Professional Documents

Culture Documents

Steps in Brand Developement

Uploaded by

aksh_teddyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Steps in Brand Developement

Uploaded by

aksh_teddyCopyright:

Available Formats

Kaleidoscope

Quick Service Restaurant Industry: Coming of Age May 2012

Eos Capital Advisors Pvt. Ltd., New Delhi, India

Quick Service Restaurant Industry

Income > Consumption> Food & Beverages CONSUMPTION is going to be the most important driver of the Indian growth engine in the ensuing decades. Led by favorable demographics, higher disposable incomes, increasing urbanization and higher government spending, total consumption will reach USD 1390 bn. by 2025 and India will be the 5 globally. The food and Beverages market will be the biggest market at USD 345 bn. by 2025. The food consumption per capita will reach to USD 242 by 2025. Restaurant Industry The restaurant industry in India is estimated at approx. USD 8.6 bn and is expected to grow to USD 12.6 bn. by 2015.The unorganized industry is estimated at 80% of the total market at USD 6.9 bn. and is growing at 8-10% p.a. The organized market is estimated at 20% of the total market at USD 1.7 bn. and is growing at 20% per annum. Organized sector is expected to grow four-fold to USD 5.6 bn. by 2015 and its share in the restaurant pie is expected to increase from 20% currently to 45% by 2015. QSR Industry Quick service restaurants (QSRs) are estimated to have a market of USD 600 mn. At CAGR of 25-30%, QSR is the fastest growing food service segment. The industry is witnessing entry of international chains like Dunkin Donuts, Starbucks, etc. The entry routes include entering directly (Yum Brands), structuring JV with a local player (Starbucks & Tata) or appointing a master franchise (Dominos Jubilant Food Works) McDonalds is present in 50 cities in India. Being a strong brand, McDonalds goes for revenue-sharing model with lessors / developers. McDonalds started with Metros and later moved to Tier I and Tier II cities.

Eos Capital Advisors Pvt. Ltd., New Delhi, India

th

On a High Growth Trajectory

Currently, there are an estimated 3,000 outlets in the country. These are located in high-streets, malls, food courts in office complexes, supermarkets, and public transport stations and therefore witness a large number of footfalls. Growth Drivers India is urbanizing at a rapid pace - Urban population to increase from 318 mn (2005) to 523 mn (2025); 20-40 age group to reach 458 mn by 2021. Growth of household income and young working class is causing share of wallet to shift from essential to discretionary Items (Indian youth is the most promising target segment for QSRs). Shift in lifestyle in modern India Increase in nuclear families & working couples, greater time spent away from home in eating & socializing and greater exposure to trends is set to create tremendous market opportunities. Increase in organized retail space (malls, shopping complexes, etc.) where people shop, hang-out, watch movies, etc. QSR joints derive substantial sales in and around these areas. Key Players The key players in this segment are McDonalds, expected to Dominos, reach KFC, 12,000 pizza by hut, 2015. Haldiram etc. Total no. of outlets is Starbucks, Quiznos and Dunkin donuts are also entering into the market.

Key Players growth Quick service Restaurant Industry Indian Consumption will grow by 4X

largest consumer market

Key Statistics

Current Level Sensex 17,464.90 Industry Classification NIFTY 5,258.45 CNX Midcap 7,221.00 DJIA 11,836.00 FTSE 100 5,484.10 WTI Crude 97.40 Gold ($/Oz) 1,797.25 10Y G-Sec 8.97%

th

% Change* -3.67% -3.50% -6.90% 12.90% 10.00% 6.50% 26.10% 72 bps

*Percentage change from 30 June th 2011 till 9 Nov 2011

KFC is currently present in 25 cities in India. It started with Metros, invested in its brand and is subsequently looking to expand to more Tier I and Tier II cities in India. Dominos is present in Approximately 100 cities. The business model is focused on home delivery, small outlet size and product innovation. Typical Customer Profile Target Audience includes young professionals on the move, teenagers, Students, multiplex audience. The age group is 16-35 yrs. A typical Customer looks for Quality of food, convenience, variety, speed of delivery and price.

Key Challenges The QSR business is characterized as a low entry-barrier business and hence is extremely competitive. QSR customers are very easy to sell to in first place; however they have low stickiness. A robust and efficient supply chain holds the key to a successful QSR operation. India still has relatively poor cold to storage developed infrastructure compared

Customer Profile & Trends

countries. Another challenge comes in face of poor transportation, and erratic power supply The other Challenge is to indianise the menu items for the Indian palate. Securing prime locations is becoming an expensive exercise owing to high real estate rentals.

Key Success factors There is a shortage of skilled labor for

Indianize the product menu to include offerings that take a leaf from most successful QSR offerings Experiment rapidly to decide on the optimal product mix Design targeted marketing campaign to influence the buying behavior of the target group Utilize the right mix of channels and content to position the brand Tie up real estates at major customer footfall areas Design the roll out strategy in accordance with the product portfolio

working in QSR restaurants especially in profiles of store managers and chefs. Future outlook The competition in the sector will intensify as more and more players will enter in to this growing market. Larger chains will expand into small cities. In terms of outlets we shall see more of express outlets and Kiosks. We shall see more product Sensex NIFTY CNX Midcap DJIA FTSE 100 WTI Crude Gold ($/Oz) 10Y G-Sec categories e.g. Breakfast Menu is being launched by jubilant foods along with Dunkin donuts. There will be more of integration of concepts e.g. McDonalds serving coffee or CCD serving Sandwiches. In terms of technology, online ordering system, IVR system for placing order and payments will develop. Investors have developed a lot of appetite for QSRs. In the past a lot of QSRs have raised PE funding like Devyani International, Sagar Ratna, Faaso, Speciality restaurants and Barbeque Nation etc. Going Forward also, we shall be see a lot more investments by PE in QSR industry.

Product Development

Brand Building

Key Statistics

Current Level 17,464.90 5,258.45 7,221.00 11,836.00 5,484.10 97.40 1,797.25 8.97%

th

Store Roll Out

Supply Chain

Invest in establishing tie ups with relevant commissaries and vendors depending on store roll out strategy

% Change* -3.67% -3.50% -6.90% 12.90% 10.00% 6.50% 26.10% 72 bps

*Percentage change from 30 June th 2011 till 9 Nov 2011

Eos Capital Advisors Pvt. Ltd., New Delhi, India

Eos Capital Advisors Pvt. Ltd.

A-1/68, Ground Floor, Safdarjung Enclave New Delhi 110029, Ph: 011-43639076 info@eoscapital.in www.eoscapital.in

Eos Capital Advisors Pvt. Ltd., New Delhi, India

You might also like

- QSRDocument41 pagesQSRVivek VkNo ratings yet

- Valuation Report (World Trail)Document11 pagesValuation Report (World Trail)Uppada SareesNo ratings yet

- The Indian Fast Food Market Has Been Witnessing Rapid Growth On The Back of Positive Developments and Presence of Massive InvestmentsDocument4 pagesThe Indian Fast Food Market Has Been Witnessing Rapid Growth On The Back of Positive Developments and Presence of Massive InvestmentsPrashant ThakurNo ratings yet

- MOS Term Paper: Marketing QSR Services in India: A Study of SubwayDocument10 pagesMOS Term Paper: Marketing QSR Services in India: A Study of Subwayarpit_9688No ratings yet

- Pantaloon IndiaDocument74 pagesPantaloon Indiazoeb_eisa2002No ratings yet

- Case 6 - Retailing in IndiaDocument22 pagesCase 6 - Retailing in IndiaSanjay NayakNo ratings yet

- QSR Market in India PDFDocument3 pagesQSR Market in India PDFVinayak KarandeNo ratings yet

- Agenda: Customer Analysis Competitor Analysis Swot 4P's ConclusionDocument43 pagesAgenda: Customer Analysis Competitor Analysis Swot 4P's Conclusionroopa81No ratings yet

- Customer Retention in Retail Setor by NonameDocument69 pagesCustomer Retention in Retail Setor by NonameMonalisa MunniNo ratings yet

- Research Papers On FMCG in IndiaDocument4 pagesResearch Papers On FMCG in Indiaefdwvgt4100% (1)

- Project Report ON Retailing - Food and Beverages RestuarantsDocument15 pagesProject Report ON Retailing - Food and Beverages RestuarantssumeetNo ratings yet

- Brand Brief Big BazaarDocument14 pagesBrand Brief Big BazaarAshwin Hemant LawanghareNo ratings yet

- PpppotaDocument4 pagesPpppotaCassandra ValdezNo ratings yet

- Indian FMCG Industry, September 2012Document77 pagesIndian FMCG Industry, September 2012Arushi DobhalNo ratings yet

- Marketing Plan For IKEA IndiaDocument21 pagesMarketing Plan For IKEA IndiaAbhishek Nag100% (1)

- QSR Sector Thematic Sector Update 7 June 2021Document109 pagesQSR Sector Thematic Sector Update 7 June 2021RAVI RAJNo ratings yet

- Internship ReportDocument41 pagesInternship ReportAnuj KumarNo ratings yet

- Buying Behaviour of Big Bazar Profit Club Card.Document89 pagesBuying Behaviour of Big Bazar Profit Club Card.Ankesh AnandNo ratings yet

- Changing Retail Landscape in IndiaDocument22 pagesChanging Retail Landscape in Indiakeyurshah38No ratings yet

- Sales Management ST YcbnkdDocument12 pagesSales Management ST YcbnkdAssignment HuntNo ratings yet

- Study of FMCGDocument28 pagesStudy of FMCGNikhil GuptaNo ratings yet

- FMCG Sector Industry Analysis FinalDocument10 pagesFMCG Sector Industry Analysis FinalLohith KumarNo ratings yet

- International Logistics and Supply Chain MnagementDocument5 pagesInternational Logistics and Supply Chain MnagementSourav SaraswatNo ratings yet

- Literature Review On Fundamental Analysis of FMCG SectorDocument5 pagesLiterature Review On Fundamental Analysis of FMCG SectorafdtsdeceNo ratings yet

- Market Analysis Of: FMCG Industry in IndiaDocument24 pagesMarket Analysis Of: FMCG Industry in IndiagauravNo ratings yet

- Analysis of Customer Satisfaction at Mcdonalds KFC Marketing EssayDocument27 pagesAnalysis of Customer Satisfaction at Mcdonalds KFC Marketing EssayHND Assignment HelpNo ratings yet

- Analysis of QSR Industry in India: Executive SummaryDocument16 pagesAnalysis of QSR Industry in India: Executive SummaryRaunak PatilNo ratings yet

- BCG RAI - Retail Resurgence in India-Leading in The New Reality (Feb 2021)Document66 pagesBCG RAI - Retail Resurgence in India-Leading in The New Reality (Feb 2021)Aadhar Bhardwaj100% (1)

- The Indian Retail Landscape: Now and BeyondDocument14 pagesThe Indian Retail Landscape: Now and BeyondRohit SharmaNo ratings yet

- Industry Analysis - RetailDocument41 pagesIndustry Analysis - RetailRahul RanganathanNo ratings yet

- BCG Rai Report Retail Resurgence in IndiaDocument66 pagesBCG Rai Report Retail Resurgence in IndiaakashNo ratings yet

- Globalization and Marketing Strategies of Multinational Fast Food Companies in The Indian Foodservice MarketDocument27 pagesGlobalization and Marketing Strategies of Multinational Fast Food Companies in The Indian Foodservice MarketUtkarsh ShallaNo ratings yet

- Synopsis: "A Study On Effect of Brand Image On Consumer'S Taste and Preferences in Consumer Durable Sector "Document52 pagesSynopsis: "A Study On Effect of Brand Image On Consumer'S Taste and Preferences in Consumer Durable Sector "Shivanku ChawlaNo ratings yet

- Shoppers Stop Campus Guru CaseDocumentDocument10 pagesShoppers Stop Campus Guru CaseDocumentumeshNo ratings yet

- Comparative Study of Preference MC Donald &KFCDocument67 pagesComparative Study of Preference MC Donald &KFCKranthi KumarNo ratings yet

- Swot Indian RetailDocument10 pagesSwot Indian RetailijustyadavNo ratings yet

- Future GroupDocument32 pagesFuture GroupFinola FernandesNo ratings yet

- Shoppers Stop Campus Guru CaseDocument PDFDocument9 pagesShoppers Stop Campus Guru CaseDocument PDFHardik GuptaNo ratings yet

- Dokumen - Tips - To Know The Consumer Preference About Nescafe CoffeeDocument80 pagesDokumen - Tips - To Know The Consumer Preference About Nescafe Coffeeabdatmeh99No ratings yet

- Work in ProgresssDocument45 pagesWork in ProgresssVilas PawarNo ratings yet

- Indian Retail Industry FinalDocument21 pagesIndian Retail Industry FinalhadpadravindraNo ratings yet

- Innovation Akshita SachdevaDocument6 pagesInnovation Akshita SachdevaParag MehtaNo ratings yet

- 1.1 Introduction To Retail in India: Today, The Flood of Products in The Market Coupled With A Wealthier, More InformedDocument52 pages1.1 Introduction To Retail in India: Today, The Flood of Products in The Market Coupled With A Wealthier, More InformedNamrata LakhotiaNo ratings yet

- Retail Sector in IndiaDocument62 pagesRetail Sector in Indiapurval16110% (1)

- Comparative Study of McDonaldsDocument38 pagesComparative Study of McDonaldsAlok Jain100% (2)

- Implications of FDI in Indian RetailDocument8 pagesImplications of FDI in Indian RetailAvishkarzNo ratings yet

- Indian Retail Presentation SDDocument43 pagesIndian Retail Presentation SDSushanta DasNo ratings yet

- RETAIL 4 0 WINNING THE 20s 1583432748 PDFDocument56 pagesRETAIL 4 0 WINNING THE 20s 1583432748 PDFkhare.tusharNo ratings yet

- India Consumption StoryDocument39 pagesIndia Consumption StoryShan MSNo ratings yet

- Final Report On FMCGDocument35 pagesFinal Report On FMCGMayankRawal0% (2)

- TrushDocument101 pagesTrushtrushna19No ratings yet

- Consumer Goods Industry in India 2Document20 pagesConsumer Goods Industry in India 2SiddharthNo ratings yet

- SYNOPSISDocument21 pagesSYNOPSISSheeba khamNo ratings yet

- FINAL Business Plan For RestaurantDocument15 pagesFINAL Business Plan For RestaurantDivyanshi SinghNo ratings yet

- FMCG Industry Overview PDFDocument4 pagesFMCG Industry Overview PDFVikas BhaskarNo ratings yet

- New Swot RetailDocument11 pagesNew Swot RetailijustyadavNo ratings yet

- Banking 2020: Transform yourself in the new era of financial servicesFrom EverandBanking 2020: Transform yourself in the new era of financial servicesNo ratings yet

- Toward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyFrom EverandToward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

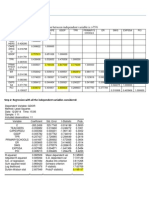

- Nagaland: Highlighted The Values Where Correlation Between Independent Variable Is 75%Document3 pagesNagaland: Highlighted The Values Where Correlation Between Independent Variable Is 75%aksh_teddyNo ratings yet

- Reference MaterialDocument5 pagesReference MaterialRipudaman KochharNo ratings yet

- What Were The Success Factors For Starbucks in 1990Document1 pageWhat Were The Success Factors For Starbucks in 1990aksh_teddyNo ratings yet

- Reporting of Counterfeit NotesDocument12 pagesReporting of Counterfeit Notesaksh_teddy100% (1)

- Types of Synergies: Three Kinds of Synergies by Combining and Customizing Resources DifferentlyDocument5 pagesTypes of Synergies: Three Kinds of Synergies by Combining and Customizing Resources Differentlyaksh_teddyNo ratings yet

- Case Presentation: Beyond The Global MatrixDocument20 pagesCase Presentation: Beyond The Global Matrixaksh_teddyNo ratings yet

- Guidelines: Do Not Change The Font or Format of The CVDocument2 pagesGuidelines: Do Not Change The Font or Format of The CVaksh_teddyNo ratings yet

- Case Questions - Walmart Stores IncDocument1 pageCase Questions - Walmart Stores Incaksh_teddyNo ratings yet

- Recent Trends in The Insurance SectorDocument16 pagesRecent Trends in The Insurance SectorOladipupo Mayowa PaulNo ratings yet

- Case Jai Jaikumar TakeawaysDocument5 pagesCase Jai Jaikumar Takeawaysaksh_teddyNo ratings yet

- InvitationDocument1 pageInvitationaksh_teddyNo ratings yet

- Affidavit of StudentDocument2 pagesAffidavit of Studentaksh_teddyNo ratings yet

- Sukh Karta DukhhartaDocument4 pagesSukh Karta Dukhhartaaksh_teddyNo ratings yet

- QuestionDocument2 pagesQuestionaksh_teddyNo ratings yet

- JargonDocument11 pagesJargonaksh_teddyNo ratings yet

- Bharti AirtelDocument1 pageBharti Airtelaksh_teddyNo ratings yet

- Progress ReportDocument7 pagesProgress Reportaksh_teddyNo ratings yet

- Section2 1Document13 pagesSection2 1JessicaNo ratings yet

- Undertake Suggestive SellingDocument40 pagesUndertake Suggestive SellingJenniebeth Valenzuela100% (1)

- Heinz Presentation On R&D Demand ForcastingDocument18 pagesHeinz Presentation On R&D Demand ForcastingManas KumarNo ratings yet

- A Bad Workman Always Blames His ToolsDocument18 pagesA Bad Workman Always Blames His ToolsPuvaNo ratings yet

- KELOMPOK 2 NDocument17 pagesKELOMPOK 2 NRahmizaniNo ratings yet

- How To Remember The Scienti C Names?Document3 pagesHow To Remember The Scienti C Names?Aditi ChauhanNo ratings yet

- UVsterarizationHIDAKA PDFDocument7 pagesUVsterarizationHIDAKA PDFAmrit Kumar PatiNo ratings yet

- Quality AssuranceDocument40 pagesQuality AssuranceM Luqman Hakim50% (2)

- 8c9a Japanese Women Dont Get Old or Fat Secrets of My Mothers Tokyo KitchenDocument3 pages8c9a Japanese Women Dont Get Old or Fat Secrets of My Mothers Tokyo KitchenKarlis Bruni10% (10)

- Productos VariosDocument8 pagesProductos VariosCarlo PizarroNo ratings yet

- ProverbsDocument11 pagesProverbsKaviraj NairNo ratings yet

- WASA 2010 Water Distribution Schedule (Trinidad)Document16 pagesWASA 2010 Water Distribution Schedule (Trinidad)Rondell PaulNo ratings yet

- Biogas - Instructables Methane For BiogasDocument19 pagesBiogas - Instructables Methane For Biogaslouis adonis silvestreNo ratings yet

- Basic Early Childhood DevelopmentDocument11 pagesBasic Early Childhood Developmentapi-548869394No ratings yet

- Full Marketing PPT - 22032015Document12 pagesFull Marketing PPT - 22032015yuki_akitsuNo ratings yet

- ASHORTTRACTORPHILOSOPHICALSUMMARYBy NICHOLASFLAMELLDocument4 pagesASHORTTRACTORPHILOSOPHICALSUMMARYBy NICHOLASFLAMELLYaniv AlgrablyNo ratings yet

- Saint Dennis Catholic School: Peace-Pass It OnDocument7 pagesSaint Dennis Catholic School: Peace-Pass It OnstdennisparishNo ratings yet

- Fruit Logistica Trend Report 2018 Part1Document19 pagesFruit Logistica Trend Report 2018 Part1Jesu Gajardo OrósticaNo ratings yet

- Describe A Memorable Place: Vocabulary HighlightsDocument3 pagesDescribe A Memorable Place: Vocabulary HighlightsPhùng Thị Kim OanhNo ratings yet

- Case StudyDocument8 pagesCase Studypao nisanNo ratings yet

- Dade County Farm Bureau Voice of AgricultureDocument16 pagesDade County Farm Bureau Voice of AgricultureSonia ColonNo ratings yet

- French ChristmasDocument13 pagesFrench ChristmasElla RaicuNo ratings yet

- Men 'S Health South Africa - June 2017Document132 pagesMen 'S Health South Africa - June 2017georgeNo ratings yet

- Avocado Oil Refined Tx008222 PdsDocument3 pagesAvocado Oil Refined Tx008222 Pdskwamina20No ratings yet

- Review Test 2 - SpeakingDocument4 pagesReview Test 2 - SpeakingNV TùngNo ratings yet

- Practical 01 06 J.a.N.gimhani BST17025Document13 pagesPractical 01 06 J.a.N.gimhani BST17025Dulanjali PereraNo ratings yet

- Final Examination Year 3 KSSR Paper 2Document7 pagesFinal Examination Year 3 KSSR Paper 2Ramadas DaughterNo ratings yet

- Lehner Monsales Curriculum VitaeDocument3 pagesLehner Monsales Curriculum VitaeMark Genesis DurbanNo ratings yet

- Fallacies Class Exercise PDFDocument7 pagesFallacies Class Exercise PDFSimran BhatiaNo ratings yet

- Samsung Timesaver 1000W (MW123H XSA-03101A GB)Document16 pagesSamsung Timesaver 1000W (MW123H XSA-03101A GB)mjmtNo ratings yet