Professional Documents

Culture Documents

Agricultural & Applied Economics Association

Uploaded by

Rachid El MoutahafOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agricultural & Applied Economics Association

Uploaded by

Rachid El MoutahafCopyright:

Available Formats

Agricultural & Applied Economics Association

Trading-Day Variation: Theory and Implications for Monthly Meat Demand Author(s): Mark S. McNulty and Wallace E. Huffman Source: American Journal of Agricultural Economics, Vol. 74, No. 4 (Nov., 1992), pp. 10031009 Published by: Blackwell Publishing on behalf of the Agricultural & Applied Economics Association Stable URL: http://www.jstor.org/stable/1243198 Accessed: 08/12/2009 10:45

Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use, available at http://www.jstor.org/page/info/about/policies/terms.jsp. JSTOR's Terms and Conditions of Use provides, in part, that unless you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you may use content in the JSTOR archive only for your personal, non-commercial use. Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at http://www.jstor.org/action/showPublisher?publisherCode=black. Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed page of such transmission. JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Agricultural & Applied Economics Association and Blackwell Publishing are collaborating with JSTOR to digitize, preserve and extend access to American Journal of Agricultural Economics.

http://www.jstor.org

Trading-DayVariation: Implications for Monthly

Demand

Theory

Meat

and

Mark S. McNulty and Wallace E. Huffman

We consider the problem of fitting regression models with data containing trading-day variation. Multiplicative and additive expressions for trading-day variation are presented. Multiplicative adjustment is more reasonable than the additive but is also more complex. Expressions are derived for biases which trading-day variation introduces into least squares estimators. Estimated retail demands for beef, pork, and chicken show the biases are large and in the directions predicted when monthly data are used, but are small when quarterly data are used. Multiplicative adjustment is statistically superior to additive adjustment, although practical differences are small. Key words: measurement error, meat demand, trading-day variation.

Time series constructed as the monthly total of daily activity levels will contain a component of variability that results from the arrangement of the calendar. Such variability is commonly referred to as trading-day variation (Salinas and Hillmer). Since at least 1965, economists have recognized trading-day variation in measures of economic activity (Shiskin, Young, and Musgrave). Methods of accounting for trading-day variation fall into two broad groups, differentiatedby the assumptionthat the days of the week affect activity in a multiplicative manner (Kendall p. 8; Hayenga and Hacklander;Pfeffermann and Fisher) or an additive manner (Shiskin, Young, and Musgrave; Cleveland and Devlin 1982; Pfeffermann and Fisher; Bell and Hillmer). Additivity implies that a given day's effect is independent of the current activity level; this may not be reasonable (Kallek; Cleveland and Devlin 1982; Salinas and Hillmer). However, additive models have the advantage of expressing trading-day variation in a parametric form that can be estimated easily. Under the assumption of multiplicative trading-day effects, the impact of each day of the week has been assigned subjectively. The objectives of the present paper are to deMarkS. McNultyis an associateprofessor of economicsat Kansas StateUniversity; WallaceE. Huffman is a professor of economics at Iowa StateUniversity. The authorswish to thanktwo anonymous refereesand Marvin Hayengafor theirhelpfulsuggestions. Review coordinated by StevenBuccola.

rive multiplicative and additive expressions for trading-dayvariationand to test hypotheses about trading-dayeffects in meat demand models. Our hypotheses with respect to beef, pork, and chicken demand are that (i) trading-day effects are importantwhen models are fit using monthly data but not when fit using quarterlydata; (ii) a multiplicative specification of trading-day variation is superior to an additive representation; (iii) trading-dayvariation biases estimates of the adjustment parameter toward one in partial adjustment models; and (iv) slope coefficient estimates in static models remain consistent in the presence of trading-day variation, but error autocorrelation estimates are biased toward zero. Although we focus on meat demand, similar results may be expected in many econometric models that use data containing trading-day variation.

Modeling Trading-day Variation Let Q' be an observed variable measuring the monthly total of daily levels of an economic activity. If Q' is constructed precisely, it will contain "trading-day" variation, arising from two sources. First, a month may contain 28, 29, 30,

' Trading-day variation also arises from holidays, which, with the exception of Easter, occur in the same month of the year. Models estimated in this study account for seasonality using monthly dummy variables.

Copyright 1992 American Agricultural Economics Association

1004 November 1992

Amer. J. Agr. Econ.

or 31 days. Long months generate larger values is additive. In terms of the variablesdefined here, for Q'. Second, the distribution of weekdays in additivity implies q?, = q, + Si, where 8, is the a particularmonth is not constant over time. For effect of the ith day of the week on activity. example, in some years, January contains 4 Substituting q, = q, + 8i into (1) and solving Wednesdays, in other years, 5. If activity is gives greater on Wednesday than on other days of the 7 week, Q, will be larger in months that contain = (2) q, Q/tDs iit. more Wednesdays. i=1 One method of adjusting for trading-day variation is to divide the observed data for a month Cleveland and Devlin's (1982) representationis by the number of fully utilized working days. identical to (2), although their derivation is difHayenga and Hacklander adjusted commercial ferent. cattle and hog slaughter measures in this fashion An alternative model, which has not been exweighting normalweekdays by one, pressed previously in parametricform, is that a by arbitrarily Saturdaysby 1/3, weekday holidays by 1/2, and particular day affects activity in multiplicative Saturday holidays and Sundays by zero. Two fashion; that is q' = q,yi, where yi is the effect salient features of their methodology are that the of the ith day of the week on activity. Hayenga trading-dayeffect is multiplicative in nature and and Hacklander make use of a multiplicative that relative activity levels on various weekdays model, although they take the values of yi as are known. known. Substitutingqi = q, y into (1) and solvCleveland and Devlin (1982) and Bell and ing gives Hillmer have presented methods of modeling univariatetime series in which average daily acq Q / D( t .j yi (3) tivity levels are estimatedalong with other model parameters.These authorsassume, however, that Parameters 61, ..., 57 and yl, .... y7 can be day of the week affects activity in an additive manner. Additivity implies that a day's effect is estimatedalong with other parametersin a model 1, independent of the level of activity; this seems containing Q'. However, because 7=1 it unlikely. Salinas and Hillmer note that an ad- direct use of (2) or (3) will result in exact colditive model may not be appropriatefor many linearity. Cleveland and Devlin (1982) suggest time series. Cleveland and Devlin (1982) sug- imposing restriction ]i7 8i = 0 in the additive gest that power transformations of the data be model. This is a natural restriction, because it explored with the intentof makingunivariatetime implies that the average adjustment to the reseries models additive. This approach would be ported daily activity level is zero. The corredifficult to apply to traditional regressionmodels, sponding restriction for the multiplicative model and the power transformationthat makes trad- is 7=l y, = 7. Imposing = I 8i = 0 in (2) and ing-day variation additive could adversely affect 1i= yi = 7 in (3), and rescaling by the average other model components. month's length (365.25/12), gives a measure of For a new approach, let Monday, Tuesday, economic activity adjusted for trading-day vari..., Sunday be indexed 1, 2, . . ., 7. Define ation.2 For the additive model, this is Zi, as the frequency of occurrence of day i in month t. Month t has length D, = 7=,Zi, and (4) Q, = (365.25/12) ???~ 7 /?:~?? day i occurs zi, = Z,/D,% of the time. If q? is ) the sample average activity level on day i in 8,i 7i Q,?/D, + z,, i=2 i=2 month t, then and for the multiplicative model, it is

(1)

Qt

-it i=1

(5)

Q" = (365.25/12)

7 \\,

Note that qi is observable but rarely reported. Let q, be the daily activity level that is a function of economic influences other than the calendar; q, cannot be observed directly. In order to derive q, from the observed Q,, one must assume a relationship between q, and q?. The simplest assumption is that a day's effect

(Q

( D, (zit7\ \ / \ V

yi

<~~=2

i=2

2The parameter restrictions have been arbitrarily imposed on the coefficient for Monday. Estimated coefficient values are invariant with respect to this choice.

McNulty and Huffman

Trading-Day Variation in Demand

1005

With appropriatevariable redefinition, (4) or (5) can be used to account for trading-day variation in quarterlydata. However, one would expect the importance of trading-day variation to diminish as the length of the measurement period increases. For example, suppose activity level is zero on Saturday and Sunday and constant on the other weekdays: (q, = q, y, =, ..., = 75, 76 = Y7 = 0). The minimum and maxi-

where A = var(Q,) - cov(x,, Q,_,)2/var(x,)

>

0. Because C < 0 and V > 0, /2 will be biased downward. The estimator of the partial adjustward, as predicted by hypothesis (iii) in the introduction. Next, consider a static model Q, = f3x, + v,

with autoregressive error v, = pv,_- + E,, 0 < ment parameter, (1 - 32), is then biased up-

p < 1. The model fit is Q, = f/x, + e,, where mum of the observed monthly time series will e, = v, + w,, e, - N(w,, o2/(l-p2)). Let /3 be the differ by 15%, whereas corresponding quarterly least-squares estimator of 3. Schmidt (p. 36) values will differ by only 3%.3 shows that f, is a biased but consistent estimator of /3 if plim(T= x,w,/T) = 0, a condition that is likely to be true when the regressors are ecoEconometric Implications of Trading-Day nomic variables such as prices and income. Variation However, estimators of the parametersof the erTrading-day variation arises because the data ror probability distribution are inconsistent. Of collection process is based on the Gregorian cal- particularinterest is the bias in the estimator of endar. Trading-day variation may be interpreted p, given by p = ,T^2et, where e = as measurement error, which is deterministic Q, - f/x,. Assuming 8 is a consistent estimator because the calendar is fixed. Impact of trading- of /3, day variation on least squares estimators is anaplim(p) = (pa2 + C)/((o2 + V). lyzed in this section using the model Q' = Q, (7) + w,, where Q, is the "true" level of economic Because C < 0 and V > 0, p will be biased activity, w, = 7=1 a,zi* (z, = zi, - 1/7) is the downward. The result that plim(,f) = f3 and error in measurement, and a,, i = 1, ..., 7, are plim(p) < p supports hypothesis (iv) in the inconstants.4 In the following regression models, troduction. x, is an observed, stationaryregressor with E(x,) = 0 and e, - i.i.d.N(O, o'2) is an unobserved model error independent of x,. Variation in Measures of Meat The properties of least-squares estimators de- Trading-Day Demand pend upon the sampling behavior of w,. The sample variance and first-order autocovariance In order to estimate retail meat demand equaof w, are VT = , I/T and CT = St 2,w, tions, a time series on tradedmeat quantitiesmust = = Denote V and C limT VT T, respectively. be constructed. Quantity demanded per capita in limT,,C,. Properties of sample functions of w, month t is often measured indirectly as disapcan be numerically evaluated because the calthe formula endar has a fixed cycle of 336 months (except pearances through for the loss of three leap years every 400 years). (8) Q = (Q + Qed')/Pop, For example, it can be shown that C, < 0 for T where Q, is a measure of slaughter; Qdij is an > 44 so that C < 0.5 for exports, imports, and inventory adjustment First, consider the partial adjustment model and Pop, is population. Let Q, be the changes; + < = 1. + 0 where < E,, Q, 32 32Q,-1 fix, observed level of monthly slaughter (the dressed The model fit is Q, = f31x, + /32Qt- + e,, where weight of meat slaughtered under federal ine, = E, + w, - P2w,-1. Let 32 be the least-squares spection in this study). The usual practice is to estimator of 32, then set Q, = Q,. plim(32) = (32A + C)/(A + V) (6) If all elements in (8) are measured precisely, the measure of quantity demanded will contain 3 Under the given assumptions, the number of "working days" trading-dayvariationresultingfrom changes over ranges from 20 to 23 in monthly data and from 64 to 66 in quarterly data. the week in consumer shopping behavior. How4 The measurement error specification does not include the inever, all the elements in (8) are not measured fluence of month length. The month length effect is nearly seasonal, and regression models typically account for seasonality in precisely. For example, the typical inventory some manner. measures, namely cold storage holdings, do not 5 This result is obtained by numerically verifying that f= Z,Z^ take into account stocks held in retail stores. z, = [z*,, ... ,z,]', is a negative definite matrix for T = 44, .... 672 for all possible calendar starting months. Other economic measures are simply inaccu-

1006

November 1992

Amer. J. Agr. Econ.

rate. Consequently, it is necessary to determine the components in (8) that require trading-day adjustment. Trading-day variation is easily detected in a variable's sample spectrum. The sample spectrum of a time series is a representationof that series in the frequency domain ratherthan in the time domain. Cleveland and Devlin (1980) show that certain spectral frequencies correspond to the particularcyclical propertiesof the calendar. McNulty and Huffman analyze the sample specover trum of trading-day variable w, = i=la,iZi, one complete cycle of the calendar. Variation in w, because of month length is m, = E,7jaji =Z,/ 7, and variation because of distribution of weekdays within the month is dt = i=laiZit m,, (w, = m, + d,). The sample spectrum of a = 2/rlt= x,ei where ok variable x, is f,(k) t = 27rk/336 for k = 1,..., 168. McNulty and

Huffman show

thatfw(wk) = fm(k)

Empirical Results Retail demands of beef, pork, and chicken typically are specified as functions of prices of all three commodities, of income, and of time of year (Smallwood, Haidacher,and Blaylock). Our demand models also include a time trend to account for changes in tastes over time, and lagged quantity demanded to account for partial adjustment of actual to desired consumption. The logarithmic representation is used here:

11

(9)

log(Qd) =

o+

i=1

3D

21og(PB,)

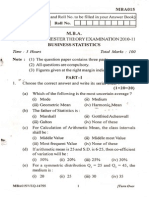

+ 1510og(INC,) + ,/331og(PP,)+ 3141og(PC,) + f16t + P17t2+ /318log(Q-l) + e, where Qd is per capita quantity of meat demanded; D,, ..., D11 are monthly dummy variables; PP,, PB,, and PC, are real retail prices of beef, chicken, and pork, respectively; INC, is per capita real disposable income; and E, is a random disturbance.7The coefficients on prices and income are short-rundemand elasticities, the coefficient on the lagged dependent variable is one minus the partial adjustmentparameter, and trend coefficients can be used to compute growth rates. To estimate model (9) with no correction for trading-day variation, substitute Q, for Q' in (8) and then (8) into (9). This model can be fit by ordinary least squares. To estimate the model with additive (multiplicative) adjustment for trading-day variation, substitute Q' (Q7) for Q, in (8) and then (8) into (9). The resulting model must be fit by nonlinear least squares. Equation (9) was fit with additive, multiplicative, and no trading-dayadjustmentsover the period 1966: 11988:12 (n = 276).8 Results are reported in table 1.

7 Chicken quantity and price data are from U.S. Egg and Poultry Statistical Series, 1960-1989 (USDA). Beef and pork price data are from Livestock and Meat Situation (USDA). Beef and pork quantity and real disposable income data are from Business Statistics (USDC). Prices are deflated by the consumer price index. 8 The validity of least squares was investigated using quantity adjusted for multiplicative trading-day variation. The Durbin-h statistic for serial correlation of the error was not significant at the 0.05 level for all three meats. The test of own-price exogeneity given by Spencer and Berk was performed using the number of cattle, hogs, and chickens on farms and real corn price as instruments. Interactions of time with each of these variables were also used. The test statistic was not significant at the 0.05 level in the pork and chicken models but was significant at the 0.01 level in the beef model. However, the instrumentalvariable estimate of beef own-price elasticity was not significantly different from zero, implying the exogeneity test result is meaningless.

+ fd(wo).

Be-

cause month length is constant between years, with the exception of Februaryin leap years, the important frequencies of fm(k) are confounded with those resulting from seasonality. Consequently, the importantfrequencies for detecting trading-day variation are those associated with

fd(wk).

fd(k) t117

the particularvalues the ais take on. Therefore, a spike in a variable's spectrum near one of the frequencies 1.91, 2.19, or 2.86 indicates trading-day variation. The sample spectrum of pork slaughter from 1966:1 to 1988:12 is presented in figure 1.6 A spike at frequency 2.19 indicates the variable contains trading-day variation. The other major spike in figure 1 is at the seasonal frequency 5rr/6 = 2.62. Beef and chicken slaughter spectra were similar. Spectral analysis of imports, exports, and inventories of the three meats did not indicate presence of substantial trading-day variation. Consequently, only the slaughter component of (8) will be adjusted for tradingday variation. It must be emphasized that trading-day variation in measures of meat demand are, in reality, trading-day variation in animal slaughter because meat demand is measured indirectly and imprecisely.

McNulty and Huffman also show that will reach a maximum at either t102 = 1.91, = 2.19, or w153 = 2.86, depending upon

6 The spectrum at low frequencies has been suppressed to improve readability of the plot. Vertical lines are at frequencies 1.91, 2.19, and 2.86.

McNulty and Huffman

Trading-Day Variation in Demand

1007

81 =, ..., = 87 = 0 with additive adjustment or y/7 = 1 with multiplicative adHo: 'y =, ...,=

E o -

The hypothesis of no trading-day effects (Ho:

{n

1.8

2.0

2.2

2.4 frequency

2.6

2.8

3.0

justment)is rejectedusing a Wald test. Both types of adjustment indicate that slaughter is greater in the middle of the work week than on Monday or Friday, and that it decreases substantially on Saturdayand is approximately zero on Sunday.9 It was conjectured that trading-day effects would be small in quarterlydata. When the data were aggregated to a quarterlylevel and (9) was fit using (4) and (5) (appropriately modified),

9 of beef, pork, and chicken Sampleaveragedaily production was 60.7, 36.6, and 27.2 (millionpoundsper day) respectively, close to the negativeof the additiveSundaycoefficients.

Figure 1. Sample spectrum of pork production, 66:1-88:12

Table 1.

Estimates of Retail Meat Demand Equations, 1966:1-1988:12

Beef Pork multiplicative none additive multiplicative none Chicken additive 6.23 (2.98) 12.6 (2.99) 7.78 (2.98) 8.50 (2.87) 6.70 (2.94) -17.2 (3.03) -24.6 (2.97) 0.102 (0.0332) 0.0355 (0.0249) -0.157 (0.0356) 0.500 (0.130) 0.0087 (0.0282) 0.015 (0.0052) 0.454 (0.0572) 0.983 540.2 multiplicative 1.26 (0.0975) 1.60 (0.0994) 1.34 (0.100) 1.36 (0.099) 1.27 (0.0982) 0.216 (0.100) -0.0731 (0.0987) 0.0677 (0.0289) 0.0241 (0.0214) -0.102 (0.0313) 0.354 (0.113) 0.0092 (0.0242) 0.0106 (0.0045) 0.607 (0.053) 0.987 1002.7

adjustment variable z,

Z2 Z3

Z4

none

additive 12.0 (6.75)a 16.6 (6.78) 20.6 (6.80) 22.9 (6.66) 7.98 (6.74) -17.7 (6.93) -62.4 (6.85) -0.310 (0.0458) 0.153 0.0271 0.0222 (0.0283) 0.337 (0.114) 0.145 (0.031) -0.0725 (0.0097) 0.543 (0.0537) 0.910 436.8

Z5

Z6

Z7

log(PB) log(PP) log(PC) log(INC) t r log(Q,_l) R2 Wald-testb

-0.609 (0.0587) 0.279 (0.038) 0.0841 (0.0419) 0.669 (0.168) 0.294 (0.0429) -0.142 (0.0119) 0.0997 (0.0617) 0.822

1.20 8.14 1.26 (0.109) (4.68) (0.127) 1.26 15.1 1.40 (0.112) (4.72) (0.129) 1.37 11.0 1.31 (0.112) (4.67) (0.130) 1.39 12.9 1.38 (0.111) (4.60) (0.128) 1.12 11.4 1.32 (0.111) (4.65) (0.128) 0.694 0.323 -23.7 (0.113) (4.77) (0.130) -0.0558 -35.0 -0.0194 (0.111) (4.66) (0.128) 0.492 0.250 -0.302 0.240 0.208 (0.045) (0.0573) (0.0435) (0.0434) (0.0509) 0.148 -0.690 -0.299 -0.287 0.0494 (0.0267) (0.0627) (0.053) (0.0529) (0.0392) 0.0218 0.0419 -0.019 -0.0175 -0.314 (0.0278) (0.0473) (0.0326) (0.0324) (0.0527) 0.326 0.306 0.225 0.211 0.979 (0.112) (0.184) (0.125) (0.124) (0.198) 0.142 0.108 0.0179 0.0184 0.0259 (0.0305) (0.0443) (0.0311) (0.0309) (0.0444) -0.0515 -0.0706 -0.0191 -0.0184 0.0259 (0.0095) (0.0088) (0.0065) (0.0065) (0.0082) 0.556 0.0082 0.519 0.537 -0.0739 (0.053) (0.0668) (0.0617) (0.0617) (0.0638) 0.913 481.5 0.809 0.897 424.2 0.899 457.7 0.960

Note: Estimates of the intercept and seasonal effects are suppressed. PB, PP, and PC are real retail beef, pork, and chicken prices; INC is real disposable income per capita; the dependent variable is log(Qd), the logarithm of per capita meat consumption. a Standard errors of the estimates in parentheses. b Wald test statistic for the hypothesis of no trading day-variation, distributed as a chi-square with 6 degrees of freedom under the null. The critical value at the 0.01 level of significance is 16.8.

1008 November 1992

Amer. J. Agr. Econ.

tests of the hypothesis of no trading-day effects gave p-values of 0.022, 0.22, and 0.72 using the additive model and 0.035, 0.26, and 0.81 using the multiplicativemodel of beef, pork, and chicken, respectively. Hence, trading-day variation at the quarterlylevel was not detectable in these data in the pork and chicken models and was only moderatelynoticeablein the beef model. Adjusting for trading-day variation did not substantially alter the parameter estimates computed using quarterly data. Consequently, the remainder of the discussion will focus on the results obtained when (9) was fit using monthly data. A nonnested hypothesis test can be used to determine whether additive or multiplicative adjustment is actually appropriate. The procedure suggested by Davidson and MacKinnon is to construct an artificial model using a weighted average of the two measures of quantity demanded:

(10) (1 - a)log[(Q, + QtJ)/Pop,] + alog[(Qm + Qad)/Popt]

where a is a parameter to be estimated. If the additive adjustment is appropriate, a = 0, whereas if the multiplicative adjustment is appropriate, a = 1. It is difficult to estimate demand equations using (10) directly because both terms of (10) contain some identical variables, resulting in high collinearity. The solution suggested by Davidson and MacKinnon is to consider one functional form as the null hypothesis and the other form as the alternative. Although the choice is arbitrary,the first null hypothesis to be tested is Ho: a = 0. The procedure is then to replace y,, ..., y7 with estimatesobtainedfrom direct estimation of (9) (that is, with the values reportedin table 1) and then to estimate (9) with (10) as the dependent (and lagged dependent) variable. Parameters estimated in this way are

a, 61, .0... 7, O, ...

P18-

Estimated values of a in the beef, pork, and chicken demand models (standard errors in parentheses)were 1.08 (0.348), 0.648 (0.289), and 1.06 (0.106). Thus, the null hypothesis that additive adjustmentis appropriateis rejected at the 5% significance level in all cases. In addition, estimates of a in the beef and chicken models are within one-quarterof a standarderrorof 1.0, providing additional confidence that the multiplicative adjustment is correct. There was practically no change in a estimates when the null and alternative hypotheses were reversed.

Although there is statistical evidence that the multiplicative adjustment is superior to the additive, parameter estimates with the two types of adjustment are very similar. The additive model may be viewed as a first-order Taylor's of the multiplicativemodel. series approximation It would appear that the approximation is quite accurate with the present data. This result is importantbecause multiplicative adjustmentseems more reasonable than the additive, although additive adjustment is easier to implement. If future research supports the empirical equivalence of the two approaches, analysts may feel justified in using the simpler, additive methodology. It was predicted by (6) that the estimated coefficient of the lagged dependentvariable, 318, would be biased toward zero when the model was fit with no trading-dayadjustment.This bias is clearly evident in all meat types. When trading-day adjustments are included in (9), 318 is significant. With no adjustment, P/18 falls dramatically and is not significantly different from zero. A substantialdifference is evident between the economic implications of the models with and without trading-daycorrection. With no tradingday correction, the estimates imply that the adjustment to desired consumption is immediate. In this case, there is no distinctionbetween shortrun and long-run demand elasticities. With trading-day adjustment, long-run own-price elasticities (-0.68, -0.63, -0.25) are more than twice the short-runelasticities (-0.30, -0.29, -0.10) in beef, pork, and chicken models, respectively. From equation (7), we predicted that fitting the model with /18 set to zero and no tradingday adjustment would give consistent estimates of the slope parameters, but that the estimate of the first-orderautocorrelationof the error would be biased downward. To investigate the magnitude of this bias, (9) was fit with 1,8 = 0 both with and without multiplicative adjustment for trading-day variation. Estimated regression coefficients were essentially unaffected by trading-day adjustment.For example, estimatedownprice elasticities of beef, pork, and chicken, were -0.67, -0.70, and -0.29 without trading-day adjustment and -0.68, -0.69, and -0.29 with trading-dayadjustment.However, estimatedfirstorder autocorrelations of errors were substantially affected. They were 0.12, 0.07, and -0.06 without trading-day adjustment and 0.56, 0.55, and 0.58 with trading-day adjustment. With trading-day adjustment, the hypothesis of zero errorautocorrelationis rejected at all reasonable

McNulty and Huffman

Trading-Day Variation in Demand

1009

significance levels.10 This conclusion is reversed when we fail to account for trading variation. Conclusions We have presented parametric methods of accounting for multiplicative and additive tradingday variation. Expressions were derived for the biases introduced into least-squares estimators by trading-day variation. In an empirical analysis of retail meat demands using monthly data, we showed that the biases were substantial and in the directions predicted. The biases were not large when models were fit with quarterlydata. Multiplicative adjustment is conceptually superior to additive adjustment.With the presentdata, however, parameter estimates were little affected by adjustment type. [Received May 1990; final revision received December 1991.]

References

Bell, W. R., and S. C. Hillmer. "Modeling Time Series with Calendar Variation." J. Amer. Statist. Assoc. 78(1983):526-34. Cleveland, W. S., and S. J. Devlin. "Calendar Effects in Monthly Time Series: Detection by Spectrum Analysis and Graphical Methods." J. Amer. Statist. Assoc. 75(1980):487-96. - . "CalendarEffects in Monthly Time Series: Modeling and Adjustment." J. Amer. Statist. Assoc. 77(1982):520-28.

10 as Xi underthe null hyThe test statisticis 276p2,distributed pothesis.

Davidson, R., and J. G. MacKinnon. "Several Tests for Model Specification in the Presence of Alternative Hypotheses." Econometrica 49(1981):781-93. Hayenga, M. L., and D. Hacklander. "Monthly SupplyDemand Relationships for Fed Cattle and Hogs." Amer. J. Agr. Econ. 52(1970):535-44. Kallek, S. "An Overview of the Objectives and Framework of Seasonal Adjustment." Seasonal Analysis of Economic Time Series, Economic Research Report, ER-1, Bureau of the Census, U.S. Department of Commerce (1976). Kendall, M. G. Time Series, 2nd edition. Griffin, London, 1975. McNulty, M. S., and W. E. Huffman. "The Sample Spectrumof Time Series with Trading-DayVariation."Econ. Letters 31(1989):367-70. Pfeffermann, D., and J. M. Fisher. "Festival and Working Days Prior Adjustmentsin Economic Time Series." Int. Statist. Rev. 50(1982):113-24. Salinas, T. S., and S. C. Hillmer. "Multicollinearity Problems in Modeling Time Series With Trading-Day Variation." J. Bus. & Econ. Statist. 5(1987):431-36. Schmidt, P. Econometrics. Marcel Dekker, Inc., New York, 1976. Shiskin, J., A. H. Young, and J. C. Musgrave. "The X11 Variant of the Census Method II Seasonal Adjustment Program." Technical Paper No. 15, Bureau of the Census, U.S. Department of Commerce (1965). Smallwood, D. M., R. C. Haidacher, and J. R. Blaylock. "A Review of the Research Literature on Meat Demand." In The Economics of Meat Demand ed. R. C. Buse, pp. 93-124, Proceedings of the Conference on The Economics of Meat Demand, October 1986, Charleston, SC. Spencer, D., and K. Berk. "A Limited Information Specification Test." Econometrica 49(1981):1079-85. U.S. Department of Agriculture. U.S. Egg and Poultry Statistical Series. 1960-1989. Washington D. C., Sept. 1990. Livestock and Meat Situation. Washington D.C., various issues. U.S. Department of Commerce. Business Statistics. Washington D.C., various issues.

You might also like

- Econometrics Research Paper SampleDocument4 pagesEconometrics Research Paper Sampleafeawobfi100% (1)

- Applied Survival Analysis: Regression Modeling of Time-to-Event DataFrom EverandApplied Survival Analysis: Regression Modeling of Time-to-Event DataRating: 4 out of 5 stars4/5 (2)

- Forecasting NotesDocument3 pagesForecasting NotesSakshi YadavNo ratings yet

- A Comparison of The Real-Time Performance of Business Cycle Dating MethodsDocument28 pagesA Comparison of The Real-Time Performance of Business Cycle Dating MethodscaitlynharveyNo ratings yet

- Artículo NearyDocument26 pagesArtículo NearyLeo AlvarezNo ratings yet

- Formation of Seasonal Groups and Application of Seasonal IndicesDocument15 pagesFormation of Seasonal Groups and Application of Seasonal Indicessarb007No ratings yet

- The University of Chicago Press Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To The Journal of Political EconomyDocument23 pagesThe University of Chicago Press Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To The Journal of Political EconomyNouman BadarNo ratings yet

- A Further Test of The Influence of Leading Indicators On The Probability of Us Business Cycle Phase ShiftsDocument8 pagesA Further Test of The Influence of Leading Indicators On The Probability of Us Business Cycle Phase Shiftsgogayin869No ratings yet

- Economic Activity and McDonalds' StockDocument8 pagesEconomic Activity and McDonalds' StockJosh CarpenterNo ratings yet

- MNGT Lesson 3 4Document5 pagesMNGT Lesson 3 4GloryMae MercadoNo ratings yet

- Campbell 2007 Equity ReturnsDocument23 pagesCampbell 2007 Equity ReturnsHamid WaqasNo ratings yet

- Decomposition MethodDocument73 pagesDecomposition MethodAbdirahman DeereNo ratings yet

- Equity Investment Styles - Cyclicalty of Investment StylesDocument118 pagesEquity Investment Styles - Cyclicalty of Investment Stylesatrader123No ratings yet

- Stock+market+returns+predictability ChaoDocument31 pagesStock+market+returns+predictability Chaoalexa_sherpyNo ratings yet

- Stock Returns, Dividend Yield, and Book-To-market RatioDocument21 pagesStock Returns, Dividend Yield, and Book-To-market RatiofirebirdshockwaveNo ratings yet

- Chapter 3 - ForecastingDocument28 pagesChapter 3 - ForecastingDahlia Abiera OritNo ratings yet

- Brown - Warner - 1985 How To Calculate Market ReturnDocument29 pagesBrown - Warner - 1985 How To Calculate Market ReturnFaisal KhalilNo ratings yet

- Forecasting: Questions and Answers Q6.1 Q6.1 AnswerDocument28 pagesForecasting: Questions and Answers Q6.1 Q6.1 AnswerjyottsnaNo ratings yet

- FORECASTING US OUTPUT GROWTH USING LEADING Indicaotr PDFDocument20 pagesFORECASTING US OUTPUT GROWTH USING LEADING Indicaotr PDFngotungnguyenty31No ratings yet

- FM101 Unit 4 24-04Document28 pagesFM101 Unit 4 24-04Maciu TuilevukaNo ratings yet

- An Introduction to Analysis of Financial Data with RFrom EverandAn Introduction to Analysis of Financial Data with RRating: 4.5 out of 5 stars4.5/5 (2)

- Research Papers Time Series EconometricsDocument6 pagesResearch Papers Time Series Econometricsafmclccre100% (1)

- Fin 2303 Notes 13 - Deseasonalised DataDocument5 pagesFin 2303 Notes 13 - Deseasonalised DatadelvisNo ratings yet

- CampbellGrossmanWang93 TRADING VOLUMEDocument35 pagesCampbellGrossmanWang93 TRADING VOLUMEFranco PascaleNo ratings yet

- Robust Test of The January Effect in Stock Markets Using Markov - Switching ModelDocument14 pagesRobust Test of The January Effect in Stock Markets Using Markov - Switching ModelMădălina MişcodanNo ratings yet

- Robust Test of The January Effect in Stock Markets Using Markov - Switching ModelDocument14 pagesRobust Test of The January Effect in Stock Markets Using Markov - Switching ModelMădălina MişcodanNo ratings yet

- Jofi13100 Sup 0001 Internet AppendixDocument56 pagesJofi13100 Sup 0001 Internet AppendixloannguyenNo ratings yet

- Research Article: Forecasting Stock Market Volatility: A Combination ApproachDocument9 pagesResearch Article: Forecasting Stock Market Volatility: A Combination ApproachShri Krishna BhatiNo ratings yet

- Finding The Seasonal VariationsDocument6 pagesFinding The Seasonal VariationssengpisalNo ratings yet

- A Linear Model of Cyclical GrowthDocument14 pagesA Linear Model of Cyclical GrowthErick ManchaNo ratings yet

- Econometric ReportDocument3 pagesEconometric Reportrao hafeezNo ratings yet

- Mba Sem-1 Decision Science-I - U-12Document18 pagesMba Sem-1 Decision Science-I - U-12VidyaNo ratings yet

- Binder (1998) - RQFA - 11 111-137Document27 pagesBinder (1998) - RQFA - 11 111-137nira_110No ratings yet

- RAresearch 12Document16 pagesRAresearch 12jhay thegreatNo ratings yet

- Components of Time Series Analysis Trends and MaDocument1 pageComponents of Time Series Analysis Trends and MabhupeshjwgarwalNo ratings yet

- Microeconomics Canadian 15th Edition Ragan Solution ManualDocument13 pagesMicroeconomics Canadian 15th Edition Ragan Solution Manualamanda100% (25)

- Solution Manual For Microeconomics Canadian 15Th Edition Ragan 0134378822 9780134378824 Full Chapter PDFDocument34 pagesSolution Manual For Microeconomics Canadian 15Th Edition Ragan 0134378822 9780134378824 Full Chapter PDFjose.clark420100% (13)

- 1.4 Forecasting Data and MethodsDocument4 pages1.4 Forecasting Data and MethodsVicente Camarillo AdameNo ratings yet

- NBP Working PapersDocument31 pagesNBP Working PapersAdminAliNo ratings yet

- ElasticityDocument41 pagesElasticityJang Jang OrtencioNo ratings yet

- Forecasting With Seasonality: Dr. Ron Tibben-Lembke Sept 9, 2003Document10 pagesForecasting With Seasonality: Dr. Ron Tibben-Lembke Sept 9, 2003kaushalsingh2No ratings yet

- Calendar Time PortfolioDocument7 pagesCalendar Time PortfolioLeszek CzapiewskiNo ratings yet

- Wiley Canadian Economics Association: Info/about/policies/terms - JSPDocument18 pagesWiley Canadian Economics Association: Info/about/policies/terms - JSPgageanu_nicoletaNo ratings yet

- 2003 - EngleDocument31 pages2003 - EnglearnoldinNo ratings yet

- Demand Estimation and For CastingDocument4 pagesDemand Estimation and For Castinggadhiya_daxesh47No ratings yet

- OPMANDocument4 pagesOPMANsnow galvezNo ratings yet

- Two Variable Regression Analysis PDFDocument13 pagesTwo Variable Regression Analysis PDFHameem KhanNo ratings yet

- Mca4020 SLM Unit 10Document45 pagesMca4020 SLM Unit 10AppTest PINo ratings yet

- Dechow Et Al - Detecting Earnings Management - PRINTDocument34 pagesDechow Et Al - Detecting Earnings Management - PRINTsyngpapamamaNo ratings yet

- MB0040Document6 pagesMB0040Tusharr AhujaNo ratings yet

- C Ovid-19 Forecast - Final Report: Mechanical Engineering 101/221 To Lean Manufacturing Sara Mcmains May 5, 2021Document34 pagesC Ovid-19 Forecast - Final Report: Mechanical Engineering 101/221 To Lean Manufacturing Sara Mcmains May 5, 2021Matthew NelsonNo ratings yet

- Topic 2 - ForecastingDocument49 pagesTopic 2 - Forecastingfaz143No ratings yet

- Time Series AnalysisDocument5 pagesTime Series AnalysisDaphane Kate AureadaNo ratings yet

- Menu Costs and Phillips CurvesDocument42 pagesMenu Costs and Phillips CurvesRoy OliveraNo ratings yet

- Powerful Forecasting With MS Excel SampleDocument257 pagesPowerful Forecasting With MS Excel SamplelpachasmNo ratings yet

- Are Daily Financial Data Useful For Forecasting GDP? Evidence From MexicoDocument16 pagesAre Daily Financial Data Useful For Forecasting GDP? Evidence From MexicoSarthak GargNo ratings yet

- M05 Rend6289 10 Im C05Document14 pagesM05 Rend6289 10 Im C05Yamin Shwe Sin Kyaw100% (2)

- Growth Dynamics in New Markets: Improving Decision Making through Model-Based ManagementFrom EverandGrowth Dynamics in New Markets: Improving Decision Making through Model-Based ManagementNo ratings yet

- American Marketing Association Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To The Journal of MarketingDocument6 pagesAmerican Marketing Association Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To The Journal of MarketingRachid El MoutahafNo ratings yet

- 1248780Document3 pages1248780Rachid El MoutahafNo ratings yet

- Association of American Geographers and Taylor & Francis, Ltd. Are Collaborating With JSTOR To DigitizeDocument11 pagesAssociation of American Geographers and Taylor & Francis, Ltd. Are Collaborating With JSTOR To DigitizeRachid El MoutahafNo ratings yet

- 184075Document15 pages184075Rachid El MoutahafNo ratings yet

- 3557163Document17 pages3557163Rachid El MoutahafNo ratings yet

- Rationalite Des Anticipations Des Menages. Tests Qualitatifs Sur Donnees Individuelles FrancaisesDocument15 pagesRationalite Des Anticipations Des Menages. Tests Qualitatifs Sur Donnees Individuelles FrancaisesRachid El MoutahafNo ratings yet

- INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Organization ScienceDocument22 pagesINFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Organization ScienceRachid El MoutahafNo ratings yet

- INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Organization ScienceDocument22 pagesINFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Organization ScienceRachid El MoutahafNo ratings yet

- INFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Management ScienceDocument20 pagesINFORMS Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Management ScienceRachid El MoutahafNo ratings yet

- 184075Document15 pages184075Rachid El MoutahafNo ratings yet

- 184075Document15 pages184075Rachid El MoutahafNo ratings yet

- MATH224 (302) EngMaths (NumMeth) FinalExamQ&As 12-06-14Document4 pagesMATH224 (302) EngMaths (NumMeth) FinalExamQ&As 12-06-14syahna rahmahNo ratings yet

- Linear Regression Models, Analysis, and ApplicationsDocument193 pagesLinear Regression Models, Analysis, and ApplicationsWerkson Santana100% (1)

- Ebook Business Analytics 5E PDF Full Chapter PDFDocument67 pagesEbook Business Analytics 5E PDF Full Chapter PDFjerry.matson224100% (26)

- Introduction To Numerical Methods For Variational Problems PDFDocument216 pagesIntroduction To Numerical Methods For Variational Problems PDFmottenerNo ratings yet

- 3 Aplication of Matrice Operations (Larson)Document14 pages3 Aplication of Matrice Operations (Larson)Neo Ndo KoNo ratings yet

- Ch17 Curve FittingDocument44 pagesCh17 Curve Fittingvarunsingh214761No ratings yet

- Fitting and Interpretation of Sediment Rating CurvesDocument21 pagesFitting and Interpretation of Sediment Rating CurvesnguyennghiahungNo ratings yet

- Business AnalyticsDocument12 pagesBusiness AnalyticsArshdeep kaurNo ratings yet

- Modelling and Parameter Estimation of Dynamic SystemsDocument405 pagesModelling and Parameter Estimation of Dynamic SystemsMunish Sharma100% (2)

- E Handbook of Statistical Methods (NIST SEMATECH)Document2,606 pagesE Handbook of Statistical Methods (NIST SEMATECH)QuantDev-M100% (2)

- Basic Estimation Techniques: Eighth EditionDocument16 pagesBasic Estimation Techniques: Eighth EditionbhuvaneshkmrsNo ratings yet

- (Spanos) Statistical Foundations of Econometric ModellingDocument672 pages(Spanos) Statistical Foundations of Econometric ModellingJuliana Tessari100% (3)

- Exercise 04 Linear Regression PDFDocument17 pagesExercise 04 Linear Regression PDFAndreea MusatNo ratings yet

- MBA-015 Business StatisticsDocument7 pagesMBA-015 Business StatisticsA170690No ratings yet

- CASIO Classpad 300 Calculator: A P P E N D I XDocument16 pagesCASIO Classpad 300 Calculator: A P P E N D I XŞükrü ErsoyNo ratings yet

- Approximations of The Aggregate Loss DistributionDocument708 pagesApproximations of The Aggregate Loss DistributionArmai ZsoltNo ratings yet

- Cost Concepts and ClassificationDocument5 pagesCost Concepts and ClassificationSaski AqmarNo ratings yet

- Regression Analysis and Calibration Recommendations For The Characterization of Balance Temperature EffectsDocument23 pagesRegression Analysis and Calibration Recommendations For The Characterization of Balance Temperature EffectsTarık YılmazNo ratings yet

- DC Time Constant EstimationDocument6 pagesDC Time Constant Estimationrasheed313No ratings yet

- Simple Linear Regression Part 1Document63 pagesSimple Linear Regression Part 1_vanitykNo ratings yet

- Cost Terms, Concepts and BehaviorsDocument4 pagesCost Terms, Concepts and BehaviorsYen ChuaNo ratings yet

- Load Forecasting Techniques and Methodologies: A Review: December 2012Document11 pagesLoad Forecasting Techniques and Methodologies: A Review: December 2012John Russell GarciaNo ratings yet

- Ahu Persembe - The Effects of Foreign Direct Investment in Turkey On Export PerformanceDocument20 pagesAhu Persembe - The Effects of Foreign Direct Investment in Turkey On Export PerformanceAhu Oral100% (1)

- Cost Behavior, Activity Analysis, and Cost EstimationDocument45 pagesCost Behavior, Activity Analysis, and Cost EstimationManuel ChaseNo ratings yet

- C !" !! !#$"%&'!$ (#) ( (C !" !!!#$"%+&+'!$ +!%PMDocument8 pagesC !" !! !#$"%&'!$ (#) ( (C !" !!!#$"%+&+'!$ +!%PMing_nistorNo ratings yet

- Funky MathematicsDocument299 pagesFunky Mathematicsemail2mithunNo ratings yet

- Stat 302 Lec 12Document59 pagesStat 302 Lec 12Rehman BukhariNo ratings yet

- Recursive Least-Squares Adaptive Filters: Dr. Yogananda IsukapalliDocument28 pagesRecursive Least-Squares Adaptive Filters: Dr. Yogananda IsukapalliAkilesh MDNo ratings yet

- Accounting & Control: Cost ManagementDocument41 pagesAccounting & Control: Cost ManagementRoristua PandianganNo ratings yet

- The Least-Mean-Square (LMS) Algorithm and Its Geophysical ApplicationsDocument28 pagesThe Least-Mean-Square (LMS) Algorithm and Its Geophysical Applicationswocow86903No ratings yet