Professional Documents

Culture Documents

Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions

Uploaded by

9chand3Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions

Uploaded by

9chand3Copyright:

Available Formats

http://www.cbseguess.

com/

Sample Paper 2013 Class XII Subject Accountancy

Time : 3Hours General instructions :Maximum Marks : 80

i. ii. iii. iv. v. vi.

All questions are compulsory. Working notes must be part of your answer (where require). Avoid overwriting and cutting. Write your roll no. on the question paper. Dont leave blank page/pages in your answer-book . (*) Before a question is an indication of inclusion of value based question.

Part A

1. 2. State any two cases of dissolution of partnership firm by the order of the Court (Sec.44).

Goodwill (According to capitalization of Super profit) = Super profit 100 1

Normal Rate of Return

What do you mean by Super profit in above formula of calculating goodwill?

3. 4.

How is new partner admitted to a partnership firm?

Steffi and Sarapova were partners in a firm. They decided to admit Sania as a partner in the firm and Sania Brought Rs.40,00,000 as premium for goodwill in cash for 1/3rd share in profits. Pass journal entry for distribution of premium for goodwill. 1 What do you mean by Convertible Preference share? 1

5. 6.

State any two purposes for which amount of Securities Premium can be utilised according to Section 78 of the Indian Companies Act, 1956. 1 Why would investor prefer to invest in Debentures of a company rather than in its shares? 1

7.

www.cbseguess.com Other Educational Portals www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com | www.iitguess.com

http://www.cbseguess.com/

8.

The net profit of a firm for the year ended 31st December, 2012 has been duly distributed between its partners A and B in their agreed ratio 3 : 2 respectively. It was discovered on 10 th Jan. 2013 that the under mentioned transactions were not recorded before distribution of Profits: (i) Interest on As Capital Rs.6,000 and interest on Bs Capital Rs.4,000. (ii) Interest on drawings @12% p.a. and drawings of A were Rs.2,000 in each month during the year. Pass an adjustment entry to rectify the above errors. 3 Shivang Ltd. On 1st Jan. 2013 acquired assets of the value of Rs.8,00,000 and liabilities worth Rs.90,000 from Saurya Ltd., at an agreed value of Rs.7,20,000. Shivang Ltd. Issued 12% Debentures of Rs.100 each at a discount of 10% in full satisfaction of purchase consideration. The debentures were redeemable 3 years later at a premium of 5%. Pass journal entries to record the above in the books of Shivang Ltd upto issue of Debentures. 3 Suraj Infrastructure Limited redeemed its 20,000, 15% Debentures of Rs.100 each at a premium of 8% and redemption is carried out in the following ways: i. 25% of the amount due to debentureholders was paid by cheques. ii. 25% of the amount due was paid by conversion into 12% Preference Shares of Rs.50 each issued at 20% premium. iii. 25% of the amount due was paid by conversion into 11% Debentures of Rs.100 each issued at 10% discount. iv. 25% of the amount due was paid by conversion into Equity Shares of Rs.50 each issued at Par. Pass journal entries for redemption of debentures in the books of Suraj Infrastructure Ltd. 3 *Zenny and Zuzu were partners in a firm sharing profits in 7 : 3 ratio. They admitted Sudesh (without any premium for goodwill) for 20% share into partnership who has won 1st position in the national level Laughter competition. However Gogoi brought Rs.2,00,000 as Capital. Sudesh acquired his share equally from Zenny and Zuzu. You are required to i. * Identify one value in admitting Mr. Sudesh into partnership. 1 ii. Pass journal entry for capital brought in by new partner and calculate new profit sharing ratio. 3

9.

10.

11.

www.cbseguess.com Other Educational Portals www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com | www.iitguess.com

http://www.cbseguess.com/

12.

*ZaheerKhan, Ajay Jadeja and Chris Cairn entered into a partnership business of sports equipments on 1st January 2012 with the capitals of Rs.5,00,000 by each. Zaheer Khan also gave a loan of Rs.4,00,000 to the firm after 3 months of starting of their firm.. Partners decided to distribute Rs.1,00,000 sports items to 10 players of the city (In which firm is carrying its business activities) for representing the state in different national level sports competitions. After considering that expense but before considering any interest on loan given by Zaheer Khan the Profits were Rs.3,55,000. Following adjustments are also to be considered : i. Interest on capital is to be allowed @4% p.a. ii. Interest on drawings @6%p.a. Drawings were Ajay Jadeja-Rs.60,000 and Chris Cairns-Rs.40,000 iii. Ajay Jadeja is allowed a commission of 2% on sales. Sales for the year were Rs.20,00,000. iv. 10% of the divisible profits is to be kept in a Reserve Account. You are Required: a.* To state the value in forming the partnership firm and the value served by the partners by taking decision of distributing the sports items among players. 2 b. Show the distribution of profit after considering above adjustments. 4 X Ltd. forfeited 500 shares of Rs.10 each(Rs.6 called-up) issued at a discount of 10% to Ram on which he has paid Rs.3 per share. Out of these 300 shares were re-issued to Z as Rs.8 paid up for 6 per share. (i) Give journal entries for forfeiture and re-issue of shares. 3 (ii) What is the minimum amount at which remaining 200 shares can be reissued as fully paid up. 1 Write the meaning of any two of the following: (i) Sweat equity shares (ii) Minimum Subscription (iii) Reserve Capital A, B and C were partners sharing profits in the ratio of 5 : 3 : 2. Their assets and liabilities as on 31st March 2012 were as follows: Assets: Cash : Rs.16,000 ; Debtors : Rs.16,000 and other assets were Rs.2,34,000. Liabilities: Creditors: Rs.20,000; Employees Compensation Fund: Rs.26,000; As Capital: Rs.1,00,000 Bs Capital: Rs.70,000 and Cs Capital: Rs.50,000. C retires on the above date and it was agreed that: (i) Cs share of Goodwill was Rs.8,000; (ii) 5% provision for doubtful debts was to be made on debtors;

www.cbseguess.com Other Educational Portals www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com | www.iitguess.com

13.

14. 15.

http://www.cbseguess.com/

(iii) Sundry creditors were valued Rs.4,000 more than the book value. Pass necessary journal entries for the above transactions on Cs retirement. 16.

X, Y and Z were partners sharing profits and losses in the ratio of 5:3:2. On 31 st March, 2012 their Assets and Liabilities were as under: Assets : Leasehold Rs.1,25,000 ; Patents Rs.30,000 ; Machinery-Rs.1,50,000; Stock-Rs.1,50,000; Profit & Loss A/c-Rs.40,000 and Cash at Bank- Rs.40,000 Liabilities : Capitals : X-Rs.1,50,000, Y-Rs.1,25,000, Z-Rs.75,000; General Reserve-Rs.30,000 ; Creditors- Rs.1,55,000 X died on 1st August, 2012 and it was agreed that: (i) Goodwill of the firm is to be valued at Rs.3,50,000. (ii) Interest on capital be provided @10% p.a. (iii) Machinery is overvalued by 20% and Patents is undervalued by 25% . (iv) Leasehold to be increased to Rs.1,50,000. (iv) For the purpose of calculating Xs share in the profits of 2012-2013, the profits should be taken to have accrued on the same scale as in 2011-2012, which were Rs.1,50,000. Prepare Revaluation Account and Xs Capital A/c to be rendered to his executor.

17.

Srijan ltd. invited applications for issuing 50,000 equity shares of Rs.10 each. The amount was payable As follows : On Application Rs.3 per share, on allotment Rs.4 per share and balance on 1St and final call. Applications were received for 75,000 shares and pro-rata allotment was made as follows : Applicants for 40,000 shares were allotted 30,000 shares on pro-rata basis. Applicants for 35,000 shares were allotted 20,000 shares on pro-rata basis. Ravi to whom 1,200 shares were allotted out of the group applying for 40,000 shares failed to pay the allotment money. His shares were forfeited immediately after allotment. Shashi, who had applied for 700 shares out of the group applying for 35,000 shares failed to pay the 1st and final call. His shares were also forfeited. All the forfeited shares were reissued for Rs.40,000. Pass necessary journal entries to record the above transactions. 8

OR

www.cbseguess.com Other Educational Portals www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com | www.iitguess.com

http://www.cbseguess.com/

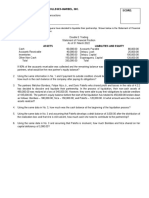

X Ltd. with a nominal capital of Rs.50,00,000 divided into equity shares of Rs10 each, issued 2,00,000 equity shares at a premium of 20%. Amount was payable Rs.3 on application, Rs.5(including premium) on allotment and balance on 1st and Final call after 3 months of allotment. All the shares were applied for and money due on allotment was duly received except one shareholder of 2,000 shares who failed to pay the allotment money, while another shareholder who held 3,000 shares paid for the first and final call also. Expenses on issue of shares were Rs.60,000 which were paid on the date of allotment and written off against the securities premium. Pass the necessary Journal entries in the companys books to record the above transactions upto allotment of shares and show the companys Balance Sheet also. 18. P and Q are in partnership sharing profits and losses in the ratio of 3:2. Their balance sheet as on 31 st March, 2012 was as under: Liabilities Creditors General Reserve Ps Capital Account Qs Capital Account Ps Current Account Q Current Account Rs. 1,50,000 1,20,000 6,00,000 3 00,000 1,00,000 20,000 12,90,000 Assets Cash Debtors Rs.2,00,000 Less: Provision Rs. 8,000 Patents Investments Fixed Assets Goodwill Rs. 50,000 1,92,000 1,48,000 80,000 7,20,000 1,00,000 12,90,000

They admit R on the following terms : i. Additional provision of 1% on debtors is to be created. ii. Accrued Income of Rs.15,000 does not appear in the books and Rs.50,000 are outstanding for salaries. iii. Present market value of investments is Rs.60,000. P takes over the Investments at this value.

www.cbseguess.com Other Educational Portals www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com | www.iitguess.com

http://www.cbseguess.com/

iv. New profit sharing ratio of partners will be 4 : 3 : 2. R will bring in Rs.2,00,000 as his capital. v. R is to pay in cash an amount equal to his share in Firms Goodwill valued at twice the average profits of the last 3 years which were Rs.3,00,000; Rs.2,60,000 and Rs.2,50,000 respectively. vi. Half the amount of goodwill is withdrawn by old partners. You are required to prepare Revaluation Account, Partners Capital A ccounts, Current Accounts and the opening Balance Sheet of the new firm. 8

OR

A, B and C are three partners sharing profits in the ratio of 3 : 1 : 1. On 31st October,2012 they decided to dissolve their firm. On that date assets and liabilities of their firm was as under:Assets : Bank balance- Rs.16,700; Debtors-Rs.24,200; Stock in trade Rs.7,800 Furniture- Rs.1,000 and Sundry Assets- Rs.17,000 Liabilities: Creditors- Rs.6,000; Provision for Bad debts- Rs.1,200; Loan- Rs.1,5000 As Capital- Rs.27,500; Bs Capital- Rs.10,000 and Cs Capital- Rs.7,000 It is agreed that:(i) A is to take over furniture at Rs.1800 and Debtors amounting to Rs.4,200 at Rs.3,600; the Creditors of Rs.6,000 to be paid by him at this figure. (ii) B is to take over all the Stock in Trade at Rs.7,000 and some of the Sundry Assets at Rs.7,200 (being 20% more than book value). (iii) C is to take over the remaining Sundry Assets at 90% of the book value- less Rs.100 as discount and assume the responsibility for the discharge of the loan together with accrued interest of Rs.300 which has not been recorded in the books. (iv) The expenses of dissolution were Rs.1,270. The remaining debtors were sold to a debt collecting agency for 80% of the book value. Prepare necessary Accounts to close the books of the firm.

Part - B

19. 20. State with reason whether repayment of Non-Current Liabilities will result in increase, decrease or no Change in Debt-Equity ratio. 1 *SRF Ltd. earned profit after tax 6 times of the last year and also has very huge cash inflow from its operating Activities. Company decided to distribute 20% of the profit among employees as bonus and

www.cbseguess.com Other Educational Portals www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com | www.iitguess.com

http://www.cbseguess.com/

21. 22.

23.

also decide to upgrade its plant to improve the working conditions. State any value served by the company in such decisions. 1 List any two items which result in inflow of cash and cash equivalent in Financing Activities. 1 State two items for each of the following sub-heads of different major head of Companys Balance Sheet (Write for any three sub-head.): 3 (i) Reserve & Surplus (ii) Long Term Borrowings (iii) Short Term Provisions (iv) Other Current Liabilities (v) Inventories From the following Balance Sheets of Royal Industries as on 31st March, 2011 and 2012, prepare a comparative Balance sheet: 4 Particulars Note 31.03.2011 31.03.2012 No. Rs. Rs. I EQUITY AND LIABILITIES : Shareholders Funds : 5,00,000 8,00,000 Share Capital 1,00,000 1,00,000 Reserve and Surplus Non-Current Liabilities 3,00,000 4,00,000 Long Term Borrowings Current Liabilities 1,00,000 2,00,000 Short Term Borrowings Total 10,00,000 15,00,000 II Assets Non-current Assets : Current Assets : Inventories Trade Receivables Cash & Cash Equivalents Total Rs. 4,00,000 2,00,000 3,00,000 1,00,000 10,00,000 Rs. 6,00,000 3,00,000 4,00,000 2,00,000 15,00,000

24.

Shareholders Fund Rs.6,00,000 ; 12% Debentures Rs.50,000; 10% Mortgage Loan Rs.1,50,000; Total Assets Rs.10,80,000 ; Income tax paid Rs.63,000 ; Rate of Income Tax was 50%. With the help of above information of Rao Limited, Calculate : (i)Debt-Equity ratio (ii) Proprietary Ratio (iii) Interest Coverage ratio. 4 From the following statement, calculate the Cash Generated from Operating Activities :

www.cbseguess.com Other Educational Portals www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com | www.iitguess.com

25.

http://www.cbseguess.com/

Statement of Profit and Loss For the year ended 31st March, 2012 Particulars Revenue from Operations (Sales) Add : Other Income : Profit on sale of machinery Dividend Received Income Tax Refund Total Revenue Less : Employees Benefit Expenses (Salaries) Depreciation Goodwill written off Other Expenses : Rent Loss on sale of Building Profit Before Tax Less : Provision for Tax Net Profit for the Period Less : Appropriations : Proposed Dividend Balance of profit The following additional information is available to you: 31-03-2011 Rs. 50,000 25,000 1,00,000 75,000 25,000

Amount Rs. 85,000 Rs. 5,000 7,000 6,000 18,000 1,03,000 10,000 20,000 8,000 5,000 5,000

48,000 55,000 21,000 34,000 10,000 24,000

Trade Receivables Inventories Cash & Cash Equivalents Trade Payables Other Current Liabilities

31-03-2012 Rs. 60,000 20,000 1,25,000 90,000 15,000

www.cbseguess.com Other Educational Portals www.icseguess.com | www.ignouguess.com | www.dulife.com | www.magicsense.com | www.niosguess.com | www.iitguess.com

You might also like

- Business FinanceDocument199 pagesBusiness FinanceSumanth Muvvala100% (8)

- Leading A Nonprofit OrganizationDocument18 pagesLeading A Nonprofit OrganizationFox Tam100% (5)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-15Document31 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-15allysa amping100% (1)

- Financial Accounting Volume 1Document29 pagesFinancial Accounting Volume 1Ferjeanie Bernandino100% (1)

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Assignment 2. Estimating Adidas' Equity ValueDocument4 pagesAssignment 2. Estimating Adidas' Equity Valuefasihullah1995No ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument11 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsSikha KaushikNo ratings yet

- AccountancyDocument0 pagesAccountancyJaimangal RajaNo ratings yet

- 12 Accountancy Sample Paper 2014 04Document6 pages12 Accountancy Sample Paper 2014 04artisingh3412No ratings yet

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNo ratings yet

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- 2016 12 SP Accountancy Solved 01Document8 pages2016 12 SP Accountancy Solved 01Sto BreakerNo ratings yet

- ACCOUNTANCY-Practice QuestionsDocument6 pagesACCOUNTANCY-Practice QuestionsMary JaineNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- 2015 12 SP Accountancy Unsolved 07Document6 pages2015 12 SP Accountancy Unsolved 07BhumitVashishtNo ratings yet

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraNo ratings yet

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- Accountancy Model QuestionsDocument19 pagesAccountancy Model QuestionsSunil Kumar AgarwalaNo ratings yet

- Test Paper 11Document8 pagesTest Paper 11Sukhjinder SinghNo ratings yet

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Document50 pagesAccountancy: Time Allowed: 3 Hours Maximum Marks: 80Sidharth NahataNo ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- Mock Paper - FinalDocument11 pagesMock Paper - FinalNaman ChotiaNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Document17 pagesCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNo ratings yet

- 12 Accountancy Sample Paper 2014Document26 pages12 Accountancy Sample Paper 2014Rachit JainNo ratings yet

- Accountancy 2018Document18 pagesAccountancy 2018MohamedZiaudeenNo ratings yet

- CBSE 12th Accountancy 2010 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2010 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Document7 pagesAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNo ratings yet

- SAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDocument5 pagesSAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDeepakPhalkeNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2013-14Document24 pagesClass 12 Cbse Accountancy Sample Paper 2013-14Sunaina RawatNo ratings yet

- TH TH STDocument3 pagesTH TH STsharathk916No ratings yet

- Part - A Partnership, Share Capital and Debentures: General InstructionsDocument7 pagesPart - A Partnership, Share Capital and Debentures: General InstructionsGaurav JaiswalNo ratings yet

- Sample Question Paper 2022-23 Acc XiiDocument12 pagesSample Question Paper 2022-23 Acc XiiTûshar ThakúrNo ratings yet

- Holidays Home Work Xii 2023-24Document5 pagesHolidays Home Work Xii 2023-24Akshat TiwariNo ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- Accountancy Set-1 Time Allowed: 3 Hours Maximum Marks: 90 General InstructionsDocument8 pagesAccountancy Set-1 Time Allowed: 3 Hours Maximum Marks: 90 General InstructionsVijayNo ratings yet

- Assessement Test 5 - Partnership Accounts & Goodwill - Docx - 1660529707799Document2 pagesAssessement Test 5 - Partnership Accounts & Goodwill - Docx - 1660529707799Shreya PushkarnaNo ratings yet

- SAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Document16 pagesSAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Shreya PalejkarNo ratings yet

- AccountsDocument59 pagesAccountsrajat0% (1)

- Class-Xii Accountancy (2020-2021) General InstructionsDocument10 pagesClass-Xii Accountancy (2020-2021) General InstructionsSaad AhmadNo ratings yet

- ACC Assignment Questions Extra PractiseDocument20 pagesACC Assignment Questions Extra Practisesikeee.exeNo ratings yet

- 03 - Accounts - Prelims 1Document7 pages03 - Accounts - Prelims 1Pawan TalrejaNo ratings yet

- Cbse-Class 12 Sample PaperDocument24 pagesCbse-Class 12 Sample PapervenumadhavNo ratings yet

- Module-2 Sample Question PaperDocument18 pagesModule-2 Sample Question PaperRay Ch100% (1)

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Document5 pagesSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaNo ratings yet

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulNo ratings yet

- Accountancy Mock Pre Board XIIDocument12 pagesAccountancy Mock Pre Board XIIAmanbir SinghNo ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- 12 2006 Accountancy 4Document5 pages12 2006 Accountancy 4Akash TamuliNo ratings yet

- 12a PP-01 (1N2) AfpDocument6 pages12a PP-01 (1N2) AfpA.c. GuptaNo ratings yet

- Class 12th Accountancy Set BDocument6 pagesClass 12th Accountancy Set BjashanjeetNo ratings yet

- Rbse Class 12 Accountancy Question Paper 2020Document10 pagesRbse Class 12 Accountancy Question Paper 2020rajwanikajal24No ratings yet

- WBHSCMock 2Document4 pagesWBHSCMock 2Smita AdhikaryNo ratings yet

- CBSE 12th Accountancy 2012 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2012 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- Screenshot 2023-11-27 at 1.48.32 PMDocument9 pagesScreenshot 2023-11-27 at 1.48.32 PManupriyakapil85No ratings yet

- Class 12th Accountancy Set ADocument6 pagesClass 12th Accountancy Set AjashanjeetNo ratings yet

- Accountancy Test-40 MarkDocument2 pagesAccountancy Test-40 MarkCharming CuteNo ratings yet

- 06ec72 Dec09 Jan10Document2 pages06ec72 Dec09 Jan109chand3No ratings yet

- 6th Sem Microwave Engineering Lab VivaDocument18 pages6th Sem Microwave Engineering Lab VivaAnand Prakash Singh80% (5)

- Unit - 6 Implementation of FFT AlgorithmDocument6 pagesUnit - 6 Implementation of FFT Algorithm9chand3No ratings yet

- First Internal Question Bank SUB: DSPA (10TE74) DATE: 03/09/2014Document2 pagesFirst Internal Question Bank SUB: DSPA (10TE74) DATE: 03/09/20149chand3No ratings yet

- Ict - NolDocument103 pagesIct - Nolsweetsundari1710No ratings yet

- ScroDocument24 pagesScro9chand3No ratings yet

- RRFFWDocument24 pagesRRFFW9chand3No ratings yet

- Project Work: Sales & Distribution ManagementDocument24 pagesProject Work: Sales & Distribution Managementraavi84187% (15)

- Lab ProgramsDocument24 pagesLab Programs9chand3No ratings yet

- Economic ProjectDocument8 pagesEconomic Project9chand3No ratings yet

- Business ProjectDocument5 pagesBusiness Project9chand3No ratings yet

- Copy (4) of AMULDocument65 pagesCopy (4) of AMULNeeraj RainaNo ratings yet

- 8086Document38 pages8086Nikhil VasudevNo ratings yet

- 08-Serial MainDocument63 pages08-Serial MainYuva RajNo ratings yet

- Project Work: Sales & Distribution ManagementDocument24 pagesProject Work: Sales & Distribution Managementraavi84187% (15)

- AOA AssignmentsDocument5 pagesAOA Assignments9chand3No ratings yet

- 1oops Viva QuestionsDocument24 pages1oops Viva Questions9chand3No ratings yet

- 6sem SyllabusDocument20 pages6sem Syllabus9chand3No ratings yet

- Subject Code: 06es64 SUBJECT NAME: Antennas and PropagationDocument8 pagesSubject Code: 06es64 SUBJECT NAME: Antennas and PropagationShwetha B HegdeNo ratings yet

- 6sem SyllabusDocument20 pages6sem Syllabus9chand3No ratings yet

- AOA Intractable ProblemsDocument14 pagesAOA Intractable Problems9chand3No ratings yet

- AOA Intractable ProblemsDocument14 pagesAOA Intractable Problems9chand3No ratings yet

- Aoa HDDDocument2 pagesAoa HDD9chand3No ratings yet

- AOA Introduction InfoSysDocument10 pagesAOA Introduction InfoSysmurthy_oct24No ratings yet

- Consumer AwarnessDocument13 pagesConsumer Awarness9chand3No ratings yet

- AOA PreludeDocument6 pagesAOA Prelude9chand3No ratings yet

- AOA Analysis of Well Known AlgorithmsDocument29 pagesAOA Analysis of Well Known AlgorithmsBalaji JadhavNo ratings yet

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Document58 pagesAccountancy: Time Allowed: 3 Hours Maximum Marks: 809chand3No ratings yet

- Business Studies: Sample Paper - 2013 Class - XII SubjectDocument4 pagesBusiness Studies: Sample Paper - 2013 Class - XII Subject9chand3No ratings yet

- Asian Paints ProjectDocument3 pagesAsian Paints ProjectRahul SinghNo ratings yet

- SQA Accounting Assignment 1Document7 pagesSQA Accounting Assignment 1SENITH J100% (1)

- Finance Group Assignment Week 13Document3 pagesFinance Group Assignment Week 13Rahman Armenzaria100% (1)

- Saints of India and Destiny K N RaoDocument36 pagesSaints of India and Destiny K N RaomitrasahNo ratings yet

- Karur Vysya BankDocument18 pagesKarur Vysya BankVishalPandeyNo ratings yet

- FPSC Accounting Mcqs Pakmcqs - Com .PKDocument102 pagesFPSC Accounting Mcqs Pakmcqs - Com .PKJibran KhalilNo ratings yet

- Psre 2400 PDFDocument19 pagesPsre 2400 PDFAJ PeredoNo ratings yet

- Case Solution 1Document18 pagesCase Solution 1maham nazirNo ratings yet

- PT Intanwijaya Internasional TBK 2016 - Revised PDFDocument67 pagesPT Intanwijaya Internasional TBK 2016 - Revised PDFHarry RayNo ratings yet

- Bharti Airtel: PrintDocument1 pageBharti Airtel: Printvivek singhNo ratings yet

- Business Valuations: Net Asset Value (Nav)Document9 pagesBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNo ratings yet

- Accountancy For LawyersDocument21 pagesAccountancy For LawyersAlex LoveNo ratings yet

- Applying IFRS: IFRS 12 - Example Disclosures For Interests in Unconsolidated Structured EntitiesDocument24 pagesApplying IFRS: IFRS 12 - Example Disclosures For Interests in Unconsolidated Structured Entitiesnicolai aquino0% (1)

- Pretest LiquidationsDocument1 pagePretest LiquidationsMondays AndNo ratings yet

- Analysis of India Cement LTD 2011Document19 pagesAnalysis of India Cement LTD 2011Kr Nishant100% (1)

- Project-Report - Sangam AlmirahDocument59 pagesProject-Report - Sangam Almirahsarfraz alamNo ratings yet

- Theories: Far Eastern University - Manila Quiz No. 1Document6 pagesTheories: Far Eastern University - Manila Quiz No. 1Kenneth Christian WilburNo ratings yet

- BIM 3rd Semester New Syllabus 2023Document12 pagesBIM 3rd Semester New Syllabus 2023Wave Wo100% (1)

- Pfrs For Micro, Small and Medium Entities (Msmes) : (Revised SRC Rule 68 (Links To An External Site.)Document20 pagesPfrs For Micro, Small and Medium Entities (Msmes) : (Revised SRC Rule 68 (Links To An External Site.)Celine Kaye AbadNo ratings yet

- RMC No 46-2014 Financial LeaseDocument3 pagesRMC No 46-2014 Financial LeaseArnold ApduaNo ratings yet

- Finance Project ReportDocument7 pagesFinance Project Reporthamzaa mazharNo ratings yet

- C01 Accounting in ActionDocument37 pagesC01 Accounting in Actionsadrubhai05spNo ratings yet

- Finance Ch4Document41 pagesFinance Ch4Tofig HuseynliNo ratings yet

- Study Material Accountancy 2023-24 - 2Document129 pagesStudy Material Accountancy 2023-24 - 2amrita100% (1)

- Nobles Acctg10 PPT 01Document61 pagesNobles Acctg10 PPT 01Tayar ElieNo ratings yet