Professional Documents

Culture Documents

Corning Exec Summary

Uploaded by

La ZerickOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corning Exec Summary

Uploaded by

La ZerickCopyright:

Available Formats

Lazerick Russell MGMT602-625 Corning Case Study 5/13/2013 Corning Incorporated Executive Summary Background Corning Incorporated has

established a strong reputation in the specialty glass market. Corning Incorporated helped pioneer the initiative for businesses to incorporate research laboratories in their business operations; and has been a leader in technology-based research for some years. Cornings initial focus was on the U.S. market but it consistently makes strides to becoming a more international company. One of the major strides Corning has taken is transforming its traditional organizational structure to a matrix representing a network of alliances. The work environment present at Corning is very flexible and cooperative. Corning does not micromanage its businesses and relies on entrepreneurial spirit and ambitious goals. Corning invests in its employees and encourages its managers to be coaches and mentors to there team. Furthermore, Corning has established an operating strategy to bring more focus to its wide variety of businesses. Corning currently operates in four segments: consumer housewares, specialty materials, telecommunications, and laboratory sciences. Corning has established a company culture that links these four segments and guides there business. Cornings company culture has established priorities in technology, common value, and shared resources to develop world-class quality. In addition, Corning has instilled the pursuit of joint ventures into its company structure. Joint venture partnerships have increased the complexity of Cornings business sectors and have helped Corning become an evolving network of businesses. Corning has found difficulty in managing the financial and technical resources required to support the variety of its businesses. In addition, it foresees tremendous opportunities from its innovative technologies.

Corning believes that these opportunities can be applied to young, expanding markets and is faced with three proposals. The first proposal takes place in the laboratory sciences sector, in which Corning sells its share in one joint venture to purchase three laboratory-testing companies. The second proposal takes place in the communications sector and is composed of two parts. The first part is to increase investment in a three-year period in the capacity of optical fiber. The second part is to offer IBM a partnership in one of Cornings newly acquired business from a joint venture. The third proposal is in the specialty materials sector. It consists of selling 49% of Cornings television glass business in the U.S. and invest in developing glass for liquid crystal displays. Analysis Proposal 1:Laboratory Sciences Sector This proposal proposed that it sell its share in one of Cornings highly reputable joint ventures of Ciba Corning for 150 million. Furthermore, use the proceeds from this deal to acquire three laboratory-testing companies for $300 million, $125 million, and $50 million. Each of these three companies are leaders in there laboratory-testing segments. Big, multi-line players with huge R&D and biotechnology companies on the cutting-edge of reagents research dominate the laboratory-testing market. Proposal 2:Communications Sector Proposal 2 proposed that management first invest $100 million in a threeyear time span to increase Cornings capacity to produce optical fibers by 50%. In addition, the proposal also suggested that management offer IBM a partnership in PlessCor Optronics (PCO). The train of thought is that when Corning offers IBM a partnership PCO will become IBMs preferred second source for cable terminal peripherals. PCO has been growing in sales to about $10 million although it still is incurring operating losses. Corning pioneered the technology of optical fiber and has the expertise to dominate and lead the market. In addition, there is tremendous

opportunity abroad with decrepit phone systems and little copper wires to be replaced. Proposal 3:Specialty Materials Sector (Television Glass) Proposal 3 proposed that Corning sell 49% of its US television glass business for about $100 million to Asahi, a Japanese glass company; and channels the proceeds into developing glass for liquid crystal displays. Corning has had previous beneficial relationships with Asahi. In addition, Asahi offers expertise in large-size television bulbs and the growing HDTV technology. More importantly, Asahi has also established relations with the Japanese TV manufacturers setting up facilities in the US. Asahi would significantly alter the connections across companies in an industry that is very tightly knit. Recommendations In conclusion, it is recommended that Corning accepts proposal 3 and invests in its specialty materials sector. There are a number of reasons why Corning should choose this option. The main reason is that this proposal most fits with Cornings strategic goals and company values. The specialty materials sector is growing at an alarming rate and by partnering with Asahi Corning is in prime position to take advantage of that growth. In addition, Asahi has many network connections that Corning has already benefitted from; therefore by fostering this relationship Corning will be promoting its strategic goal of becoming an evolving network of alliances. Furthermore, this proposal also helps reestablish Corning in foreign markets and further its pursuit for a larger international presence. The other proposals are intriguing offers, however, they have some downfalls. The first proposal offers a tremendous opportunity to delve into an untapped market in the medical diagnostics field. However, the investment needs are too large and profits in Cornings current ventures are low. This makes it very difficult to support without a return for a long period of time. The second proposal offers a great opportunity as well. However, Cornings lack of action in this market has brought on competition. This makes it even harder to dominate the market and

a much more riskier investment. Overall, proposal 3 offers the most potential and also supports Cornings strategic goals and vision.

You might also like

- Corning Inc.: A Network of Alliances: Presented By: Kriti Agarwal Roll No.: 201Document9 pagesCorning Inc.: A Network of Alliances: Presented By: Kriti Agarwal Roll No.: 201ami8783No ratings yet

- Corning Inc.: Submitted By: Nishant Singh (E058)Document2 pagesCorning Inc.: Submitted By: Nishant Singh (E058)PratikJainNo ratings yet

- Classic Knitwear and Guardian - A Perfect FitDocument6 pagesClassic Knitwear and Guardian - A Perfect FitSHRUTI100% (1)

- Hospital SupplyDocument3 pagesHospital SupplyKate BurgosNo ratings yet

- Cost Volume ProfitDocument15 pagesCost Volume Profitprashant0071988No ratings yet

- How The Pricing Strategies For Paul Williamson Vary by SportDocument3 pagesHow The Pricing Strategies For Paul Williamson Vary by SportPooja ShreeNo ratings yet

- Linear Programming OverviewDocument40 pagesLinear Programming OverviewJoli SmithNo ratings yet

- Classic Knitwear and Guardian: A Perfect Fit?Document15 pagesClassic Knitwear and Guardian: A Perfect Fit?womesh sahuNo ratings yet

- Davey Brothers Case: Total 0.272Document6 pagesDavey Brothers Case: Total 0.272Bhavik LodhaNo ratings yet

- Flexcon 1Document2 pagesFlexcon 1api-534398799100% (1)

- NUCORDocument12 pagesNUCORKurniawan Che-uNo ratings yet

- Metro Cash & CarryDocument9 pagesMetro Cash & CarrySaurav SanganeriaNo ratings yet

- Cell Name Original Value Final ValueDocument7 pagesCell Name Original Value Final ValuedebojyotiNo ratings yet

- Group5 SectionA negotiationOnThinIceDocument8 pagesGroup5 SectionA negotiationOnThinIceKayNo ratings yet

- ME15 - Unit 3Document59 pagesME15 - Unit 3Bharathi RajuNo ratings yet

- Ccbe CASE Presentation: Group 2Document13 pagesCcbe CASE Presentation: Group 2Rakesh SethyNo ratings yet

- Bergerac Systems: THE Challenge OF Backward Integration: J J J J J JDocument5 pagesBergerac Systems: THE Challenge OF Backward Integration: J J J J J JsrivatsavNo ratings yet

- Newell's Corporate StrategyDocument1 pageNewell's Corporate StrategyAmogh Suman0% (1)

- Business Analytics-Bharti Airtel: Group 7 Members: Rajani Nair Akansha Dwivedi Moumita Basak Jayasekharan UnnikrishnanDocument7 pagesBusiness Analytics-Bharti Airtel: Group 7 Members: Rajani Nair Akansha Dwivedi Moumita Basak Jayasekharan UnnikrishnanRajani Nair (PGPMX-2019 Batch 1)No ratings yet

- Tetley Most Updated PPT 1Document32 pagesTetley Most Updated PPT 1api-247080646No ratings yet

- Os Q1Document18 pagesOs Q1satyam kumarNo ratings yet

- CMR Enterprises: B2B Marketing - Case PresentationDocument17 pagesCMR Enterprises: B2B Marketing - Case PresentationdevilmiraNo ratings yet

- ECO7 WorksheetDocument9 pagesECO7 WorksheetSaswat Kumar DeyNo ratings yet

- Dozier Hedging AlternativesDocument3 pagesDozier Hedging AlternativesCcv PauliNo ratings yet

- Bergerac Systems: The Challenge of Backward IntegrationDocument8 pagesBergerac Systems: The Challenge of Backward IntegrationSujith KumarNo ratings yet

- Mis Case Submission: CISCO SYSTEMS, Inc.: Implementing ERPDocument3 pagesMis Case Submission: CISCO SYSTEMS, Inc.: Implementing ERPMalini RajashekaranNo ratings yet

- IBM Startegic AllianceDocument11 pagesIBM Startegic Alliancenonsenseatul0% (1)

- Practise Problems 2Document3 pagesPractise Problems 2Sounak BhadraNo ratings yet

- Soal Capital Budgeting Chapter 11Document1 pageSoal Capital Budgeting Chapter 11febrythiodorNo ratings yet

- 2003 Edition: This Bibliography Contains Abstracts of The 100 Best-Selling Cases During 2002Document30 pages2003 Edition: This Bibliography Contains Abstracts of The 100 Best-Selling Cases During 2002Raghib AliNo ratings yet

- Case SolutionDocument20 pagesCase SolutionKhurram Sadiq (Father Name:Muhammad Sadiq)No ratings yet

- ERP (Group Week 1)Document14 pagesERP (Group Week 1)Nguyên Nguyễn KhôiNo ratings yet

- PKCLDocument32,767 pagesPKCLRahul GandhiNo ratings yet

- Merloni Elettrodomestici Spa: The Transit Point ExperimentDocument23 pagesMerloni Elettrodomestici Spa: The Transit Point ExperimenthehehuhuNo ratings yet

- Turnaround Plan For Linens N ThingsDocument15 pagesTurnaround Plan For Linens N ThingsTinakhaladze100% (1)

- CMR Enterprises: Presented by - Division B - Group 10Document9 pagesCMR Enterprises: Presented by - Division B - Group 10Apoorva SomaniNo ratings yet

- TDC Case FinalDocument3 pagesTDC Case Finalbjefferson21No ratings yet

- Biocon LimitedDocument4 pagesBiocon LimitedMukesh SahuNo ratings yet

- OTA Vs AirlinesDocument1 pageOTA Vs AirlinesprateekNo ratings yet

- 12 1 Estylar Full Team PDFDocument20 pages12 1 Estylar Full Team PDFAugusto ChesiniNo ratings yet

- CiscoDocument80 pagesCiscoAnonymous fEViTz3v6No ratings yet

- Corning QuestionsDocument1 pageCorning QuestionsAnant Kapoor0% (1)

- IoT-Article - Ali - 2019-IoT-based Solar Hydroponics FarmingDocument5 pagesIoT-Article - Ali - 2019-IoT-based Solar Hydroponics FarmingRoberto VelazquezNo ratings yet

- Destin Brass ProductDocument5 pagesDestin Brass ProductRamalu Dinesh ReddyNo ratings yet

- Additional Questions - Competitive Advantage - Strategic ManagementDocument6 pagesAdditional Questions - Competitive Advantage - Strategic ManagementkarimanrlfNo ratings yet

- Forest Gump 11Document1 pageForest Gump 11Dennis KorirNo ratings yet

- Takeover & Acquisition: Mergers and Acquisitions and CRDocument11 pagesTakeover & Acquisition: Mergers and Acquisitions and CROmkar PandeyNo ratings yet

- Davey BrothersDocument2 pagesDavey BrothersJigyasu PritNo ratings yet

- K-Pop Fans' Identity and The Meaning of Being A Fan: June 2020Document50 pagesK-Pop Fans' Identity and The Meaning of Being A Fan: June 2020T TQNo ratings yet

- IB SummaryDocument7 pagesIB SummaryrronakrjainNo ratings yet

- Piyush Sevaldasani C WAC1 1Document5 pagesPiyush Sevaldasani C WAC1 1Piyush SevaldasaniNo ratings yet

- Crisis Management - OdwallaDocument11 pagesCrisis Management - Odwallarahulgupta2405100% (1)

- Sai Coating CaseDocument7 pagesSai Coating CaseSreejith MadhavNo ratings yet

- PGP MAJVCG 2019-20 S3 Unrelated Diversification PDFDocument22 pagesPGP MAJVCG 2019-20 S3 Unrelated Diversification PDFBschool caseNo ratings yet

- 5dbdcadfc4731 Hul TechtonicDocument1 page5dbdcadfc4731 Hul TechtonicARVINDNo ratings yet

- AnswersDocument10 pagesAnswersSaqib HanifNo ratings yet

- Path To Improved Returns in Material CommercializationDocument9 pagesPath To Improved Returns in Material CommercializationrponnanNo ratings yet

- Presented By: Smriti Narendran 523 Mohit Mundra 511 Harshit Saran 514 Ruchi Adhikari 501 & Prameet Gupta 507Document11 pagesPresented By: Smriti Narendran 523 Mohit Mundra 511 Harshit Saran 514 Ruchi Adhikari 501 & Prameet Gupta 507prameet4uNo ratings yet

- MGT3102 Case StudyDocument2 pagesMGT3102 Case StudyMon LuffyNo ratings yet

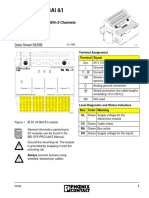

- Ib ST (ZF) 24 Bai 8/I: Analog Input Module With 8 ChannelsDocument24 pagesIb ST (ZF) 24 Bai 8/I: Analog Input Module With 8 ChannelsJosep Giménez CreixellNo ratings yet

- E-Marketing ResearchDocument61 pagesE-Marketing Researchshivraj kumar singhNo ratings yet

- Lab Report 4 ZARYAB RAUF FA17-ECE-046Document17 pagesLab Report 4 ZARYAB RAUF FA17-ECE-046HAMZA ALINo ratings yet

- Um en Axc F XT SPLC 1000 109449 en 01Document202 pagesUm en Axc F XT SPLC 1000 109449 en 01Javier Alarcon VelazcoNo ratings yet

- CSEC Technical Drawing June 2013 2 - 11 01 - 56 - 07 UTC)Document8 pagesCSEC Technical Drawing June 2013 2 - 11 01 - 56 - 07 UTC)derickNo ratings yet

- 1 Dealer AddressDocument1 page1 Dealer AddressguneshwwarNo ratings yet

- Welded Wire Reinforcement WWM WWR Common SizesDocument2 pagesWelded Wire Reinforcement WWM WWR Common Sizesgullipalli100% (1)

- 8.5-MMD65R Report-Well Ru-473 - Comments by ChenDocument11 pages8.5-MMD65R Report-Well Ru-473 - Comments by ChenWHWENNo ratings yet

- 3M Green Corps 3M Green Corps Cut Off Wheels: Depressed Center WheelDocument10 pages3M Green Corps 3M Green Corps Cut Off Wheels: Depressed Center Wheelherysyam1980No ratings yet

- UE18EE325 - Unit1 - Class3 - Methods of CorrectionDocument17 pagesUE18EE325 - Unit1 - Class3 - Methods of CorrectionGAYATHRI DEVI BNo ratings yet

- Mini Caisson Design-CalculationsDocument6 pagesMini Caisson Design-CalculationsRobert SiqecaNo ratings yet

- React JS Interview QuestionsDocument35 pagesReact JS Interview QuestionsAli AyubNo ratings yet

- 8kg 11kg 14kg: High Spin Industrial Washer ExtractorsDocument41 pages8kg 11kg 14kg: High Spin Industrial Washer ExtractorsAgustin FernandezNo ratings yet

- Dezeen X Samsung Out of The Box Competition - Brief and Rules - Dezeen PDFDocument5 pagesDezeen X Samsung Out of The Box Competition - Brief and Rules - Dezeen PDFVivek EadaraNo ratings yet

- Sony Cdx-gt130, Gt180, Gt230, Gt280, Gt280s, Gt282s Ver-1.0 SMDocument38 pagesSony Cdx-gt130, Gt180, Gt230, Gt280, Gt280s, Gt282s Ver-1.0 SMAnonymous JIvcJUNo ratings yet

- Chapter 2 The System Unit, Processing, and MemoryDocument2 pagesChapter 2 The System Unit, Processing, and MemoryJayson BadilloNo ratings yet

- Bitjet+: High Speed, Versatile In-Line Ink Jet Printing SystemDocument6 pagesBitjet+: High Speed, Versatile In-Line Ink Jet Printing SystemAndrewNo ratings yet

- Online Bus Ticket Reservation System: Statistics and Computing January 2015Document18 pagesOnline Bus Ticket Reservation System: Statistics and Computing January 2015muhdNo ratings yet

- Ebin Joy P: Mechanical EngineerDocument4 pagesEbin Joy P: Mechanical Engineermohammad baniissaNo ratings yet

- Chemray 240 User's Manual V1.1eDocument67 pagesChemray 240 User's Manual V1.1eJose PersiaNo ratings yet

- Mathan Internship ReportDocument21 pagesMathan Internship ReportdeepanchackNo ratings yet

- Teacher 08070201513Document9 pagesTeacher 08070201513aman.nick0001No ratings yet

- Chapter 9-Data Hiding and SteganographyDocument24 pagesChapter 9-Data Hiding and SteganographyelenacharlsblackNo ratings yet

- A Machine Learning Approach For Bengali Handwritten Vowel Character RecognitionDocument10 pagesA Machine Learning Approach For Bengali Handwritten Vowel Character RecognitionIAES IJAINo ratings yet

- Protocols For Public-Key CryptosystemsDocument13 pagesProtocols For Public-Key CryptosystemsIvo LemosNo ratings yet

- Ads 51 HDBKDocument494 pagesAds 51 HDBKhplchagasNo ratings yet

- Abhishek TableauDocument11 pagesAbhishek TableauAbhishek BidhanNo ratings yet

- Application of Bar Code On Line PipeDocument5 pagesApplication of Bar Code On Line PipeSaravanan SelvamaniNo ratings yet

- Grove Rt890e - PM - 225441Document1,023 pagesGrove Rt890e - PM - 225441mariojoaofreireNo ratings yet

- Functions of Two Variables LimitsDocument43 pagesFunctions of Two Variables Limitssakshiverma.hNo ratings yet