Professional Documents

Culture Documents

Choice, Utility, Demand

Uploaded by

Mohit RakyanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Choice, Utility, Demand

Uploaded by

Mohit RakyanCopyright:

Available Formats

INTERMEDIATE MICROECEONOMICS BA (HONOURS) ECONOMICS, MIRANDA HOUSE SEMESTER 3, 2013-14 PRACTICE QUESTIONS True/False/Uncertain 1.

If you know the slope of the budget constraint for two goods, X and Y, then you know the prices of the two goods, X and Y. Explain. 2. A person who gives money away to people on the street does not have preferences that can be represented by a utility function. 3. If Patrick's utility function is U ( x , y ) = x y and Julie's utility function is U(x,y) = x1/2 y1/2, then Patrick will always derive more happiness than Julie does from any combination of x and y . 4. A monotonic transformation of a utility function does not change the marginal rate of substitution at any point. 5. If Lori has downward-sloping indifference curves, then this is the same thing as saying that she prefers averages to extremes. 6. If Steve is maximizing U(x,y) subject to a budget constraint, then at the maximal point, the marginal utilities of x and y will be equal.

Short Answer 1. Keith's preferences over cars are described as follows: One car is preferred to another if its fuel efficiency is lower by 2 km/lt. Otherwise Keith is indifferent between the two. Are Keith's preferences complete? Are they transitive? Can they be represented by a utility function. 2. Mr. Smith likes cashews better than almonds and likes almonds better than walnuts. He likes pecans equally well as macadamia nuts and prefers macadamia nuts to almonds. Assuming his preferences are transitive, which does he prefer i. pecans or walnuts? ii. cashew or macadamia? Picabo, an aggressive skier, spends her entire income on skis and bindings. (Binding are the mechanism by which skiers attach their boots to the skis.) a. If Picabo wears out one pair of bindings for every one pair of skis, graph her indifference curves for skis and bindings, illustrating bindings on the horizontal axis and skis on the vertical axis. b. If Picabo wears out two pairs of bindings for every one pair of skis, graph her indifference curves for skis and bindings, illustrating bindings on the horizontal axis and skis on the vertical axis. c. Now assume that Picabo has $5,760 in income to spend on binding and skis each year. Skis cost $480 per pair, and bindings cost $240 per pair. i. Graph Picabo's optimal consumption bundle for skis and bindings under the assumptions in part a). ii. Graph Picabo's optimal consumption bundle for skis and bindings under the assumptions in part b).

3.

4.

Paula, a former actress, spends all her income attending plays and movies. She likes plays exactly three times as much as she likes movies. a. b. Graph Paula's indifference curves, illustrating plays on the horizontal axis and movies on the vertical axis. Paula earns $120 per week. If tickets to plays cost $12 each and tickets to movies cost $5 each, graph her optimal consumption bundle, illustrating plays on the horizontal axis and movies on the vertical axis.

5.

Sally likes peppermint candy canes in her hot chocolate. Specifically, she will only drink hot chocolate with 2 candy canes in each cup. Sally has a weekly income of $15 to spend on hot chocolate and candy canes. Hot chocolate costs $1.50 per cup. For the purposes of deriving Sally's demand curve for candy canes, use the following three prices for candy canes: P1=$0.25, P2=$0.50, and P3=$0.75. Draw two separate graphs. On the top graph, illustrate the three optimal consumption points. On the bottom graph, illustrate Sally's demand curve.

6. Consumer A has utility function u(x,y)=x1/3y2/3. Provide an expression that describes the consumer maximization problem. Derive the optimal bundle when px=10, py=5 and I=60. How does the bundle change if py=10? 7. Consumer B's utility for goods x1 and x2 is described by u(x1,x2)=x1ax2b. Prices and income are given by p1; p2 and I. Derive consumer A's demand for goods x1 and x2. What are the shares of income spent on goods x1 and x2, respectively? How do the shares change if the price of good x1 doubles?

8. Consumer C's preferences are described by the utility function u(x,y)=sqrt(xy). Her desired utility level is given by the parameter u*. Given prices px and py, derive the expenditure-minimizing bundle of goods that provides this level of utility u*. Describe how the consumption of goods x and y changes in response to changes in u*, px and py. 9. Maximize u(x,y)=x1/2+y subject to pxx+pyy=I. You may need to consider different solutions for different values of the parameters. Briefly explain your solution.

10. Suppose there are three commodities, all of which can be consumed in any non-negative amount, and a consumer has a utility function u ( x 1 , x 2 , x 3 ). The consumer's choice of a commodity bundle must satisfy the budget inequality: P1 + P2 + P3 < m, where P1 , P2 , P3 and m denote the market prices and income, respectively (all assumed to be strictly positive). If the marginal utility for each commodity is positive (all commodities are goods), is it possible that a utility maximizing consumer will choose a commodity bundle which costs less than m? Explain your answer. Prove that if m were to increase, while prices remain unchanged, the demand for at least one commodity will increase, i.e., at least one commodity is a normal good.

11. Suppose a consumer has an income of $25 and buys 10 apples and 5 oranges when the price of apples is $2 and that of oranges is $1. At another time, the same consumer is observed consuming 5 apples and 10 oranges when the price of apples is $1 and that of oranges is $2. Is this behavior consistent with utility maximization? Explain. (A diagram will help). You may assume that the consumer's income and tastes remain unchanged during the period these observations were made. Also assume that both commodities are goods. 12. Consumer 1 has a utility function u(x1, x2) = x1 x2 and consumer 2 has a utility function u(x1, x2) = min(x1, x2). Derive the demand functions for each consumer. a. Suppose each consumer has income of $90 and the market prices are p1 = 1, p2 =1. How much does each consumer demand of each commodity? b. Suppose the government needs to raise revenues through taxation the two proposals being considered are the following: i. a specific tax of $ 1 per unit will be imposed on commodity 2. This means that the consumers will face a new price of $2 for commodity 2. For every unit of commodity 2 that a consumer buys the government collects $1. ii. a lump-sum tax of $30 on each consumer. This means that the prices remain (1,1) but each consumers disposable incomes goes down from $90 to $60. How much total revenue does the government collect from policy (A)? How much does it collect from policy (B)? Does consumer 1 prefer one tax policy to the other? If so, which one and why? Make the same comparison for consumer 2. Based on your answers can you conclude that one kind of tax policy is better than the other? Explain.

13. Derive the demand functions for the utility function U(x1 , x2) = x11/2 + x21/2 a. Assume that the consumption of both commodities in non-negative and that prices and income are strictly positive. You do not need to explicitly use the Lagrangian for the derivation but state clearly why the solution to the consumer's problem is unique. For example, if you get a tangency solution state clearly why there is no corner solution. b. What are the demands when p1 = p2 = 1 and m = 4? Suppose the price of commodity 1 goes up to 2 (but p2 remains unchanged). Of course, if income remains unchanged, the consumer is made worse-off. Suppose the consumer succeeds in convincing her employer that her income should be raised to m' so that even after p1 goes up from 1 to 2, she can still just afford to buy her original demand bundle. What is the value of m'? c. Sketch the original budget line, the original demand, and the new budget line. Although the consumer can now continue to consume the original commodity bundle (before the change in p1 and m), is it rational to do so? From your figure can you argue that the consumer is actually better-off with this new budget line? d. Use your derivation of the demand functions to compute the demands on the new budget line, and use these to prove that the consumer is better-off on the new line. (Use the utility function to check whether or not one bundle is better than another). e. Calculate the value of income, m*, which would leave the utility of the consumer unchanged, after p1 goes up to 2 but p2 remains unchanged. In other words, find the value of m* such that when the budget line is 2x1 + x2 = m*, the consumer's utility remains the same as it was with the original demand bundle.

14. (Special credit) Consider the consumption maximization problem of young John D. Rockefeller in 1855. He chooses to work hours L for wage w, since he is only a clerk in the merchant house of Hewitt & Tuttle. He must choose how to spend his income on two goods: clothing C and housing H, from which he derives utility via utility function U = Ca + Ha L where a (0,1). Suppose that prices of one year of rent for housing and on year's worth of clothing are r and p, respectively. 1. Solve for Rockefeller's optimal choice of L1 , C1, H1. 2. It is now 1872, and John D. Rockefeller has just finished consolidating his competitors in oil refining to form Standard Oil. His hourly wage has now jumped to W> w . He still lives in the same small house in Cleveland as he did in 1855, though, since he still has time left on his lease. Solve for his optimal choice of C2 and L2. 3. At the end of the year, Rockefeller's lease is finally up, so he can choose housing freely. Solve for his new choices of L3,C3, and H3. 4. In which period did Rockefeller work the most?

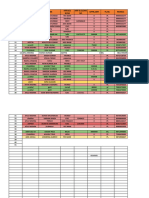

You might also like

- Problems With Solutions Part 1 PDFDocument19 pagesProblems With Solutions Part 1 PDFyirgaNo ratings yet

- Harvard Economics 2020a Problem Set 3Document2 pagesHarvard Economics 2020a Problem Set 3JNo ratings yet

- Instructions: Students May Work in Groups On The Problem Set. Each Student Must Turn in His/her OWNDocument16 pagesInstructions: Students May Work in Groups On The Problem Set. Each Student Must Turn in His/her OWNHamna AzeezNo ratings yet

- Consumer Theory Practice ProblemsDocument22 pagesConsumer Theory Practice Problemsben114No ratings yet

- Consumer 1Document15 pagesConsumer 1krishna murariNo ratings yet

- Week 3 Theory of The Consumer Questions1Document25 pagesWeek 3 Theory of The Consumer Questions1Hiếu MinhNo ratings yet

- Practice Problem Set 2Document7 pagesPractice Problem Set 2AkshayNo ratings yet

- BS 110 Assignment 1Document4 pagesBS 110 Assignment 1Mario Rioux JnrNo ratings yet

- MBA OUM Demo Lecture QuestionsDocument15 pagesMBA OUM Demo Lecture Questionsmup100% (2)

- Microeconomics SPRING 2020 Elasticity: Elastic?Document4 pagesMicroeconomics SPRING 2020 Elasticity: Elastic?Nayeli Ramirez100% (1)

- Midterm Answers 2016Document14 pagesMidterm Answers 2016Manan ShahNo ratings yet

- Econ201 Quiz 4Document10 pagesEcon201 Quiz 4arichard88215No ratings yet

- Demand and Supply AnalysisDocument48 pagesDemand and Supply AnalysisSaJa M YounesNo ratings yet

- Worksheet - 2 Demand & SupplyDocument2 pagesWorksheet - 2 Demand & SupplyPrince SingalNo ratings yet

- CH 2Document11 pagesCH 2ceojiNo ratings yet

- FALL2019 ECON2113 HomeworkDocument9 pagesFALL2019 ECON2113 HomeworkNamanNo ratings yet

- Problem Set 3 - SolutionDocument9 pagesProblem Set 3 - SolutionAditi Goyal100% (1)

- Pre-Test Chapter 18 Ed17Document7 pagesPre-Test Chapter 18 Ed17dware2kNo ratings yet

- Elesticity of DemandDocument48 pagesElesticity of DemandDr.Ashok Kumar Panigrahi100% (1)

- ECON 102 Midterm 2012W2Document7 pagesECON 102 Midterm 2012W2examkillerNo ratings yet

- Utility and DemandDocument47 pagesUtility and DemandAnkush BhoriaNo ratings yet

- MicroeconomicsDocument10 pagesMicroeconomicsCarlos Funs0% (1)

- Akbulut Sample Midterm 1Document11 pagesAkbulut Sample Midterm 1tony4dongNo ratings yet

- Microeconomics Problem Set 3Document10 pagesMicroeconomics Problem Set 3Thăng Nguyễn BáNo ratings yet

- Microeconomics Assignment - Kobra SoltaniDocument8 pagesMicroeconomics Assignment - Kobra SoltanibaqirNo ratings yet

- Answers To Summer 2010 Perfect Competition QuestionsDocument7 pagesAnswers To Summer 2010 Perfect Competition QuestionsNikhil Darak100% (1)

- Chapter 3: Practice Quiz: U (X, Y) 4x + 2yDocument2 pagesChapter 3: Practice Quiz: U (X, Y) 4x + 2yKyleNo ratings yet

- Basics of Industrial Motor Control: 440 Electrical and Electronic DrivesDocument103 pagesBasics of Industrial Motor Control: 440 Electrical and Electronic DrivesBilly Busway0% (1)

- Chapter 4-Elasticity Practice QuestionsDocument6 pagesChapter 4-Elasticity Practice QuestionsTrung Kiên Nguyễn100% (1)

- 178.200 06-4Document34 pages178.200 06-4api-3860979No ratings yet

- 201 Sample Midterm1Document4 pages201 Sample Midterm1SooHan MoonNo ratings yet

- Constrained Cost MinimisationDocument3 pagesConstrained Cost MinimisationYogish PatgarNo ratings yet

- CH 04Document40 pagesCH 04Mohammed Aljabri100% (1)

- The Measurement and Structure of The National Economy: Numerical ProblemsDocument0 pagesThe Measurement and Structure of The National Economy: Numerical ProblemsNaga Manasa K0% (1)

- EC 102 Revisions Lectures - Macro - 2015Document54 pagesEC 102 Revisions Lectures - Macro - 2015TylerTangTengYangNo ratings yet

- ECON 201 Practice Test 2 (Chapter 5, 6 and 21)Document9 pagesECON 201 Practice Test 2 (Chapter 5, 6 and 21)Meghna N MenonNo ratings yet

- Harvard Economics 2020a Problem Set 2Document2 pagesHarvard Economics 2020a Problem Set 2J100% (2)

- Measuring A Nation'S Income: Questions For ReviewDocument4 pagesMeasuring A Nation'S Income: Questions For ReviewNoman MustafaNo ratings yet

- Case Study 1 Demand and Supply of Wii Console Questions and DiscussionsDocument29 pagesCase Study 1 Demand and Supply of Wii Console Questions and DiscussionsVisitacion Sunshine Baradi100% (1)

- Mid-Term Exam (With Answers)Document12 pagesMid-Term Exam (With Answers)Wallace HungNo ratings yet

- UNIT II Exercises SolutionsDocument8 pagesUNIT II Exercises Solutionsvajra1 1999No ratings yet

- Practice Multiple Choice1Document11 pagesPractice Multiple Choice1rajman22No ratings yet

- AP Econ Practice Test #2, Chapters 5-9Document83 pagesAP Econ Practice Test #2, Chapters 5-9Rodger12100% (1)

- Market Failure Essay Questions - Set 2Document1 pageMarket Failure Essay Questions - Set 2HàLinhNo ratings yet

- End Term MEP 16 With AnswersDocument9 pagesEnd Term MEP 16 With AnswersVimal AnbalaganNo ratings yet

- Solved The Equation For A Demand Curve Has Been Estimated ToDocument1 pageSolved The Equation For A Demand Curve Has Been Estimated ToM Bilal SaleemNo ratings yet

- Est For BTECHDocument2 pagesEst For BTECHRakesh SharmaNo ratings yet

- Theories of Foeign Exchange DeterminationDocument57 pagesTheories of Foeign Exchange DeterminationPakki Harika MeghanaNo ratings yet

- How Is National Income Distributed To The FactorsDocument26 pagesHow Is National Income Distributed To The FactorsSaurav kumar0% (2)

- EC101 Revision Questions - Graphical Analysis - SolutionsDocument10 pagesEC101 Revision Questions - Graphical Analysis - SolutionsZaffia AliNo ratings yet

- Econ Q and ADocument93 pagesEcon Q and AGel Mi Amor100% (1)

- Managerial Economics Topic 5Document65 pagesManagerial Economics Topic 5Anish Kumar SinghNo ratings yet

- Compensated Demand CurveDocument4 pagesCompensated Demand CurveTado LehnsherrNo ratings yet

- What Are The Important Properties of Indifference Curves?Document4 pagesWhat Are The Important Properties of Indifference Curves?Khalil AhmedNo ratings yet

- HBSE 11th Business Studies 2018 PaperDocument7 pagesHBSE 11th Business Studies 2018 PaperRajiv KharbandaNo ratings yet

- Assignment From Lecture IV: 1. Multiple Choice QuestionsDocument6 pagesAssignment From Lecture IV: 1. Multiple Choice QuestionsJ. NawreenNo ratings yet

- EC203 - Problem Set 2 - KopyaDocument3 pagesEC203 - Problem Set 2 - KopyaKyle MckinseyNo ratings yet

- EC203 - Problem Set 2Document3 pagesEC203 - Problem Set 2Yiğit KocamanNo ratings yet

- Problem Set 3Document2 pagesProblem Set 3iannaNo ratings yet

- Methods of Microeconomics: A Simple IntroductionFrom EverandMethods of Microeconomics: A Simple IntroductionRating: 5 out of 5 stars5/5 (2)

- Cre PDFDocument4 pagesCre PDFMohit RakyanNo ratings yet

- Normal CaseDocument2 pagesNormal CaseMohit RakyanNo ratings yet

- Q3FY18 Earnings Report Adani Enterprises LTD: Net Sales Turnover Ebitda Margin PAT Margin Net ProfitDocument5 pagesQ3FY18 Earnings Report Adani Enterprises LTD: Net Sales Turnover Ebitda Margin PAT Margin Net ProfitMohit RakyanNo ratings yet

- Date Time Section BDocument8 pagesDate Time Section BMohit RakyanNo ratings yet

- Formula SheetDocument7 pagesFormula SheetMohit RakyanNo ratings yet

- 27 Chem 30 Maths 31 Maths 27 Trans 10 - 11 1 Eco 2eng Limit Os Sum 31 9-10 Definite 1 3 PH P Block 6 Chem 8 Maths 13 Maths 14 Eng 31 STDocument1 page27 Chem 30 Maths 31 Maths 27 Trans 10 - 11 1 Eco 2eng Limit Os Sum 31 9-10 Definite 1 3 PH P Block 6 Chem 8 Maths 13 Maths 14 Eng 31 STMohit RakyanNo ratings yet

- Assignment Chapters 7-10Document1 pageAssignment Chapters 7-10Mohit RakyanNo ratings yet

- 3550 Ch3Q KeyDocument6 pages3550 Ch3Q KeyMohit RakyanNo ratings yet

- Wage SettingDocument3 pagesWage SettingMohit RakyanNo ratings yet

- Class XII: Unit 16: Chemistry in Everyday LifeDocument2 pagesClass XII: Unit 16: Chemistry in Everyday LifeMohit RakyanNo ratings yet

- Kudos - 4 21 14Document1 pageKudos - 4 21 14Stephanie Rose GliddenNo ratings yet

- BS 2898Document16 pagesBS 2898jiwani87No ratings yet

- Totality Rule-Kinds of ActionsDocument8 pagesTotality Rule-Kinds of ActionsAisha TejadaNo ratings yet

- The Assessment of The Training Program For Employees of VXI Business Process Outsourcing Company 1 1Document36 pagesThe Assessment of The Training Program For Employees of VXI Business Process Outsourcing Company 1 1Sofia SanchezNo ratings yet

- 1st Class: Certificate of Posting For Online PostageDocument1 page1st Class: Certificate of Posting For Online PostageEllie JeanNo ratings yet

- Boston Consulting Group Matrix (BCG Matrix)Document19 pagesBoston Consulting Group Matrix (BCG Matrix)c-191786No ratings yet

- CPM TerminologyDocument27 pagesCPM TerminologyHaytham S. AtiaNo ratings yet

- AWS High Performance ComputingDocument47 pagesAWS High Performance ComputingNineToNine Goregaon East MumbaiNo ratings yet

- Iop - 21 01 2021Document29 pagesIop - 21 01 2021Ravi0% (1)

- HBC 2103 Mathematics For BusinessDocument4 pagesHBC 2103 Mathematics For BusinessJohn MbugiNo ratings yet

- May 22Document2 pagesMay 22digiloansNo ratings yet

- SCC/AQPC Webinar: SCOR Benchmarking & SCC Member Benefits: Webinar Joseph Francis - CTO Supply Chain CouncilDocument23 pagesSCC/AQPC Webinar: SCOR Benchmarking & SCC Member Benefits: Webinar Joseph Francis - CTO Supply Chain CouncilDenny SheatsNo ratings yet

- WORKING CAPITAL MANAGEMENT of Axis Bank Finance Research 2014Document112 pagesWORKING CAPITAL MANAGEMENT of Axis Bank Finance Research 2014Indu Gupta82% (11)

- (Te Fu Chen) Implementing New Business Models PDFDocument396 pages(Te Fu Chen) Implementing New Business Models PDFdsdamosNo ratings yet

- Compendium of GOs For Epc in AP PDFDocument444 pagesCompendium of GOs For Epc in AP PDFPavan CCDMC100% (1)

- Social Cost Benefit AnalysisDocument13 pagesSocial Cost Benefit AnalysisMohammad Nayamat Ali Rubel100% (1)

- Chap 012Document14 pagesChap 012HassaanAhmadNo ratings yet

- Abid RehmatDocument5 pagesAbid RehmatSheikh Aabid RehmatNo ratings yet

- Assignment Unit1Document2 pagesAssignment Unit1Akhil DayaluNo ratings yet

- FABM2 (QUIZ 2) November 09, 2020 Ian BregueraDocument2 pagesFABM2 (QUIZ 2) November 09, 2020 Ian Breguerafennie ilinah molinaNo ratings yet

- Corporate Identity ManualDocument54 pagesCorporate Identity ManualAleksandra Ruzic67% (3)

- USPTO TTAB Cancellation 92050564 For NETBOOK (Psion Teklogix)Document6 pagesUSPTO TTAB Cancellation 92050564 For NETBOOK (Psion Teklogix)savethenetbooks100% (2)

- Vimi - Resume UptDocument1 pageVimi - Resume Uptapi-278914207No ratings yet

- MillWorker EnglishDocument10 pagesMillWorker EnglishRajveer SinghNo ratings yet

- PasarLaut PDFDocument39 pagesPasarLaut PDFSantoso Muhammad ImanNo ratings yet

- Chapter 8 - Direct Investment and Collaborative StrategiesDocument34 pagesChapter 8 - Direct Investment and Collaborative StrategiesGia GavicaNo ratings yet

- QB PDFDocument18 pagesQB PDFThanooz MuthukuruNo ratings yet

- BrochureDocument12 pagesBrochureKundan KushwahaNo ratings yet

- Report On VoltassDocument37 pagesReport On VoltassDharmendra Pratap SinghNo ratings yet

- Designing Good Fiscal System FinalDocument54 pagesDesigning Good Fiscal System Finalbillal_m_aslamNo ratings yet