Professional Documents

Culture Documents

ITR62 Form 15 CA

Uploaded by

Mohit47Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITR62 Form 15 CA

Uploaded by

Mohit47Copyright:

Available Formats

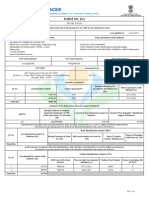

FORM NO.

15CA (See rule 37BB) Income-Tax Department Information to be furnished for payments, chargeable to tax, to a non-resident not being a company, or to a foreign company Ack. No.

Part A (To be filled up if the remittance is chargeable to tax and does not exceed fifty thousand rupees and the aggregate of such remittances made during the financial year does not exceed two lakh fifty thousand rupees) Name of remitter REMITTER PAN of the remitter (if available) TAN of the remitter (if available) Complete address, email and phone number of the remitter Status of remitter1 Name of recipient of remittance PAN of the recipient of remittance, if available2 Complete address, email3 and phone number4 of the recipient of remittance Country to which remittance is made Amount payable before TDS (In Indian Currency) Aggregate amount of remittance made during the financial year including this proposes remittance REMITTANCE Name of bank Name of the branch of the bank Proposed date of remittance Nature of remittance Tax deducted (a) Amount of tax deducted (b) Date of deduction VERIFICATION I/We*, _______________________ (full name in block letters), son/daughter of _______________________ in the capacity of _________ (designation) solemnly declare that the information given above is true to the best of my knowledge and belief and no relevant information has been concealed. I/We* further undertake to submit the requisite documents for enabling the income-tax authorities to determine the nature and amount of income of the recipient of the above remittance as well as documents required for determining my liability under the Income-tax Act as a person responsible for deduction of tax at source. Place: _____________________ Signature: _____________________

Date: _____________________ Designation: _____________________ * Delete whichever is not applicable. 1 . Write 1 if company, write 2 if firm, write 3 if individual and write 4 if others.

REMITTEE

2. 3.

If the remittance is chargeable to tax, non-furnishing of PAN shall attract the provisions of section 206AA. If available. 4. If available. Part B (To be filled up if the remittance is chargeable to tax and exceeds fifty thousand rupees and the aggregate of such remittances made during the financial year exceeds two lakh fifty thousand rupees) Section A Name of the remitter PAN of remitter REMITTER Area Code Principal Place of Business Complete address, email and phone number of the remitter Status ii Name of remittance REMITEE Status iv Address Principal place of business Email address Country to wish remittance is made: (ISD code) Number ( (a) Name of the Accountant signing the certificate ACCOUNTANT (b) Name of accountant (c) Address (d) Registration no. of the accountant (e) Date of certificate (DD/MM/YYYY) Certificate No.

vi v

GENERAL INFORMATION Area Code AO Type Range Code AO No

TAN of remitter i

In case of company - If domestic, write 'l' and if other than domestic, --write '2' recipient of PAN of recipient remittance iii of

-Phone )

the

proprietorship/firm

of

the

A.O. ORDER

(a) Whether any order/ certificate u/s 195(2)/ (Tick) 195(3)/ 197 of Income-tax Act has been obtained from the Assessing Officer. (b) Section under which order/certificate has been obtained (c) Name and designation of the Assessing Officer who issued the order/certificate (d) Date of order/certificate (e) Order/certificate number

Yes

No

Section B 1. 2. 3. REMITTANCE 4. 5.

PARTICULARS OF REMITTANCE AND TDS (as per certificate of the accountant Country to which remittance is made Amount payable ____________________ Name of the Bank ___________________ BSR Code of the bank branch (7 digit) Proposed date of remittance (DD/MM/YYYY) 6. 7. 8. Nature of remittance agreement/document as per Yes No Country : __________________ Currency : In foreign currency __________ Branch of the Bank __________ In Indian Rs.

In case the remittance is net of taxes, (Tick) whether tax payable has been grossed up? Taxability under the provisions of the Income-tax Act (without considering DTAA) (a) the relevant section of the Act under which the remittance is covered (b) the amount of income chargeable to tax (c) the tax liability (d) basis of determining taxable income and tax liability

I.T. ACT

9.

If any relief is claimed under DTAA(i) Whether tax residency certificate is (Tick) obtained from the recipient of remittance (ii) Please specify relevant DTAA

Yes

No

(iii) Please specify relevant article of DTAA Nature of payment as per DTAA (iv) Taxable income as per DTAA (v) Tax liability as per DTAA DTAA In Indian Rs. _______________ In Indian Rs. _______________ Yes No

A. If the remittance is for royalties, fee for (Tick) technical services, interest, dividend. etc, (not connected with permanent establishment) please indicate :(a) Article of DTAA

(b) Rate of TDS required to be deducted in As per DTAA (%) __________ terms of such article of the applicable DTAA B. In case the remittance is on account of (Tick) business income, please indicate:(a) The amount of income liable to tax in India Yes No

(b) The basis of arriving at the rate of deduction of tax. C. In case the remittance is on account of (Tick) capital gains, please indicate:(a) amount of long term capital gains (b) amount of short-term capital gains (c) basis of arriving at taxable income D. In case of other remittance not covered (Tick) by sub-items A, B and C (a) Please specify nature of remittance (b) Whether taxable in India as per DTAA (c) If yes, rate of TDS required to be deducted in terms of such article of the applicable DTAA (d) if not, please furnish brief reasons thereof specifying relevant article of DTAA 10. 11. TDS Amount of tax deducted at source Rate of TDS In foreign currency __________ In Indian Rs. _______________ As per Income-tax Act (%) or As per DTAA (%) 12. 13. Actual amount of remittance after TDS Date of deduction of tax at source, if any (DD/MM/YYYY) VERIFICATION 1. I/We*________________________ (full name in block letters), son/daughter of ________________________ in the capacity of ________________________ (designation) solemnly declare that the information given above is true to the best of my/our* knowledge and belief and no relevant Information has been concealed. 2. I/We* certify that a certificate has been obtained from an accountant, particulars of which are given in this Form, certifying the amount, nature and correctness of deduction of tax at source. I/We* certify that certificate/order under section 195(2)/195(3)/197 of the Income-tax Act, 1961, particulars of which are given in this Form*. 3. In case where it is found that the tax actually deductible on the amount of remittance has not been deducted or after deduction has not been paid or not paid in full, I/We* undertake to pay the amount of tax not deducted or not paid, as the case may be along with interest due. I/We* shall also be subject to the provisions of penalty for the said default as per the provisions of the Income-tax Act, 1961. 4. 1/We* further undertake to submit the requisite documents for enabling the Income-tax Authorities to determine the nature and amount of income of the recipient of the above remittance as well as documents required for determining my/our liability under the Income-tax Act, 1961 as a .person responsible for deduction of tax at source. 5. I/We* further declare that I/we* am/are* furnishing this information in my/our* capacity as and I/we* am/are* also competent to sign the return of income as per provisions of section 140 of the Income-tax Act, 1961 and verify it. In foreign currency __________ Yes No Yes No

Place: _______________________ Date: _______________________ * Delete whichever is not applicable. For Office Use only

Signature: _______________________ Designation: _______________________ For Office Use Only Receipt No. _______________________ Date _______________________ Seal and Signature of receiving official _____________________________

In case TAN is applied for, please furnish acknowledgement number of the application. Write 1 if company. Write 2 if firm. Write 3 if individual and Write 4 if others. iii In case of non-availability of PAN, provisions of section 206AA shall be applicable. iv Write 1 if company, Write 2 if firm, Write 3 if individual and Write 4 if others. v Accountant (other than an employee) shall have the same meaning as defined in the Explanation to Section 288 of Income-tax Act, 1961. vi Please fill the serial number as mentioned in the certificate of the accountant

ii

You might also like

- Revised Form A2 Cum Application FormDocument3 pagesRevised Form A2 Cum Application FormnoshadNo ratings yet

- 15 CaDocument8 pages15 CadamanNo ratings yet

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekaleNo ratings yet

- Re-KYC Diligence of NRE or NRO or FCNR (B) AccountDocument4 pagesRe-KYC Diligence of NRE or NRO or FCNR (B) AccountMahendran KuppusamyNo ratings yet

- Remittance Certificate ChecklistDocument8 pagesRemittance Certificate ChecklistAnuj GuptaNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Tax Clearance FormDocument1 pageTax Clearance FormJhen FigueroaNo ratings yet

- Form No. 15CBDocument3 pagesForm No. 15CBParth UpadhyayNo ratings yet

- Dtaa AnnexureDocument4 pagesDtaa AnnexureAkansha SharmaNo ratings yet

- FACTA-CRS Non Individual Declaration FormDocument1 pageFACTA-CRS Non Individual Declaration FormGSTMS ANSARINo ratings yet

- Form 15ca FormatDocument4 pagesForm 15ca FormattejashtannaNo ratings yet

- Form 16Document3 pagesForm 16Bijay TiwariNo ratings yet

- Undetaking For Remittance For NRDocument5 pagesUndetaking For Remittance For NRhds1979No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Declaration For Rekyc Non IndividualsDocument2 pagesDeclaration For Rekyc Non IndividualsPartha SundarNo ratings yet

- Form No. 15CB: B 1. Country To Which Remittance Is MadeDocument3 pagesForm No. 15CB: B 1. Country To Which Remittance Is MadeDaman GillNo ratings yet

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document7 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Tejas SompuraNo ratings yet

- Form No 16Document4 pagesForm No 16Md ZhidNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Self CertificationDocument6 pagesSelf CertificationGuocheng MaNo ratings yet

- LRSFormDocument3 pagesLRSFormtirthendu senNo ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument5 pagesRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNo ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- GST Note & Faqs Jan. 2018Document29 pagesGST Note & Faqs Jan. 2018Prakash C RaavudiNo ratings yet

- Tax Hand Book of KPTCL 16-02-16Document111 pagesTax Hand Book of KPTCL 16-02-16Prasad IyengarNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- A1 For Import Goods PaymentsDocument3 pagesA1 For Import Goods PaymentskollarajasekharNo ratings yet

- Revised Request Letter Format For Import Remittance (Advance & Direct)Document3 pagesRevised Request Letter Format For Import Remittance (Advance & Direct)SALE EXECUTIVES75% (4)

- CRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaDocument6 pagesCRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaJoris RectoNo ratings yet

- VAT Procedure in MaharashtraDocument14 pagesVAT Procedure in MaharashtraDeva DrillTechNo ratings yet

- CRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Document2 pagesCRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Salman ArshadNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- A 1 FormDocument3 pagesA 1 FormRajeev Kumar100% (1)

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

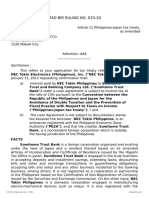

- BirDocument6 pagesBirbge5No ratings yet

- 15 G Form (Blank)Document2 pages15 G Form (Blank)nst27No ratings yet

- LetterDocument3 pagesLetteranupam_saha_9No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNo ratings yet

- Fatca Non Individual Form Annexure IIDocument6 pagesFatca Non Individual Form Annexure IIabhijit_bhandurge5011No ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- 15G FormDocument2 pages15G Formgrover.jatinNo ratings yet

- CRS Entity (Organization)Document7 pagesCRS Entity (Organization)Muhammad HarisNo ratings yet

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Document2 pages(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNo ratings yet

- Who Are Not Required To File Income Tax ReturnsDocument2 pagesWho Are Not Required To File Income Tax ReturnsCarolina VillenaNo ratings yet

- Form DVAT 09 Cover Page: Application For Cancellation of Registration Under Delhi Value Added Tax Act, 2004Document4 pagesForm DVAT 09 Cover Page: Application For Cancellation of Registration Under Delhi Value Added Tax Act, 2004hhhhhhhuuuuuyyuyyyyyNo ratings yet

- Request LetterDocument4 pagesRequest LetterMayur JoshiNo ratings yet

- For Re-KYC Nredocument NRI - 18.5Document4 pagesFor Re-KYC Nredocument NRI - 18.5rajucbit_2000No ratings yet

- Form A1Document13 pagesForm A1Ben DennisNo ratings yet

- Request For Converting Resident Indian' Savings Bank (SB) Account Into NRO SB AccountDocument9 pagesRequest For Converting Resident Indian' Savings Bank (SB) Account Into NRO SB AccountnevinkoshyNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- FORM6Document9 pagesFORM6syampnaiduNo ratings yet

- Pan Card Application FormDocument15 pagesPan Card Application Formrmp3shoresNo ratings yet

- Form 9Document2 pagesForm 9Aprajita SharmaNo ratings yet

- Form 1: (See Section 7, 54 & 135 and Rule 20 (1) )Document3 pagesForm 1: (See Section 7, 54 & 135 and Rule 20 (1) )Mohit47No ratings yet

- FORM Parichay PatraDocument5 pagesFORM Parichay PatraHirendra Pratap Singh100% (3)

- Form 1 PDFDocument1 pageForm 1 PDFHerbert AnisionNo ratings yet

- Form 1 PDFDocument1 pageForm 1 PDFHerbert AnisionNo ratings yet

- Instructions For Form W-7: (Rev. November 2018)Document14 pagesInstructions For Form W-7: (Rev. November 2018)AndreeaNo ratings yet

- How To Compute Quarterly Income Tax ReturnDocument20 pagesHow To Compute Quarterly Income Tax ReturnJo LouiseNo ratings yet

- Piedmont Pricing ProcedureDocument113 pagesPiedmont Pricing ProcedureDipankar BiswasNo ratings yet

- Final Income TaxationDocument15 pagesFinal Income TaxationElizalen MacarilayNo ratings yet

- Salient Features of Sukanya Samriddhi YojanaDocument3 pagesSalient Features of Sukanya Samriddhi Yojanajha.sofcon5941No ratings yet

- Abdul Alim Salary SheetDocument2 pagesAbdul Alim Salary SheetSabbir AhmedNo ratings yet

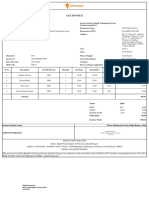

- Swiggy Lunch HDLBDocument1 pageSwiggy Lunch HDLBskhNo ratings yet

- Indirect TaxDocument3 pagesIndirect TaxRupal DalalNo ratings yet

- The GST Council 28th MeetingDocument2 pagesThe GST Council 28th Meetingphani raja kumarNo ratings yet

- Interest Rates For Fixed DepositsDocument2 pagesInterest Rates For Fixed Depositssaurav katarukaNo ratings yet

- Tax Form 2013 (Trinidad)Document5 pagesTax Form 2013 (Trinidad)Natasha ThomasNo ratings yet

- 022 Cir vs. Marubeni Corporation GR No. 137377Document1 page022 Cir vs. Marubeni Corporation GR No. 137377Anonymous MikI28PkJcNo ratings yet

- Chapt-13 Income Taxes - Partnerships, Estates & TrustsDocument11 pagesChapt-13 Income Taxes - Partnerships, Estates & Trustshumnarvios100% (6)

- Bir Ruling 2021 - DST On Loan Exemption by PezaDocument5 pagesBir Ruling 2021 - DST On Loan Exemption by Pezajohn allen MarillaNo ratings yet

- UADC 2020 Interim Income Statement (FINAL)Document2 pagesUADC 2020 Interim Income Statement (FINAL)YameteKudasaiNo ratings yet

- BIR Form Page 2Document1 pageBIR Form Page 2Mark De JesusNo ratings yet

- 1040es Estimated Tax 2014 For IndividualsDocument12 pages1040es Estimated Tax 2014 For IndividualsClaudia MaldonadoNo ratings yet

- Efu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0Document1 pageEfu Life Assurance LTD.: Total 20,480 Provisional Sales Tax 0.0 0ASAD RAHMANNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Games NathanNo ratings yet

- Pensioners Live CirtificateDocument2 pagesPensioners Live CirtificateSravan KumarNo ratings yet

- Capital Gains Tax and Documentary Stamp Tax: Multiple Choice: Choose The Best Possible AnswerDocument16 pagesCapital Gains Tax and Documentary Stamp Tax: Multiple Choice: Choose The Best Possible AnswerMaryane AngelaNo ratings yet

- What Is Community Tax?: Speaker: Valerie A. OngDocument25 pagesWhat Is Community Tax?: Speaker: Valerie A. Ongmarz busaNo ratings yet

- Cir Vs CastanedaDocument2 pagesCir Vs CastanedaAyra CadigalNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountYash SinghviNo ratings yet

- May PurchasesDocument1 pageMay Purchasessrinivasa annamayyaNo ratings yet

- Lazaro Hernandez Roque 6751 W Indian School RD PHOENIX, AZ 85033Document2 pagesLazaro Hernandez Roque 6751 W Indian School RD PHOENIX, AZ 85033Rielzaruxo Ka Rioelzarux Ko XNo ratings yet

- The Following Are Several Transactions of Ardery Company That OccurredDocument1 pageThe Following Are Several Transactions of Ardery Company That OccurredTaimur TechnologistNo ratings yet

- Dec22 - Compliance CalendarDocument4 pagesDec22 - Compliance CalendarArman KhanNo ratings yet

- Chapter 12 Tax Answer KeyDocument5 pagesChapter 12 Tax Answer Keyjustine reine cornico100% (1)

- Task 3 - Task TemplateDocument1 pageTask 3 - Task TemplateShahvaiz AliNo ratings yet