Professional Documents

Culture Documents

Gary Brode of Silver Arrow Investment Management: Long NCR

Uploaded by

currygoatCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gary Brode of Silver Arrow Investment Management: Long NCR

Uploaded by

currygoatCopyright:

Available Formats

Produced by

Institutional Investor and SumZero are not registered investment advisors or broker-dealers, and are not licensed nor

qualied to provide investment advice. There is no requirement that any of the Information Providers presented here be

registered investment advisors or broker-dealers. Nothing published or made available by or through Institutional Investor

and SumZero should be considered personalized investment advice, investment services or a solicitation to BUY, SELL, or

HOLD any securities or other investments mentioned by Institutional Investor, SumZero or the Information Providers. Nev-

er invest based purely on our publication or information, which is provided on an as is basis without representations.

Past performance is not indicative of future results. YOU SHOULD VERIFY ALL CLAIMS, DO YOUR OWN DUE DILIGENCE

AND/OR SEEK YOUR OWN PROFESSIONAL ADVISOR AND CONSIDER THE INVESTMENT OBJECTIVES AND RISKS

AND YOUR OWN NEEDS AND GOALS BEFORE INVESTING IN ANY SECURITIES MENTIONED. INVESTMENT DOES

NOT GUARANTEE A POSITIVE RETURN AS STOCKS ARE SUBJECT TO MARKET RISKS, INCLUDING THE POTENTIAL

LOSS OF PRINCIPAL. You further acknowledge that Institutional Investor, SumZero, the Information Providers or their

respective afliates, employers, employees, ofcers, members, managers and directors, may or may not hold positions

in one or more of the securities in the Information and may trade at any time, without notication to you, based on the

information they are providing and will not necessarily disclose this information, nor the time the positions in the securities

were acquired. You conrm that you have read and understand, and agree to, this full disclaimer and terms of use and that

neither Institutional Investor, SumZero nor any of the Information Providers presented here are in any way responsible for

any investment losses you may incur under any circumstances.

On Tuesday, November 12, 2013, Institutional Investor and SumZero, the worlds largest online

membership community of buy-side investment professionals, hosted an idea competition at

Columbia University Business Schools Uris Hall Auditorium.

Nineteen emerging managers were selected from within the SumZero community on the basis of

strong performance and high-quality peer reviews. Each manager gave a three minute pitch on their

best idea to an audience of analysts and investors who rated their pitch for validity of the thesis,

strength of the argument, feasibility of the trade and originality.

We invite you to view these ideas and register to download each presenters bio and full pitch paper.

If youre a professional investment ofcer or analyst, we invite you to register to vote for the winning

idea.

UPDATE (12/5/13) FROM GARY BRODE (SILVER ARROW):

"Since our presentation, NCR has announced a material acquisition of a Digital Insight,

a privately owned company. Silver Arrow Investment Management has closed its po-

sition in NCR while we are researching this new acquisition. We may re-enter it at a

future date."

Favorite Investment Book:

Margin of Safety by Seth Klarman, Fooled by Randomness

by Nassim Taleb, One up on Wall Street by Peter Lynch

Favorite Quote/Author:

If you could make 100 investments like this one, youd do

it and make money overall. Doug Hirsch when evaluat-

ing an uncertain investment with a high probability-weight-

ed chance of success.

Most Attractive Area of the Market Right Now:

Economically sensitive companies and nancial services.

Least Attractive Area of the Market Right Now:

Defensive investments and hyper-growth companies trad-

ing at triple digit valuations.

Best Past Investment Made:

Las Vegas Sands (LVS) The company has irreplaceable

assets including more than 20% market share in Macau,

and one of only two casinos in Singapore. LVS produces

high free cash ow and management is shareholder-friend-

ly. We rst bought it 18 months ago in the mid-$30s and

sold it in the mid-$60s increasing that prot by buying and

selling multiple times during that period.

Worst Past Investment Made:

The Active Network (ACTV) Weak nancials, a stressed

balance sheet, huge management turnover, and conversa-

tions with race directors, online advertising salespeople,

and competitors led us to believe this was a company with

little value. An acquirer with a lot of cash disagreed with

our assessment.

Personal Investing Style:

Value / Value with a catalyst

Areas of Personal Expertise:

We primarily focus on US-based equities. We are gener-

alists and have done extensive work in Media, Healthcare,

Gaming, Banks, Technology, Insurance, Transportation,

and restructurings and reorganizations over the past 2

years.

Gary Brode Silver Arrow Investment Management, LLC

Age: 44 Title: Managing Partner Location: New York, NY

Education (Undergrad/Grad/Certications): University of Michigan

Previous Employers/Positions: Managing Partner and Founder of Akita Capital Management, LLC,

Senior Analyst at John A. Levin & Co., Securities Analyst at Brahman Capital and Seneca Capital

Bio: Mr. Brode began his career in the M&A department of Morgan Stanley, and then moved to the

buy-side. He worked in Risk Arbitrage under Doug Hirsch at Smith New Court, and joined Mr. Hirsch when he started

Seneca Capital focusing on special situations investing. Mr. Brode began doing long/short equity investing over 13 years

ago. At Brahman Capital, he initiated positions across many industries, and was also responsible for Brahmans health-

care portfolio which was a signicant reason for the rms excellent performance (up approximately 64%) during his

three years there. Mr. Brode joined John Levin & Co. where he exercised investment discretion and made the rm money

in each of the 15 positions he initiated. He Co-Founded Akita Capital where he was a Portfolio Manager for the rms

research-intensive value-oriented long/short equity strategy. The rm held up well in 2008, and put its investors in cash

in September of 2008; shortly before the signicant market decline. In January of 2012, Mr. Brode joined Raji Khabbaz in

starting Silver Arrow. He is a Co-Portfolio Manager for the rms long/short equity concentrated best ideas fund. He is

also the author of TV is Next; a book on the coming decline of the television business.

AUM: $5 million Firm Strategy: Long/Short Equity Fund Disclaimer: Please see section 3 of appendix.

Fund Description:

Silver Arrow Investment Management, LLC is a New York-based investment rm that manages the investment partner-

ship, Silver Arrow Partners, L.P., and selected managed accounts. The managers employ a long-biased, concentrated

portfolio strategy, relying on a rigorous and fundamentally driven value investing approach. The rms objective is to

focus capital in select opportunities that boast the best risk-reward tradeoff, and then achieve a knowledge edge.

Focusing efforts on fewer and more meaningful investment opportunities has a profound and positive impact on security

selection. Limiting a portfolio to the best ideas, results in a very high research threshold. The portfolio managers each

have over 15 years of experience in value investing, with specialization in restructurings and reorganizations, and other

special situations.

Firm Focus: Fundamental value and special situations.

We manage a focused best ideas fund based on in-depth

research.

Past Ideas Submitted on SumZero: Fifth & Pacic Cos

Inc (FNP), Wellpoint (WLP), Digital Realty Trust (DLR),

Metlife Inc (MET), Royal Bank of Scotland Group PLC

(RBS)

NCR - The Rise of The Machines

Man vs Machine vs The Future

In science fiction writer Frederick Pohls The Midas Plague, Pohl

imagines a world where robots overproduce consumer goods forcing the poor to

consume constantly while the wealthy live simple austere lives. Kurt Vonneguts

Harrison Bergeron posits a world where the government uses technology to

handicap people who are smart, attractive, or physically talented to ensure a

world of complete equality and constant discomfort. Alternatively, Star Trek

describes a much different future where access to unlimited energy and

replicators that can instantly produce any food or consumer good means that all

of humanity has unlimited material wealth. Whether the future is a utopia or a

dystopia, whether it features greater or lesser equality, or whether it promises a

higher standard of living or not, it seems that all agree that the future belongs to

machines.

While it is interesting to debate whether machines replacing human jobs is

good or bad, these changes are taking place irrespective of our moral bias, or

feelings on the matter. NCR began as the National Manufacturing Company in

1879 and in 1884 was renamed the National Cash Register Company. Many

people view NCR as the sleepy manufacturer of ATMs which have been

ubiquitous in the United States for 30 years. In contrast, we see NCR as a

leader in producing technology that will replace human labor and reduce costs for

business owners. We believe that a misperception about NCRs growth

opportunity as well as investor concern about a once-serious, but now-resolved

pension issue has led to a value opportunity in the stock.

1GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

Financial Services

NCRs product lineup is large and diverse. The Financial Services division

sells automated equipment to banks including ATMs. This division accounts for

a little over half of NCRs revenue and a little under half of its segment EBIT.

Financial Services had a weak third quarter this year with sales down 4% which

was a primary reason the stock sold off after the earnings announcement. Sales

to US-based financial institutions were weak and that lack of growth is acting as

a weight on the stock price. On its recent earnings call, NCR said that fourth

quarter bookings look strong.

Looking beyond the short-term quarterly noise, there are reasons to be

optimistic. At their introduction in the United States in the 1960s, ATMs were an

effective cost cutting device for banks as they enabled financial institutions to

replace expense tellers with machines. There was always a natural limit to how

far this trend could continue because ATMs were only able to handle certain

transactions. Were now seeing an upgrade cycle in the US driven by a new

generation of ATMs that have enhanced capabilities.

The new generation of ATMs allows customers to deposit cash and

checks without envelopes. While this may sound like an insignificant change,

some bank customers didnt like the idea of putting a bundle of checks in an

envelope, putting that envelope in a machine, and counting on someone to

properly account for it later when the customer isnt present. The new machines

immediately confirm to the customer the dollar amount of the checks and print

out a scanned copy of the checks on the customer receipt. 80% of teller activity

relates to deposit-taking and check cashing, and the new machines should be

able to handle 90% of what tellers do now. The more transactions that can be

handled by machine, the fewer expensive tellers are required in the branch.

2GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

In the not too distant future, well start to see more video teller machines

where a customer can speak to a remote bank teller who can operate the

machine. Bank tellers in high wage areas are going to be replaced by cheaper

labor in other locations. Because the tellers will be remote and required staffing

across many branches is more predictable than in individual branches, the

overall need for tellers will be reduced.

Many of us can remember the days of waiting in line at the bank to

withdraw cash. Customers prefer the speed and convenience of ATM banking.

Were headed for a world where mobile banking directly interacts with ATMs in

many ways. Soon, youll be able to use your phone to program a cash

withdrawal. Then, when you get to the ATM, youll just enter a code and the

machine will dispense your cash. Youll receive a receipt by email. This will

reduce the amount of time customers spend at the ATM. Even the machines are

becoming more efficient.

While the US ATM upgrade will benefit NCR, the best opportunity for

growth in this business is overseas. According to a Barrons article last year, the

US has 1,500 ATMs per million people. That figure is just 100 in China and 50 in

India. According to RBR, the Russian ATM market is growing almost 10% a year,

China is growing between 10% and 15% a year, and India is around 20% a year.

Globally, NCR has number 1 share in ATMs.

The Financial Services division grew 6% in 2012 and is roughly flat this

year. Last year, NCR projected that this business could grow the top line 6% -

8% a year for the next couple of years and that they could increase EBIT margins

from 10% to 11% to 13% by 2015. Given the opportunity for a US upgrade cycle

and for international growth, this seems reasonable to us.

3GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

We would note that due to a deadline for the SumZero / Institutional

Investor conference where this will be presented, this report had to be

completed before the 2013 NCR Investor Day.

Retail Solutions

NCRs Retail Solutions division is an area where were particularly excited

about the opportunity. NCRs electronic point of sale (ePOS) systems can be

thought of as a modern version of the business started in the 1800s by the

National Cash Register Company. Globally, NCR has 11% share of this

business, ranking #2 behind Toshiba. The worldwide ePOS business has been

growing around 5% - 10% a year, and there are several innovations that could

allow this growth to continue.

NCRs Silver point of sale product is aimed at helping small businesses

connect with their customers. Armed with Silver, a business owner can check

on sales and inventory from their smart phone or tablet anywhere or anytime. It

also enables businesses to receive and process payment away from their main

cash register. A gardener or home fitness instructor can take payment on their

mobile phone. A business owner could go to a trade show, take payment for

orders on their tablet while keeping track of sales at their physical business. A

retail establishment could sell outdoor or impulse items in front of their store

without putting in the wiring or weather protection required for a full POS system

outside.

The area where we see the most opportunity for growth is in electronics

that allow businesses to operate with fewer employees. One example would be

a deli counter at your local supermarket. Currently, customers take a number,

and wait to tell the supermarket employee what they want to order. The

employee spends part of their time taking the order and part of their time filling it.

4GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

5GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

An NCR kiosk would allow customers to enter their order while they wait.

Employees behind the counter would then spend all of their time filling orders

and none taking them from the customer. Greater efficiency means a busy deli

counter could operate with fewer employees. This is one example, but the

general principle can be applied across many retail opportunities.

In our opinion, the next big area where retail establishments will replace

employees with machines is self-checkout. Weve seen these machines in New

York-based drugstores for years. They are also regularly used in supermarkets.

They can be a little uncomfortable for customers who have spent a lifetime

interacting with store employees to buy a pack of gum, but technology moves on

and people always adjust.

Self-checkout is NCRs market. The company has 70% share

worldwide up from 64% a year earlier and 79% share in the US. Bears on

the stock justifiably point to the fact that the global self-checkout market barely

grew last year, and is growing this year only due to a huge order by WalMart.

Our view is this market is growing due to a huge order by WalMart! Self-

checkout machines allow a store to use less human labor and reduce costs.

WalMart is a leader in reducing costs and passing a share of those cost savings

on to their customers.

1

While WalMart focuses on labor savings, some Asian locations are

choosing self-checkout due to their small footprint. When youre running a small

store with high rent, maximizing your available selling space can be a difference-

maker to these businesses. We expect to see continued adoption of this

technology in more retail locations. RBR projects that yearly sales and the

1

We understand that the idea of WalMart putting additional pressure on employment and wages

is upsetting to many people, and that others believe that its beneficial for WalMart to be as

profitable as possible. While we enjoy political and philosophical debates in our free time, as fund

managers, our goal is to interpret the world as it exists as accurately as possible.

installed base of self-checkout machines will double between 2012 and 2018.

This strikes us as a conservative estimate.

Retail Solutions represents about one third of NCRs revenue and a little

less than 30% of segment EBIT. At its 2012 analyst day, NCR projected that

Retail Solutions would grow 7% - 9% (excluding the Retalix acquisition) a year

and raise operating margins to 8% - 10% by 2015 from the 6% level in 2012. For

the reasons explained in the previous paragraphs, we think that those revenue

projections are not aggressive. As for the targeted 200 to 400 basis point

improvement in operating margins by 2015, NCR is already seeing that level of

improvement in 2013.

Hospitality

The Hospitality division is only 10% of NCRs revenue, but with EBIT

margins in the mid to high teens, it has the potential to earn almost as much as

the Retail Solutions division. Hospitality has a similar business to Retail

Solutions. Hospitaility primarily provide ePOS systems to restaurants, stadiums,

and other entertainment venues.

A good POS system is crucial for any restaurant or bar. It facilitates

communication between servers and the kitchen, and enables much better

inventory and expense control than would be possible without one. NCR has #1

share in this market.

A new generation of mobile and kiosk systems will both enable future

growth and reduce employee payroll for business owners. NCR is already rolling

out new systems that allow customers to order to-go items from apps on their

phones. Earlier this year, the company announced a new system enabling

customers to place an order at select J amba J uice locations from their phone

and pay for the order using PayPal. Instead of waiting in line to speak to an

6GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

employee at the counter and then have that employee handle payment, the

customer just walks in and receives their pre-paid and pre-ordered shake. For

the customer, it means a much shorter wait or no wait. J ust like the earlier deli

counter example, the J amba J uice employee would go from taking orders,

making shakes, and collecting money to just making shakes. Eventually,

innovations like this will lead to lower staffing levels and reduced employee

expense for business owners.

Well start to see the same kind of functionality in restaurants. While we

expect high-end white-tablecloth restaurants to remain full service, mid-range

restaurants will soon be taking orders from in-store seated customers using their

cell phones. These orders will go straight to the kitchen, and servers will bring

them out to the table. Customers will be able to pay from their phone using a

credit card or PayPal. Again, server responsibility will go from taking orders,

delivering food, and handling payment to just delivering food. Restaurants will

need fewer servers to handle the same number of tables.

We are surprised that there arent already more self-serve kiosks at quick

serve restaurants. We dont think customers require a lot of personal interaction

to order the #1 combo meal at a Burger King of McDonalds, and we suspect that

many of them would be happy to punch in their order at a kiosk, pay there, and

go to the counter to collect their meal. By eliminating order-taking and payment

collection from counter employees responsibilities, these restaurants could

provide the same service with fewer staff members.

Last year, NCR projected 3 year revenue growth in Hospitality of 13% -

15% annualized. Year to date, theyre up 21% over last year. Were a little less

confident in NCRs margin guidance for Hospitality. NCR projects 2015 EBIT

margin of 20% - 22% which is up considerably over last years 16.3%. There

hasnt been a lift in margins this year despite the revenue increase, so while the

projections are possible, wed like to see a few quarters of improvement before

7GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

we express more confidence in NCRs projections. It is worth noting that due to

the relatively small size of Hospitality compared to the rest of NCRs business,

each margin point of EBIT in this division will only amount to $7MM - $8MM of

pre-tax income so a miss of a couple hundred basis points here wouldnt have

much of an impact on 2015 results.

Emerging Industries

NCRs Emerging Industries is executing on several opportunities to use

machines to replace jobs formerly done by humans. The most obvious example

is airline check-in kiosks. NCR provides the kiosks for 4 of the 5 largest airlines.

It was not that long ago that any trip to the airport meant waiting in a long

line to check in and receive your boarding pass. Now, you can walk into the

terminal, swipe your credit card to bring up your reservation, and the machine will

print your boarding pass. The kiosks will also allow you to see the aircraft

seating chart, change your seat, and pay for an upgrade or more desirable seat.

If you need to check a bag, you can indicate it on the screen, then just bring your

bag to a baggage specialist. The entire process is much faster for the customer,

and reduces the need for contact with a counter agent leading to lower demand

for these employees.

Similar kiosks can be used for self check-in at hotels, rental car facilities,

and to purchase bus tickets. In each of these cases, NCR technology will reduce

the demand for counter staff. While we typically find airline counter

representatives, hotel check-in personal, and rental car staff to be friendly helpful

people, it is uncommon that we have a situation where they can provide

additional value. In most situations, if using an automated kiosk gets us through

the check-in experience more quickly, that is what wed prefer. In no case, would

we look forward to a return to waiting in long lines to check in for short domestic

flights.

8GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

In 2012, NCRs management projected 3 year CAGR of 10% - 15% in

Emerging Industries with flat, but high operating margins of 23% - 25%. This

division is small and contracts are lumpy. Year to date in 2013, there has been a

slight decrease in revenue versus last year and a decrease in margins. We do

like the overall opportunity for NCR in this segment, but it hasnt executed on that

growth promise yet in 2013. The good news is that with this segment

representing only 6% of NCRs revenue, a miss in this segment this year wont

have much impact on the bottom line.

Pension

We believe that the pension issue is one reason that NCR trades at a

discount to its peers. Back in 2008, NCR had a traditional pension system that

was heavily invested in equities. The equity portion of the pension plan had

substantial losses that year, and NCR has been climbing out of a giant pension

hole since then.

Over the next few years, NCR moved almost all of its pension assets to

fixed income. It also shut down most of its pension plans which capped the

amount of shortfall the company had to address. Then, NCR offered buyouts to

certain participants in its US pension plan. Finally, the company invested large

amounts of capital into the remaining pension system to reduce its obligations.

This issue has been an overhang on the company for the past 5 years and

has necessitated pro-forma reporting of earnings and operating income. The

good news is that the company is just about at the end of dealing with its pension

requirements. At the time of this writing, NCRs pension shortfall is down to

$326MM which is less than $2/share. Our view is that it makes sense to use

non-pension earnings and cash flow to value the company and to subtract $2

from that valuation to account for the pension.

9GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

Management

We are focused on two things when we evaluate this management team.

First, they regularly give three year guidance, and have a habit of making those

numbers. In 2010, management gave revenue, operating income, and EPS

guidance for 2013. We still have one quarter to go, but it looks like the company

will clear each of those hurdles with room to spare. In general, it is difficult to

make 3 year predictions about the revenue and margins of a large worldwide

business. This management team has offered aggressive multi-year guidance

and made those numbers.

Wed like to see the company do a better job of converting earnings into

free cash flow. To managements credit, they agree. On the last conference call,

the CEO noted that his top priority was being a good operator and his second

priority was improving cash flow generation. As investors, we like his priorities.

Hes executing on the operational side. Well be looking for the cash flow

generation to improve over the next few quarters.

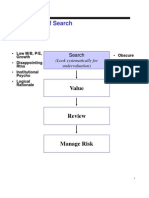

Valuation

In 2012, NCR earned $2.49 before extraordinary items and pension.

Company guidance is for $2.70 - $2.80 in 2013 and $3.65 - $4.25 in 2015. (As

noted earlier, the deadline for this report was before the 2013 NCR Investor Day

where we expect the company will update guidance). We are modeling $3.13 in

EPS in 2014 and $4.01 in 2015. We expect 2015 free cash flow/share to be

approximately equal to EPS.

Its often helpful to get a sense of how comparable public companies are

valued. We looked at Diebold and Wincor Nixdorf in the ATM market, Toshiba,

Hewlett-Packard, and MICROS Systems in ePOS, and Fujitsu and ITAB in self-

10GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

checkout. Most of these companies trade at earnings multiples in the mid-teens

to mid-twenties, but we dont find that to be particularly influential in our view on

valuation. NCR isnt a pure play in any specific area, and neither are most of the

comps. Several of these companies arent growing much, several of them only

compete with NCR in small areas of their business, and others arent very liquid.

We prefer to focus on NCRs earnings growth which we expect will come

from high single digit revenue growth, and a few hundred basis points of margin

expansion. If NCR can go from $2.49 in earnings to around $4 in 3 year years,

we would expect that kind of multi-year secular growth story combined with final

resolution of any pension issues will result in at least a 15 multiple. (We reiterate

that the NCR pension shortfall is now less than $2 a share and should be under

$1.50 a share by year end). NCR currently trades at 11.5x our 2014 estimate

and 9.0x our 2015 estimate; multiples typically reserved for low-growth

companies. We think a $60 stock price 12 18 months from now is possible.

Summary

In NCR, we see a fundamental story highlighted by a multi-year secular

growth trend. Regardless of whether we like it or not, many of the jobs requiring

human interaction will be replaced with machines in the form of computers, smart

phones, tablets, and kiosks. This will happen because in most cases, the

machines can take orders and instructions from customers faster, more

accurately, and at any hour. Customer time spent waiting in line, explaining what

they want, and exchanging payment will be significantly reduced. More

importantly, these devices will allow both large and small businesses to cut staff

and reduce expenses. As we noted earlier in this report, once WalMart has

found a way to reduce its expense structure, others will follow, or be

uncompetitive.

11GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

Weve seen anecdotal reports of customer discomfort with some of these

devices including self-checkout machines at drug stores and supermarkets. We

think those reports are accurate and unimportant. As we noted in a previous

piece of Silver Arrow research, there was a time when most VCRs in the country

were blinking 00:00 because no one could figure out how to program the time.

Eventually, technology becomes more familiar and easier to use. People adapt.

NCR is a leader in enabling this trend. The company is #1 in ATM market

share, #1 in hospitality, #2 in ePOS globally, has 4 of the 5 largest airlines as self

check-in customers, and has 70% of the global share of retail self-checkout

machines.

Management has a history of delivering on long-term promises, and the

2015 guidance they gave at the 2012 investor day looks reasonable. The areas

where 2013 results to date imply that management might be a little aggressive

are small, and a miss in those areas are not likely to cause the whole company to

fall short of its guidance.

We believe that the stock is inexpensive relative to its prospects due to

two reasons. First, we think the market is overly focused on recent unimpressive

results in the US ATM market. We expect that a US upgrade cycle and much

higher growth overseas will address this concern. Second, NCRs pension issue

has been a big overhang on the stock for years. The company has now moved

its pension assets out of equities, has stopped adding most new employees to

the pension plans, and has bought out many plan participants. After spending

years making up for the pension shortfall, NCRs pension underfunding is now

less than $2 a share. This issue is about to disappear from any list of investor

concerns.

NCR earned $2.49 in 2012 excluding pension and extraordinary items,

and has given guidance of $2.70 - $2.80 for 2013. We think $4 in EPS and free

12GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

cash flow per share in 2015 is within reasonable possibility. We expect that kind

of growth combined with a lifting of the pension overhang, and a long-term

secular growth story can get the company a 15 multiple and a $60 stock price

(versus the current $36 price) 12 to 18 months from now.

13GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

14GaryBrode|SilverArrowInvestmentManagement|Gary.Brode@SilverArrowCap.com|(917)5466821

Gary Brode is a Managing Partner and Portfolio Manager for Silver Arrow Investment

Management, LLC. He started his career in the Mergers & Acquisitions Department at

Morgan Stanley & Co. and has spent the last 20 years working for hedge funds, including

Seneca Capital, Brahman Capital, and the Event Driven Group of John A. Levin & Co.; all

funds with up to $2.5 billion in assets. He was a Founder and Managing Partner of Akita

Capital Management, LLC, a value-oriented long/short equity hedge fund.

Raji Khabbaz is a Managing Partner and Senior Portfolio Manager for Silver Arrow

Investment Management, LLC. He has spent the last 18 years working as a portfolio

manager, focused on value investing, special situations, and long/ short equity investing. He

co-founded Highline Capital Management, LLC and Pierce Street Capital Management, LLC,

two value-oriented long/short equity hedge funds. He also served as a portfolio manager at

Ivory Capital, overseeing up to $1 billion in firm assets. In 2009, he formed Silver Arrow

Investment Management, LLC, a value investing investment partnership, focused on

managing concentrated equity portfolios. Mr. Khabbaz began his career in the Mergers &

Acquisitions Departments at Morgan Stanley & Co. and Gleacher & Co. He received at MBA

from the Harvard Graduate School of Business and B.A. in Economics with honors from the

University of California at Berkeley.

Silver Arrow Investment Management, LLC is a New York-based investment firm that

manages the investment partnership, Silver Arrow Partners, L.P., and selected managed

accounts. The managers employ a long-biased, concentrated portfolio strategy, relying on a

rigorous and fundamentally driven value investing approach. The firms objective is to focus

capital in select opportunities that boast the best risk-reward tradeoff, and then achieve a

knowledge edge. Focusing efforts on fewer and more meaningful investment opportunities

has a profound and positive impact on security selection. Limiting a portfolio to the best

ideas, results in a very high research threshold. The portfolio managers each have over 15

years of experience in value investing, with specialization in restructurings and

reorganizations, and other special situations.

SumZero is the worlds largest community of investment fund professionals. SumZeros

members-only website is designed to help fund pros identify and connect with other

professional investors in a compliant environment, share proprietary data and research, and

identify career opportunities within their industry. SumZeros membership currently includes

thousands of the worlds largest and most prominent hedge funds, mutual funds, and private

equity funds. Founded in 2008, SumZero is built on the belief that investing is not a zero-

sum game.

Gary Brode and Raji Khabbaz are SumZero contributors.

You might also like

- Eileen Segall of Tildenrow Partners: Long On ReachLocalDocument0 pagesEileen Segall of Tildenrow Partners: Long On ReachLocalcurrygoatNo ratings yet

- Graham & Doddsville Spring 2011 NewsletterDocument27 pagesGraham & Doddsville Spring 2011 NewsletterOld School ValueNo ratings yet

- Value: InvestorDocument4 pagesValue: InvestorAlex WongNo ratings yet

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketFrom EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNo ratings yet

- Coho Capital Letter 2016Document13 pagesCoho Capital Letter 2016raissakisNo ratings yet

- BAM Airport Thesis 2020.08 FINALDocument17 pagesBAM Airport Thesis 2020.08 FINALYog MehtaNo ratings yet

- Kevin Byun's Q1 2010 Denali Investors LetterDocument9 pagesKevin Byun's Q1 2010 Denali Investors LetterThe Manual of IdeasNo ratings yet

- Ragupati Chandrasekaran's Notes From The Biglari Holdings 2012 Annual MeetingDocument10 pagesRagupati Chandrasekaran's Notes From The Biglari Holdings 2012 Annual MeetingThe Manual of Ideas100% (1)

- Sequoia Fund Investor Day 2014Document24 pagesSequoia Fund Investor Day 2014CanadianValueNo ratings yet

- VII MairsPower Reprint2Document8 pagesVII MairsPower Reprint2Mitesh ParonawalaNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNo ratings yet

- Insight: Prime PropertiesDocument8 pagesInsight: Prime PropertiesvahssNo ratings yet

- Artko Capital 2018 Q4 LetterDocument9 pagesArtko Capital 2018 Q4 LetterSmitty WNo ratings yet

- Eric Khrom of Khrom Capital 2012 Q4 LetterDocument5 pagesEric Khrom of Khrom Capital 2012 Q4 LetterallaboutvalueNo ratings yet

- RV Capital June 2015 LetterDocument8 pagesRV Capital June 2015 LetterCanadianValueNo ratings yet

- Prem Watsa - The 2 Billion Dollar Man - Toronto Live - 04-2009Document6 pagesPrem Watsa - The 2 Billion Dollar Man - Toronto Live - 04-2009Damon MengNo ratings yet

- David Einhorn MSFT Speech-2006Document5 pagesDavid Einhorn MSFT Speech-2006mikesfbayNo ratings yet

- Greenhaven Road Capital Q1 2017Document12 pagesGreenhaven Road Capital Q1 2017superinvestorbulletiNo ratings yet

- An Investment Only A Mother Could Love The Case For Natural Resource EquitiesDocument12 pagesAn Investment Only A Mother Could Love The Case For Natural Resource EquitiessuperinvestorbulletiNo ratings yet

- 5x5x5 InterviewDocument7 pages5x5x5 InterviewspachecofdzNo ratings yet

- The Playing Field - Graham Duncan - MediumDocument11 pagesThe Playing Field - Graham Duncan - MediumPradeep RaghunathanNo ratings yet

- Chou LettersDocument90 pagesChou LettersLuke ConstableNo ratings yet

- PremWatsaFairfaxNewsletter7 12-20-11Document6 pagesPremWatsaFairfaxNewsletter7 12-20-11able1No ratings yet

- Letters of The Manager Since 1998Document111 pagesLetters of The Manager Since 1998Lukas SavickasNo ratings yet

- 1 L I LL I: WWW EscDocument4 pages1 L I LL I: WWW EscforexmastertanNo ratings yet

- Tianhe PDFDocument67 pagesTianhe PDFValueWalkNo ratings yet

- EdelweissMF CommonStocksDocument3 pagesEdelweissMF CommonStocksAlex DavidNo ratings yet

- When Entry Multiples Don't Matter - Andreessen Horowitz PDFDocument12 pagesWhen Entry Multiples Don't Matter - Andreessen Horowitz PDFbrineshrimpNo ratings yet

- Downside Protection Report - 2009 Recap and ScorecardDocument3 pagesDownside Protection Report - 2009 Recap and ScorecardThe Manual of IdeasNo ratings yet

- BuybacksDocument22 pagesBuybackssamson1190No ratings yet

- Graham Doddsville - Issue 23 - FinalDocument43 pagesGraham Doddsville - Issue 23 - FinalCanadianValueNo ratings yet

- Letter To Bruce BerkowitzDocument1 pageLetter To Bruce BerkowitzmattpaulsNo ratings yet

- A Note On Venture Capital IndustryDocument9 pagesA Note On Venture Capital Industryneha singhNo ratings yet

- East Coast Asset Management (Q4 2009) Investor LetterDocument10 pagesEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comNo ratings yet

- Dempster Mills Manufacturing Case Study BPLsDocument15 pagesDempster Mills Manufacturing Case Study BPLstycoonshan24No ratings yet

- Viking Form 2 ADVDocument36 pagesViking Form 2 ADVSOeNo ratings yet

- Investment Digest Top Stock Picks ReportDocument16 pagesInvestment Digest Top Stock Picks ReportAnonymous oTrMza100% (1)

- The End of Arbitrage, Part 1Document8 pagesThe End of Arbitrage, Part 1Carmine Robert La MuraNo ratings yet

- Dakshana Report 2013Document87 pagesDakshana Report 2013cooljoe9No ratings yet

- Icahn LetterDocument3 pagesIcahn Lettergrw7No ratings yet

- Bruce Berkowitz On WFC 90sDocument4 pagesBruce Berkowitz On WFC 90sVu Latticework PoetNo ratings yet

- Reading List J Montier 2008-06-16Document12 pagesReading List J Montier 2008-06-16rodmorley100% (2)

- Understanding DilutionDocument4 pagesUnderstanding DilutionKunalNo ratings yet

- To: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: July 16, 2012 ReDocument13 pagesTo: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: July 16, 2012 Recrees25No ratings yet

- Greenlight Capital Open Letter To AppleDocument5 pagesGreenlight Capital Open Letter To AppleZim VicomNo ratings yet

- Ackman Letter May 2016Document14 pagesAckman Letter May 2016ZerohedgeNo ratings yet

- Market at Much Less Than Book Value. The Weighted Average Stock Price in Relation To Book Value ForDocument10 pagesMarket at Much Less Than Book Value. The Weighted Average Stock Price in Relation To Book Value ForT Anil KumarNo ratings yet

- Valeant Presentation PershingDocument47 pagesValeant Presentation PershingNick SposaNo ratings yet

- East Coast Q1 2015 MR Market RevisitedDocument17 pagesEast Coast Q1 2015 MR Market RevisitedCanadianValue0% (1)

- 2010 Q4 Letter Khrom CapitalDocument5 pages2010 Q4 Letter Khrom CapitalallaboutvalueNo ratings yet

- Impact of Short Selling Bans in EuropeDocument5 pagesImpact of Short Selling Bans in EuropeGeorge AdcockNo ratings yet

- Annual Report 2014Document115 pagesAnnual Report 2014paNo ratings yet

- The Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachFrom EverandThe Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- Outperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueFrom EverandOutperform with Expectations-Based Management: A State-of-the-Art Approach to Creating and Enhancing Shareholder ValueNo ratings yet

- Financial Fine Print: Uncovering a Company's True ValueFrom EverandFinancial Fine Print: Uncovering a Company's True ValueRating: 3 out of 5 stars3/5 (3)

- Cale Smith InvestPitch2013Document11 pagesCale Smith InvestPitch2013BowenQianNo ratings yet

- Scott Miller of Greenhaven Road Capital: Long On Zix CorpDocument0 pagesScott Miller of Greenhaven Road Capital: Long On Zix CorpcurrygoatNo ratings yet

- VIChallenge LOCK DavidSwartzDocument57 pagesVIChallenge LOCK DavidSwartzcurrygoatNo ratings yet

- VIChallenge JACK RyanFusaroDocument7 pagesVIChallenge JACK RyanFusarocurrygoatNo ratings yet

- VIChallenge ASH DanielLawrenceDocument88 pagesVIChallenge ASH DanielLawrencecurrygoatNo ratings yet

- VIChallenge FMI StevenWoodDocument13 pagesVIChallenge FMI StevenWoodcurrygoatNo ratings yet

- Valuation MetricsDocument18 pagesValuation MetricsVALUEWALK LLCNo ratings yet

- 6-17-11 Dan Amoss VALUEx VailDocument17 pages6-17-11 Dan Amoss VALUEx VailcurrygoatNo ratings yet

- Cincinnati Bell (Nyse: CBB) : by Matthew Kirk, Lonestar Capital ManagementDocument19 pagesCincinnati Bell (Nyse: CBB) : by Matthew Kirk, Lonestar Capital ManagementcurrygoatNo ratings yet

- VII332Document21 pagesVII332currygoatNo ratings yet

- VIS2Document18 pagesVIS2currygoatNo ratings yet

- Investing For The Long Run - Ang, KjaerDocument15 pagesInvesting For The Long Run - Ang, KjaercurrygoatNo ratings yet

- 16 Ways To Find Undervalued StocksDocument14 pages16 Ways To Find Undervalued Stockscurrygoat100% (1)

- 01 - Greenlea Lane Capital - VALUEx Vail 2011 - Pricing PowerDocument27 pages01 - Greenlea Lane Capital - VALUEx Vail 2011 - Pricing PowercurrygoatNo ratings yet

- Barry WRLS - ValueXDocument8 pagesBarry WRLS - ValueXcurrygoatNo ratings yet

- 06 - Jake Rosser - Valuex Vail Oshkosh PresentationDocument18 pages06 - Jake Rosser - Valuex Vail Oshkosh PresentationcurrygoatNo ratings yet

- NCR Selfserv BrochureDocument8 pagesNCR Selfserv BrochureRakesh ReddyNo ratings yet

- Aptra: Advance XFS Product OverviewDocument48 pagesAptra: Advance XFS Product OverviewJalal Zahidur RahmanNo ratings yet

- ECSS-Q-ST-10-09C-Rev.1 (1march2018) Annex ADocument5 pagesECSS-Q-ST-10-09C-Rev.1 (1march2018) Annex AdiegobhiNo ratings yet

- Competitor AnalysisDocument6 pagesCompetitor AnalysisOh ChungNo ratings yet

- Error Codes 700 BNA3Document97 pagesError Codes 700 BNA3cesar riosNo ratings yet

- 17fin8653 e NCR Selfserv 38 DsDocument2 pages17fin8653 e NCR Selfserv 38 DsAntonio SolisNo ratings yet

- NCR Selfserv 34 Walk Up Atm Site PreparationDocument54 pagesNCR Selfserv 34 Walk Up Atm Site PreparationMaria CastroNo ratings yet

- 17fin6542 Atm Fraud Inspection Guide NCR RGBDocument11 pages17fin6542 Atm Fraud Inspection Guide NCR RGBBoby JosephNo ratings yet

- NCR Realpos60Document2 pagesNCR Realpos60Akrom77khasaniNo ratings yet

- Appendix D13 Contents of Project Close-Out ReportDocument11 pagesAppendix D13 Contents of Project Close-Out ReportHamza ShujaNo ratings yet

- Operator Guide SS34 PDFDocument30 pagesOperator Guide SS34 PDFGilbert KamanziNo ratings yet

- NCR Teeing Up New Strategic Decision: Presentation Presented by Roll No. A11 A12 A19 A20Document12 pagesNCR Teeing Up New Strategic Decision: Presentation Presented by Roll No. A11 A12 A19 A20Dinesh KumarNo ratings yet

- BedsideDocument8 pagesBedsidemr_histalk5532No ratings yet

- Wincor Nixdorf Vs NCR Doc 2 PDFDocument35 pagesWincor Nixdorf Vs NCR Doc 2 PDFManseriNo ratings yet

- NCR Selfserv™ 22E: Connect Your Customers To Their CashDocument2 pagesNCR Selfserv™ 22E: Connect Your Customers To Their Cashرانا راشدNo ratings yet

- NCR Ts215 Ts230 Cheque Scanner w622-100Document30 pagesNCR Ts215 Ts230 Cheque Scanner w622-100Grip HardNo ratings yet

- CRSE-SA-T-718 3rd Quality Management Review Meeting MOMDocument60 pagesCRSE-SA-T-718 3rd Quality Management Review Meeting MOMAhmad Assad mrednNo ratings yet

- 7167 Parts IdentificationDocument42 pages7167 Parts IdentificationFelixRodriguezNo ratings yet

- MoniPlus2 02.03.06.00 Release NotesDocument18 pagesMoniPlus2 02.03.06.00 Release Noteswinihoo123No ratings yet

- At&T-Ncr:Failed MergerDocument3 pagesAt&T-Ncr:Failed MergerMONIKA3008No ratings yet

- 1962+02+rev - Computers and AutomstationDocument60 pages1962+02+rev - Computers and AutomstationfrechesNo ratings yet

- 1634FDocument125 pages1634FNejam RajaNo ratings yet

- ManuvalDocument320 pagesManuvalsiva123kumartrcNo ratings yet

- NCR SelfServ 64 - DatasheetDocument2 pagesNCR SelfServ 64 - DatasheetYisak Tamrat100% (1)

- 56xx/personas Self-Service Financial Terminal: Diagnostic Status Code NotebookDocument270 pages56xx/personas Self-Service Financial Terminal: Diagnostic Status Code NotebookJuan Cuba AlarcónNo ratings yet

- Dispenser Operator GuidDocument24 pagesDispenser Operator GuidbeakalNo ratings yet

- Busines PlanDocument126 pagesBusines PlanbamarteNo ratings yet

- Realscan 7875 Installation/Owner Guide: 497-0001843 Release K March 27, 2003Document68 pagesRealscan 7875 Installation/Owner Guide: 497-0001843 Release K March 27, 2003LARRYNo ratings yet

- 5887 Site PrepDocument118 pages5887 Site PrepLeeNo ratings yet

- B66273K Vol3Document114 pagesB66273K Vol3nunocoitoNo ratings yet