Professional Documents

Culture Documents

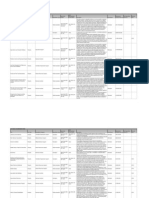

TAD 1 Tax Increment and Maximum Percentage Calcultions Page

Uploaded by

CityStink AugustaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAD 1 Tax Increment and Maximum Percentage Calcultions Page

Uploaded by

CityStink AugustaCopyright:

Available Formats

Attachment number 3 \nPage 40

Assessed Valuation of Redevelopment Area*

The redevelopment area defined in this Redevelopment Plan has a current 2008 fair market value of $ 520,804,370 and an assessed (40%) value of $ 208,321,748 that is taxable, according to Augusta-Richmond County tax records. The last few years of assessments show that the tax base of the proposed redevelopment area has not contributed to the overall growth of the county for decades. In fact, property values within the proposed TAD declined during the last few years while the overall county assessments increased in value. Pursuant to the Redevelopment Powers Law, upon adoption of the Redevelopment Plan and the creation of the tax allocation district, the Augusta-Richmond County Commission will request that the Commissioner of Revenue of the State of Georgia certify the tax base for 2008, the base year for the tax allocation district. Once this Redevelopment Plan and Augusta TAD are approved and the financing of public improvements is implemented via pay-as-you-go or the issuance of tax allocation bonds, this area is expected to stimulate private investment that will expand the tax base. In addition, the redevelopment proposed is intended to create an environment that encourages additional new development in the district - a spillover effect - leading to an overall increase in property values that further improves revenue generation within the City and County.

Tax Allocation Increment Base Value*

On or before December 30, 2008, the Augusta-Richmond County Commission will apply to the Georgia State Revenue Commissioner for a determination of the tax allocation increment base of the proposed tax allocation district. The base assessed value is estimated as follows:

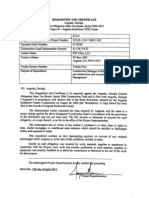

Augusta Tax Allocation District Parcel Information, 2008 (Amended 11/2013)

Total Number of Parcels (Taxable) Total Area (Taxable)

7,630 Approximately 4645 acres

Total Assessed Value (40%) of Taxable Parcels in the Augusta TAD (2008) $208,321,748 Total Assessed Value of Taxable Parcels in Augusta-Richmond County (2008) $ 3,700,435,246 Value of TAD as a Percent of the City of Augusta's Total Tax Digest (2008) .0562 %

Total Property Taxes Collected to Serve as the Increment Base

Property Taxes that will serve as the base will depend on whether the property is located in the urban services district or in the suburban district and whether the School Board participates. To determine the base value, the assessed value of the taxable property will be multiplied by the applicable millage rate. For parcels located in the urban services district both the millage rate for the County Incorporated and the Augusta Urban City Service (along with the Board of Education millage rate if applicable) would be used and for the suburban district

Item # 2

Another Tool Helping to Build One Augusta

Page 39

You might also like

- Tad One Resolution Amended 2010 With HighlightsDocument75 pagesTad One Resolution Amended 2010 With HighlightsCityStink AugustaNo ratings yet

- Augusta TAD 1 2013 AmendmentDocument102 pagesAugusta TAD 1 2013 AmendmentCityStink AugustaNo ratings yet

- TAD 4 Plan Saying LOST UnneededDocument1 pageTAD 4 Plan Saying LOST UnneededCityStink AugustaNo ratings yet

- 04-12-2004 HeeryDocument24 pages04-12-2004 HeeryCityStink AugustaNo ratings yet

- TAD 4 Tax Increment and Maximum Percentage Calcultions PageDocument1 pageTAD 4 Tax Increment and Maximum Percentage Calcultions PageCityStink AugustaNo ratings yet

- ARC Amendment 4 013012 ExecutedDocument3 pagesARC Amendment 4 013012 ExecutedCityStink AugustaNo ratings yet

- TAD Homeowner ExampleDocument1 pageTAD Homeowner ExampleCityStink AugustaNo ratings yet

- TAD 2 Tax Increment and Maximum Percentage Calcultions PageDocument1 pageTAD 2 Tax Increment and Maximum Percentage Calcultions PageCityStink AugustaNo ratings yet

- Example TAD District and General Fund DisplacementDocument1 pageExample TAD District and General Fund DisplacementCityStink AugustaNo ratings yet

- TAD 4 Resolution LOST FundsDocument1 pageTAD 4 Resolution LOST FundsCityStink AugustaNo ratings yet

- Proposal Letter Heery May 2013Document3 pagesProposal Letter Heery May 2013CityStink AugustaNo ratings yet

- Heery 2011 InvoiceDocument1 pageHeery 2011 InvoiceCityStink AugustaNo ratings yet

- Heery Augusta Contract 2004Document22 pagesHeery Augusta Contract 2004CityStink AugustaNo ratings yet

- Heery 2010 ModificationDocument7 pagesHeery 2010 ModificationCityStink AugustaNo ratings yet

- Tee ReaDocument12 pagesTee ReaCityStink AugustaNo ratings yet

- RWA Certification General Obligation Sales Tax BondDocument1 pageRWA Certification General Obligation Sales Tax BondCityStink AugustaNo ratings yet

- Lori Davis GORA 10312012 ResponseDocument2 pagesLori Davis GORA 10312012 ResponseCityStink AugustaNo ratings yet

- RWA Certification General Obligation Sales Tax BondDocument1 pageRWA Certification General Obligation Sales Tax BondCityStink AugustaNo ratings yet

- Primary and Major Issues - Tee Reciprocal Easement AgreementDocument2 pagesPrimary and Major Issues - Tee Reciprocal Easement AgreementCityStink AugustaNo ratings yet

- Primary and Major Issues - Management AgreementDocument5 pagesPrimary and Major Issues - Management AgreementCityStink AugustaNo ratings yet

- Lori Davis GORA Response 10262012 - Conference Center LeaseDocument20 pagesLori Davis GORA Response 10262012 - Conference Center LeaseCityStink AugustaNo ratings yet

- Primary and Major Issues - Catering AgreementDocument2 pagesPrimary and Major Issues - Catering AgreementCityStink AugustaNo ratings yet

- TEE Center Worksession1032012Document20 pagesTEE Center Worksession1032012CityStink AugustaNo ratings yet

- Primary and Major Issues - Amended COREDocument1 pagePrimary and Major Issues - Amended CORECityStink AugustaNo ratings yet

- RSPD Core Agreement (00455906-10)Document21 pagesRSPD Core Agreement (00455906-10)CityStink AugustaNo ratings yet

- The Augusta Convention CenterDocument2 pagesThe Augusta Convention CenterCityStink AugustaNo ratings yet

- Conference Center 2008 ScheduleDocument1 pageConference Center 2008 ScheduleCityStink AugustaNo ratings yet

- Tee Catering Definitions From 9-2012 AgreementDocument3 pagesTee Catering Definitions From 9-2012 AgreementCityStink AugustaNo ratings yet

- 1999 Core Agreement Conference Center - RevenuesDocument1 page1999 Core Agreement Conference Center - RevenuesCityStink AugustaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lopez vs. City of Manila, G.R. No. 127139, Feb. 19, 1999Document14 pagesLopez vs. City of Manila, G.R. No. 127139, Feb. 19, 1999Vox PopuliNo ratings yet

- Property Tax Impact 2010Document5 pagesProperty Tax Impact 2010GazetteonlineNo ratings yet

- Urban Renewal: Improving Cities Through Tax Increment FinancingDocument6 pagesUrban Renewal: Improving Cities Through Tax Increment FinancingashimaNo ratings yet

- Mark Property Tax ReceiptDocument2 pagesMark Property Tax Receiptpeterson greyNo ratings yet

- Reclassification of LandsDocument3 pagesReclassification of LandsStan Lee100% (2)

- Module 3 The New Standard Chart of Accounts PDFDocument24 pagesModule 3 The New Standard Chart of Accounts PDFcha11No ratings yet

- MIAA Exempt from Pasay RPTDocument1 pageMIAA Exempt from Pasay RPTeizNo ratings yet

- 08 - Manila Electric Co (MERALCO) Vs Central BankBoard of Assessment Appeals 114 SCRA 273Document3 pages08 - Manila Electric Co (MERALCO) Vs Central BankBoard of Assessment Appeals 114 SCRA 273Jarvin David ResusNo ratings yet

- Concepts in Federal Taxation 2016 23rd Edition Murphy Test Bank 1Document39 pagesConcepts in Federal Taxation 2016 23rd Edition Murphy Test Bank 1hiedi100% (32)

- Chapter No.18 Manual XVII: Under Clause 4 (B) (Xvii) of Chapter II of The Right To Information Act, 2005Document75 pagesChapter No.18 Manual XVII: Under Clause 4 (B) (Xvii) of Chapter II of The Right To Information Act, 2005Anonymous lfw4mfCmNo ratings yet

- Basic Taxation Reviewer For Taxation 1 in The Philippines by Atty AbanDocument51 pagesBasic Taxation Reviewer For Taxation 1 in The Philippines by Atty AbanStruggleizreal LoyalCarrotNo ratings yet

- Sindh Land Revenue Act 1967Document62 pagesSindh Land Revenue Act 1967Tarique Jamali100% (1)

- City vs Shell: Groundwater UseDocument106 pagesCity vs Shell: Groundwater UseVan John MagallanesNo ratings yet

- Contract To Sell: WitnessethDocument4 pagesContract To Sell: WitnessethNicki BombezaNo ratings yet

- PubCorp Digitel Vs Province of PangasinanDocument6 pagesPubCorp Digitel Vs Province of PangasinanElla CardenasNo ratings yet

- Natural Resources and Environmental Law 13: GR No. 98332Document6 pagesNatural Resources and Environmental Law 13: GR No. 98332King RodilNo ratings yet

- CRES2015 Module1 Mocknov302015Document29 pagesCRES2015 Module1 Mocknov302015Law_PortalNo ratings yet

- Income Taxation by Nick Aduana Answer KeyDocument113 pagesIncome Taxation by Nick Aduana Answer KeyJonbon Tabas100% (1)

- 2017-An Ordinance Enacting The Revised Pasig Revenue CodeDocument194 pages2017-An Ordinance Enacting The Revised Pasig Revenue CodeRandy PaderesNo ratings yet

- UNIVERSITY OF THE PHILIPPINES vs. CITY TREASURER OF QUEZON CITYDocument2 pagesUNIVERSITY OF THE PHILIPPINES vs. CITY TREASURER OF QUEZON CITYPrincessClarizeNo ratings yet

- Abhyudaya NagarDocument2 pagesAbhyudaya NagarAshish PawarNo ratings yet

- 2016budget FBCAD PDFDocument444 pages2016budget FBCAD PDFO'Connor AssociateNo ratings yet

- Valuation and Assessment of Immovable Property PDFDocument27 pagesValuation and Assessment of Immovable Property PDFDanang UTNo ratings yet

- Manila Revenue CodeDocument149 pagesManila Revenue CodeDiego B. GarciaNo ratings yet

- Survey of Makati RatesDocument5 pagesSurvey of Makati RatesMarcus DoroteoNo ratings yet

- DETAILED TAX SUMMARY FOR 2166 RED OAK CIRCLEDocument2 pagesDETAILED TAX SUMMARY FOR 2166 RED OAK CIRCLEAlicia RuckerNo ratings yet

- Plainview Grocery Store CID and TIF in Wichita, KansasDocument15 pagesPlainview Grocery Store CID and TIF in Wichita, KansasBob WeeksNo ratings yet

- Ahmedabad City Development PlanDocument180 pagesAhmedabad City Development Planapi-1746277675% (4)

- Tax 2 Outline (Consolidated)Document24 pagesTax 2 Outline (Consolidated)MRNo ratings yet

- A Guide To Condominium Living by Inland Property ManagementDocument7 pagesA Guide To Condominium Living by Inland Property Managementapi-283790301No ratings yet