Professional Documents

Culture Documents

Excel Functions

Uploaded by

fhlim2069Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel Functions

Uploaded by

fhlim2069Copyright:

Available Formats

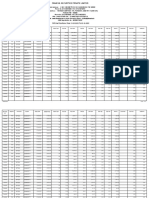

Spreadsheet Option Functions Available with Derivatives Markets, third edition

Robert L. McDonald July 19, 2012

Contents

1 Introduction 1.1 Spreadsheets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.2 Using the Add-ins . . . . . . . . . . . . . . . . . . . . . . . . . . 1.3 A Note on Array Functions . . . . . . . . . . . . . . . . . . . . . 2 Black-Scholes Functions 2.1 Prices . . . . . . . . . . . . . . 2.2 Greeks . . . . . . . . . . . . . . 2.3 Black-Scholes Array Functions 2.4 Black Formula . . . . . . . . . 2.5 Perpetual American Options . 2.6 CEV Pricing . . . . . . . . . . 2.7 Merton Jump Formula . . . . . 3 Binomial Functions 4 Exotic Options 4.1 Vanilla Barrier Options . . . . 4.2 Other Barrier Options . . . . . . 4.2.1 Cash-or-Nothing . . . . . 4.2.2 Asset-or-Nothing . . . . . 4.3 Asian Options . . . . . . . . . . . 4.4 Compound Options . . . . . . . . 4.5 Exchange and Rainbow Options . 5 Interest Rate Functions 2 2 2 3 3 3 4 5 5 5 6 6 6 7 7 8 9 10 11 11 12 12

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

. . . . . . .

Introduction

This is documentation for the option-pricing functions available in the spreadsheets accompanying the third edition of Derivatives Markets. All are userdened functions in Excel, written in VBA, with the code accessible and modiable via the Visual Basic editor built into Excel.

1.1

Spreadsheets

The following spreadsheets come with the book: OptAll3.xls This provides examples of most (not all) of the pricing functions described here. OptAll3.xla This is an add-in version of OptAll2.xls. See Section 1.2. OptBasic3.xls This provides the basic Black-Scholes and binomial calculations, along with formulas for barrier, binary, and perpetual options. It is a subset of OptAll3.xls. OptBasic3.xla This is an add-in version of OptBasic3. VBA examples3.xls This contains the VBA examples from Appendix D. Data.xls This spreadsheet provides stock price and option price data for some of the end-of-chapter problems.

1.2

Using the Add-ins

Spreadsheets dened as add-ins have the extension .xla. Add-ins are typically used to provide additional functionality for Excel. The add-ins provided on this CD-Rom allow you to have the option pricing functions automatically available for use when you run Excel. To use the add-ins, you rst need to place this le where Excel can nd it. Oce 2003 By default, according to the Excel help le:

Add-ins are stored by default in one of the following places: The Library folder or one of its subfolders in the Microsoft Oce/Oce folder. The Documents and Settings/<user name>/Application Data/ Microsoft/AddIns folder. You can place the add-in elsewhere, but you will then have to browse for it to use it. To install the add-in, select Tools|Add-ins and check the box for OptAll2.xla. If the add-in you want does not appear in the list, you need to select browse and locate it yourself. Once you install the add-in, you will have access to all of the functions in this spreadsheet, without needing to open the spreadsheet explicitly. 2

Oce 2010 On the File menu, click Options, and then Add-ins. At the bottom of the dialog is a button that says Go. Click this. Then click Browse on the dialog that pops up. You can browse to locate your add-in. Please note that when you use add-in functions in a spreadsheet, the functions are not saved with your spreadsheet and do not move from computer to computer with the spreadsheet. If you want to have a portable spreadsheet you should start with one of the option pricing spreadsheets, modify it as you please, and then save it under a dierent name.

1.3

A Note on Array Functions

Some of the functions described here are array functions. This means that the output of the function can be in more than one cell. In order to enter an array function, do the following: 1. highlight the output range 2. press the F2 key to edit the rst cell in the range 3. enter the formula 4. press the control, shift, and enter keys simultaneously. Once you have completed these steps, you will notice that cells in the array range exhibit the formula you entered surrounded by curly braces. Once an array function is entered in a range, that range can only be edited or deleted as a single entity. Excel will prohibit you from editing one cell of an array.

Black-Scholes Functions

The following symbol denitions are used in this section: s = stock price, k = strike price, v = volatility (annualized), r = interest rate (continuouslycompounded, annualized), t = time to expiration (years), and d = dividend yield (continuously-compounded, annualized).

2.1

Prices

Function Description European call option price European put option price

Function Denition BSCall(s, k, v, r, t, d) BSPut(s, k, v, r, t, d)

2.2

Greeks

European call delta European put delta European call gamma European put gamma European call vega European put vega European call rho European put rho European call theta European put theta European call psi European put psi European call elasticity European put elasticity Implied volatility for European call The option price is entered as c; the volatility entered does not matter. Implied volatility for European put The option price is entered as c; the volatility entered does not matter. Implied stock price for a given European call option price Implied stock price for a given European put option price

BSCallDelta(s, k, v, r, t, d) BSPutDelta(s, k, v, r, t, d) BSCallGamma(s, k, v, r, t, d) BSPutGamma(s, k, v, r, t, d) BSCallVega(s, k, v, r, t, d) BSPutVega(s, k, v, r, t, d) BSCallRho(s, k, v, r, t, d) BSPutRho(s, k, v, r, t, d) BSCallTheta(s, k, v, r, t, d) BSPutTheta(s, k, v, r, t, d) BSCallPsi(s, k, v, r, t, d) BSPutPsi(s, k, v, r, t, d) BSCallElast(s, k, v, r, t, d) BSPutElast(s, k, v, r, t, d) BSCallImpVol(s, k, v, r, t, d, c)

BSPutImpVol(s, k, v, r, t, d, c)

BSCallImpS(s, k, v, r, t, d, c) BSPutImpS(s, k, v, r, t, d, c)

2.3

Black-Scholes Array Functions

The functions in this section are all array functions (up to 16 16) and have an extra string, x as a parameter. This parameter controls the output, with a c denoting call and p denoting put, and d, g, r, v, t, and e denoting delta, gamma, rho, vega, theta, and elasticity. A+ means continue placing the output in the same row and a / means move to the next row. For example, the string cp+cd+cg/pp+pd+pg will output a 2 row, 3 column array containing a call price, delta, and gamma in the rst row, with the same information for a put in the second row. BS(s,k,v,r,t,d,x) BS Text(x) BS Text Greek(x) Black-Scholes prices and Greeks Array function providing text description of the items in the string x Array function providing text description of the Greeks corresponding to items in the string x

2.4

Black Formula

The Black formula gives the price of an option where a futures contract is the underlying asset. The Black formula is the Black-Scholes formula with the dividend yield set equal to the interest rate. It is implemented as an array function, exactly like the Black-Scholes array functions described in Section 2.3. In particular, x is a format string, controlling the output of the function. BlackFormula(s,k,v,r,t,d,x) Black Text(x) Black Text Greek(x) Black-Scholes prices and Greeks Array function providing text description of the items in the string x Array function providing text description of the Greeks corresponding to items in the string x

2.5

Perpetual American Options

There is no simple pricing formula for American options except when the options are innitely-lived. These functions are array functions, returning the option price and the stock price at which the option should optimally be exercised, in that order. The results may be returned in either a horizontal or vertical array. Function CallPerpetual(s, k, v, r, d) Function PutPerpetual(s, k, v, r, d) Perpetual American call Perpetual American put

2.6

CEV Pricing

The CEV model for the stock price species the instantaneous standard deviation of the stock return as (S ) = S ( 2)/2 (1)

Thus, the CEV pricing formula has two parameters in place of volatility: and . Setting these parameters appropriately requires care. If you observe a stock to have a 30% volatility, then given a , you would set such that = 0.30 S (2 )/2 When = 2, the CEV pricing model is the same as the Black-Scholes formula. The CEV pricing functions are CEVCall(s,k, ,r,t,d, ) CEVPut(s,k, ,r,t,d, ) CEV call price CEV put price

2.7

Merton Jump Formula

The Merton formula for pricing with jumps requires three extra parameters: the jump probability, ; the expected size of a jump when one does occur, J ; and the volatility of the jump magnitude, J . In the implementation here, the jump mean and volatility are measured with respect to the natural log of the jump. The jump pricing formula returns both the call and put prices in a 2 2 array. MertonJump(s,k,v,r,t,d,,J ,J ) Call and put prices when the stock price can jump, with the jump magnitude determined by the lognormal distribution.

Binomial Functions

The following symbol denitions are used in this section: s = stock price, k = strike price, v = volatility (annualized), r = interest rate (continuouslycompounded, annualized), t = time to expiration (years), d = dividend yield (continuously-compounded, annualized), N = number of binomial steps, opstyle = option style (0 = European, 1 = American), and vest = the period of time during which the option cannot be exercised (after this time, exercise is permitted). If N, the number of binomial steps, is set less than or equal to 0, then N is internally reset to be 100. By default, all binomial calculations are done using the forward tree used in Chapter ??. There is a constant in the VBA code called TreeType. If set equal to 0 (the default), all calculations are done with a forward tree. If equal to 1, a CRR tree is used, and if equal to 2, a lognormal tree is used (see CSection ??).

The functions in this section are all array functions, returning the option price, along with delta, gamma, and theta, in that order. So, for example, if you just enter the BinomCall function in a single cell, it will return the option price. If you enter it as an array function spanning two cells, you will get the price and delta, etc... The array can be entered either horizontally or vertically. BinomCall(s, k, v, r, t, d, Binomial call opstyle, N) BinomPut(s, k, v, r, t, d, opstyle, N) BinomCallBermudan(s, k, v, r, t, d, opstyle, N, vest) BinomPutBermudan(s, k, v, r, t, d, opstyle, N, vest) BinomOptFixedDivCall(s, k, v, r, t, div amt, div h, div next, opstyle, N) Binomial put Binomial Bermudan call Binomial Bermudan put Binomial call price when underlying asset pays dollar dividends in amount div amt, with the rst payment coming at time div next, with dividends spaced div h apart. The function Binomial put price when underlying asset pays dollar dividends in amount div amt, with the rst payment coming at time div next, with dividends spaced div h apart.

BinomOptFixedDivPut(s, k, v, r, t, div amt, div h, div next, opstyle, N)

Exotic Options

The following symbol denitions are used in this section: s = stock price, k = strike price, v = volatility (annualized), r = interest rate (continuouslycompounded, annualized), t = time to expiration (years), d = dividend yield (continuously-compounded, annualized), rho = correlation coecient, and H = barrier.

4.1

Vanilla Barrier Options

For ordinary barrier puts and calls, the (descriptive) names are of the form Option Type + Barrier Type For example, the pricing function for an up-and-in call is CallUpIn. CallDownIn(s, k, v, r, t, d, h) CallDownOut(s, k, v, r, t, d, h) Down-and-in call Down-and-out call

CallUpIn(s, k, v, r, t, d, h) CallUpOut(s, k, v, r, t, d, h) PutDownIn(s, k, v, r, t, d, h) PutDownOut(s, k, v, r, t, d, h) PutUpIn(s, k, v, r, t, d, h) PutUpOut(s, k, v, r, t, d, h)

Up-and-in call Up-and-out call Down-and-in put Down-and-out put Up-and-in put Up-and-out put

4.2

Other Barrier Options

For most other barrier options, the function names are mnemonic, and have three parts: Payo Type + Barrier Type + Option Type In particular, The payo type is one of Cash the payo is $1 Asset the payo is one unit of the asset The barrier type is one of DI down-and-in, in other words the stock price is initally above the barrier, which must be hit in order for the payo to be received. DO down-and-out, in other words the stock price is initally above the barrier, which must not be hit in order for the payo to be received. UI up-and-in, in other words the stock price is initally below the barrier, which must be hit in order for the payo to be received. UO up-and-out, in other words the stock price is initally below the barrier, which must not be hit in order for the payo to be received. The option type is one of Call in order for the payo to be received, the asset price must be above the strike at expiration Put in order for the payo to be received, the asset price must be below the strike at expiration

For example, an option that pays $1 if the stock price exceeds the strike price at expiration, provided that the barrier, below the inital stock price, has not been hit would have the name CashDOCall = Cash Payo of $1 + DO if the barrier, below the intial stock price, has not been hit + Call and the stock price exceeds the strike at expiration

4.2.1

Cash-or-Nothing Cash-or-nothing call Receive $1 if st > k at expiration Cash-or-nothing put Receive $1 if st < k at expiration Cash-or-nothing down-and-in call Receive $1 if st > k at expiration and the barrier H < s has been hit. Cash-or-nothing down-and-out call Receive $1 if st > k at expiration and the barrier H < s has not been hit. Cash-or-nothing down-and-out put Receive $1 if st < k at expiration and the barrier H < s has not been hit. Cash-or-nothing down-and-out put Receive $1 if st < k at expiration and the barrier H < s has been hit. Cash-or-nothing up-and-in call Receive $1 if st > k at expiration and the barrier H > s has been hit. Cash-or-nothing up-and-out call Receive $1 if st > k at expiration and the barrier H > s has not been hit. Cash-or-nothing up-and-out put Receive $1 if st < k at expiration and the barrier H > s has not been hit.

CashCall(s, k, v, r, t, d) CashPut(s, k, v, r, t, d) CashDICall(s, k, v, r, t, d, h)

CashDOCall(s, k, v, r, t, d, h)

CashDOPut(s, k, v, r, t, d, h)

CashDIPut(s, k, v, r, t, d, h)

CashUICall(s, k, v, r, t, d, h)

CashUOCall(s, k, v, r, t, d, h)

CashUOPut(s, k, v, r, t, d, h)

CashUIPut(s, k, v, r, t, d, h)

DR(s, v, r, t, d, h) UR(s, v, r, t, d, h) DRDeferred(s, v, r, t, d, h)

URDeferred(s, v, r, t, d, h)

Cash-or-nothing up-and-in put Receive $1 if st < k at expiration and the barrier H > s has been hit. Down rebate Receive $1 at the time the barrier, H < s, is hit. Up rebate Receive $1 at the time the barrier, H > s, is hit. Deferred down rebate Receive $1 at expiration if prior to expiration the barrier, H < s, is hit. Deferred up rebate Receive $1 at expiration if prior to expiration the barrier, H < s, is hit.

4.2.2

Asset-or-Nothing

Note that there is no dierence between an option that pays H if the share price hits H , and an option that pays a share if the share price hits H . AssetCall(s, k, v, r, t, d) Asset-or-nothing call Receive one unit of the asset if st > k at expiration Asset-or-nothing put Receive one unit of the asset if st < k at expiration Asset-or-nothing down-and-in call Receive one unit of the asset if st > k at expiration and the barrier H < s has been hit. Asset-or-nothing down-and-out call Receive one unit of the asset if st > k at expiration and the barrier H < s has not been hit. Asset-or-nothing down-and-out put Receive one unit of the asset if st < k at expiration and the barrier H < s has not been hit. Asset-or-nothing down-and-out put Receive one unit of the asset if st < k at expiration and the barrier H < s has been hit.

AssetPut(s, k, v, r, t, d)

AssetDICall(s, k, v, r, t, d, h)

AssetDOCall(s, k, v, r, t, d, h)

AssetDOPut(s, k, v, r, t, d, h)

AssetDIPut(s, k, v, r, t, d, h)

10

AssetUICall(s, k, v, r, t, d, h)

AssetUOCall(s, k, v, r, t, d, h)

AssetUOPut(s, k, v, r, t, d, h)

AssetUIPut(s, k, v, r, t, d, h)

Asset-or-nothing up-and-in call Receive one unit of the asset if st > k at expiration and the barrier H > s has been hit. Asset-or-nothing up-and-out call Receive one unit of the asset if st > k at expiration and the barrier H > s has not been hit. Asset-or-nothing up-and-out put Receive one unit of the asset if st < k at expiration and the barrier H > s has not been hit. Asset-or-nothing up-and-in put Receive one unit of the asset if st < k at expiration and the barrier H > s has been hit.

4.3

Asian Options

There are straightforward closed-form solutions for geometric average European options, but not for arithmetic average options (see Chapter ??). Hence, the only functions implemented in Excel are for options with payos based on the geometric average price at expiration, Gt , which is computed over the life of the option. The geometric average can be computed based on prices sampled N times over the life of the option. If N is not specied, a continuous average is assumed. GeomAvgPriceCall(s, k, v, r, t, d, Optional N) GeomAvgPricePut(s, k, v, r, t, d, Optional N) GeomAvgStrikeCall(s, m, v, r, t, d, Optional N) GeomAvgStrikePut(s, m, v, r, t, d, Optional N) Geometric average price call Option with time t payo max(0, Gt k ). Geometric average price put Option with time t payo max(0, k Gt ). Geometric average strike call Option with time t payo max(0, st Gt ). Geometric average strike put Option with time t payo max(0, Gt st ).

4.4

Compound Options

European compound options are options to buy or sell some other option, and as such have two expiration dates. The rst, denoted t1, is the date at which the option to buy or sell an option must be exercised. The second, t2 is the

11

date at which the bought or sold option expires. The strike price for buying or selling the underlying option at date t1 is denoted x. CallOnCall(s, k, x, v, r, t1, t2, Compound call on call Call option d) to buy a call option PutOnCall(s, k, x, v, r, t1, t2, d) Compound put on call Put option to sell a call option CallOnPut(s, k, x, v, r, t1, t2, d) Compound call on put Call option to buy a put option PutOnPut(s, k, x, v, r, t1, t2, d) Compound put on put Put option to sell a put option

4.5

Exchange and Rainbow Options

Exchange options and rainbow options have payos depending on two or more asset prices. An exchange option is the right to exchange one asset for another (ordinary calls and puts are exchange options where one of the two assets is cash). A rainbow option has the payo max(S, Q, K ), where S and Q are risky asset prices with dividend yields s and q , volatilities vs and vq , and correlation coecient . For binomial valuation, the number of binomial steps is N and the option style, OpStyle, is 0 for a European option and 1 for an American option. BSCallExchange(s,vs , s , q, vq , q , European exchange call Option to , t) acquire s by giving up q . BSPutExchange(s,vs , s , q, vq , q , European exchange put Option to , t) give up s in exchange for q . BinomCallExchange(s,vs , s , q, vq , American exchange call Option to q , , t, OpStyle, N) acquire s by giving up q . BinomPutExchange(s,vs , s , q, vq , q , , t, OpStyle, N) RainbowCall(s,vs , s , q, vq , q ,, K, r, t) RainbowPut(s,vs , s , q, vq , q ,, K, r, t) American exchange put Option to give up s in exchange for q . European rainbow call Option on the maximum of s, q, and K. European rainbow put Option on the minimum of s, q, and K.

Interest Rate Functions

These are array functions which compute prices, yields, delta, and gamma for zero-coupon bonds. These functions assume the short-term interest rate is generated by a process of the form dr = a(b r)dt + sr dZ where = 0 for the Vasicek formula and = 0.5 for the CIR formula. The interest rate risk premium is . 12

Vasicek(a, b, , v, r, T)

CIR(a, b, , v, r, T)

Vasicek interest rate function Array function which returns the price of a zero-coupon bond paying $1, the long-term yield, delta and gamma with respect to the interest rate, and the yield to maturity. Cox-Ingersoll-Ross interest rate function Array function which returns the price of a zero-coupon bond paying $1, the long-term yield, delta and gamma with respect to the interest rate, and the yield to maturity.

13

You might also like

- Spreadsheet Option Functions Available With Derivatives MarketsDocument13 pagesSpreadsheet Option Functions Available With Derivatives MarketsFanny Sylvia C.100% (4)

- Option Pricer Black Scholes VB ADocument6 pagesOption Pricer Black Scholes VB AgarycwkNo ratings yet

- Black-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDocument8 pagesBlack-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDickson phiriNo ratings yet

- Fitting The Smile, Smart Parameters For SABR and HestonDocument13 pagesFitting The Smile, Smart Parameters For SABR and Hestonhazerider2No ratings yet

- Antoon Pelsser - Pricing Double Barrier Options Using Laplace Transforms PDFDocument10 pagesAntoon Pelsser - Pricing Double Barrier Options Using Laplace Transforms PDFChun Ming Jeffy TamNo ratings yet

- Sabr SLVDocument21 pagesSabr SLVArturo ZamudioNo ratings yet

- Better Hedge Ratios For Pairs TradingDocument11 pagesBetter Hedge Ratios For Pairs TradingAlex AleksicNo ratings yet

- Static Versus Dynamic Hedging of Exotic OptionsDocument29 pagesStatic Versus Dynamic Hedging of Exotic OptionsjustinlfangNo ratings yet

- Log NormalDocument12 pagesLog NormalAlexir86No ratings yet

- Short Condor Spread With Puts - FidelityDocument7 pagesShort Condor Spread With Puts - FidelityanalystbankNo ratings yet

- Yahoo Finance Excel Formula Reference - User Guide - Excel Price FeedDocument2 pagesYahoo Finance Excel Formula Reference - User Guide - Excel Price FeedShakeel AhmedNo ratings yet

- MSR Hedging CostsDocument10 pagesMSR Hedging CostsMayankNo ratings yet

- Dupire Local VolatilityDocument15 pagesDupire Local VolatilityJohn MclaughlinNo ratings yet

- Option Greeks 4&5Document64 pagesOption Greeks 4&5Saha AmitNo ratings yet

- Asset and Equity VolatilitiesDocument40 pagesAsset and Equity Volatilitiescorporateboy36596No ratings yet

- Change Point DetectionDocument23 pagesChange Point DetectionSalbani ChakraborttyNo ratings yet

- Auto Call Able SDocument37 pagesAuto Call Able SAnkit VermaNo ratings yet

- Options Based Risk MGMT SummaryDocument8 pagesOptions Based Risk MGMT SummarynsquantNo ratings yet

- Udemy Python Financial Analysis SlidesDocument35 pagesUdemy Python Financial Analysis SlidesWang ShenghaoNo ratings yet

- A Primer On Hedge FundsDocument10 pagesA Primer On Hedge FundsOladipupo Mayowa PaulNo ratings yet

- FlyletsDocument1 pageFlyletsKranthi KiranNo ratings yet

- Jackel 2006 - ByImplication PDFDocument6 pagesJackel 2006 - ByImplication PDFpukkapadNo ratings yet

- Optimal Delta Hedging For OptionsDocument11 pagesOptimal Delta Hedging For OptionsSandeep LimbasiyaNo ratings yet

- Ezzahti, Ali - The Accuracy of The Black Scholes Model in Pricing AEX Index Call Options, Literature and Emperical StudyDocument35 pagesEzzahti, Ali - The Accuracy of The Black Scholes Model in Pricing AEX Index Call Options, Literature and Emperical StudyEdwin HauwertNo ratings yet

- Stock Price Simulation in RDocument37 pagesStock Price Simulation in Rthcm2011100% (1)

- Black Scholes Option Pricing ModelDocument20 pagesBlack Scholes Option Pricing Modelsze0920No ratings yet

- Risk Management: Greek LettersDocument22 pagesRisk Management: Greek LettersJenab PathanNo ratings yet

- KILIN ForwardVolatilitySensitiveDerivativesDocument84 pagesKILIN ForwardVolatilitySensitiveDerivativesLameuneNo ratings yet

- Espen Gaarder Haug: Space-Time FinanceDocument14 pagesEspen Gaarder Haug: Space-Time Financedeenutz93No ratings yet

- HW FINS3635 2018 1 1Document9 pagesHW FINS3635 2018 1 1Roger GuoNo ratings yet

- Short Butterfly Spread With Calls - FidelityDocument8 pagesShort Butterfly Spread With Calls - FidelityanalystbankNo ratings yet

- Pricing OptionsDocument6 pagesPricing Optionspradeep3673No ratings yet

- 1x2 Ratio Volatility Spread With Puts - FidelityDocument8 pages1x2 Ratio Volatility Spread With Puts - FidelityanalystbankNo ratings yet

- From Implied To Spot Volatilities: Valdo DurrlemanDocument21 pagesFrom Implied To Spot Volatilities: Valdo DurrlemanginovainmonaNo ratings yet

- Finessing Fixed DividendsDocument2 pagesFinessing Fixed DividendsVeeken Chaglassian100% (1)

- Commodity Volatility SurfaceDocument4 pagesCommodity Volatility SurfaceMarco Avello IbarraNo ratings yet

- Why Distributions Matter (16 Jan 2012)Document43 pagesWhy Distributions Matter (16 Jan 2012)Peter UrbaniNo ratings yet

- Jackel, Kawai - The Future Is Convex - Wilmott Magazine - Feb 2005Document12 pagesJackel, Kawai - The Future Is Convex - Wilmott Magazine - Feb 2005levine_simonNo ratings yet

- Investopedia. Using - The Greeks - To Undersand OptionsDocument5 pagesInvestopedia. Using - The Greeks - To Undersand OptionsEnrique BustillosNo ratings yet

- Bloomberg Stochastic Local VolatilityDocument7 pagesBloomberg Stochastic Local VolatilityborobuduNo ratings yet

- Fourier Transform Methods in Option PricingDocument40 pagesFourier Transform Methods in Option PricingespacotempoNo ratings yet

- Flow Chart For Quant StrategiesDocument1 pageFlow Chart For Quant StrategiesKaustubh KeskarNo ratings yet

- Assignment Option Pricing ModelDocument28 pagesAssignment Option Pricing Modeleccentric123No ratings yet

- Market Volatility BulletinDocument22 pagesMarket Volatility BulletinThomasNo ratings yet

- Rainbow OptionsDocument6 pagesRainbow OptionsAshwini Kumar PalNo ratings yet

- Trading Volatility Spreads: A Test of Index Option Market EfficiencyDocument26 pagesTrading Volatility Spreads: A Test of Index Option Market EfficiencyWagner RamosNo ratings yet

- Derman Lectures SummaryDocument30 pagesDerman Lectures SummaryPranay PankajNo ratings yet

- Factor Investing RevisedDocument22 pagesFactor Investing Revisedalexa_sherpyNo ratings yet

- Hedge Barrier OptionDocument6 pagesHedge Barrier OptionKevin ChanNo ratings yet

- Dispersion TradingDocument2 pagesDispersion TradingPuneet KinraNo ratings yet

- True Strength IndexDocument2 pagesTrue Strength IndexVincent Lau0% (1)

- Pykhtin MFADocument6 pagesPykhtin MFAhsch345No ratings yet

- Alex Lipton and Artur Sepp - Stochastic Volatility Models and Kelvin WavesDocument27 pagesAlex Lipton and Artur Sepp - Stochastic Volatility Models and Kelvin WavesPlamcfeNo ratings yet

- Dynamic Risk ParityDocument31 pagesDynamic Risk ParityThe touristNo ratings yet

- SSRN d2715517Document327 pagesSSRN d2715517hc87No ratings yet

- BNP Paribas Dupire Arbitrage Pricing With Stochastic VolatilityDocument18 pagesBNP Paribas Dupire Arbitrage Pricing With Stochastic Volatilityvictormatos90949No ratings yet

- A Simple and Reliable Way To Compute Option-Based Risk-Neutral DistributionsDocument42 pagesA Simple and Reliable Way To Compute Option-Based Risk-Neutral Distributionsalanpicard2303No ratings yet

- 2023 Tutorial 12Document6 pages2023 Tutorial 12Đinh Thanh TrúcNo ratings yet

- Descriptive and Inferential Statistics With RDocument6 pagesDescriptive and Inferential Statistics With RTrần Thị Bích Thảo 3KT -19No ratings yet

- Heston ModelDocument34 pagesHeston ModelahmadNo ratings yet

- Gabion All1Document144 pagesGabion All1fhlim2069No ratings yet

- Free Surface1 29082020212740Document118 pagesFree Surface1 29082020212740fhlim2069No ratings yet

- LPile Plus Student Edition DocumentationDocument53 pagesLPile Plus Student Edition Documentationfhlim2069No ratings yet

- Design Building1 03012018234353Document312 pagesDesign Building1 03012018234353fhlim2069No ratings yet

- RMS - Pavement Standard Drawings - Steel Fibre RCPDocument5 pagesRMS - Pavement Standard Drawings - Steel Fibre RCPbraackwNo ratings yet

- Eh1 Eng HdrologyDocument206 pagesEh1 Eng Hdrologyfhlim2069No ratings yet

- Dameq 1Document344 pagesDameq 1fhlim2069No ratings yet

- Tastylive Options Strategy Guide 2023Document39 pagesTastylive Options Strategy Guide 2023shertwaNo ratings yet

- Assignment1 QuestionsDocument4 pagesAssignment1 QuestionsUjjwal MarahattaNo ratings yet

- Nse Options Strategies Explanation With ExamplesDocument63 pagesNse Options Strategies Explanation With Exampleskumarmba09No ratings yet

- Study Notes Trading StrategiesDocument16 pagesStudy Notes Trading Strategiesalok kundaliaNo ratings yet

- StrapDocument2 pagesStrapAKSHAYA AKSHAYANo ratings yet

- Tutorial 8.solutionDocument4 pagesTutorial 8.solutionasfgh afhNo ratings yet

- Option Price Basics ExerciseDocument20 pagesOption Price Basics ExerciseVishalNo ratings yet

- Options Theory For Professional TradingDocument134 pagesOptions Theory For Professional TradingVibhats VibhorNo ratings yet

- Lesson 4 Selling Covered CallsDocument12 pagesLesson 4 Selling Covered Callsvvpvarun100% (1)

- Fin P&LDocument14 pagesFin P&LBotiyoNo ratings yet

- Nifty Options Writing StrategyDocument8 pagesNifty Options Writing Strategyfrank georgeNo ratings yet

- Please List Team Members BelowDocument35 pagesPlease List Team Members BelowHarshit Verma17% (6)

- Option Pricing Models (Black-Scholes & Binomial) - HoadleyDocument6 pagesOption Pricing Models (Black-Scholes & Binomial) - HoadleyDavid GonzalezNo ratings yet

- Derivative Markets Solutions PDFDocument30 pagesDerivative Markets Solutions PDFPeter HuaNo ratings yet

- Implied Volatility Step by Step GuideDocument22 pagesImplied Volatility Step by Step GuideAriol ZereNo ratings yet

- Tutorial 2 AnswersDocument11 pagesTutorial 2 AnswersKhairina IshakNo ratings yet

- CH 11 Hull OFOD9 TH EditionDocument20 pagesCH 11 Hull OFOD9 TH Editionseanwu95No ratings yet

- Chapter 3 - Insurance, Collars and Other StrategiesDocument41 pagesChapter 3 - Insurance, Collars and Other Strategiescalun12100% (1)

- Double Calendar SpreadsDocument22 pagesDouble Calendar SpreadsSasikumar ThangaveluNo ratings yet

- Option Trading Strategies - Part 2Document35 pagesOption Trading Strategies - Part 2Phan ChiNo ratings yet

- Strategy Name Number of Option Legs Direction: Put Ratio Backspread Three BearishDocument4 pagesStrategy Name Number of Option Legs Direction: Put Ratio Backspread Three Bearishg_ayyanarNo ratings yet

- Brian Johnson Option Strategy Risk Return Ratios: A Revolutionary New Approach To Optimizing, Adjusting, and Trading Any Option Income StrategyDocument183 pagesBrian Johnson Option Strategy Risk Return Ratios: A Revolutionary New Approach To Optimizing, Adjusting, and Trading Any Option Income Strategypiwp0w100% (15)

- Options GreeksDocument12 pagesOptions GreeksAnupriya NagpalNo ratings yet

- 6.1 Futures and Options AnalysisDocument2 pages6.1 Futures and Options AnalysisSuraj DecorousNo ratings yet

- Chapter 6 Test Bank 10eDocument7 pagesChapter 6 Test Bank 10eQUÂN PHAN NGUYỄN ANHNo ratings yet

- Black ScholesDocument6 pagesBlack Scholesvarshachotalia1305No ratings yet

- 6 OptionsDocument35 pages6 OptionsEbru ReisNo ratings yet

- Short Call Calendar SpreadDocument2 pagesShort Call Calendar SpreadpkkothariNo ratings yet

- Art of Options TradingDocument17 pagesArt of Options TradingSaiSudheerreddy Annareddy100% (1)

- Option Trading Strategies & Option SpreadsDocument30 pagesOption Trading Strategies & Option SpreadsPushkar GautamNo ratings yet