Professional Documents

Culture Documents

Limitations of Ratio Analysis

Uploaded by

Jahanzeb Hussain QureshiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Limitations of Ratio Analysis

Uploaded by

Jahanzeb Hussain QureshiCopyright:

Available Formats

USESANDLIMITATIONSOFRATIOANALYSIS As noted earlier, ratio analysis is used by three main groups: (1) managers, who employ ratios to help

p analyze, control, and thus improve their firms operations; (2) credit analysts, including bank loan officers and bond rating analysts, who analyze ratios to help ascertain a companys ability to pay its debts; and (3) stock analysts, who are interested in a companys efficiency, risk, and growth prospects. In later chapters we will look more closely at the basic factors that underlie each ratio, which will give you a better idea about how to interpret and use ratios. Note, though, that while ratio analysis can provide useful information concerning a companys operations and financial condition, it does have limitations that necessitate care and judgment. Some potentialproblemsarelistedbelow: 1.Manylargefirmsoperate different divisions indifferentindustries,andfor such companies it is difficult to develop a meaningful set of industry averages. Therefore, ratio analysis is more useful for small, narrowly focused firmsthanforlarge,multidivisionalones. 2. Most firms want to be better than average, so merely attaining average performance is not necessarily good. As a target for highlevel performance, it is best to focus on the industry leaders ratios. Benchmarking helps in this regard. 3. Inflation may have badly distorted firms balance sheetsrecorded values are often substantially different from true values. Further, since inflation affects both depreciation charges and inventory costs, profits are also affected. Thus, a ratio analysis for one firm over time, or a comparative analysisoffirmsofdifferentages,mustbeinterpretedwithjudgment. 4. Seasonal factors can also distort a ratio analysis. For example, the inventory turnover ratio for a food processor will be radically different if the balancesheetfigureusedforinventoryistheonejustbeforeversusjustafter the close of the canning season. This problem can be minimized by using monthly averages for inventory (and receivables) when calculating turnover ratios.

5.Firmscanemploywindowdressingtechniquestomaketheirfinancial statements look stronger. To illustrate, a Chicago builder borrowed on a twoyear basis on December 29, 2001, held the proceeds of the loan as cash for a few days, and then paid off the loan ahead of time on January 2, 2002. This improved his current and quick ratios, and made his yearend 2001 balance sheet look good. However, the improvement was strictly window dressing;aweeklaterthebalancesheetwasbackattheoldlevel. 6. Different accounting practices can distort comparisons. As noted earlier, inventory valuation and depreciation methods can affect financial statements and thus distort comparisons among firms. Also, if one firm leases a substantial amount of its productive equipment, then its assets may appear low relative to sales because leased assets often do not appear on the balancesheet.Atthesametime,theliabilityassociatedwiththelease obligation may not be shown as a debt. Therefore, leasing can artificially improve both the turnover and the debt ratios. However, the accounting professionhastakenstepstoreducethisproblem. 7. It is difficult to generalize about whether a particular ratio is good or bad. For example, a high current ratio may indicate a strong liquidity position, which is good, or excessive cash, which is bad (because excess cash in the bank is a nonearning asset). Similarly, a high fixed assets turnover ratiomaydenoteeitherafirmthatusesitsassets efficiently or one that is undercapitalized and cannot afford to buy enough assets. 8. A firm may have some ratios that look good and others that look bad, making it difficult to tell whether the company is, on balance, strong or weak. However, statistical procedures can be used to analyze the net effects of a set of ratios. Many banks and other lending organizations use such procedures to analyze firms financial ratios, and then to classify them accordingtotheirprobabilityofgettingintofinancialtrouble.15 Ratio analysis is useful, but analysts should be aware of these problems and make adjustments as necessary. Ratio analysis conducted in a mechanical, unthinking manner is dangerous, but used intelligently and with good judgment,itcanprovideusefulinsightsintoafirmsoperations.

You might also like

- Looking For Warning Signs Within The Financial StatementsDocument4 pagesLooking For Warning Signs Within The Financial StatementsShakeel IqbalNo ratings yet

- Financial Ratio Analysis IDocument12 pagesFinancial Ratio Analysis IumavensudNo ratings yet

- Limitations of Ratio AnalysisDocument1 pageLimitations of Ratio AnalysisumairNo ratings yet

- Usese & Profitability Ratio AnalysisDocument3 pagesUsese & Profitability Ratio AnalysisztgaffNo ratings yet

- Accounting RatiosDocument5 pagesAccounting RatiosNaga NikhilNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisShalemRaj100% (1)

- Fundamental Analysis Liquidity RatiosDocument43 pagesFundamental Analysis Liquidity RatiosEftinoiu Catalin100% (1)

- Final Accounts ConclusionsDocument6 pagesFinal Accounts ConclusionsayeshaNo ratings yet

- Financial Ratio Analysis IDocument12 pagesFinancial Ratio Analysis IManvi Jain0% (1)

- Horizontal Analysis - Horizontal Analysis Is Used in Financial Statement Analysis To CompareDocument3 pagesHorizontal Analysis - Horizontal Analysis Is Used in Financial Statement Analysis To CompareShanelle SilmaroNo ratings yet

- Financial and Accounting Digital Assignment-2Document22 pagesFinancial and Accounting Digital Assignment-2Vignesh ShanmugamNo ratings yet

- ADL 03 Accounting For Managers V3Document21 pagesADL 03 Accounting For Managers V3Amit RaoNo ratings yet

- Ratio AnalysisDocument57 pagesRatio AnalysisShaik Sajid AhmedNo ratings yet

- ADL 03 Accounting For Managers V3final PDFDocument22 pagesADL 03 Accounting For Managers V3final PDFgouravNo ratings yet

- Meaning of Ratio AnalysisDocument31 pagesMeaning of Ratio AnalysisPrakash Bhanushali100% (1)

- Ratio AnalysisDocument4 pagesRatio AnalysisJohn MuemaNo ratings yet

- Seprod Ratio AnalysisDocument41 pagesSeprod Ratio AnalysisGerron Thomas100% (1)

- Asodl Accounts Sol 1st SemDocument17 pagesAsodl Accounts Sol 1st SemIm__NehaThakurNo ratings yet

- Cost of Goods Sold: 1. Gross Profit MarginDocument10 pagesCost of Goods Sold: 1. Gross Profit MarginYuga ShiniNo ratings yet

- CH 04 Study GuideDocument10 pagesCH 04 Study GuideJessNo ratings yet

- Session 2 Additional NotesDocument9 pagesSession 2 Additional NotesDang Minh HaNo ratings yet

- Finantial Statement AnalysisDocument19 pagesFinantial Statement AnalysisShaekh AzmiNo ratings yet

- The main limitations of a balance sheetDocument5 pagesThe main limitations of a balance sheetRiyas ParakkattilNo ratings yet

- REVIEWER Chapter 3 Analysis of Financial StatementsDocument7 pagesREVIEWER Chapter 3 Analysis of Financial StatementsKim DavilloNo ratings yet

- Module Fs AnalysisDocument12 pagesModule Fs AnalysisCeejay RoblesNo ratings yet

- Financial Statement Analysis GuideDocument3 pagesFinancial Statement Analysis GuideAmit KumarNo ratings yet

- Ch5 - Financial Statement AnalysisDocument39 pagesCh5 - Financial Statement AnalysisLaura TurbatuNo ratings yet

- Financial Evaluation of Co Operative Credit SocietyDocument48 pagesFinancial Evaluation of Co Operative Credit SocietyGLOBAL INFO-TECH KUMBAKONAMNo ratings yet

- Analyzing PNB's Financial RatiosDocument73 pagesAnalyzing PNB's Financial RatiosPrithviNo ratings yet

- Analysis of Financial StatementsDocument12 pagesAnalysis of Financial StatementsMulia PutriNo ratings yet

- Tools of Financial AnalysisDocument16 pagesTools of Financial AnalysisShubham MohabeNo ratings yet

- Financial Analysis - Kotak Mahindra BankDocument43 pagesFinancial Analysis - Kotak Mahindra BankKishan ReddyNo ratings yet

- 2M AmDocument27 pages2M AmMohamed AbzarNo ratings yet

- Asset Liability MGMTDocument23 pagesAsset Liability MGMTEkta chodankarNo ratings yet

- FINMANDocument16 pagesFINMANSecret SecretNo ratings yet

- Synopsis of Financial Analysis of Indian Overseas BankDocument8 pagesSynopsis of Financial Analysis of Indian Overseas BankAmit MishraNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisRam KrishnaNo ratings yet

- WCM - FULL PROJECT - FINANCE - CommentsDocument54 pagesWCM - FULL PROJECT - FINANCE - CommentsAmit KhannaNo ratings yet

- Sorsogon State University module analyzes financial statementsDocument11 pagesSorsogon State University module analyzes financial statementserickson hernanNo ratings yet

- Limitations of Ratio Analysis: Creative AccountingDocument2 pagesLimitations of Ratio Analysis: Creative AccountingGerron ThomasNo ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementsRoland BimohartoNo ratings yet

- FMA (Comperative Project On Ratio Analysis Managerial Tool)Document13 pagesFMA (Comperative Project On Ratio Analysis Managerial Tool)PowerPoint GoNo ratings yet

- Financial RatiosDocument27 pagesFinancial RatiosVenz LacreNo ratings yet

- Financial Statement AnalysisDocument14 pagesFinancial Statement AnalysisJosephine MoranteNo ratings yet

- Financial Statement Analysis CourseworkDocument8 pagesFinancial Statement Analysis Courseworkpqltufajd100% (2)

- CHAPTER 6hshshsWPS OfficeDocument78 pagesCHAPTER 6hshshsWPS OfficeKris Van HalenNo ratings yet

- Financial RatiosDocument30 pagesFinancial RatiosVenz LacreNo ratings yet

- Financial Statement Analysis GuideDocument110 pagesFinancial Statement Analysis GuidevidhyabalajiNo ratings yet

- Project Ratio Analysis 3Document57 pagesProject Ratio Analysis 3anusuyanag2822100% (1)

- Proj 3.0 2Document26 pagesProj 3.0 2Shivam KharuleNo ratings yet

- Basanta FinalDocument5 pagesBasanta FinalDirty RajanNo ratings yet

- FSA 8e Ch11 SMDocument62 pagesFSA 8e Ch11 SMhomeworkping1No ratings yet

- BCO 10 Block 02 1Document52 pagesBCO 10 Block 02 1Madhumitha ANo ratings yet

- Ratio AnalysisDocument9 pagesRatio Analysisbharti gupta100% (1)

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisNEHA BUTTTNo ratings yet

- AFM Project Ratio AnalysisDocument41 pagesAFM Project Ratio AnalysisBharat GhoghariNo ratings yet

- Limitations of Balance SheetDocument6 pagesLimitations of Balance Sheetshoms_007No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Bata Om ProjectDocument14 pagesBata Om ProjectJahanzeb Hussain Qureshi100% (1)

- Kq4502006enc 001Document196 pagesKq4502006enc 001Jahanzeb Hussain QureshiNo ratings yet

- Abstract TransparencyDocument4 pagesAbstract TransparencyJahanzeb Hussain QureshiNo ratings yet

- Names of CitiesDocument1 pageNames of CitiesJahanzeb Hussain QureshiNo ratings yet

- Financial Analysis TechniquesDocument16 pagesFinancial Analysis TechniquesJahanzeb Hussain QureshiNo ratings yet

- Easy CarDocument1 pageEasy CarJahanzeb Hussain QureshiNo ratings yet

- Expanding Chipotle's Healthy MenuDocument10 pagesExpanding Chipotle's Healthy MenuJahanzeb Hussain QureshiNo ratings yet

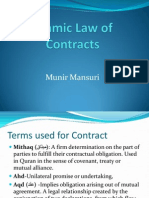

- Islamic Law of ContractsDocument81 pagesIslamic Law of ContractsJahanzeb Hussain Qureshi67% (3)

- Merrill Lynch - How To Read A Financial ReportDocument53 pagesMerrill Lynch - How To Read A Financial Reportstephenspw92% (12)

- Discussion On Taxes Budget 2013-14Document16 pagesDiscussion On Taxes Budget 2013-14Jahanzeb Hussain QureshiNo ratings yet

- Feasability Report Ice Cream ParlourDocument5 pagesFeasability Report Ice Cream ParlourJahanzeb Hussain QureshiNo ratings yet

- Jetblue AirwaysDocument8 pagesJetblue AirwaysJahanzeb Hussain Qureshi50% (2)

- International Business (Case Studies)Document12 pagesInternational Business (Case Studies)Jahanzeb Hussain QureshiNo ratings yet

- Financial Analysis TechniquesDocument16 pagesFinancial Analysis TechniquesJahanzeb Hussain QureshiNo ratings yet

- Human NatureDocument1 pageHuman NatureJahanzeb Hussain QureshiNo ratings yet

- Pakistan Federal Budget - A New Beginning in Difficult TimesDocument21 pagesPakistan Federal Budget - A New Beginning in Difficult TimesJahanzeb Hussain QureshiNo ratings yet

- Discriminant AnalysisDocument13 pagesDiscriminant AnalysisJahanzeb Hussain QureshiNo ratings yet

- ICAP Proposals for Pakistan's Federal Budget 2013-14Document62 pagesICAP Proposals for Pakistan's Federal Budget 2013-14Jahanzeb Hussain QureshiNo ratings yet

- Strong Medium Weak Strong Competitive Strength: Bartl EsDocument1 pageStrong Medium Weak Strong Competitive Strength: Bartl EsJahanzeb Hussain QureshiNo ratings yet

- Whole FoodDocument9 pagesWhole FoodJahanzeb Hussain Qureshi100% (1)

- Using Factor Analysis To Evaluate Checklist Items.27Document4 pagesUsing Factor Analysis To Evaluate Checklist Items.27Jahanzeb Hussain QureshiNo ratings yet

- Using Factor Analysis To Evaluate Checklist Items.27Document4 pagesUsing Factor Analysis To Evaluate Checklist Items.27Jahanzeb Hussain QureshiNo ratings yet

- Vendor-managed inventory reduces bullwhip effectDocument17 pagesVendor-managed inventory reduces bullwhip effectJahanzeb Hussain QureshiNo ratings yet

- Right Issue: Prepared by William Armah ForDocument13 pagesRight Issue: Prepared by William Armah ForJahanzeb Hussain QureshiNo ratings yet

- Money MarketDocument19 pagesMoney MarketJahanzeb Hussain QureshiNo ratings yet

- Jahanzeb Hussain Qureshi - 11503Document9 pagesJahanzeb Hussain Qureshi - 11503Jahanzeb Hussain QureshiNo ratings yet

- UNIQUE Co Feasibility StudyDocument18 pagesUNIQUE Co Feasibility StudyJahanzeb Hussain QureshiNo ratings yet

- Microeconomics I - Chapter FiveDocument36 pagesMicroeconomics I - Chapter FiveGena DuresaNo ratings yet

- Name Change Request ApplicationDocument3 pagesName Change Request Applicationutkarsh440% (3)

- ....Document60 pages....Ankit MaldeNo ratings yet

- Interest Change Prepayment Repayment Schedule: Input Details Details 14396Document22 pagesInterest Change Prepayment Repayment Schedule: Input Details Details 14396bidyut_roy_1No ratings yet

- Untitled DocumentDocument10 pagesUntitled DocumentThiaNo ratings yet

- LKP Jalan Reko Pedestrian Hand Railing Sight Distance Issue ReportDocument29 pagesLKP Jalan Reko Pedestrian Hand Railing Sight Distance Issue ReportLokman Hakim Abdul AzizNo ratings yet

- Dgcis Report Kolkata PDFDocument12 pagesDgcis Report Kolkata PDFABCDNo ratings yet

- Accounting Standard Setting and Its Economic ConsequencesDocument18 pagesAccounting Standard Setting and Its Economic ConsequencesFabian QuincheNo ratings yet

- Communicating Vessels Communicating Vessels Issue 20 Fallwinter 20082009Document48 pagesCommunicating Vessels Communicating Vessels Issue 20 Fallwinter 20082009captainfreakoutNo ratings yet

- Drilling Workover ManualDocument187 pagesDrilling Workover Manualmohammed100% (1)

- Role of Central BankDocument2 pagesRole of Central BankHarvir Singh100% (1)

- Inspire - Innovate - EnterpriseDocument11 pagesInspire - Innovate - EnterpriseLashierNo ratings yet

- Regional Acceptance Ach Draft Form-OneDocument2 pagesRegional Acceptance Ach Draft Form-Onejohnlove720% (1)

- Cloud Family PAMM IB PlanDocument4 pagesCloud Family PAMM IB Plantrevorsum123No ratings yet

- Maharashtra Scooters LTDDocument36 pagesMaharashtra Scooters LTDSumit Mohan AtriNo ratings yet

- June 2010 (v1) QP - Paper 1 CIE Economics IGCSEDocument12 pagesJune 2010 (v1) QP - Paper 1 CIE Economics IGCSEjoseph oukoNo ratings yet

- Formulación Matemática Del Sistema RicardianoDocument22 pagesFormulación Matemática Del Sistema RicardianoPili BarrosNo ratings yet

- RA 7183 FirecrackersDocument2 pagesRA 7183 FirecrackersKathreen Lavapie100% (1)

- Ali BabaDocument1 pageAli BabaRahhal AjbilouNo ratings yet

- Machinery PartsDocument2 pagesMachinery PartsSHANTHALASPHEROCAST PVT LTDNo ratings yet

- Final Presentation On Ambuja Cements LTDDocument25 pagesFinal Presentation On Ambuja Cements LTDRocky SyalNo ratings yet

- Suburban Nation: The Rise of Sprawl and The Decline of The American DreamDocument30 pagesSuburban Nation: The Rise of Sprawl and The Decline of The American DreamFernando Abad100% (1)

- Deed of Sale for Movable AssetsDocument2 pagesDeed of Sale for Movable AssetsAyesha JaafarNo ratings yet

- Foreign Investment Act SummaryDocument3 pagesForeign Investment Act SummaryPrisiclla C CarfelNo ratings yet

- Nluj Deal Mediation Competition 3.0: March 4 - 6, 2022Document4 pagesNluj Deal Mediation Competition 3.0: March 4 - 6, 2022Sidhant KampaniNo ratings yet

- Adv Statement LegalDocument2 pagesAdv Statement LegalAMR ERFANNo ratings yet

- Student Partners Program (SPP) ChecklistDocument4 pagesStudent Partners Program (SPP) ChecklistSoney ArjunNo ratings yet

- Jonathan Timm ResumeDocument2 pagesJonathan Timm ResumeJonathan TimmNo ratings yet

- Pro Forma Invoice for Visa Processing FeesDocument1 pagePro Forma Invoice for Visa Processing FeesShakeel AbbasiNo ratings yet

- HNIDocument5 pagesHNIAmrita MishraNo ratings yet