Professional Documents

Culture Documents

Fundamental Distinctions Among Tenancy

Uploaded by

william091090Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Distinctions Among Tenancy

Uploaded by

william091090Copyright:

Available Formats

FUNDAMENTAL DISTINCTIONS AMONG TENANCY, TENANT EMANCIPATION DECREE AND CARP LEASEHOLD TENANCY I LEGAL BASIS: 1.

. Republic Act No. 3844 Agricultural Land Reform Code (August 8, 1963) 2. Republic Act No. 6389 Code of Agrarian Reform (September 10, 1971) 3. Presidential Decree No. 1425 Amending Presidential Decree No. 1040 by Strengthening the Prohibition against Agricultural Share Tenancy and Providing Penalties for Violation thereof. (June 10, 1978) TENANT EMANCIPATION DECREE 1. Presidential Decree No. 27 Tenants' Emancipation Decree (October 21, 1972) 2. Letter of Instructions No. 474PLACING UNDER OLT TENANTED RICE/CORN LANDS SEVEN HECTARES OR LESS IN AREAS UNDER CERTAIN CONDITIONS (OCTOBER 21, 1976) 1. Presidential Decree No. 27 was assumed to be constitutional and upheld as part and parcel of the law of the land in De Chavez vs. Zobel, 155 SCRA 26; Gonzales vs. Estrella, 91 SCRA 294 (1979) and Association of Small Landowners in the Philippines Inc. vs. Secretary of Agrarian Reform, 175 SCRA 342 (1989) 2. Letter of Instructions No. 474; Constitutionality was upheld in Zurbano vs. Estrella, 137 SCRA 333 (1989) The REQUISITES FOR COVERAGE under OPERATION LAND TRANSFER (OLT) program are the following: 1. The land must be DEVOTED to RICE or CORN crops; and 2. There must be a system of SHARE CROP or LEASE TENANCY obtaining therein. If either of these requisites is ABSENT, the land is NOT COVERED under OLT. Hence, a landowner NEED NOT APPLY FOR RETENTION, where his ownership over the entire landholding is INTACT and UNDISTURBED. (Eudosia Daez and/or Her Heirs represented by Edriano D. Daez vs. the Hon. CA, et al., 325 SCRA 857). RULES ON COVERAGE OF LANDS UNDER PD 27. Rule 1 Landed estates or landholdings larger than 24 hectares (LOI 46 (December 7, 1972) - covered by OLT and there is no retention to the landowner. COMPREHENSIVE AGRARIAN REFORM PROGRAM 1. Presidential Proclamation No. 131Instituting a Comprehensive Agrarian Reform Program (July 22, 1987) 2. Republic Act No. 6657 An Act instituting a Comprehensive Agrarian Reform Program to Promote Social Justice and Industrialization, providing the Mechanism for its Implementation and other purposes. (June 15, 1988) 1. The power of President Aquino to promulgate Proc. No. 131 and E.O. Nos. 228 and 229 was authorized under Section 6 of the Transitory Provision of the 1987 Constitution. All assaults against the validity of RA 6657 were set aside. (Association of Small Landowners in the Philippines, Inc. vs. Secretary of Agrarian Reform, 175 SCRA 342 (1989) COVERAGE OF CARL 1988 Scope All PUBLIC and PRIVATE Agricultural Lands regardless oftenurial arrangement and commodity produced, including lands of the public domain suitable for agriculture. (1st par., Sec. 4, RA 6657) Specific lands covered by CARP. a. All alienable and disposable lands of the public domain devoted to or suitable for agriculture b. All lands of the public domain in excess of the specific limits as determined by Congress in the preceding paragraph; c. All other lands owned by the Government devoted to or suitable for agriculture; and d. All private lands devoted to or suitable for agriculture regardless of the agricultural products raised or that can be raised thereon. PRIORITIES The DAR, in coordination with the PARC, shall plan and program the acquisition and distribution of all agricultural lands

4. Section 12, Republic Act No. 6657 Comprehensive Agrarian Reform Law of 1988. II JURISPRUDENCE ON CONSTITUTIONALITY 1. Security of Tenure Primero vs. CAR, 101 Phil. 675 (1957); Pineda vs. de Guzman, 21 SCRA 1450 (1967). III COVERAGE OR SCOPE Agricultural Leasehold shall apply to all tenanted agricultural lands, including but not limited to the following A. Retained areas under R.A. 6657 and P.D. 27; B. Tenanted Agricultural Lands not yet acquired for distribution under CARP pursuant to RA 6657; C. All tenanted areas under Section 10 of RA 6657 which may be covered by this Order. (Administrative Order No. 4, Series of 1989) IV AREA OF COVERAGE It shall be unlawful for the tenant, whenever the area of his holding is five hectares or more, or is of sufficient size to make him and the members of his immediate farm household fully occupied in its cultivation, to CONTRACT TO WORK at the same time on TWO OR MORE SEPARATE HOLDINGS belonging todifferent landholders under any system of tenancy WITHOUT THE KNOWLEDGE AND CONSENT of the landholder with whom he first entered into tenancy relationship. (Par. 1, Sec. 24, Republic Act No. 1199)

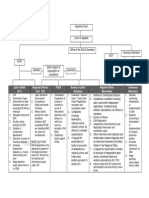

V EXEMPTION OR EXCLUSION FROM COVERAGE Absence of any of the six (6) Essential Elements of Tenancy Relationship. Essential Relationship: Elements of Tenancy

Rule 2 Landholding of 24 hectares or less (but above 7 hectares (LOI 46 (ibid) and LOI 227 (November 16, 1974) covered by OLT but landowner is entitled to retention except if LOI 474 (October 21, 1976) applies. Rule 3

through a period of ten (10) years from the effectivity of this Act. Land shall be acquired and distributed as follows: Phase One: 1. Rice and corn land under PD 27; 2. Idle and abandoned lands 3. Private lands voluntarily offeredby the owners for agrarian reform; 4. Foreclosed land by government financial institutions; 5. Land acquired by the Presidential Commission on Good Government; and 6. All other lands owned by the Government devoted to or suitable for agriculture. These shall be acquired and distributed immediately upon effectivity of the Act, with the implementation to be completed within a period of not more than four (4) years. (Sec. 7, par. 2, RA 6657) Phase Two: 1. All disposable and alienable public agricultural lands; 2. All arable public agricultural lands under agro-forest, pasture and agricultural leases already cultivated and planted for crops in accordance with Sec. 6, Art. XIII of the Constitution; 3. All public agricultural lands which are open for new development and resettlement; and 4. All private agricultural lands in excess of fifty (50) hectares These shall be distributed immediately upon the effectivity of the Act, with the implementation to be completed within a period of not more than four (4) years. Phase Three: All private AGRICULTURAL LANDS commencing with LARGE landholdings and proceeding to MEDIUM and SMALL landholdings under the

1. The parties are the landholder and thetenant; 2. The subject is agricultural land; 3. There is consent; 4. The purpose is agricultural production; 5. There is personal cultivation; 6. There is sharing of harvest or payment of rentals. (Caballes vs. DAR, 168 SCRA 247; Qua vs. Court of Appeals, 198 SCRA 247.) VI RETENTION In Leasehold Tenancy, the Landowner or agricultural lessor RETAIN OWNERSHIPof the subject landholding. The landowner EXERCISES the ATTRIBUTES OF OWNERSHIP. Under Art. 428 of the New Civil Code, the OWNER has the RIGHT TO DISPOSE OF a thing without other limitation than those imposed by law. As an incident of ownership. Therefore, there is nothing to prevent a landowner from DONATING his NAKED TITLE TO THE LAND. However, the new owner MUST RESPECT THE RIGHT OF THE TENANT. The agricultural leasehold relation under this Code shall not be extinguished by MERE EXPIRATION OF THE TERM OR PERIOD in a leasehold contract nor by theSALE, ALIENATION OR TRANSFER of the legal possession of the landholding. In case the agricultural lessor SELLS, ALIENATES, OR TRANSFERS the legal possession of the landholding, the PURCHASER OR TRANSFEREE thereof shall be subrogated to the rights and substituted to the obligations of the agricultural lessor. (see. 10, RA 3844) VII BENEFICIARIES The beneficiaries under Republic Act No. 1199, Republic Act No. 3844 as amended by Republic Act No. 6389 areSHARE-TENANT OR AGRICULTURAL LESSEES (TENANTS). Thus: In the INTERPRETATION AND ENFORCEMENT of this Act and other

Landholding of seven (7) hectares or less is EXEMPTED from OLT except if LOI 474 is applicable under the following circumstances: Landowner owns other agricultural land of more than seven hectares in aggregate area, or he owns COMMERCIAL, INDUSTRIAL, RESIDENTIAL or URBAN LAND where he derives an adequate income, DAR Memo, Circular No. 11, s. 1978 (April 21, 1978) Adequate income is at least FIVE THOUSAND (P5000.00) PESOS per annum. (Gross Income). Lands not covered by Presidential Decree No. 27. 1. Private agricultural lands which are NOT PRIMARILY DEVOTED TO RICE OR CORN, or 2. There is NO SYSTEM OF SHARE CROP OR LEASE TENANCY obtaining in the landholding. (Daez vs. CA, ibid) * The REQUISITES for the exercise by the landowner of his RIGHT OF RETENTION are the following: 1. The land must be DEVOTED TO RICE OR CORN CROPS; 2. There must be a system of sharecrop or lease tenancy obtaining there. 3. The size of the landholding MUST NOT EXCEED TWENTY FOUR (24) hectares provided that at least seven (7) hectares thereof are covered lands and more than seven (7) hectares of it consist of other agricultural lands. Daez vs. CA, Ibid)

laws as well as of the stipulations between the landholder and the tenant the COURTS AND ADMINISTRATIVE OFFICIALS SHALL RESOLVE ALL GRAVE DOUBTS IN FAVOR OF THE TENANT. (Sec. 56, Republic Act No. 1199) VIII AWARD CEILING The share-tenant/ agricultural lessee who is already cultivating a landholding with an area of FIVE (5) HECTARES or more or ofsufficient size to make him and member of his immediate farm household fully occupied in its cultivation is prohibited to CONTRACT TO WORK at the same time to two or more separate holdings belonging to different landholders WITHOUT THE KNOWLEDGE AND CONSENT OF THE LANDOWNER/AGRICULTURAL LESSOR (Par. 1, Sec. 24, Republic Act No. 1199) IX PAYMENT FOR THE COST OF THE LAND In the exercise of RIGHT OF PREEMPTION by the agricultural lessee-tenant, he must EITHER TENDER PAYMENT OF, OR PRESENT A CERTIFICATE FROM THE LBP that it shall make payment under Section 80 of Republic Act No. 3844 (10% CASH and 90% in six percent, tax free, redeemable bonds issued by the LBP.) If the landowner refuses to accept TENDER or PRESENTMENT, the agricultural lessee may CONSIGN it in COURT, (Sec. 11, Republic Act No. 3844 as amended by Republic Act No. 6389. The REDEMPTION PRICE shall be the REASONABLE PRICE OF THE LAND at the time of sale. (Sec. 12, Republic Act No. 3844 as amended by Republic Act No. 6389) X TRANSFERABILITY OF LANDHOLDING 1. Sale, Alienation or Transfer of the legal possession of the landholding 2. Extinguishment of Agricultural Leasehold Relations (Sec. 8, RA 3844) A. ABANDONMENT of the landholding without the knowledge of the agricultural lessor. (Teodoro vs. Macaraeg, 27 SCRA 7 (1969) To constitute abandonment there must be an absolute relinquishment of the premises of the tenant. This "overt act" must be coupled with his intention to do so "which is carried into effect." (Philippine Labor and Social Legislation, Martin, 70 Ed. Pp. 405-406). Abandonment to validly terminate tenancy relationship is characterized by:

Right of Retention by Landowners under Presidential Decree No. 27. Supplemental Guideline A.O. No. 04, Series of 1991). The policy statements are as follows: a. Landowners covered by PD 27 are entitled to retain SEVEN hectares, except those whose entire tenanted rice and corn lands are subject to acquisition and distribution under OLT. AN OWNER MAY NOT RETAIN UNDER THE FOLLOWING CASES: a) If he, as of October 21, 1972, owned more than 24 hectares of tenanted rice or corn lands; or b) By virtue of LOI 474, if he, as of 21 October 1972, owns less than 24 hectares of tenanted rice but additionally owns the following = Other agricultural land of more than seven hectares, whether tenanted or not, whether cultivated or not, and regardless of the income derived therefrom; or Land used for commercial, industrial, residential or other urban purposes, from which he derives adequate income to support himself and his family. b. Landowners who filed their application for retention BEFORE 27 August 1985, the deadline set by Administrative Order No. 1, Series of 1985, may retain not more than seven hectares of their landholding covered by PD 27 regardless of whether or not they complied with LOI Nos. 41, 45, and 52. Landowners who filed their application AFTER 27 August 1985 but complied with the requirement of LOI No. 41, 45 and 52 shall likewise be entitled to such a seven-

following schedules: a) Landholdings ABOVE 24 hectares up to 50 hectares to begin on the fourth year from effectivity of this Act and to be completed within three years; and, b) Landholdings from the RETENTION LIMIT up to 24 hectares, to begin on the sixth year from effectivity of this Act and to be completed within four years. LANDS NOT COVERED BY CARP 1. Those which are not suitable for agriculture or those which are classified as mineral, forest, residential, commercial or industrial lands. (Sec. 3. (c), RA 6657); 2. Those which have been classified and approved as NONAGRICULTURAL prior to June 15, 1988. (DOJ Opinion No. 44, S. 1990) 3. Those which are EXEMPT pursuant to Sec. 10, RA 6657. 4. Those which are devoted to poultry, swine or livestock-raising as of June 15, 1988 pursuant to the Supreme Court ruling on Luz Farms vs. The Hon. Secretary of Agrarian Reform (192 SCRA 51); 5. Fishponds and prawn farms exempted pursuant to R.A. No. 7881, and its implementing Administrative Order No. 3, Series of 1995;

6. Those which are retained by the landowners; 7. Those lands or portions thereof under the coverage of EO 407 but found to be no longer suitable for agriculture and therefore could not be given appropriate valuation by the LBP as determined by DAR/LBP; and 8. Those lands declared by Presidential Proclamations for certain uses other than agricultural. Rules and Procedures Governing the Exercise of Retention Rights by Landowners and Award to Children under Sec. 6 of RA 6657 (A.O. No. 11, Series of 1990; and A.O. No. 2, S. 2003)

(a) an INTENT to ABANDON, and (b) an OVERT ACT to carry out such intention There must be, therefore, NO ANIMUS REVERTENDI on the part of the tenant.(Labor, Agrarian and Social Legislation, Montemayor, 2nd Ed., 1968, pp. 54-55) B. VOLUNTARY SURRENDER of the landholding by the agricultural lessee, written notice of which shall be served three months in advance (Nisnisan, et al., vs. CA, 294 SCRA 173 (1998). As a mode of extinguishing tenancy relationship it connotes a decision in the part of the tenant to return the possession of the landholding and relinquish his right as tenant thereon uninfluenced by any compelling factor, coming particularly from the landholder. For surrender to be valid, there must be (a) an intention to abandon, and (b) an external act or an omission to act, by which such intention is carried out into effect. When a tenant voluntarily yields the land, he terminates the tenancy relationship by his unilateral act. (Anacleto Inson vs. Planas de Asis, et al., CA GR No. Sp-01769, October 11, 1974) NOTE: SUBLEASING by the agricultural lessee is also a ground for the extinguishments of Agricultural Leasehold Relations. (Par. 2, Sec. 27, Republic Act No. 3844) XI EVIDENCE OF RIGHT/TITLE OVER THE LANDHOLDING. AGRICULTURAL LEASE-HOLD CONTRACT IN GENERAL. The agricultural lessor and theagricultural lessee shall be FREE to ENTERinto any kind of TERMS, CONDITIONS orSTIPULATIONS in a LEASEHOLD CONTRACT as long as they are not contrary to LAW, MORALS OR PUBLIC POLICY. (Sec. 15, Republic Act No. 3844). Except in case of mistake, violence,intimidation, undue influence, or fraud, an AGRICULTURAL CONTRACT reduced in writing and registered as hereinafter provided SHALL BE CONCLUSIVE BETWEEN THE CONTRACTING PARTIES, if not DENOUNCED OR IMPUGNED WITHIN THIRTY DAYS AFTER REGISTRATION. (Sec. 17, Republic Act No. 3844) XII MODES OF TRANSFER OF THE LAND

hectare retention area. However, landowners who filed their application for retention AFTER the 27 August 1985 deadline and DID NOT COMPLY with the requirements of LOI Nos. 41, 45, and 52 shall only be entitled to a maximum of five (5) hectares as retention area. c. A landowner WHO HAS DIED must have manifested during his lifetime his intention to exercise his right of retention prior to 23 AUGUST 1990 (The finality of the Supreme Court decision in the case "Association of Small Landowners of the Philippines, Inc. et al. vs. Honorable Secretary of Agrarian Reform) toallow his heirs to now exercise such right under these Guidelines. Said heirs must show proof of the original landowner's intention. The heirs may also exercise the original landowner's right of retention if they can prove that the decedent HAD NO KNOWLEDGE of OLT coverage over the subject property. The BENEFICIARIES of Presidential Decree No. 27 are TENANT-FARMERS, thus: This shall apply to TENANT-FARMERS of PRIVATE AGRICULTURAL LANDS PRIMARILY DEVOTED TO RICE OR CORN under a SYSTEM OF SHARE-CROP or LEASETENANCY, whether classified as landed estate or not. (Par. 5, Presidential Decree No. 27) The tenant-farmers, whether in land classified as landed estate or not shall be DEEMED OWNER of a portion constituting a family-size farm of FIVE (5) hectares if not irrigated and THREE (3) HECTARES IF IRRIGATED. (Par. 6, Presidential Decree No. 27) The tenant shall pay for THE COST OF THE LAND, includinginterest of six (6) percent per annum in FIFTEEN (15) YEARS of fifteen (15) equal annual amortizations. NOTE: The period is extended to

A. Landowners whose landholdings are covered by CARP may retain an area of FIVE (5) hectares. In addition, each of his children, (legitimate, illegitimate or adopted, may be AWARDED three (3) hectares as PREFERRED BENEFICIARY provided 1. That the child was at least 15 years of age on June 15, 1988 (RA 6657 effectivity); and 2. The child was actually tilling the land or directly managing the farmland from June 15, 1988 to the filing of the application for retention and/or at the time of acquisition of the land under CARP. Retention of husband and wife: 1. For marriages covered by the New Civil Code, the spouse who owns only CONJUGAL PROPERTIES may retain a total of five (5) hectares unless there is an agreement for the JUDICIAL SEPARATION OF PROPERTIES. However, if either or both of them are landowners in their respective rights (capital and/or paraphernal), they may retain not more than five (5) hectares each from their respective landholdings. In no case, however, shall the total retention of such a couple exceed 10 hectares, and 2. For marriages covered by the New Family Code (August 3, 1988), a husband owning capital property and/or a wife owning paraphernal property may retain not more than five (5) hectares each provided they execute a JUDICIAL SPERATION OF PROPERTIES prior to entering the marriage. In the absence of such an agreement all properties (capital, paraphernal and conjugal) shall be considered held in absolute community. QUALIFIED BENEFICIARIES. The lands covered by the CARP shall be distributed as much as possible to landless residents of the same barangay, or in the absence thereof, landless residents of the same municipality in the following order of priority:

TO THE TENANT OR BENEFICIARY The landowner-agricultural lessor can FREELY AND VOLUNTARILY TRANSFER the landholding to the agricultural lessor by way of: 1. Sale 2. Donation 3. Succession the agricultural lessee as DEVISEE to the testators free portion in the will. However, the limitation imposed by law on his right to acquire must be observed, i.e. Legal prohibition on the acquisition of property. By operation of law, the agriculturallessee can acquire ownership of the subject landholding by the exercise of the following rights. 1. Right of Pre-emption; and 2. Right of Redemption XIII CONSIDERATION FOR THE USE OF VALUE OF THE LAND. Consideration Agricultural lands: for the Lease of

twenty (20) years equal annual amortizations under Sec. 6, E.O. 228 of July 17, 1987 by Pres. Corazon C. Aquino. The TITLE to the land owned by the tenant shall not be transferable except BY HEREDITARY SUCCESSION or TO THE GOVERNMENT in accordance with this Decree, the Code of Agrarian Reform and other existing laws and regulations. NOTE: Sec. 6, EO 228 provides, "Ownership of lands acquired by the farmer-beneficiary may be transferred after full payment of amortizations." The EMANCIPATION PATENT awarded to the TENANT-BENEFICIARY CREATES a VESTED RIGHT OF ABSOLUTE OWNERSHIP in the landholding "a right which has become fixed and established and is no longer open to doubt or controversy." (Pagtalunan vs. Tamayo, 183 SCRA 252) The Mode of Transfer of Lands to Tenant-Beneficiaries under Presidential Decree No. 27 are the following: 1. OPERATION LAND TRANSFER (OLT) under PD 27 and EO 228; and Operation Land Transfer is the ORDERLY and SYSTEMATIC TRANSFER of land from the landowner to the tenantfarmer under Presidential Decree No. 27. 2. DIRECT PAYMENT SCHEME (DPS). The landowner and the tenant-beneficiary can AGREE on the DIRECT SALE terms and conditions which are not onerous to the tenantbeneficiary. The value of the land shall be equivalent to two and one half (2-1/2) times the AVERAGE HARVEST OF THREE NORMAL CROP YEARS IMMEDIATELY PRECEDING THE PROMULGATION OF THIS DECREE.

a) agricultural lessees and share tenants; b) regular farmworkers; c) seasonal farmworkers; d) other farmworkers; e) actual tillers or occupants of public lands; f) collectives or cooperatives of the above beneficiaries; and g) others directly working on the land. (Par. 1, Sec. 22, RA 6657) The children of landowners who are qualified under Sec. 6 of this Act shall be given preference in the distribution of the land of their parents; And, further, that actual tenant-tillers in the landholding shall be ejected or removed therefrom. (Par. 2, Sec. 22, RA 6657) Distribution Limit No qualified beneficiary may own more than three (3) hectares of agricultural land. (Sec. 23, RA 6657) Award Ceiling for Beneficiaries. Beneficiaries shall be awarded an area NOT EXCEEDING THREE (3) HECTARES which may cover a CONTIGUOUS tract of land or SEVERAL PARCELS of land cumulated up to the prescribed award limits. (Sec. 25, RA 6657). Payment by Beneficiaries. Lands awarded pursuant to this Act shall be paid for the beneficiaries to the LBP in thirty (30) annual amortizations at six percent (6%) per annum. The payments for the first three (3) years after the award may be at reduced amounts as established by the PARC: Provided, That the first five (5) annual payments may not be more than five percent (5%) of the value of the annual gross production as established by the DAR. Should the scheduled annual payments after the fifth year exceed ten percent (10%) of the annual gross production and the failure to produce accordingly is not due to the beneficiarys fault, the LBP may reduce the interest rate or reduce the principal obligation to make the repayment affordable. The LBP shall have a lien by way

1. Not more than 25 per centum of the average normal harvest during the three agricultural years immediately preceding the date the leasehold was established. 2. Deductible items: a. Seedlings b. Cost of Harvesting c. Cost of Threshing d. Cost of Loading e. Cost of Hauling f. Cost of Processing 3. If the land is cultivated for a period of less than three years, the initial consideration is based on the average normal harvest during the preceding years when the land was actually cultivated or on the harvest of the first year if newly cultivated, and the harvest is normal.

4. After the lapse of the first three normal harvests, the final consideration shall be based on the average normal harvest during these three preceding agricultural years. 5. In the absence of any agreement as to the rental, the maximum allowed shall be applied. 6. If Capital Improvement is introduced not by the lessee to increase productivity, the rentals shall be increased proportionally to the consequent increase in production due to the improvement. 7. In case of Disagreement the Court shall determine the reasonable increase in rental. 8. Capital improvement refers to any permanent and tangible improvement on the land that will result in increased productivity. If done with the consent of the lessee, then the lease rental shall be increased proportionately.

of mortgage on the land awarded to the beneficiary; and this mortgage may be foreclosed by the LBP for nonpayment of an aggregate of three (3) annual amortizations. The LBP shall advise the DAR of such proceedings and the latter shall subsequently award the forfeited landholding to other qualified beneficiaries. A beneficiary whose land, as provided herein, has been foreclosed shall thereafter be permanently disqualified from becoming a beneficiary under this Act. (Sec. 26, RA 6657) Transferability of Awarded Lands. - lands acquired by beneficiaries under this Act may not be sold, transferred or conveyed except through hereditary succession, or to the government, or to the LBP, or to other qualified beneficiaries for a period of ten (10) years; Provided, however, That the children or the spouse of the transferor shall have a right to repurchase the land from the government or LBP within the period of two (2) years. Due notice of the availability of the land shall be given by the LBP to he Barangay Agrarian Reform Committee (BARC) of the barangay where the land is situated. The Provincial Agrarian Reform Coordinating Committee (PARCCOM), as herein provided, shall, in turn, be given due notice thereof by the BARC. If the land has not yet been fully paid by the beneficiary, the rights to the land may be transferred or conveyed, with prior approval of the DAR, to any heir of the beneficiary or to any other beneficiary who, as a condition for such transfer or conveyance, shall cultivate the land himself. Failing compliance herewith, the land shall be transferred to the LBP which shall give due notice of the availability of the land in the manner specified in the immediately preceding paragraph. In the event of such transfer to the LBP, the latter shall compensate the beneficiary in one lump sum for the amounts the latter has already paid, together with the value of improvements he has made on the land. (Sec. 27, RA 6657) The TITLES awarded to farmerbeneficiaries under the CARP are the following: 1. Free Patent for Public, Alienable and

Disposable Lands; 2. CERTIFICATE OF LAND OWNERSHIP AWARD (CLOA) for Resettlement Sites: 3. STEWARDSHIP CONTRACT for Lands covered by INTEGRATED SOCIAL FORESTRY PROGRAM (ISFP); and 4. CLOA for Private Agricultural Lands. The MODES OF ACQUIRING LANDS for distribution under CARP: a. COMPULSORY ACQUISITION (CA) (Sec. 16, RA 6657) b. VOLUNTARY OFFER TO SELL (VOS) (Sec. 19, RA 6657) c. VOLUNTARY LAND TRANSFER/DIRECT PAYMENT SCHEME (VLT/DPS) (Sec. 20, RA 6657). in

Factors/Criteria considered determining just compensation: 1. Cost of Acquisition of the land; 2. Current Value of like properties; 3. Nature of the land; 4. Actual use; 5. Income;

6. Sworn valuation by the landowner; 7. Tax Declaration; 8. Assessment made by government assessors; 9. The social and economic benefits contributed by the farmers, and 10. Non-payment of taxes or loans secured from any government financing institution on the land. Basic Formula for the valuation of lands covered by VOS and CA LV = (CNI x 0.6) + (CS x 0.3) + (MV x 0.1) where:

LV = Land Value CNI = Capitalized Net Income CS = Comparable Sales MV = Market Value per Tax Declaration The above formula shall be used if all three factors are present, relevant and applicable. A.1. When the CS factor is not present and CNI and MV are applicable, the formula shall be: LV = (CNI x 0.9) + (MV x 0.1) A.2. When the CNI factor is not present and CS and MV are applicable, the formula shall be: LV = (CS x 0.9) + (MV x 0.1) A.3. When both CS and CNI are not present and only MV is applicable, theformula shall be: LV = (MV x 2)

You might also like

- Learning MaterialsDocument30 pagesLearning Materialsdivine venturaNo ratings yet

- Fundamental Distinctions Among Leasehold Tenancy, Tenant Emancipation Decree and CARPDocument17 pagesFundamental Distinctions Among Leasehold Tenancy, Tenant Emancipation Decree and CARPTiger KneeNo ratings yet

- Tenant Emancipation LawDocument30 pagesTenant Emancipation LawJaybel Ng BotolanNo ratings yet

- Mago Vs VarbinDocument7 pagesMago Vs VarbinMonique LhuillierNo ratings yet

- A Compilation of Some Case Digests For ADocument33 pagesA Compilation of Some Case Digests For AJuanPaolo DayagdalNo ratings yet

- Agrarian Law and Social Legislation ReportDocument61 pagesAgrarian Law and Social Legislation ReportLm Ricasio100% (1)

- Association of Small Landowners of The Phil V Secretary of DAR DigestDocument4 pagesAssociation of Small Landowners of The Phil V Secretary of DAR DigestAlice Marie AlburoNo ratings yet

- SocLeg 1st ExamDocument37 pagesSocLeg 1st ExamJennica Gyrl G. DelfinNo ratings yet

- Fundamental Distinctions Between Tenancy and Tenant Emancipation DecreeDocument5 pagesFundamental Distinctions Between Tenancy and Tenant Emancipation Decreeトレンティーノ アップルNo ratings yet

- Sikkim Agricultural Land Ceiling and Reforms Act 1977Document34 pagesSikkim Agricultural Land Ceiling and Reforms Act 1977Latest Laws TeamNo ratings yet

- Sec. 3 (C) of RA 6657 in Relation To DOJ Opinion No. 44 S. 1990 and The Case of Natalia Realty Et. Al.. Versus DAR, GR No. 103302, August 12, 1993Document5 pagesSec. 3 (C) of RA 6657 in Relation To DOJ Opinion No. 44 S. 1990 and The Case of Natalia Realty Et. Al.. Versus DAR, GR No. 103302, August 12, 1993Anonymous 7BpT9OWPNo ratings yet

- Land Title & Deeds: Aejay V. BariasDocument41 pagesLand Title & Deeds: Aejay V. BariasAejay Villaruz BariasNo ratings yet

- RA 6657: A Report On Exemptions and ExclusionsDocument30 pagesRA 6657: A Report On Exemptions and ExclusionsEulaNo ratings yet

- Dar Vs Carriedo DigestDocument2 pagesDar Vs Carriedo DigestJennica Gyrl G. Delfin100% (3)

- Matrix - Leasehold-Tenancy-Tenant-Emancipation-Decree-and-CARPDocument8 pagesMatrix - Leasehold-Tenancy-Tenant-Emancipation-Decree-and-CARPGabrielNo ratings yet

- Case: 2. 3Document10 pagesCase: 2. 3maanyag6685No ratings yet

- CARP - Retention, Exemption and ExclusionDocument34 pagesCARP - Retention, Exemption and Exclusionnaty833188% (8)

- Dar Administrative Order No. 02-06Document10 pagesDar Administrative Order No. 02-06Fatima Sarpina HinayNo ratings yet

- Dar Administrative Order No. 02-06Document34 pagesDar Administrative Order No. 02-06Jer SeyNo ratings yet

- Heirs of Sandueta v. RoblesDocument3 pagesHeirs of Sandueta v. RoblesPaul Joshua SubaNo ratings yet

- Dar Ao No 5Document10 pagesDar Ao No 5HeidiNo ratings yet

- Report and Cases For Legal Technique PD 410Document11 pagesReport and Cases For Legal Technique PD 410PRECIOUS GRACE DAROYNo ratings yet

- G.R. No. L-23785 November 27, 1975Document5 pagesG.R. No. L-23785 November 27, 1975Analou Agustin VillezaNo ratings yet

- Commodity Produced, All Public and Private Agricultural Lands, As Provided in PROCLAM 131 and EO 229, Including Other Lands ofDocument5 pagesCommodity Produced, All Public and Private Agricultural Lands, As Provided in PROCLAM 131 and EO 229, Including Other Lands ofRoseanne MateoNo ratings yet

- CHAPTER IV REVIEWER From Online From Previous ClassDocument43 pagesCHAPTER IV REVIEWER From Online From Previous ClassChap ChoyNo ratings yet

- Agrarian Law (Alita Et. Al. vs. CA)Document3 pagesAgrarian Law (Alita Et. Al. vs. CA)Maestro LazaroNo ratings yet

- Agrarian Law Midterm ReviewerDocument41 pagesAgrarian Law Midterm ReviewerEmmanuel Ortega100% (3)

- Notes On Agrarian LawDocument14 pagesNotes On Agrarian Lawrian5852No ratings yet

- Association of Small Landowners v. SARDocument7 pagesAssociation of Small Landowners v. SARBill MarNo ratings yet

- A) - B) C) D) : SECTION 4. ScopeDocument3 pagesA) - B) C) D) : SECTION 4. ScopeKDNo ratings yet

- Eminent Domain Is An Inherent Power of The State That Enables It To ForciblyDocument9 pagesEminent Domain Is An Inherent Power of The State That Enables It To ForciblySendirly Liz S MetranNo ratings yet

- Dar Administrative Order NoDocument32 pagesDar Administrative Order NoJel LyNo ratings yet

- Dar Administrative Order No. 02-06Document28 pagesDar Administrative Order No. 02-06DiazNo ratings yet

- Lithuania 12Document27 pagesLithuania 12Mark JNo ratings yet

- EP CLOA CCLOA ParcelizationDocument80 pagesEP CLOA CCLOA ParcelizationEnrryson SebastianNo ratings yet

- Land LawsDocument7 pagesLand LawsDivya Gayatri Datla100% (1)

- Dar Administrative Order No. 02-03Document16 pagesDar Administrative Order No. 02-03Anonymous 7BpT9OWPNo ratings yet

- I. Comprehensive Agrarian Reform Program 7Document5 pagesI. Comprehensive Agrarian Reform Program 7Laurene Ashley S QuirosNo ratings yet

- Agrarian Law Case Digests - Set2Document8 pagesAgrarian Law Case Digests - Set2Jai Delos SantosNo ratings yet

- Amendment To The ConstitutionDocument150 pagesAmendment To The Constitutionracel joyce gemotoNo ratings yet

- Ao No. 03 s14 Guidelines in The Disposition of Untitled Privately Claimed Agricultural Lands PDFDocument18 pagesAo No. 03 s14 Guidelines in The Disposition of Untitled Privately Claimed Agricultural Lands PDFchachiNo ratings yet

- Who May Apply For Retention?: Period To Exercise Right of RetentionDocument4 pagesWho May Apply For Retention?: Period To Exercise Right of Retentionmilcah valenciaNo ratings yet

- Case Digests Agra 1Document14 pagesCase Digests Agra 1Angelica Mojica Laroya100% (1)

- Luz Farms vs. Secretary of The Department of Agrarian ReformDocument9 pagesLuz Farms vs. Secretary of The Department of Agrarian ReformAlexis Kyle SalesNo ratings yet

- Dar Administrative Order No 2Document12 pagesDar Administrative Order No 2andrew estimo100% (1)

- CARP and DARDocument36 pagesCARP and DARMeku DigeNo ratings yet

- The Maharashtra Agricultural Lands Ceiling On Holdings Act 1961Document28 pagesThe Maharashtra Agricultural Lands Ceiling On Holdings Act 1961Joint Chief Officer, MB MHADANo ratings yet

- Department of Agrarian Reform, Quezon City & Pablo Mendoza, Petitioners, vs. ROMEO C. CARRIEDO, Respondent G.R. No.176549 January 20, 2016Document7 pagesDepartment of Agrarian Reform, Quezon City & Pablo Mendoza, Petitioners, vs. ROMEO C. CARRIEDO, Respondent G.R. No.176549 January 20, 2016Earl YoungNo ratings yet

- Land Acquisition Sec. 3a Definition of Agrarian ReformDocument25 pagesLand Acquisition Sec. 3a Definition of Agrarian ReformtheresaNo ratings yet

- 1 The Indefeasibility of EP and The CLOA BillDocument7 pages1 The Indefeasibility of EP and The CLOA BillJUM07No ratings yet

- LTD - Excerpts From LawsDocument35 pagesLTD - Excerpts From LawsPerkymeNo ratings yet

- Presidential Decree No. 27 Republic Act No. 6657Document8 pagesPresidential Decree No. 27 Republic Act No. 6657Rajan NumbanalNo ratings yet

- Asso V Sec, Luz, NataliaDocument6 pagesAsso V Sec, Luz, NataliaAnonymous BXOjExQ5No ratings yet

- Hacienda Luisita Vs PARCDocument10 pagesHacienda Luisita Vs PARCPing EdulanNo ratings yet

- Presidential Decree No. 27 (PD 27) October 21, 1972Document8 pagesPresidential Decree No. 27 (PD 27) October 21, 1972Jage Joseph Marco SuropiaNo ratings yet

- Leasehold ContractsDocument13 pagesLeasehold ContractsJig-jig AbanNo ratings yet

- Ra 3844 UncDocument26 pagesRa 3844 UncRogelineNo ratings yet

- Republic Act No. 3844 - Official Gazette of The Republic of The PhilippinesDocument77 pagesRepublic Act No. 3844 - Official Gazette of The Republic of The PhilippinesDarren RuelanNo ratings yet

- Enterobacter CloacaeDocument7 pagesEnterobacter Cloacaewilliam091090No ratings yet

- The Law On Alternative Dispute Resolution: Private Justice in The PhilippinesDocument13 pagesThe Law On Alternative Dispute Resolution: Private Justice in The PhilippinesJane Garcia-Comilang94% (18)

- Alternative Dispute Resolution Provisions PDFDocument13 pagesAlternative Dispute Resolution Provisions PDFwilliam091090No ratings yet

- History of The PhilippinesDocument13 pagesHistory of The Philippineswilliam091090No ratings yet

- The Law On Alternative Dispute Resolution: Private Justice in The PhilippinesDocument13 pagesThe Law On Alternative Dispute Resolution: Private Justice in The PhilippinesJane Garcia-Comilang94% (18)

- Enterobacter CloacaeDocument7 pagesEnterobacter Cloacaewilliam091090No ratings yet

- Enterobacter CloacaeDocument7 pagesEnterobacter Cloacaewilliam091090No ratings yet

- Labor ReviewerDocument83 pagesLabor ReviewerChristian Francis Valdez DumaguingNo ratings yet

- Pale CaseDocument11 pagesPale Casewilliam091090No ratings yet

- Taxation LawDocument191 pagesTaxation LawHarvy Brian Hao ValenciaNo ratings yet

- Annexes Part 3.printableDocument1 pageAnnexes Part 3.printablewilliam091090No ratings yet

- Annexes Part 2.printable PDFDocument11 pagesAnnexes Part 2.printable PDFwilliam091090No ratings yet

- Salient Features of Gsis and Sss LawDocument8 pagesSalient Features of Gsis and Sss LawIvan Montealegre Conchas0% (1)

- Criminal Law (Arts. 1-237)Document124 pagesCriminal Law (Arts. 1-237)MiGay Tan-Pelaez94% (18)

- Requirements For RegistrationDocument2 pagesRequirements For Registrationjusang16No ratings yet

- The Law On Alternative Dispute Resolution: Private Justice in The PhilippinesDocument13 pagesThe Law On Alternative Dispute Resolution: Private Justice in The PhilippinesJane Garcia-Comilang94% (18)

- 3 Income Taxation Final PDFDocument109 pages3 Income Taxation Final PDFwilliam0910900% (1)

- Alternative Dispute Resolution Provisions PDFDocument13 pagesAlternative Dispute Resolution Provisions PDFwilliam091090No ratings yet

- Alternative Dispute Resolution Provisions PDFDocument13 pagesAlternative Dispute Resolution Provisions PDFwilliam091090No ratings yet

- Cases On CreditDocument71 pagesCases On Creditwilliam091090No ratings yet

- Mauricio Ulep Vs The Legal ClinicDocument3 pagesMauricio Ulep Vs The Legal Clinicwilliam091090No ratings yet

- 4 Income Tax Tables Final PDFDocument8 pages4 Income Tax Tables Final PDFwilliam091090No ratings yet

- Foreign LiteratureDocument6 pagesForeign Literaturewilliam091090No ratings yet

- Chattel MortgageDocument11 pagesChattel Mortgagewilliam091090No ratings yet

- Nil 1Document78 pagesNil 1william091090No ratings yet

- Chattel MortgageDocument11 pagesChattel Mortgagewilliam091090No ratings yet

- People Vs AbarcaDocument2 pagesPeople Vs Abarcawilliam091090No ratings yet

- Blue Cross V Olivares GDocument12 pagesBlue Cross V Olivares Gwilliam091090No ratings yet

- Cases On CreditDocument71 pagesCases On Creditwilliam091090No ratings yet

- A Guide For Municipal MayorsDocument100 pagesA Guide For Municipal MayorsjejemonchNo ratings yet

- Lea 3: Introduction To Industrial Security ConceptsDocument10 pagesLea 3: Introduction To Industrial Security ConceptsLorelene Romero100% (3)

- Terry Maketa-Chris Olson E-Mail ExchangeDocument4 pagesTerry Maketa-Chris Olson E-Mail ExchangeMichael_Lee_RobertsNo ratings yet

- Assignment On Critical Analysis of Written StatementDocument25 pagesAssignment On Critical Analysis of Written Statementdivya srivastavaNo ratings yet

- Areola Vs MendozaDocument4 pagesAreola Vs MendozaIrang GandiaNo ratings yet

- 10.27.23 MEMO Capitol Complex SecurityDocument2 pages10.27.23 MEMO Capitol Complex SecurityJacob OglesNo ratings yet

- Language Exercises (With Answer Key)Document14 pagesLanguage Exercises (With Answer Key)John BondNo ratings yet

- Sagala-Eslao v. CA (PFR Digest)Document1 pageSagala-Eslao v. CA (PFR Digest)Hannah Plamiano Tome100% (1)

- Commissioner of Cutoms Vs Hypermix Feeds CorporationDocument2 pagesCommissioner of Cutoms Vs Hypermix Feeds CorporationEileen Eika Dela Cruz-Lee83% (6)

- Melva Theresa Alviar Gonzales Vs RCBCDocument1 pageMelva Theresa Alviar Gonzales Vs RCBCAlexir MendozaNo ratings yet

- SPL DoctrinesDocument31 pagesSPL DoctrinesAw LapuzNo ratings yet

- How To Regain Dutch CitizenshipDocument20 pagesHow To Regain Dutch CitizenshipmayirpNo ratings yet

- Government of Andhra Pradesh Backward Classes Welfare DepartmentDocument3 pagesGovernment of Andhra Pradesh Backward Classes Welfare DepartmentDjazz RohanNo ratings yet

- Okey Payne Arrest AffidavitDocument7 pagesOkey Payne Arrest AffidavitMichael_Roberts2019No ratings yet

- Uprcme Qtourt: 3republic of Tbe BihppinesDocument21 pagesUprcme Qtourt: 3republic of Tbe BihppinesValaris ColeNo ratings yet

- G.A Machineries vs. Yaptinchay PDFDocument13 pagesG.A Machineries vs. Yaptinchay PDFsynthNo ratings yet

- 10th Nelson Mandela World Human Rights Moot Court Competition Hypothetical Case Version 20 December 2017Document7 pages10th Nelson Mandela World Human Rights Moot Court Competition Hypothetical Case Version 20 December 2017kikowhzzNo ratings yet

- 03.GO Ms No 44 Recruitment Employment ExchangesDocument3 pages03.GO Ms No 44 Recruitment Employment Exchangesnandhini0% (1)

- The Law of Employees' Provident Funds - A Case Law PerspectiveDocument28 pagesThe Law of Employees' Provident Funds - A Case Law PerspectiveRamesh ChidambaramNo ratings yet

- Family Project FinalDocument11 pagesFamily Project Finalsai kiran gudisevaNo ratings yet

- WBSR I PDFDocument183 pagesWBSR I PDFRakesh RanjanNo ratings yet

- Indian Oil Corporation LTD and Ors Vs Subrata BoraDocument4 pagesIndian Oil Corporation LTD and Ors Vs Subrata Boraabhinandan khanduriNo ratings yet

- Cathay v. Reyes GR No. 185891 June 26, 2013 FactsDocument3 pagesCathay v. Reyes GR No. 185891 June 26, 2013 FactsJoshua OuanoNo ratings yet

- Converse Rubber Corp vs. Universal Rubber ProductsDocument13 pagesConverse Rubber Corp vs. Universal Rubber ProductsJerome ArañezNo ratings yet

- Case Title Facts Doctrine/ Notes: Rule 114 - BailDocument9 pagesCase Title Facts Doctrine/ Notes: Rule 114 - BailJoyceNo ratings yet

- R.A. No. 9262: Anti-Violence Against Women and Their Children Act of 2004Document66 pagesR.A. No. 9262: Anti-Violence Against Women and Their Children Act of 2004MEL JUN DIASANTA100% (4)

- Defence Cross Examination Can Be in This Manner To PW1Document3 pagesDefence Cross Examination Can Be in This Manner To PW1Arjita SinghNo ratings yet

- SAMASAH-NUWHRAIN Vs Hon Buenvaentura MagsalinDocument13 pagesSAMASAH-NUWHRAIN Vs Hon Buenvaentura MagsalinIvan Montealegre ConchasNo ratings yet

- AIESEC in IndiaDocument4 pagesAIESEC in IndiaVibhav PawarNo ratings yet

- Midterm (Assignment (1) Income TaxationDocument3 pagesMidterm (Assignment (1) Income TaxationMark Emil BaritNo ratings yet