Professional Documents

Culture Documents

Bond Pricing DQ

Uploaded by

permafrostXx0 ratings0% found this document useful (0 votes)

20 views0 pagesAt a YTM of 5.445%, the settlement price is $106. 426. Ii) the Percentage Change in price is -0.59%. Iv) the low coupon bond is more price sensitive as the % drop in price is larger for the low coupon bond (-0.59%) given the same basis point rise in rates.

Original Description:

Original Title

Bond+Pricing+DQ

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAt a YTM of 5.445%, the settlement price is $106. 426. Ii) the Percentage Change in price is -0.59%. Iv) the low coupon bond is more price sensitive as the % drop in price is larger for the low coupon bond (-0.59%) given the same basis point rise in rates.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views0 pagesBond Pricing DQ

Uploaded by

permafrostXxAt a YTM of 5.445%, the settlement price is $106. 426. Ii) the Percentage Change in price is -0.59%. Iv) the low coupon bond is more price sensitive as the % drop in price is larger for the low coupon bond (-0.59%) given the same basis point rise in rates.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 0

1

Session 2: Bond Pricing

A. For class discussion.

B.

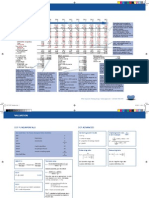

i) At a YTM of 5.445%, the settlement price is $106. 426.

ii) The percentage change in price is 0.59%.

Valuation Yield Coupon Present

or To Coupon No. of Discount Per Value Face Present SETTLEMENT

Transaction Settlement Maturity Maturity Rate Periods to Rate Period Annuity Value Value PRICE

Date Date Date (%) (%) Maturity Per Period ($) Factor ($) Factor ($)

YTM C t r CPP PVA(r,t) FV PVF(r,t) P0

11/11/05 15/11/05 15/05/13 5.345% 6.50% 15 2.6725% 3.250 12.2257 100 0.6733 107.060

11/11/05 15/11/05 15/05/13 5.445% 6.50% 15 2.7225% 3.250 12.1811 100 0.6684 106.426

Percentage Change -0.59%

C.

i) The settlement price is $128.455.

ii) The settlement price is $127.743.

iii) The percentage change in price is 0.55%.

iv) The low coupon bond is more price sensitive as the % drop in price is larger

for the low coupon bond (-0.59%) than the high coupon bond (-0.55%) given

the same basis point rise in rates.

Valuation Yield Coupon Present

or To Coupon No. of Discount Per Value Face Present SETTLEMENT

Transaction Settlement Maturity Maturity Rate Periods to Rate Period Annuity Value Value PRICE

Date Date Date (%) (%) Maturity Per Period ($) Factor ($) Factor ($)

YTM C t r CPP PVA(r,t) FV PVF(r,t) P0

11/11/05 15/11/05 15/05/13 5.345% 10.00% 15 2.6725% 5.000 12.2257 100 0.6733 128.455

11/11/05 15/11/05 15/05/13 5.445% 10.00% 15 2.7225% 5.000 12.1811 100 0.6684 127.743

Percentage Change -0.55%

D.

i) The settlement price is $104.566.

ii) The settlement price is $104.161.

iii) The percentage change in price is 0.39%.

iv) The long term bond is more price sensitive as the % drop in price is larger for

the long term bond (-0.59%) than the short term bond (-0.39%) given the same

basis point rise in rates.

Valuation Yield Coupon Present

Or To Coupon No. of Discount Per Value Face Present SETTLEMENT

Transaction Settlement Maturity Maturity Rate Periods Rate Period Annuity Value Value PRICE

Date Date Date (%) (%) to Maturity Per Period ($) Factor ($) Factor ($)

2

YTM C t r CPP PVA(r,t) FV PVF(r,t) P

0

11/11/05 15/11/05 15/05/10 5.345% 6.50% 9 2.6725% 3.250 7.9064 100 0.7887 104.566

11/11/05 15/11/05 15/05/10 5.445% 6.50% 9 2.7225% 3.250 7.8878 100 0.7853 104.161

Percentage Change -0.39%

E. If interest rates are expected to rise (fall), I tend to shift funds away from the long (short)

term low (high) coupon bonds towards the short (long) term high (low) coupon bonds to

minimise (maximise) the potential capital loss (gain).

You might also like

- BANK3011 Workshop Week 4 SolutionsDocument5 pagesBANK3011 Workshop Week 4 SolutionsZahraaNo ratings yet

- BOND Financial ManagementDocument42 pagesBOND Financial ManagementsmritakachruNo ratings yet

- Bond Price VolatilityDocument56 pagesBond Price Volatilityanurag71500No ratings yet

- Fixed Income Attribution AnalysisDocument21 pagesFixed Income Attribution AnalysisJaz MNo ratings yet

- Bond Risks and Yield Curve AnalysisDocument33 pagesBond Risks and Yield Curve Analysisarmando.chappell1005No ratings yet

- Lecture Note 03 - Bond Price VolatilityDocument53 pagesLecture Note 03 - Bond Price Volatilityben tenNo ratings yet

- Chapter 009Document33 pagesChapter 009AfnanNo ratings yet

- IPPTChap 003Document35 pagesIPPTChap 003Ghita RochdiNo ratings yet

- Chap 009Document39 pagesChap 009Shahrukh Mushtaq0% (1)

- Sample Final Term Exam-Solutions PGDocument3 pagesSample Final Term Exam-Solutions PGYilin YANGNo ratings yet

- Fabozzi Ch04 BMAS 7thedDocument51 pagesFabozzi Ch04 BMAS 7thedBilalTariqNo ratings yet

- Valuation of Financial AssetsDocument47 pagesValuation of Financial AssetsprashantkumbhaniNo ratings yet

- Bond Return Valuatio DurationDocument63 pagesBond Return Valuatio DurationSambi Reddy Gari NeelimaNo ratings yet

- Bond Yeild Present ValueDocument9 pagesBond Yeild Present ValueVijay ParmarNo ratings yet

- CH 4Document22 pagesCH 4Asif Abdullah KhanNo ratings yet

- Cost of DebtDocument10 pagesCost of DebtOlivier MNo ratings yet

- Overview of PortfolioDocument22 pagesOverview of PortfolioLindsay DavisNo ratings yet

- Cost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockDocument18 pagesCost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockFadhila HanifNo ratings yet

- Solutions To Problems: Coupon Interest Market Price Current YieldDocument4 pagesSolutions To Problems: Coupon Interest Market Price Current YieldAhmed El KhateebNo ratings yet

- CFA Level1 - Fixed Income - SS15 v2021Document85 pagesCFA Level1 - Fixed Income - SS15 v2021Carl Anthony FabicNo ratings yet

- Chapter 7: Interest Rates and Bond ValuationDocument36 pagesChapter 7: Interest Rates and Bond ValuationHins LeeNo ratings yet

- Bond CalculationDocument2 pagesBond CalculationARUN PRATAP SINGHNo ratings yet

- Bond Valuation Formulas in ExcelDocument22 pagesBond Valuation Formulas in Excelrameessalam852569No ratings yet

- SS15 Fixed-Income: Basic Concepts SS15 Fixed-Income: Analysis of RiskDocument39 pagesSS15 Fixed-Income: Basic Concepts SS15 Fixed-Income: Analysis of RiskAydin GaniyevNo ratings yet

- Bond Pricing Basics InputDocument9 pagesBond Pricing Basics InputJocelyn CenNo ratings yet

- Global Edition: Bond Price VolatilityDocument54 pagesGlobal Edition: Bond Price VolatilityTesar Handy AfrianNo ratings yet

- Answers To Exercises On Lecture 5Document13 pagesAnswers To Exercises On Lecture 5Abdu0% (1)

- Risk, Cost of Capital, and Capital BudgetingDocument23 pagesRisk, Cost of Capital, and Capital BudgetingBussines LearnNo ratings yet

- 04 Risk Analysis (Session 8, 9, 10) - RevisionDocument20 pages04 Risk Analysis (Session 8, 9, 10) - RevisioncreamellzNo ratings yet

- DCF Valuation Financial ModelingDocument10 pagesDCF Valuation Financial ModelingHilal MilmoNo ratings yet

- Semester 1: When Annuity Payments Are Made in Advance, We Call Them Annuity DueDocument72 pagesSemester 1: When Annuity Payments Are Made in Advance, We Call Them Annuity Duepriyanka bohraNo ratings yet

- Commodity Maths Latest VersionDocument50 pagesCommodity Maths Latest VersionAishwarya GaneshNo ratings yet

- Valuation of Securities BondsDocument14 pagesValuation of Securities BondsHedayatullah PashteenNo ratings yet

- FIS PPT Covering Multiple Interest Rate Related Concepts - Cash and DerivativesDocument34 pagesFIS PPT Covering Multiple Interest Rate Related Concepts - Cash and DerivativesAbhinav MahajanNo ratings yet

- Fixed-Income Valuation - Price and YieldDocument55 pagesFixed-Income Valuation - Price and YieldShriya JanjikhelNo ratings yet

- UBS - Bond BasicsDocument51 pagesUBS - Bond Basicshuqixin1100% (2)

- Answers To Problem Sets: Est. Time: 01-05Document16 pagesAnswers To Problem Sets: Est. Time: 01-05Ankit SaxenaNo ratings yet

- WSP Yield To Maturity YTM VFDocument4 pagesWSP Yield To Maturity YTM VFFabrizio ChippariNo ratings yet

- Lecture 5Document21 pagesLecture 5Mahina NozirovaNo ratings yet

- FCFE and FCFF Model SessionDocument25 pagesFCFE and FCFF Model SessionABHIJEET BHUNIA MBA 2021-23 (Delhi)No ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- By: Kevin Yee Goh Jian JunDocument20 pagesBy: Kevin Yee Goh Jian JunYong RenNo ratings yet

- Fixed Income Analysis - PDF Good FileDocument15 pagesFixed Income Analysis - PDF Good FilechetandeepakNo ratings yet

- FCFF2 21HS10002Document21 pagesFCFF2 21HS10002aayush.5.parasharNo ratings yet

- FIN7520 Notes On Chapter 14 and 15 Bond Prices and YieldsDocument8 pagesFIN7520 Notes On Chapter 14 and 15 Bond Prices and YieldsMichael PironeNo ratings yet

- Fmi Assignment2Document140 pagesFmi Assignment2Ankit TiwariNo ratings yet

- Fixed Income Class Examples ADocument9 pagesFixed Income Class Examples ADebashis MallickNo ratings yet

- Interest Rate RiskDocument25 pagesInterest Rate Riskmailinh1991No ratings yet

- Fins 2624 Problem Set 3 SolutionDocument11 pagesFins 2624 Problem Set 3 SolutionUnswlegend100% (2)

- AmazonDocument16 pagesAmazonEsteban Camilo Ortiz ZambranoNo ratings yet

- Chapter 4 Part 1Document10 pagesChapter 4 Part 1Aditya GhoshNo ratings yet

- Fundamentals of Investments Valuation and Management 7th Edition Jordan Solutions ManualDocument8 pagesFundamentals of Investments Valuation and Management 7th Edition Jordan Solutions Manualwarrenerambi70w35h100% (20)

- Valuation of Bonds and Shares: Problem 1Document29 pagesValuation of Bonds and Shares: Problem 1Sourav Kumar DasNo ratings yet

- Basic Financial Concepts - FinalDocument34 pagesBasic Financial Concepts - FinalDu Baladad Andrew MichaelNo ratings yet

- The Passive and Active Stances: Bond Portfolio ManagementDocument41 pagesThe Passive and Active Stances: Bond Portfolio ManagementvaibhavNo ratings yet

- FIS Duration 20 07 2023Document20 pagesFIS Duration 20 07 2023Vishwajit GoudNo ratings yet

- Financial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskFrom EverandFinancial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskNo ratings yet

- SERIES 7 EXAM STUDY GUIDE + TEST BANKFrom EverandSERIES 7 EXAM STUDY GUIDE + TEST BANKRating: 2.5 out of 5 stars2.5/5 (3)

- Pricing with Confidence: Ten Rules for Increasing Profits and Staying Ahead of InflationFrom EverandPricing with Confidence: Ten Rules for Increasing Profits and Staying Ahead of InflationNo ratings yet

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKRating: 5 out of 5 stars5/5 (1)

- ACF - Boston BeerDocument42 pagesACF - Boston BeerpermafrostXx89% (9)

- PresentationDocument29 pagesPresentationpermafrostXx0% (1)

- Week 9 Tute HWKDocument1 pageWeek 9 Tute HWKpermafrostXxNo ratings yet

- Optimal+Portfolios+DQ 2008s1Document2 pagesOptimal+Portfolios+DQ 2008s1permafrostXxNo ratings yet

- Week 2 Tute HWKDocument2 pagesWeek 2 Tute HWKpermafrostXxNo ratings yet

- Session 8: Capital Asset Pricing Model: Discussion Question EDocument1 pageSession 8: Capital Asset Pricing Model: Discussion Question EpermafrostXxNo ratings yet

- Homework 2008s2Document6 pagesHomework 2008s2permafrostXxNo ratings yet

- Roland Barthes Textual Analysis of A Tale by Edgar Allan PoeDocument4 pagesRoland Barthes Textual Analysis of A Tale by Edgar Allan PoeFarooq KhanNo ratings yet

- The Challenge of OrientalismDocument20 pagesThe Challenge of OrientalismpermafrostXxNo ratings yet

- Emh DQDocument0 pagesEmh DQpermafrostXxNo ratings yet

- Essay Assignment-Due Monday, 16 December at 16:00.Document1 pageEssay Assignment-Due Monday, 16 December at 16:00.permafrostXxNo ratings yet

- Critical Review mgmt2001Document5 pagesCritical Review mgmt2001permafrostXxNo ratings yet

- LEGT 2721 Course Outline s12010Document17 pagesLEGT 2721 Course Outline s12010permafrostXxNo ratings yet

- MGMT 2002Document4 pagesMGMT 2002permafrostXxNo ratings yet

- Buddong Systems Case Study AnalysisDocument10 pagesBuddong Systems Case Study AnalysispermafrostXxNo ratings yet

- Buddong Systems Case StudyDocument3 pagesBuddong Systems Case StudypermafrostXxNo ratings yet

- 1999 Maths3 P BurwoodGHSDocument4 pages1999 Maths3 P BurwoodGHSpermafrostXxNo ratings yet