Professional Documents

Culture Documents

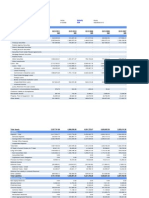

ICICI Bank Ratios

Uploaded by

Sriharsha KrishnaprakashCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICICI Bank Ratios

Uploaded by

Sriharsha KrishnaprakashCopyright:

Available Formats

ICICI Bank | > Banks - Private Sector > of ICICI Bank - BSE: 532174, NS...

1 of 2

http://www.moneycontrol.com/stocks/company_info/print_financials.php...

This data can be easily copy pasted into a Microsoft Excel sheet

ICICI Bank

Previous Years

------------------- in Rs. Cr. ------------------Mar '13

Mar '12

Mar '11

Mar '10

Mar '09

10.00

10.00

10.00

10.00

10.00

--

--

--

--

--

Operating Profit Per Share (Rs)

-112.54

-78.85

-125.17

-120.46

-120.35

Net Operating Profit Per Share (Rs)

389.09

398.05

325.97

347.53

398.65

Free Reserves Per Share (Rs)

--

380.08

353.96

348.48

324.39

Bonus in Equity Capital

--

--

--

--

--

--

--

--

--

--

Adjusted Cash Margin(%)

14.49

12.94

11.47

9.28

6.58

Net Profit Margin

12.94

11.48

9.94

7.85

5.63

Return on Long Term Fund(%)

55.87

57.98

50.09

53.53

68.05

Return on Net Worth(%)

13.96

12.47

11.01

9.10

7.64

Adjusted Return on Net Worth(%)

14.73

12.96

11.37

9.28

7.22

Return on Assets Excluding Revaluations

596.04

531.56

480.15

460.12

420.19

Return on Assets Including Revaluations

596.04

531.56

480.15

460.12

420.19

Interest Income / Total Funds

7.04

8.08

7.36

7.99

9.18

Net Interest Income / Total Funds

2.60

3.68

3.57

3.72

3.70

Non Interest Income / Total Funds

4.60

3.64

4.65

4.28

3.96

Interest Expended / Total Funds

4.43

4.41

3.79

4.27

5.48

Operating Expense / Total Funds

4.64

5.28

6.39

6.48

6.47

Profit Before Provisions / Total Funds

2.46

1.92

1.68

1.35

1.02

Net Profit / Total Funds

1.59

1.40

1.24

1.00

0.70

Loans Turnover

0.33

0.18

0.16

0.16

0.18

11.63

11.72

12.00

12.27

13.14

Interest Expended / Capital Employed(%)

4.43

4.41

3.79

4.27

5.48

Total Assets Turnover Ratios

0.07

0.08

0.07

0.08

0.09

Asset Turnover Ratio

0.08

0.10

0.09

4.69

5.18

Interest Expended / Interest Earned

63.02

65.83

64.30

68.75

73.07

Other Income / Total Income

39.51

31.05

38.70

34.87

30.13

Operating Expense / Total Income

39.87

45.02

53.26

52.86

49.26

--

1.49

1.71

1.76

2.12

Capital Adequacy Ratio

--

--

--

--

14.73

Advances / Loans Funds(%)

--

65.25

65.63

60.77

71.91

Investment Valuation Ratios

Face Value

Dividend Per Share

Profitability Ratios

Interest Spread

Management Efficiency Ratios

Total Income / Capital Employed(%)

Profit And Loss Account Ratios

Selling Distribution Cost Composition

Balance Sheet Ratios

7/16/2013 12:19 PM

ICICI Bank | > Banks - Private Sector > of ICICI Bank - BSE: 532174, NS...

2 of 2

http://www.moneycontrol.com/stocks/company_info/print_financials.php...

Debt Coverage Ratios

Credit Deposit Ratio

45.28

94.95

91.58

93.54

92.19

Investment Deposit Ratio

83.04

83.08

79.09

66.43

57.19

Cash Deposit Ratio

6.71

7.76

9.80

9.08

8.85

Total Debt to Owners Fund

4.58

4.60

4.69

4.71

5.61

Financial Charges Coverage Ratio

1.58

1.46

1.48

1.35

1.22

Financial Charges Coverage Ratio Post

Tax

1.36

1.33

1.35

1.26

1.17

Current Ratio

0.84

0.12

0.10

0.11

0.11

Quick Ratio

3.29

3.44

3.26

3.50

3.71

Dividend Payout Ratio Net Profit

28.12

29.14

30.80

33.53

40.06

Dividend Payout Ratio Cash Profit

26.40

26.79

27.46

28.82

32.68

Earning Retention Ratio

73.34

71.95

70.16

67.11

57.58

Cash Earning Retention Ratio

74.89

74.14

73.30

71.65

65.76

AdjustedCash Flow Times

29.27

32.74

36.87

43.73

62.58

Leverage Ratios

Cash Flow Indicator Ratios

Source : Dion Global Solutions Limited

7/16/2013 12:19 PM

You might also like

- Balance SheetDocument1 pageBalance SheetKian EganNo ratings yet

- ICICI Bank Key Financial Ratios AnalysisDocument2 pagesICICI Bank Key Financial Ratios AnalysisSriharsha KrishnaprakashNo ratings yet

- Maruti Suzuki India: PrintDocument2 pagesMaruti Suzuki India: PrintAbhinav Prakash100% (1)

- Money Control 3Document2 pagesMoney Control 3Deepraj PathakNo ratings yet

- Eveready Industries India Cash Flow Statement Data for Past 5 YearsDocument1 pageEveready Industries India Cash Flow Statement Data for Past 5 YearsDeepraj PathakNo ratings yet

- Moneycontrol BOIDocument1 pageMoneycontrol BOIswap2390No ratings yet

- SBI Financial Statements 2009-2013Document2 pagesSBI Financial Statements 2009-2013akshayNo ratings yet

- South Indian Bank: PrintDocument1 pageSouth Indian Bank: Printrohitplus123No ratings yet

- Money RolDocument2 pagesMoney RolAman BansalNo ratings yet

- Mahindra & Mahindra Financial Services: Previous YearsDocument4 pagesMahindra & Mahindra Financial Services: Previous YearsJacob KvNo ratings yet

- Bs Syndicate BankDocument1 pageBs Syndicate BankMangesh ChandeNo ratings yet

- Balance SheetDocument2 pagesBalance SheetFarash MuhamedNo ratings yet

- Revenue StatementDocument2 pagesRevenue StatementShiva ShettyNo ratings yet

- HDFC Bank Balance Sheet Data 2007-2011Document1 pageHDFC Bank Balance Sheet Data 2007-2011Rishu ThakurNo ratings yet

- 2 FaaaltuDocument1 page2 FaaaltuMehul DhameliyaNo ratings yet

- Steel Authority of India: PrintDocument2 pagesSteel Authority of India: PrintSwarup RanjanNo ratings yet

- TCS Balance Sheet Analysis 2011-2007Document2 pagesTCS Balance Sheet Analysis 2011-2007Suraj GeorgeNo ratings yet

- Profit&LossDocument2 pagesProfit&LossDebangshee DasNo ratings yet

- Cairn India Standalone Balance SheetDocument2 pagesCairn India Standalone Balance SheetmeetmukeshNo ratings yet

- Balance Sheet of ICICI BankDocument1 pageBalance Sheet of ICICI BankSriya SenguptaNo ratings yet

- Mahindra and Mahindra: PrintDocument2 pagesMahindra and Mahindra: PrintSombwit KabasiNo ratings yet

- Tata Steel: PrintDocument2 pagesTata Steel: PrintKanika SinghNo ratings yet

- Adani Ports and Special Economic Zone - Consolidated Balance Sheet - Infrastructure - General - Consolidated Balance Sheet of Adani Ports and Special Economic Zone - BSE - 532921, NSE - ADANIPORTS PDFDocument2 pagesAdani Ports and Special Economic Zone - Consolidated Balance Sheet - Infrastructure - General - Consolidated Balance Sheet of Adani Ports and Special Economic Zone - BSE - 532921, NSE - ADANIPORTS PDFShashank YadavNo ratings yet

- Hindustan Petroleum Corporation: PrintDocument2 pagesHindustan Petroleum Corporation: PrintRakesh RoshanNo ratings yet

- Icici Bank Balance Sheet - in Rs. Cr.Document2 pagesIcici Bank Balance Sheet - in Rs. Cr.Darshan RavalNo ratings yet

- ICICI Bank balance sheet analysis 2012-2008Document1 pageICICI Bank balance sheet analysis 2012-2008john_muellorNo ratings yet

- Money ControlDocument1 pageMoney ControlsindhukotaruNo ratings yet

- Money Control 2Document2 pagesMoney Control 2sun1986No ratings yet

- Money Control KDocument2 pagesMoney Control Ksamrocks0007No ratings yet

- Cash Flow of Cadbury India: - in Rs. Cr.Document6 pagesCash Flow of Cadbury India: - in Rs. Cr.Somraj RoyNo ratings yet

- Balance Sheet of Reliance PowerDocument10 pagesBalance Sheet of Reliance PowerJoe SharmaNo ratings yet

- Icici Bank Limited-Balance20yDocument9 pagesIcici Bank Limited-Balance20yKavinath SwaminathanNo ratings yet

- My Bank Has Better NPA Than Your BankDocument7 pagesMy Bank Has Better NPA Than Your Bankhk_scribdNo ratings yet

- Basic StatisticsDocument2 pagesBasic StatisticsBeing Sumit SharmaNo ratings yet

- Consolidated: Print/Copy To ExcelDocument1 pageConsolidated: Print/Copy To ExcelYug SoniNo ratings yet

- Allied Bank ReportDocument70 pagesAllied Bank ReportRaja YasirNo ratings yet

- Q1 FY09 TablesDocument3 pagesQ1 FY09 TablesPerminder Singh KhalsaNo ratings yet

- Determining Optimal Cash Allocation at ICICI Bank Branches With SAS Enterprise Guide and SAS/OR SoftwareDocument13 pagesDetermining Optimal Cash Allocation at ICICI Bank Branches With SAS Enterprise Guide and SAS/OR SoftwareFlute ManNo ratings yet

- Previous Years : Sintex Industrie SDocument4 pagesPrevious Years : Sintex Industrie Sprince455No ratings yet

- Balance Sheet of ICICI BankDocument3 pagesBalance Sheet of ICICI BankomarwardakNo ratings yet

- Balance Sheet of ICICI BankDocument3 pagesBalance Sheet of ICICI Banknikitagupta44No ratings yet

- Evaluation of VRS in BanksDocument16 pagesEvaluation of VRS in Banksramesh.kNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- SANDDocument1 pageSANDkhatawakarsankalpNo ratings yet

- PayslipDocument3 pagesPayslipkarnancy100% (1)

- Kotak Mahindra Bank balance sheet data for March 2013, 2012 and 2011Document2 pagesKotak Mahindra Bank balance sheet data for March 2013, 2012 and 2011Sandip PatelNo ratings yet

- 11 05 17-31 12 17Document1 page11 05 17-31 12 17daya141079No ratings yet

- Balance Sheet of Bajaj AutoDocument6 pagesBalance Sheet of Bajaj Autogurjit20No ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Mini Project PradnyaDocument14 pagesMini Project PradnyaRusti HopperNo ratings yet

- Sbi Annual Report 2012 13Document190 pagesSbi Annual Report 2012 13udit_mca_blyNo ratings yet

- Moneycontrol cf3Document1 pageMoneycontrol cf3Avalanche SainiNo ratings yet

- Data 2010Document9 pagesData 2010krittika03No ratings yet

- Balance Sheet of ICICI BankDocument1 pageBalance Sheet of ICICI BankRahul RanjanNo ratings yet

- Zahur Cotton Mills Ltd 2001 Balance Sheet and Financial StatementsDocument11 pagesZahur Cotton Mills Ltd 2001 Balance Sheet and Financial StatementsPrince AdyNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated AccountDocument44 pagesConsolidated Accountnaveed153331No ratings yet

- Syndicate Bank capital structure and financial performance from 1999-2010Document6 pagesSyndicate Bank capital structure and financial performance from 1999-2010dsgoudNo ratings yet

- The Ring In Which We Must Fight~ Loss Love Life Through GRIEFFrom EverandThe Ring In Which We Must Fight~ Loss Love Life Through GRIEFNo ratings yet

- Sovereign Credit AnalyisDocument7 pagesSovereign Credit AnalyisSriharsha KrishnaprakashNo ratings yet

- Equilibrium Forward Curves For CommoditiesDocument42 pagesEquilibrium Forward Curves For CommoditiesSriharsha KrishnaprakashNo ratings yet

- Health PackagesDocument2 pagesHealth PackagesSriharsha KrishnaprakashNo ratings yet

- Risk Management Failures - What Are They and When Do They Happen PDFDocument20 pagesRisk Management Failures - What Are They and When Do They Happen PDFSriharsha KrishnaprakashNo ratings yet

- Burghardt Hoskins The Convexity Bias in Eurodollar FutureDocument16 pagesBurghardt Hoskins The Convexity Bias in Eurodollar FutureMohamad KarakiNo ratings yet

- Morningstar Equity and Credit Research CoverageDocument25 pagesMorningstar Equity and Credit Research CoverageSriharsha KrishnaprakashNo ratings yet

- Relation BT Forw Price & Fut Price - Journal of Financial Economics PDFDocument26 pagesRelation BT Forw Price & Fut Price - Journal of Financial Economics PDFSriharsha KrishnaprakashNo ratings yet

- Sovereign Credit AnalyisDocument7 pagesSovereign Credit AnalyisSriharsha KrishnaprakashNo ratings yet

- Deciphering The Liquidity and Credit CrunchDocument25 pagesDeciphering The Liquidity and Credit CrunchSriharsha KrishnaprakashNo ratings yet

- Indian Banking IndustryDocument19 pagesIndian Banking IndustryCarlos BaileyNo ratings yet

- Excel FormulaeDocument208 pagesExcel FormulaePrasoon SinghNo ratings yet

- Financial RatiosDocument15 pagesFinancial RatiosValentinorossiNo ratings yet

- Financial RatiosDocument15 pagesFinancial RatiosValentinorossiNo ratings yet

- Obama's Speech ParliamentDocument9 pagesObama's Speech ParliamentNikhil TrivediNo ratings yet

- Union Budget FY13Document8 pagesUnion Budget FY13Sriharsha KrishnaprakashNo ratings yet

- Obama's Speech ParliamentDocument9 pagesObama's Speech ParliamentNikhil TrivediNo ratings yet

- Trikala Rigvediya Sandhya VandanamDocument74 pagesTrikala Rigvediya Sandhya Vandanamrrachuri100% (2)

- 1 - Top Interview QuestionsDocument6 pages1 - Top Interview QuestionsMahesh SudrikNo ratings yet

- Keating Capital Lists Shares On NasdaqDocument2 pagesKeating Capital Lists Shares On NasdaqkeatingcapitalNo ratings yet

- Trading Chart Patterns - Trading Guides - CMC MarketsDocument12 pagesTrading Chart Patterns - Trading Guides - CMC MarketsRohit PurandareNo ratings yet

- 【寶塔個經私藏筆記】Ch1Economic ModelsDocument4 pages【寶塔個經私藏筆記】Ch1Economic Models黃譯民No ratings yet

- TAFA Profit SharingDocument5 pagesTAFA Profit SharingRiza D. SiocoNo ratings yet

- Roadmap FASB 123R Share-Based Pymt - DeloitteDocument280 pagesRoadmap FASB 123R Share-Based Pymt - DeloitteAlycia SkousenNo ratings yet

- Madura ch4 TBDocument11 pagesMadura ch4 TBSameh Ahmed Hassan80% (5)

- Islamic Bonds: Learning ObjectivesDocument20 pagesIslamic Bonds: Learning ObjectivesAbdelnasir HaiderNo ratings yet

- Topic 1Document59 pagesTopic 1SarannyaRajendraNo ratings yet

- ch01Document50 pagesch01Fahad Afzal CheemaNo ratings yet

- Level I of CFA Program 2 Mock Exam June 2020 Revision 1Document40 pagesLevel I of CFA Program 2 Mock Exam June 2020 Revision 1JasonNo ratings yet

- As1 LeadershipDocument19 pagesAs1 LeadershipSandeep BholahNo ratings yet

- Yawyaw Ka SisDocument8 pagesYawyaw Ka SisMary Rose PontejosNo ratings yet

- Overview of Financial Statement Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedDocument45 pagesOverview of Financial Statement Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedMutiara RamadhaniNo ratings yet

- Cypher Pattern Trading Strategy - How To Correctly Draw Cypher PatternDocument17 pagesCypher Pattern Trading Strategy - How To Correctly Draw Cypher PatternsudhakarrrrrrNo ratings yet

- Research Methodology Presentation - Group AssignmentDocument11 pagesResearch Methodology Presentation - Group AssignmentsalsabilaharitsaNo ratings yet

- Emabb Ebook - Share 150523Document8 pagesEmabb Ebook - Share 150523Suyitno Bunga Abimanyu RetnoNo ratings yet

- Azerbaijan Oil Company 2017 IFRS ReportsDocument96 pagesAzerbaijan Oil Company 2017 IFRS ReportsMehemmed MemmedliNo ratings yet

- Kuis AK 2Document4 pagesKuis AK 2Jhon F SinagaNo ratings yet

- Ratio Analysis ObjectiveDocument5 pagesRatio Analysis ObjectiveAnjali AgarwalNo ratings yet

- One For All For One Fin ManDocument3 pagesOne For All For One Fin ManArly Kurt TorresNo ratings yet

- 1.4 An Overview of The Capital Allocation Process: Self-TestDocument1 page1.4 An Overview of The Capital Allocation Process: Self-Testadrien_ducaillouNo ratings yet

- Study of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementDocument45 pagesStudy of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementmaheshNo ratings yet

- Ratio Analysis: Profitability RatiosDocument10 pagesRatio Analysis: Profitability RatiosREHANRAJNo ratings yet

- Exam 3 MBA 631 Spring 22Document8 pagesExam 3 MBA 631 Spring 22Rakesh PatelNo ratings yet

- Reading 53: Portfolio Risk and Return: Part IIDocument37 pagesReading 53: Portfolio Risk and Return: Part IIAlex PaulNo ratings yet

- ISSUE OF DEBENTURES REVISION QUESTIONS - SolnDocument18 pagesISSUE OF DEBENTURES REVISION QUESTIONS - Solnlalitha sureshNo ratings yet

- IFM AssignmentDocument3 pagesIFM AssignmentUsmanNo ratings yet

- An Overview of Financial SystemDocument4 pagesAn Overview of Financial SystemYee Sin MeiNo ratings yet

- Difference Between Financial & Managerial AccountingDocument3 pagesDifference Between Financial & Managerial AccountingAnisa LabibaNo ratings yet

- Bond and Bond Features and Its Example AssignmentDocument4 pagesBond and Bond Features and Its Example AssignmentWaqaarNo ratings yet