject bonuses to ETEU in no uncertain terms.

ETPI continued to sustain losses for the succeeding years of 2001 and 2002 in the amounts of P 348,783,013.00 and P 315,474,444.00, respectively. Still and all, it continued to give the subject bonuses to each of the union members in 2001 and 2002 despite its alleged precarious financial condition. It must be emphasized that ETPI even agreed to the payment of the 14th, 15th and 16th month bonuses for 2003 although it opted to defer the actual grant in April 2004. Hence, business losses could not be cited as grounds for ETPI to repudiate its obligation under the 2001-2004 CBA Side Agreement. ON THE GRANT OF BONUSES AS AN ESTABLISHED COMPANY PRACTICE Granting arguendo that the CBA Side Agreement does not contractually bind petitioner ETPI to give the subject bonuses, nevertheless, the Court finds that its act of granting the same has become an established company practice such that it has virtually become part of the employees salary or wage. A bonus may be granted on equitable consideration when the giving of such bonus has been the companys long and regular practice. To be considered a "regular practice," however, the giving of the bonus should have been done over a long period of time, and must be shown to have been consistent and deliberate. The test or rationale of this rule on long practice requires an indubitable showing that the employer agreed to continue giving the benefits knowing fully well that said employees are not covered by the law requiring payment thereof. (Philippine Appliance Corporation v. Court of Appeals) The records show that ETPI, aside from complying with the regular 13th month bonus, has been further giving its employees 14th month bonus every April as well as 15th and 16th month bonuses every December of the year, without fail, from 1975 to 2002 or for 27 years whether it earned profits or not. The considerable length of time ETPI has been giving the special grants to its employees indicates a unilateral and voluntary act on its part to continue giving said benefits knowing that such act was not required by law. Accordingly, a company practice in favor of the employees has been established and the payments made by ETPI pursuant thereto ripened into benefits enjoyed by the employees.1wphi1 ON THE OTHER CONTENTIONS OF THE COMPANY The Court finds no merit in ETPIs contention that the bonus provision confirms the grant of the subject bonuses only on a single instance because: If this is so, the parties should have included such limitation in the agreement. Nowhere in the Side Agreement does it say that the subject bonuses shall be conferred once during the year the Side Agreement was signed. The bonus provision in question is exactly the same as that contained in the Side Agreement of the 1998-2001 CBA and there is no denying that from 1998 to 2001, ETPI granted the subject bonuses for each of those years. Article 1267. When the service has become so difficult as to be manifestly beyond the contemplation of the parties, the obligor may also be released therefrom, in whole or in part. ETPI then argues that even if it is contractually bound to distribute the subject bonuses to ETEU members under the Side Agreements, its current financial difficulties should have released it from the obligatory force of said contract invoking Article 1267 of the Civil Code. DOCTRINE: The parties to the contract must be presumed to have assumed the risks of unfavorable developments. It is, therefore, only in absolutely exceptional changes of circumstances that equity demands assistance for the debtor. ETPIs claimed depressed financial state will not release it from the binding effect of the 2001-2004 CBA Side Agreement because: Considering that ETPI had been continuously suffering huge losses from 2000 to 2002, its business losses in the year 2003 were not exactly unforeseen or unexpected. Consequently, it cannot be said that the difficulty in complying with its obligation under the Side Agreement was "manifestly beyond the contemplation of the parties." Besides, as held in Central Bank of the Philippines v. Court of Appeals, mere pecuniary inability to fulfill an engagement does not discharge a contractual obligation. ETPI cannot renege from the obligation it has freely assumed when it signed the 2001-2004 CBA Side Agreement. ON THE LABOR CODE PROVISION VIOLATED The giving of the subject bonuses cannot be peremptorily withdrawn by ETPI without violating Article 100 of the Labor Code: Art. 100. Prohibition against elimination or diminution of benefits. Nothing in this Book shall be construed to eliminate or in any way diminish supplements, or other employee benefits being enjoyed at the time of promulgation of this Code. The rule is settled that any benefit and supplement being enjoyed by the employees cannot be reduced, diminished, discontinued or eliminated by the employer. The principle of non-diminution of benefits is founded on the constitutional mandate to protect the rights of workers and to promote their welfare and to afford labor full protection.

You might also like

- 5.6.a Eastern-Telecom-Vs-Eastern-Telecoms-Employees-UnionDocument2 pages5.6.a Eastern-Telecom-Vs-Eastern-Telecoms-Employees-UnionRochelle Othin Odsinada MarquesesNo ratings yet

- 24 Kimberly-Clark Phil., Inc. v. DimayugaDocument2 pages24 Kimberly-Clark Phil., Inc. v. DimayugaMikhel BeltranNo ratings yet

- Manila Terminal Co V CIRDocument2 pagesManila Terminal Co V CIRBetson CajayonNo ratings yet

- Ultra Villa Food Haus VS, Geniston (1999) G.R. 120473Document2 pagesUltra Villa Food Haus VS, Geniston (1999) G.R. 120473Roosevelt GuerreroNo ratings yet

- San Miguel Brewery Sales Force Union (PTGWO) vs. Hon. Blas Ople G.R. No. L-53515, February 8, 1989Document1 pageSan Miguel Brewery Sales Force Union (PTGWO) vs. Hon. Blas Ople G.R. No. L-53515, February 8, 1989Gela Bea BarriosNo ratings yet

- Fonterra v. Largado & EstrelladoDocument1 pageFonterra v. Largado & Estrelladorobby100% (1)

- Pan Am Vs Pan Am Employees Association Case DigestDocument2 pagesPan Am Vs Pan Am Employees Association Case DigestPrincess Loyola TapiaNo ratings yet

- Labrel CasesDocument5 pagesLabrel CasesJoy Orena0% (1)

- Maraguinot Et. Al - VS-NLRCDocument2 pagesMaraguinot Et. Al - VS-NLRCRuss TuazonNo ratings yet

- 191 Radio Philippines Network v. Ruth Yap Plus 4 OthersDocument4 pages191 Radio Philippines Network v. Ruth Yap Plus 4 OthersEdvin HitosisNo ratings yet

- Goya, Inc. vs. Goya Employees UnionDocument3 pagesGoya, Inc. vs. Goya Employees Unionfay garneth buscatoNo ratings yet

- 74 Automotive Engine Rebuilders Vs UNYONDocument3 pages74 Automotive Engine Rebuilders Vs UNYONJet SiangNo ratings yet

- Canadian Opportunities Unlimited, Inc. v. DalanginDocument1 pageCanadian Opportunities Unlimited, Inc. v. DalanginAdrian KitNo ratings yet

- Metrobank vs. NLRC DigestDocument3 pagesMetrobank vs. NLRC DigestJam RxNo ratings yet

- McBurnie V Ganzon DigestDocument1 pageMcBurnie V Ganzon DigestAnn Quebec100% (2)

- 21 PCI Automation Vs NLRCDocument4 pages21 PCI Automation Vs NLRCKEDNo ratings yet

- Dator Vs UST Et AlDocument2 pagesDator Vs UST Et AlAmbra Kaye AriolaNo ratings yet

- San Miguel Corporation V MAERC Integrated ServicesDocument2 pagesSan Miguel Corporation V MAERC Integrated ServicesbarcelonnaNo ratings yet

- Roy Pasos v. Philippine Nation Construction CorporationDocument3 pagesRoy Pasos v. Philippine Nation Construction Corporationsnhlao100% (1)

- SAN MIGUEL BREWERY, INC. vs. DEMOCRATIC LABOR ORGANIZATIONDocument1 pageSAN MIGUEL BREWERY, INC. vs. DEMOCRATIC LABOR ORGANIZATIONBeverlyn JamisonNo ratings yet

- Capitol Medical Center v. TrajanoDocument2 pagesCapitol Medical Center v. TrajanoRuby Reyes100% (1)

- Dasco vs. PhiltrancoDocument2 pagesDasco vs. PhiltrancoChristine Gel MadrilejoNo ratings yet

- 5 Our Haus Realty Vs Alexander Parian Jay C Erinco Alexander Canlas Bernard Tenedero and Jerry SabulaoDocument1 page5 Our Haus Realty Vs Alexander Parian Jay C Erinco Alexander Canlas Bernard Tenedero and Jerry SabulaoRheymar OngNo ratings yet

- (Probationary Employee - Extension of Contract) Ma. Carmela Umali v. Hobbying Solutions, IncDocument4 pages(Probationary Employee - Extension of Contract) Ma. Carmela Umali v. Hobbying Solutions, IncJude FanilaNo ratings yet

- Labor Law - Goya, Inc. v. Goya, Inc. Employees Union-FFW, G.R. No. 170054, January 21, 2013Document2 pagesLabor Law - Goya, Inc. v. Goya, Inc. Employees Union-FFW, G.R. No. 170054, January 21, 2013Dayday AbleNo ratings yet

- PNCC Vs PNCCDocument2 pagesPNCC Vs PNCCDhin Carag0% (1)

- SLL International Cables V NLRCDocument2 pagesSLL International Cables V NLRCZoe VelascoNo ratings yet

- Framanlis Farms v. Hon Minister of Labor RedigestedDocument2 pagesFramanlis Farms v. Hon Minister of Labor RedigestedMarichu Castillo Hernandez100% (1)

- PBCOM Vs NLRCDocument3 pagesPBCOM Vs NLRCmamp05100% (1)

- Maraguinot vs. NLRC Case DigestDocument1 pageMaraguinot vs. NLRC Case Digestunbeatable38100% (1)

- Digest Interphil Laboratories Employees Union v. Interphil Laboratories IncDocument6 pagesDigest Interphil Laboratories Employees Union v. Interphil Laboratories IncLoi VillarinNo ratings yet

- PAG-ASA STEEL WORKS, INC. vs. CA GR. 166647Document2 pagesPAG-ASA STEEL WORKS, INC. vs. CA GR. 166647Christian TonogbanuaNo ratings yet

- 182 Bisig Manggagawa Sa Tryco v. NLRCDocument1 page182 Bisig Manggagawa Sa Tryco v. NLRCRem SerranoNo ratings yet

- Case Digest A. Nate Casket Maker v. Arango Et Al PDFDocument1 pageCase Digest A. Nate Casket Maker v. Arango Et Al PDFJesh RadazaNo ratings yet

- Bermiso vs. EscanoDocument2 pagesBermiso vs. EscanoJoan Eunise FernandezNo ratings yet

- 16 Sampaguita Garments Corp. v. NLRC (Digest: Labor)Document2 pages16 Sampaguita Garments Corp. v. NLRC (Digest: Labor)Dany AbuelNo ratings yet

- Sugue v. Triumph International DigestDocument1 pageSugue v. Triumph International DigestayumosNo ratings yet

- Mercidar Fishing Corp. V NLRC G.R. No. 112574 (1998) Mendoza, JDocument2 pagesMercidar Fishing Corp. V NLRC G.R. No. 112574 (1998) Mendoza, JYaneeza MacapadoNo ratings yet

- Boie-Takeda V de La SernaDocument3 pagesBoie-Takeda V de La SernaSocNo ratings yet

- DIGEST 33 - Gemina V BankwiseDocument1 pageDIGEST 33 - Gemina V BankwiseJestherin BalitonNo ratings yet

- New Pacific Timber Supply Company Vs NLRCDocument2 pagesNew Pacific Timber Supply Company Vs NLRCRaje Paul Artuz100% (1)

- 251 Philippine Hoteliers v. NUWHRAINDocument3 pages251 Philippine Hoteliers v. NUWHRAINNN DDLNo ratings yet

- FVC Labor Union V Sanama FVC SigloDocument2 pagesFVC Labor Union V Sanama FVC SigloTelle MarieNo ratings yet

- DIGEST San Miguel vs. OpleDocument1 pageDIGEST San Miguel vs. OpleKornessa ParasNo ratings yet

- San Miguel Corporation Vs LayocDocument2 pagesSan Miguel Corporation Vs LayocMichelle Vale CruzNo ratings yet

- Wage Distortion Case DigestDocument2 pagesWage Distortion Case Digestmilleran100% (1)

- Aklan Electric Cooperative Incorporated v. NLRCDocument2 pagesAklan Electric Cooperative Incorporated v. NLRCheinnah100% (2)

- Republic of The Phils Vs Asiapro CoopDocument1 pageRepublic of The Phils Vs Asiapro Cooppja_14No ratings yet

- Vinoya vs. National Labor Relations Commission, 324 SCRA 469, February 02, 2000Document4 pagesVinoya vs. National Labor Relations Commission, 324 SCRA 469, February 02, 2000idolbondocNo ratings yet

- Wack Wack Golf and Country Club Vs NLRCDocument1 pageWack Wack Golf and Country Club Vs NLRCJaps De la CruzNo ratings yet

- E. GANZON, INC. (EGI) vs. FORTUNATO B. ANDO, JR., G.R. No. 214183Document1 pageE. GANZON, INC. (EGI) vs. FORTUNATO B. ANDO, JR., G.R. No. 214183Monica FerilNo ratings yet

- 21 Balladares Vs Peak VenturesDocument2 pages21 Balladares Vs Peak VenturesAngelo NavarroNo ratings yet

- South Motorists v. TosocDocument2 pagesSouth Motorists v. TosoclovesresearchNo ratings yet

- 38 - Ranara Vs NLRCDocument1 page38 - Ranara Vs NLRCJel LyNo ratings yet

- 08 Begino Vs ABS-CBNDocument2 pages08 Begino Vs ABS-CBNPlaneteer Prana100% (1)

- Gaa Vs CADocument2 pagesGaa Vs CAmenforeverNo ratings yet

- Davao Fruits Corp Vs Alu Case DigestDocument1 pageDavao Fruits Corp Vs Alu Case DigesttengloyNo ratings yet

- Abing Vs NLRCDocument3 pagesAbing Vs NLRCAnonymous CX8RWEANo ratings yet

- Goya, Inc., vs. Goya, Inc. Employees Union-FfwDocument2 pagesGoya, Inc., vs. Goya, Inc. Employees Union-FfwRatani UnfriendlyNo ratings yet

- Eastern Telecom Philippines, Inc. Vs Eastern TelecomDocument2 pagesEastern Telecom Philippines, Inc. Vs Eastern TelecomBenitez GheroldNo ratings yet

- 1601E - August 2008Document3 pages1601E - August 2008lovesresearchNo ratings yet

- Bir Form 1701Document12 pagesBir Form 1701miles1280No ratings yet

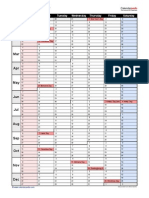

- 2015 Calendar Landscape 4 PagesDocument8 pages2015 Calendar Landscape 4 PageslovesresearchNo ratings yet

- 2015 Calendar Portrait RollingDocument1 page2015 Calendar Portrait RollinglovesresearchNo ratings yet

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 pagesAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArleneNo ratings yet

- 3 FijiDocument33 pages3 FijilovesresearchNo ratings yet

- 2015 Calendar Portrait 2 PagesDocument2 pages2015 Calendar Portrait 2 PageslovesresearchNo ratings yet

- 31 CathayPacific2003 - Invol UpgradingDocument13 pages31 CathayPacific2003 - Invol UpgradinglovesresearchNo ratings yet

- RA 10607 Part4A (Settl-Prescription)Document2 pagesRA 10607 Part4A (Settl-Prescription)lovesresearchNo ratings yet

- 2015 Calendar Landscape 4 PagesDocument8 pages2015 Calendar Landscape 4 PageslovesresearchNo ratings yet

- De GuzmanDocument7 pagesDe GuzmanlovesresearchNo ratings yet

- 2015 Calendar Landscape 2 Pages LinearDocument2 pages2015 Calendar Landscape 2 Pages LinearEdmir AsllaniNo ratings yet

- Calvo V UCPBDocument9 pagesCalvo V UCPBlovesresearchNo ratings yet

- RA 10607 Part4A (Settl-Prescription)Document2 pagesRA 10607 Part4A (Settl-Prescription)lovesresearchNo ratings yet

- A.F. Sanchez BrokerageDocument13 pagesA.F. Sanchez BrokeragelovesresearchNo ratings yet

- De GuzmanDocument7 pagesDe GuzmanlovesresearchNo ratings yet

- Legal Primer On Foreign InvestmentDocument9 pagesLegal Primer On Foreign InvestmentleslansanganNo ratings yet

- RA 10607 Part4 (Reins, Settlement)Document3 pagesRA 10607 Part4 (Reins, Settlement)lovesresearchNo ratings yet

- First Phil Industrial CorpDocument10 pagesFirst Phil Industrial CorplovesresearchNo ratings yet

- RA 10607 Part4A (Settl-Prescription)Document2 pagesRA 10607 Part4A (Settl-Prescription)lovesresearchNo ratings yet

- RA 10607 Part4 (Reins, Settlement)Document3 pagesRA 10607 Part4 (Reins, Settlement)lovesresearchNo ratings yet

- Further, That The Right To Import The Drugs: Wretz Musni Page 1 of 5Document5 pagesFurther, That The Right To Import The Drugs: Wretz Musni Page 1 of 5lovesresearchNo ratings yet

- RA 10607 Part4A (Settl-Prescription)Document2 pagesRA 10607 Part4A (Settl-Prescription)lovesresearchNo ratings yet

- 10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5Document226 pages10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5lovesresearchNo ratings yet

- 60 SB V MartinezDocument4 pages60 SB V MartinezlovesresearchNo ratings yet

- 10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5Document226 pages10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5lovesresearchNo ratings yet

- RA 10607 Part1 (Gen)Document10 pagesRA 10607 Part1 (Gen)lovesresearchNo ratings yet

- Villanueva V Quisumbing PDFDocument7 pagesVillanueva V Quisumbing PDFlovesresearchNo ratings yet

- Dulay V Dulay PDFDocument8 pagesDulay V Dulay PDFlovesresearchNo ratings yet

- CIR V Marubeni CorporationDocument5 pagesCIR V Marubeni CorporationJosef MacanasNo ratings yet

- Reviewer in Persons and Family RelationsDocument5 pagesReviewer in Persons and Family Relationssam baysa100% (1)

- DDOT CM Manual Section 1Document9 pagesDDOT CM Manual Section 1highwayNo ratings yet

- Basic: Insurance CertificateDocument5 pagesBasic: Insurance Certificatetest gggNo ratings yet

- PSBA v. CA, 205 SCRA 729 (1992)Document4 pagesPSBA v. CA, 205 SCRA 729 (1992)Clive HendelsonNo ratings yet

- Canoo Oklahoma ContractDocument6 pagesCanoo Oklahoma ContractKTUL - Tulsa's Channel 8No ratings yet

- General Principles of Civil Engineering MeasurementDocument20 pagesGeneral Principles of Civil Engineering MeasurementMohamed A.Hanafy88% (8)

- 53 ADocument53 pages53 AKumar NaveenNo ratings yet

- Lo vs. KJS Eco Formwork System Phil. Inc.Document9 pagesLo vs. KJS Eco Formwork System Phil. Inc.Eunice NavarroNo ratings yet

- Richard Annen Lawyer Client Lawsuit For BreachDocument22 pagesRichard Annen Lawyer Client Lawsuit For Breachian_phelps1961No ratings yet

- Student Copypdf Seminar 6 AB1301 Lecture Notes - Vitiating FactorsDocument54 pagesStudent Copypdf Seminar 6 AB1301 Lecture Notes - Vitiating FactorsJulianne Mari WongNo ratings yet

- Decisions On PEDocument26 pagesDecisions On PEPritha BhangaleNo ratings yet

- Chlorinated ParaffinsDocument1 pageChlorinated Paraffinsdow2008No ratings yet

- 01 Vol I ITB R0 (P3.1 - Genda Circle)Document102 pages01 Vol I ITB R0 (P3.1 - Genda Circle)MAULIK RAVALNo ratings yet

- Contract GEMC 511687705674119 Mon - 02 Dec 2019 12 04 42Document2 pagesContract GEMC 511687705674119 Mon - 02 Dec 2019 12 04 42Monika ThakurNo ratings yet

- Notes Unit-2Document40 pagesNotes Unit-2Pallavi MedepalliNo ratings yet

- Dealer Agreement - 001Document5 pagesDealer Agreement - 001Kavin SengodanNo ratings yet

- Mercantie Law Bar Questions 2007, 2008, 2009, 2010, 2012Document44 pagesMercantie Law Bar Questions 2007, 2008, 2009, 2010, 2012Gemale PHNo ratings yet

- Political Law Review BongLo - CASES IVDocument27 pagesPolitical Law Review BongLo - CASES IVJan VelascoNo ratings yet

- Commencement of Arbitration:: Deepdharshan Builders (P) LTD Saroj & OrsDocument4 pagesCommencement of Arbitration:: Deepdharshan Builders (P) LTD Saroj & OrsPushkar PandeyNo ratings yet

- Compendium On: Office of CAO (C), Central RailwayDocument145 pagesCompendium On: Office of CAO (C), Central Railwayabhaskumar68No ratings yet

- G.V. Florida Inc. vs. Heirs of Rommeo L. Batung JR., 772 SCRA 579 (2015) PDFDocument6 pagesG.V. Florida Inc. vs. Heirs of Rommeo L. Batung JR., 772 SCRA 579 (2015) PDFSandra DomingoNo ratings yet

- Project Quality PlanDocument35 pagesProject Quality Planlee100% (19)

- 1Document41 pages1Arrianne ObiasNo ratings yet

- Labor Standards ReviewerDocument19 pagesLabor Standards ReviewerKathleen KindipanNo ratings yet

- Securities and Exchange Commission: Republic of The PhilippinesDocument3 pagesSecurities and Exchange Commission: Republic of The PhilippinesJhei VictorianoNo ratings yet

- Chapter 1 - Introduction To Cost AccountingDocument29 pagesChapter 1 - Introduction To Cost AccountingLala SalvatoreNo ratings yet

- 36 Siochi v. GozonDocument5 pages36 Siochi v. GozonhdhshNo ratings yet

- Contrato Compra-Venta 4.4Document4 pagesContrato Compra-Venta 4.4EMMELI ESTEPHANYA HERNANDEZ SANCHEZNo ratings yet

- Marketing Service AgreementDocument8 pagesMarketing Service AgreementsasavujisicNo ratings yet