Professional Documents

Culture Documents

Untitled

Uploaded by

api-234474152Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

api-234474152Copyright:

Available Formats

Pharmaceuticals

InstitutionalEquities

IndiaResearch

December05,2013

IndocoRemedies

Bloomberg:INDRIN

Reuters:INDR.BO

COMPANYUPDATE

BUY

USSterileProductDealtoDriveRevenuegrowth

Recommendation

CMP:

Domestic Formulations to Outperform: With minimum impact on the TargetPrice:

domestic formulations (DF) business for the current quarter despite the Upside(%)

NLEM, Indoco Remedies (Indoco) is set to achieve double digit growth in StockInformation

H2FY14. Focus on chronic segment, increasing productivity and stocking up MarketCap.(Rsbn/US$mn)

by the trade will enable the Company to grow by double digits. We have 52weekHigh/Low(Rs)

3mADV(Rsmn/US$mn)

factored11%&14%growthforFY14E&FY15E,respectively.

Beta

USSterileProductDealtoDriveGrowthMomentuminRegulatedMarkets: Sensex/Nifty

Indoco has an alliance with Watson for 23 ophthalmic filings. The recent Shareoutstanding(mn)

regulatoryinspectionwillpavethewayfortwoUSlaunchesinQ4FY14Eand StockPerformance(%)

3additionallaunchesinFY15E,whichwouldenabletheregulatedmarketsto

1M

3M

Absolute

24.3

69.9

growtoRs1.6bninFY15EfromRs.63mninFY14E.

Rel.toSensex

Outlook & Valuation: We downgrade our revenue estimates for FY14E

by7%toRs7,154mnduetodowngradeinrevenuesofWatson,semiregulated

marketsanddomesticformulationsforFY14Eandupgraderevenuesby8.6%

to Rs9,775mn for FY15E mainly on account of upgrade in Watson revenues

due to deferment of launches from FY14E and higher traction in domestic

space for FY15E. We maintain our EBDITAM for FY14E while increase our

EBDITAM from 13.1% to 19.2% despite factoring higher R & D in the books.

We downgrade our EPS for FY14E by 13.9% to Rs 5.9 and upgrade our EPS

estimates by 74% to Rs13.8 for FY15E. We upgrade the stock to BUY with a

pricetargetofRs152basedon11xFY15E.

52.4

Sensex(LHS)

IndocoRemedies(RHS)

Source:Bloomberg,KarvyInstitutionalResearch

EarningsRevision

(%)

FY14E

FY15E

Revenue

7.0

8.6

EBITDA

8.1

59.2

13.9

74.4

Source:Company

Y/EMar(RsMn)

FY11

FY12

FY13

FY14E

FY15E

NetRevenues

4,804

5,643

6,350

7,154

9,775

EBITDA

552

692

793

936

1,875

NetProfit

327

290

245

532

1,270

EPS(Rs)

3.6

3.1

2.7

5.8

13.8

EPSgrowth(%)

16.2

11.4

15.5

116.9

138.8

EBITDAmargin(%)

11.5

12.3

12.5

13.1

19.2

PER(x)

29.7

33.5

39.7

18.3

7.7

EV/EBITDA(x)

18.9

15.3

12.1

10.3

5.0

2.0

1.7

1.5

1.4

1.0

RoCE(%)

11.2

10.6

9.6

13.7

26.7

RoE(%)

10.2

8.5

6.4

12.2

25.3

P/BV(x)

3.0

2.7

2.3

2.1

1.8

Source:Company,KarvyInstitutionalResearch..IndianGAAPConsolidated

12M YTD

58.4 65.7

48.0 55.4

115

105

95

85

75

65

55

PAT

KeyFinancials

P/S(x)

27.5

10/157

114/55

12/0.2

0.7

20,709/6,161

92

Dec12

Jan13

Feb13

Apr13

May13

Jun13

Aug13

Sep13

Oct13

Nov13

CapitalizationofR&DExpenseBoostsMargins:OnaccountofsurgeinR&D

spendandsubsequentauditorsadvice,IndocoiscapitalizingitsR&Dspend Performance

andamortizing over 5 year timespan. We believe thisis not in line with the 23,500

practicefollowedbymostofthecompanies.Wehaveadoptedamoreprudent 21,500

practice of writing off the same from the P&L Account and removing 19,500

17,500

amortizationfromdepreciation.WehavealsoexcludedMATcreditinorderto 15,500

reflectnormalizedearnings.

Rs106

Rs152

43%

AnalystsContact

RahulSharma

02261844310

rahul.sharma@karvy.com

AmeyChalke

02261844325

amey.chalke@karvy.com

December05,2013

IndocoRemedies

India Operations Formulations Space to

Outperform

The Companys performance was good for Q2FY14 despite trade related issues.

WithhighermarginsgivenbytheCompanytothestockistsandretailers,thetrade

fillingwillriseto40daysfrom30days.Focusonchronicspacewhichislikelyto

growby20%andincreasedproductivitywillsetpaceforhighergrowth.Wehave

factored 15% growth in domestic formulations business in H2FY14E and 14%

growth in FY15E. Higher growth in domestic formulations will entail better

marginsfortheCompany.

Exhibit1: Therapywise

Therapy(RsMn)

Stomatologicals

Q2FY14

Q2FY13

Gwth%

204.6

187.4

9.2

GastroIntestinal

171.8

154.5

11.2

Pain/Analgesics

93.4

80.4

16.2

Vitamins/Minerals/Nutrients

76.6

55.7

37.5

Ophthalmic/Otologicals

64.7

57.2

13.1

Gyneac

57.5

50.7

13.4

AntiDiabetic

46.1

39.8

15.8

Source:Company

Exhibit2: Productwise

Product(RsMn)

Q2FY14

Q2FY13

Gwth%

CyclopamTab

75.7

66.2

14.4

CitalLiquid

33.4

28

19.3

CyclopamSusp/

29.8

27.6

ClobenG15Gms

33.8

31.4

7.6

Sensoform100gms

27.3

26.3

3.8

SensodentKF100gms

26.2

24.6

6.5

FebrexPlusTab10s

52.9

42.8

23.6

MCBM6910s

23.3

16.7

39.5

Vepan500Tab10s

22.4

20.5

9.3

GlychekMForte

17.5

13.7

27.7

Source:Company

Therapies like GastroIntestinal (11.2%YoY), Pain/Analgesic (16.2%), Vitamins

(37.5%)andOphthalmics(13.1%YoY)havegrownindoubledigitsduringQ2FY14.

Productwise,CyclopamTab,Cital,Febrexplustab,MCBM69andGlychekhave

showngrowthinexcessof10%YoYduringthequarter.

Our View: The key therapies have seen outperformance over last two quarters

mainly due to better focus imparted by way of therapyfocused divisions. We

believe that relatively smaller scale of the Company in the domestic market can

facilitateittooutperformtheIPMgrowth.

December05,2013

IndocoRemedies

OverseasOperationsExportstoGainTraction

US Sterile Product to drive growth momentum in Regulated markets:

Indoco finalized a generic product development alliance with Watson in

Feb10 for ophthalmic products. Currently, the Watson portfolio has 23

products with cumulative market size of US$4 bn in the US out of which 12

have been filed. The two products which are going to be launched in the

current year have a market size of US$200 mn (Glucoma category)and 6

competitorsi.e.Apotex,Sandoz,Teva,Ahlcon,HiTechPharmaandBausch&

Lomb. We expect Watson to garner 10% market share in FY14E & FY15E,

respectively. We estimate its revenues at Rs. 63 mn & Rs. 1.6 bn in FY14E &

FY15E,respectively.Wehaveassumed2launchesaddressingamarketsizeof

US$200mninQ4FY14Eandadditional3productlaunchesinFY15E(6mths

period).Thecumulativemarketsizeof5productsisatUS$600mn.

Partnership in Emerging Market: In Mar10, Indoco entered into a dossier

licensingandsupplydealwithAspenforsupplyofophthalmicproductsto30

EMs including BRICS. Over last 3 years the deal has been expanded to

include50products.Currently,Indocoisworkingon45projectsforAspenfor

South Africa, Venzuela, Mexico & Australia. Indoco reported Rs. 200 mn

revenuesinFY13,whichislikelytoscaleuptoRs.250mninFY14EandRs350

mninFY15.

RoW Markets: In the generic markets of South Africa, Australia & New

Zealand, the Company has already tied with front end partners while in the

branded promotion space of Africa, CIS, Latin America and SE Asia the

Companywillpromoteitsownbrands.IntheRoWregion,theCompanyhas

movedoutoflowmargintenderbusiness,whichwillenablethemtopromote

brands.

European Operations: In European space, with the EU inspecting the plant,

theCompanyisinnegotiationswithsomelargeplayersforCRAMssupplyin

theophthalmicsegment.TheCompanyisintheprocessoffiling56dossiers

beforeMar14.Theapprovaltimecouldbeanywherebetween1418months.

CapitalizationofR&DExpenseBoostsMargins

On account of surge in research expenses and auditors advice, the Company is

capitalizingresearchexpensesandamortizingoverfiveyearspan.Webelievethis

isnotinlinewiththepracticefollowedbymostcompaniesandwehaveadopteda

moreprudentpracticeofwritingoffthesamefromP&LAccount.Thetablebelow

givestheR&DexpensesthathavebeenaddedtoP&Laccount.

Exhibit3: R&DSchedule

(RsMn)

FY11

FY12

FY13

FY14E

FY15E

R&D(aspercompany)

93

108

125

171

233

%ofsales

1.9

1.9

2.4

2.4

AdditionalR&Dexpensesdeducted

111

109

181

200

200

TotalR&Dexpenses

204

217

306

371

433

%ofsales(%)

4.3

3.9

4.9

5.2

4.4

Source:Company,KarvyInstitutionalResearch

December05,2013

IndocoRemedies

Exhibit4: DepreciationSchedule

(RsMn)

FY11

FY12

FY13

FY14E

FY15E

Depreciation

135

192

237

311

332

AdjustedDepreciation

133

167

184

226

245

Source:Company,KarvyInstitutionalResearch

The Company doesnt include entire R&D spend including capitalized in

calculation of tax, as it is already in MAT. However, it does take the benefit of

depreciation/amortizationofintangibleassetsinitsbooks.WehavechargedR&D

inP&LaccountandremovedamortizationofR&Dexpensesfromdepreciation.

MATCreditEntitlementExcluded

WehavealsotakenthetaxratesgoingaheadatMATratesandnotfactoredinthe

MAT credit entitlement to get a prudent picture of EPS. The tax rates for FY11,

FY12&FY13reflecttaxexMATcreditentitlement.TheCompanyisnottakingtax

benefitinlieuofR&DasitisalreadyunderMAT.

Exhibit5: TaxSchedule

CurrentTax(RsMn)

FY11

FY12

FY13

FY14E

FY15E

PBT

565

513

484

673

1607

CurrentTax

113

103

97

141

337

15

37

54

73

90

97

Totaltax

55

49

57

141

337

Taxrate(asreported)(%)

9.7

9.6

11.8

21

21

NewPBT

455

429

400

673

1607

Adjustedtax

127

139

155

141

337

28

32.4

38

21

21

Add:DeferredTax

Less:MATcreditentitlement

EarlieryrAdj

AdjustedTaxRate(%)

Source:Company,KarvyInstitutionalResearch

Risks : Deferment of Opthalmic ANDA launches would impact revenue and

EPSofthecompanyasgrossmarginsoftheseproductsaremuchhigherthanthe

companysgrossmargins.

December05,2013

IndocoRemedies

ChangeinEstimates

Exhibit6: ChangeinEstimates

(RsMn)

FY14E

FY15E

Comment

New

Old%change

New

Old%change

DomesticForm

4315

4379

4919

4899

ExportForm

2,389

2,859

(16.5)

4,315

3,567

21.0

RegMarket

2,079

2,349

(11.5)

3,905

2,967

63

528

(88.1)

1608

880

31.6

lowerWatsontractionduetodelayinapproval,

82.7 fullimpactof5approvalsinFY15

SemiReg

310

510

(39.2)

410

600

(31.7)

AspenDeal

250

450

(44.4)

350

540

(35.2) lowertractioninAspen

APIDom

181

181

(0.2)

199

199

(0.2)

APIExport

234

234

281

281

(0.1)

8.6

Watson

NetRevenues

(1.5)

0.4 UpgradeFY15nosbasedonlowbaselastyear

7154

7696

(7.0)

9775

8999

Ebitda

936

1018

(8.1)

1875

1178

EbitdaMargins(%)

13.1

13.2 (10bps)

19.2

13.1

NetProfit

532

615

(13.6)

1,270

727

74.6

EPS(Rs)

5.8

6.7

(13.9)

13.8

7.9

74.4

59.2 HighermarginsonaccountofWatsondeal

610bps

Source:Company,KarvyInstitutionalResearch

Valuations

Exhibit7: FinancialsIndocoRemediesvs.Unichem&AlembicPharma

(RsMn)

IndocoRemedies

FY14E

FY15E

FY14E

FY15E

FY14E

FY15E

7,154

9,775

11,911

14,312

17,899

20,964

13.1

19.2

16.2

18.5

18.4

20.1

Totalrevenues

EBITDAMargins(%)

EPS(Rs)

Unichem

AlembicPharma

5.8

13.8

12.9

19.2

10.6

14.7

P/E(x)

18.3

7.7

15.0

10.1

19.6

14.1

P/S(x)

1.4

1.0

1.5

1.2

2.2

1.9

RoCE(%)

13.7

26.7

18.5

23.8

34.9

41.3

RoE(%)

12.2

25.3

15.3

20.3

34.2

37.5

CMP(Rs)

108

193

207

Target(Rs)

152

221

UnderReview

Reco

BUY

HOLD

UnderReview

Source:Company,KarvyInstitutionalResearch

December05,2013

IndocoRemedies

Financials

Exhibit8: Profit&LossStatement

Y/EMar(RsMn)

TotalRevenues

RawMaterial

Staff

R&DExps

OthersExps

TotalExpenditure

EBITDA

EBITDAmargin(%)

Otherincome

Interest

GrossProfit

Depreciation

ProfitBeforeTax

Tax

Effectivetaxrate(%)

NetProfit

%growth

Minorityinterest

Extraordinaries

ReportedNetProfit

FY11

4,804

2,131

670

205

1,245

4,252

552

11.5

60

24

588

133

455

127

28.0

327

16.2

1

328

FY12

5,643

2,450

819

217

1,465

4,951

692

12.3

67

163

596

167

429

139

32.4

290

11.4

290

FY13

6,350

2,620

1,004

310

1,622

5,557

793

12.5

9

92

583

184

400

155

38.7

245

15.5

0.4

245

FY14E

7,154

2,750

1,205

357

1,906

6,218

936

13.1

62

99

899

226

673

141

21.0

532

116.9

532

FY15E

9,775

3,562

1,446

433

2,458

7,900

1,875

19.2

102

125

1,852

245

1,607

337

21.0

1,270

138.8

1,270

FY14E

184

4,364

4,548

712

274

986

343

2

5,879

4,036

1,427

2,608

240

1,051

1,433

1,090

1

1,090

4,664

717

918

1,635

3,030

5,879

FY15E

184

5,310

5,494

971

274

1,245

343

2

7,084

4,366

1,672

2,694

259

1,434

1,956

1,515

1

1,458

6,362

928

1,304

2,232

4,130

7,084

Source:Company,KarvyInstitutionalResearch

Exhibit9: BalanceSheet

Y/EMar(RsMn)

Equity

Reserves

Networth

ShorttermLoans

LongtermLoans

TotalLoans

DeferredtaxLiability

MinorityInterest

Liabilities

GrossBlock

Depreciation

NetBlock

Capitalworkinprogress

Inventories

Debtors

Cash

Investments

OtherCurrentassets

TotalCurrentassets

Creditors

Othercurrentliabilities

Totalcurrentliabilities

Netcurrentassets

TotalAssets

FY11

123

3,173

3,296

163

836

999

257

0

4,552

2,949

831

2,117

625

804

918

270

0

691

2,684

459

415

874

1,810

4,552

FY12

123

3,433

3,556

415

560

974

294

0

4,824

3,876

994

2,882

169

1,019

1,137

105

1

959

3,220

765

684

1,448

1,772

4,824

FY13

184

3,957

4,142

648

274

922

348

2

5,414

3,705

1,201

2,504

220

932

1,271

1,009

1

982

4,194

683

822

1,505

2,689

5,414

Source:Company,KarvyInstitutionalResearch

December05,2013

IndocoRemedies

Exhibit10: CashFlowStatement

Y/EMar(RsMn)

EBIT

(Inc.)/Decinworkingcapital

Cashflowfromoperations

FY11

FY12

FY13

FY14E

FY15E

419

525

610

710

1,630

(187)

(127)

(13)

(260)

(676)

232

398

597

450

953

Otherincome

60

67

62

102

Depreciation

134

167

184

226

245

Interestpaid()

(24)

(163)

(219)

(99)

(125)

DeferredTaxliability

15

37

54

(5)

Taxpaid()

(127)

(139)

(152)

(141)

(337)

Dividendspaid()

(115)

(119)

(129)

(140)

(323)

MiscellaneousExp

Netcashfromoperations

174

248

344

352

515

CapitalExpenditure()

(596)

(476)

143

(350)

(350)

FreeCashFlow

(422)

(228)

487

165

Inc./(Dec.)inshorttermborrowing

(8)

251

234

63

260

Inc./(dec.)inlongtermborrowing

347

(276)

(286)

Inc./(dec.)inborrowings

339

(25)

(52)

63

260

(Inc.)/Dec.inInvestments

(0)

(0)

CashfromFinancialActivities

339

(24)

(51)

63

260

Others

(22)

86

468

15

Openingcash

375

270

105

1,009

1,090

Closingcash

270

105

1,009

1,090

1,515

(105)

(166)

905

81

424

FY13

FY14E

FY15E

Equityissue/(Buyback)

ChangeinCash

Source:Company,KarvyInstitutionalResearch

Exhibit11: KeyRatios

Y/EMar(RsMn)

FY11

FY12

PER(x)

29.7

33.5

39.7

18.3

7.7

EV/EBITDA(x)

18.9

15.3

12.1

10.3

5.0

2.0

1.7

1.5

1.4

1.0

RoCE(%)

11.2

10.6

9.6

13.7

26.7

RoE(%)

10.2

8.5

6.4

12.2

25.3

P/BV(x)

3.0

2.7

2.3

2.1

1.8

P/S(x)

Source:Company,KarvyInstitutionalResearch

December05,2013

IndocoRemedies

InstitutionalEquitiesTeam

RangachariMuralikrishnan

HeadInstitutionalEquities /

Research/Strategy

+912261844301

muralikrishnan@karvy.com

K.AnantRao

HeadSalesTrading&Derivatives

+912261844303

k.anantrao@karvy.com

Analysts

Industry/Sector

DeskPhone

EmailID

AmeyChalke

PharmaceuticalsAssociate

+912261844325

amey.chalke@karvy.com

AnkurLakhotia

DerivativesandQuantAssociate

+912261844327

ankur.lakhotia@karvy.com

HatimBroachwala,CFA

Banking

+912261844329

hatim.broachwala@karvy.com

KrutiShah,CFA

Economist

+912261844320

kruti.shah@karvy.com

ManojKumarManish

DerivativesandQuantAnalyst

+912261844343

manojkumar.m@karvy.com

MarutiKadam

ResearchAssociate

+912261844326

maruti.kadam@karvy.com

MitulShah

Automobiles

+912261844312

mitul.shah@karvy.com

ParikshitKandpal

Infra/RealEstate/Strategy

+912261844311

parikshit.kandpal@karvy.com

RahulSharma

Pharmaceuticals

+912261844310

rahul.sharma@karvy.com

RahulSingh

Textiles

+914044857911

rahulsingh@karvy.com

RajeshKumarRavi

Cement&Logistics

+912261844313

rajesh.ravi@karvy.com

RupeshSankhe

Power/CapitalGoods

+912261844315

rupesh.sankhe@karvy.com

SagarShah

Media&Entertainment

+912261844316

sagarshah@karvy.com

VarunChakri

ResearchAssociate

+912261844326

varun.chakri@karvy.com

CelineDsouza

Sales

+912261844341

celine.dsouza@karvy.com

EdelbertDcosta

Sales

+912261844344

edelbert.dcosta@karvy.com

INSTITUTIONALRESEARCH

INSTITUTIONALSALES

INSTITUTIONALSALESTRADING&DEALING

BhaveshGandhi

Dealer

+912261844368/69

bhavesh.gandhi@karvy.com

PrashantOza

Dealer

+912261844370/71

prashant.oza@karvy.com

GurdarshanSinghKharbanda

Dealer

+912261844368/69

gurdarshansingh.k@karvy.com

AsimKumarMohapatra

Editor

+912261844318

asim.mohapatra@karvy.com

VijayalaxmiL.Moolya

Production

+912261844328

vijayalaxmi.m@karvy.com

PRODUCTION

December05,2013

IndocoRemedies

StockRatings

Buy

Hold

Sell

:

:

:

AbsoluteReturns

>15%

515%

<5%

Forfurtherenquiriespleasecontact:

research@karvy.com

Tel:+912261844300

DisclosuresAppendix

Analystcertification

The following analyst(s), who is (are) primarily responsible for this report, certify (ies) that the views expressed herein

accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their)

compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this

researchreport.

Disclaimer

TheinformationandviewspresentedinthisreportarepreparedbyKarvyStockBrokingLimited.Theinformationcontained

hereinisbasedonouranalysisanduponsourcesthatweconsiderreliable.We,however,donotvouchfortheaccuracyorthe

completenessthereof.Thismaterialisforpersonalinformationandwearenotresponsibleforanylossincurredbaseduponit.

Theinvestmentsdiscussedorrecommendedinthisreportmaynotbesuitableforallinvestors.Investorsmustmaketheirown

investmentdecisionsbasedontheirspecificinvestmentobjectivesandfinancialpositionandusingsuchindependentadvice,as

theybelievenecessary.Whileactinguponanyinformationoranalysismentionedinthisreport,investorsmaypleasenotethat

neitherKarvynorKarvyStockBrokingnoranypersonconnectedwithanyassociatecompaniesofKarvyacceptsanyliability

arisingfromtheuseofthisinformationandviewsmentionedinthisdocument.

Theauthor,directorsandotheremployeesofKarvyanditsaffiliatesmayholdlongorshortpositionsintheabovementioned

companies from time to time. Every employee of Karvy and its associate companies are required to disclose their individual

stock holdings and details of trades, if any, that they undertake. The team rendering corporate analysis and investment

recommendations are restricted in purchasing/selling of shares or other securities till such a time this recommendation has

either been displayed or has been forwarded to clients of Karvy. All employees are further restricted to place orders only

throughKarvyStockBrokingLtd.Thisreportisintendedforarestrictedaudienceandwearenotsolicitinganyactionbasedon

it.Neithertheinformationnoranyopinionexpressedhereinconstitutesanofferoraninvitationtomakeanoffer,tobuyorsell

anysecurities,oranyoptions,futuresnorotherderivativesrelatedtosuchsecurities.

KarvyStockBrokingLimited

InstitutionalEquities

OfficeNo.702,7thFloor,HallmarkBusinessPlaza,Opp.GurunanakHospital,Mumbai400051

RegdOff:46,RoadNo4,StreetNo1,BanjaraHills,Hyderabad500034.

KarvyStockBrokingResearchisalsoavailableon:BloombergKRVY<GO>,ThomsonPublisher&Reuters.

You might also like

- Guidelines For Licensing of Payments Banks: Press ReleaseDocument3 pagesGuidelines For Licensing of Payments Banks: Press Releaseapi-234474152No ratings yet

- UntitledDocument12 pagesUntitledapi-234474152No ratings yet

- UntitledDocument3 pagesUntitledapi-234474152No ratings yet

- Kellton Tech Surges Ahead in 2014-15Document18 pagesKellton Tech Surges Ahead in 2014-15api-234474152No ratings yet

- UntitledDocument15 pagesUntitledapi-234474152No ratings yet

- Vivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A BuyDocument20 pagesVivimed Labs: Good Times Ahead, Attractive Valuations Initiating, With A Buyapi-234474152No ratings yet

- UntitledDocument23 pagesUntitledapi-234474152No ratings yet

- Corp LTD: (GMDV)Document3 pagesCorp LTD: (GMDV)api-234474152No ratings yet

- UntitledDocument3 pagesUntitledapi-234474152No ratings yet

- UntitledDocument16 pagesUntitledapi-234474152No ratings yet

- Corp LTD: (GMDV)Document5 pagesCorp LTD: (GMDV)api-234474152No ratings yet

- UntitledDocument6 pagesUntitledapi-234474152No ratings yet

- UntitledDocument11 pagesUntitledapi-234474152No ratings yet

- 87 9::67 ?6 7 @AB CCD 7 E45F7 G 7 Hcihhjd 7 3 7 K 7 ?6 7 LC CCDDocument2 pages87 9::67 ?6 7 @AB CCD 7 E45F7 G 7 Hcihhjd 7 3 7 K 7 ?6 7 LC CCDapi-234474152No ratings yet

- Corp LTD: (GMDV)Document5 pagesCorp LTD: (GMDV)api-234474152No ratings yet

- UntitledDocument8 pagesUntitledapi-234474152No ratings yet

- Welspun India Limited (WIL) : Investor PresentationDocument33 pagesWelspun India Limited (WIL) : Investor Presentationapi-234474152No ratings yet

- Marksans Pharma: Rating: BUYDocument3 pagesMarksans Pharma: Rating: BUYapi-234474152No ratings yet

- UntitledDocument22 pagesUntitledapi-234474152No ratings yet

- Apar Industries LTD.: Tomorrow's Progress TodayDocument25 pagesApar Industries LTD.: Tomorrow's Progress Todayapi-234474152No ratings yet

- Marksans Pharma: Rating: BUYDocument3 pagesMarksans Pharma: Rating: BUYapi-234474152No ratings yet

- UntitledDocument32 pagesUntitledapi-234474152No ratings yet

- An Essay On Money, As A Medium of CommerceDocument36 pagesAn Essay On Money, As A Medium of Commerceapi-234474152No ratings yet

- Midcaps: Value BuysDocument4 pagesMidcaps: Value Buysapi-234474152No ratings yet

- CRISIL Research NRB BearingsDocument28 pagesCRISIL Research NRB BearingsRudra GoudNo ratings yet

- Private Banks-Comparative Valuations: Alpha Ideas-Investment Blog For The Indian MarketsDocument1 pagePrivate Banks-Comparative Valuations: Alpha Ideas-Investment Blog For The Indian Marketsapi-234474152No ratings yet

- Q4 - Result Review Mumbai, 18 February 2014Document16 pagesQ4 - Result Review Mumbai, 18 February 2014api-234474152No ratings yet

- Shalimar Paints Ltd. Sa A Atstd: January 06, 2014Document0 pagesShalimar Paints Ltd. Sa A Atstd: January 06, 2014api-234474152No ratings yet

- Sushil Finance Wishes You and Your Family A Very Happy Diwali and A Prosperous New Year AheadDocument19 pagesSushil Finance Wishes You and Your Family A Very Happy Diwali and A Prosperous New Year Aheadapi-234474152No ratings yet

- UntitledDocument3 pagesUntitledapi-234474152No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LBO AnalysisDocument7 pagesLBO AnalysisLeonardoNo ratings yet

- Management AccountingDocument132 pagesManagement Accountingaanchal singhNo ratings yet

- Measuring Investment Returns: Questions and ExercisesDocument9 pagesMeasuring Investment Returns: Questions and ExercisesKinNo ratings yet

- Question Bank: JMD TutorialsDocument11 pagesQuestion Bank: JMD TutorialsGrishma MoreNo ratings yet

- Accounting Level 3: LCCI International QualificationsDocument17 pagesAccounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (4)

- Caso ChryslerDocument7 pagesCaso ChryslerAntonioNo ratings yet

- Illustration Ratio AnalysisDocument6 pagesIllustration Ratio AnalysisMUINDI MUASYA KENNEDY D190/18836/2020No ratings yet

- Consolidation TheoryDocument22 pagesConsolidation TheorySmruti RanjanNo ratings yet

- Acct-111e - Quiz CompDocument18 pagesAcct-111e - Quiz CompJap Keren LirazanNo ratings yet

- CH 03Document122 pagesCH 03Mar Sih100% (1)

- Equity ValuationDocument36 pagesEquity ValuationANo ratings yet

- Sample Financial PlanDocument12 pagesSample Financial PlanSneha KhuranaNo ratings yet

- Solution Financial Accounting FundamentalsDocument7 pagesSolution Financial Accounting Fundamentalsone thymeNo ratings yet

- Mattel StocksDocument21 pagesMattel StocksjaquelineNo ratings yet

- Business Finance ESSAYDocument6 pagesBusiness Finance ESSAYAra ArinqueNo ratings yet

- Courses and DescriptionsDocument96 pagesCourses and DescriptionsMatt CosentinoNo ratings yet

- M1 Initial PageDocument14 pagesM1 Initial PageRaj DasNo ratings yet

- INTRODUCTIONDocument79 pagesINTRODUCTIONdrkotianrajeshNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisUyen Thao Dang96% (54)

- Beechy7e Vol 1 SM Ch08Document59 pagesBeechy7e Vol 1 SM Ch08Aayush AgarwalNo ratings yet

- Audit Prob - ReceivablesDocument27 pagesAudit Prob - ReceivablesCharis Marie Urgel100% (3)

- Quizzes Chapter 9 Acctg Cycle of A Service BusinessDocument26 pagesQuizzes Chapter 9 Acctg Cycle of A Service BusinessJames CastañedaNo ratings yet

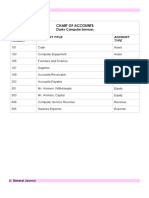

- ACTIVITY 2. Setting Up of Chart of Accounts and Journalizing of Entries ActivityDocument2 pagesACTIVITY 2. Setting Up of Chart of Accounts and Journalizing of Entries Activityfernandez 4No ratings yet

- Paper5 SolutionDocument20 pagesPaper5 SolutionArjun ThawaniNo ratings yet

- Corporate Finance Present ValueDocument37 pagesCorporate Finance Present ValueTalib DoaNo ratings yet

- CAPITAL BUDGETING in Automobile SectorDocument12 pagesCAPITAL BUDGETING in Automobile SectorSheel VictoriaNo ratings yet

- Multiple Choice Questions Presentation of FSDocument4 pagesMultiple Choice Questions Presentation of FSUy Uy ChoiceNo ratings yet

- TUTORIAL 6 - Increasing Shareholding (Answer) : UKAF4034 Advanced Corporate Reporting (Tutorial 6)Document11 pagesTUTORIAL 6 - Increasing Shareholding (Answer) : UKAF4034 Advanced Corporate Reporting (Tutorial 6)Murali RasamahNo ratings yet

- Chapter 1 Test BankDocument4 pagesChapter 1 Test BankshanjidakterimiNo ratings yet

- Colgate Ratio Analysis WSM 2020 SolvedDocument17 pagesColgate Ratio Analysis WSM 2020 Solvedabi habudinNo ratings yet